Between the rock of the pandemic and the hard place of stocks

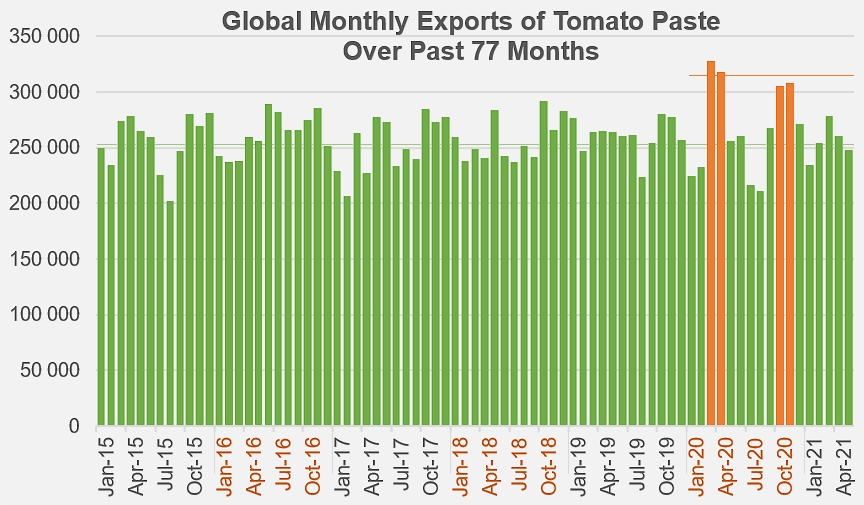

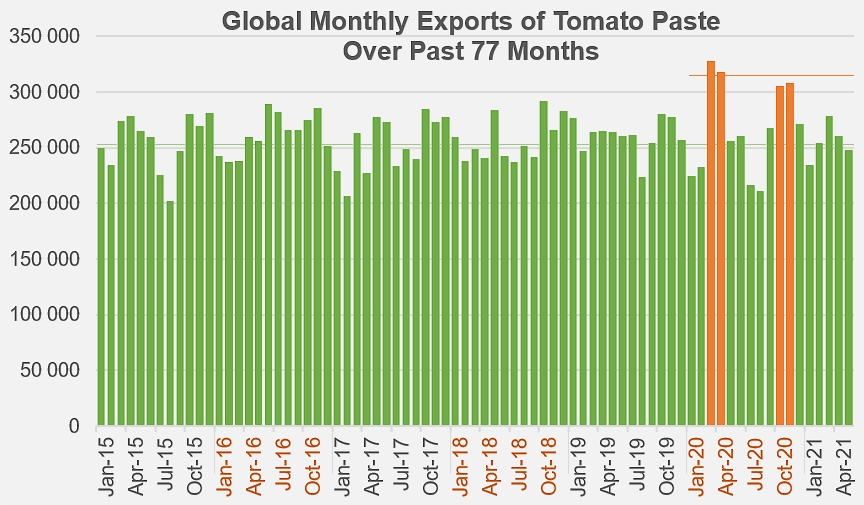

Only four times during the past seven years, and probably going much further back in the history of our industry, have global monthly exports of tomato paste exceeded the 300,000-tonne threshold. These four exceptional months all occurred in 2020, the first two in March and April (328,000 mT and 318,000 mT respectively), and the last two in October and November (306,000 mT and 308,000 mT). After two years of relatively modest production on a global scale in 2018 and 2019, these spectacular episodes linked to the Covid pandemic made 2020 an historic year, but above all largely contributed to almost completely drying up global stocks of tomato paste.

The dynamics that appeared during the health crisis, compounded by an increasingly tense situation in terms of product availability, have seemingly raised demand for the 2019/2020 marketing year to a record level without being able to fully satisfy it. Just a few weeks off the end of the 2021 campaign, while the pandemic is now in the process of being controlled if not resolved, the dynamic effects on consumption and trade are gradually fading, but without necessarily returning to a "pre-Covid" situation (see Tomato News conference in June 2021). As the monthly reports published on the TomatoNews website have shown in recent months, the high monthly levels of global "export" operations recorded at the end of 2020 and at the start of 2021 are now giving way to a return to levels that are closer to those of previous years.

