In January 2024, the Italian institute ISMEA (Istituto di Servizi per il Mercato Agricolo Alimentare) published its report dedicated to the Italian processing tomato sector, entitled “Focus Conserve Di Pomodoro, Tendenze E Dinamiche Recenti” (“Focus On Tomato products, Trends And Recent Dynamics").

In this article, we present the main points of this report.

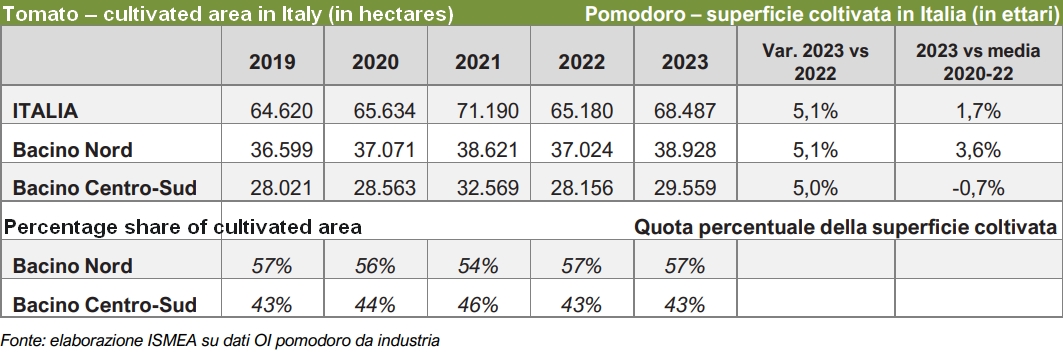

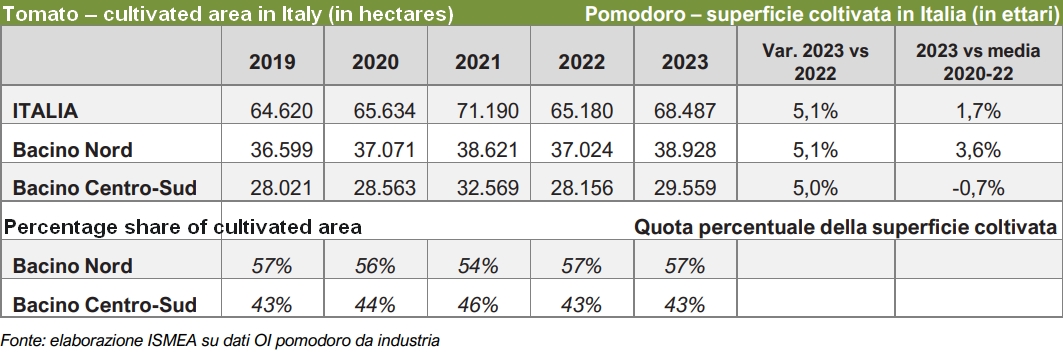

In 2023, in Italy, the surface area planted with tomatoes for processing amounted to approximately 68,500 hectares. This represents an increase both compared to 2022 (+5%) and compared to the average figure for the three-year period 2020-2022 (+1.7%). At the macro-area level, the increase in acreage was very similar both in the production basin of south-central Italy (+5%) and in the northern Italy basin (+5.1%).

In 2023, in Italy, the surface area planted with tomatoes for processing amounted to approximately 68,500 hectares. This represents an increase both compared to 2022 (+5%) and compared to the average figure for the three-year period 2020-2022 (+1.7%). At the macro-area level, the increase in acreage was very similar both in the production basin of south-central Italy (+5%) and in the northern Italy basin (+5.1%).

Over the last year, there has been an acceleration of the dynamics of price increases at all stages of the supply chain. The agricultural upstream has had to deal with the increase in the prices of production inputs, in particular fertilizers and energy products, and this has led to an increase in the price of raw tomatoes. The industrial downstream sector has been affected not only by the increase in the cost of agricultural raw materials, but also by the increase in the price of energy, glass, steel and cardboard. Finally, the price increase has been transferred to the distribution sector and to wholesale and retail sales.

