After the impetus given to consumer demand by the Covid pandemic, the dynamics of trade are readjusting to a new normal.

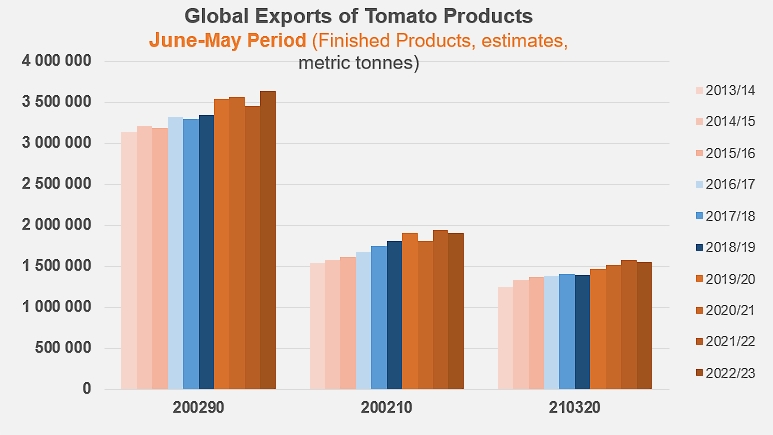

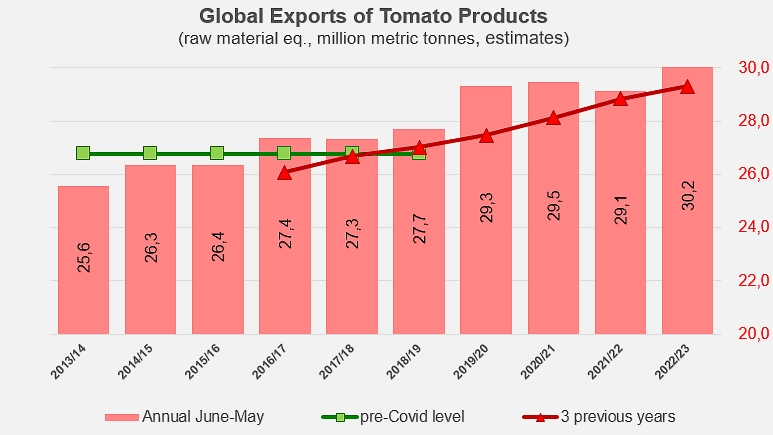

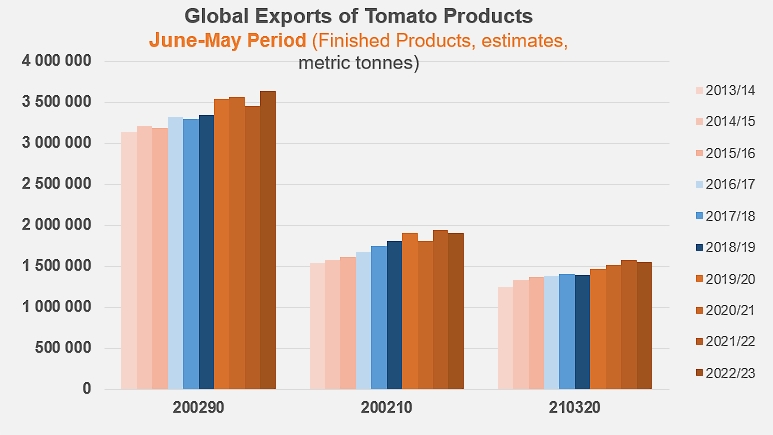

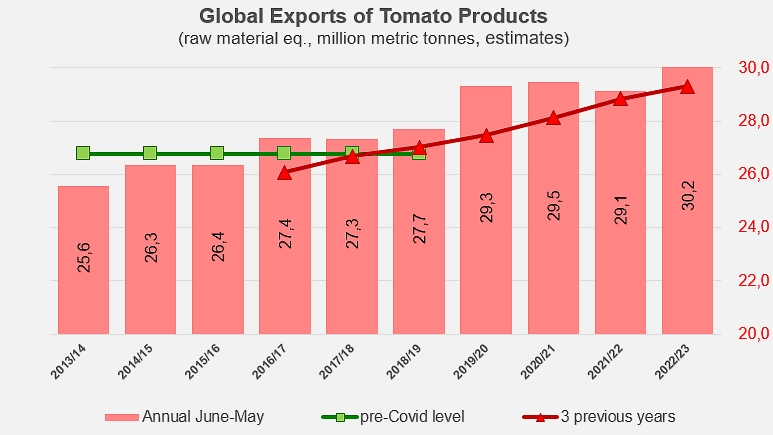

The twelve months between June 1, 2022 and May 31, 2023 took place against a general backdrop of increasing world trade in tomato products. For each product category (paste, canned tomatoes and sauces), the increase in trade was more marked than in the period preceding the Covid health crisis (around 10%), and more marked than the average for the last three years (around 3%).