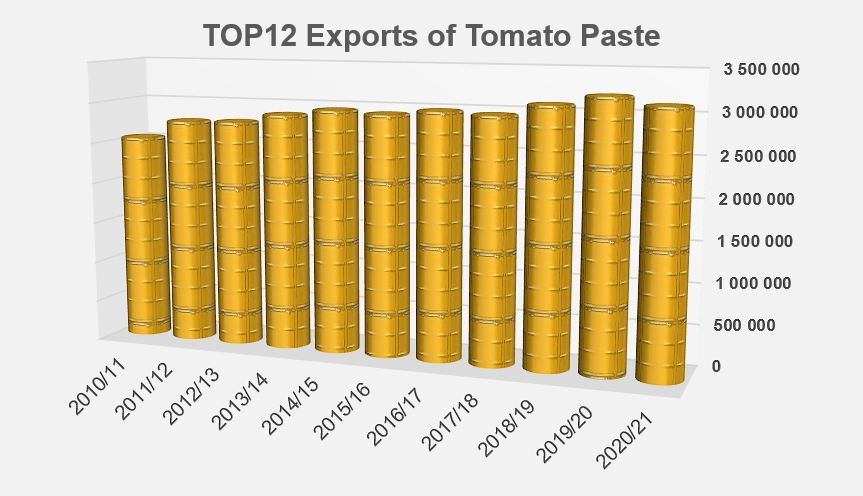

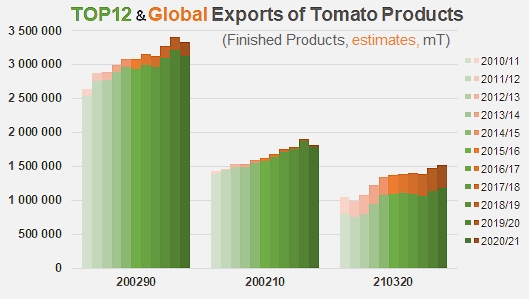

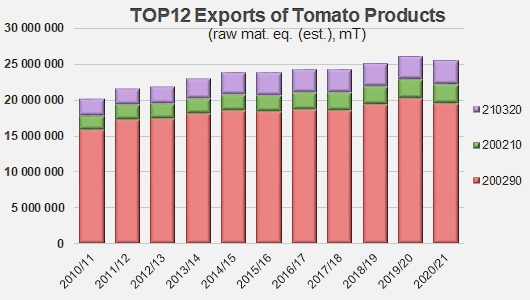

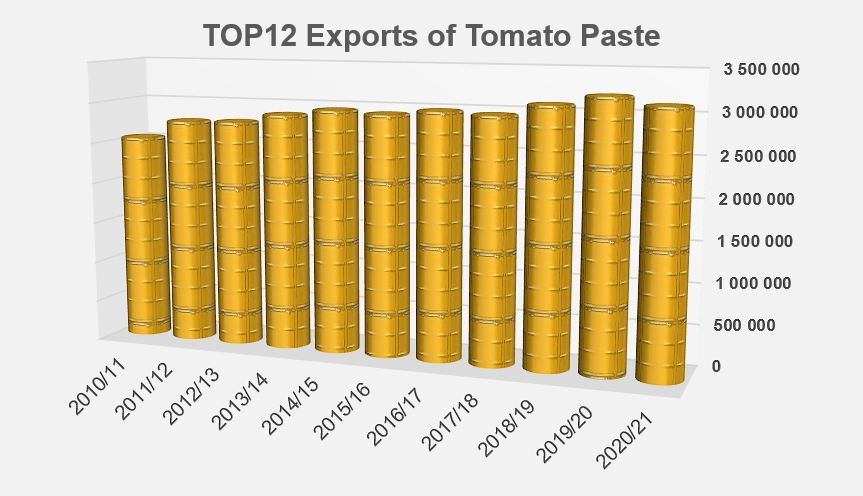

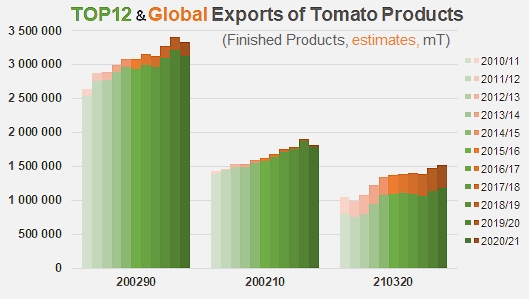

So by the end of the marketing year ending in June 2021, the final result was quite logically lower than that of 2019/2020, yet at the same time in clear progression compared to the three previous years (2017/2018, 2018/2019 and 2019/2020). Regarding trade of the world's TOP12 paste exporting countries as a whole (pending figures to complete the final overall performance of 2020/2021), the quantities exported (HS codes 200290) amounted during the last marketing year to just over 3.12 million metric tonnes (mT) of finished products (all product categories and packs combined). During the previous marketing year (2019/2020), this same group of twelve leading countries in the sector exported 3.21 million tonnes of finished products, representing a decrease in results for 2020/2021 at around 3% (just over 92,000 mT). On the other hand, the result of the last marketing year recorded an increase of 1% (a little more than 29,000 mT) compared to the average performance of the three previous years, thus consolidating the "progression", thanks to the upward trend observed over the past two years.

With nearly 1.8 million mT exported between July 2020 and June 2021, the total result for marketing year 2020/2021 for exports of canned tomatoes (HS codes 200210) from the twelve main countries involved in the sector is also down (-88,000 mT of finished products approximately) compared to the figure recorded for the previous year, and a very slight increase compared to the average performance over the three previous years (2017/2018, 2018/2019 and 2019/2020). Like for pastes, these "mixed" results are more the consequence of the strong growth recorded in 2019/2020 than of an actual "slowdown" in overall activity, even though the year also saw some serious disruptions in maritime traffic linked to a shortage of containers, slowdowns due to the congestion of several major international ports and, locally, to some labor conflicts, in the very restrictive context of the Covid pandemic (see related articles at the end of this report).

Despite these limiting factors, the quantities of tomato sauces and ketchup (HS codes 210320) absorbed by exports from the twelve main exporting countries recorded substantial increases of some 35,000 mT of finished products compared to the 2019/2020 marketing year (+3%) and close on 75,000 mT (almost 7%) compared to the average level of trade over the three previous years. Sauces and ketchup exports have been less impacted by the difficulties of maritime traffic because they are less dependent on intercontinental trade. They have benefited from a spectacular increase in demand due to the boom in home catering due to the current situation: the quantities exchanged at the level of the TOP12 over the last marketing year amounted to around 1.18 million mT of finished products.