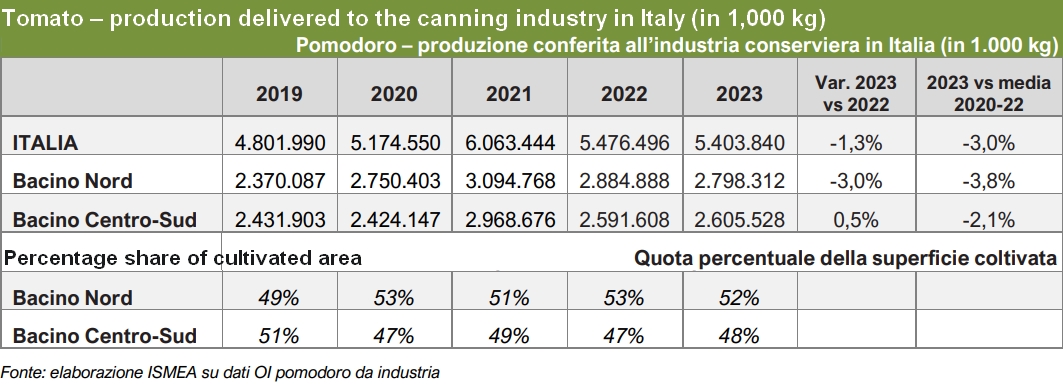

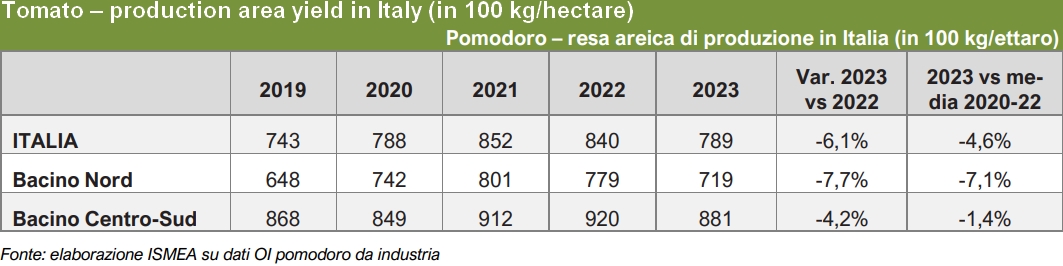

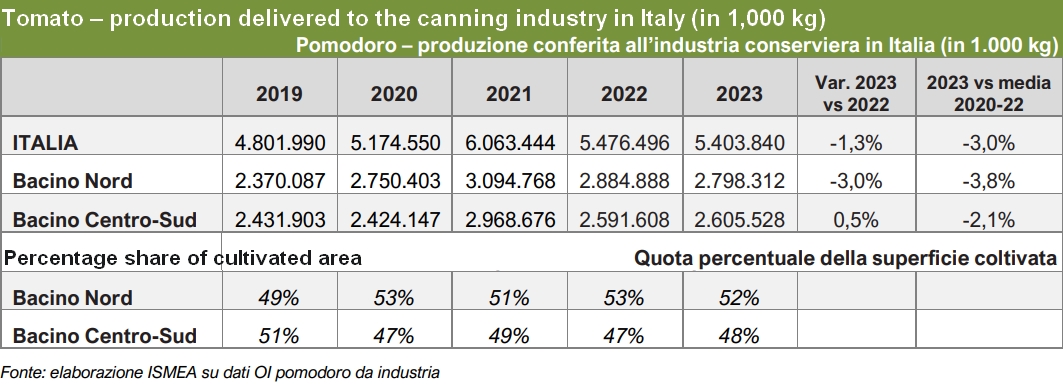

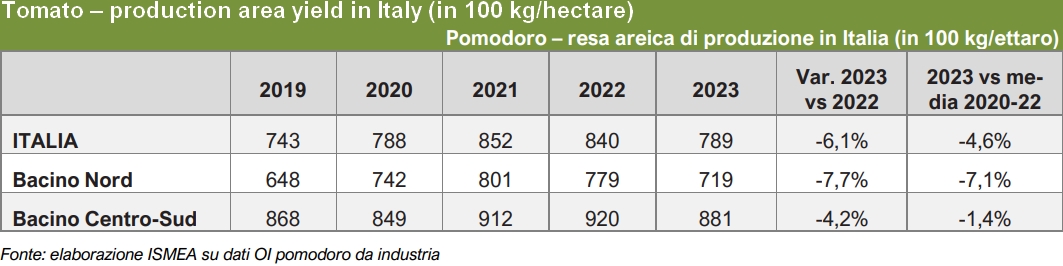

Extreme climatic events and an unfavorable climate in general have led to a decline in the production yield per hectare both compared to 2022 and compared to the average figures of the last three years. The decline in yield has been more severe in the production basin of northern Italy compared to the south-central basin, and the 2023 tomato processing season ended with an overall production of approximately 5.4 million tonnes, down 1.3% compared to 2022. In particular, in northern Italy, tomato deliveries to processing operators amounted to approximately 2.8 million tonnes – a decrease of 3% compared to last year – while in south-central Italy, approximately 2.6 million tonnes were delivered to processors, which is a slight increase compared to 2022 (+0.5%).

In 2023, the national average yield stood just below 790 quintals (79 t) of fresh tomatoes per hectare cultivated, down 6% on an annual basis and 4.6% compared to the average figure for the last three years. It is worth highlighting that despite this decline, taking the last decade as a reference, the average yield of 2023 is only lower than the yields of 2017, 2021 and 2022.

