Press release

, François-Xavier Branthôme

-

Less out-of-home catering, more sales in local shops

The ISMEA report on Italian trade activity published in December 2020 shows that retail sales of tomato products for the last marketing year – from September 2019 to August 2020 – were very satisfactory. Indeed, after several years marked by “an inexorable decline in the quantities purchased,” last year saw a 7% increase over the 12-month period.

The 2019/2020 marketing year was characterized by a “reset of stocks” in retail formats available from operators, due to the increase in domestic consumption recorded during the period of confinement as well as during the months that followed.

This scenario was radically different for the Horeca channel (public and private catering) which usually absorbs one third of the production of tomato products: sales in this sector literally collapsed during the months of the first health crisis, due to the closure of out-of-home consumption venues both in Italy and abroad. The negative effects of these restrictive measures are still being felt today.

Retail sales

The health crisis linked to Covid has had a considerable impact on retail sales of tomato products in Italy and on trade abroad. According to the most recent data from the last marketing year (September 2019 to August 2020), confinement measures, travel restrictions and the introduction of working-from-home have resulted in a significant increase in retail purchases and a drop in out-of-home consumption.

The health crisis linked to Covid has had a considerable impact on retail sales of tomato products in Italy and on trade abroad. According to the most recent data from the last marketing year (September 2019 to August 2020), confinement measures, travel restrictions and the introduction of working-from-home have resulted in a significant increase in retail purchases and a drop in out-of-home consumption.

