Ismea 2021 Report

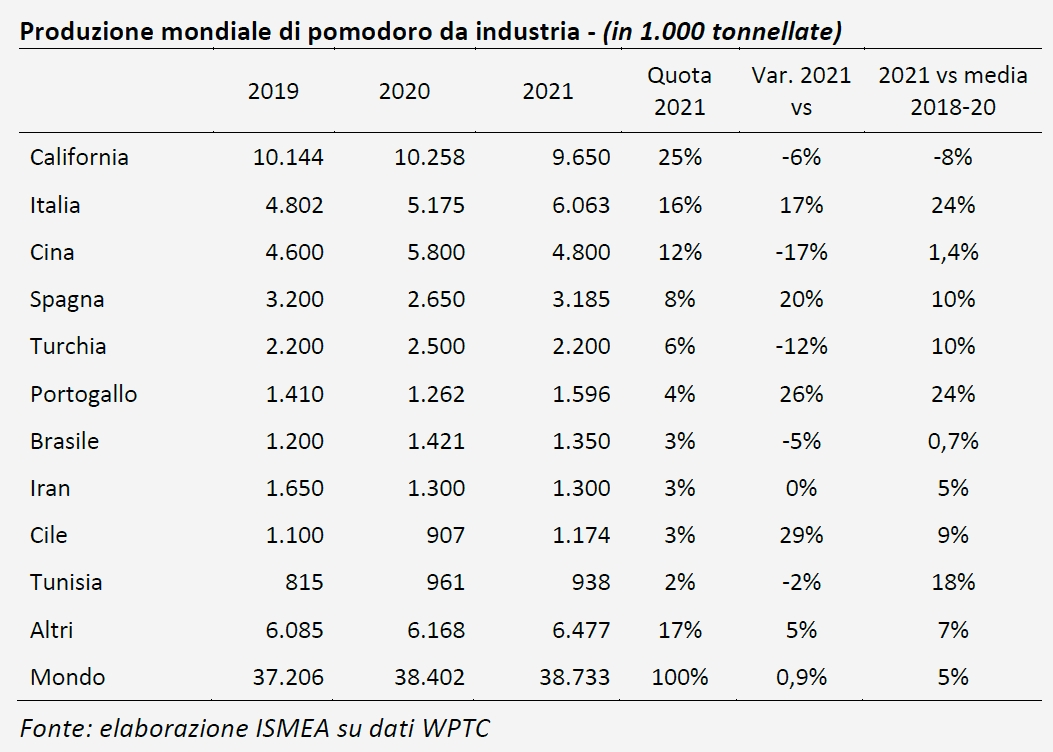

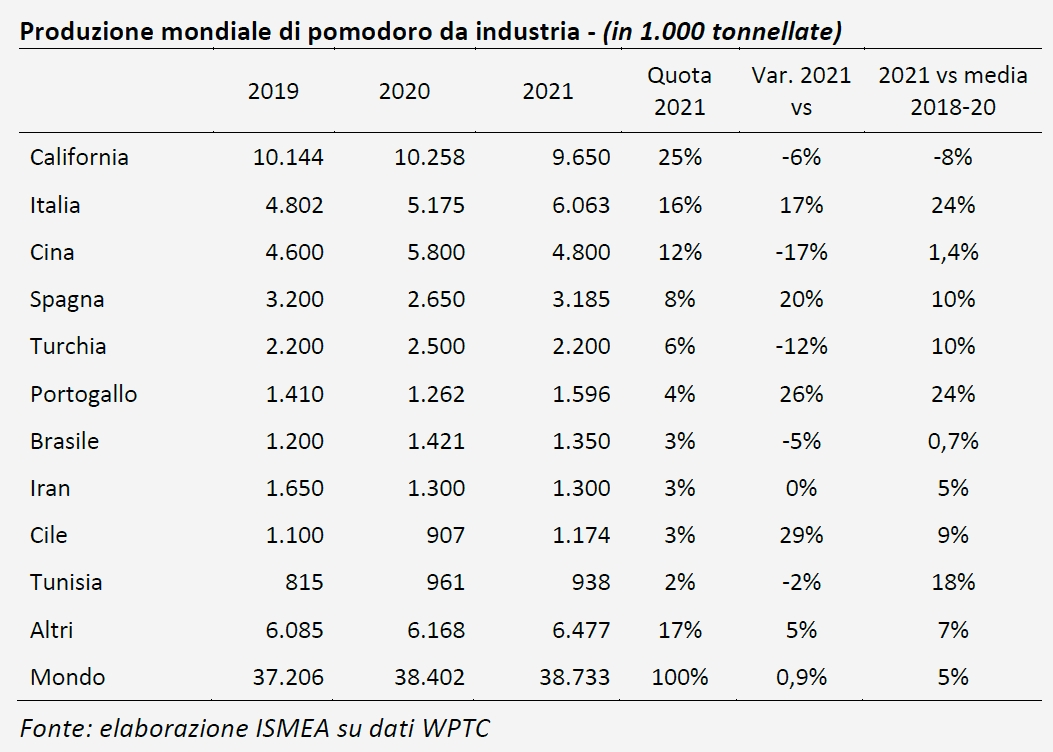

Italy is the second largest producer of fresh tomatoes for processing in the world. In 2021, more than six million tonnes of tomatoes were grown and processed, accounting for 16% of the world's production and 52% of European production.

Italy is the second largest producer of fresh tomatoes for processing in the world. In 2021, more than six million tonnes of tomatoes were grown and processed, accounting for 16% of the world's production and 52% of European production.

The industrial turnover of the sector amounts to about EUR 3.7 billion, of which exports account for EUR 1.9 billion. 60% of the quantities processed in Italy are produced for export. Italy has also confirmed its position as the world's leading producer of tomato products intended directly for end-consumers.

This is some of the data that highlights Italy's leading role in the world and therefore the importance of this sector for the national food industry sector.

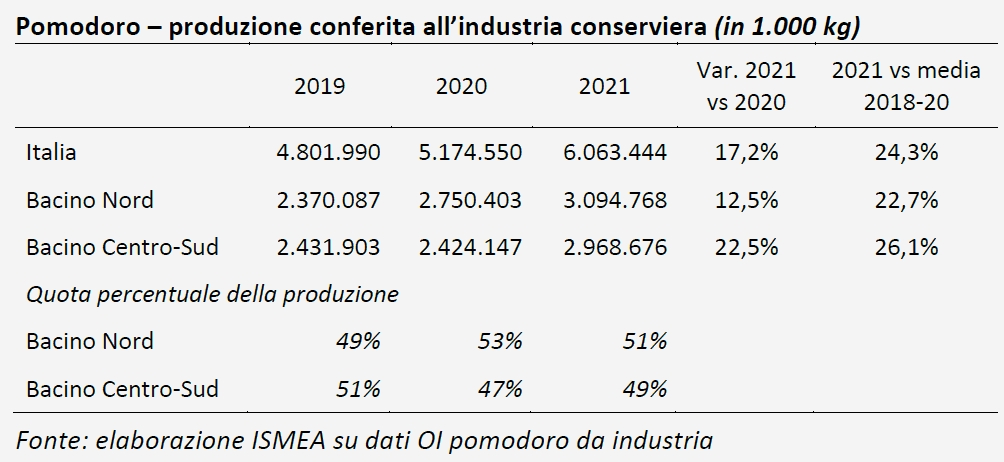

In 2021, in Italy, according to data published by the Processing Tomato Interbranch Organizations, in particular the organizations representing the northern region and the south-central region, 6,063,000 metric tonnes (mT) of fresh tomatoes were delivered to processors, a quantity that is 17% higher than in 2020. In an international context that is stable in terms of supply, this data reinforces Italy's position as a world leader in the production of tomato products intended directly for end-consumers.

