Press release

, François-Xavier Branthôme

In 2020, exports decreased, but average prices increased

A report published in December by the ISMEA confirmed the essential role played by Italy at a worldwide level as the country with the third biggest production of tomatoes for processing. In 2020, Italian operators accounted for 13% of the world’s production and 53% of European results. The country also confirmed its position as the main producer and exporter of tomato products distributed directly to end-consumers. Approximately 60% of the tomato products processed in Italy are destined for the export market.

Foreign trade

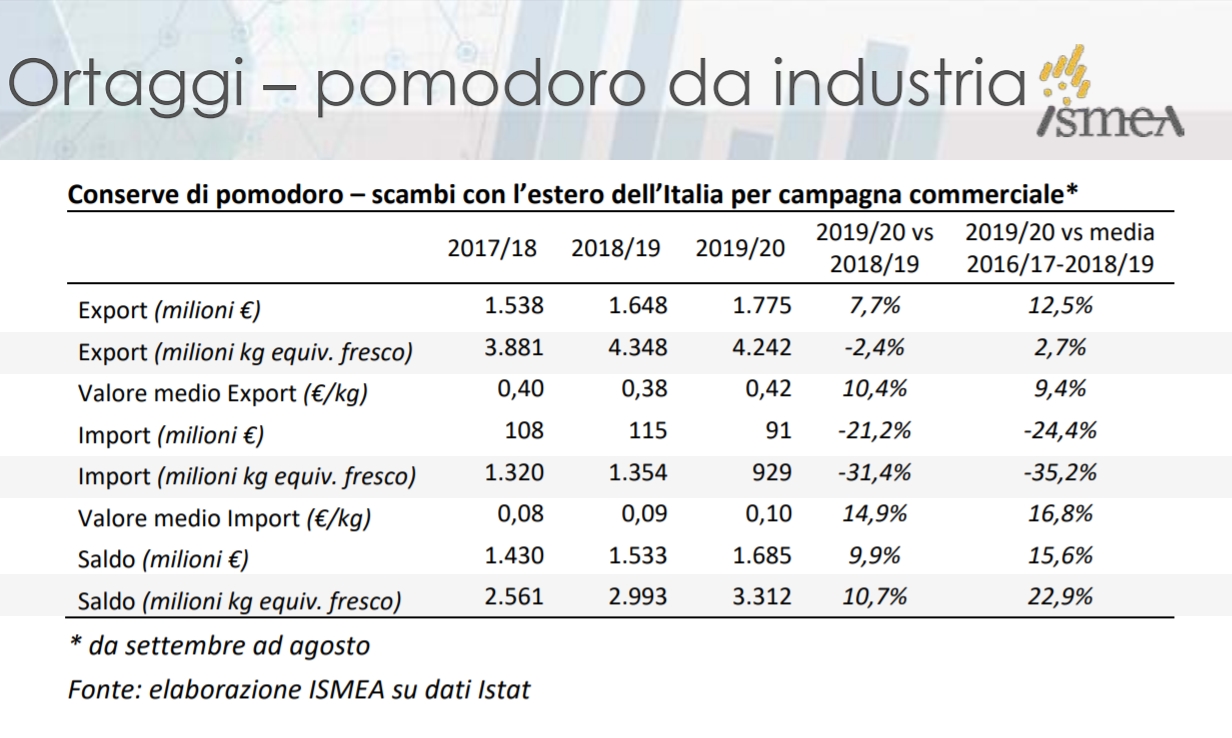

Foreign tradeCanned tomatoes are the sector of the “fruit and vegetables” market that has recorded Italy’s best trade balance results. The pattern followed by indicators of foreign trade have underlined the preeminence of this product: over the past marketing year – from September 2019 to August 2020 – figures for the Italian trade balance rose to a record level of EUR 1.7 billion, thanks to the exported equivalent of 4.2 million tonnes of raw tomatoes.

Although the pandemic has sometimes made foreign exchanges difficult, Italy’s trade balance increased by 8% over the 2019/2020 marketing year, compared to the previous period. This performance is the result of an increase in export revenue (+8%) and a reduction in import expenditure (-21%).

In terms of quantity, exports decreased by 2.4%, while imports decreased by 31%.

