Over the past few months, US exports of tomato paste have recorded a considerable acceleration, which we have been mentioning in our monthly reports on world trade flows, including commenting on the effects of this development on available inventories of tomato products in the US as of June 1 (see linked articles at the end of this report).

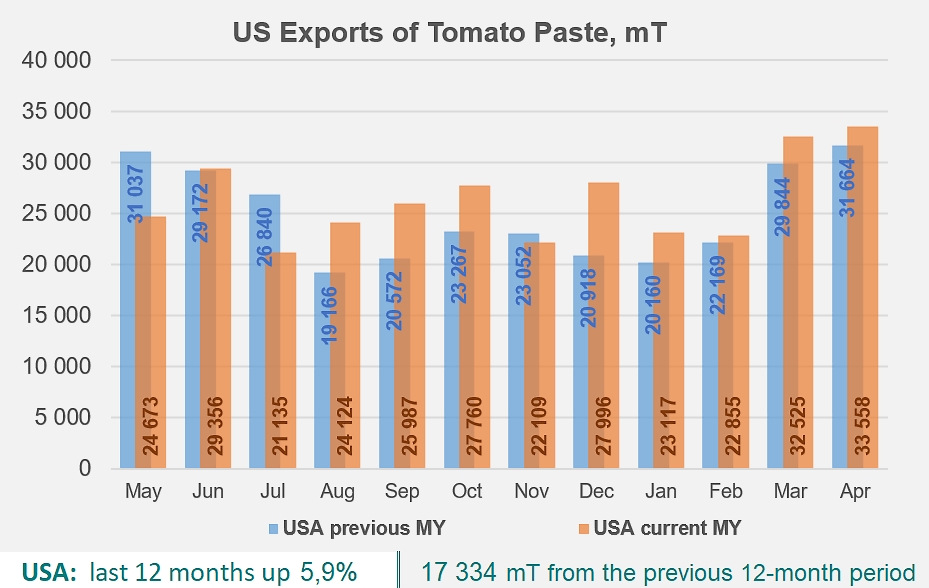

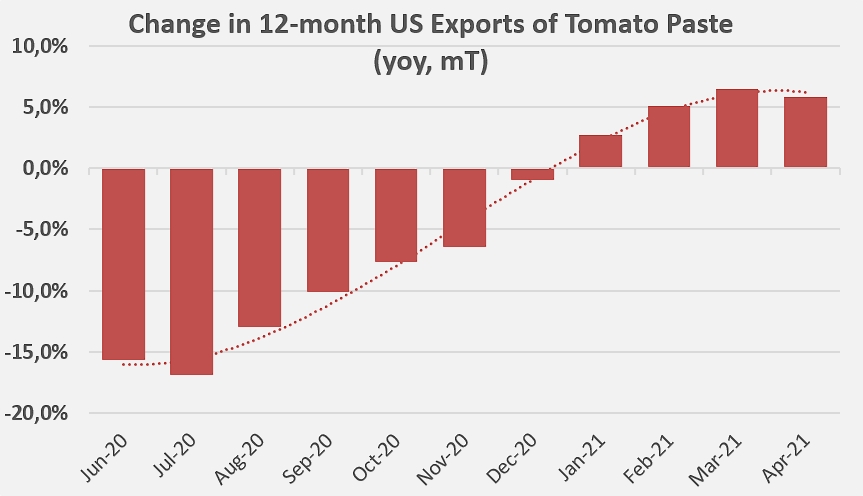

Indeed, available statistics (as of April 30, 2021, source: TDM) show an increase in US foreign sales of more than 17,000 mT (5.9%) for the period running May 2020-April 2021. Data published by the CLFP on June 21 (recorded as of May 30, 2021) confirms these results, with sales volumes over 12 months up 6.2% compared to what they were on June 1, 2020.

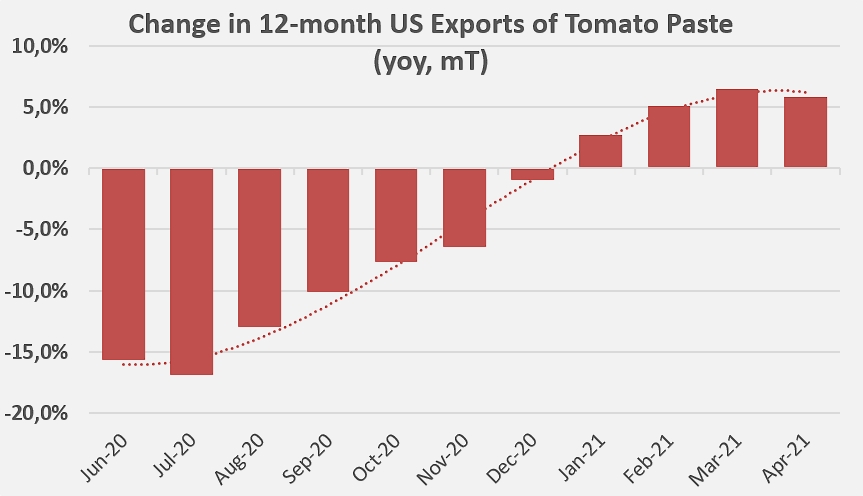

The progressive recovery of US export dynamics is clearly apparent in this graph illustrating successive monthly results over the past 12 months. However, it seems that this improvement may have been limited by the greatly reduced volumes still available in stock during the spring and to the end of May.