This increase in the volumes harvested in 2021 in Italy is linked to the fact that wider surface areas were planted with tomatoes for processing, and the average yield also increased. In the two main cultivation areas (the northern region and the south-central basin), the 2021 season was very satisfactory, both in terms of the quantities harvested and of the excellent quality of fresh tomatoes, resulting in equally satisfactory industrial yields.

This increase in agricultural production has been welcomed by the food sector because it has helped to replenish stocks that were totally depleted by the Covid 19 health crisis. In fact, industry experts are unanimous in stressing the importance of a positive season like 2021, after two difficult campaigns characterized by a shortage of raw materials and a sudden acceleration in the consumption of tomato products triggered by the months of home confinement and anti-Covid restriction measures.

However, the 2021 season has not been easy and several events disrupted its progress. In mid-July, floods and hail caused damage to crops and developing fruit. These unusual adverse weather episodes were followed by very high temperatures in the last ten days of July and early August, which caused further damage. During the harvest, logistical problems due to the road transport crisis were added to weather-related issues, slowing down and hindering the shipping of fresh product to the processing sites, sometimes located several hundred kilometers away.

The agricultural sector

In 2021, the level of world supply increased by 1% compared to the previous season, mainly due to the recovery of Italian production, but also to that of Spain and Portugal, which offset the declines recorded by China, California and Turkey.