Tomato products: foreign trade over the period running September 2019 to August 2020

Last marketing year featured a significant increase in average prices, which reached 10% for exported products and 15% for imported products.

In this regard, it is important to note that Italy imports semi-finished products (mainly concentrated tomato purées of more than 30% soluble solids) at an average price of EUR 0.10 /kg of raw tomato equivalent (EUR 100 /mT) and exports finished products (purées, peeled tomatoes and paste with a soluble solids content below 30%) at an average price of EUR 0.42 /kg of raw tomato equivalent (EUR 420 /mT).

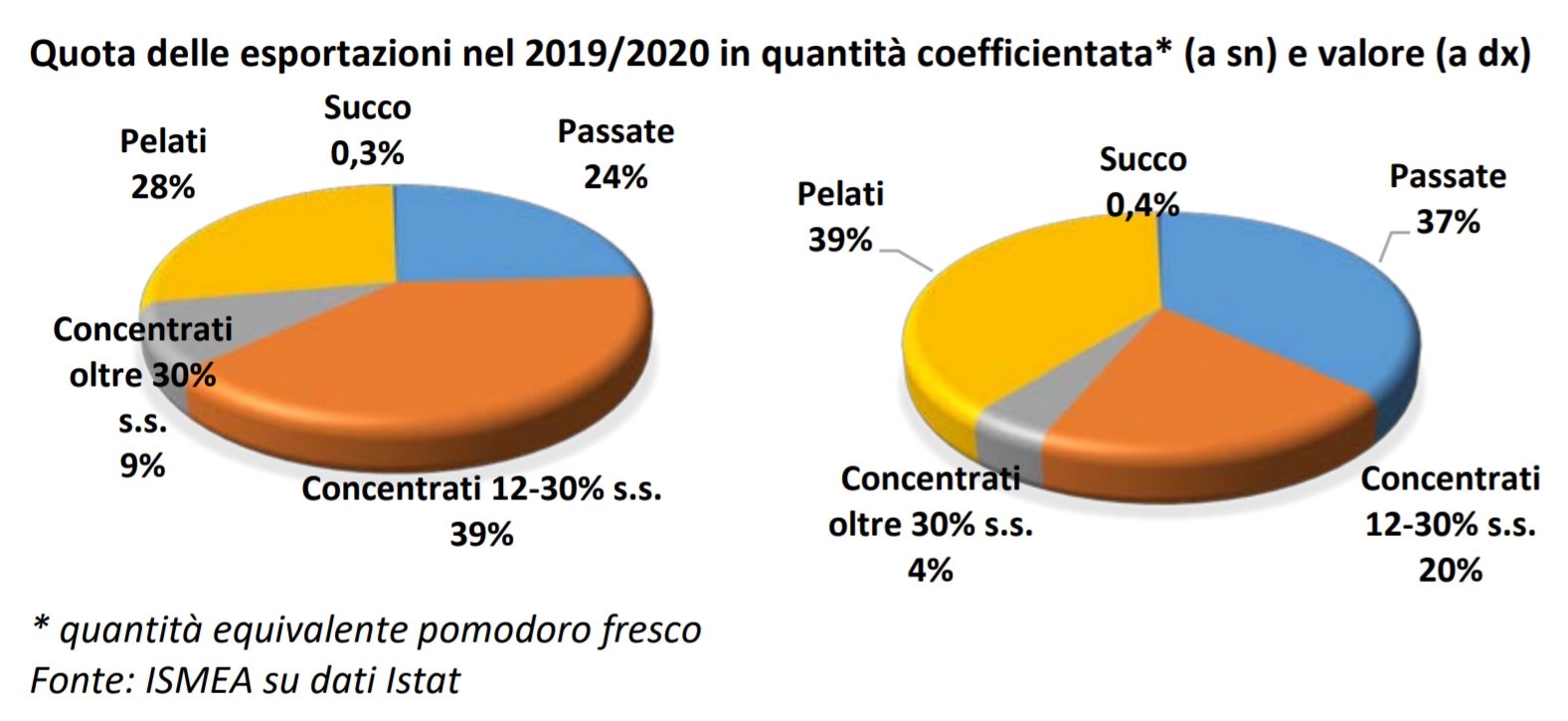

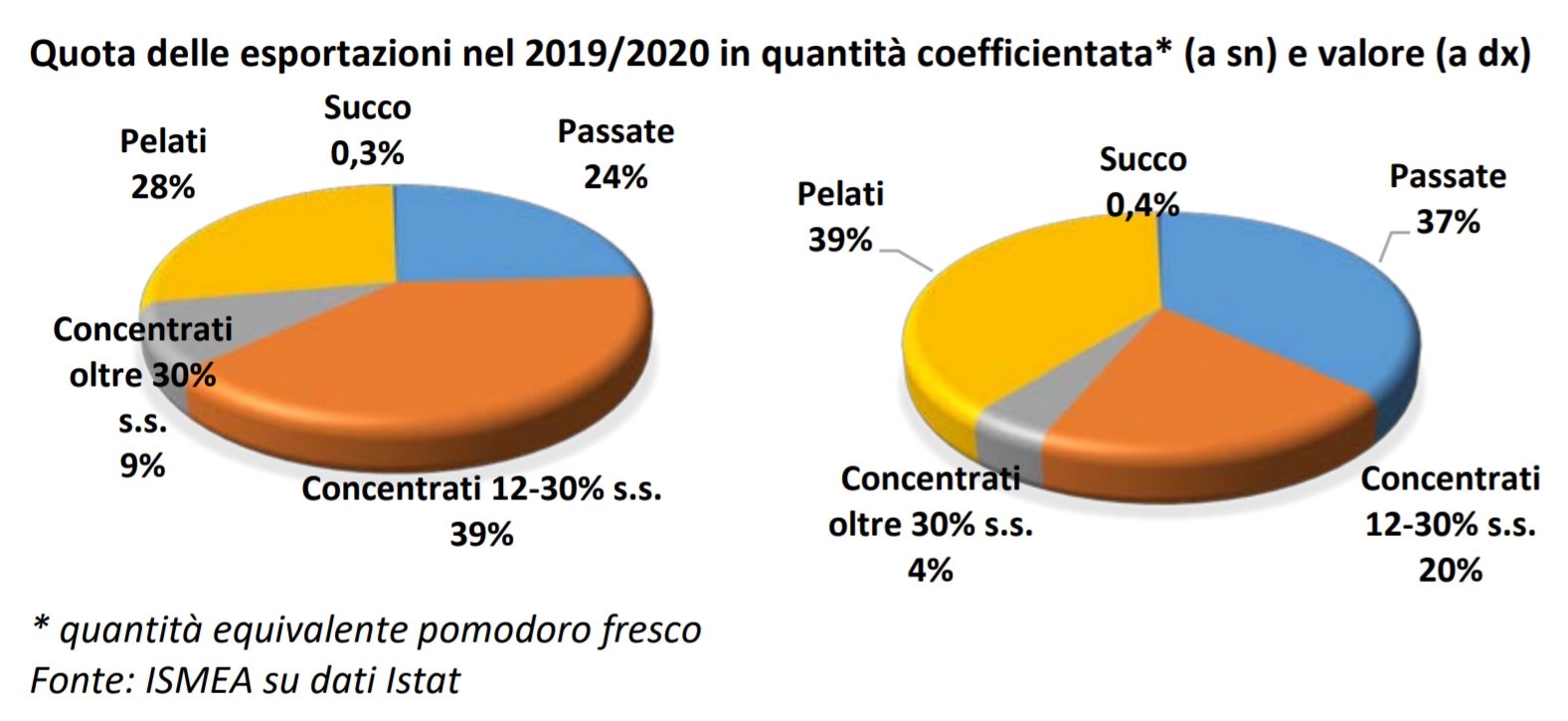

In terms of value, the most frequently exported tomato products are peeled tomatoes (39%) and purées (37%), which together account for three quarters of export volumes. The proportion reaches 96% of total trade if one takes account of the role played by tomato pastes (12-30% soluble solids). This list is rounded off by pastes of more than 30% soluble solids (4%) and by tomato juice (an anecdotal proportion of less than 1%).

Changes compared to the previous season demonstrate a notable increase in exports of purées (+13%) and peeled tomatoes (+9%).

Expressed in raw tomato equivalent, exports of peeled tomatoes, purées and pastes (12-30% soluble solids) account for 90% of total foreign operations, with pastes representing the main contribution to the overall total (39%).