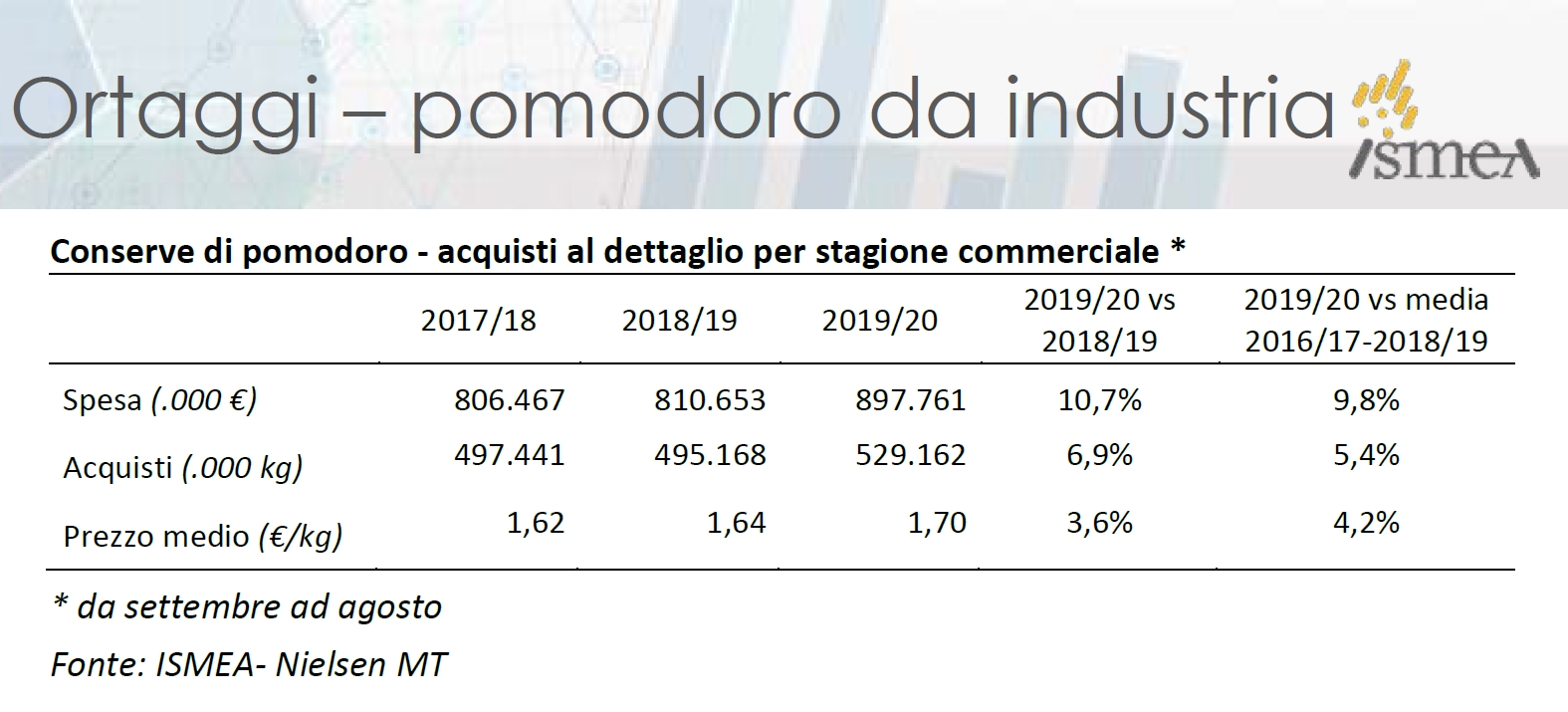

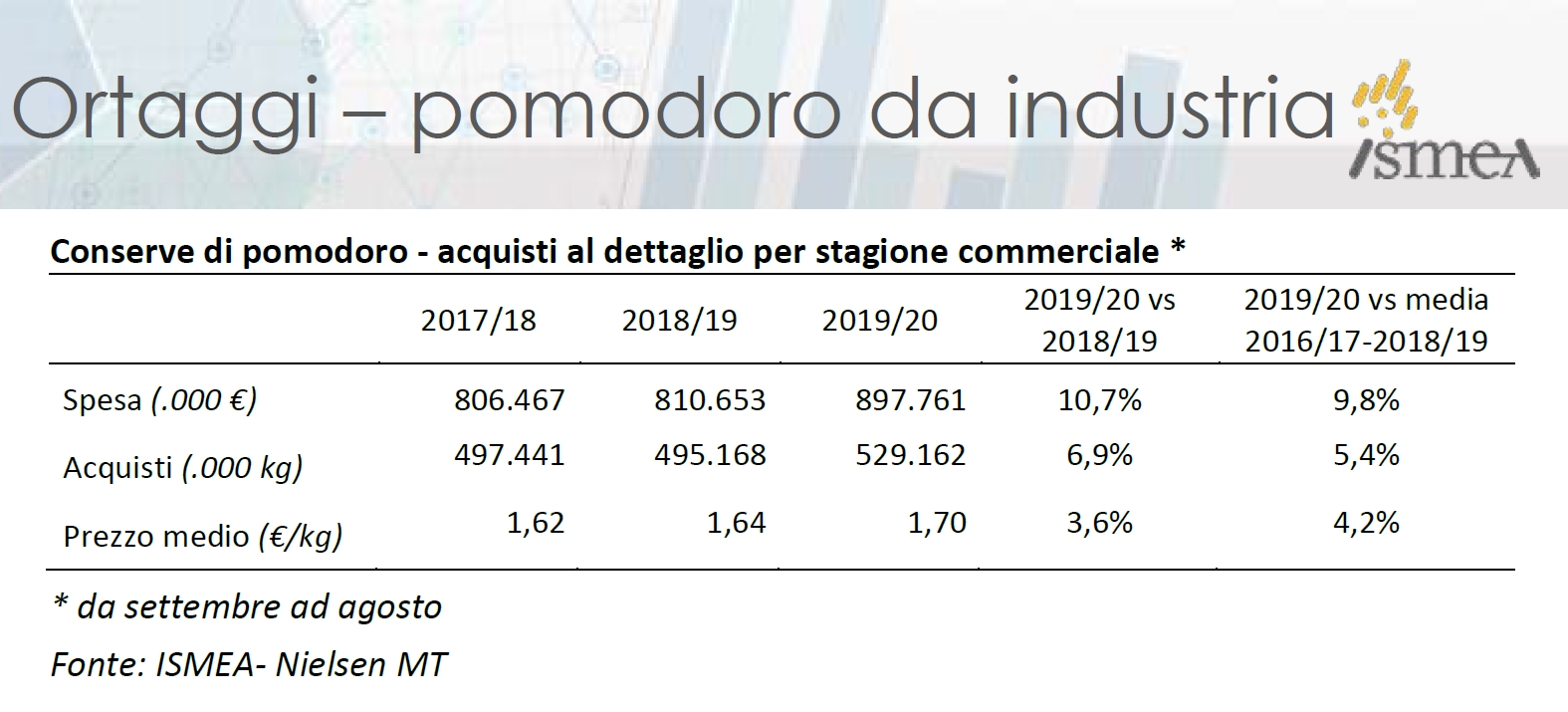

The considerable increases in retail sales of tomato products recorded during this period have halted the downward dynamics observed in recent decades: purchases increased by 7% in quantity over one year and by 5.4% compared to the average of the three previous years, while spending – driven by the increase in prices – grew by around 11% over one year and by 10% compared to the average of the three previous years.

Regarding the increase in average prices (+3.6% on an annual basis), it should be noted that several factors have had an impact, including the less frequent use of promotions and offers of all kinds, as well as the displacement of significant sales from large chain retail stores (super- and hyper-markets) to convenience stores and corner-shops characterized by higher average prices.

