Consumption , 2022 WPTC congress

37 million metric tonnes consumed; the effects of the pandemic are still being felt

As is often the case after an exceptional year, performance tends to return to previous levels, while annual results nonetheless consolidate part of the "gain" made during the crisis period, as they benefit for a time from an "aspiration effect".

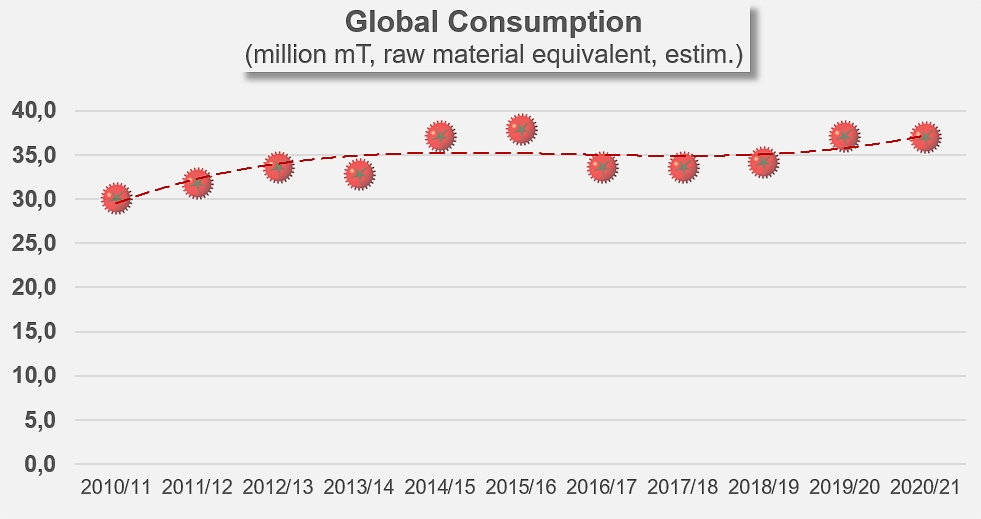

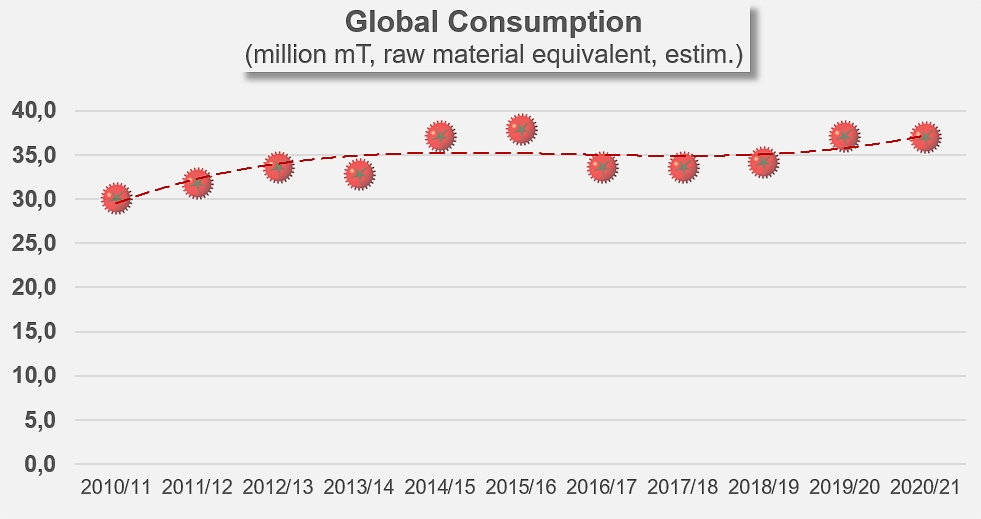

The 2020/2021 marketing year was no exception to the rule, with a quantity consumed at the global level estimated at around 37 million metric tonnes (mT, raw material equivalent), very close to the result of the previous year. The difference between the results of the last two years is almost insignificant, and it is worth noting that, by remaining about 10% higher than the average of the three marketing years that preceded the start of the pandemic (2016/2017, 2017/2018, 2018/2019), the 2020/2021 year confirms for the time being a good degree of sustainability for the changes that have taken place in consumers' purchasing habits.

The various features of consumption patterns

Processing in 2020

The 2020/2021 processing season took place in an extremely tense context from several points of view. Frequently adverse weather conditions disrupted the season, which was also complicated by the uncertainties and disruptions related to the first months of the Covid pandemic. In addition, the preparation and management of the harvest were carried out in a context of stocks greatly reduced by two successive campaigns that were not sufficient to match estimated levels of world consumption (37 and 38 million mT processed over the 2019 and 2020 seasons), and this situation placed a heavy burden on the 2020 season in terms of the dual imperative of satisfying global demand and replenishing national stocks to required levels.

All in all, the 2020 season resulted in the processing of 38.4 million tonnes of fresh tomatoes, a volume likely to meet world demand but, once again, apparently insufficient to ease the tension on world supplies observed in recent years.