In the south-central region, the surface area yield is always higher than in the north, both due to pedoclimatic issues and because oblong tomatoes are the main crop, while in the northern area, the choice is focused on round fruit varieties. In 2023, the yield fell below the threshold of 900 quintals per hectare (90 t/ha), stopping at 88.1 t/hectare with a decrease of 4% compared to 2022 and 1.4% compared to the average figure of the last three years. Despite the decline, the 2023 figure is still the fourth best result of the last decade.

In the northern area of Italy, the average yield was recorded at 71.9 t/hectare, down 7.7% compared to 2022 and 7.1% compared to the average figure for the last three years. In this region, the yield has been particularly low compared to recent years, but it must be kept in mind that over the last ten years, the average figure has not reached 70.0 t/hectare more than five times.

In particular, in Emilia Romagna, the season presented two very different faces. In the western provinces, production recorded positive results, despite these areas being hit hard by hail, while in the eastern provinces and in particular in Ravenna and Ferrara, yields were decidedly low due to the persistent rains in May and the floods that hit the Ravenna area hard on 20 May 2023, also leading to the loss of areas already transplanted. The insistent rains in May caused transplanting operations to be delayed to June and the harvest to be dragged on into September and October.

In the production basin of northern Italy, the field yield of organic tomatoes was significantly lower than the average yield of the past five-year period, recorded at 47.4 t/hectare compared to the historical average figure of 62.9 t/hectare.