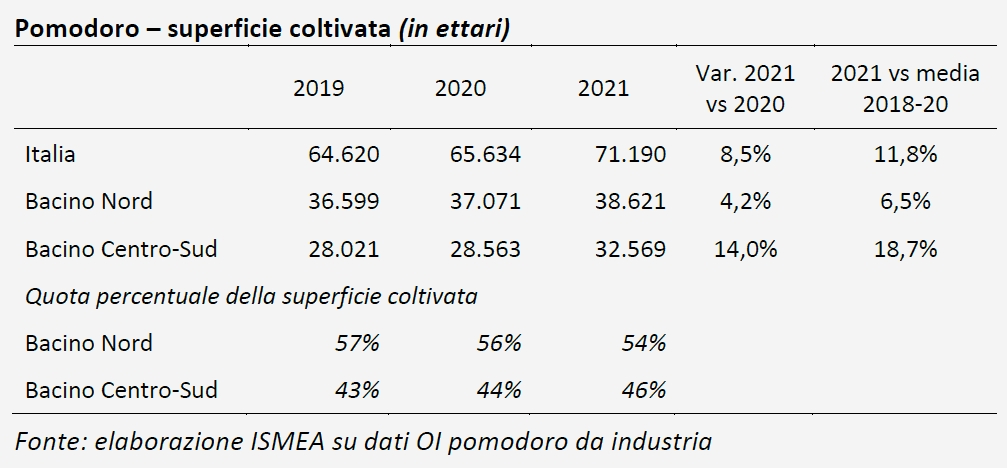

At the national level, the surface areas dedicated to processing tomatoes in 2021 increased by 8.5% compared to those of the previous campaign but also by 12% compared to the average of the previous three seasons (2018-2020). Over the last ten years, only the surfaces planted in 2015 were greater than those of 2021. In detail, the surface areas planted with processing tomatoes increased by 4.2% compared to 2020 in northern Italy, while they increased by 14% compared to 2020 and by 19% compared to the average of the 2018-2020 period in south-central Italy.

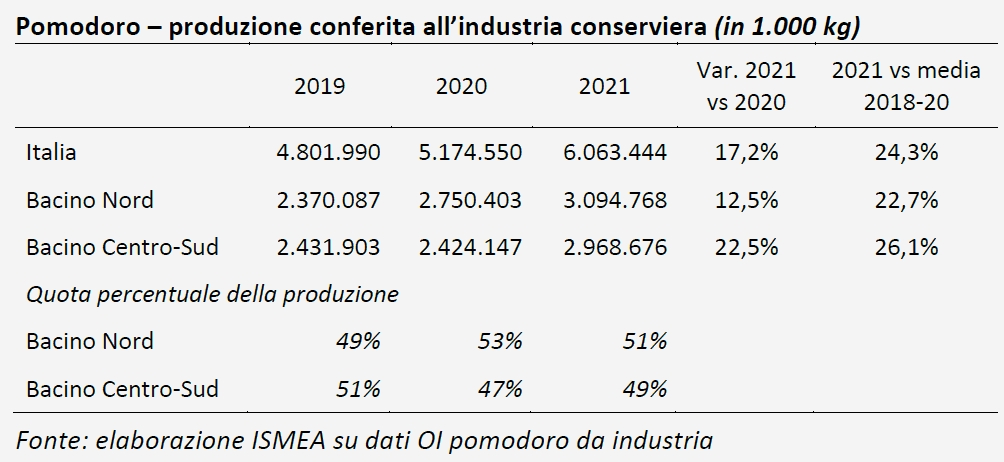

The Italian processing season ended with an overall production increase of 17% compared to 2020, for a planted area of 71,190 hectares, up 8%. Approximately 3.1 million tonnes of tomatoes were delivered to processing facilities in northern Italy, up 12.5% from the previous year. In south-central Italy, approximately 3 million tonnes were delivered to processors, up 22.5% from 2020.

