Ismea 2021 Report, Second part

Italy is the second largest producer of fresh tomatoes for processing in the world. In 2021, more than six million tonnes of tomatoes were grown and processed, accounting for 16% of the world's production and 52% of European production.

Italy is the second largest producer of fresh tomatoes for processing in the world. In 2021, more than six million tonnes of tomatoes were grown and processed, accounting for 16% of the world's production and 52% of European production.

The industrial turnover of the sector amounts to about EUR 3.7 billion, of which exports account for EUR 1.9 billion. 60% of the quantities processed in Italy are produced for export. Italy has also confirmed its position as the world's leading producer of tomato products intended directly for end-consumers.

Italy's foreign trade

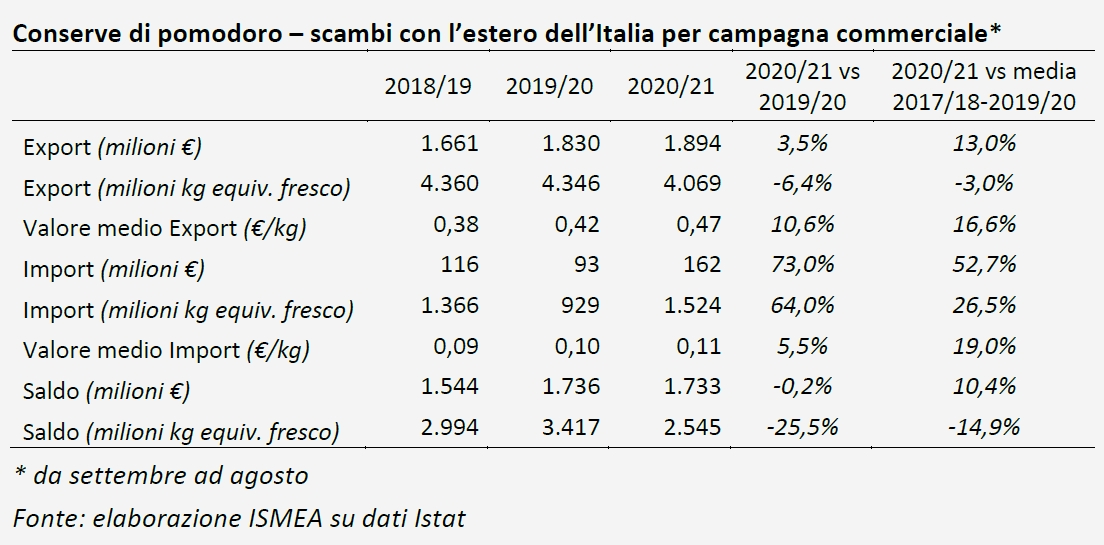

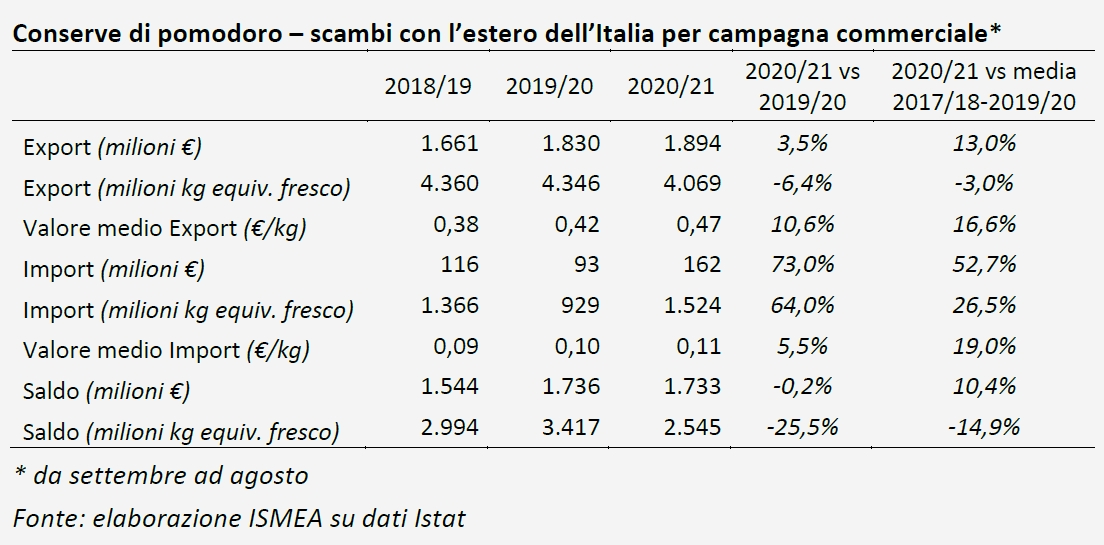

Canned tomato products are among the processed fruit and vegetable foods that record the best trade balance result in Italy. The evolution of foreign trade indicators testifies to this level of excellence: in the twelve-month period from September 2020 to August 2021, Italy's trade balance for tomato products exceeded the record figure of EUR 1.7 billion, thanks to exports estimated at over 4 million tonnes, in fresh tomato equivalent.

Although the pandemic has often made international trade more difficult, the Italian trade balance for the processed tomato sector for the marketing year 2020/2021 has been confirmed at the same level as over the previous period, despite the strong increase in imported quantities (+64%).

The last marketing year was characterized by a significant increase in average prices, which rose by 11% for exported products and 5.5% for imported products.

In this regard, it should be noted that Italy imports semi-finished products – mainly tomato paste with more than 30% soluble solids – at an average price of EUR 0.11 per kg of fresh tomato equivalent and exports finished products (puree, peeled tomatoes and paste with a soluble solids content of less than 30%) at an average price of EUR 0.47 per kg of fresh tomato equivalent.