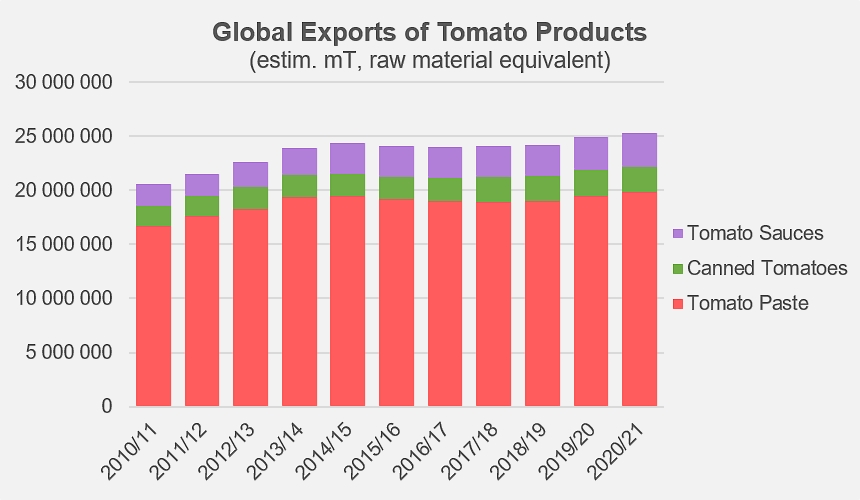

World trade in 2020/2021

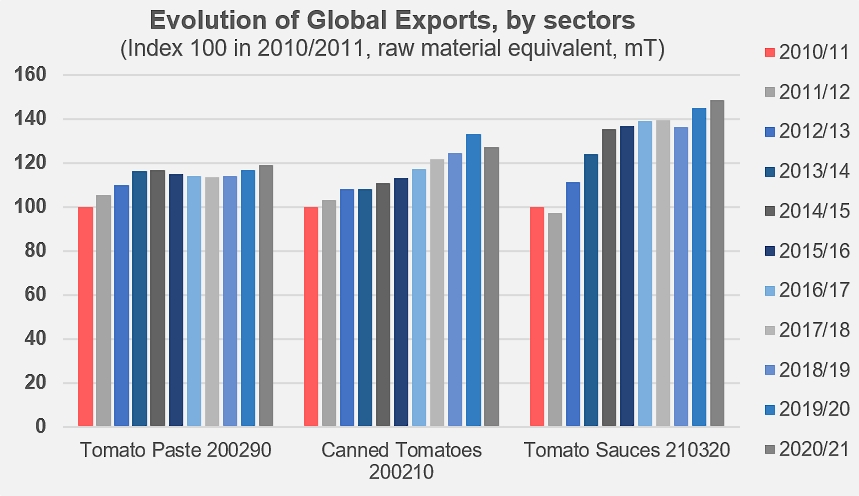

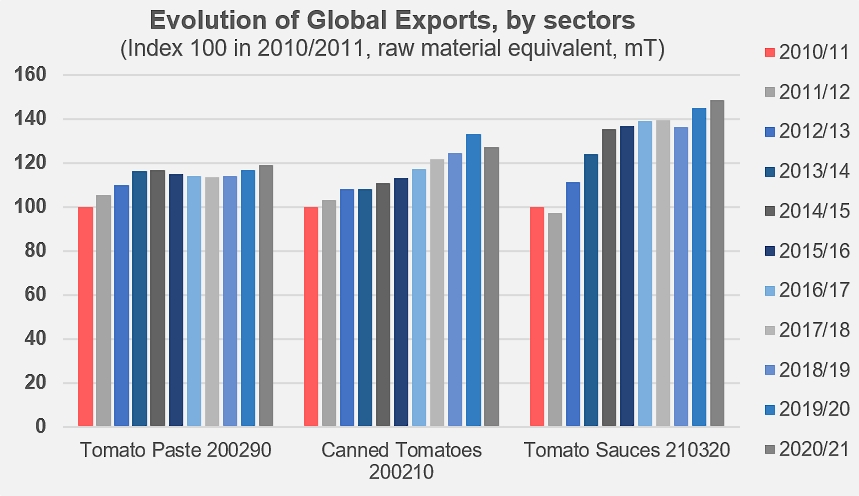

In parallel to these production hazards, the features of world consumption have continued to be directly affected by a basic dynamic, which has been observed for several years in trade patterns, combining an increasing demand for "low concentration" products and a stagnation of the "medium" and "high" concentration product segments (see our related articles below). Whereas the quantities (expressed in raw material equivalent) absorbed by the worldwide trade of sauces & ketchup and canned tomatoes (peeled, unpeeled, whole, cubed, etc.) have grown at average annual rates (CAGR) of 4% and 2.5% respectively over the past decade, the volumes of raw material absorbed by trade in our industry's main sector of operations – concentrated purees – have grown over the same period at a modest rate of 1.7% per year for the overall activity, and only 0.8% per year for the share of the global market covered by the ten main exporting countries of the sector.

In a detailed breakdown, the major component of demand that is the "paste" category has only grown in the categories of products that absorb lesser volumes of raw materials (low-concentration products), which means that growth – when it has occurred – has only resulted in a small increase in the volumes actually traded and consumed. The final result is that the development of trade and, by analogy, of demand, has been driven for several years by the categories that absorb smaller volumes of raw materials and therefore of agricultural production, in addition to the mechanical progression linked to simple demographic growth (see additional data at the end of this article).