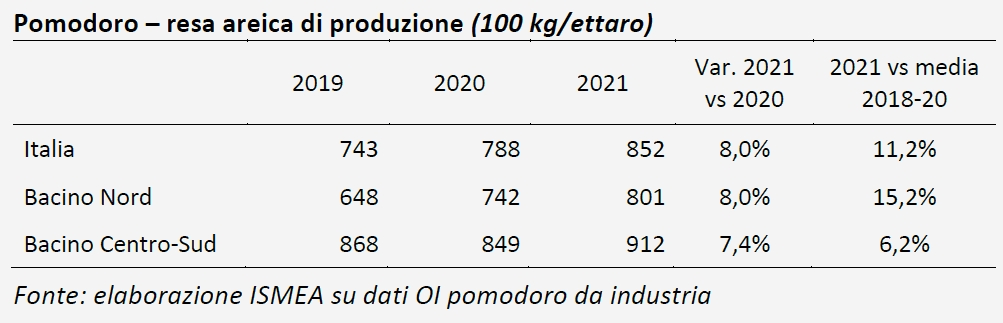

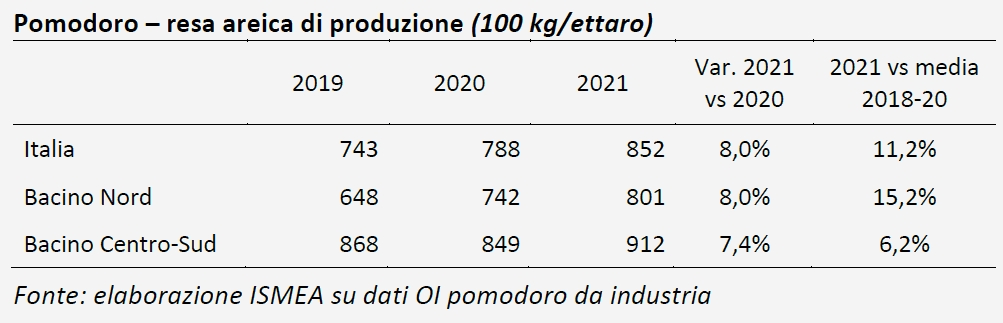

In 2021, the average yield for Italy was 85 metric tonnes of tomatoes per hectare, up 8% from 2020 but also up 11% from the average of the previous three years. Yields were particularly high, both in the north, which broke a new record at 80 mT/ha, and in the south-central basin, where the threshold of 91 mT/ha was exceeded, a result that represents the second-best performance of the last ten years, just behind the 93.4 mT/ha recorded in 2017. Yields are always higher in the south-central region than in the north, for pedoclimatic and varietal reasons (oblong tomatoes are mostly grown in the south-central region, while round varieties are grown more in the north).

The Italian raw materials market is characterized by prices defined in the context of interbranch agreements and therefore the price is determined in each of the two cultivation areas, for each of the product types (round fruit, oblong fruit and cherry tomatoes). A comparison of 2021 prices with those of previous years shows a substantial stability in reference prices.