Proportion of exports in 2019/2020, in terms of quantity (left) and value (right)

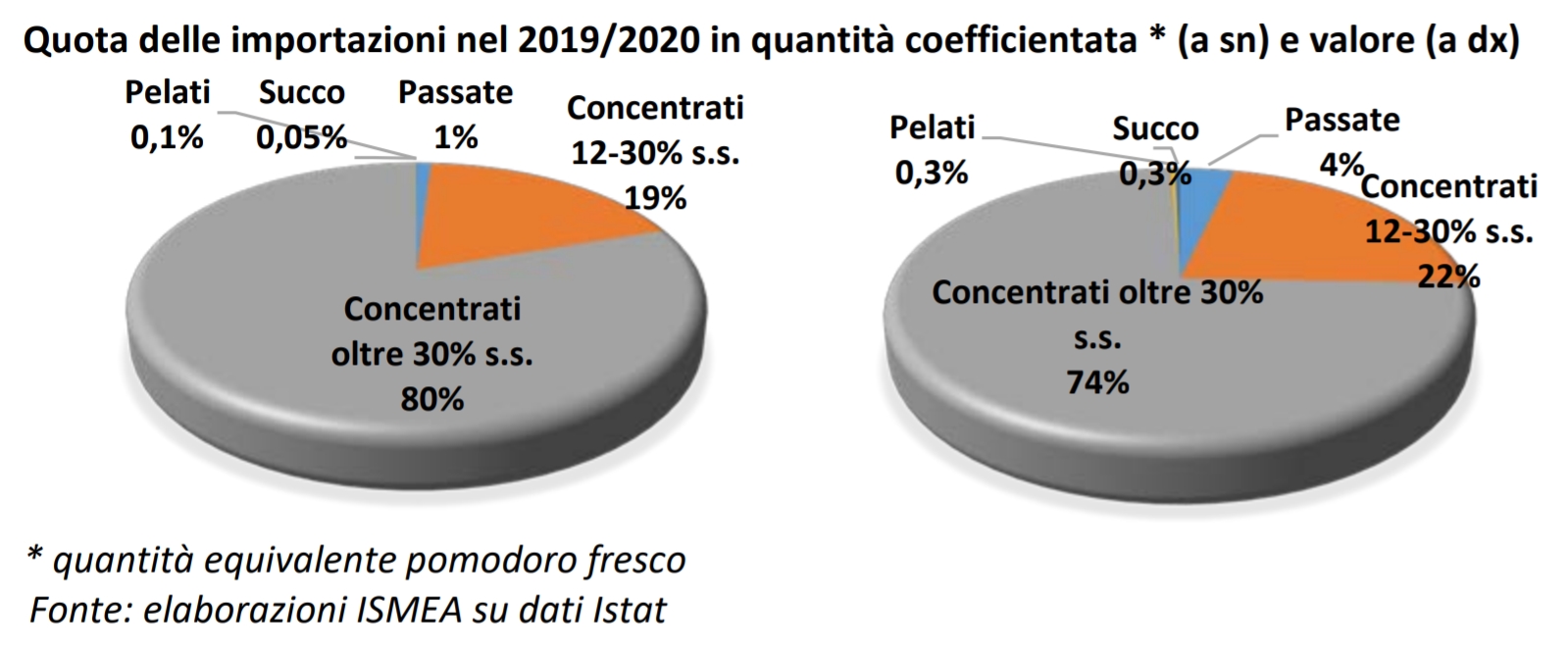

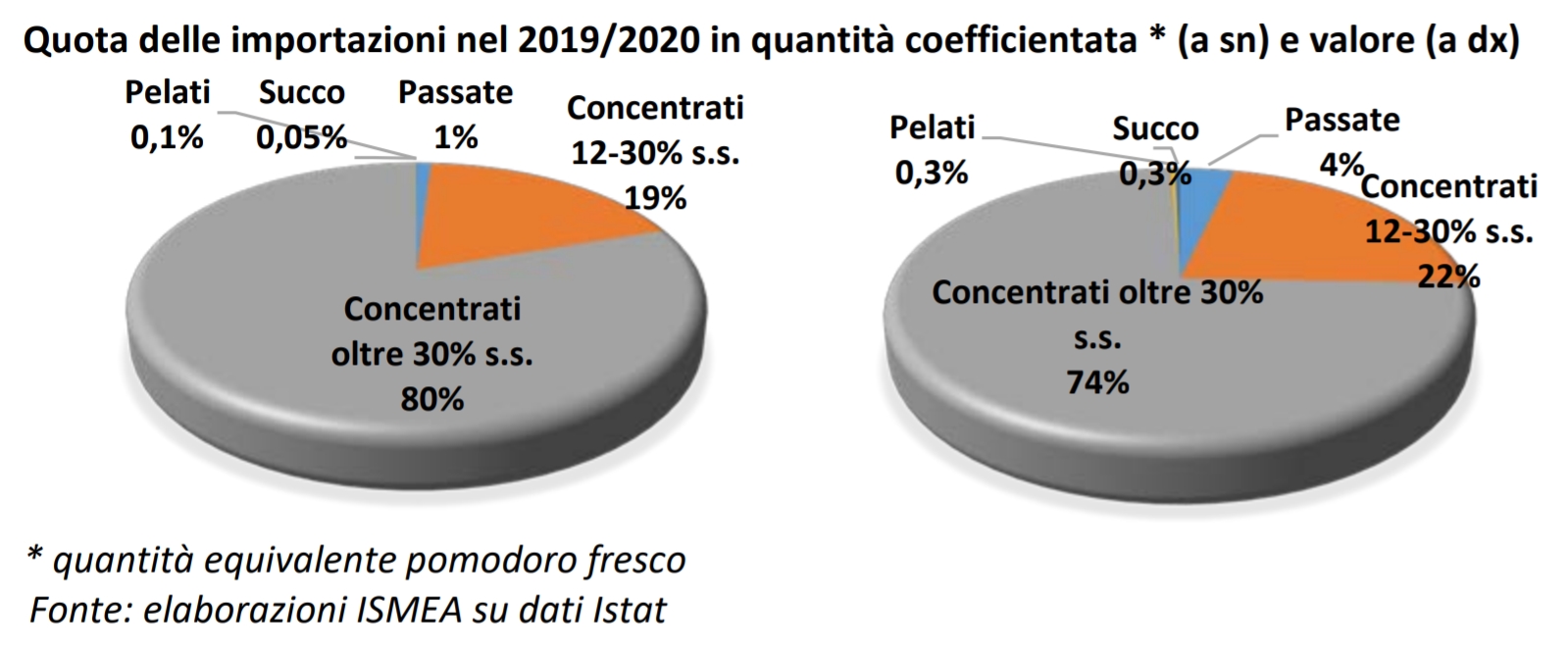

Over the last marketing year, imports of canned tomatoes amounted to the equivalent of approximately 930,000 tonnes of raw materials, for a total of EUR 91 million. The most significant decrease in expenditure for imports has been in the category of tomato pastes of more than 30% soluble solids, whose total value has shrunk from EUR 94 million to EUR 67 million, which is a relative decrease of 29%. On the other hand, expenditure on purchases of purées has doubled, climbing from EUR 1.6 million to EUR 3.2 million.

Pastes with a soluble solids contents of more than 30% make up the main segment of Italian imports. These products account for 74% of total imports in terms of value and 80% in terms of quantity (expressed in farm weight equivalent). Then come simple pastes with a 22% share in terms of value and 19% in terms of quantity. Among the other imported products, purées should be noted for their 4% share of the total in terms of value and 1% in terms of quantity over the past marketing year.

Proportion of imports in 2019/2020, in terms of quantity (left) and value (right)