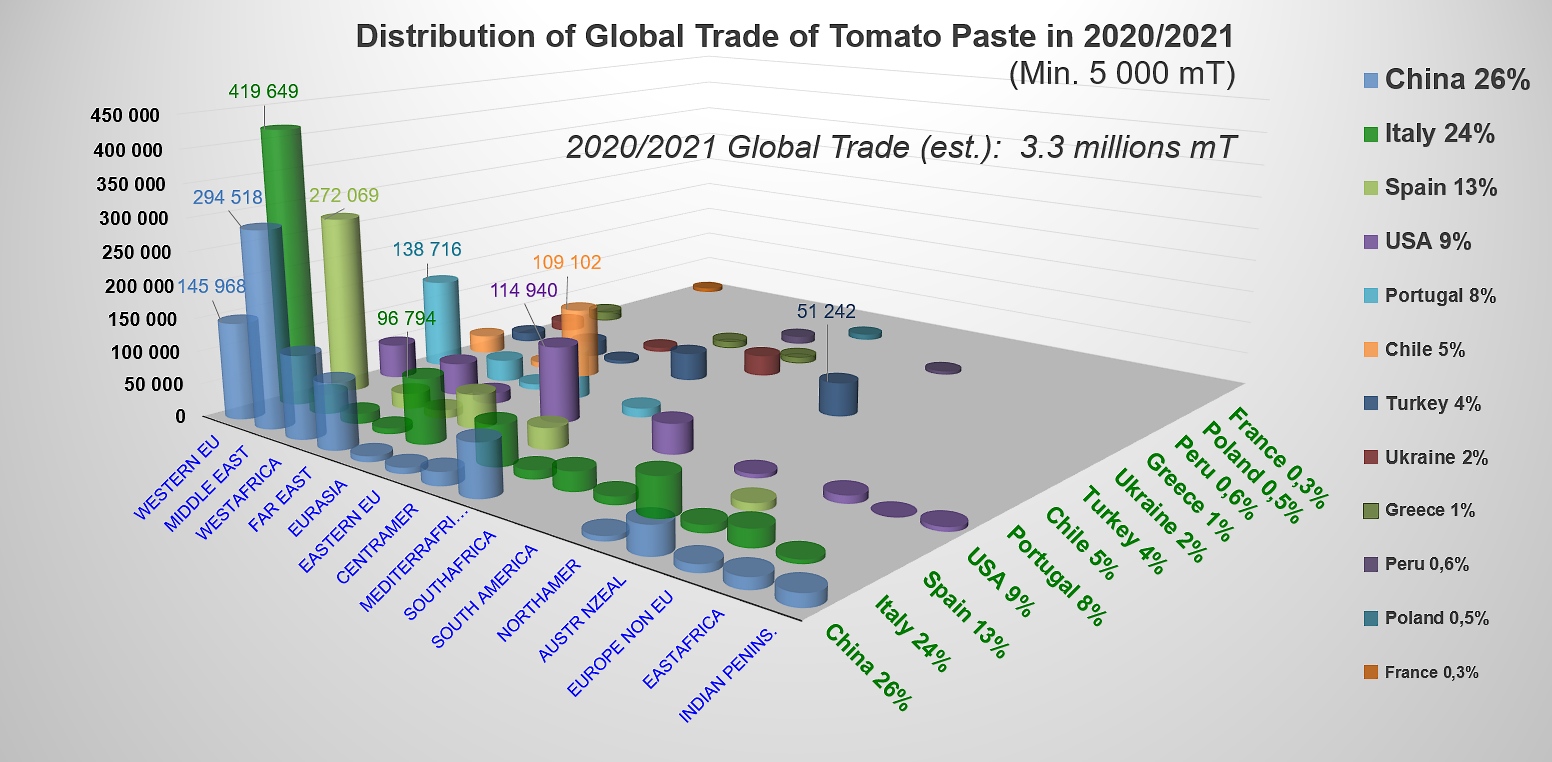

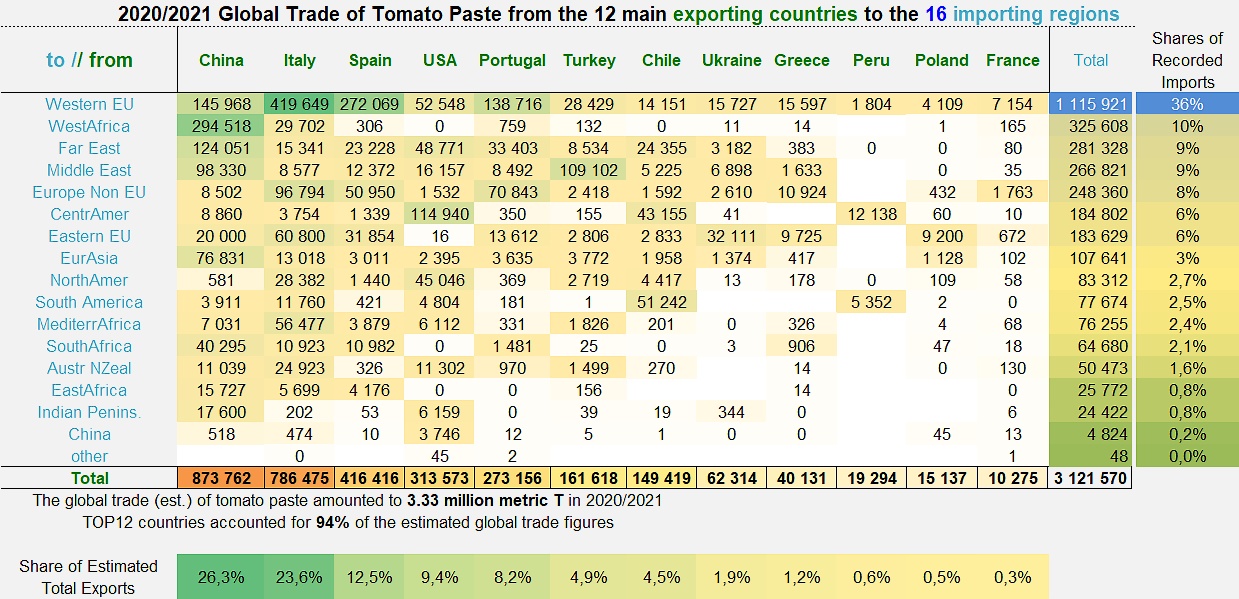

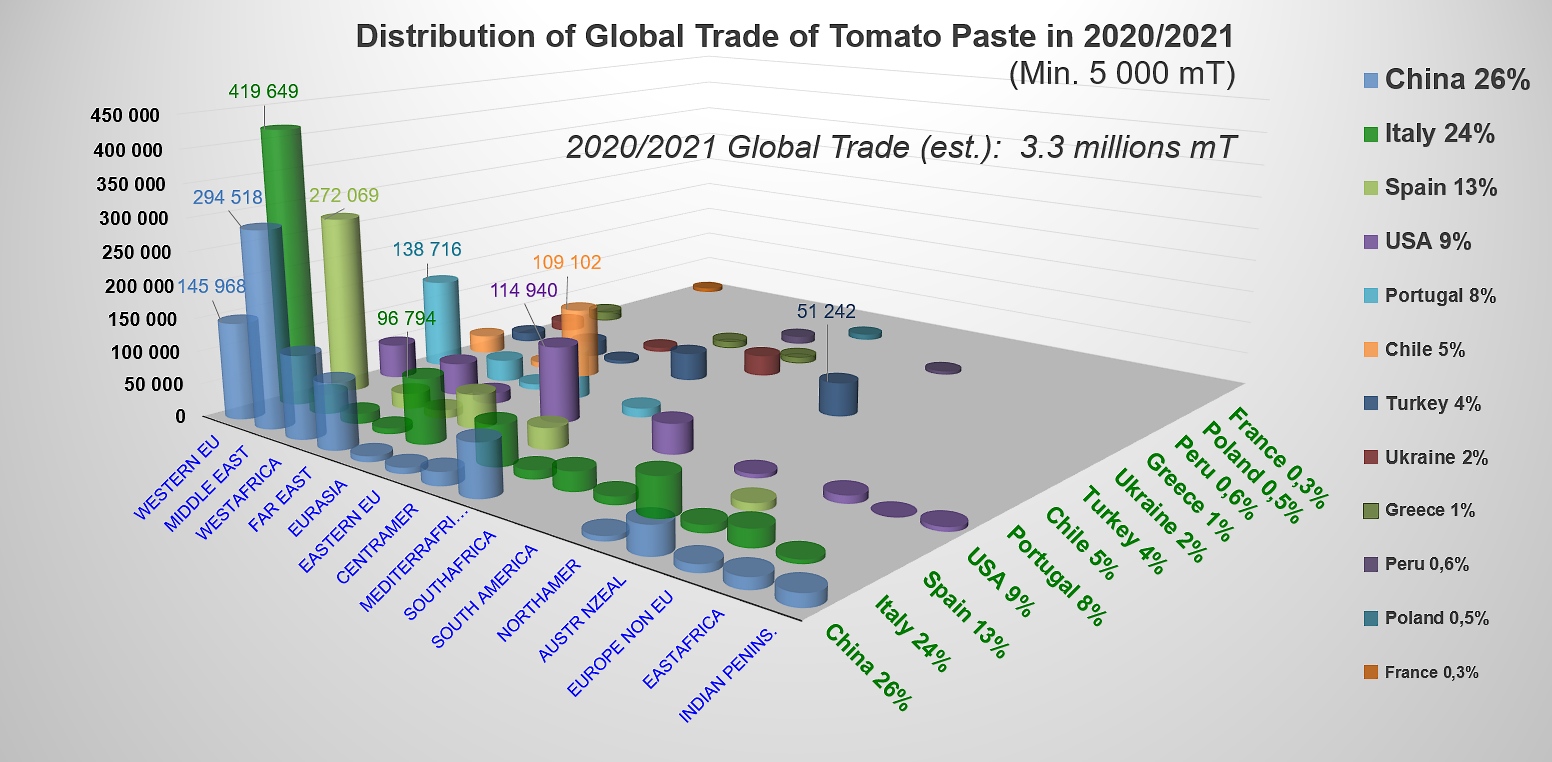

Subject to modifications when all the final export figures are known for all declaring countries, the volumes traded in 2020/2021 on a global scale are estimated at around 3.33 million mT of pastes (all qualities and conditionings combined, HS codes 200290), 1.82 million mT of canned tomatoes (HS codes 200210) and 1.53 million mT of sauces and ketchup (HS codes 210320).