Retail sales

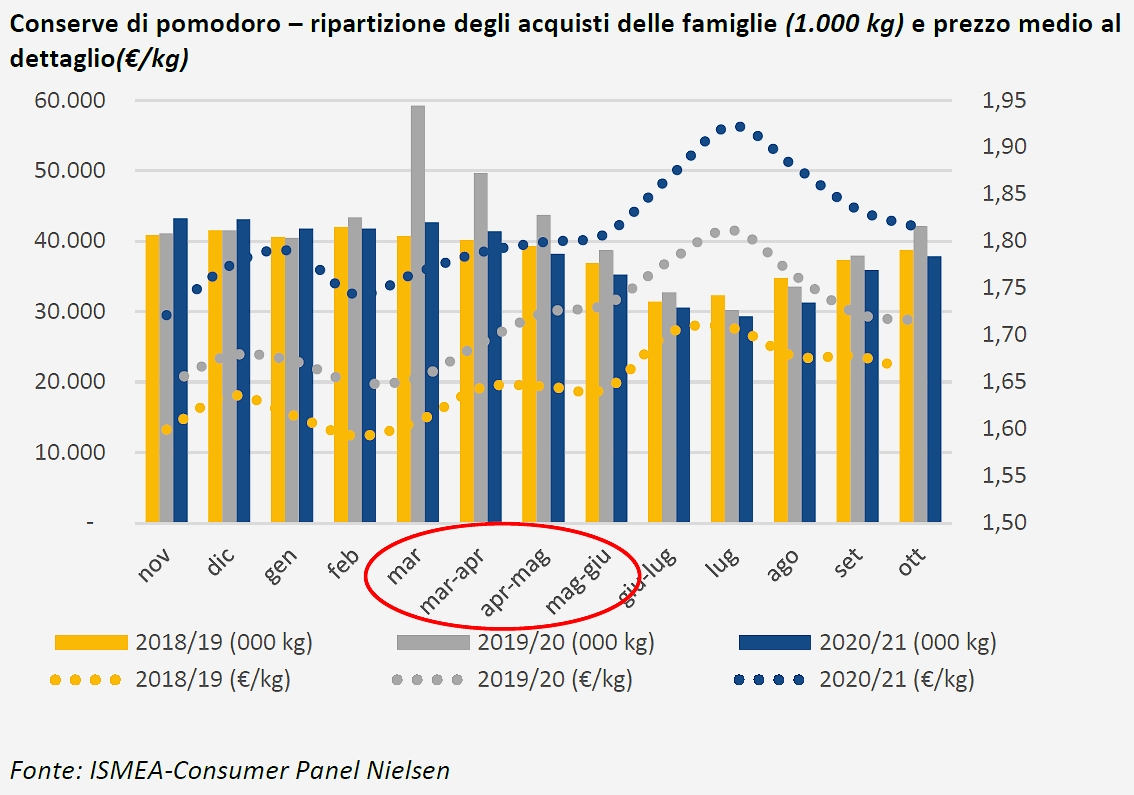

The health crisis related to the spread of the SARS CoV 2 coronavirus has had an exceptional impact on retail sales of tomato products in Italy and on the country's foreign trade in this sector. Home confinement measures, travel restrictions, and the adoption of working-from-home whenever possible resulted in an unprecedented spike in retail purchases and a collapse in out-of-home consumption between March and June 2020.

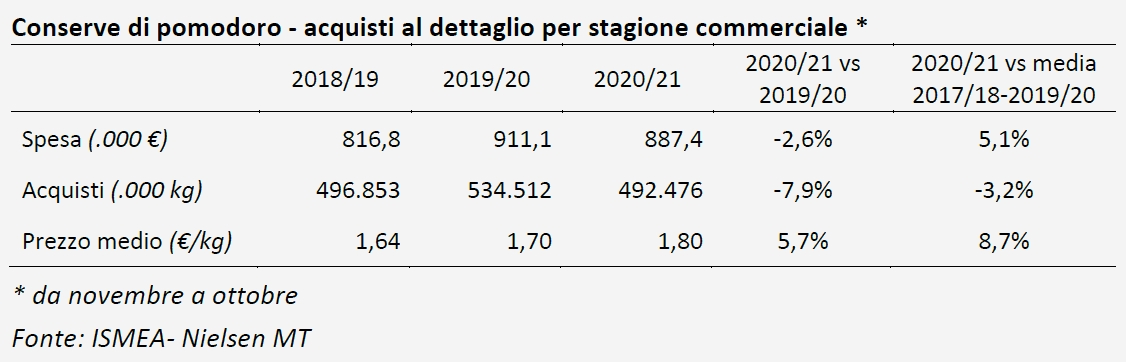

Indeed, retail sales of tomato products recorded strong increases over the 2019/2020 marketing year, putting an end to the negative dynamics observed in recent years. Over the twelve months between November 2019 and October 2020, purchases increased by 7.6% compared to the previous corresponding period, while expenditure, due to the rise in prices, increased by about 11.5% year-on-year.