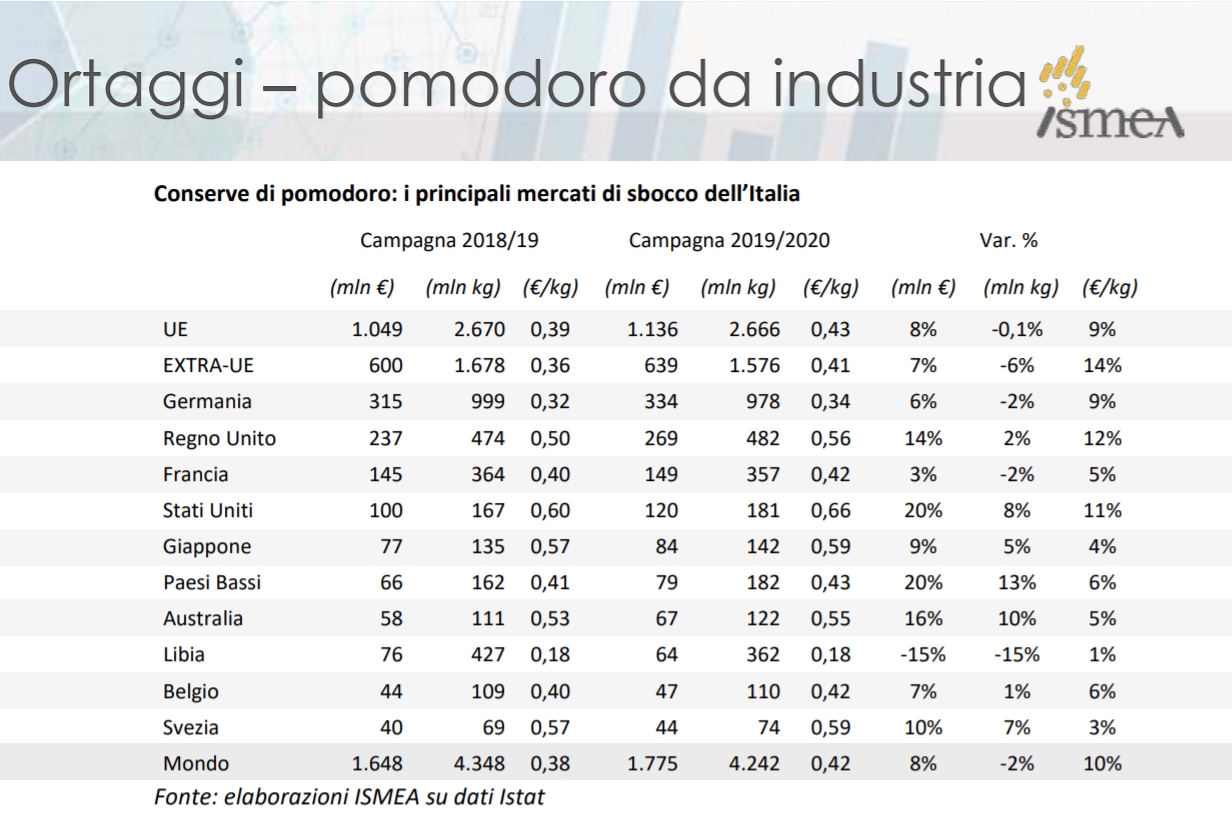

Last year, the European Union absorbed 64% of Italian exports of tomato products, but a total of close on 180 countries imported products from Italy. Among the main trade outlets for the 2019/2020 marketing year, Germany confirmed its position as the biggest buyer of Italian tomato products, with a 6% increase in value compared to the previous season. Germany alone accounts for about one fifth of the total income generated by exports. The United Kingdom ranks second, with a share that increased by 2% in terms of quantity and 14% in terms of value.

Among the ten main outlets for Italian tomato products, it is important to note the sharp drop in sales to Libya (-15%), taking that country from 6th to 8th place in the ranking of importers, while France, the USA and Japan maintained their positions in respectively 3rd, 4th and 5th places.