Tomato products: retail purchases for marketing year 2019/2020

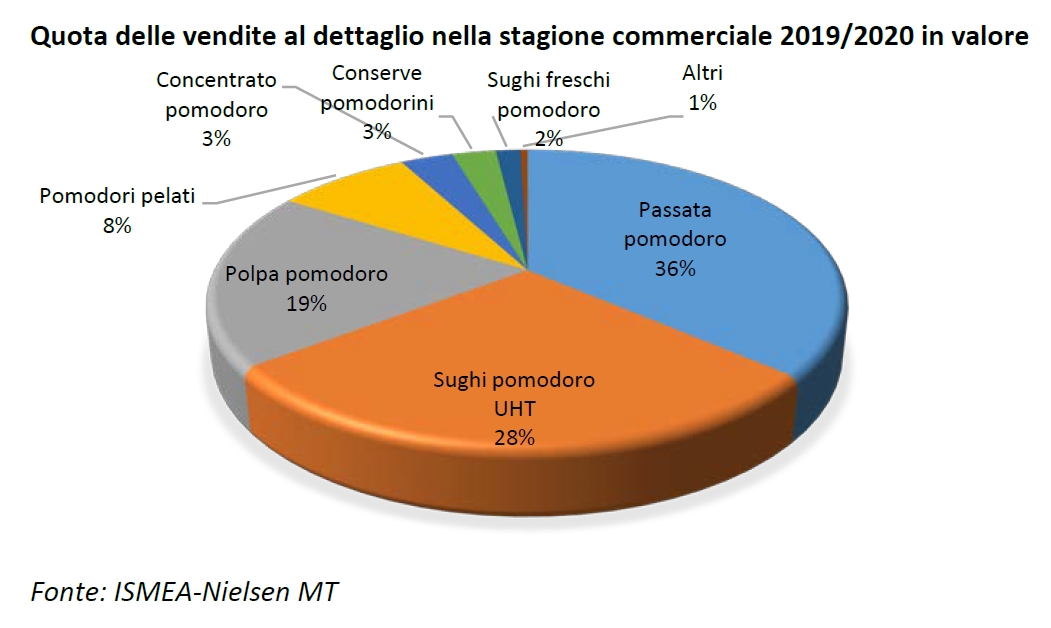

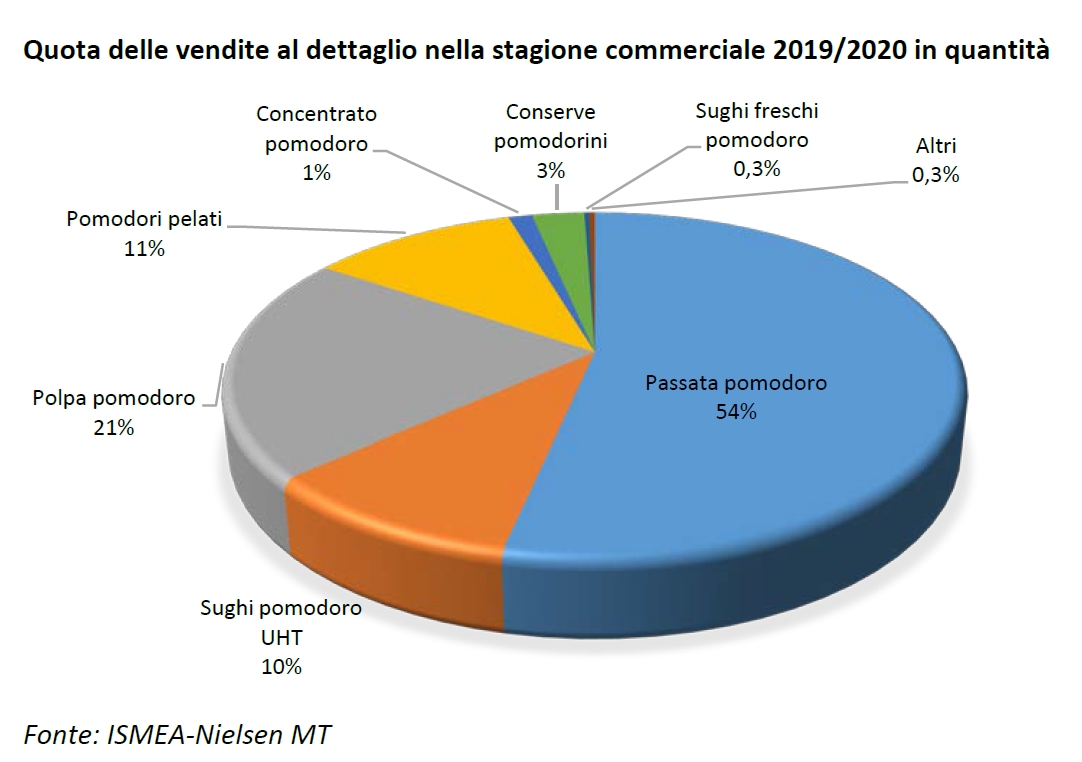

This year, the ISMEA study has confirmed the trends observed in recent years in terms of which products are most popular: tomato puree (passata) remains the most frequently purchased product, with a market share of 54% in volume and 36% in value. UHT ready-to-use sauces occupy second place with 28% of total expenditure and 10% of the volumes, ahead of tomato pulps (21% of volumes purchased and 19% of expenditure), peeled tomatoes with 11% of volumes and 8% of expenditure and finally tomato paste and canned cherry tomatoes with a value share of 3% each.