As can be seen from the national trade statistics published monthly on our website www.tomatonews.com, exports of tomato pastes continued to grow last year (+6% year-on-year), while exports of canned tomatoes (-2%) and sauces (-3%) seem to have stabilized, following the spectacular increases of recent marketing years.

The result has been a new trade dynamic which, for the time being, confirms the interruption of the slowdown observed before 2019, and brings the total quantities of raw tomatoes absorbed by the worldwide trade in processed tomato products to over 30 million tonnes (metric, t). With this new record, the sector has also taken a decisive step forward in terms of quantities dedicated to foreign sales, which over the period under consideration (June 2022 to May 2023) reached a threshold of 80% of the quantities processed during the previous season.

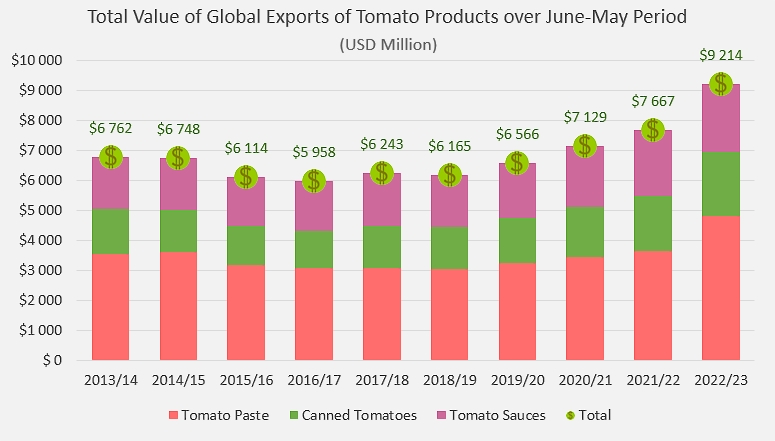

Another striking feature of this marketing year, which took place against a backdrop of generalized inflation, was the exceptional rise in the value of global exports. Estimated foreign sales for the period June 2022-May 2023 amounted to over USD 9 billion, up 29% on the average of the previous three marketing years, and over 50% on the average for the three pre-Covid years.

