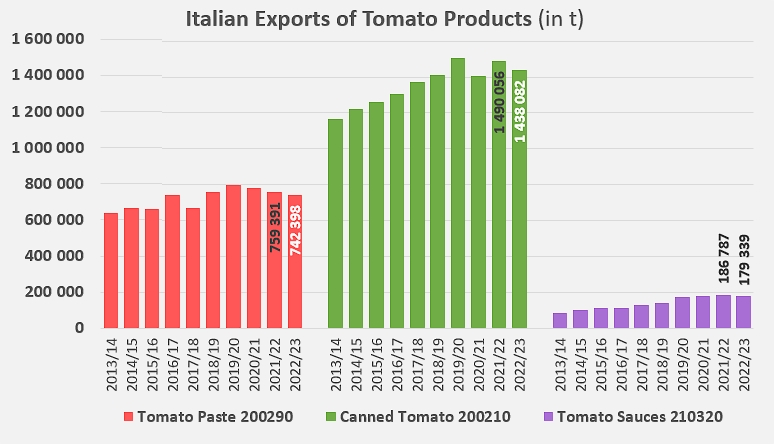

The quantities exported show a downward trend in all categories, but this should be considered in the context of the exceptional increases recorded in recent years. These readjustments bring 2023 sales back to levels comparable to pre-Covid times, sometimes higher.

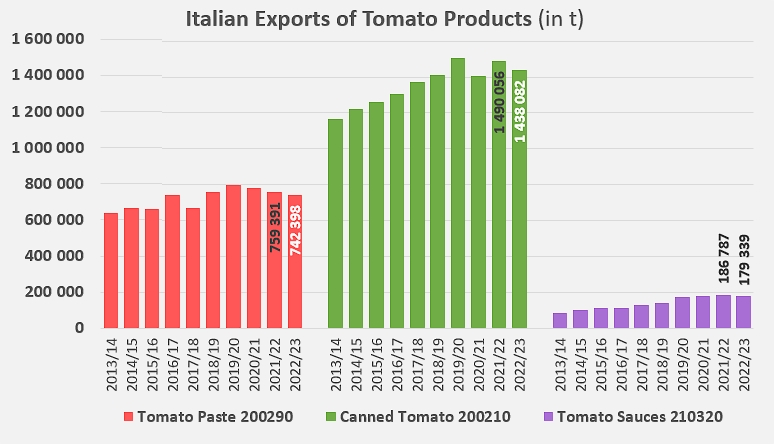

The Italian export performance in the tomato products sector was lower in 2022/2023 than the previous year: 742,400 metric tonnes (t) of pastes (HS codes 200290), 1.438 million t of canned tomatoes (HS codes 200210) and 179,400 t of ketchup and tomato sauces (HS codes 210320) were delivered abroad over the last marketing year as a whole.

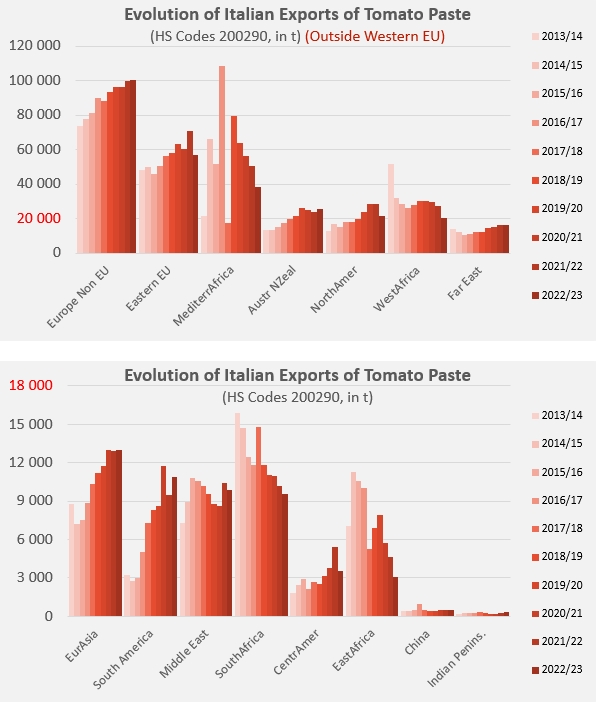

The decrease has affected all categories, but must be seen in the context of the exceptional increases recorded in recent years. In the paste category, for example, the drop is around 17,000 t compared to the 2021/2022 marketing year (759,400 t), and 37,700 t compared to the average activity over the last three marketing years. Despite these downturns, sales remained virtually identical (+330 t) to the average of the three pre-Covid years.

