Press release

, François-Xavier Branthôme

-

The situation as it stands

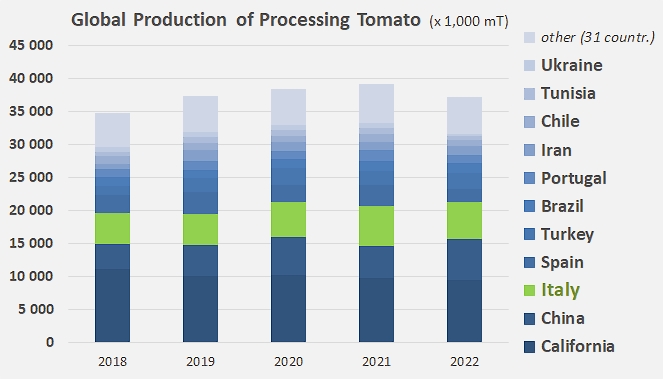

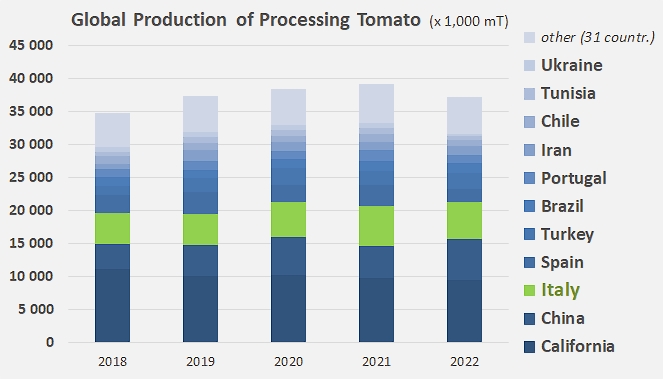

According to a report published last December by ISMEA, Italy is the third largest producer of tomatoes for processing in the world. In 2022, about 5.5 million tonnes of tomatoes were produced and processed in the country, which is about 15% of the world's production and 56% of the European crop.

According to a report published last December by ISMEA, Italy is the third largest producer of tomatoes for processing in the world. In 2022, about 5.5 million tonnes of tomatoes were produced and processed in the country, which is about 15% of the world's production and 56% of the European crop.

The industrial turnover of this sector exceeds EUR 4 billion, of which exports account for 2.2%.

The ISMEA report also confirms that Italy is the leading producer of canned tomatoes destined directly for final consumers and that 60% of Italian processed products are exported.

These items of information highlight Italy's leading role at the global level and therefore the importance of this sector within the national agri-food industry.

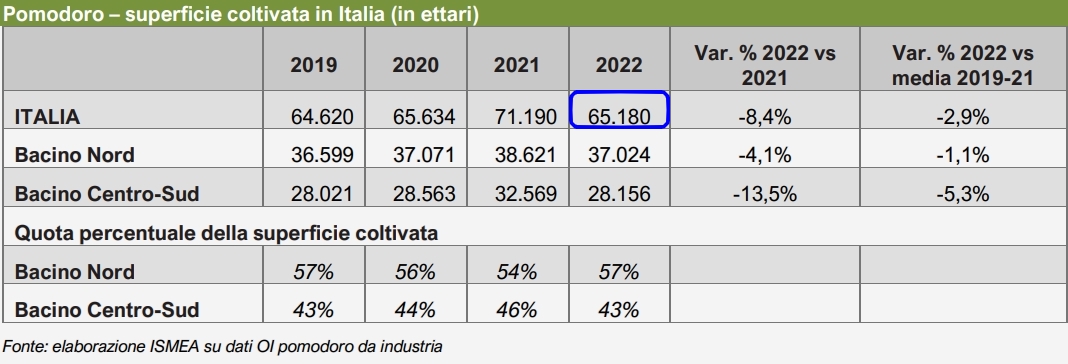

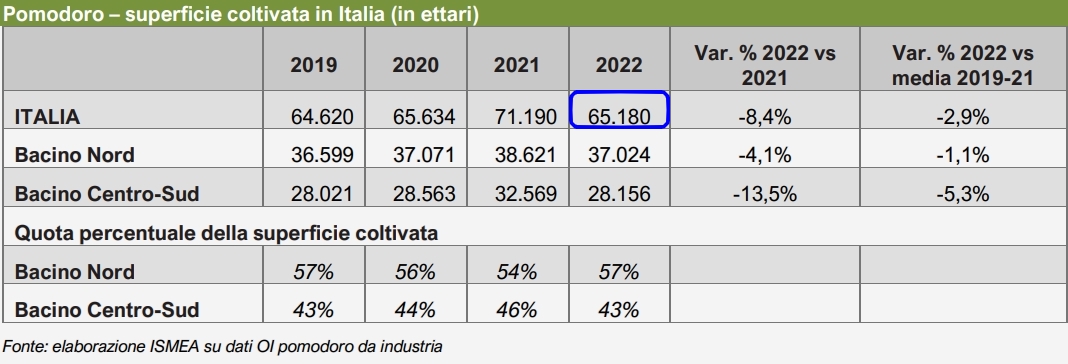

In 2022, in Italy, the surface area planted with tomatoes for processing decreased both compared to 2021 (-8.4%) and compared to the average of the three-year period 2019-2021 (-2.9%). Although this contraction is significant, the figure can nonetheless be considered of little concern as it remains in line with the average surface area dedicated to this crop over the last decade.

In regional terms, the most marked decrease in surface area was recorded in the production region of south-central Italy (-13.5%), while in northern Italy the area planted decreased by 4.1%. The reasons for this contraction in planted areas are diverse and, among the main ones, it is necessary to mention the scarcity of water available for irrigation, competition from alternative crops and the increase in cultivation costs, particularly for energy and especially for fertilizers.

