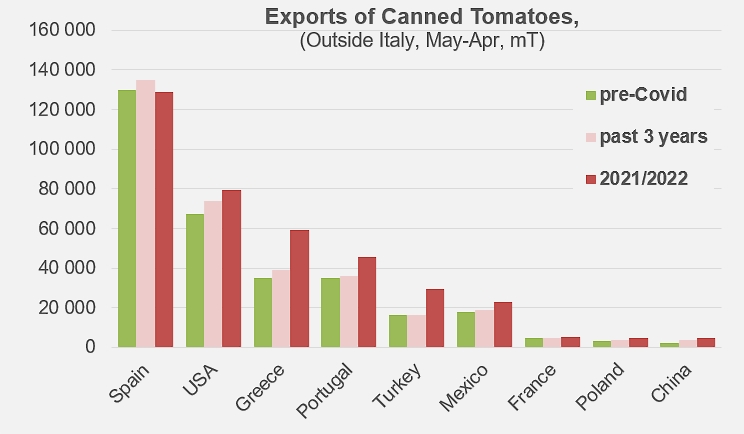

Despite a slight annual decline, the quantities traded are significantly higher than pre-Covid activity levels.

Canned tomatoes trade results for the TOP10: levels comparable to those reached at the height of the pandemic

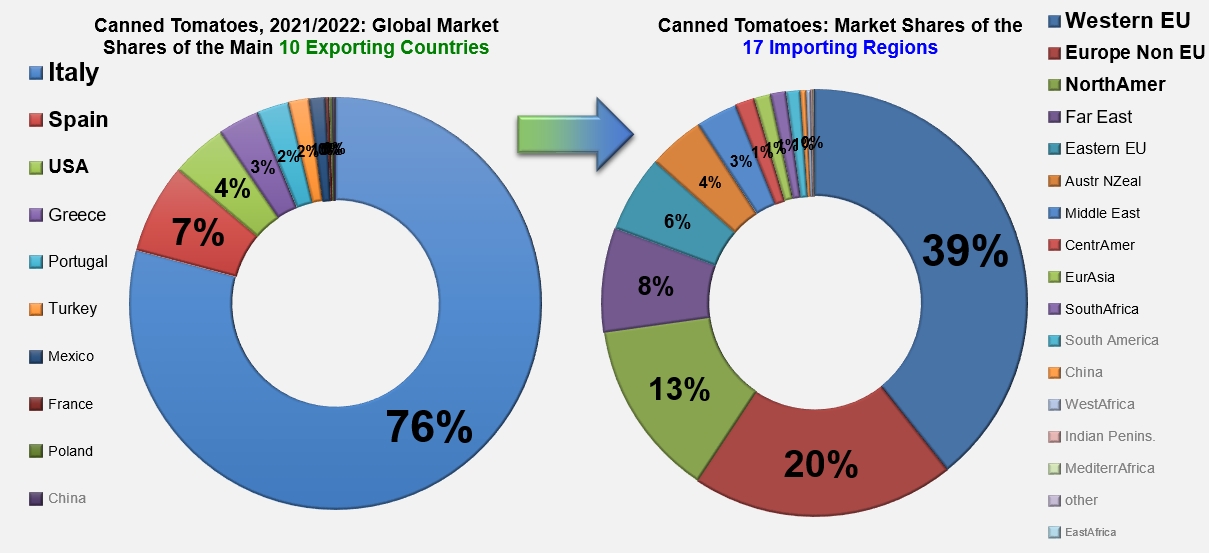

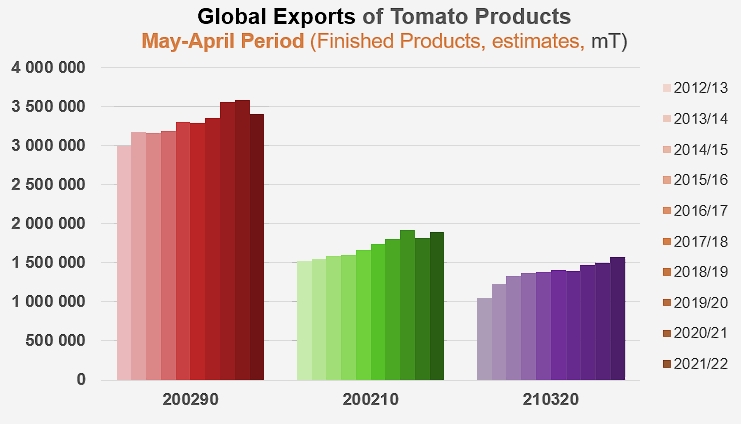

Foreign sales of canned tomatoes (peeled, unpeeled, whole, cubed, etc., customs codes 200210) during the period running May 2021-April 2022 took place in a particularly buoyant context which, for the TOP10 exporting countries of the industry as well as for global movements as a whole, resulted in a significant increase of 4.6% compared to the previous year and 9% compared to the three-year period preceding