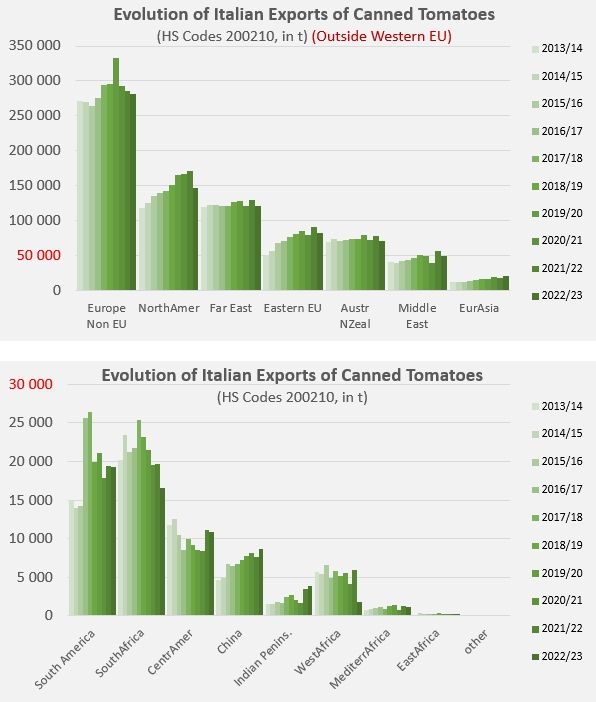

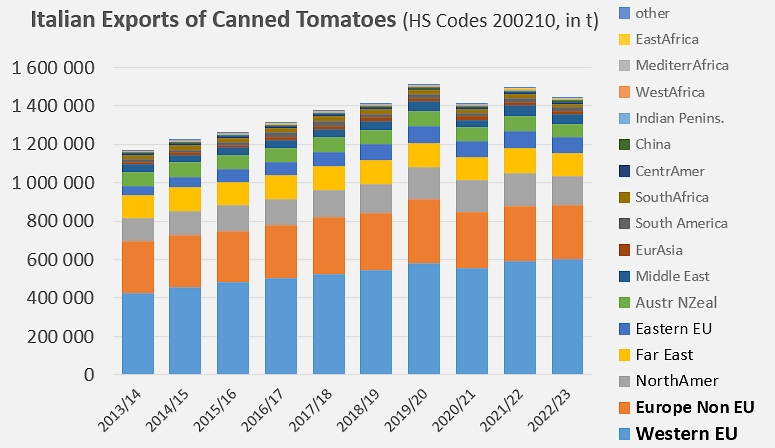

The dynamics of canned tomato exports are fairly comparable, with significant decreases of 52,000 t and 30,000 t compared to 2021/2022 and to the previous three years, but at the same time, they have recorded a result that is slightly higher (8,200 t, +0.6%) than in the pre-Covid period.