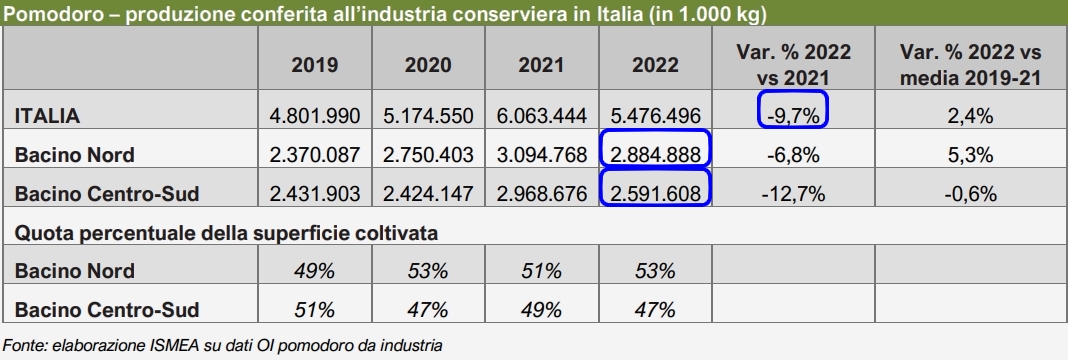

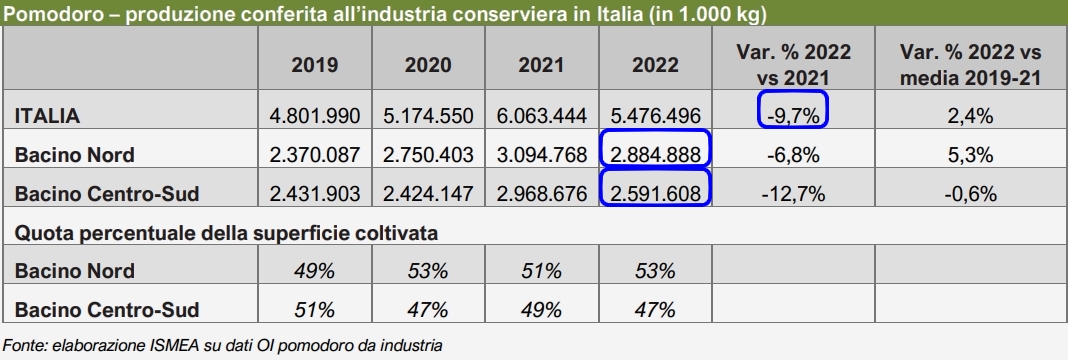

In Italy, the 2022 processing season ended with national production down 9.7% compared to 2021, with 65,180 hectares cultivated. In northern Italy, the quantities of tomatoes delivered to the processing industry amounted to about 2.9 million tonnes, down 6.8% from last year, while in south-central Italy the quantities delivered amounted to about 2.6 million tonnes, down 12.7% from 2021.

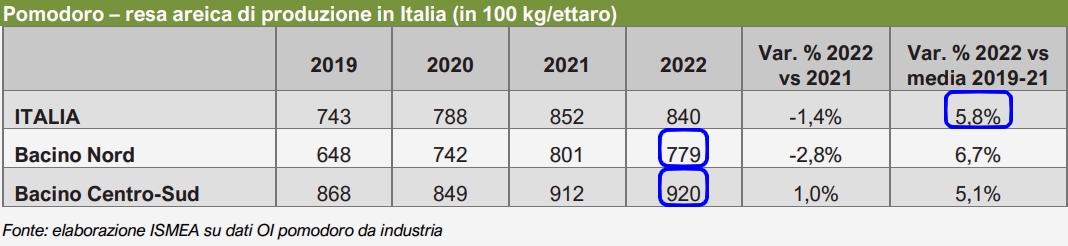

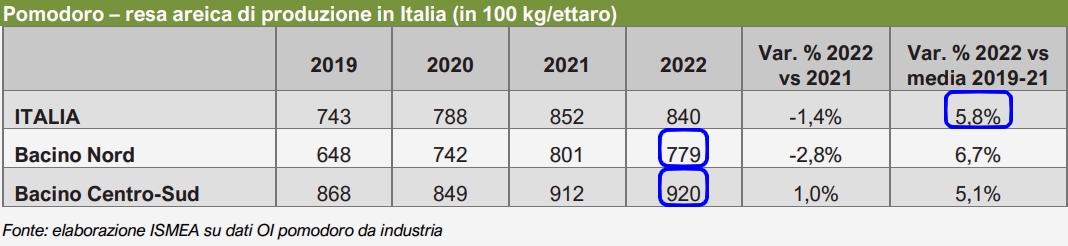

The average national yield in 2022 was 84.0 metric tonnes (mT) of fresh tomatoes per cultivated hectare, marking a slight decrease from the previous year but also a notable increase of 5.8% over the average of the last three seasons. Yields were particularly high in the south-central region, reaching 92.0 mT/ha (+1% y/y): this exceptional result places the 2022 season just behind the 93.4 mT/ha recorded in 2017. In northern Italy, the average yield was 77.9 mT/ha, down 2.8% from 2021 but still above the average of the last three seasons.

The agricultural yield per hectare is always higher in the south-central region than in the northern region, both for pedoclimatic reasons and because the yields of the elongated varieties of tomato, mainly grown in the south-central region, are generally higher than those of the round varieties, which are preferentially chosen in the north.

The raw material market is characterized by prices defined in the framework of interbranch agreements and therefore the price is determined in each of the two production basins, for each of the types of products (round fruit, oblong fruit and cherry tomatoes). However, a comparison of 2022 prices with previous years shows an increase in reference prices.