Overall consumption in 2020/2021

As we have previously reported in a recent analysis of global trade (see our related articles below), the volumes absorbed last year appear to have capitalized on a significant proportion of the gain recorded during the Covid pandemic crisis. However, while a comparison with the 2016/2019 period (excluding the record year of 2019/2020) shows an increase of nearly 5%, the 3.46 million tonnes of paste (finished products, estimated) traded last year also puts 2020/2021 in line with the progression recorded in the "pre-Covid" trade years. In other words, the 2020/2021 performance is not yet out of the range of "bottom-line growth" discussed at the Tomato News Online Conference in November 2020.

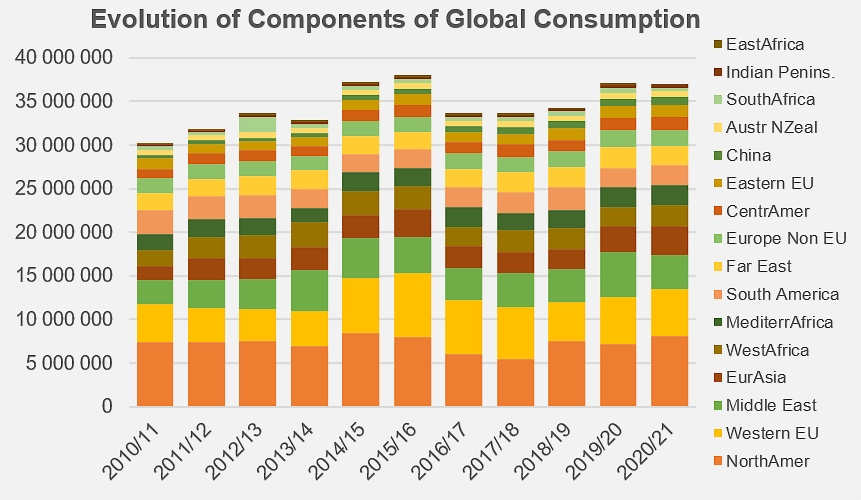

Indeed, an analysis of known or estimated production along with trade and stock data indicates that overall consumption of tomato products has, on the whole, increased reasonably in recent years, although actual year-to-year variations are most likely less pronounced at the global and regional levels than shown by the "calculated" results of this study for the WPTC. Ultimately, the quantities consumed in 2020/2021 amounted to around 37 million tonnes (*) of 'raw material equivalent', a minimal variation compared to the previous marketing year, but a significant increase (+10%) compared to the 'pre-Covid' period.

Over the past decade, the level of global consumption has increased from around 30 million mT of raw material equivalent in 2010/2011 to 37 million mT in 2020/2021, at an average annual rate (CAGR) of around 2%.