Share of retail sales in terms of value for the 2019/2020 marketing year

Share of retail sales in terms of volume for the 2019/2020 marketing year

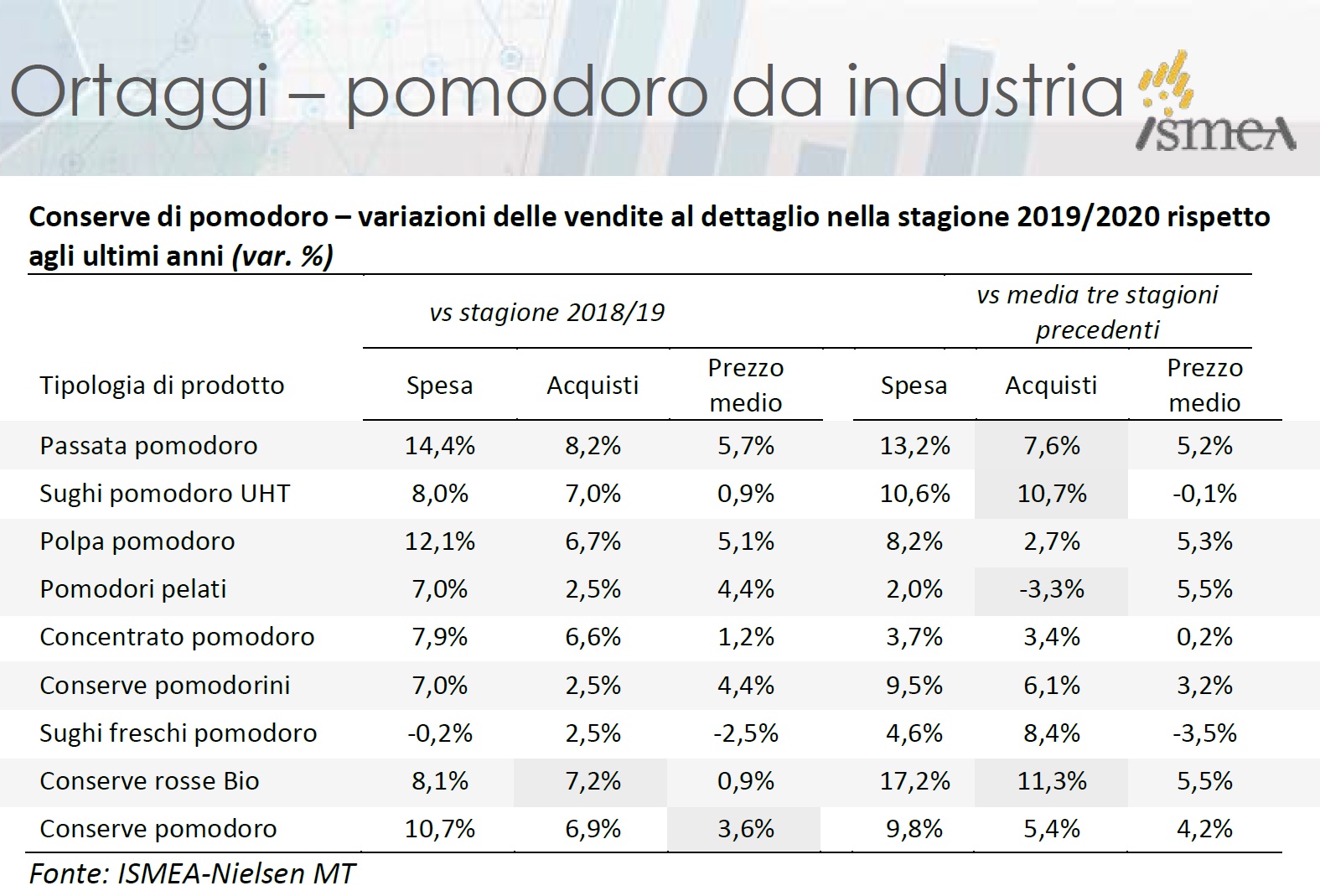

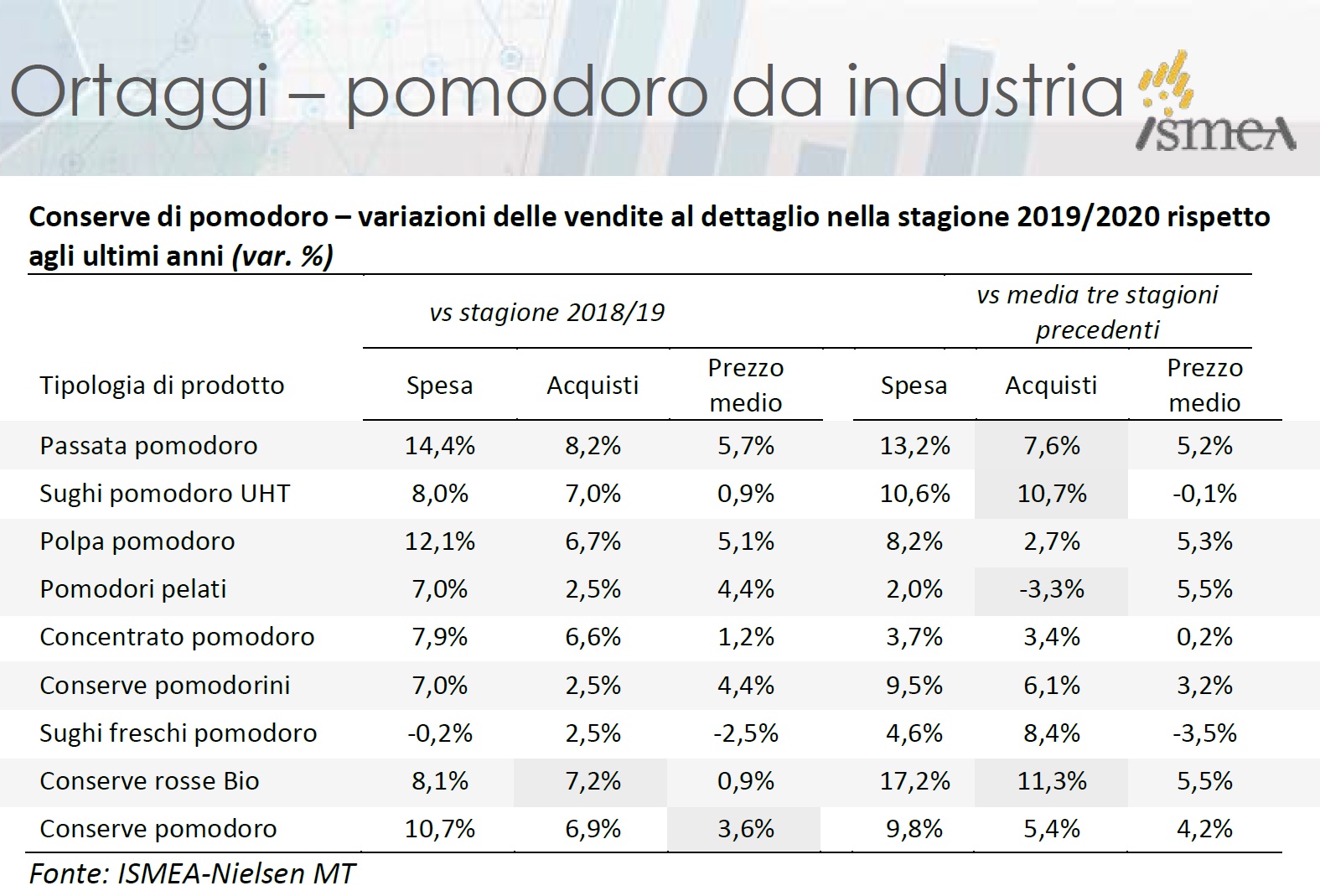

The variations recorded for each type of product indicate that the increases concern all categories, insofar as there are no notable differences compared to the market shares held by the different products during the previous marketing year. However, it should be noted that above average increases were recorded for the two most popular products, namely passata (+8.2% in quantity) and ready-to-use sauces (+7%).

The popularity of purees (passata) has continued to increase in recent years, due to the great versatility and ease of use of these products, which can be used both for preparing quick sauces and for seasoning pizzas. In the case of ready-made sauces, on the other hand, the key to their success is certainly the service they provide, a winning feature at a time when many Italians have been forced to eat at home twice a day.

In terms of average prices, the most significant increases over one year were observed in the categories of purées (passata) (+5.7%), pulps (+5.1%), peeled tomatoes and canned cherry tomatoes (+4.4%). At the same time, a comparison of the result for the 2019/2020 marketing year with the average results of the three previous years shows a notable drop in quantity in the peeled tomatoes category (-3.3%) and strong growth in the categories of ready-to-use sauces (+10.7%) and purees (+7.6%).

