The Italian tomato processing industry: Ismea 2024 report

Italy's foreign trade

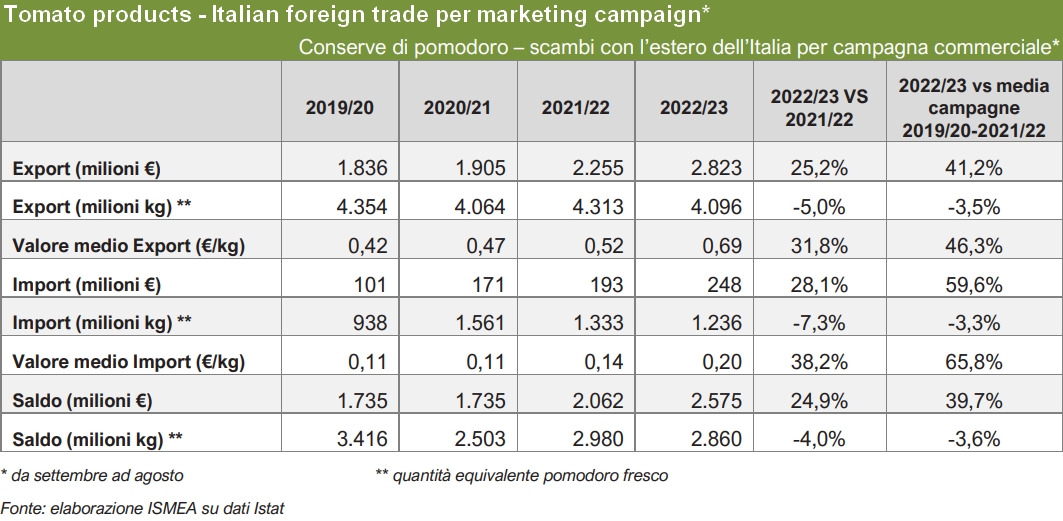

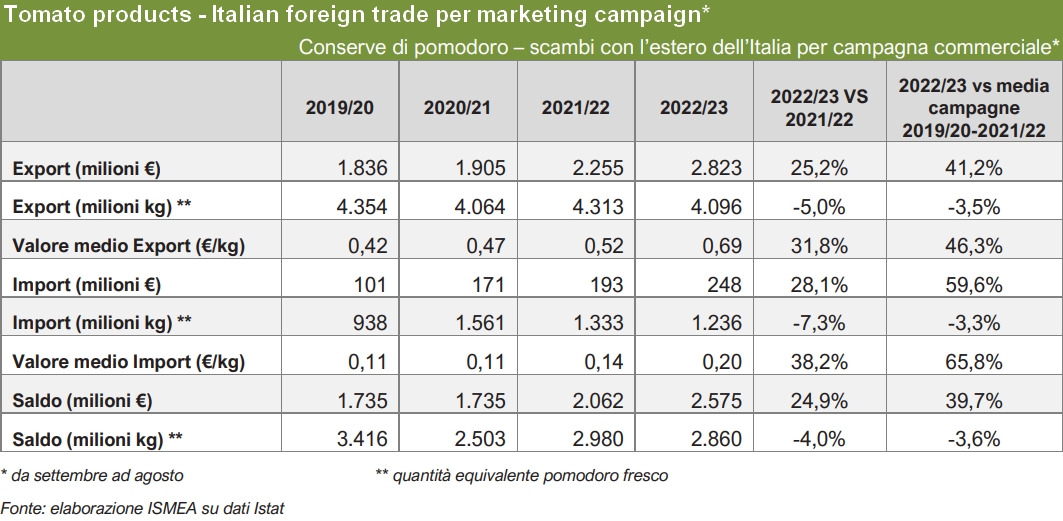

Tomato products are among the fruit and vegetable products that boast the best results in the Italian trade balance. The pattern of foreign trade indicators bears witness to this record. In fact, over the last season – which ran from September 2022 to August 2023 – Italy's balance reached the record figure of EUR 2.5 billion thanks to exports of tomato products amounting to approximately 4.1 million tonnes, a quantity expressed in equivalent weight of raw tomatoes, worth over EUR 2.8 billion.