the Covid pandemic. Quantities traded worldwide amounted to 1.897 million mT of finished products between May 2020 and April 2021, while they had reached the record level of 1.922 million mT at the height of the pandemic in 2019/2020.

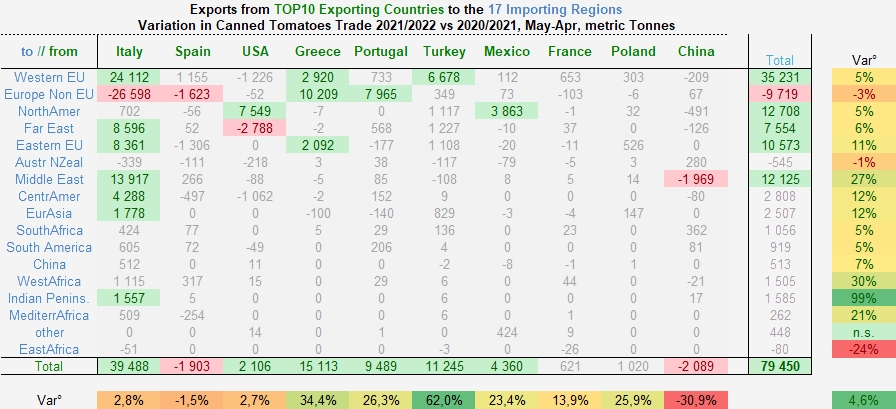

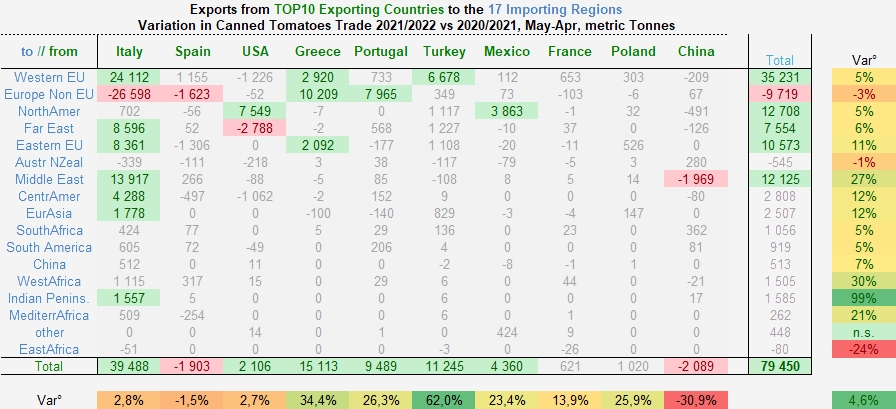

The acceleration has affected virtually all regions, with the exception of non-EU Europe, where the result was clearly influenced (-3%) by the sudden return of British imports to their pre-Covid level. For those regions that are usually large consumers of canned tomatoes (western EU, North America, Middle East, eastern EU and Far East), the most significant increases ranged from 5% to 27%, with world flows increasing by almost 80,000 mT.