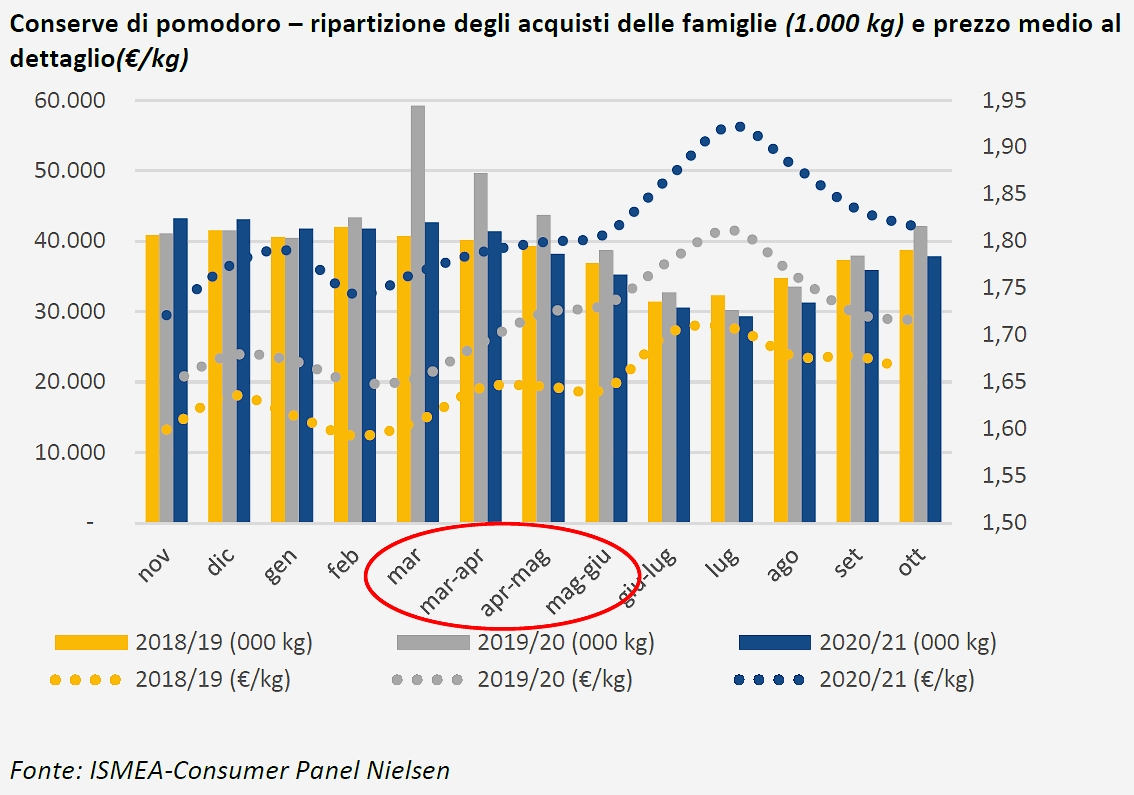

Monthly retail sales data provides an accurate picture of the effects of the home-confinement enforced between February and May 2020.

Data from February 2020 highlights the first "raids" on supermarket shelves that preceded (by only a few days) and heralded the national lockdown, resulting in an unexpected 3% increase in purchases (February 2020 vs February 2019).

In March, the declaration of a national state of emergency and the start of lockdown led to a 45% surge in purchases of tomato products in terms of volume on an annual basis, causing a number of stockouts and giving de facto "strategic food" status to canned tomatoes for Italian families. Tomato products are among the food items that Italians chose to store in their reserves in order to cope with the lockdown.

In the following months, the reduction in supply slowed sales, which nevertheless recorded significant increases over the year, with a 24% rise in April and 11% in May.

It wasn't until August that purchases of "red products" slowed, with a 5% drop compared to August 2019. However, a new phase of increased purchases began in September (+1.5%) and continued into October (+8.6%) and November (+5.3%).

The 2020/21 marketing year saw a return to normal sales rates, and therefore a decrease in volume of around 8% year-on-year, while the decrease in expenditure was mitigated by the increase in average prices (+5.7%).

Purchases for 2020/21 were also down compared to the average sales results over the last three years (-3.2%) even though spending increased by 5.1% due to the 8.7% rise in prices.