As it stands, the quantities of tomato as a raw material absorbed by export operations around the world during the last marketing year ending 1 July 2021 can be estimated at some 28 million tonnes. However approximate it may be, this estimate bears witness to a slight decrease (-470,000 mT of raw tomato equivalent, i.e. -1.5%) compared to the quantities exported during the 2019/2020 marketing year, but also a significant increase (+700,000 mT, i.e. +2.5%) compared to the average export activity of the three previous years.

In the difficult context created by the Covid pandemic and impacted by the multiple imbalances and upheavals accompanying recovery on a global scale, it is probably appropriate to consider the 2020/2021 marketing year as a period of adjustment occurring after a year 2019/2020, which was indeed exceptional, but the result of which was artificially "inflated" by the economic situation and which will no doubt not be repeated.

Tomato pastes: performance clearly impacted by a general readjustment

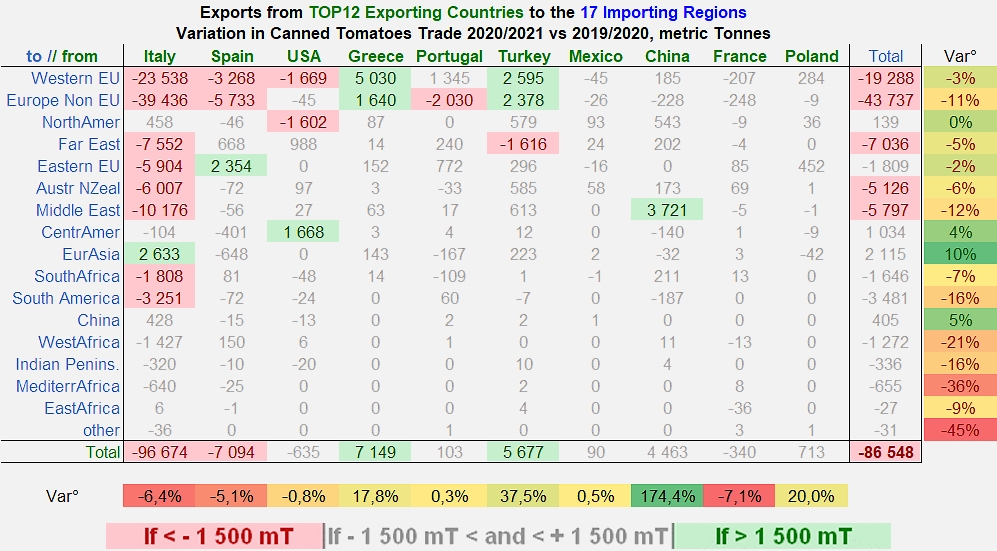

Even if the slowdown remains measured, at just a few tens of thousands of tonnes and less than 3% compared to the result for marketing year 20219/2020, the 2020/2021 report features several significant changes and some notable down-scaled performances, illustrating the sudden and temporary variations that have appeared in the wake of the Covid pandemic.