As in the case of the paste category, Turkey and Greece stand out for the intensity of the progression of canned tomato sales, which began during the Covid pandemic and continued beyond. These two countries have seen their foreign sales increase by more than 11,000 mT (+60%) and 15,000 mT (+34%) respectively, with Turkish canned tomatoes performing well on the Italian and German markets, and Greek products on the British market. This latter market also proved to be a buoyant one for Portuguese products, providing them with most of their annual growth (9,500 mT, +26%). Mexico is also among the countries that recorded strong growth between 2021 and 2022 (+23%) on smaller volumes (+4,400 mT, mainly shipped to the US market).

The annual variations recorded by the other important industries of the sector were of much more modest proportions. For their part, foreign sales of US canned tomatoes only increased by a little more than 2,000 mT (2.7%), against annual operations of around 78,000 mT. The Canadian market, historically its main outlet, largely contributed to the improvement in the US performance, but significant reductions in flows impacted sales of US canned goods to South Korea and several Central American countries (Honduras, El Salvador, Colombia, Belize). In the final count, the latest US result shows an 18% increase compared to the average level of the pre-Covid period.

The exception to the general rule of growth is Spain, the world's second largest supplier, which recorded a very slight decline (-1.5%) of a few hundred tonnes over the year. In fact, none of the variations recorded in the seventeen regions supplied are particularly critical. The few decreases reported concerning Estonia (1,000 mT), the United Kingdom (1,800 mT), the Netherlands (1,300 mT), Italy (1,300 mT), and Belgium (1,100 mT), have been compensated by a net increase in products shipped to France (4,300 mT). Ultimately, Spanish exports of canned tomatoes are the only ones to show a result for 2021/2022 that is merely equivalent to that of the period before the pandemic.