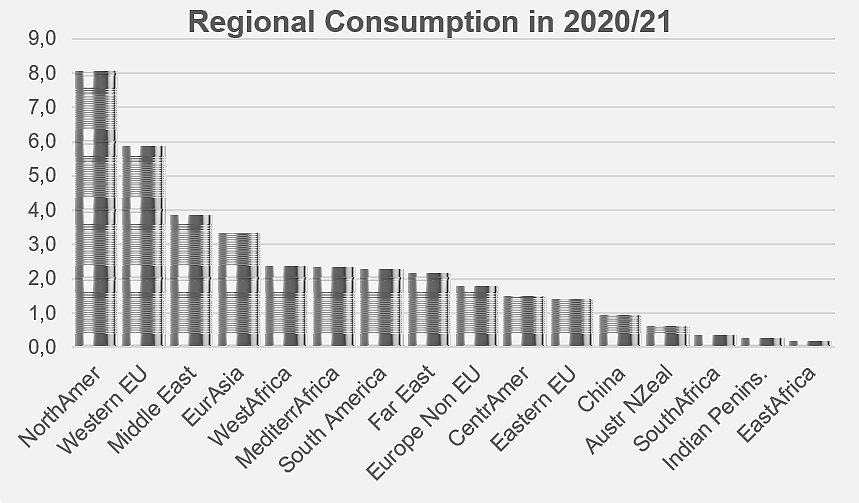

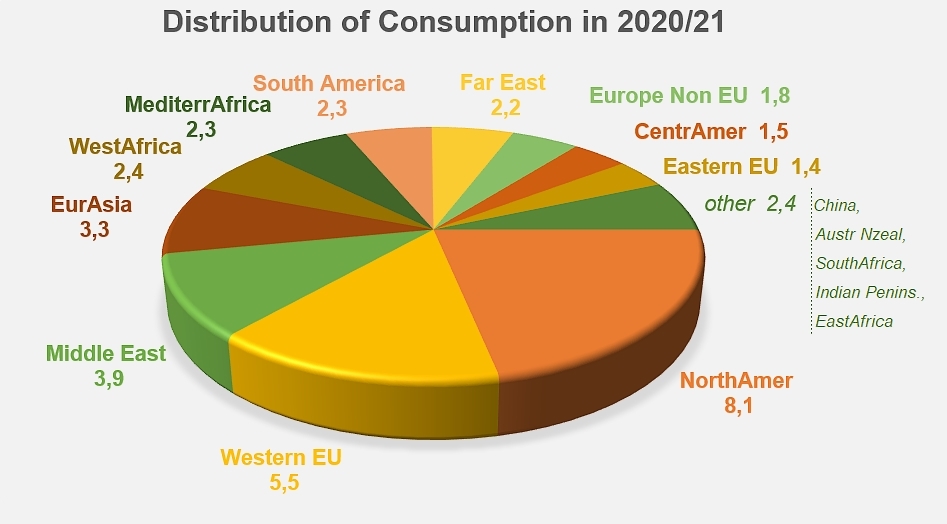

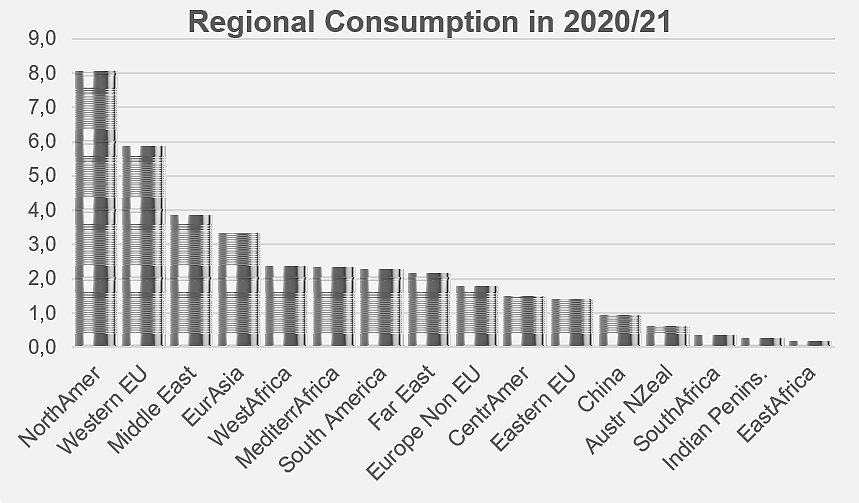

With the exception of a few minor changes in ranking within groups of regions with similar performances (West Africa, Mediterranean Africa, South America and the Far East, between 2.4 and 2.2 million mT of raw material equivalent), the similarity in the results of the last two marketing years is accompanied by a logical continuation of the regional hierarchy of quantities consumed. The only notable change is the exit of the United Kingdom from the European Union region and its entry into the non-EU Europe region, resulting in a slight decrease in consumption in the former and a significant increase in the latter in the overall ranking by quantity.

North America remains the main consumption region on a global scale (8 million mT of raw material equivalent), ahead of the Western European Union (5.9 million mT), in a ranking that once again confirms the emergence of regions such as the Middle East (3.9 million mT) and Eurasia (3.3 million mT), as well as their increasingly important place in the global landscape. The other regions together account for less than half (44%) of estimated global consumption.