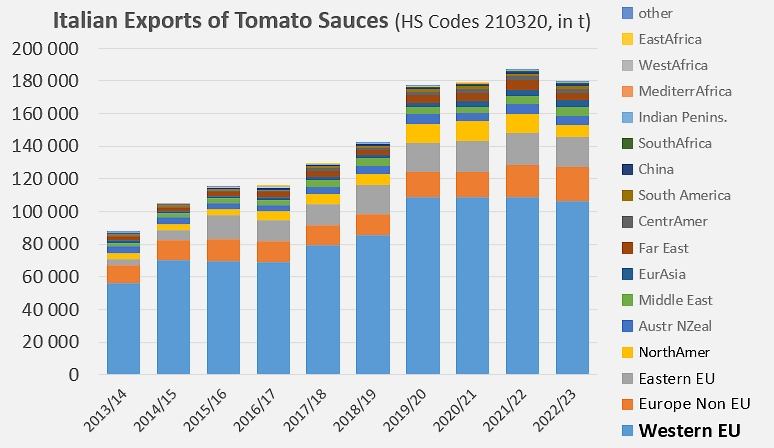

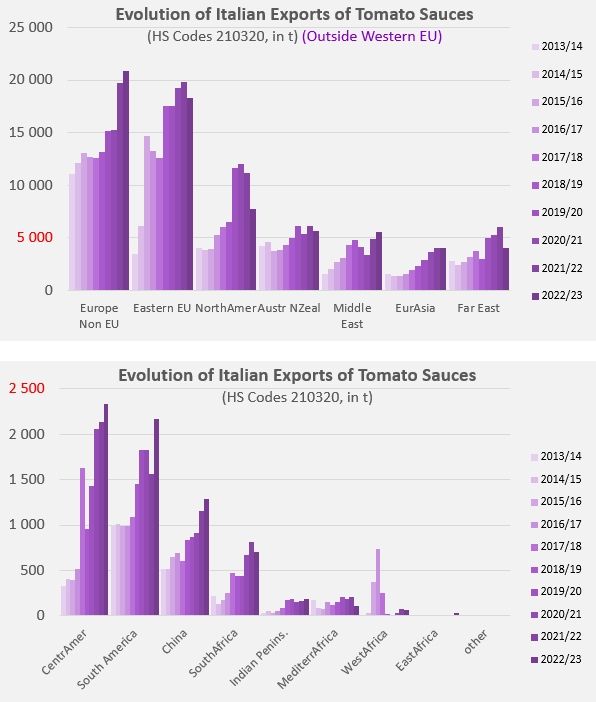

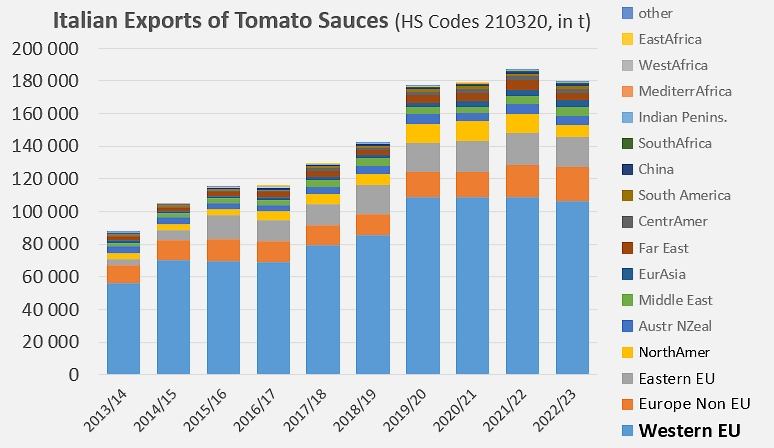

Against this difficult backdrop, the sauces sector has held up best, with moderate decreases of 7,400 t and 1,300 t compared to previous years, and above all a remarkable increase (+30,000 t, +20%) compared to the pre-Covid period.

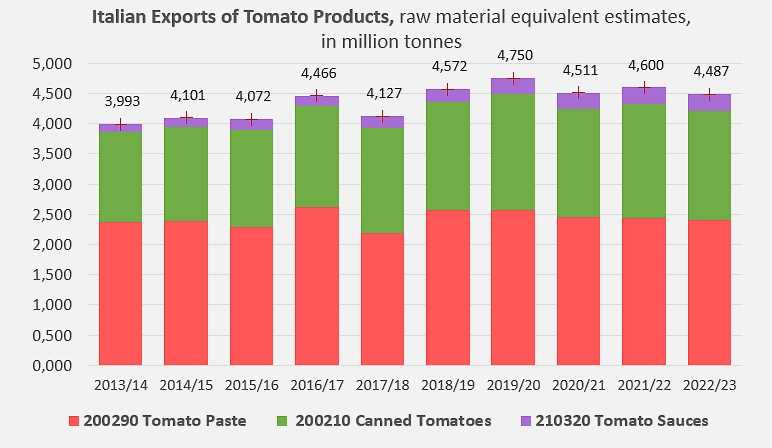

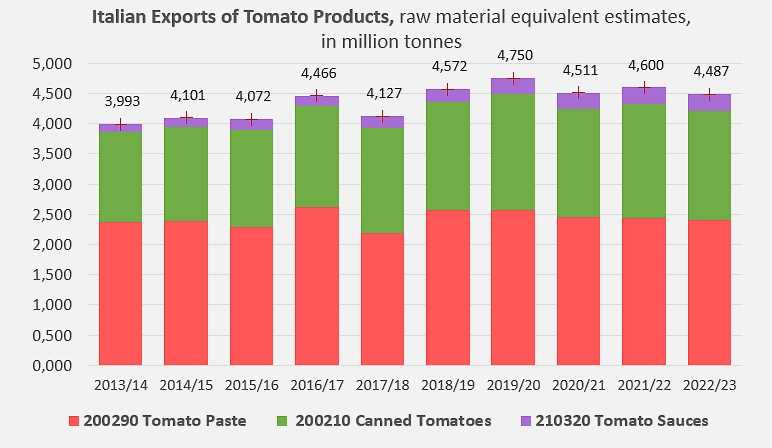

An estimate of the quantities of raw materials absorbed by Italian exports of processed tomato products in recent years shows that, after the peak recorded in 2019/2020, a gradual readjustment in operations has taken place, progressively bringing the level of Italian foreign activity back to more or less what it was before the health crisis.