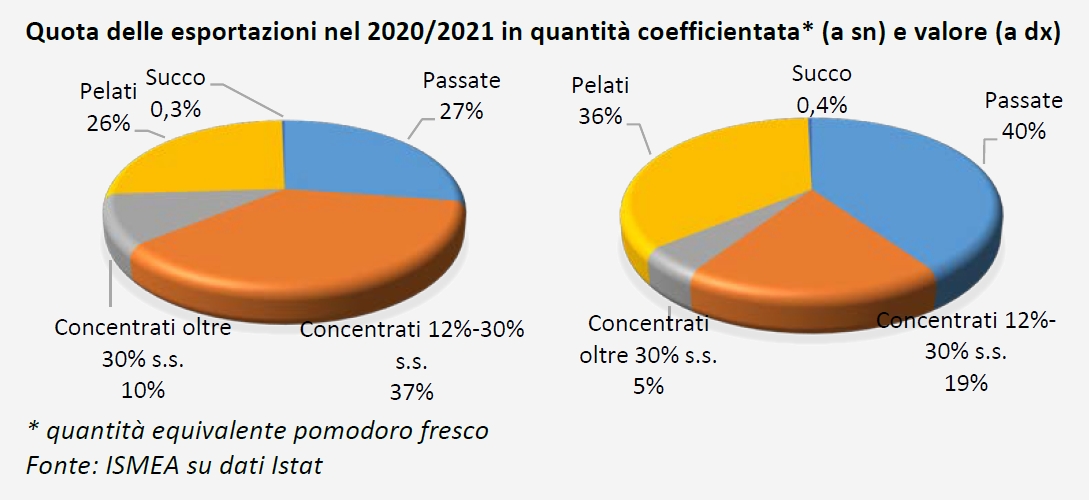

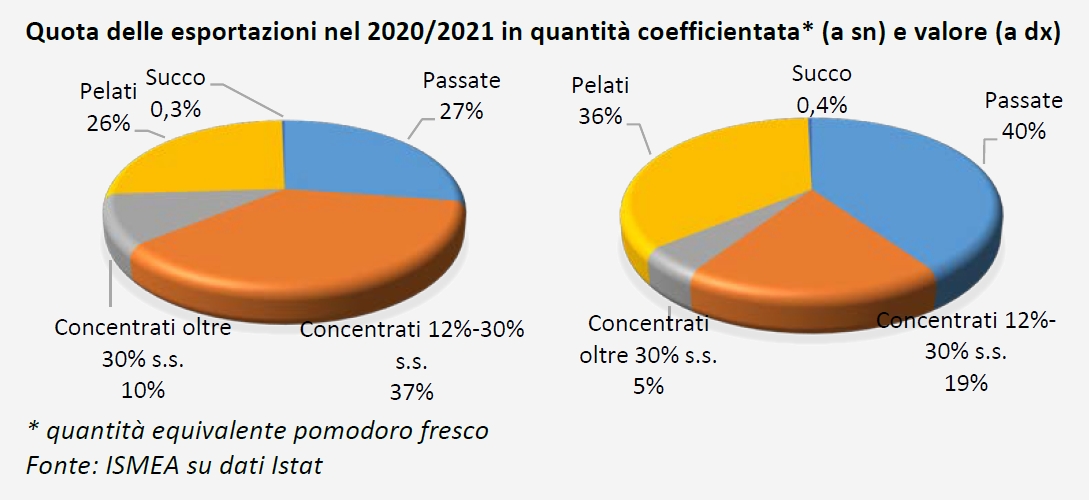

In terms of value, the most frequently exported tomato products are peeled tomatoes and puréed tomatoes, which together account for three quarters of export volumes. This proportion rises to 95% when exports of tomato pastes (12-30% soluble solids) are taken into account. Foreign sales of pastes with a soluble solids content over 30% represent about 5% of the total, while tomato juice sales account for about 1%.

In 2020/21, exports (expressed in fresh tomato equivalent) decreased by about 6% on an annual basis. This decrease was observed mainly for peeled tomatoes (-13%) and tomato pastes with a soluble solids content between 12% and 30% (-11%). On the other hand, exports of purees increased (+6% compared to the previous season) as well as exports of pastes with a soluble solids content of more than 30%.

External sales turnover increased by 3.5% due to an increase in average prices of about 11%. The turnover of exports of purees and pastes with a soluble solids content above 30% increased by 15% and 10% respectively, while the turnover of peeled tomatoes decreased by 6%. The performance of foreign sales of pastes with a soluble solids content between 12% and 30% remained unchanged.

Overall, the results for the 2020/2021 marketing year were better than the average of the previous three years.