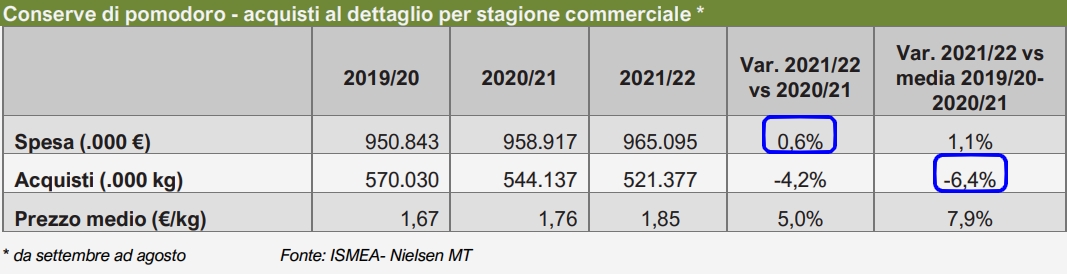

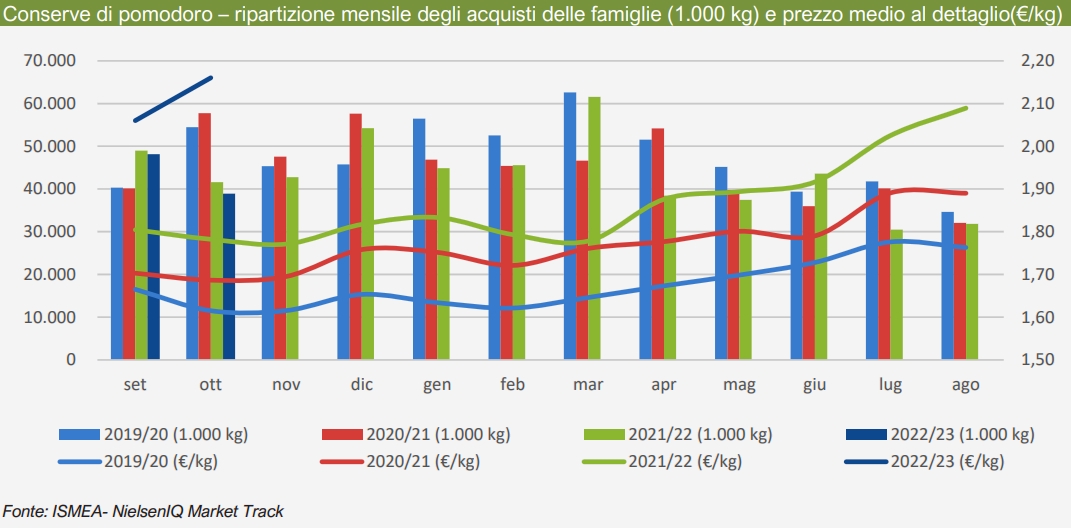

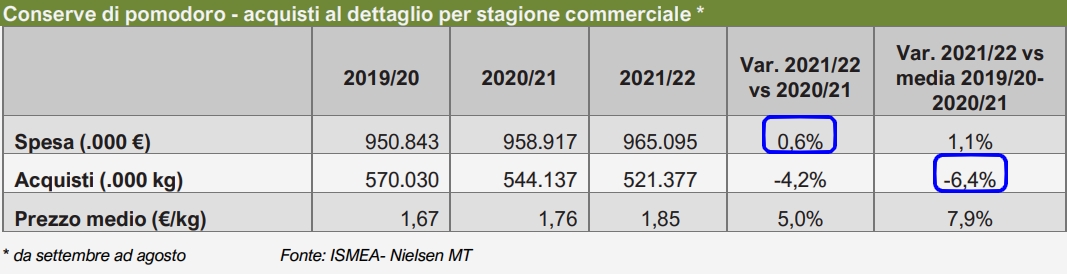

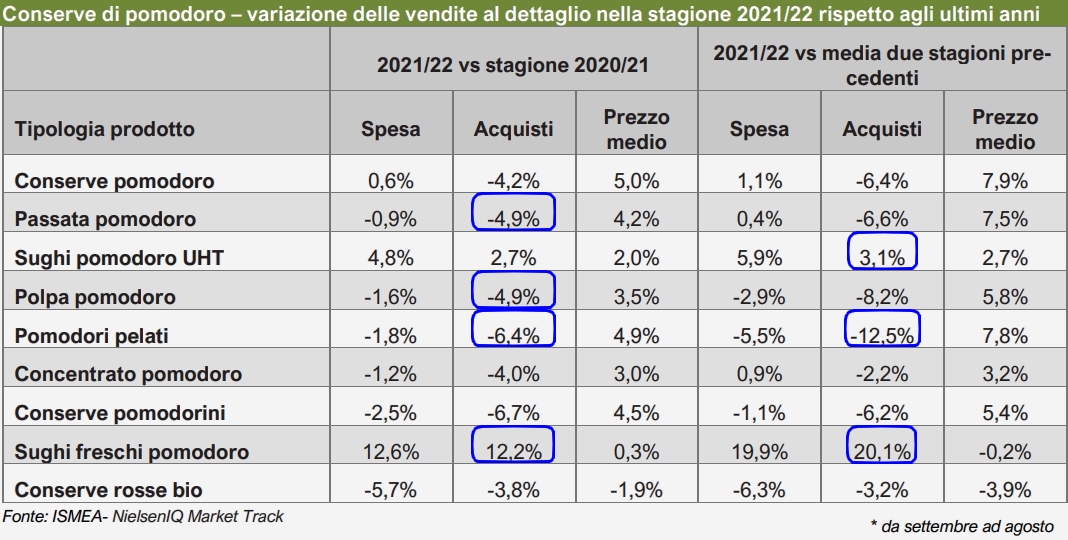

Retail sales

The 2021/22 marketing year was marked by a drop in purchases both compared with 2020/21 (-4.1%) and with the average for the last two years (-6.4%), due in particular to the exceptional level of sales volumes during these periods, linked to the restrictions imposed by the Covid-19 health crisis and the increase in the use of tomato products in the preparation of meals at home. At the same time, the increase in average prices (+5% annualized) led to an increase in expenditure (+0.6%). 2021/22 purchases also recorded a decline from the average purchasing data for the last two marketing years, even though spending increased by 1.1% due to the 7.9% increase in prices.