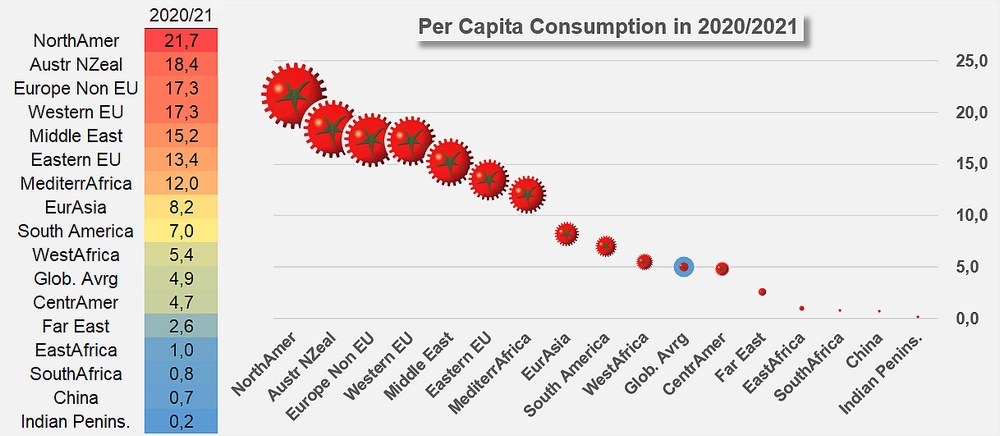

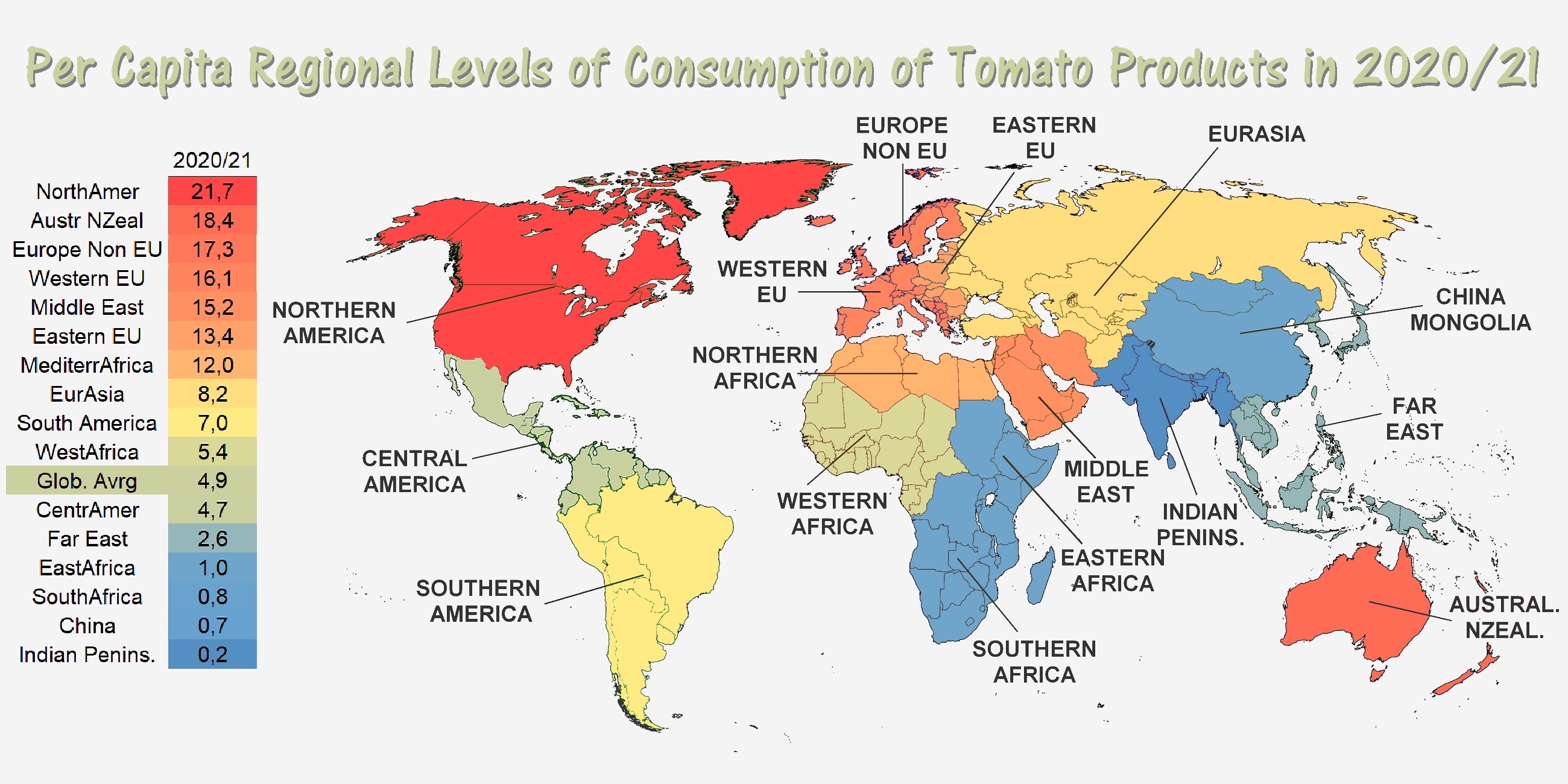

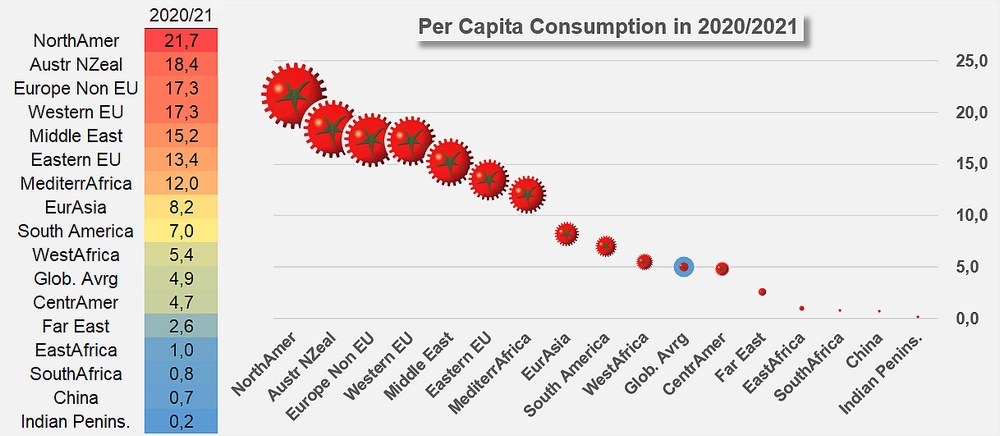

Individual consumption

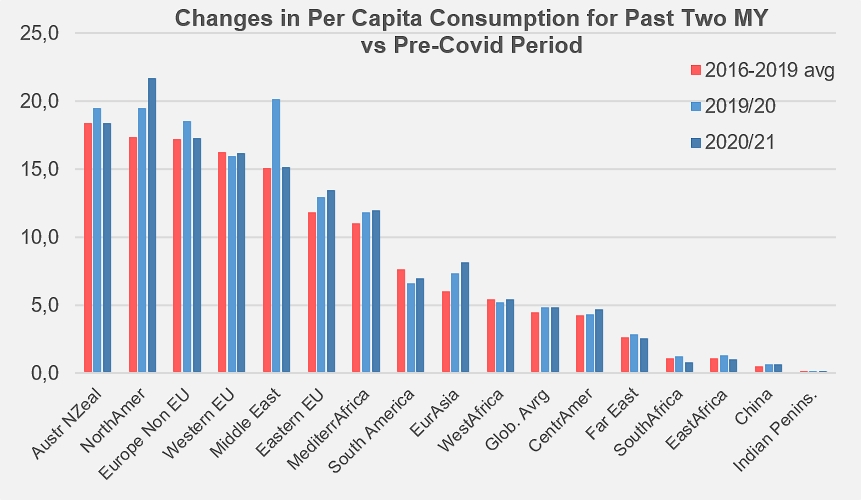

The previous marketing year (2019/2020) has singularly increased the overall average level of individual consumption, with certain disparities between the different regions that have already been commented on. Per capita consumption thus rose rapidly from 4.5 kg/year in 2018/2019 to 4.9 kg/year in 2019/2020, a spectacular increase that has been confirmed during the 2020/2021 marketing year with an overall average level consistently recorded at around 4.9 kg/year. This acceleration and the relatively high result compared to previous years undoubtedly explains in part the current state of tension in stocks and the pressure on the industrial and agricultural segments of production.