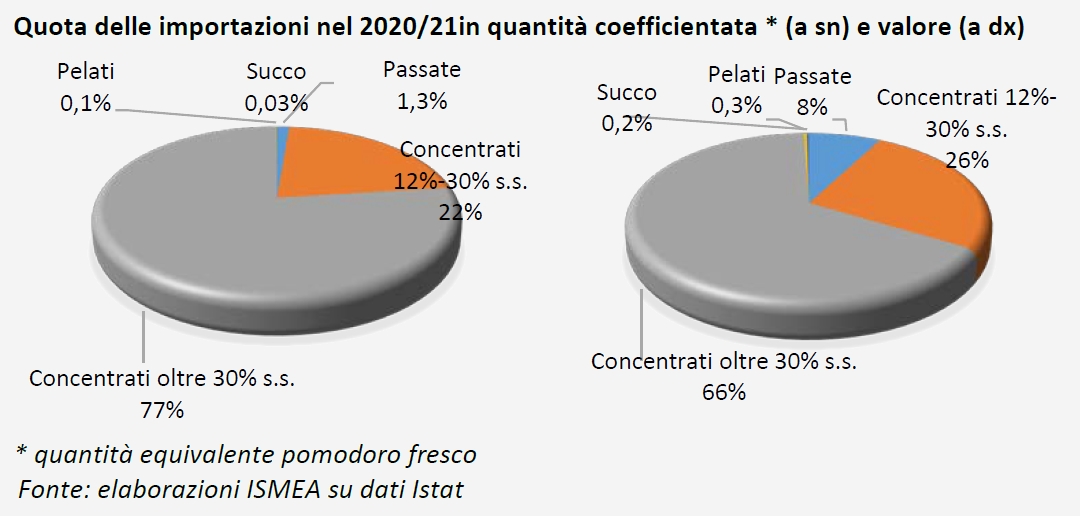

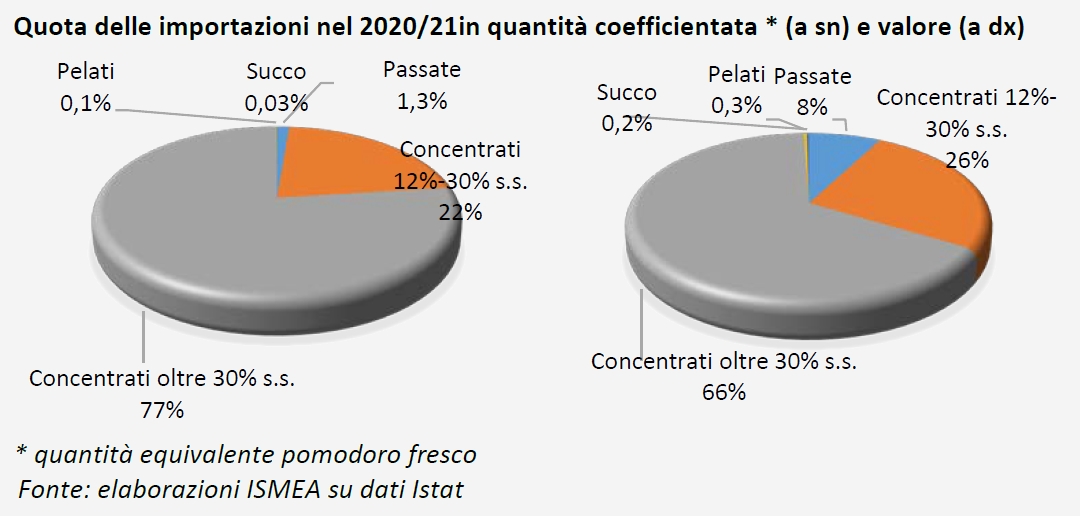

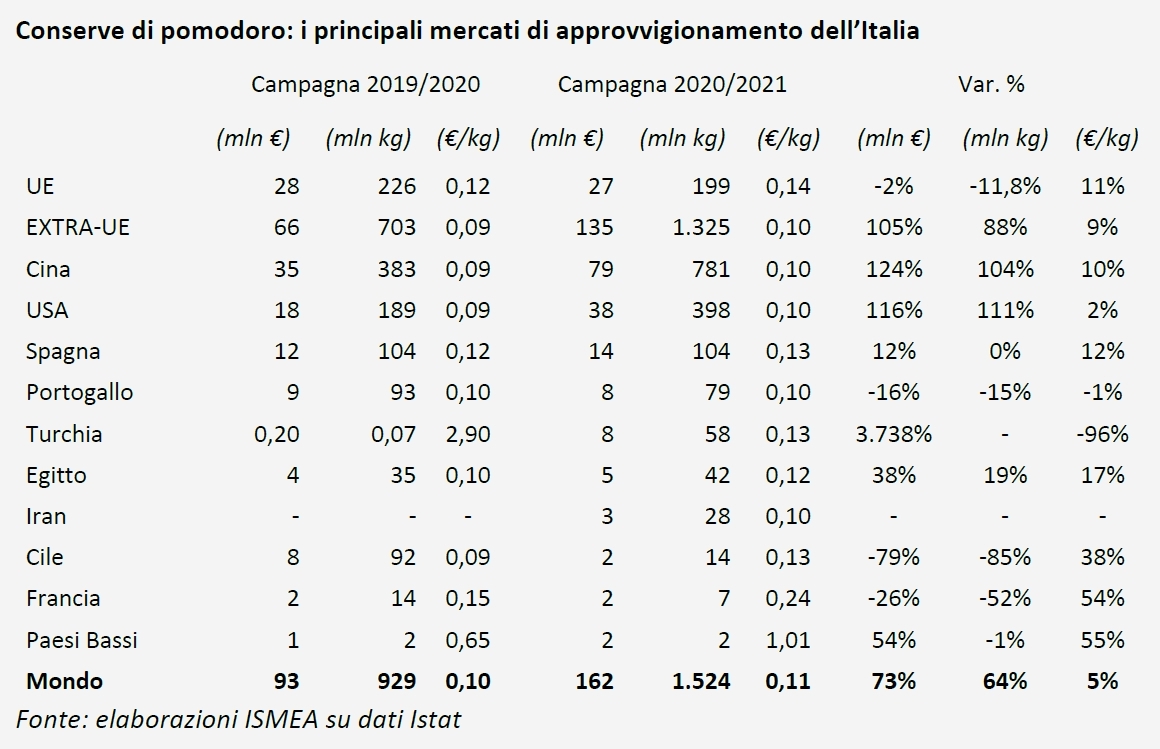

In the last marketing year, imports of tomato products represented an expenditure of EUR 162 million for 1.5 million tonnes of products, fresh tomato equivalent. The most significant increase in spending was recorded for imports of tomato pastes of more than 30% soluble solids content, which rose from EUR 67 million to 106 million, an increase of 58%. At the same time, the cost of supplies of pastes with a soluble solids content between 12% and 30% doubled from EUR 20 million to 42 million. Finally, the increase recorded for foreign purchases of puree is also significant, with expenditure increasing from EUR 5 million to 12 million.

Pastes with more than 30% soluble solids are the most imported products in Italy, accounting for 66% of the total value of imports and 77% of the total quantities expressed in fresh tomato equivalent. They are followed by pastes with a soluble solids content between 12% and 30%, which represented 26% of the total value and 22% of the quantities (expressed in fresh tomato equivalent). Among other imported tomato products, it is also worth mentioning purees, which accounted for about 8% of total revenue.