In particular, the last marketing year was characterized by a notable increase in average prices, which grew by 32% for exported products and 38% for imported ones.

In this regard, it should be noted that Italy imports semi-finished products – mostly tomato paste with over 30% soluble solids content – at an average price of EUR 20 euro per tonne of fresh tomato equivalent and exports finished products (purées, peeled and paste with a soluble solids content of less than 30%) at an average price of EUR 690 per tonne of fresh tomato equivalent.

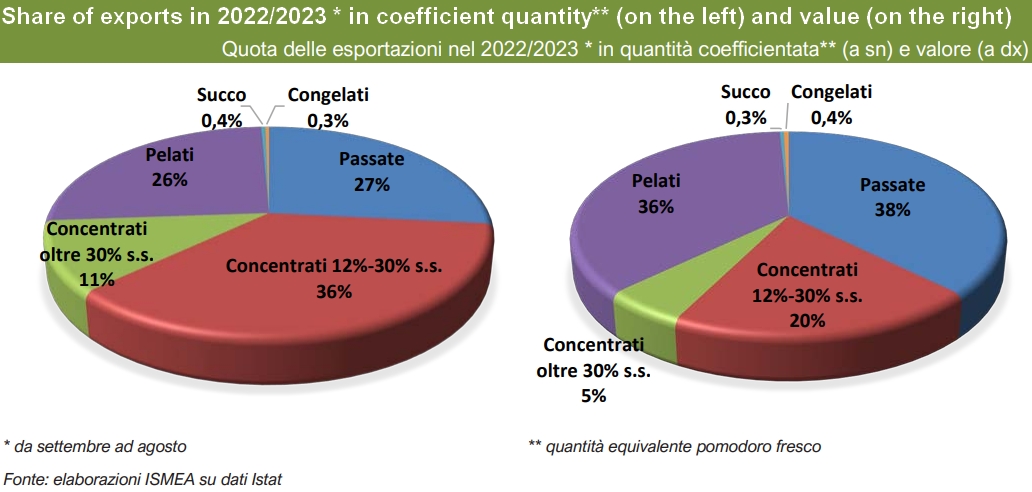

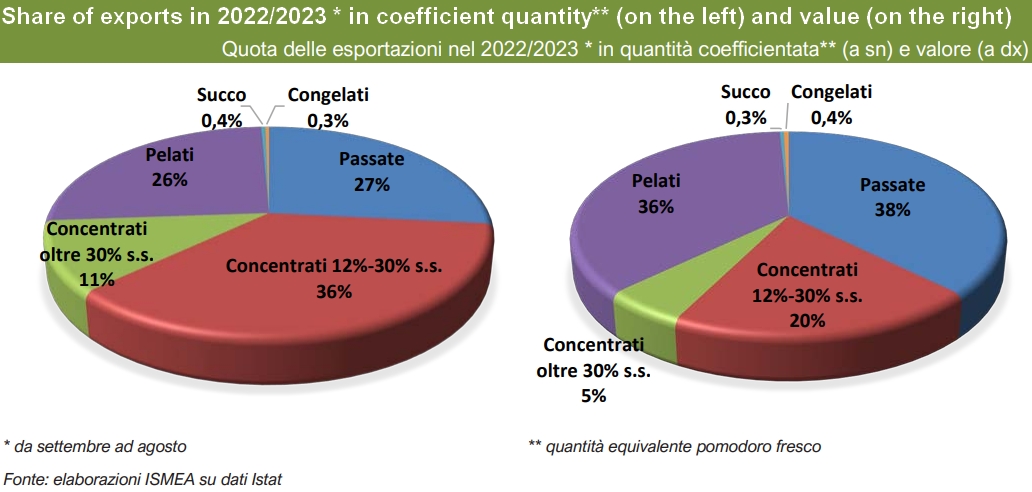

In terms of value, the most exported tomato products are peeled tomatoes and purees which, together, represent around three-quarters of exports. When adding tomato paste (12-30% soluble solids) to these figures, the cumulated share reaches 94%. The list ends with tomato paste with over 30% of soluble solids and a 5% share, followed by a residual amount of less than 1% of the market attributable to tomato juice and frozen foods.