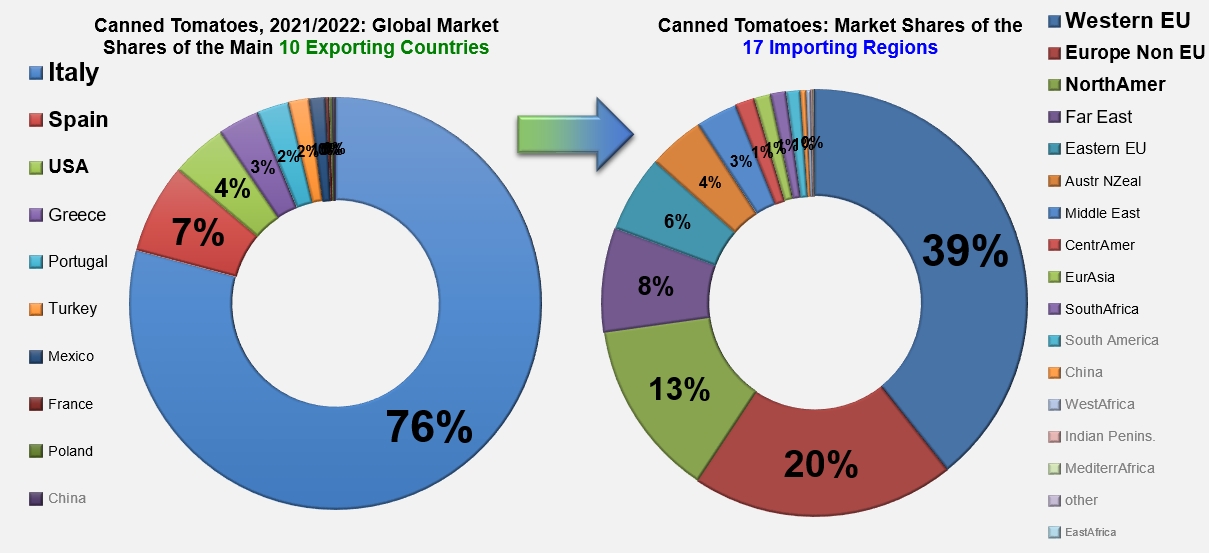

Despite the severe contraction of British supplies, significantly lower even than their pre-Covid levels, Italy has consolidated its position as the undisputed market leader and has alone contributed to almost half of the overall increase. In parallel with the fall in sales to the United Kingdom (-30,000 mT), the Italian industry has recorded several significant increases on the markets of the western EU (Germany, Spain, Belgium, Sweden, etc.), the Middle East (Saudi Arabia, Israel, Emirates), the Far East (South Korea), the eastern EU (Poland, Czech Republic), Central America, etc. With more than 1.44 million mT exported in 2021/2022 (compared to 1.4 million mT last year) and only 130,000 mT for its "immediate" challenger (Spain), the Italian sector signs its second best recorded performance and a result that is up 6% on pre-Covid levels of operations (see our additional information at the end of the article, our related articles below and the monthly trade situations published on our website www.tomatonews.com).

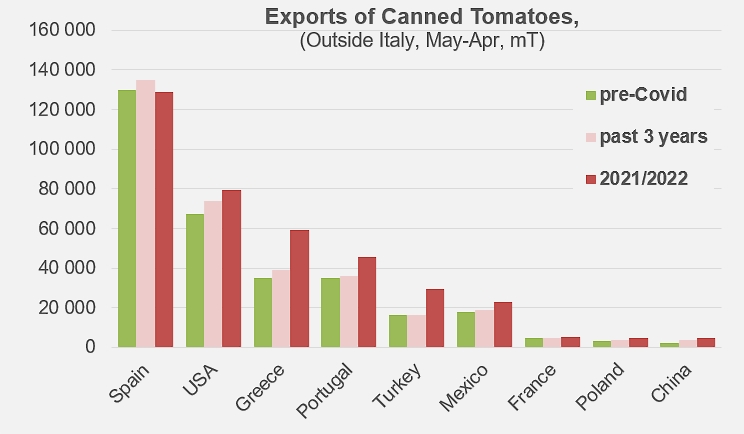

Comparison of results for the baseline period (May 2021-April 2022) with the corresponding periods for the previous three years (2018/2019 through 2020/2021) and the three pre-Covid years (2016/2017 through 2018/2019). For presentation reasons, Italian results are not shown on this histogram.

With the exception of Spain, whose results can be considered stable, all countries show a net increase in performance compared to the pre-Covid period.

Some complementary data

World exports of tomato products over the period May 2021 - April 2022.

Canned tomatoes (200210...)