Tomato products: main outlets for Italian products

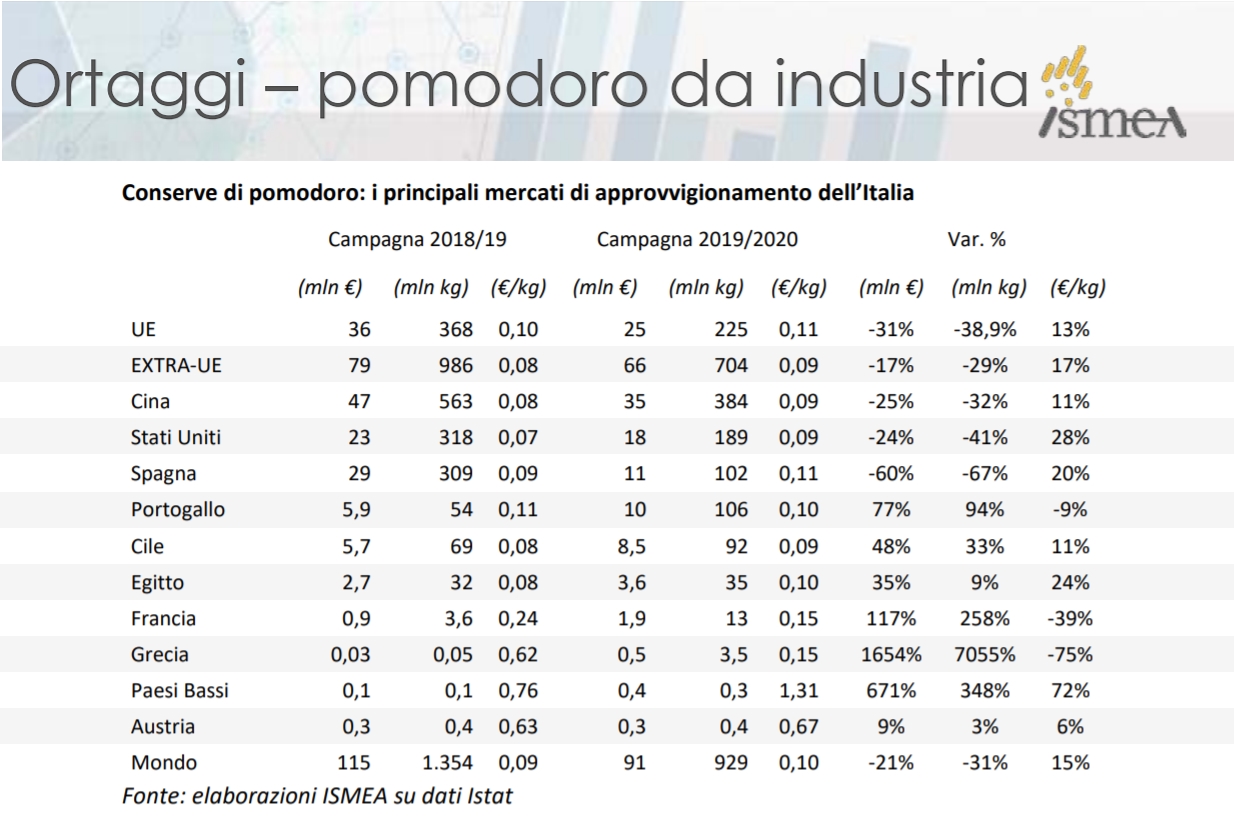

As for Italy’s supply sources, the situation is the reverse of what has been observed for exports, as products originating in third-party countries represent a 72% share of Italy’s supplies.

Furthermore, Italian foreign purchases remain limited to a small number of countries. Over the past marketing year (2019/2020), the five main countries to supply Italy accounted for 90% of total shipments, with China and the USA alone accounting for 58% of this trade flow. Over this period, the volumes shipped in from the main supply sources decreased, particularly those coming from China (-32%), from the United States (-41%) and from Spain (-67%). Among the main suppliers, only Portugal and Chile saw their shipments to Italy increase.

Tomato products: Italy’s main supply sources

Future prospects

According to the terms of the report, “the morale of Italian operators in the tomato processing industry has improved markedly in recent weeks, compared to the beginning of the year (2020). A recent survey carried out by ISMEA regarding the degree of confidence within the Italian food industry has shown that companies that process fruit and vegetables (among them, canned tomato products being the main category) are demonstrating good levels of satisfaction regarding the current situation, and are also fairly optimistic as to the evolution of their business due to an increase in demand. The reasons for this optimism are mainly linked to the recovery of domestic consumption resulting from the pandemic in Italy (see the second installment of this report, which will be published in the near future).

Furthermore, it can also be said that prospects for this sector are inextricably linked to the success of processed tomato products on foreign markets and, in this sense, the shrinkage of production recorded during the 2020 season in Portugal and Spain no doubt represents a further cause for optimism over coming months.

Finally, it is important to underline the role played by research and the development of new processes in offering better prospects to the industry. Special mention should be made of research into new varieties of tomatoes that can provide both agricultural productivity and organoleptic and technological qualities of the fruit. Furthermore, in terms of industrial processing itself, innovations in the fields of products and production processes have allowed the industry to evolve and progress in a worldwide context that is increasingly competitive.”

Source: ismea

Further details in attached documents (in Italian):

Foreign trade

Foreign trade