Tomato pastes (codes 200290..): significant increase in exports

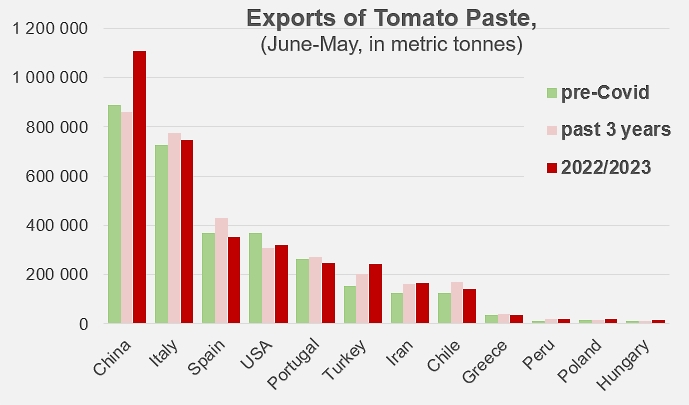

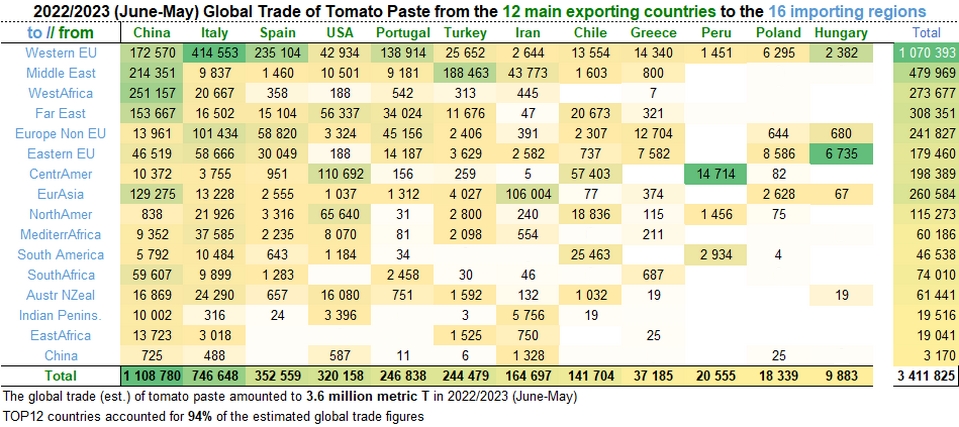

With more than 3.4 million tonnes out of the 3.6 million mobilized worldwide in 2022/2023, TOP12 exports of tomato pastes have risen sharply (+5%). China, Turkey, Iran, etc. are the most notable performers in this area.