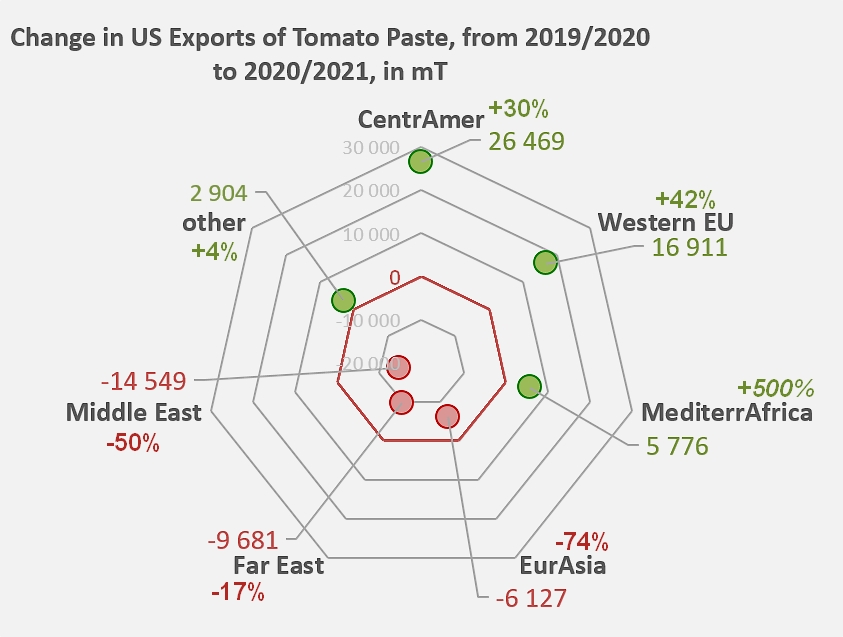

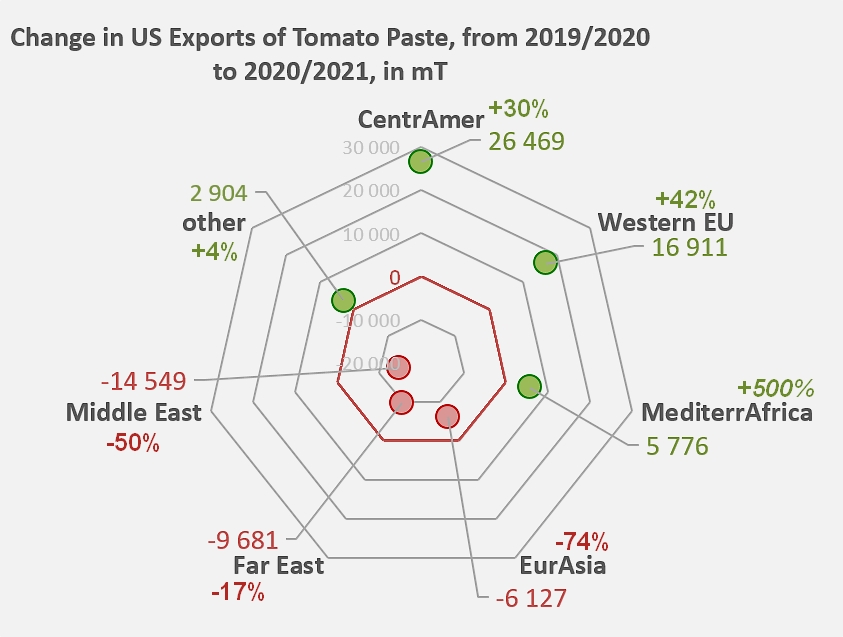

Thanks to a slight extrapolation of foreign trade flows over the last month of the marketing year, the “geographical” profile of results for 2020/2021 indicates notable variations for half a dozen outlet regions, with trade flows to “other destinations” as a whole recording only very small changes (positively or negatively).

Three particularly noteworthy shifts should be mentioned, either due to their importance with regard to current trade, or because they have emerged unexpectedly among the usual trade flows. The first one is the increase (26,500 mT, 30%) recorded for paste exports to Central America (115,500 mT this year), driven in particular by sales to the Dominican Republic, Mexico, Costa Rica, Panama, and Honduras, to only mention the main ones.