Tomato products – changes in retail patterns (expenditure, quantity and average price) for marketing year 2019/2020 compared to previous years (% change)

As for the category of certified organic tomato products, which represents around 5% of total retail sales of Italy's “red products” market, it mainly concerns purees (passata), pulps, sauces and, to a lesser extent, peeled tomatoes. The segment of organic tomato products has, however, recorded very good dynamics in recent years. The 2019/2020 marketing year saw an 11.3% increase in purchases in terms of volume, compared to the average of the previous three years, and a 5.5% increase in the average retail price. A comparison with the previous marketing year for this segment shows a sales increase of 7.2% in quantity and relative stability in average prices (+0.9% over one year), which contrasts with a general 3.6% increase in the prices paid for tomato products.

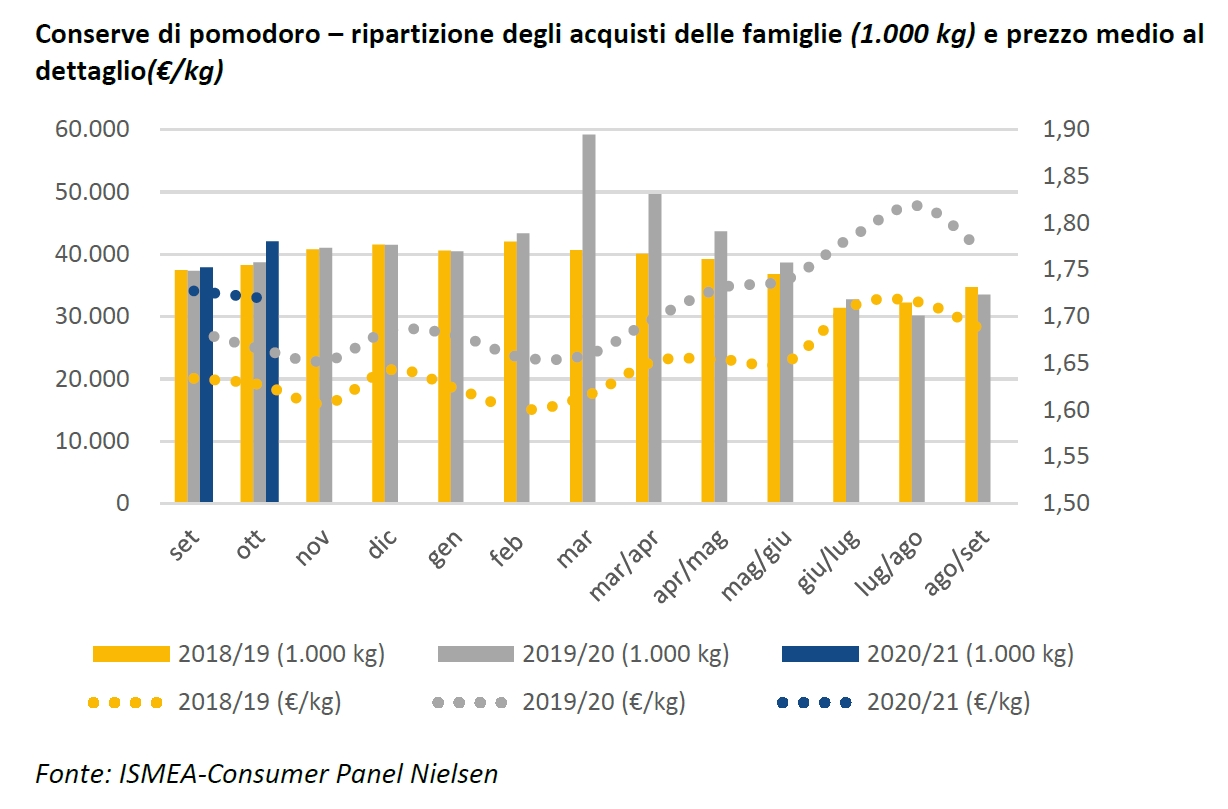

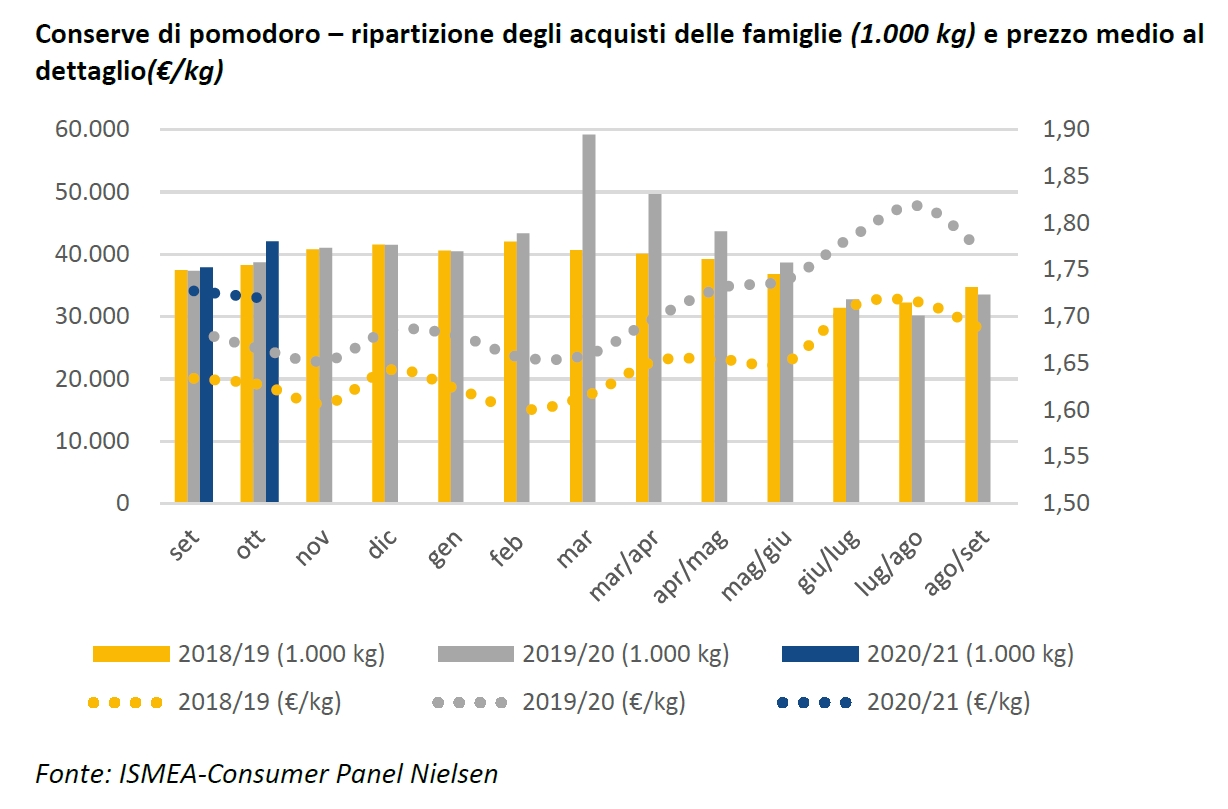

And finally, an analysis of monthly purchasing data shows the effect that the Covid confinement has had on the pace of retail sales of tomato products. In particular, its appears that between March and May 2020, sales rose considerably (+22% in quantity) compared to the same period of the year 2019 even though average prices in the sector recorded an increase of a few centimes of a euro (+3.6%). This conjunction of dynamics led to a 26% increase in spending.

Tomato products – evolution of household purchases (1000 kg) and average retail price (€/kg)

Source: ISMEA

Further details in the attached documents:

The health crisis linked to Covid has had a considerable impact on retail sales of tomato products in Italy and on trade abroad. According to the most recent data from the last marketing year (September 2019 to August 2020), confinement measures, travel restrictions and the introduction of working-from-home have resulted in a significant increase in retail purchases and a drop in out-of-home consumption.

The health crisis linked to Covid has had a considerable impact on retail sales of tomato products in Italy and on trade abroad. According to the most recent data from the last marketing year (September 2019 to August 2020), confinement measures, travel restrictions and the introduction of working-from-home have resulted in a significant increase in retail purchases and a drop in out-of-home consumption.