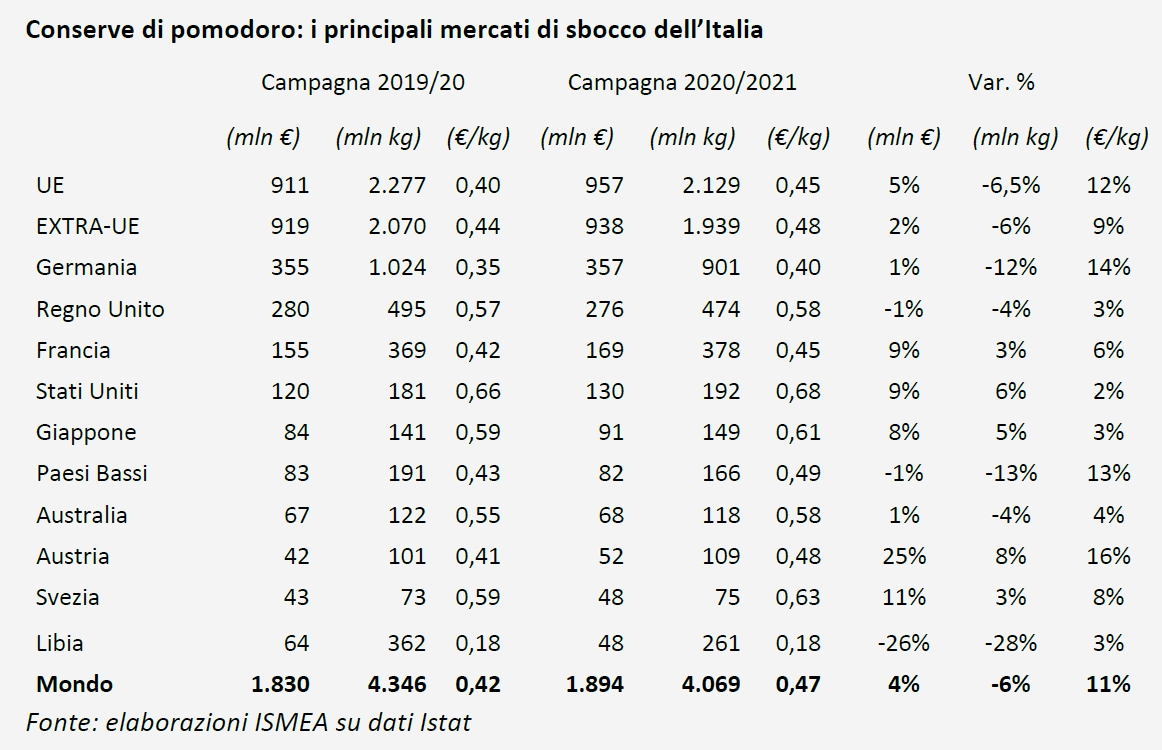

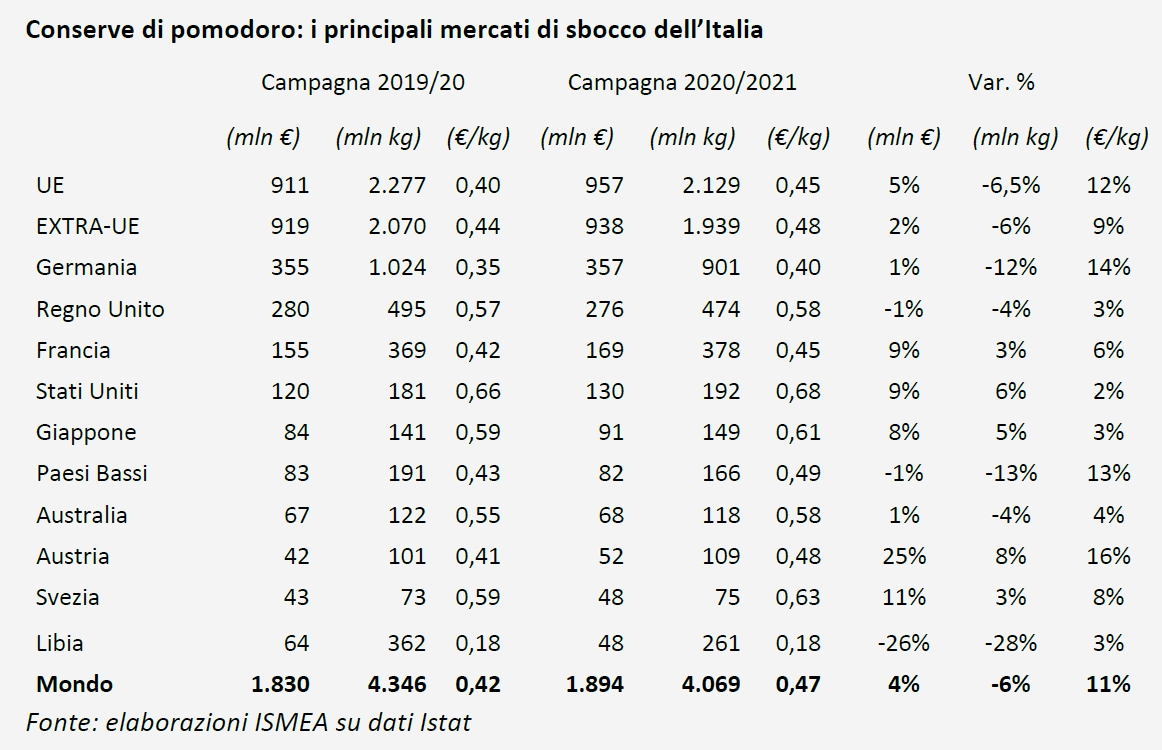

As for the main outlet markets, the European Union attracts 50% of Italian exports of tomato products but, overall, about 180 countries are supplied by the Italian tomato industry. Over the marketing year 2020/2021, Germany confirmed its position as the leading buyer, with a 1% increase in value compared to the previous period. Germany alone accounts for about one-fifth of Italy's total revenue generated by exports. The United Kingdom ranks in second position, with a slight decline both in terms of quantities imported (-4%) and in terms of value (-1%). France, the United States and Japan maintain their unchanged positions in third, fourth and fifth place respectively, while Austria (+25%) and Sweden (+11%) have moved up in this ranking. Among the top ten outlets for Italian tomato products, it should be noted that Libya's purchases have declined sharply for the second consecutive year, taking the country from eighth to tenth place in the ranking.