Retail sales

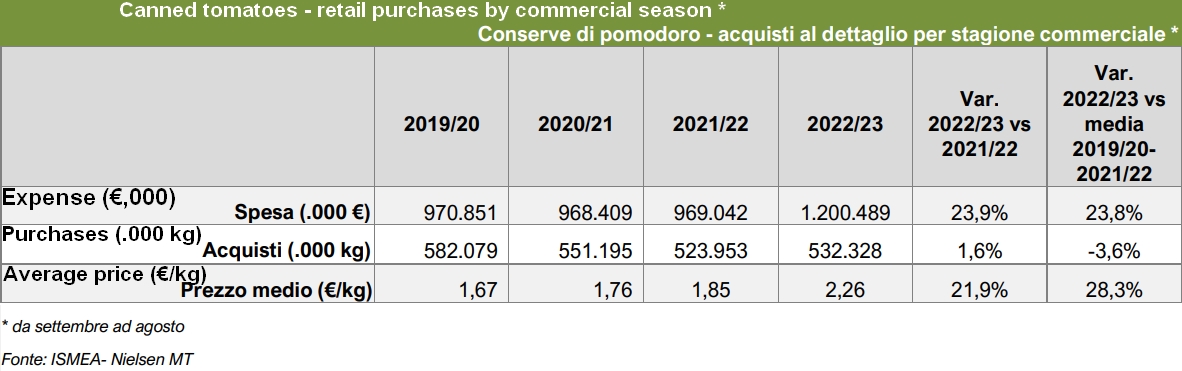

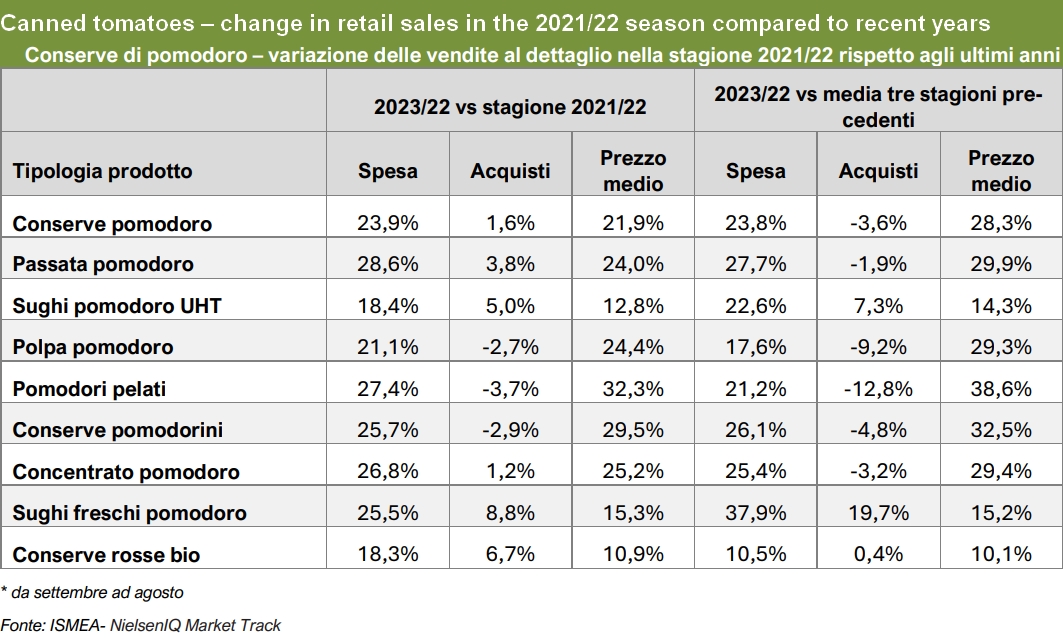

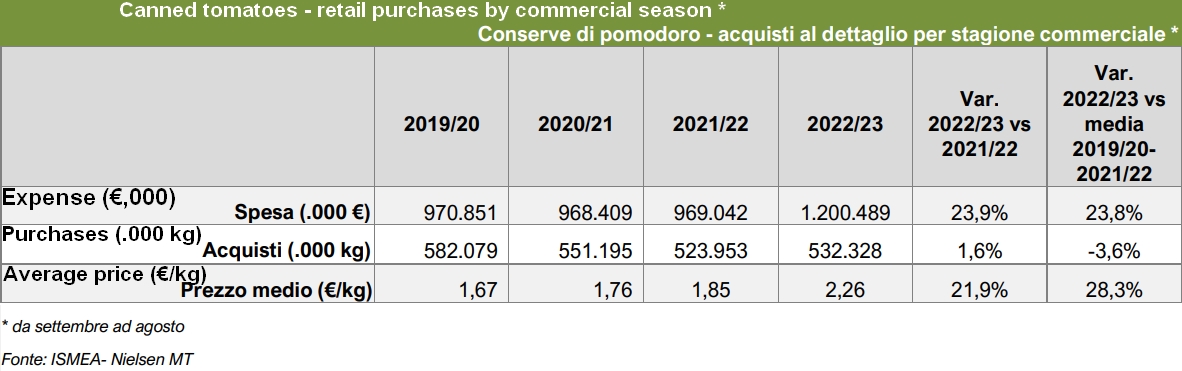

The 2022/23 marketing year was marked by an increase in purchases compared to 2021/22 (+1.6%), but a decrease compared to the average figure of the last three marketing years (-3.6%), which, however, had been characterized by exceptional sales volumes due to the increase in home-prepared meals, due to the restrictions imposed by the Covid 19 situation. The increase in average price (+22% on an annual basis and +28% compared to the average price of the three previous years) determined the strong increase in spending (+24% both on an annual basis and compared to the previous three years).

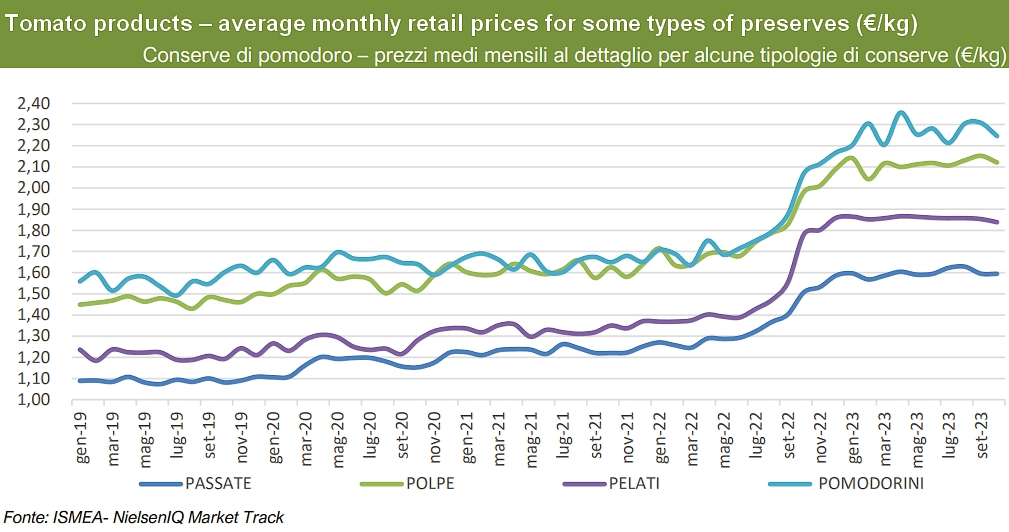

The monthly data for retail purchases of canned tomatoes allows a precise snapshot of the acceleration of the average retail prices of these products, which increased by approximately 30% in two years, having gone from an average of EUR 1.78/kg in October 2021 to EUR 2.31/kg in October 2023. This growth in price was fueled first by the increase in demand due to the pandemic and subsequently by the surge in prices of energy products, which had a heavy impact on all phases of the supply chain (tomato production, processing and distribution), as well as by the three-digit increase in mineral fertilizers which have penalized the agricultural sector. To these must be added the increases in packaging costs (aluminium, glass, paper and cardboard).