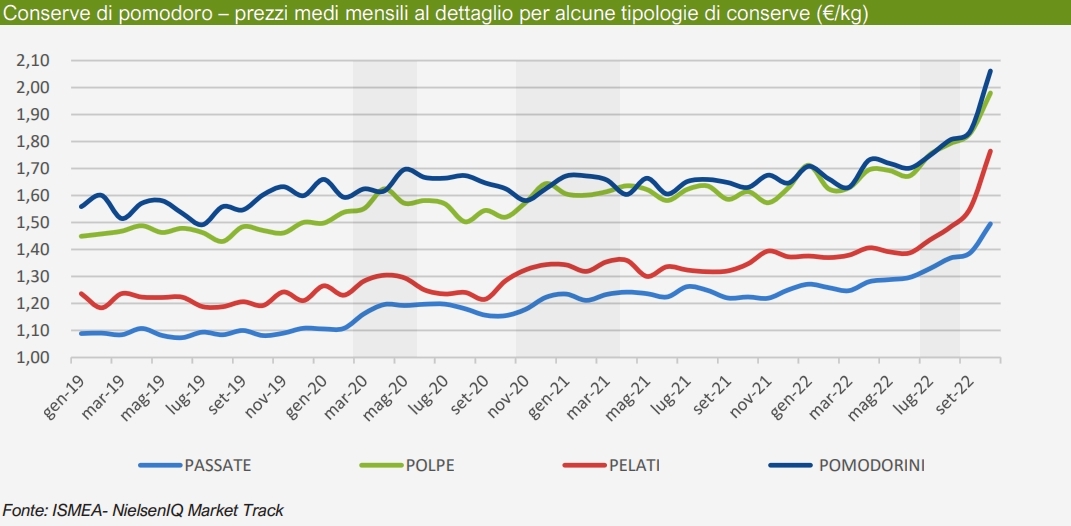

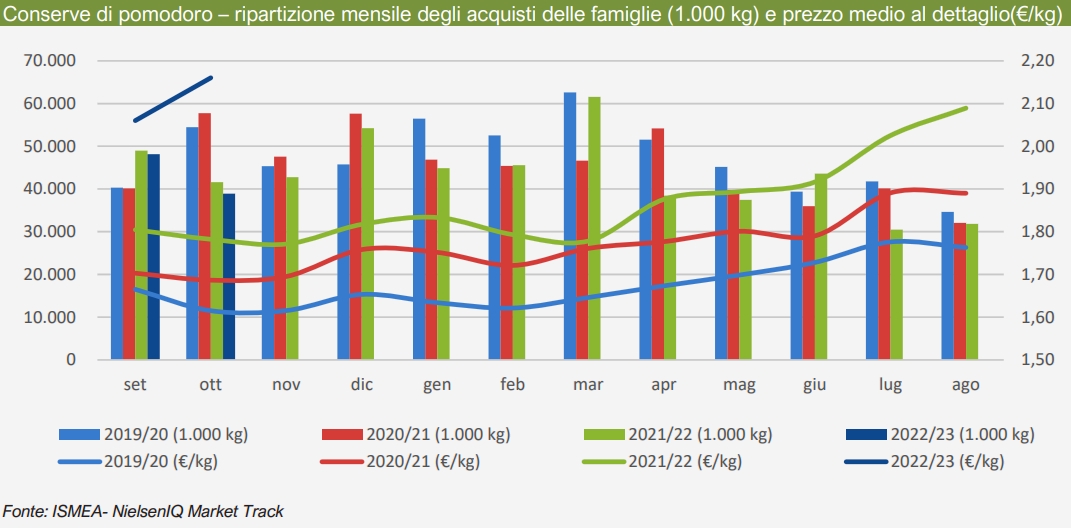

Monthly data regarding the retail sales of canned tomatoes provides a clear picture of the acceleration of average retail prices, which have increased by about 35% over twelve months, from an average of €1.60/kg in 2019 to €2.15/kg in October 2022. The rise in prices was initially driven by the increase in demand due to the pandemic, then by the surge in energy costs that deeply affected all stages of the industry (tomato production, processing and distribution), as well as the triple-digit increase in mineral fertilizer prices that penalized the agricultural upstream. In addition to these increases, the cost of packaging (aluminum, glass, paper and cardboard) has also risen.

The following chart shows the average retail prices of some of the most common canned tomato products: tomato puree, pulp, peeled tomatoes and canned cherry tomatoes. Of particular note is the coincidence of retail price increases with the first pandemic lockdown (March-May 2020), with the second pandemic wave (November 2020-March 2021), and finally, in July 2022, with the sharp rise in energy prices.

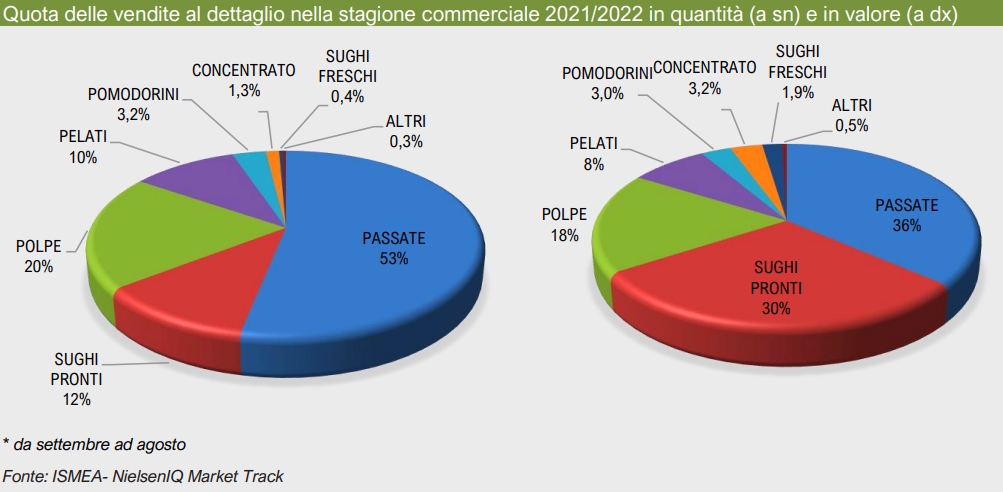

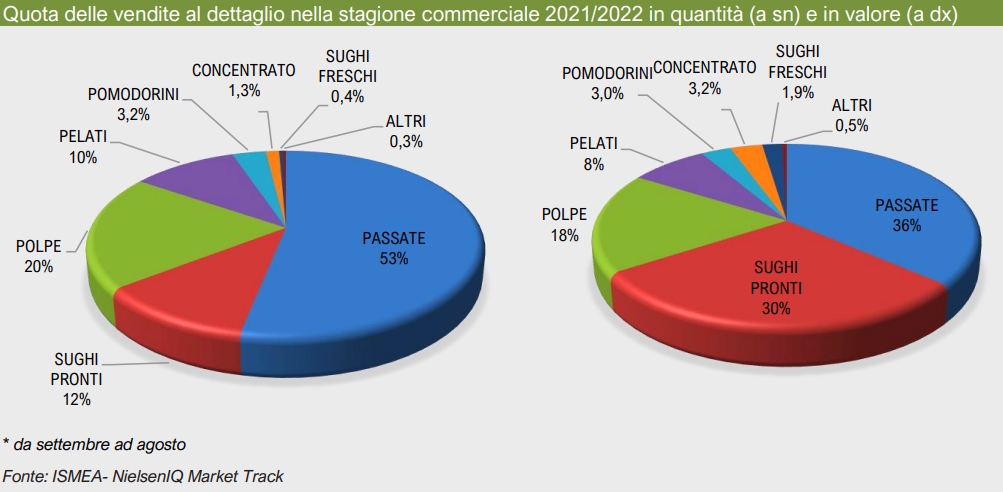

In Italy, the types of canned tomato products that are most frequently purchased in the retail distribution channels are purees and pulps, which account for about three quarters of volumes and 54% of total expenditure. The next most sold products are prepared sauces (12% of volumes and about 30% of expenditure) and peeled tomatoes (10% of purchases and 8% of expenditure). This shopping basket is completed with canned cherry tomatoes, tomato paste and fresh sauces.