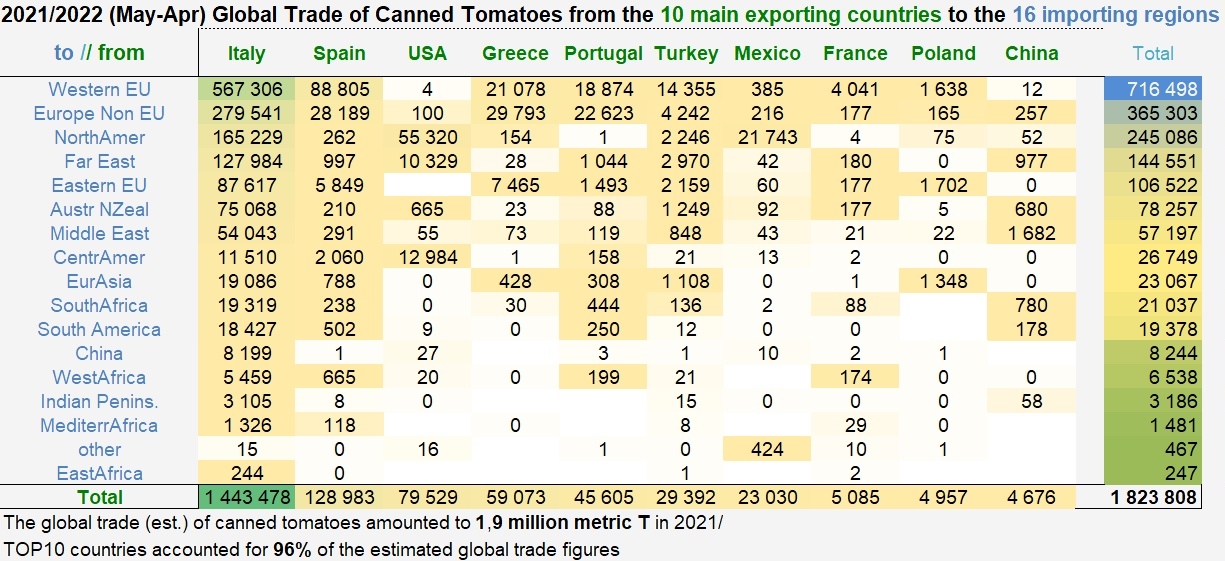

Quantities of canned tomatoes exported between May 2021 and April 2022 by the ten main exporting countries operating in the category, to the sixteen importing regions.

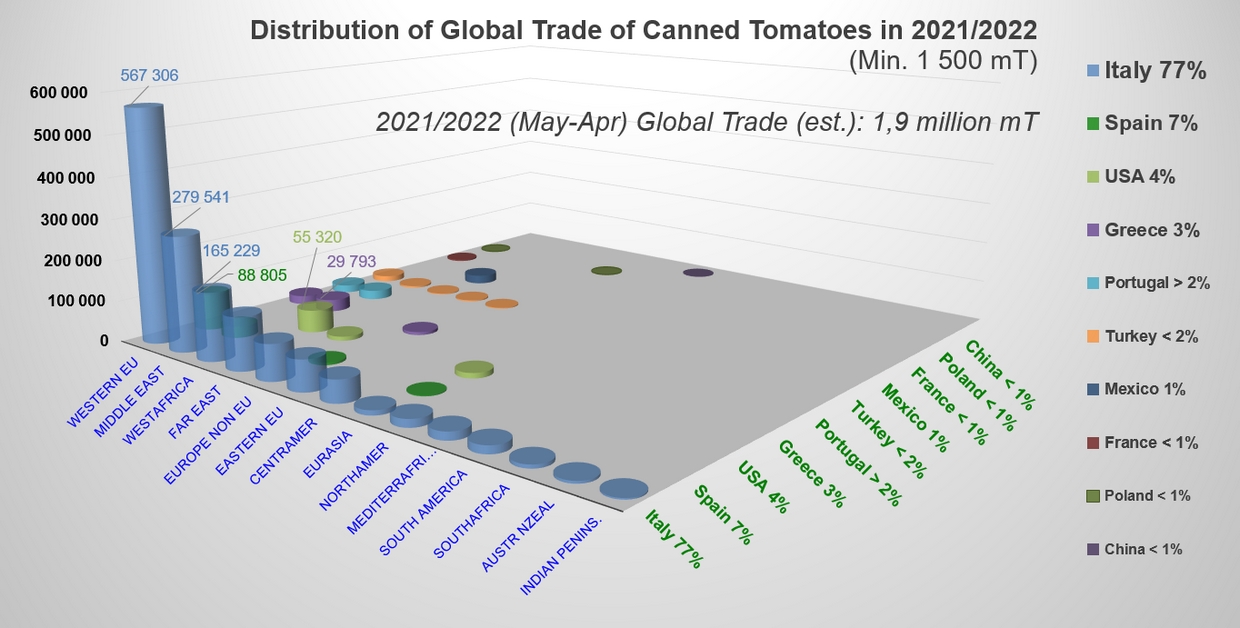

Presentation of 2021/2022 canned tomato sales, for annual trade flows above 1,500 mT.