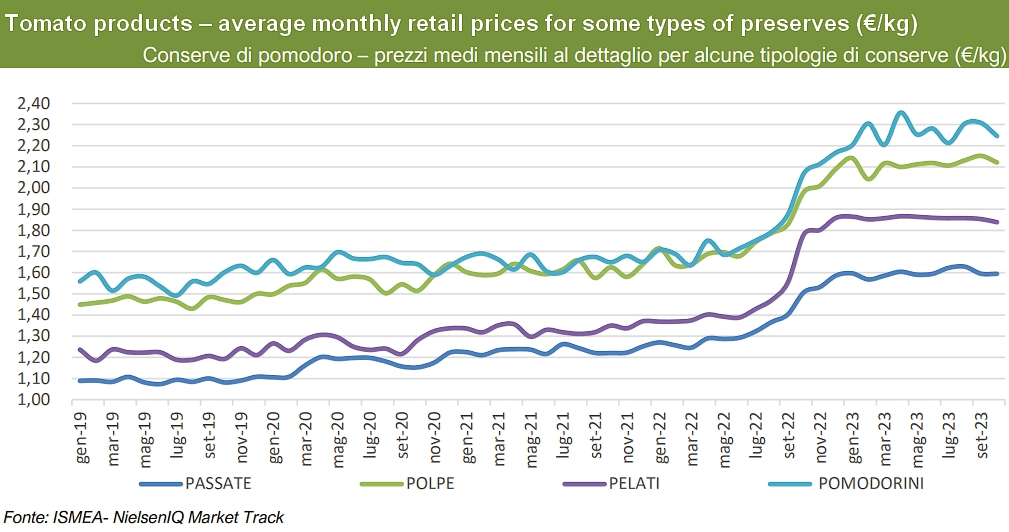

The following graph shows the average retail prices of some of the-most popular tomato products: purées, pulp, peeled tomatoes and canned cherry-tomatoes. In particular, the Ismea’s report notes the increase in retail prices coinciding with the first lockdown of the pandemic (March-May 2020), the second pandemic wave (November 2020-March 2021), and finally the big step between July and October 2022 as a consequence of the increases in the production costs of agricultural raw materials and energy, due to the Russian-Ukrainian conflict.

Among the main products, cherry-tomatoes and pulp maintain higher prices than peeled tomatoes and purees.

In Italy, the types of tomato products most purchased in the retail sector are purees and pulps, which account for around three-quarters of the quantities and 55% of total expenditure. Next, the best-selling products include ready-made sauces (12% of volumes and approximately 28% of expenditure) and peeled tomatoes (10% of purchases and 8% of expenditure). The consumer’s basket is completed by canned cherry-tomatoes, tomato paste and fresh sauces.

Over the last thirty years, the concordance of various phenomena including the decline in the number of meals consumed at home, the reduction in the time dedicated to preparing meals and the replacement of red condiments with other types of condiments have led to a gradual reduction in the market for tomato products. In this long-term scenario, there has also been a progressive replacement of lower service content products (pulp and peeled tomatoes) with higher service content products (purees and ready-made sauces).

Focusing attention on what happened more recently, between 2020 and today, the increase in retail purchases of canned tomatoes due to the pandemic is evident, and subsequently, starting from July 2022, the surge in retail prices has led to a considerable increase in household spending.