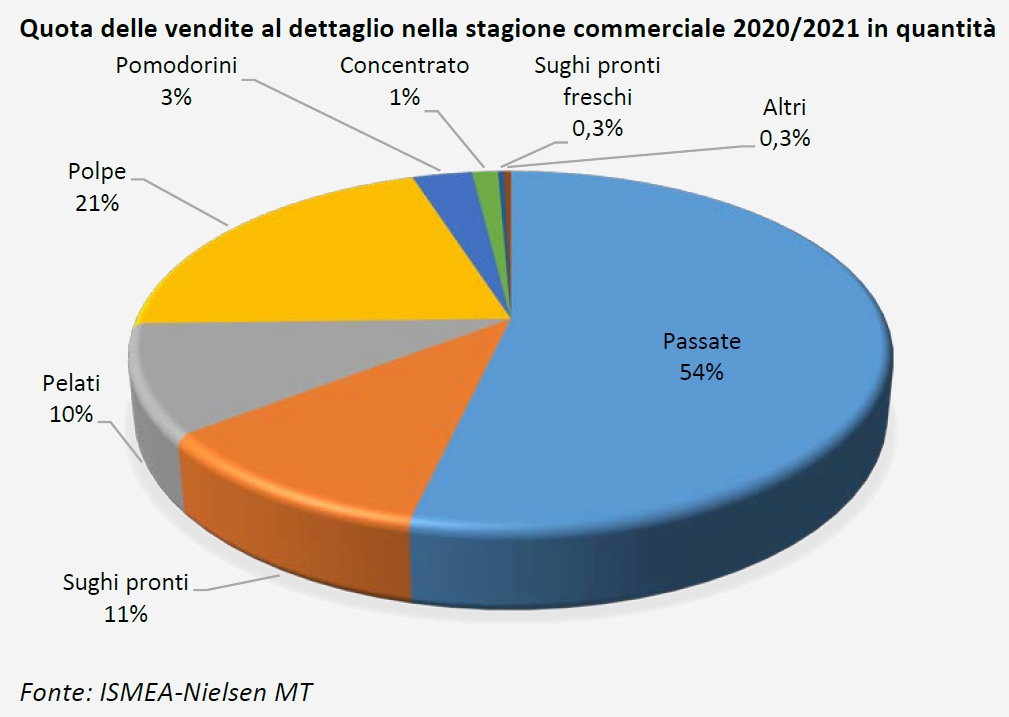

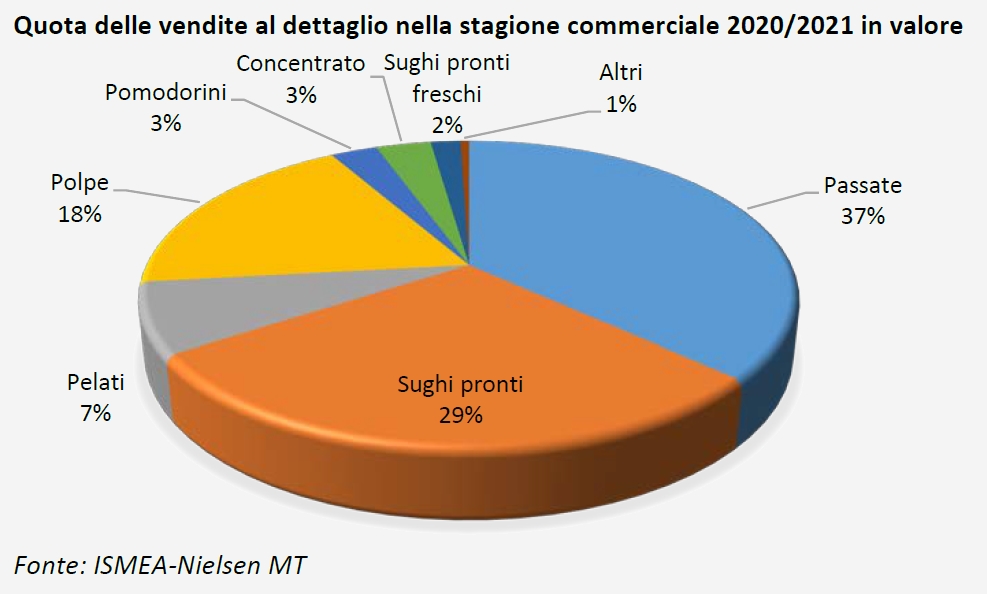

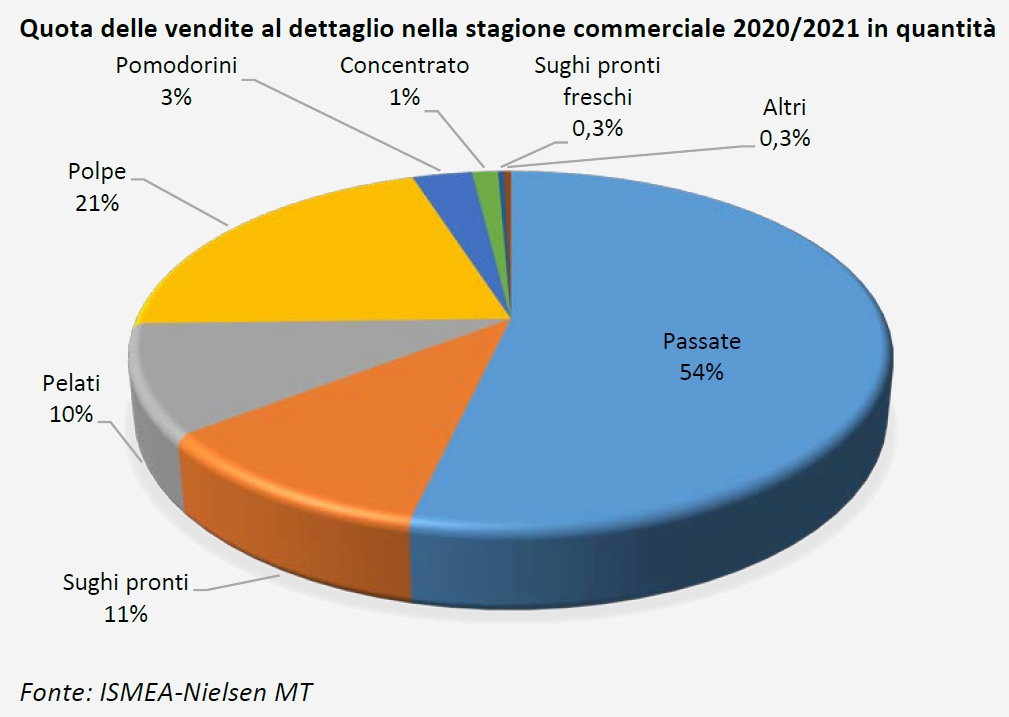

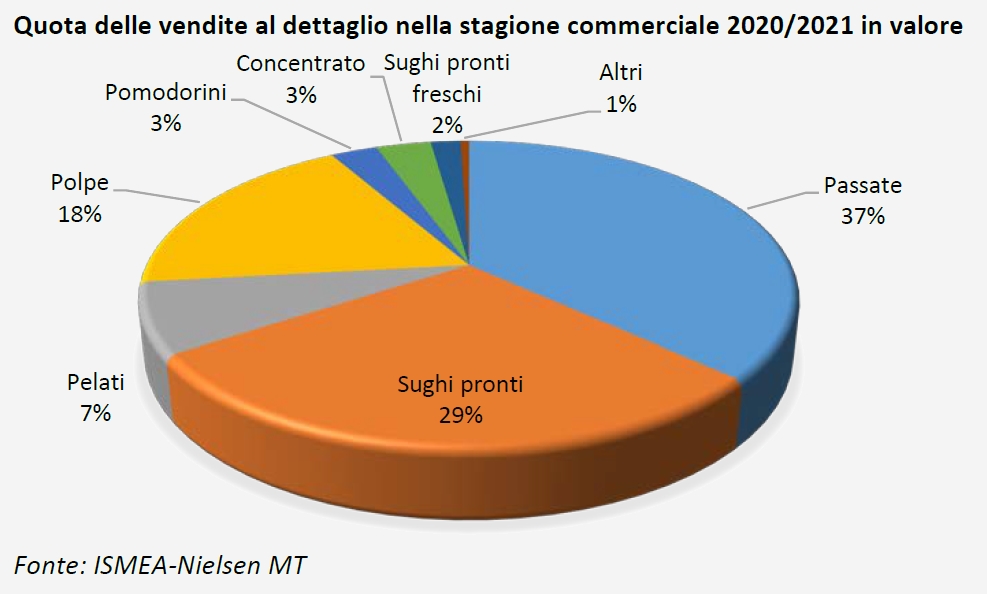

In Italy, the types of tomato products most frequently sold in retail outlets are purees (passata) and pulps, which account for three quarters of the quantities and 55% of total expenditure. They are followed by ready-to-use sauces (10% of volumes and about 30% of expenditure) and peeled tomatoes (10% of purchases and 8% of expenditure). This shopping basket is completed by canned cherry tomatoes, tomato paste and fresh sauces.

The underlying pattern in the Italian tomato products market has been a gradual reduction in sales due to the drop in the number of meals eaten at home and the replacement of "red products" with other types of condiments.

The decrease in quantities sold is offset by an increase in expenditure, which is based on the one hand on a gradual increase in the average prices of all tomato product references and, on the other hand, on a phenomenon that has been identified for several years, which sees the gradual replacement of basic products (peeled tomatoes and pulp) by products with a higher service content (purees and ready-to-use sauces).

The year 2020 marked a break in this medium- to long-term pattern, as the forced domestic lockdown due to the pandemic led to a boom in the retail sales of certain food products, among which canned tomatoes played a significant role. On the other hand, once the effect of the lockdown passed, sales of this type of product returned to their usual level, following the pattern of purchasing habits in recent years and a hesitant trend between a contraction in volumes and an increase in expenditure linked to the rise in retail prices.

The variations in sales figures observed in 2021 on an annual basis for each product type are summarized in the table below. The decline has affected all product references, so there are no substantial differences to be observed between the market shares held by the various products compared to the previous year.