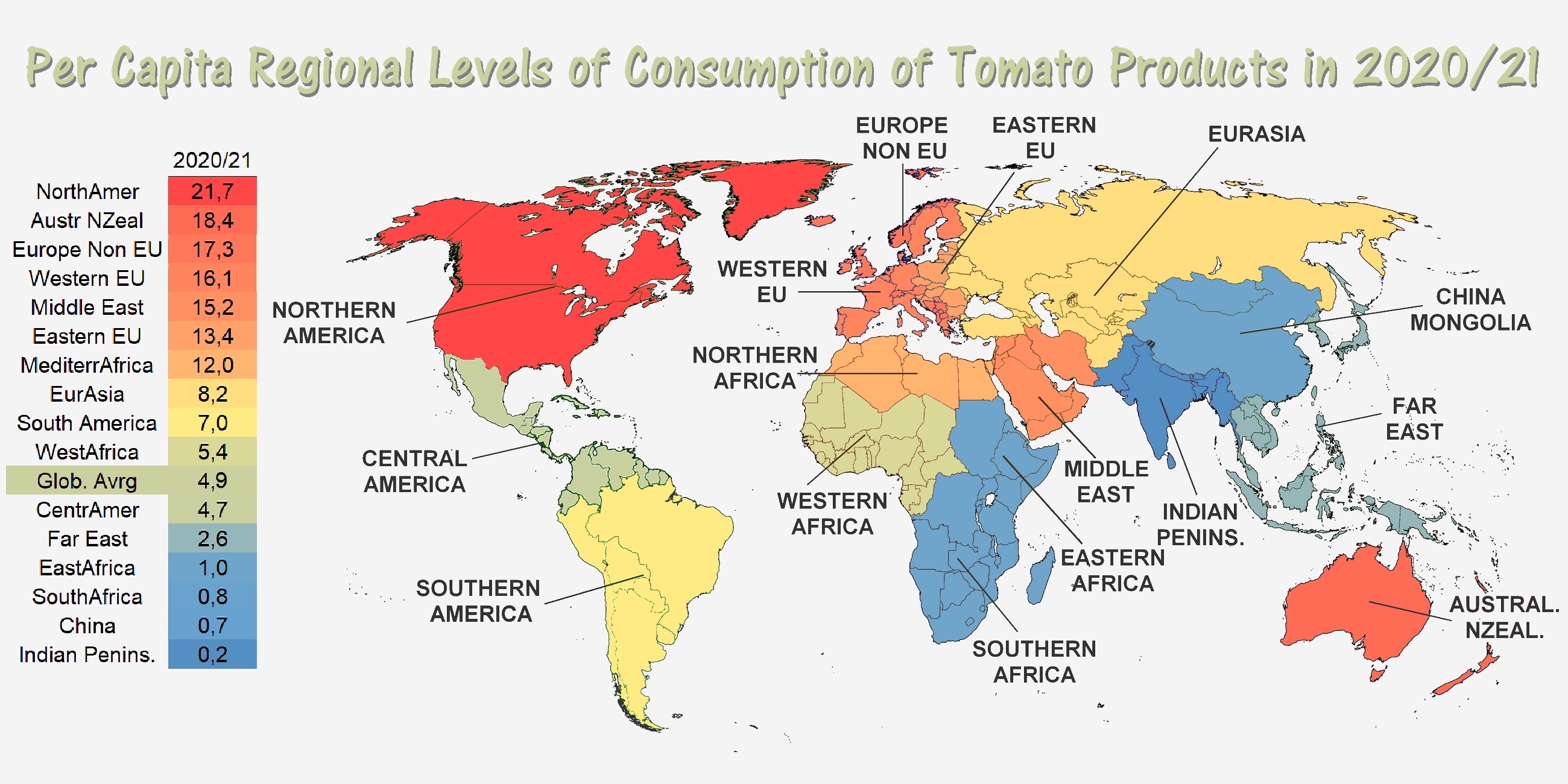

The ranking of regions in terms of individual consumption differs markedly from the regional ranking by overall volume, but also does not fundamentally change the results of previous studies. The Western and Mediterranean regions show the highest per capita consumption in the world and contrast strongly with the regions of Asia, the rest of Africa and South America, where processed tomatoes traditionally occupy only a marginal place in the kitchen.

It seems that the regions with the highest levels of individual consumption are also logically those where the acceleration of consumption during the Covid health crisis was the most marked, with its attendant limitations on sales in supermarkets. Peaks in 2019/2020 echoing over into 2020/2021 have thus affected per capita consumption rates in the regions of Australia-New Zealand, North America, non-EU Europe, the Middle East, Eastern EU, Mediterranean Africa and Eurasia, while the crisis has had no apparent or measurable effect in South America, Western Africa, Central America, the Far East, etc. (See additional information at the end of this article.)