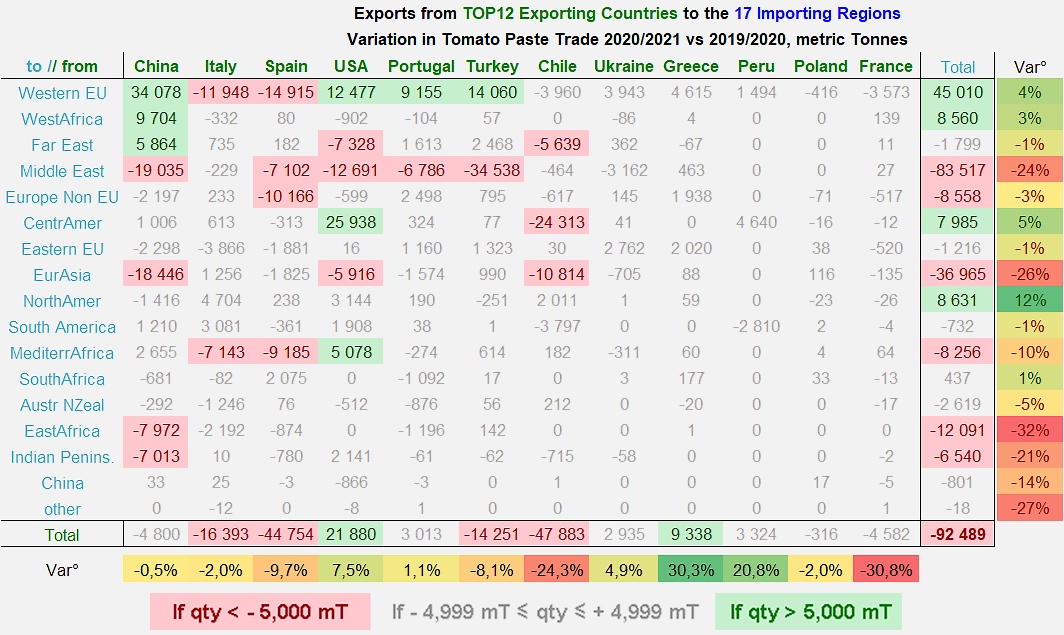

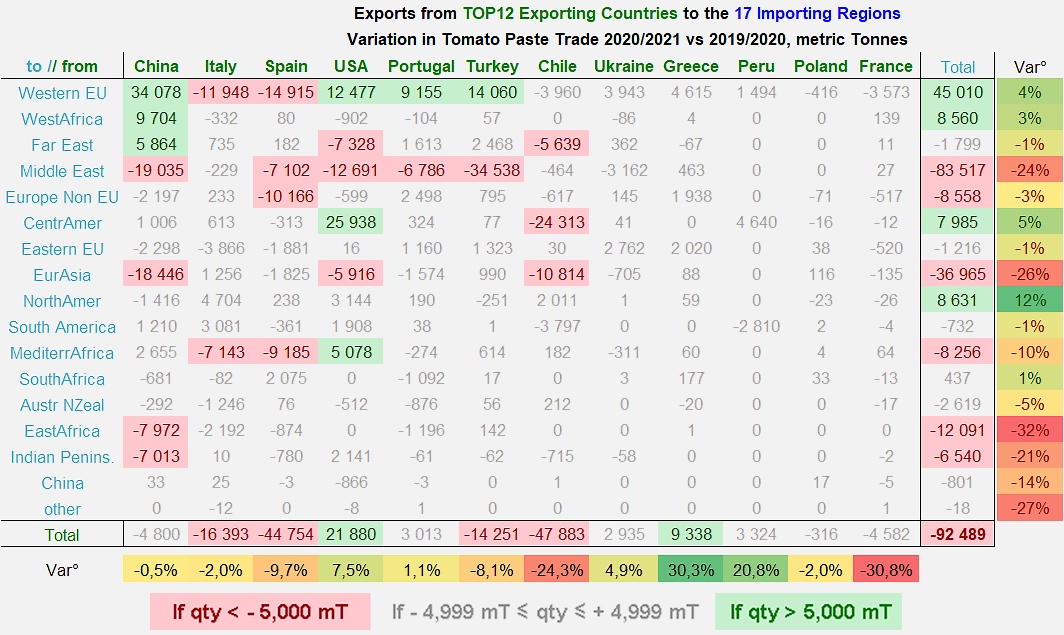

As already indicated in the latest monthly reports regarding exports, published on the TomatoNews website, Chilean foreign trade recorded a significant drop between the last two years: the decline has amounted to about 48,000 mT of finished products, or nearly a quarter of the exceptional result recorded in 2019/2020, placing Chilean trade levels for 2020/2021 (149,000 mT) in line with those of previous years (see tables and histograms in the additional information at the end of this article). The outlets that have been most affected by the decline are the Far East (Thailand), Central America (responsible for a large part of the increase recorded the previous year) (Mexico and Costa Rica), Eurasia (Turkey, Russia), as well as the Dutch and Italian markets.

A similar decrease (around 45,000 mT) affected Spanish foreign sales, for a result almost 10% lower than the previous year; the slowdowns recorded in Europe (EU and outside the EU), the Middle East and Mediterranean Africa partially rectify the spectacular increase that took place in 2019/2020, but the momentum in this instance also consolidates the performances achieved in recent years by placing the result of the past marketing year in the exact continuation of the three previous years, at just over 416,000 mT exported.

The foreign operations of the Italian and Turkish sectors were also subject to declines last year, of some 16,000 mT for Italy and 14,000 mT for Turkey. In the case of Italy, whose situation is similar to that of Spain, it is paradoxically the EU markets (Germany, Belgium, the Netherlands) that have shrunk, while the region as a whole has seen its imports increase. Likewise, foreign purchases of the African Mediterranean region, in particular those of Libya, have significantly decreased. This decline in Libyan imports of tomato pastes (known to be extremely variable from one year to the next) was the main cause of the decline in foreign operations of the Turkish industry, and could not compensate for the good performances achieved on the market outlets of Western EU (Italy, Germany, France).

In this uncertain context of redefined demand, conversely, a number of countries have improved their annual performance, though not necessarily permanently. First and foremost is Greece, whose foreign sales of tomato paste (40,000 mT in 2020/2021) increased by almost a third compared to the previous year. This increase was mainly due to demand from European outlets (Austria, Belgium, Poland, United Kingdom), in a context only affected by two very slight slowdowns (Japan and Australia), the total of which does not even reach 90 mT.

It is also worth mentioning US results, the importance of which is less linked to the tonnage involved (313,000 mT) than to the respite that it signals in the uninterrupted decline of paste exports from the world's largest processor over the past six years. Although weakened by mediocre results in the Middle East, the Far East and Eurasia, the US momentum clearly increased over 2020/2021 thanks to the progression recorded on the markets of the Western EU (Italy), Mediterranean Africa (Libya) and especially Central America (Mexico, Costa Rica, Dominican Republic, Honduras, Panama).

Among the usual players of the world's TOP12 paste processing and exporting countries, several recorded only minimal variations in their foreign operations in 2020/2021. Among these are China (-4,800 mT, a drop of less than one half of a percentage point), Portugal (+3,000 mT, a 1% increase), Ukraine (+2,935 mT, nearly a 5% increase) and Poland (-300 mT, -2%). Two countries, however, recorded strong variations in their annual performance: Peru, whose exports jumped by more than 3,300 mT and nearly 21%, and France, whose foreign sales fell sharply, with a 2020/2021 result that is more than 30% lower (-4,600 mT) than in 2019/2020 (see tables and histograms in the additional information at the end of this article).