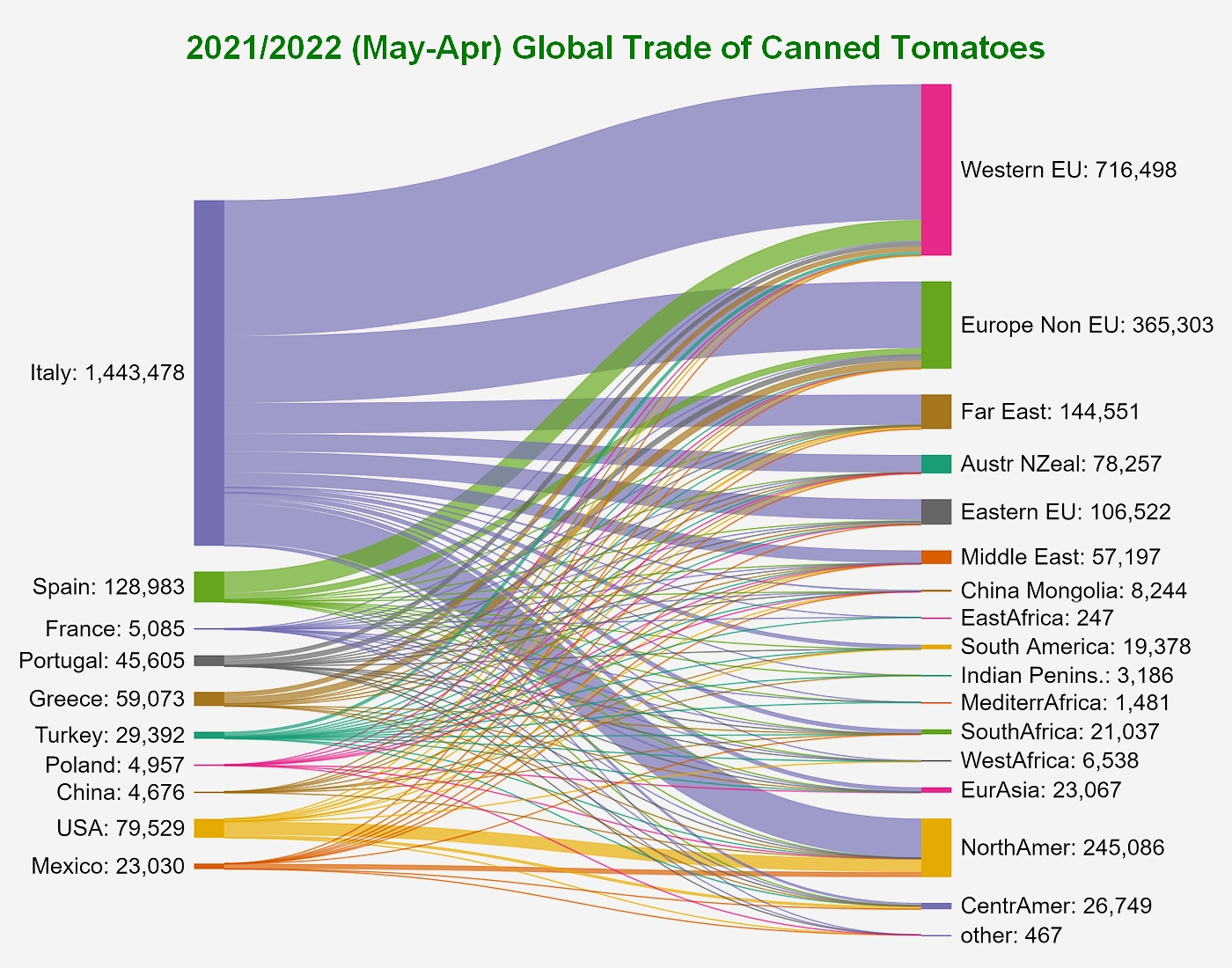

Schematic representation of Canned Tomatoes (codes 200210..) exports over the period May 2021 - April 2022, from the 10 main exporting countries to the 16 recipient regions.

A detailed breakdown of the 2021/2022 performances for each of the countries mentioned is available on request from the TomatoNews Team.

Find all the topics published under the tag “Trade, Statistics, Consumption” by entering the keyword “trade” in our quick and/or advanced article search module on the TomatoNews website at www.tomatonews.com.

The monthly trade results (exports, imports, pastes, canned tomatoes, quantities, prices) are published on the TomatoNews website for each of the most important countries in each category. Consult them regularly and be among the first to know!

Sources: Trade Data Monitor