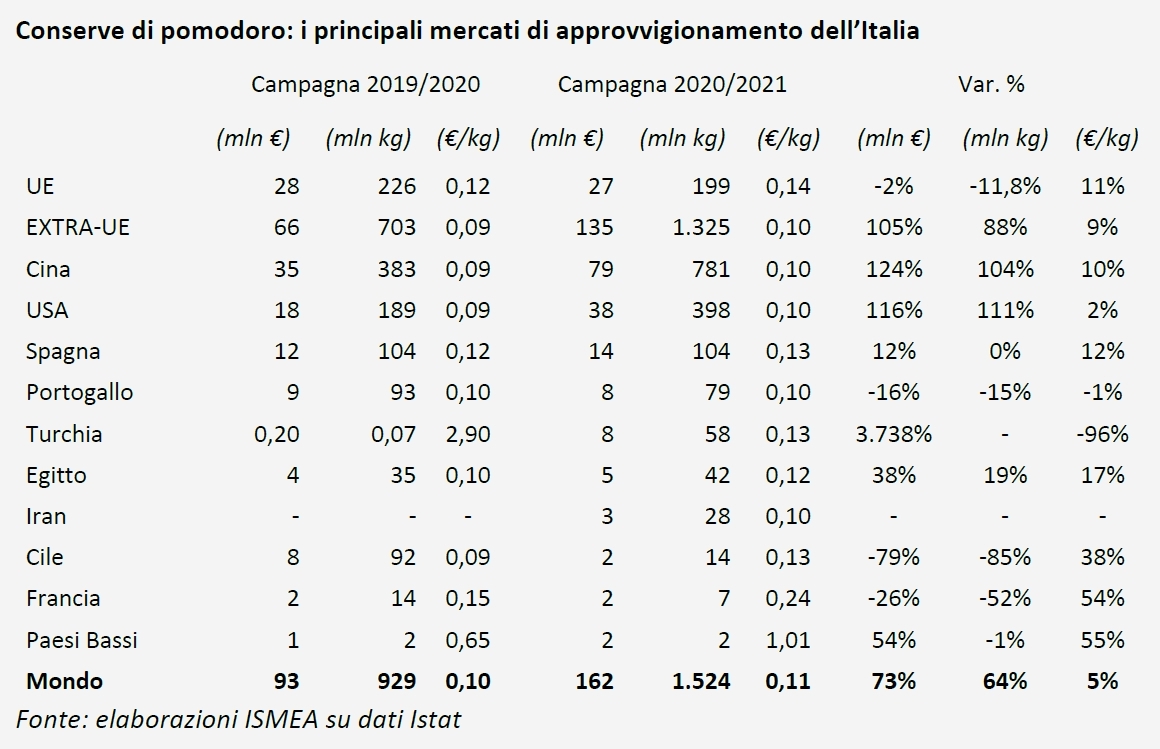

Countries outside the EU account for 83% of Italy's suppliers, and of these, a small number concentrate the bulk of the country's supply sources. In 2020/2021, the top five suppliers accounted for more than 90% of Italy's overall supply, with China and the US alone accounting for 72% of imports.

Over the last marketing year, the volumes supplied by the main supplier countries increased significantly. In this regard, of particular note, in order of importance, China's sales to Italy increased by 104%, while those of the United States increased by 111% and those of Spain by 12%. Among the main suppliers, only Portugal and Chile have seen their sales to Italy decrease, while sales of Turkish products have risen sharply, placing Turkey in fifth place among Italy's supplier countries.

Final remarks

Once the processing season is over, the main concerns for the 2021/22 marketing year are linked to the impact on the retail price of rising energy costs and of the costs for raw material. This concern is even greater for exports, due to the exceptional increase in ocean freight costs. It should be noted that the sector's prospects are inextricably linked to the success of processed products on foreign markets and, in this sense, news of rising transportation costs does not inspire much optimism for the coming months.

Finally, it is worth highlighting the role of research and development in offering new products and good prospects for the sector, as well as the development of new varieties of tomatoes capable of combining productivity in the field and organoleptic qualities in the fruit itself, in order to allow the sector to evolve and progress in a global scenario that is increasingly competitive.

Source: ISMEA

To access the full reports (in Italian), click here

The first part of this dossier in the related articles below