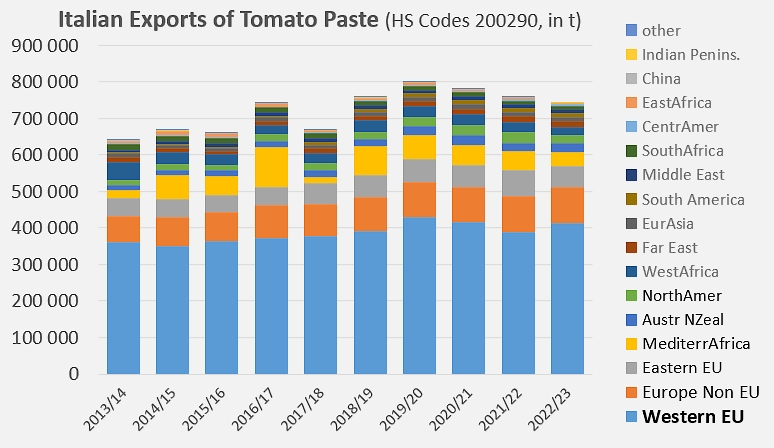

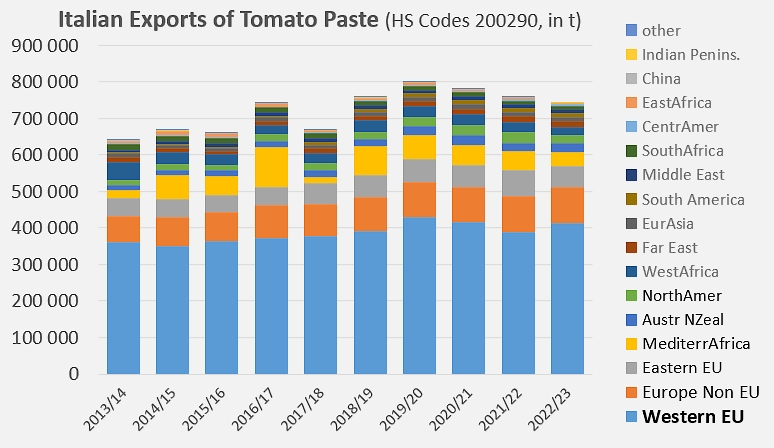

Europe, in the geographical sense of the term, naturally occupies a privileged and therefore strategic place in Italy's foreign trade. Over the last ten years, 74% of the country's exports of pastes, 85% of its exports of canned tomatoes and 81% of its exports of sauces and ketchup went to the EU and non-EU countries of Europe. As such, this part of Italy's foreign trade has been of particular importance over the 2022/2023 marketing year. In the paste category (HS codes 200290), the second pillar of Italy's foreign sales, the most significant annual decreases in quantities were recorded (in order of importance) for the eastern EU (Poland, Romania, Czech Republic, Hungary), Mediterranean Africa (Libya), North America, West Africa (Burkina Faso, Togo, Ivory Coast), Central America (Cuba) and East Africa (Sudan). Furthermore, despite a significant drop in German purchases, Italian sales of paste have risen sharply over the last two years on the markets of the Netherlands, Austria, Spain, France and Portugal, with a consequential refocusing of Italian foreign shipments on western EU countries.

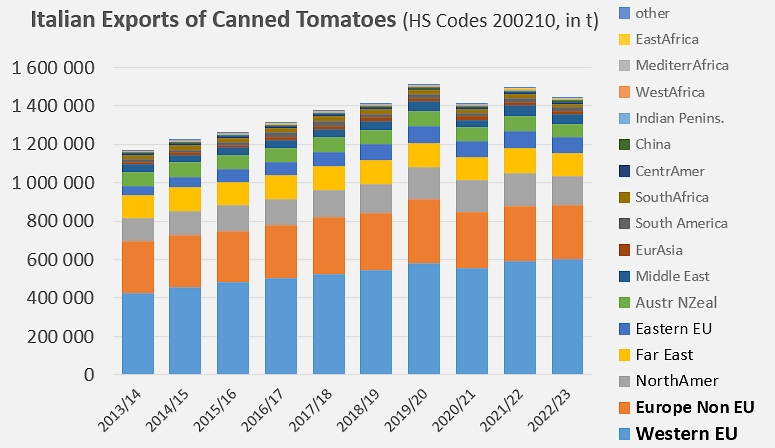

A similar and more accentuated dynamic has affected Italian exports of canned tomatoes (HS codes 200210) in 2022/2023, which have decreased in annual variation by nearly 52,000 t and 3.5%. The main outlets for Italian canned tomatoes, with the notable exception of the western EU and Eurasia, have significantly reduced their purchases in this sector, with the biggest drop affecting product flows destined for the North American market (USA, Canada). Furthermore, the eastern EU (Romania, Poland), the Far East (Japan, South Korea), Australia and New Zealand, the Middle East (Saudi Arabia), but also France, Sweden, Belgium, and the United Kingdom have all significantly reduced their supplies from Italy. In this category also, there has been an increase in the proportional importance of the western EU in Italy's total foreign activity.