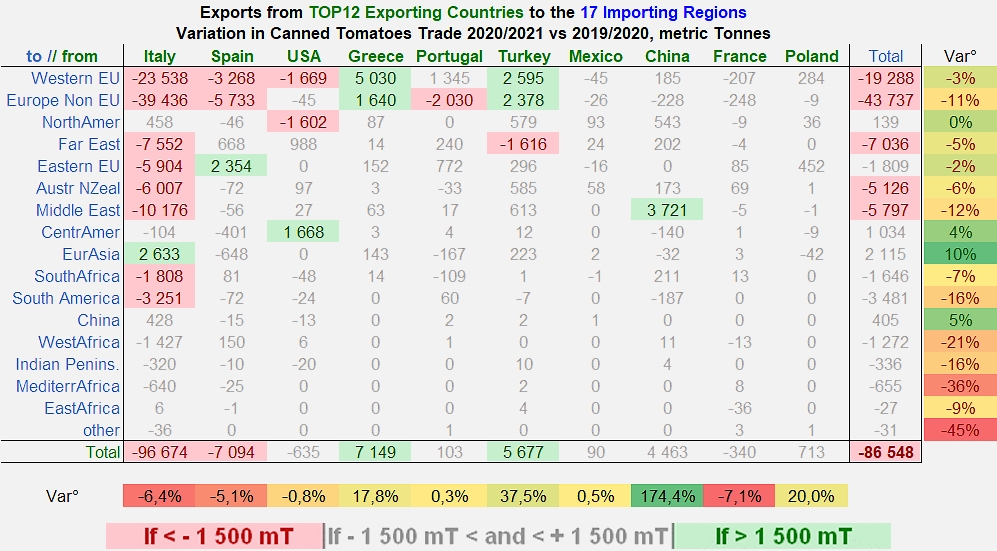

Canned tomatoes: the leaders are in trouble

Although the leading positions of Italy and Spain are rarely contested in the canned tomatoes sector, these countries similarly concentrate the supply of world markets as well as the annual vagaries of the sector.

It is a fact that by disrupting the patterns and rhythms of consumption and supply, the Covid pandemic has curbed – at least temporarily – a growth dynamic that had been in place for many years. Steady development had brought the quantities traded worldwide in 2019/2020 to around 1.91 million tonnes, at the end of a year marked by an exceptional increase of nearly 117,000 mT (+7%!) compared to the previous marketing year. Over 2020/2021, the volumes traded logically lost a significant proportion of the growth achieved, for a result over the year as a whole that is 4.5% lower than the previous one. However, a significant part of the gain recorded during the pandemic was maintained last year, so global exports of canned tomatoes (peeled, unpeeled, whole or chopped) were recorded in 2020/2021 in line with the average levels of the three previous marketing years (2017/2018 to 2019/2020).

Paradoxically, the two leaders of the sector did not take advantage of this improvement: by dropping by almost 97,000 mT over the last marketing year, Italian operations declined not only compared to the previous year (-6%) but also in comparison with the three previous years (-2%). The situation is similar for Spanish operations which, on a much smaller scale, "gave up" over the same periods 5% and 1% of their results, respectively.

There is no indication at this time how this situation will develop. For the time being, this last marketing year has resulted in an accumulated decrease of around 23,000 mT from the two leading countries, compared to the average of the three previous years (-1.5%), while at the same time recording an increase of more than 26,000 mT (12%) in the overall activity of the other TOP10 countries for the canned tomatoes sector (see tables and histograms in the additional information at the end of this article).

In this rather unprecedented context, good performances were recorded for Greece and Turkey. The gains are all the more remarkable in that they were mainly achieved despite the general trend, at the expense of the leading countries, and on European markets (Western EU and non-EU Europe) that had declined quite markedly over the previous marketing year. Although these changes did not fundamentally upset the overall balance in the distribution of market shares, 2020/2021 was nevertheless marked by a notable increase in the participation of the "other countries" of the TOP10, in the wake of canned tomato exports from Greece (+18%) and Turkey (+37%).

Some additional information

Evolution of sector components (pastes, canned tomatoes, sauces) of total exports (expressed in estimates of raw material equivalent) of the TOP12 exporting countries.

2020/2021 export result of the twelve main processing countries exporting tomato paste over the marketing year 2020/2021, for the 16 destination regions.