The market for canned tomatoes features a basic pattern of gradual reduction in quantities due to the decrease in the number of meals at home, the reduction in time spent preparing meals and the replacement of red condiments by other types of condiments.

The contraction of the quantities sold is counterbalanced by an increase in spending, which is based on two different mechanisms. On the one hand, there is an increase in average prices which affects all tomato product references. On the other hand, a dynamic has been affecting the market for several years now, tending to gradually replace basic products (peeled tomatoes and pulp) in the consumer's basket with products that have a higher service content (ready-to-use purees and sauces).

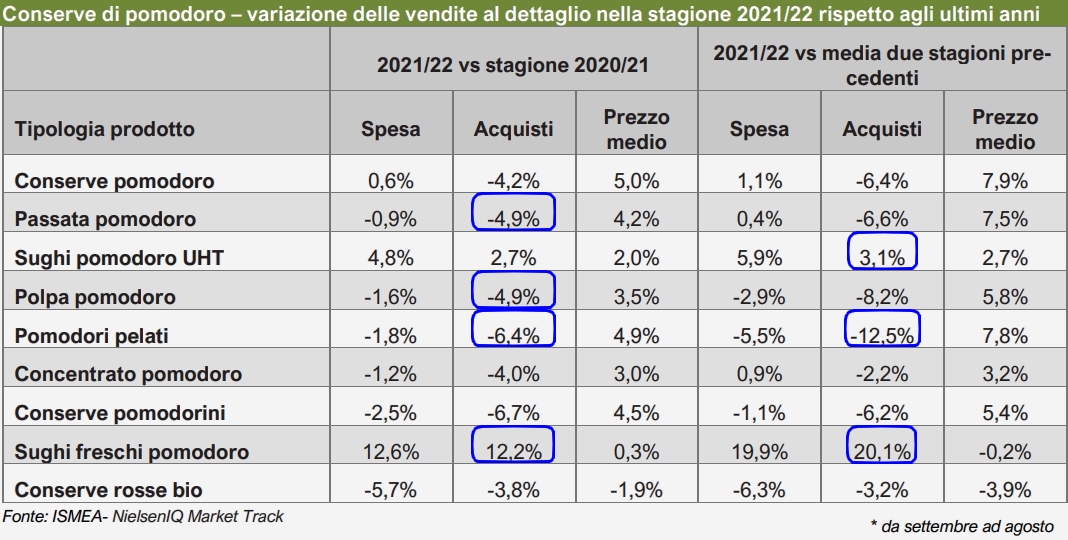

Variations in annual sales recorded for the 2021/2022 marketing year for each product type are summarized in the table below. As the decline affected all the main product references, there was no substantial difference in terms of shares held by the various products compared to previous year records.

On an annual basis, above-average declines were recorded for the two products with the lowest service content, pulps and purees (-4.9% in quantity) and peeled tomatoes (-6.4%).

In the case of ready-to-eat sauces, on the other hand, the key element of success is certainly the service content, a winning principle in a period when many Italians have found themselves eating their two daily meals at home. In 2021/22, ready-made sauces increased their sales by 2.7% (on an annual basis). Fresh sauces, in particular, increased their sales by 12%, a progress worth noting even if this segment still represents only a niche market, with about 2% of total expenditure.

Regarding the average price, the increases have affected all products: purees (+4.2% year-on-year), pulps (+3.5%) and peeled tomatoes (+4.9%), ready-made sauces (+2%).

If, on the other hand, the sales data for the 2021/22 marketing year is compared to the average of the previous two years, it can be seen that the most dynamic products are prepared sauces (+3.1% in quantity), fresh sauces (+20%), while purchases of peeled tomatoes (-12.5% in quantity), pulp (-8%) and tomato puree (-6.6%) have declined.

Certified organic tomato products in cans now represent about 5% of total retail sales in Italy, with the main product categories being purees, pulps, sauces and to a lesser extent peeled tomatoes. This market segment has proven to be very dynamic in recent years. However, the 2021/2022 campaign has been marked by a slowdown in sales. A comparison with the previous business year shows a slowdown in sales (-3.8%) and a slight fall in average prices (-1.9%), for a segment that was unable to keep up the pace of sales recorded during the pandemic.