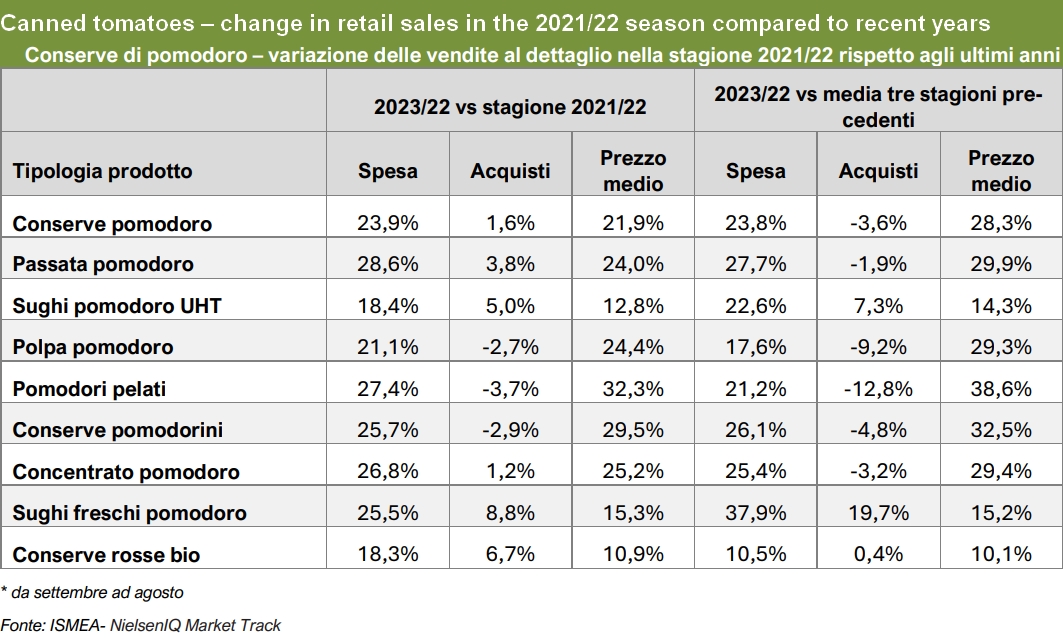

The evolutions in sales for the 2022/23 marketing year observed for each type of product are summarized in the table below. Overall, compared to the previous year, there has been a 1.6% increase in the volume of purchases. This data is the result of the opposite dynamics that characterized the main products. On the one hand, purchases of purees (+3.8%), ready-made UHT sauces (+5%) and fresh ready-made sauces (+8.8%) increased, while on the other hand purchases of pulp (-2.7%), peeled tomatoes (-3.7%) and canned cherry-tomatoes (-2.9%) decreased. Fresh sauces constitute a product segment that is still relegated to a market niche, with around 2% of overall spending, but sales of this product have increased by 8.8% over the last year and by 20% compared to the average figure for the past three-year period. In terms of spending, the increase in average prices affected all types of products and led to an increase in household spending for the entire range of processed tomato products.

In relative terms, the increases in retail prices were greater for those products that have a lower price per kg, while on the other hand, products with a higher service content, such as ready-made sauces, have a higher retail price than other items, and therefore recorded a lower percentage increase in prices.

A comparison of the sales data of the 2022/23 marketing year with the average data of the previous three-year period highlights that the products with the greatest purchasing dynamics were UHT sauces (+7.3% in quantity) and fresh sauces (+20%), while purchases of peeled tomatoes decreased (-13% in quantity), pulp (-9%), canned cherry tomatoes (-5%) and puréed tomatoes lost around 2%.

Finally, mention should be made of the retail sales of certified organic products, which in Italy account for approximately 4% of overall sales and are mainly represented by purees, pulps, sauces and to a lesser extent peeled tomatoes. In recent years, this market segment has followed a highly dynamic pattern: in the 2022/2023 marketing year, there was a recovery in sales compared to the previous season (+6.7%), against an increase in average prices of approximately 11%. In fact, the market returned to purchasing levels similar to those recorded during the pandemic.

The wider distribution of sales of organic tomato products is leading to a narrowing of the price differential with non-organic items. As a consequence of this, there has been a noticeable decrease in the impact of organic products on overall purchases in terms of quantity (3.2% in the 2022/23 marketing year), along with a 3.8% drop in value share.

The second part of this dossier, devoted to Italian foreign trade in tomato products, will be published very soon.

Sources: ISMEA

In 2023, in Italy, the surface area planted with tomatoes for processing amounted to approximately 68,500 hectares. This represents an increase both compared to 2022 (+5%) and compared to the average figure for the three-year period 2020-2022 (+1.7%). At the macro-area level, the increase in acreage was very similar both in the production basin of south-central Italy (+5%) and in the northern Italy basin (+5.1%).

In 2023, in Italy, the surface area planted with tomatoes for processing amounted to approximately 68,500 hectares. This represents an increase both compared to 2022 (+5%) and compared to the average figure for the three-year period 2020-2022 (+1.7%). At the macro-area level, the increase in acreage was very similar both in the production basin of south-central Italy (+5%) and in the northern Italy basin (+5.1%).