These observations clearly contrast mature markets with young or emerging markets and raise the question of the growth reserve. The recent health crisis and the contrasting responses of consumers in different parts of the world have clearly demonstrated the need for a cultural and historical foundation of consumption as an indispensable basis for future commercial development.

Finally, it is worth mentioning the particular case of Western EU, where the proven "booster" effect of the pandemic on consumption has been erased by the transfer of the UK to non-EU Europe. This change, which occurred in 2020/2021 following Brexit, has raised per capita consumption in non-EU Europe from less than 11 kg/year to more than 17 kg/year and has propelled it to third place in the world, replacing the Western European Union, whose per capita consumption has fallen from more than 18 kg/year to 16 kg/year and has thus been relegated to fourth place in the worldwide ranking.

See also the world map of per capita regional consumptions at the end of this article

Drivers of growth

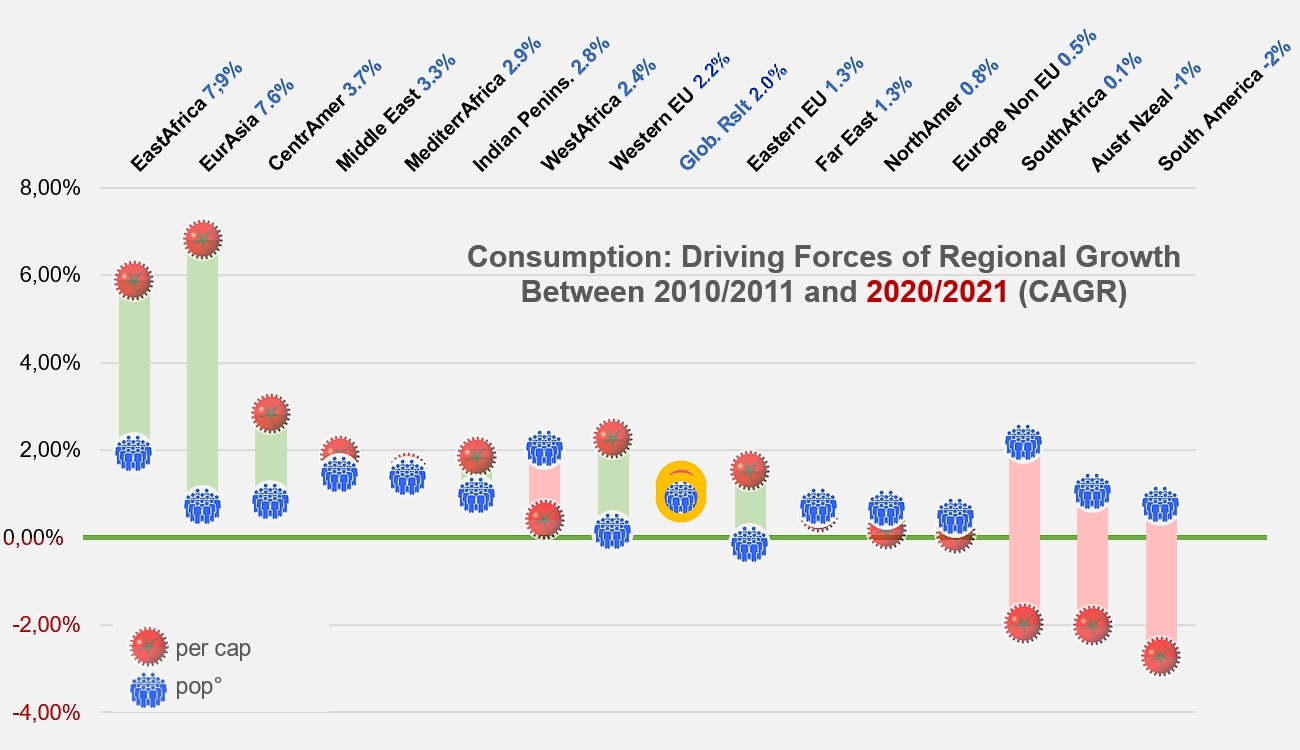

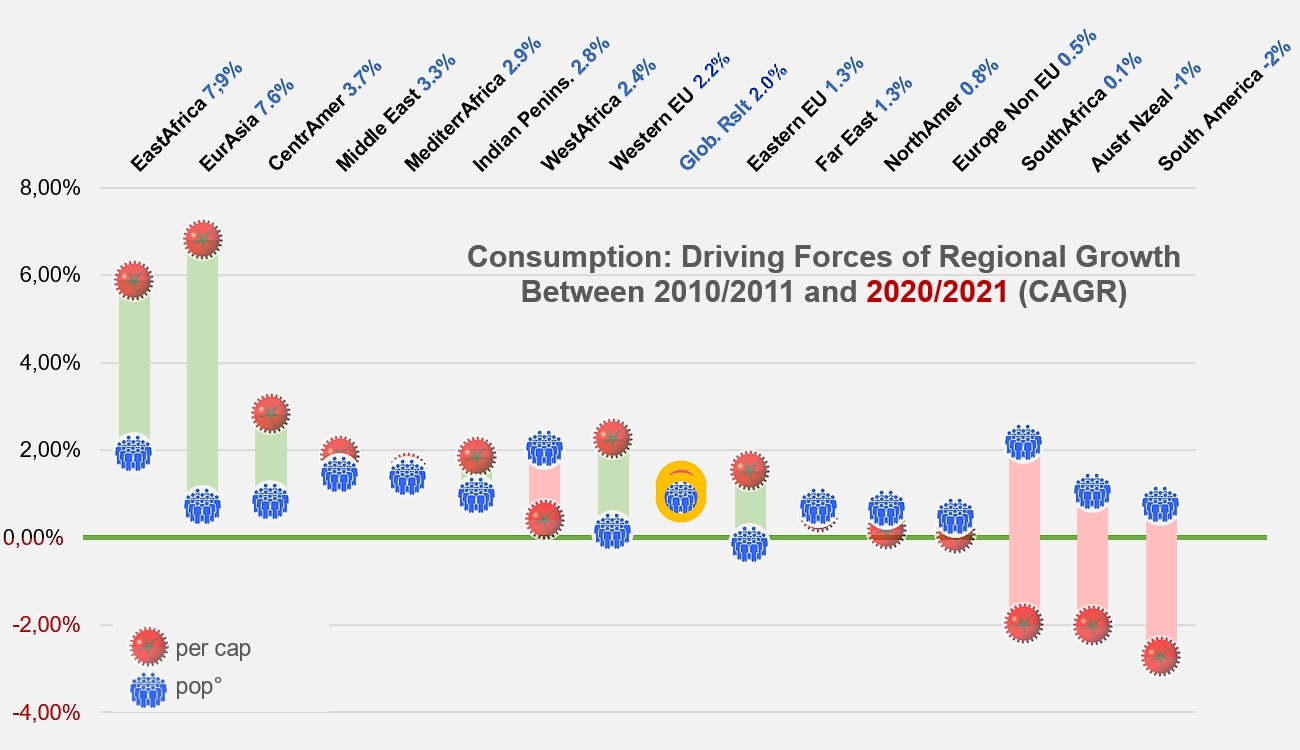

The surge in global consumption over the past two years has raised the average annual growth rate of global tomato product consumption over the past decade to more than 2% per year. For the record, the same ratio was around 1.5% in the period prior to the Covid health crisis in 2020.

As previous editions of the consumption study have already shown, global growth is naturally based on demographic development, but above all it is supported by the growth of individual consumption. In addition to an annual increase in the "world population" component of around 0.9% over the last ten years, the latest available data show that the "per capita consumption" component is growing at a rate of around 1.2% per year, which is slightly more dynamic than before the pandemic.

This overall result masks significant disparities between the different regions, which contrast markets where sustained growth (CAGR above 7.5%, in China, East Africa, Eurasia) is essentially driven by a growing individual interest in tomato products, with those where less spectacular progress (CAGR between 2% and 4%) is driven by a combination of less contrasting demographic or individual components (Central America, Middle East, Mediterranean Africa, Indian subcontinent). West Africa occupies a special position here, which it owes above all to its dynamic demographic development.