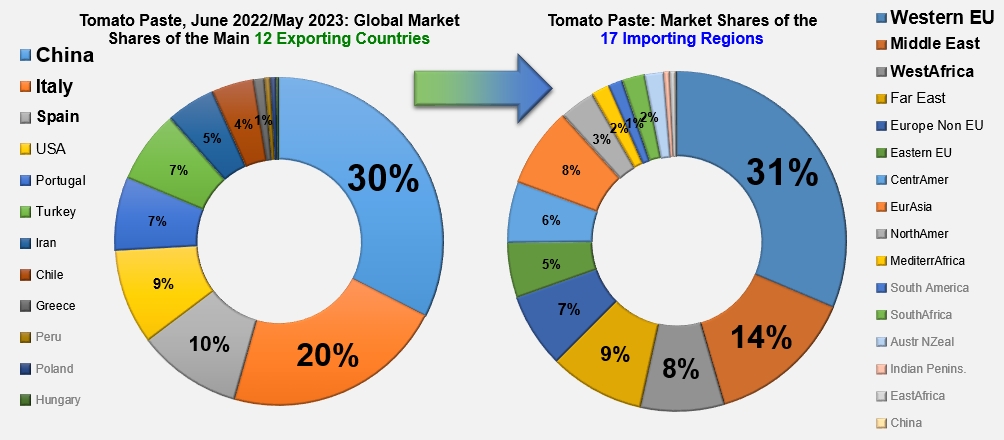

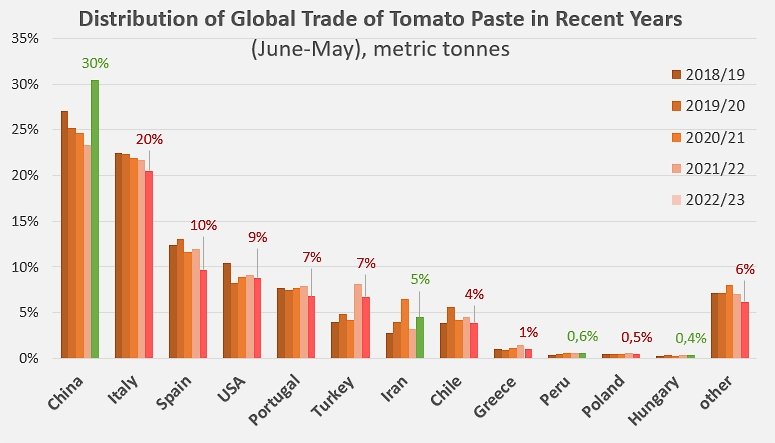

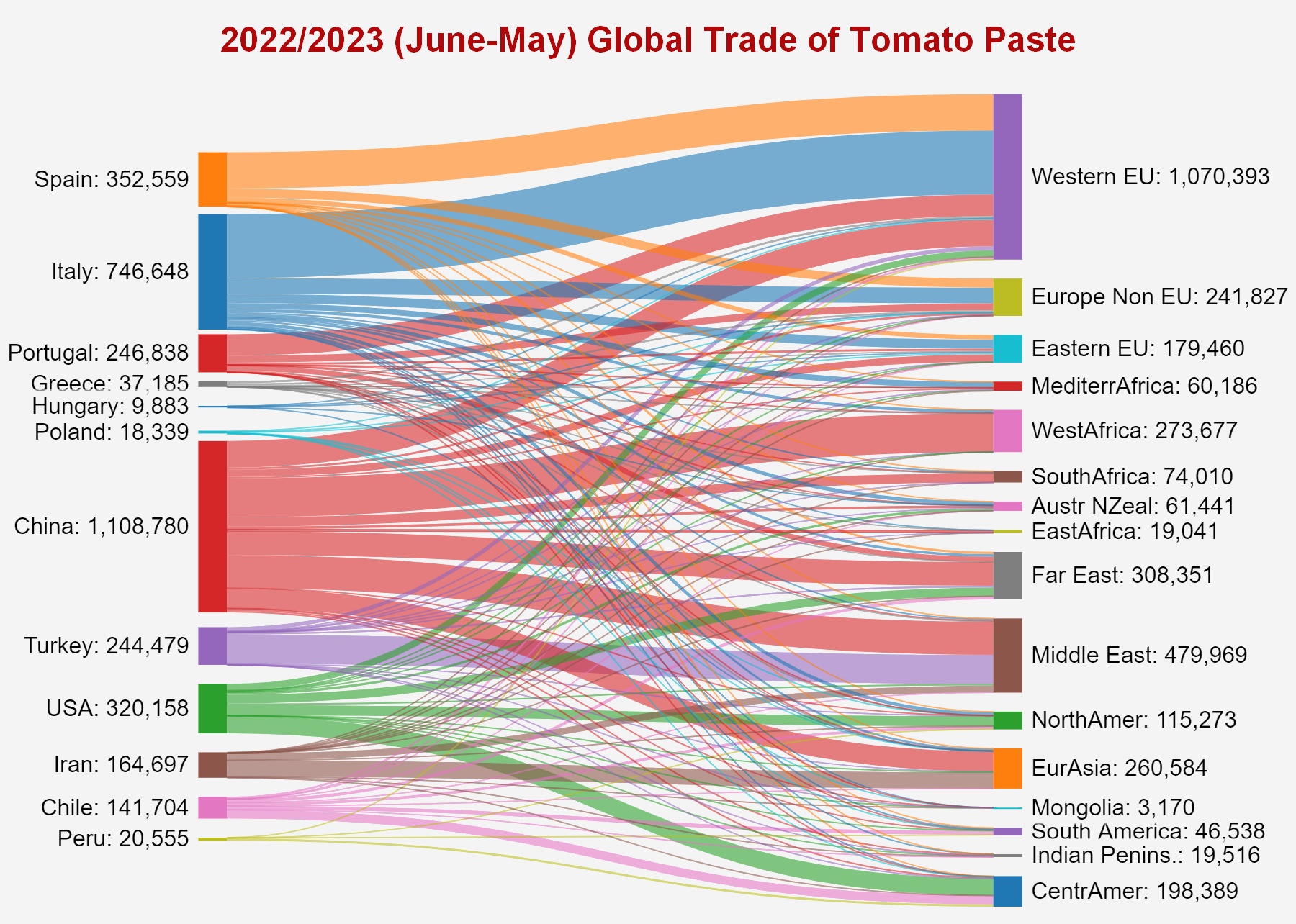

The 2022/2023 marketing year brought no fundamental changes in the distribution of market shares between leading processing countries, nor in that of consumer regions. China, Italy, Spain and the US remain the main production and supply centers, while the Western EU, the Middle East, the Far East and West Africa still absorb the bulk of the products involved.

The following tables show the export performance of the twelve major processing countries to the sixteen main consumer regions: three quarters of global shipments involve products of Chinese, Italian, Spanish, US or Portuguese origin.