The moderate decline in foreign sales of tomato sauces and ketchup between the last two marketing years is essentially due to the slowdown in sales within the EU itself (Germany, Netherlands, Sweden, Austria, Belgium, Poland, Czech Republic, -4,100 t), North America (USA, -3,400 t), and in the Far East (Japan, Singapore, Hong Kong, -2,000 t).

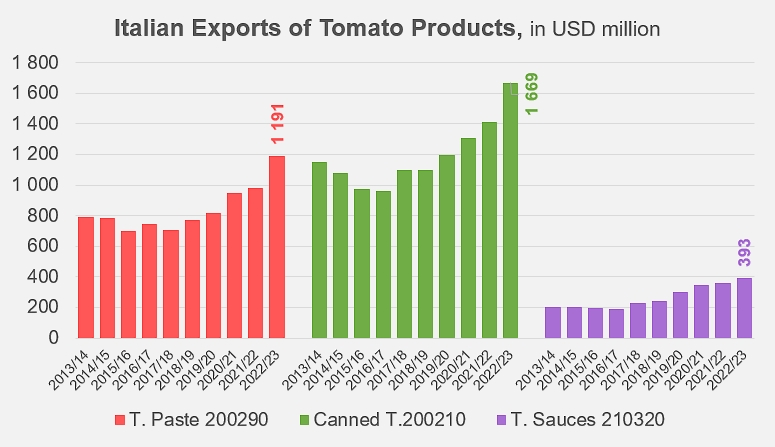

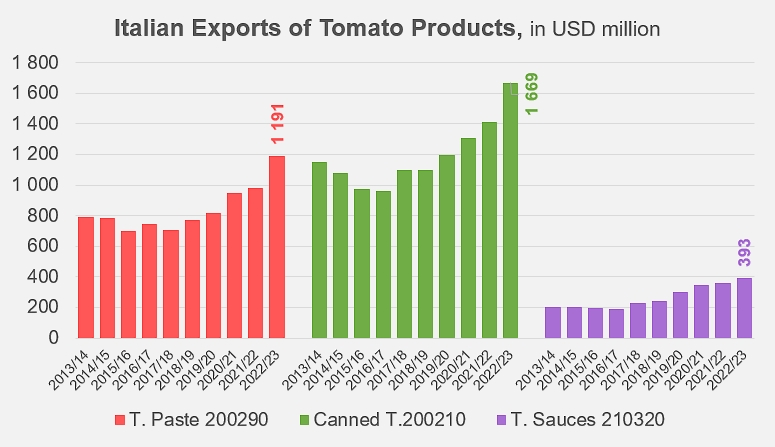

Alongside the rather dissimilar results in quantitative terms revealed by a comparison with the situation prior to the Covid health crisis, the rise in the price of tomato products on the world market has profoundly reshaped the value landscape of the various export categories of the Italian industry, and in a relatively uniform manner. According to data provided by national customs services, the total value of exports of Italian tomato products in the 2022/2023 marketing year broke a new record, exceeding EUR 3.253 billion, up EUR 496 million (+18%) on 2021/2022, up EUR 695 million (+27%) on the average for the previous three marketing years, and up EUR 1.1 billion (+51%) on the period prior to the Covid crisis. With sales of EUR 1.19 billion last year, the biggest percentage increase on the pre-Covid level was in the total value of exported pastes (+56%, EUR 426 million), but increases in other categories were equally impressive: EUR 536 million (+47%) for canned tomatoes, with an export value of EUR 1.67 billion, and EUR 134 million (+52%) for foreign sales of sauces, which reached EUR 393 million last year.

These results for the period running July 2022 to June 2023 confirm those presented and commented on in our annual study of world trade, published in the Yearbook distributed free of charge to participants at the Tomato Day organized on October 27, 2023, as part of the CibusTec expo in Parma (Italy).

Some complementary data

Evolution of Italian exports of tomato pastes (HS codes 200290) by region, over the last ten years.

Evolution of Italian exports of canned tomatoes (HS codes 200210) by region, over the last ten years.

Evolution of Italian exports of ketchup and tomato sauces (HS codes 210320) by region, over the last ten years.

Sources: Trade Data Monitor