On a yearly basis, above average declines were recorded for the two products with lower service content, namely pulps (-11% in quantity) and peeled tomatoes (-15%). Purees recorded a 7% drop in sales. This product category has been growing in popularity in recent years and has been successful due to its versatility and ease of use, making it a basic ingredient for quick sauces or pizza toppings.

In the case of ready-made sauces, however, the key element of success is certainly the service content, a decisive aspect in a period when many Italians have to eat at home twice a day. In 2021, sales of ready-to-use sauces were maintained at similar levels to those of 2020, and fresh sauces – even though this product segment still represents only a niche market – even increased their sales by 13% on an annual basis.

In terms of average price, the strongest annual increases were recorded for purees (+6.1%), pulps (+4.6%) and peeled tomatoes (+5.3%).

On the other hand, a comparison of sales figures for the 2020/21 marketing year with the average of the previous three years shows that the most dynamic products were cooked sauces (+5.9% in quantity), fresh sauces (+18%) and canned cherry tomatoes (+5.3%), while purchases of peeled tomatoes and pulps decreased (-15% and -7% in quantity, respectively).

It is also important to mention certified organic tomato products, which represent about 5% of total retail sales in Italy and mainly concern purees, pulps, sauces and to a lesser extent peeled tomatoes. In recent years, this segment has shown a particularly remarkable drive: the 2020/2021 marketing year actually saw purchases in this category increase by 2.9% compared to the average of the previous three years.

A comparison with the last marketing year shows a mechanical decrease in purchases (-2.6%) as it was not possible to maintain the pace recorded during the year when the pandemic started.

Source: ISMEA

To access the full reports (in Italian), click here

The first part of this dossier is available in the related articles below