In 2022/23, exports “in coefficient quantities” – i.e., expressed in equivalent weight of raw tomatoes – decreased by approximately 5% on an annual basis. The decline mainly concerned exports of tomato paste with soluble solids between 12 and 30% (-7%), peeled tomatoes (-6% compared to the previous season) and pureed tomatoes (-4%), while shipments of paste with soluble solids over 30% grew by 2%.

Revenue from exported products grew by 25% thanks to the 32% increase in average prices. In particular, income from exports of purees increased (+21%), as well as exports of peeled tomatoes (+27%), tomato paste with 12-30% soluble solids (+27%) and pastes over 30% soluble solids (+37%).

The 2022/23 marketing year recorded positive changes in terms of export value compared to the average results of the three previous years , while shipments were decreasing in terms of volumes.

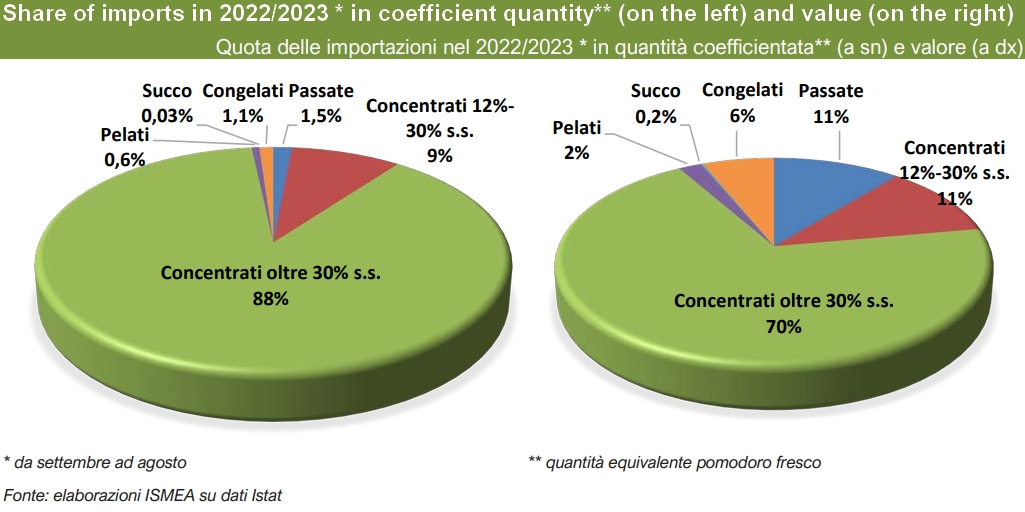

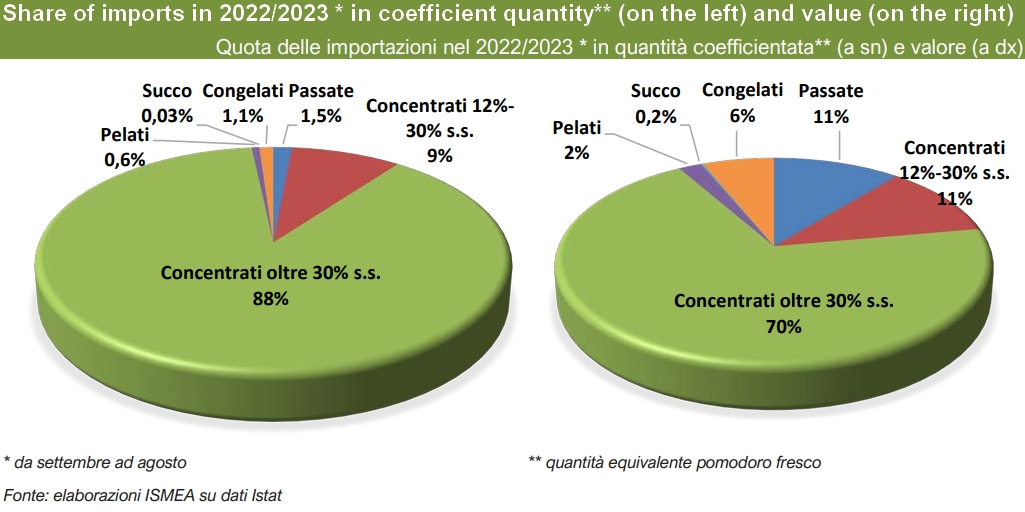

Over the last marketing year, imports of canned products represented expenditure of EUR 248 million and concerned approximately 1.2 million tonnes of product, expressed in fresh tomato equivalent. The largest increase in imports concerned spending on tomato paste with over 30% of soluble solids, which grew by 35%, from EUR 128 to 172 million. Likewise, it is important to note the particularly significant increase recorded by passata, imports of which increased from EUR 15 to 27 million (+82%). On the other hand, expenditure on the supply of tomato paste with a soluble solids content between 12 and 30% dropped by 19% – from EUR 34 to 28 million. Tomato pastes with soluble solids over 30% are the most imported products from Italy and account for 70% of total imports in value and 88% in terms of “coefficient” quantity. Next are tomato pastes with 12-30% soluble solids, with shares of 11% in value and 9% in quantity. Among the other imported products, passata stands out, having reached a value share of 11% during the last marketing year.

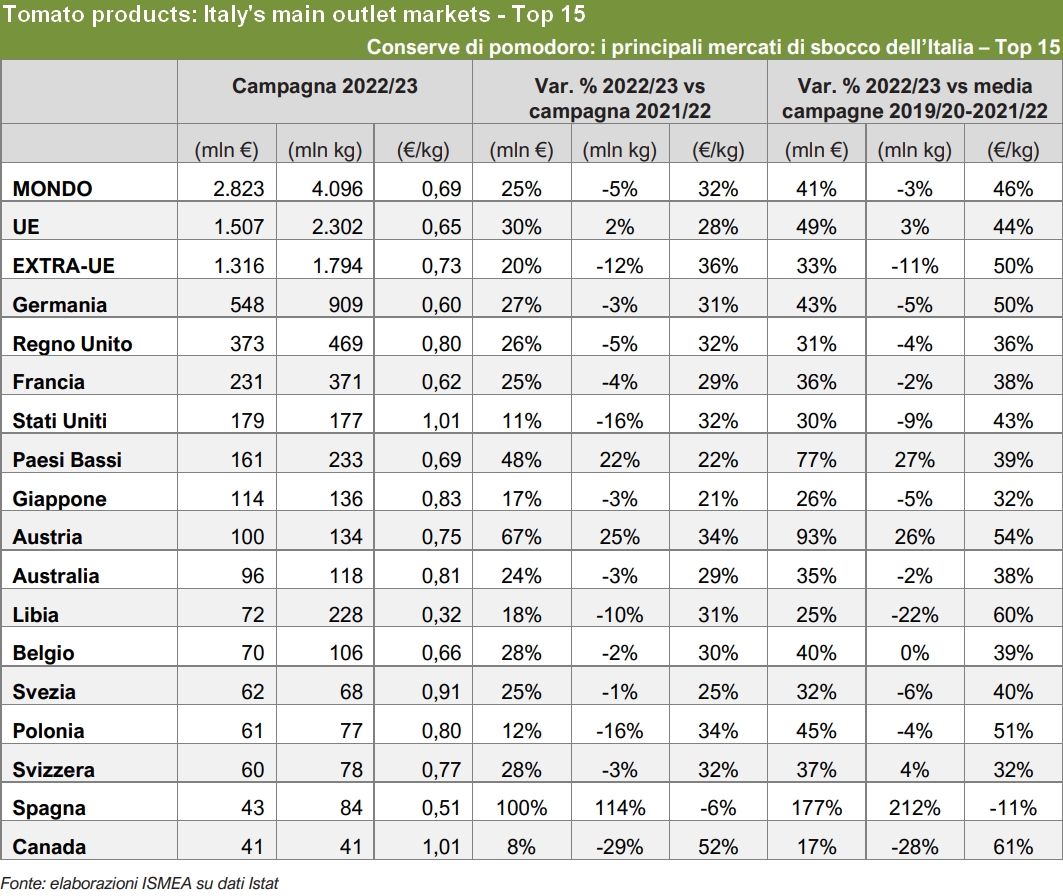

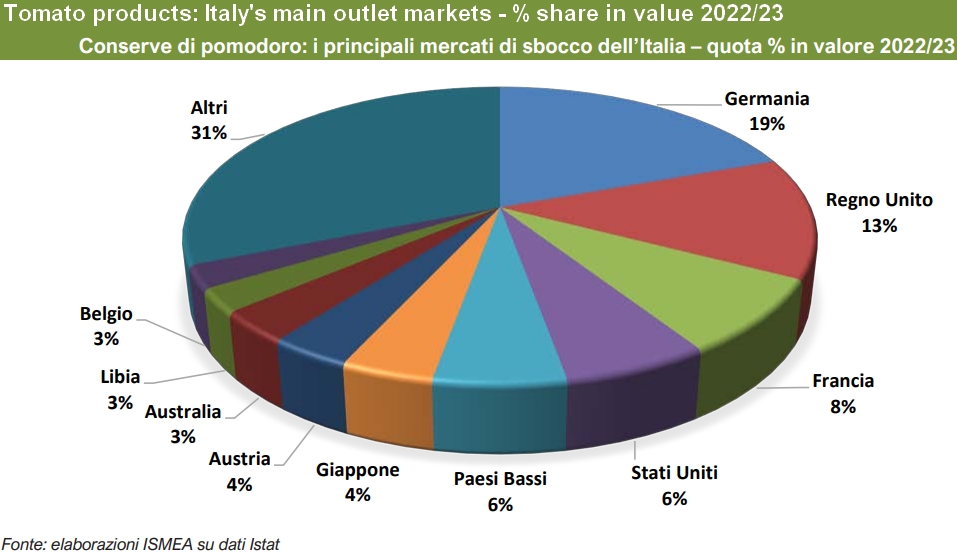

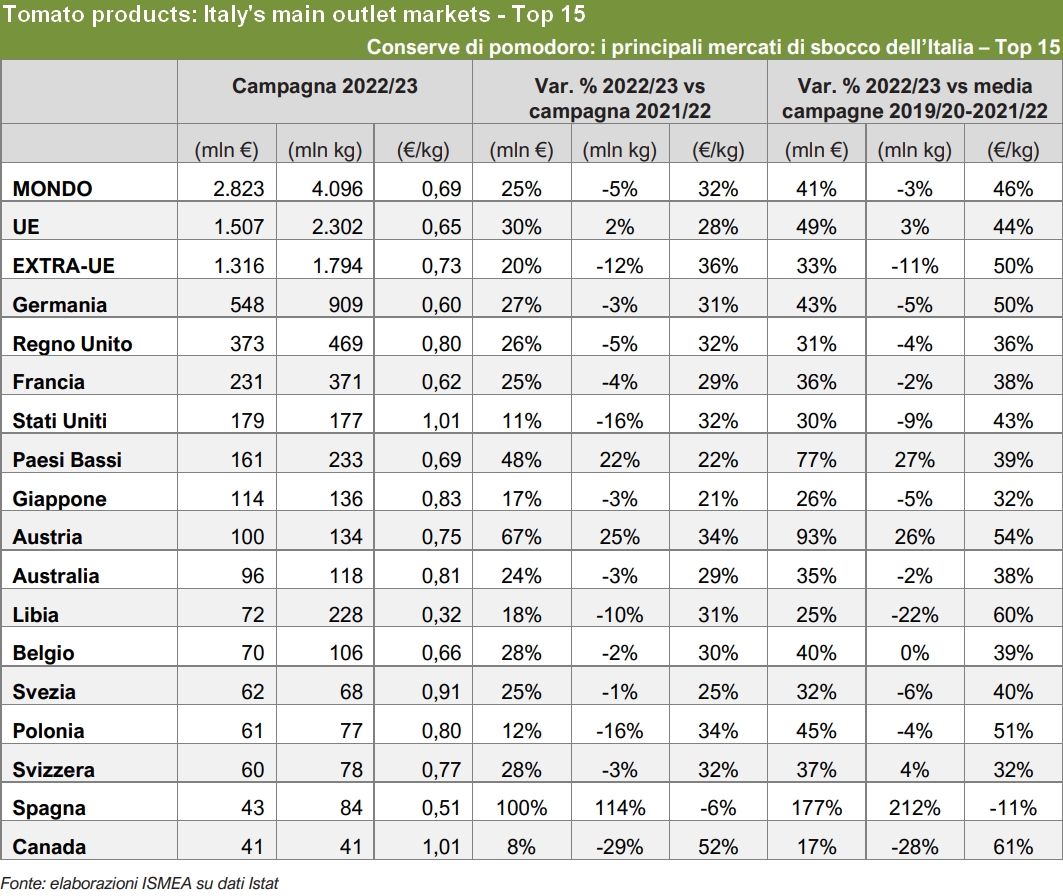

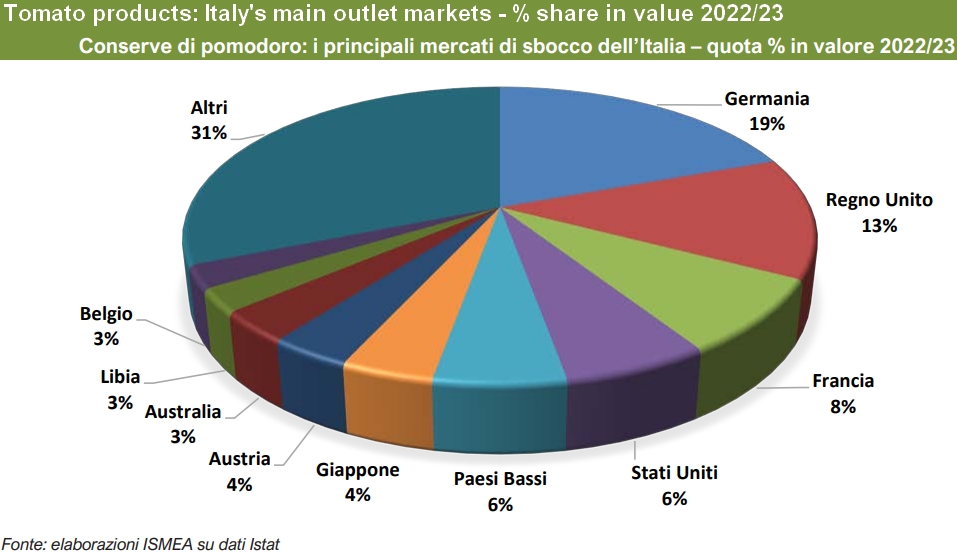

As regards the main outlet markets, 53% of Italian exports of canned tomatoes are destined for the European Union. Overall, there are around 180 countries that purchase these products from Italy even though the top 10 account for 69% of exports. During the 2022/2023 marketing year, Germany confirmed itself as the main customer with a 27% increase in value compared to the previous period. Germany alone accounts for about one fifth of the total revenue generated by Italy's exports of tomato products. The United Kingdom is in second position with an increase in value terms of 26%. Following are France, the USA, Japan and the Netherlands, which maintain their position unchanged compared to the previous exercise. Among the top fifteen outlet markets, the Netherlands, Austria and Spain stand out, increasing imports from Italy both in terms of value and quantity.

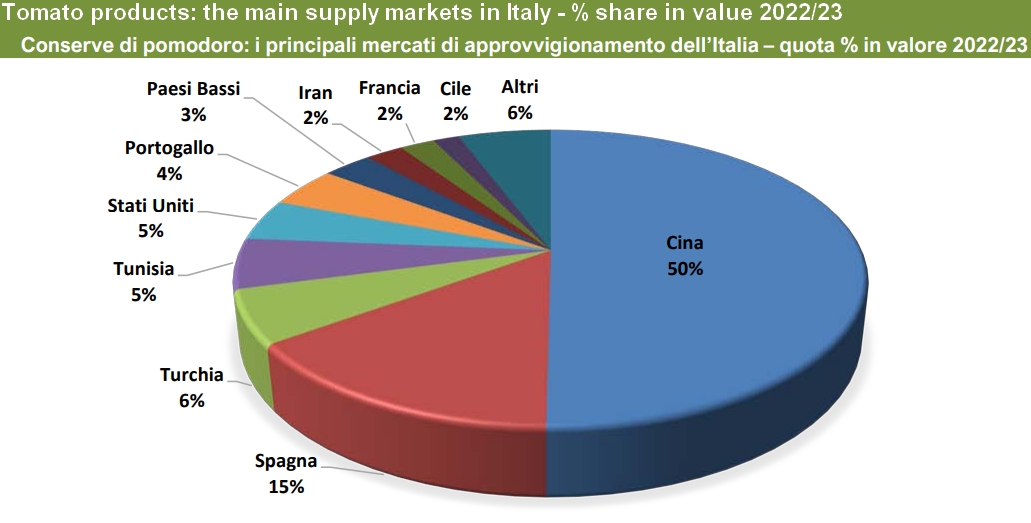

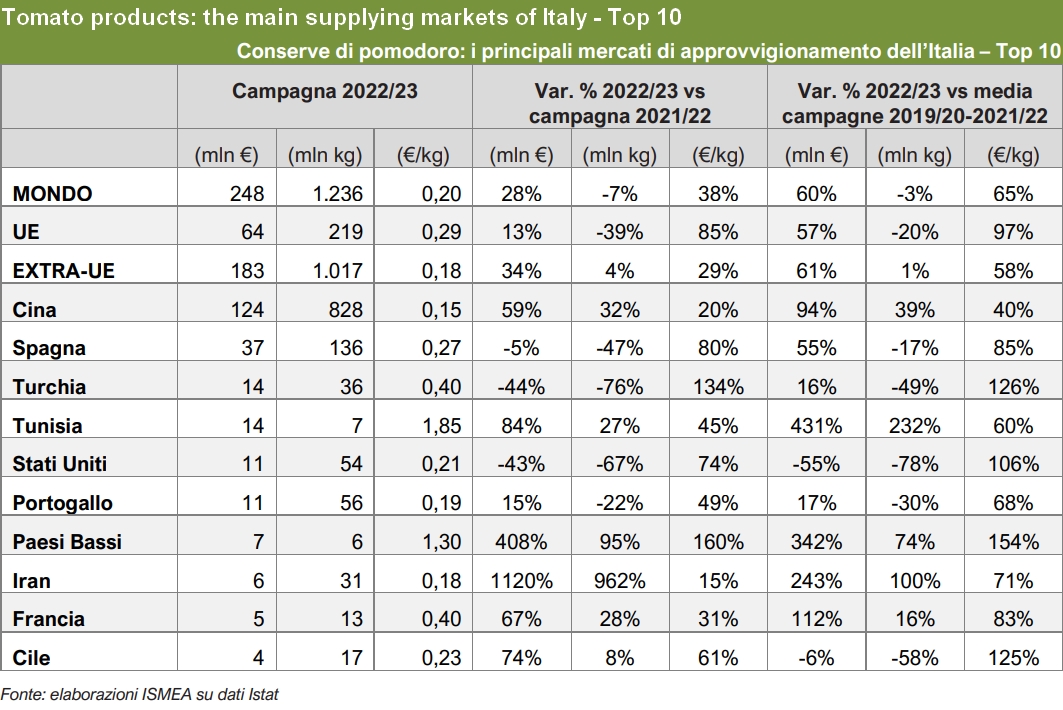

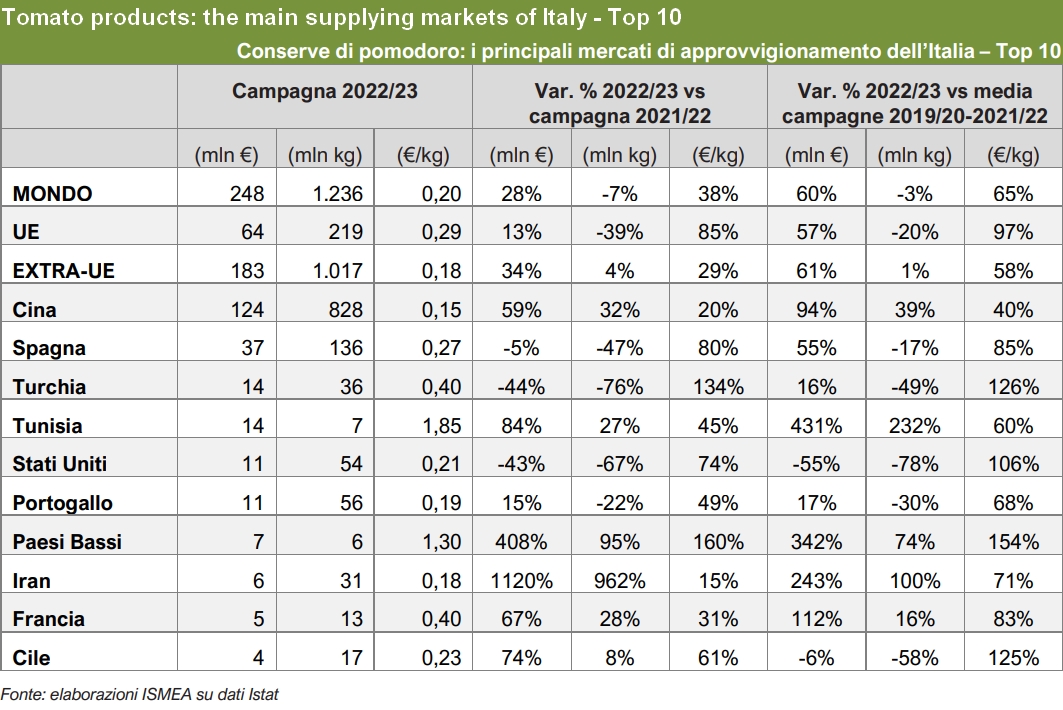

As regards supply markets, Italy's imports originate in just a few countries. The share of non-EU countries is 74%, of which 50% come from China alone. In the 2022/2023 season, the top five suppliers combined 81% of Italy's overall supply, with China and Spain alone covering 65% of imports.

In the last season , supplies from China increased sharply (+32% of imported volumes and +59% of expenditure), as did imports from Iran, which ranked sixth among Italian suppliers, with 31 000 tonnes in terms of quantity (raw tomato equivalent) and an expenditure of approximately EUR 6 million. On the other hand, Italy's imports from Spain, Turkey, the USA and Portugal have significantly reduced.

Final thoughts

The prospects of the sector are inextricably linked to the success of Italian products on foreign markets. In this sense, the increase in the global supply of tomato products should lead to a reduction in the international price of pastes. However, Italy's exports are focused on products with greater added value, such as peeled tomatoes and purees whose global supply is stable and therefore prices should remain at the levels of the last two years. On the domestic front, positive notes are expected from the growth in demand from the catering sector, both due to the increase in the number of meals taken away from home by the resident population and to the increase in international tourism in Italy. On the contrary, retail purchases are expected to remain unchanged compared to the last marketing season.

Sources: ISMEA