Italy's foreign trade

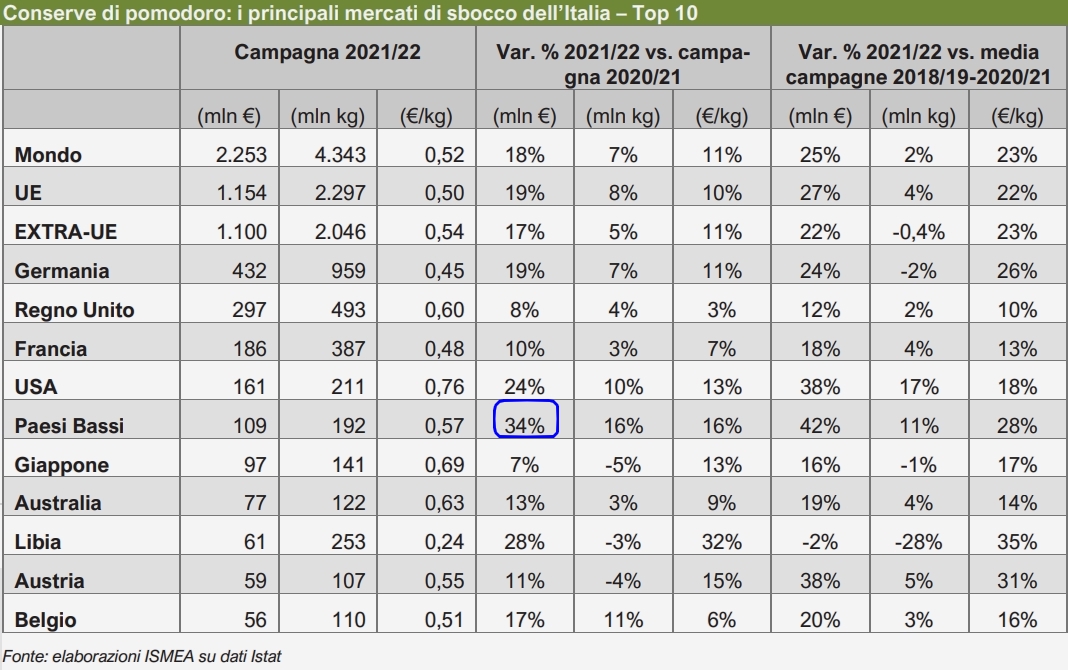

Canned tomatoes are among the fruit and vegetable products with the most stable trade balance of the Italian market. The evolution of foreign trade indicators testifies to this supremacy. In fact, over the last marketing year – between September 2021 and August 2022 – Italy's trade balance exceeded the record figure of EUR 2 billion thanks to exports of more than 4.3 million tonnes, expressed in fresh tomato weight equivalent, for a value of EUR 2.2 billion.

The comparison of annual performances shows that the last marketing year was characterized by a significant increase in average prices, which rose by 32% for imported products and 11% for exported products.

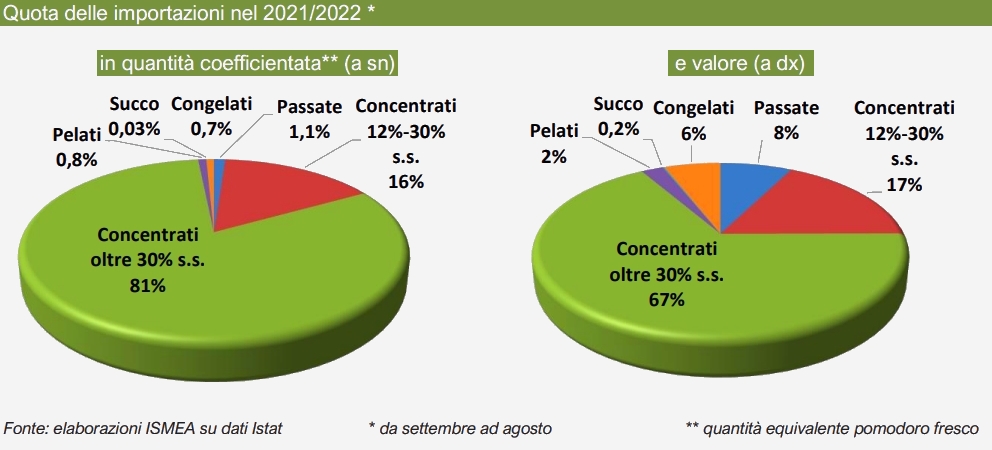

In this regard, it should be noted that Italy imports semi-finished products – mainly tomato paste with more than 30% soluble solids content – at an average price of 14 cents of a euro per kg of raw tomato equivalent, and exports finished products (purees, peels and paste with a soluble solids content of less than 30%) at an average price of 52 cents of a euro per kg of raw tomato equivalent.

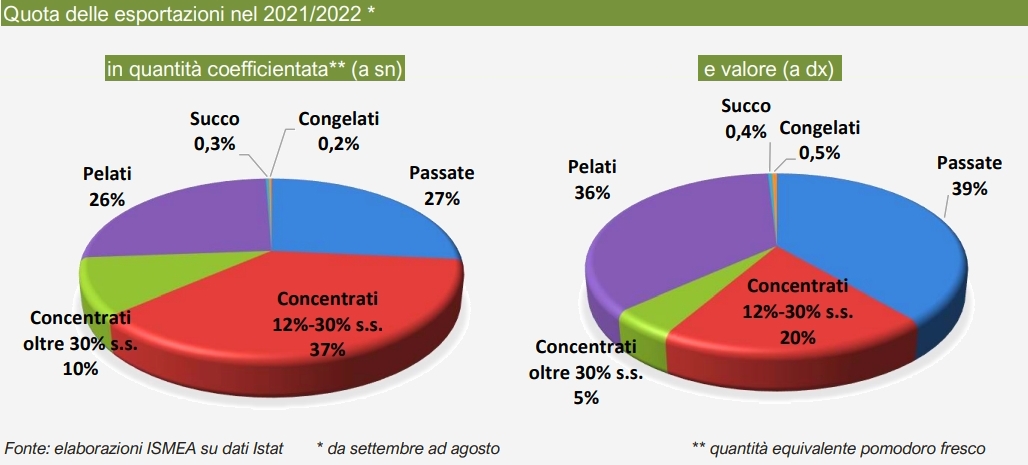

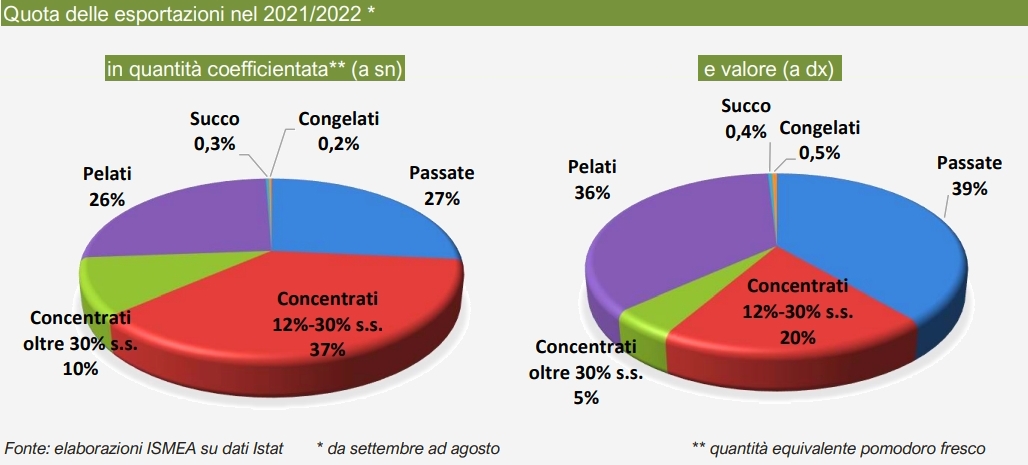

In terms of value, the most exported canned tomato products are peeled tomatoes (36%) and purees (39%), which together account for three quarters of exports. The 20% share of tomato paste (12-30% soluble solids) brings this total to more than 95%, the list being completed by the 5% share of pastes with more than 30% soluble solids and by a marginal quantity of less than 1% attributable to tomato juice.