Either side of a core point defined by the overall growth rate of per capita consumption (2.1% per year) are a number of mature markets, including the EU (Western and Eastern) and the Far East, with average growth rates of between 1.3% and 2.5%, as well as North America and non-EU Europe, two regions where the weak demographic and consumption components result in sluggish growth. Beyond this are markets where the decline in individual consumption is outpacing population growth and leading to a decrease in the quantities consumed (South Africa, Australia-New Zealand and South America).

Regions ranked by decreasing order of the average annual growth rate (CAGR) of overall regional consumption

In conclusion, the total consumption of tomato products recorded a satisfactory level in 2020/2021. The results of this last marketing year have extended those of 2019/2020 and confirmed a clear rise in the overall level of individual consumption. However, a significant part of the good performance in 2020/2021 is based on a situational, and therefore potentially transitory, increase in the wake of the Covid pandemic. The 37 million tonnes of apparent disappearance last year in no way predict the course of the current marketing year, for which uncertainties persist both regarding the sector's ability to maintain a high level of consumption and regarding its capacity to respond in an efficient but reasoned manner to a level of demand that is currently impossible to predict.

It will therefore be necessary to wait for the results of the current 2021/2022 marketing year – and probably the next ones – before knowing if the marketing results recorded during the pandemic have indeed raised the average level of global dynamics or if they were only a notable parenthesis without any lasting effect on consumption habits worldwide.

PerCap Consumption World Map

Some additional information

(*) The observable differences in the estimated levels of global consumption and some regional results between the last two studies are due to the use of revised processing coefficients between our last two publications. Overall growth profiles have not been affected by this revision; only the overall level of the global consumption profile has changed, having been reduced to slightly lower values than it was in previous studies.

Evolution of global exports of tomato products, estimates expressed in raw material equivalent.

Evolution of the regional components of global consumption of tomato products over the past 10 marketing years.

Regional distribution of global consumption of tomato products in 2020/2021.

The Covid pandemic had a boosting effect on per capita consumption in some regions, including those that already had very high individual levels even before the health crisis, and this effect appears to have persisted in several of them.

Sources: WPTC, TDM

Slides from François-Xavier Branthôme presentation at the WPTC congress: