Behind the apparent stability of annual volumes traded in the context that has prevailed since the invasion of Ukraine in February 2022, the origins of the products that supply the Russian market and the destinations of Russian exports have undergone major changes.

On April 4, 2022, the Federal Customs Service of Russia suspended the publication of statistics until further notice.

For the past two years, the only trade statistics available for Russia have been those supplied by its customers and/or supplier countries: the data shows that the volume of trade in tomato products involving this country has not been particularly affected by the consequences of the invasion of Ukraine, if at all, but that Russian exports and imports have undergone a fairly marked geographical reorientation.

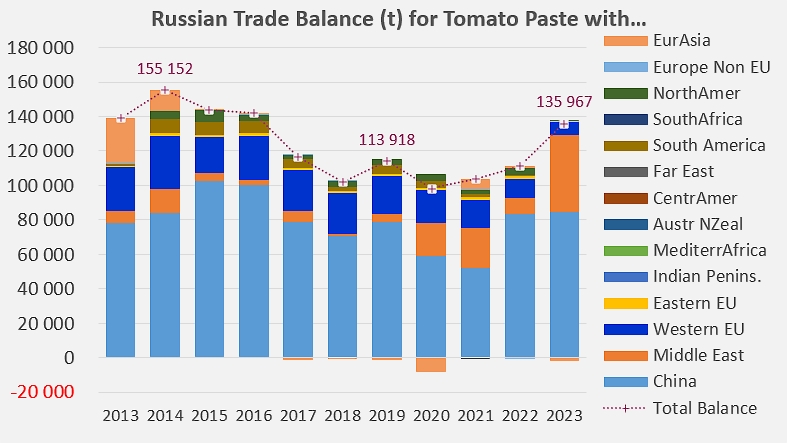

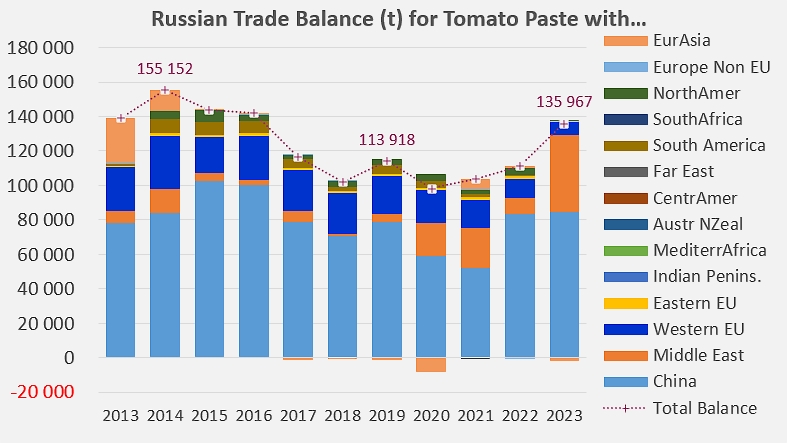

The first observation concerning imports of tomato pastes is that quantities have risen sharply again since 2021, after having gradually declined since around 2014. In 2023, Russia's foreign purchases of tomato pastes can be estimated at around 142,800 t, up 25% on the average annual quantities of the 2019-2021 period. Annual Russian exports of pastes have remained stable and marginal overall, averaging around 6,600 t over the last three years.

The second observation to be made is that a comparison of Russian supply purchases in 2023 with those of the 2019-2021 period shows that the increase in imported quantities of pastes combines three distinct dynamics. China, the main and historic supplier to the Russian market, increased its deliveries by 21,200 tonnes, but gave up some market share. At the same time, quantities sold to Russia by EU countries (notably Portugal, Italy, Spain and, to a lesser extent, Poland) fell by 60% and by over 12,000 t. Exports of US and Chilean products (around 3,000 to 4,000 t) ceased altogether, and flows from Kazakhstan fell off sharply. Finally, a strong dynamic has emerged in this massive reorientation pattern: Iranian exports have come to compete with Chinese products and have exploded between the 2019-2021 period and last year. More than 45,000 t of Iranian pastes were delivered to Russia in 2023, an increase of over 29,000 t (+184%) compared to the period preceding the February 2022 invasion.

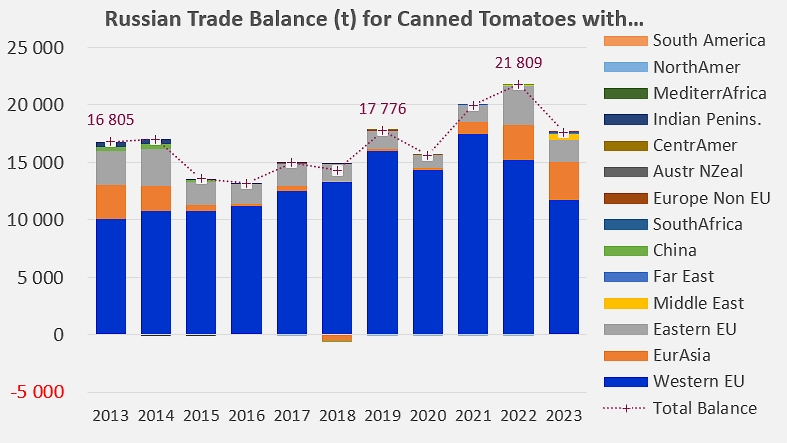

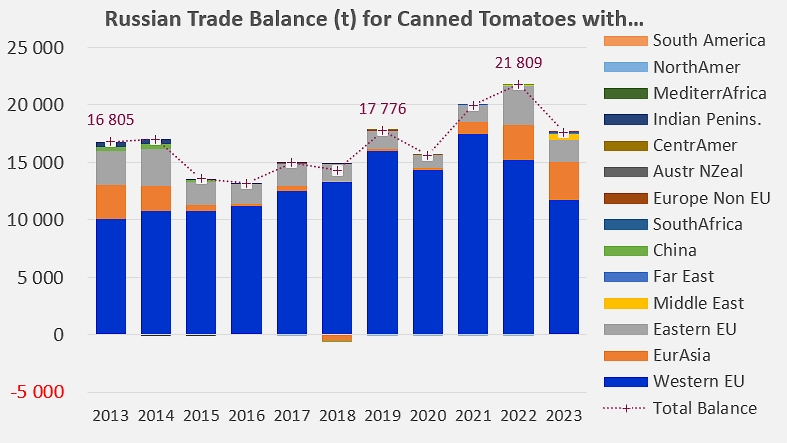

Supplies of canned tomatoes to the Russian market, although highly variable in quantity over the last four or five years, were practically identical in 2023 to those of the reference period (2018-2021). 18,200 t were imported last year and around 600 t exported. The gradual withdrawal of several EU countries (Italy, Spain, Greece and Portugal) from the Russian market, which accounted for a large quarter of deliveries, was offset by increased purchases of products from Turkey, Poland, Armenia and Iran.

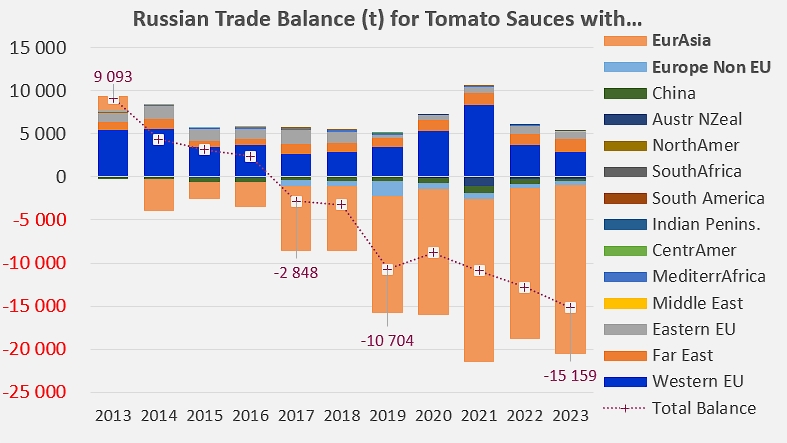

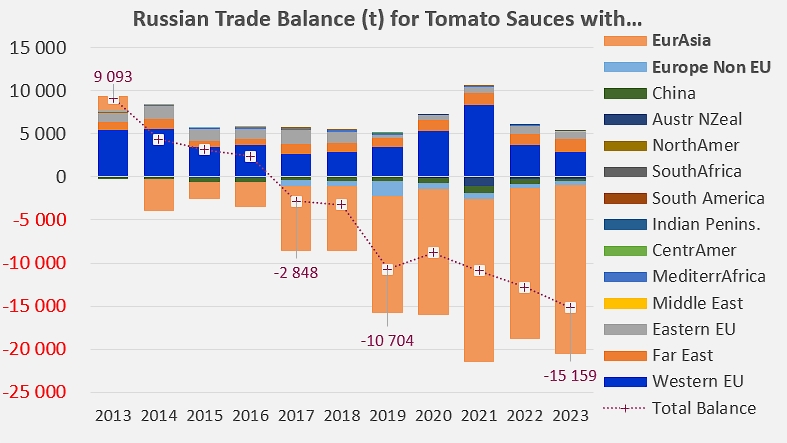

Since 2017, Russia has posted a surplus trade balance for tomato-based sauces. Whereas it was still in deficit by more than 9,000 tonnes in 2013, the Russian industry's balance for this category has risen over six or seven years from some 2,800 tonnes to more than 15,100 tonnes. The tipping point came in 2017, when imports followed a hesitant downward trend, while foreign sales grew at an average annual rate (CAGR) of around 13%.

The countries that have traditionally been regular customers of Russian sauce exports (Kazakhstan, Belarus, Uzbekistan, Armenia, Azerbaijan, Georgia) have been the main drivers of this momentum, which began well before February 2022. Conversely, a number of secondary and occasional buyers of Russian products (Czech Republic, Poland, Moldavia) have significantly reduced their purchases compared with the reference period.

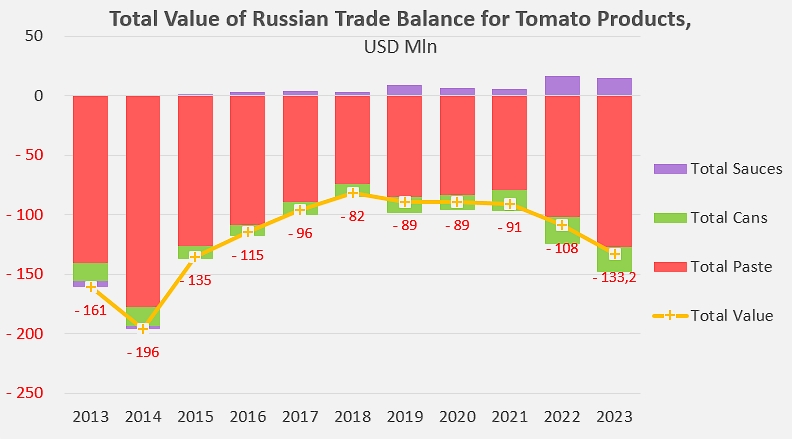

However, this boom in foreign sales of sauces remains marginal in economic terms. Net expenditure on supplying the Russian market with tomato products amounted to over USD 133 million in 2023, up 48% on the annual average of the 2019-2021 period. Revenue from sauce exports in 2023 has been estimated at around USD 15 million, while purchases of pastes and canned tomatoes are estimated at around USD 127 million and 21 million respectively.

Sources: Trade Data Monitor