In 2021/22, exports in weighted quantities – that is, expressed in raw tomato weight equivalent – increased by about 7% compared to the marketing year 2020/2021. This increase is mainly attributable to exports of peeled tomatoes (+7% compared to the previous campaign), paste with soluble solids between 12 and 30% (+8%), purees (+4%), and pastes with more than 30% soluble solids (+10%).

Revenue from exports increased by 18% due to an increase of approximately 11% in average prices. In a detailed breakdown, revenue from exports of purees increased by 14%, peeled tomatoes by 20%, 12-30% pastes by 24% and pastes of more than 30% soluble solids by 22%.

The 2021/22 season was also marked by positive developments compared to the average results recorded over the previous three seasons.

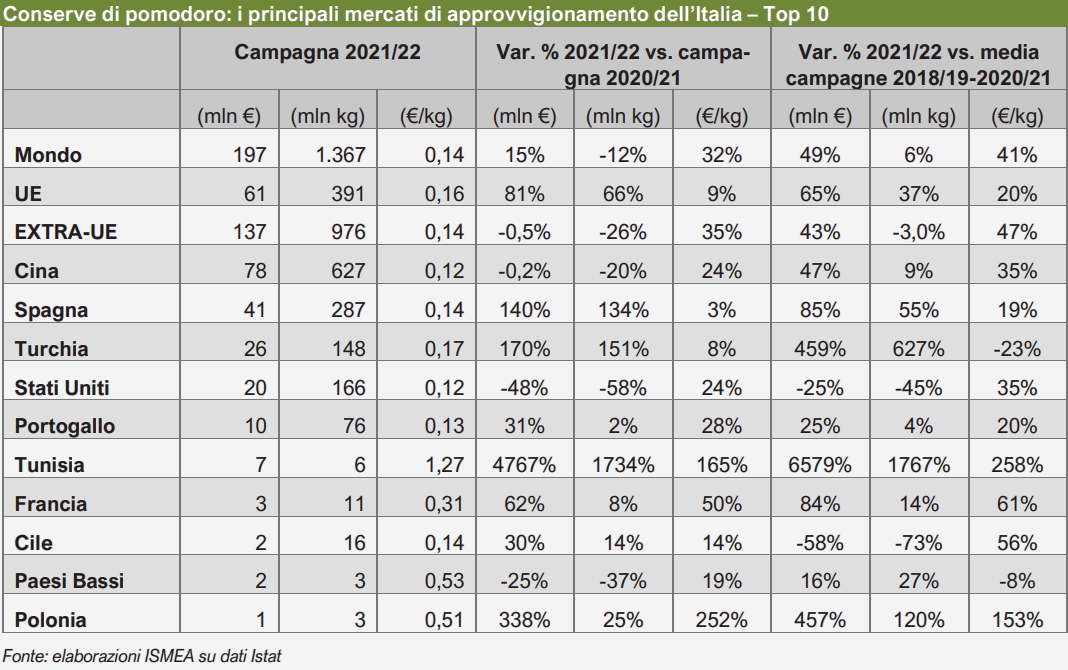

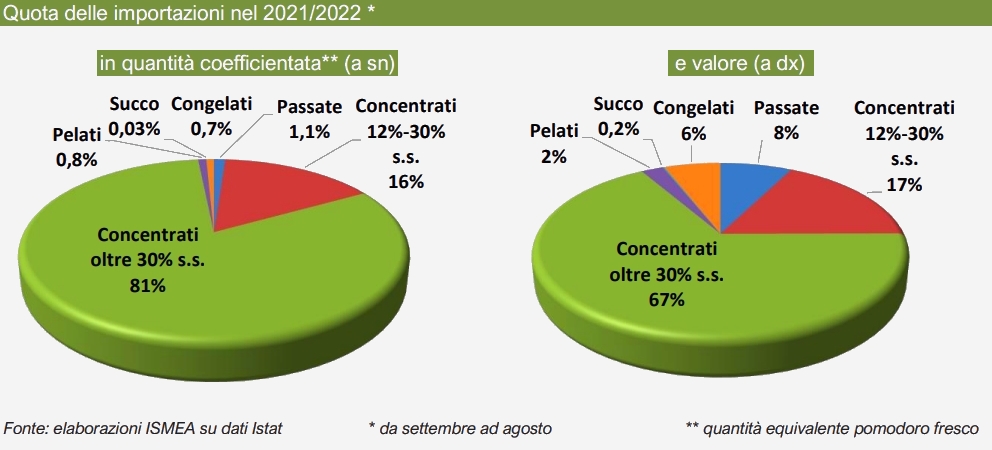

During the last marketing year, imports of canned tomatoes accounted for an expenditure of EUR 197 million, with 1.4 million tonnes of products shipped (raw tomato equivalent). The most notable increase in imports is the expenditure on tomato pastes of more than 30% soluble solids, which increased by 21% from EUR 109 million to 132 million, while expenditure on the supply of pastes with a soluble solids content between 12 and 30% decreased by 19% from EUR 43 million to 34 million. Similarly, the increase recorded by the passata category is also significant, with imports that increased by 19% from EUR 12 to 15 million. Pastes of more than 30% soluble solids content are the most imported tomato product items in Italy and account for 67% of total imports in terms of value and 82% in terms of weighted volume. These products are followed by pastes with a soluble solids content of 12-30%, with shares of 17% in value and 16% in volume. Among the other imported products, it is necessary to mention purees which, during the last marketing year, reached an 8% share in terms of value.

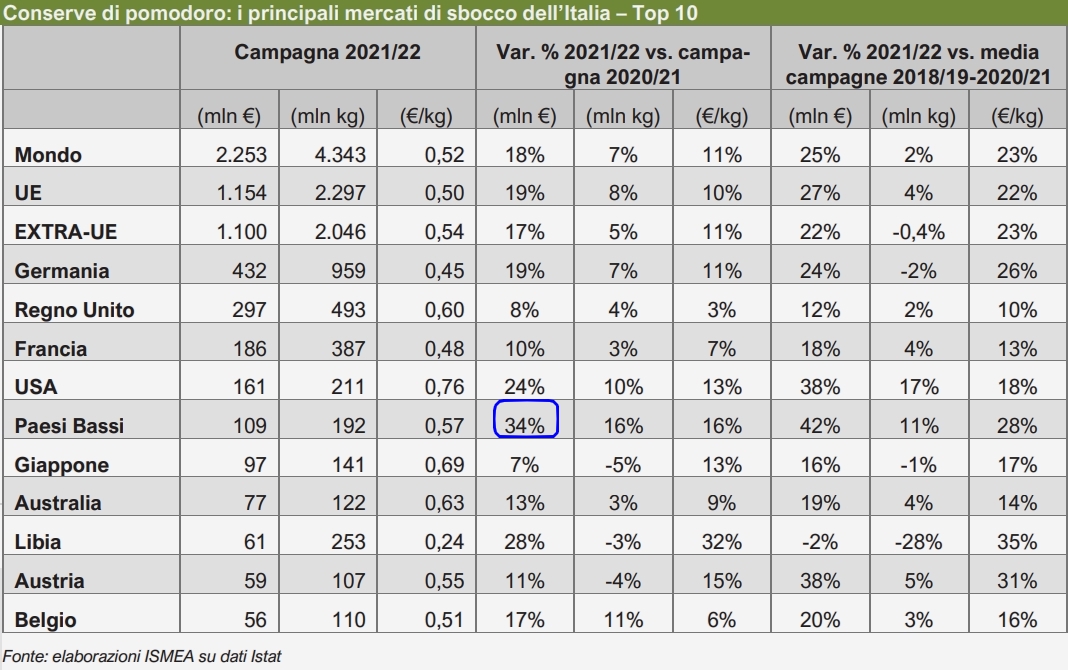

Regarding the main exit markets, 50% of Italian exports of canned tomatoes are shipped to the European Union, but in total about 180 countries buy these products from Italy. Over the latest marketing year (2021/2022), Germany confirmed its position as the leading buyer with a 19% increase in value compared to the previous period. Germany alone accounts for about one-fifth of total export revenue. The United Kingdom ranks in second place, with an increase of 4% in terms of quantities imported and 8% in terms of value. France and the United States maintain their positions in third and fourth place respectively, while the Netherlands are in fifth place with an increase of 34% in the value of their imports from Italy. Among the other countries, note should be taken of the progress of Libya from tenth to eighth place in the Top 10 thanks to a 28% increase in spending on imports of tomato products from Italy.

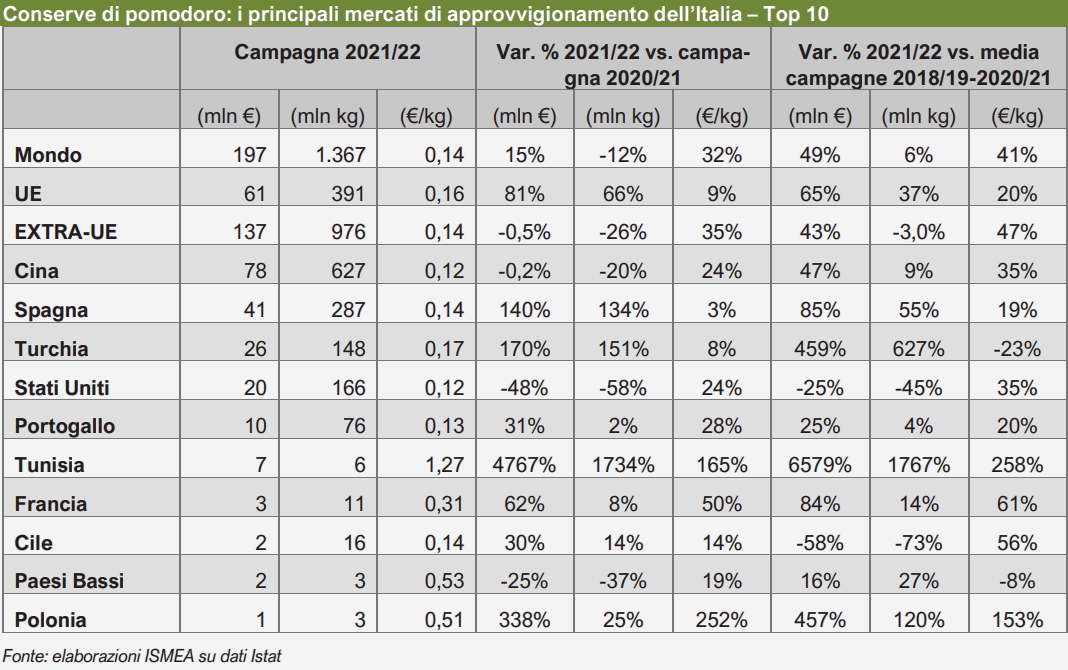

As for Italy's supplier countries, non-EU countries account for a 69% share, including 40% from China alone. The source countries of Italian imports only make up a small group. During the 2021/2022 season, the top five suppliers accounted for 90% of Italy's overall supply, with China and Spain alone covering 61% of these imports.

During the last season, the quantities supplied by the two main supplier markets decreased significantly: volumes from China decreased by 20% and those from the United States by 58%. On the other hand, supplies from Spain (+140%) and Turkey (+150) progressed considerably, taking second and third place, respectively.

Final considerations

Once the processing season is over, the main concerns for the 2022/23 marketing year are the impact on retail prices of rising energy and raw material costs, and the inflationary wave that has hit European households.

It is important to emphasize that the prospects of the sector are inextricably linked to the success of canned tomatoes on foreign markets and, in this sense, the news of reduced transportation costs provides a degree of optimism for trade in the coming months.

Some complementary information

The full ISMEA report published in December 2022 is available by clicking here

Sources: ismeamercati.it, corriereortofrutticolo.it

According to a report published last December by ISMEA, Italy is the third largest producer of tomatoes for processing in the world. In 2022, about 5.5 million tonnes of tomatoes were produced and processed in the country, which is about 15% of the world's production and 56% of the European crop.

According to a report published last December by ISMEA, Italy is the third largest producer of tomatoes for processing in the world. In 2022, about 5.5 million tonnes of tomatoes were produced and processed in the country, which is about 15% of the world's production and 56% of the European crop.