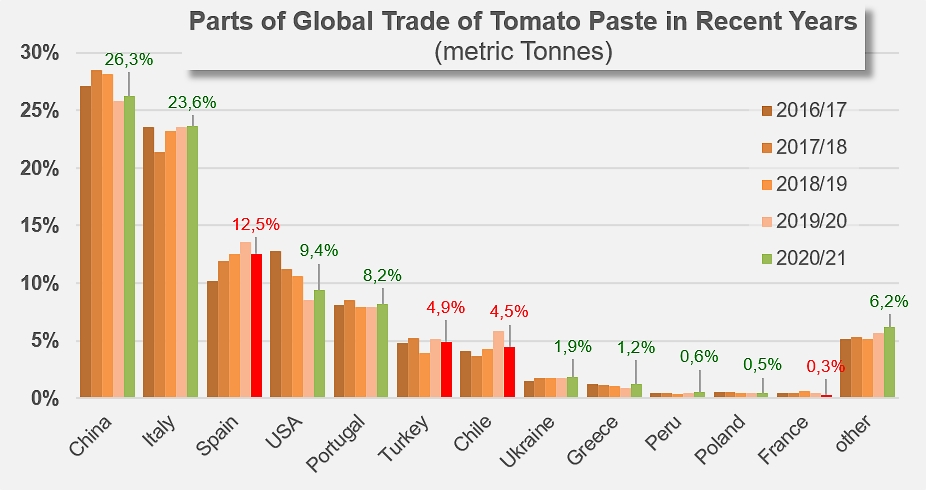

Evolution of the overall market shares of pastes of the twelve main exporting countries in the sector.

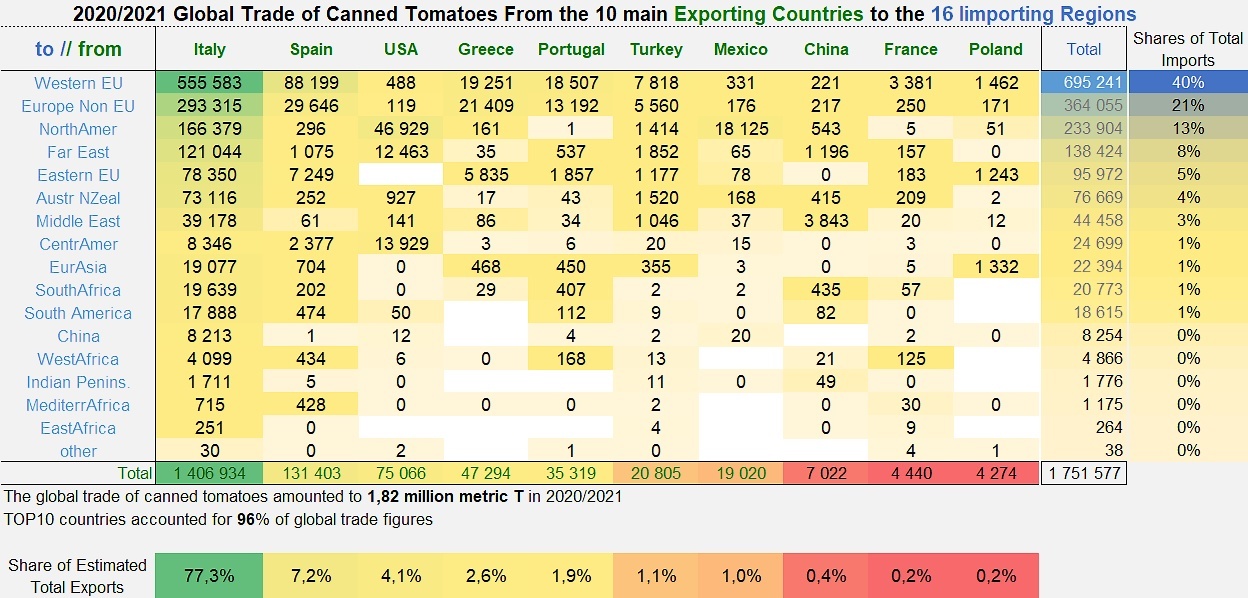

2020/2021 export results of the ten main processing countries exporting canned tomatoes over the marketing year 2020/2021, for the 16 destination regions.

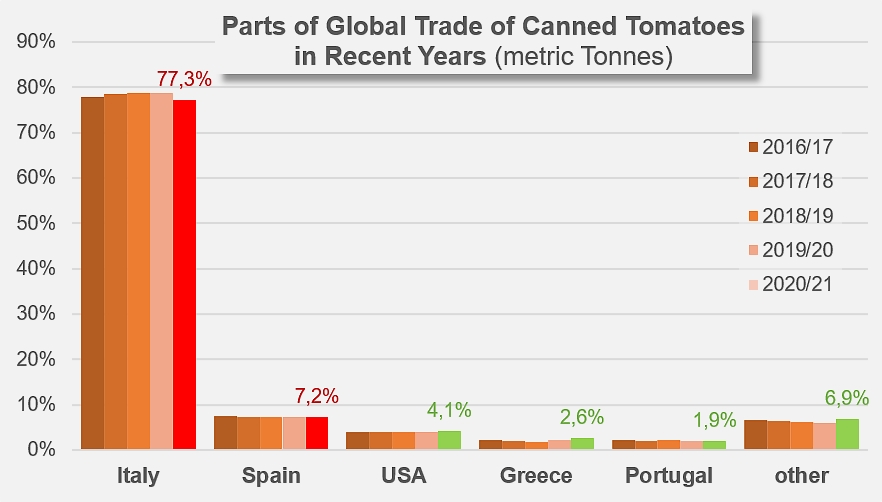

Evolution of the global canned tomatoes market shares of the five main exporting countries in the sector.

The second part of this dossier will be published very shortly

A detailed breakdown of the 2020/2021 performances for each of the countries mentioned is available on request from the TomatoNews team.

Find all the topics published under the tag "Trade, statistics, Consumption" by entering the keyword "trade" in our quick and/or advanced article search module.

Source: tradedatamonitor.com