Volumes shipped to the European Union, more specifically to Italy, which is the main buyer (90%) of US products in this region, recorded an increase of over 16,900 mT for the period running May 2020 to April 2021, for a total of about 57,000 mT, which is 42% higher than during the previous marketing year and 10% higher than the average performance of the three previous years.

Special mention should be made of the exceptional volume of close on 5700 mT shipped to Libya in 2020/2021, given than the trade volume to that country did not exceed 12,000 mT over the preceding 10 marketing years (including more than three quarters shipped between 2017 and 2019).

In the current context and given the business prospects described by operators of the US industry (see the TomatoNews online conference of June 8, 2021), it is unlikely that the increases recorded this year will carry on into next year, unless they were to become even more focused on these destinations at the expense of those that already decreased between 2019/2020 and 2020/2021.

Among these destinations, six countries considerably reduced their paste purchases from the USA and, for the time being at least, have considerably modified their long-standing levels of imports. The most spectacular slowdowns have been recorded for the United Arab Emirates (-8900 mT, -60%), Kuwait (-4200 mT, -73%), and Malaysia (-5900 mT, -78%). In this last instance, the decrease actually represents a return to ordinary supply levels following an unusual increase over the preceding period (May 2019-April 2020). For the other destinations as a whole, the decreases in imported volumes account for a considerable fraction of the trade flows: Russian purchases of US paste have dropped by 2300 mT (-51%), and Japanese ones by 3200 mT (-10%). Turkey would seem to have imported no US paste at all between May 2020 and April 2021.

Variations of the volumes exported by the USA (for the period May-April) between 2019/2020 et 2020/2021

Variations of the volumes exported by the USA (for the period May-April) between 2019/2020 et 2020/2021

US exports to other regions (North America (Canada), Australia-New Zealand, the Indian Peninsula, South America, China, Africa, the Western EU15, etc.) have not undergone any decisive evolutions over the latest 12-month period. The quantities involved have amounted to approximately 71,000 mT, compared to 68,000 mT over the preceding marketing period, mainly shipped to the markets of Canada and Australia.

Some complementary information

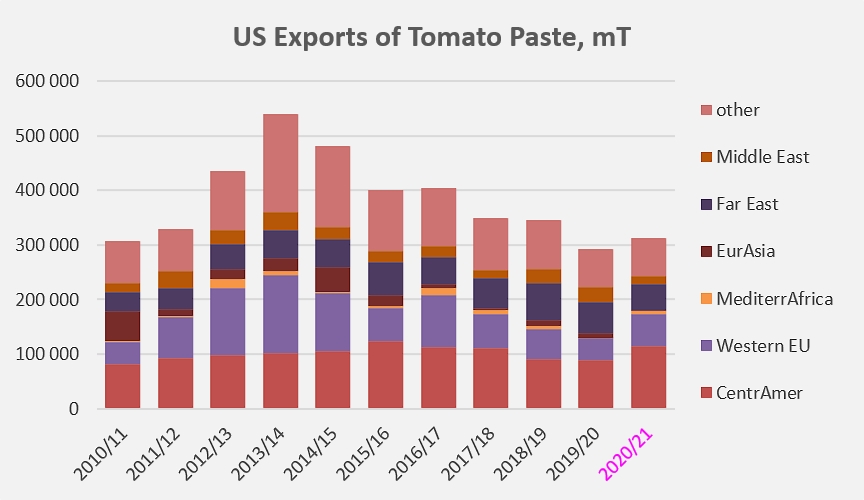

Regional components of US annual exports of tomato paste

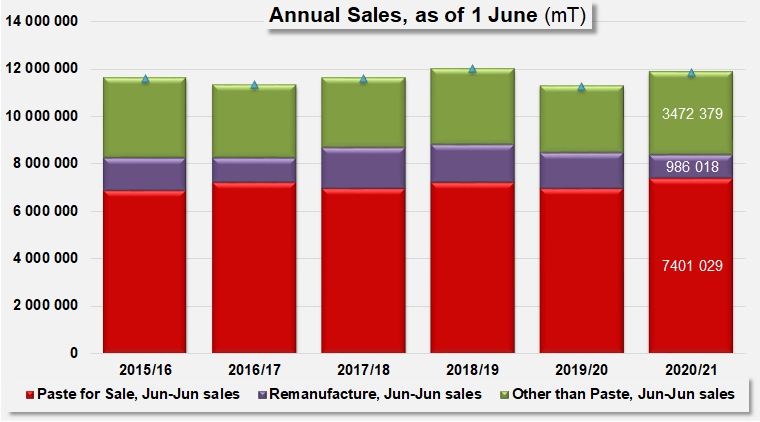

Annual sales of tomato products, according to figures published by the CLFP.

Source: Trade Data Monitor