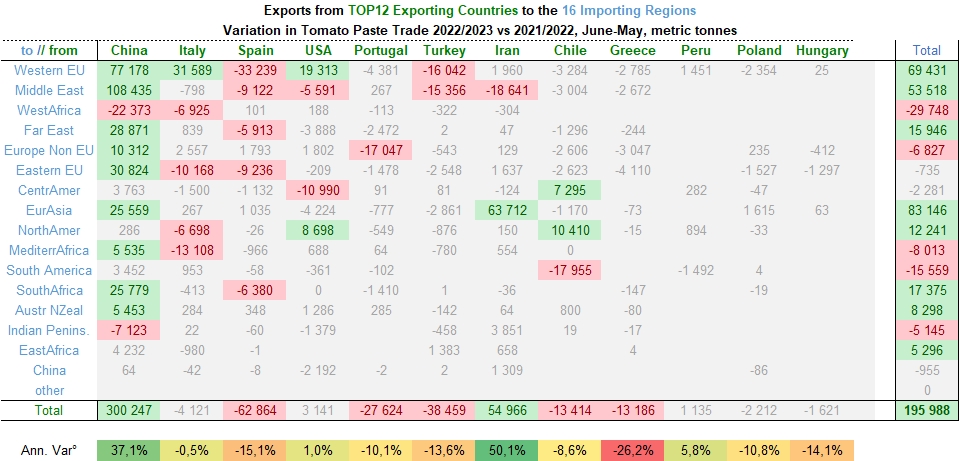

In a global market where the major importing regions have, with a few rare exceptions, increased their purchases in 2022/2023, Chinese and Iranian foreign sales have recorded strong growth. The Italian and US sectors more or less repeated their previous results. On the other hand, exports of pastes from Spain, Portugal, Turkey, Chile and Greece were lower than during the previous period.

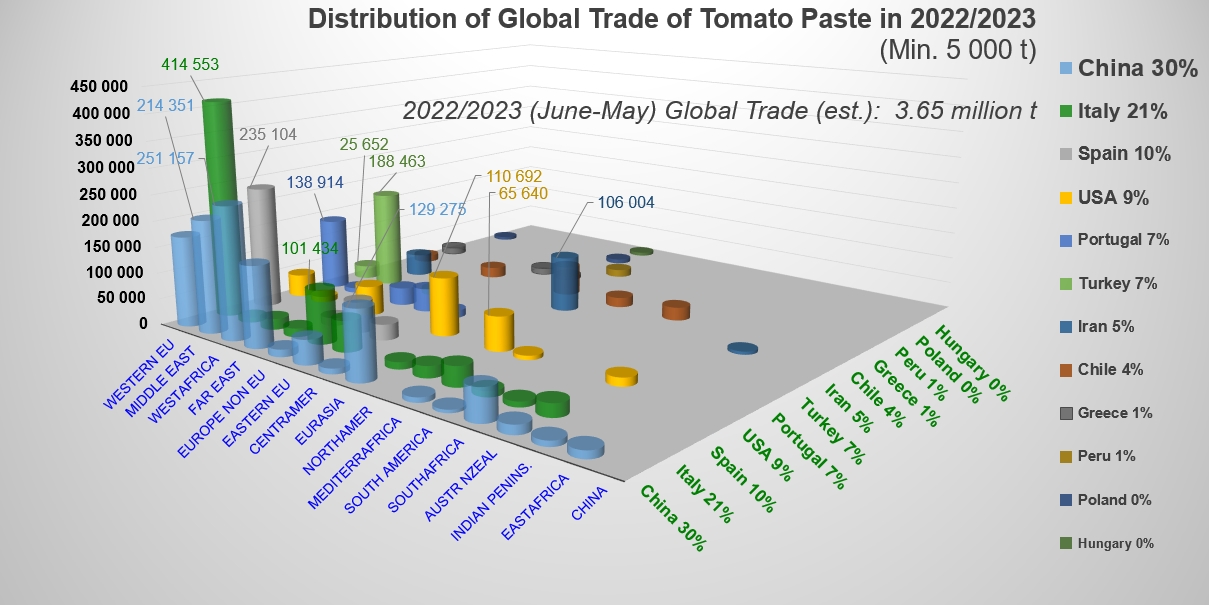

Summary presentation of tomato paste exports in 2022/2023, for trade flows over 5,000 metric tonnes (t).

Some complementary information

Evolution of national performances over past five years for tomato paste exports.

Distribution of global trade of tomato paste (codes 200290..) in 2022/2023

The second part of this file will be published very soon.

A detailed breakdown of the 2022/2023 performances for each of the countries mentioned is available on request from the Tomato News Team.

Find all the topics published under the tag "Trade, Statistics, Consumption" by entering the keyword "trade" in our quick and/or advanced article search module on the TomatoNews website at www.tomatonews.com.

Monthly trade figures (exports, imports, pastes, canned tomatoes, quantities, prices) are published on the Tomato News website for each of the most important countries in each category. Consult them regularly and be among the first to know!

Source: tradedatamonitor.com