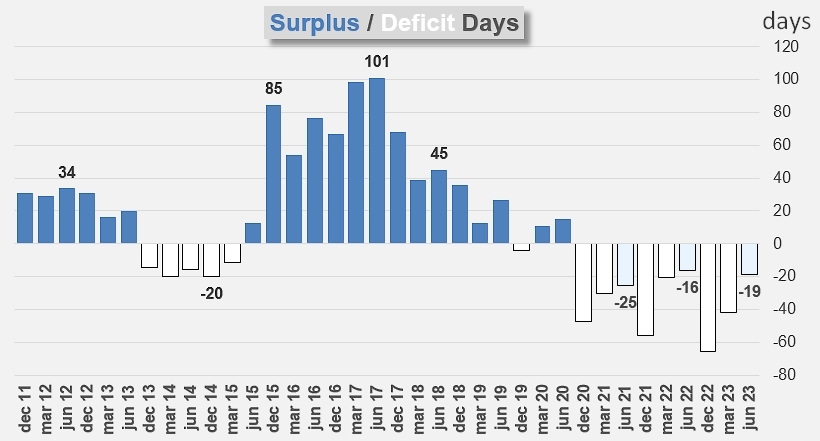

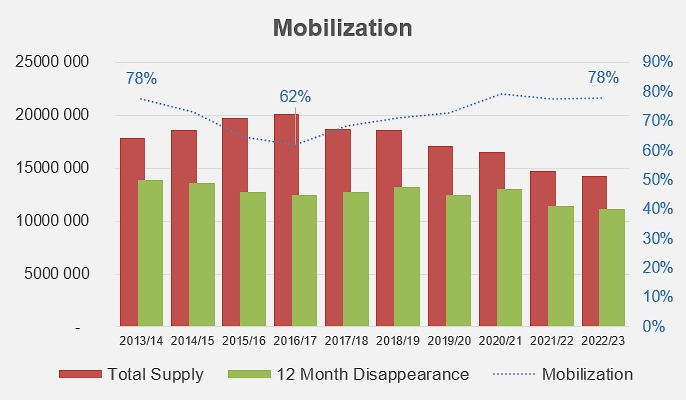

Inventory levels and apparent annual disappearance as of June 1st are at very low levels, so processing intentions are closely in line with forecast demand.

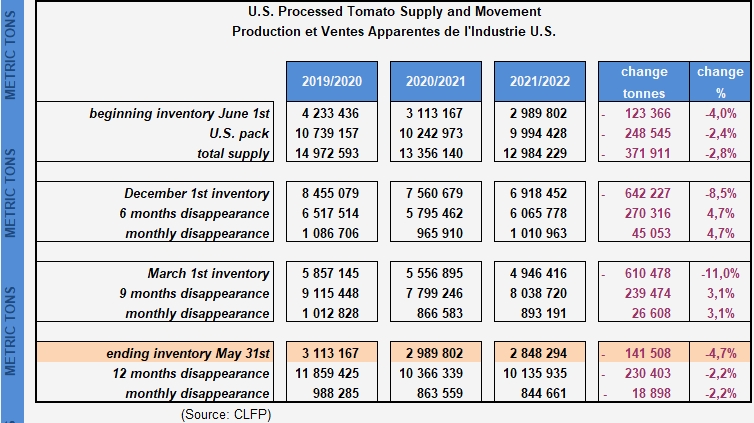

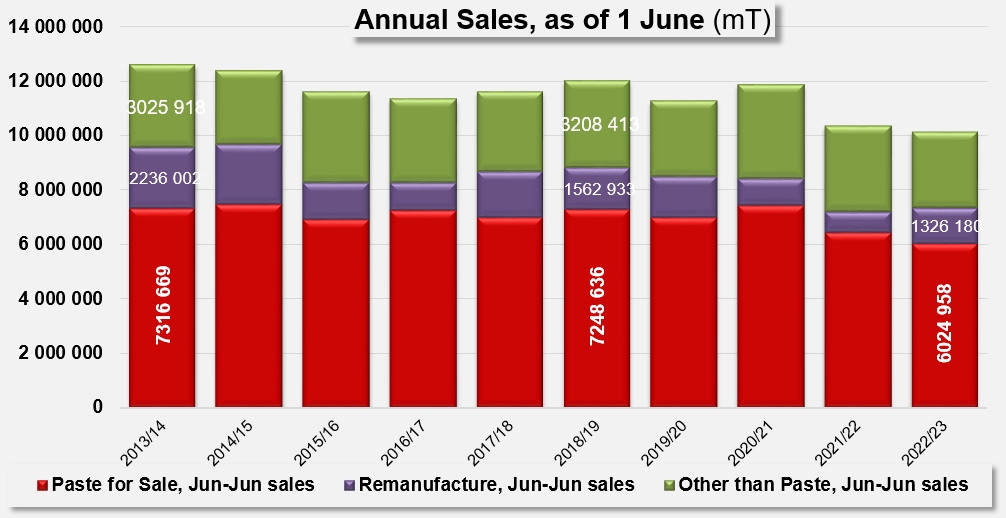

The marketing year 2022/2023 began with a stock of tomato products equivalent to 2.99 million tonnes of raw tomatoes, and ended on May 31 with a slightly lower stock (-4.7%), equivalent to 2.85 million tonnes. According to the CLFP commentary, the rate of apparent disappearance of stocks over the last twelve months (June 1, 2022, to June 1, 2023) has fallen by 2.2% compared with what was recorded at the beginning of June 2022 (10.37 million metric tonnes (mT)), to around 10.14 million mT.

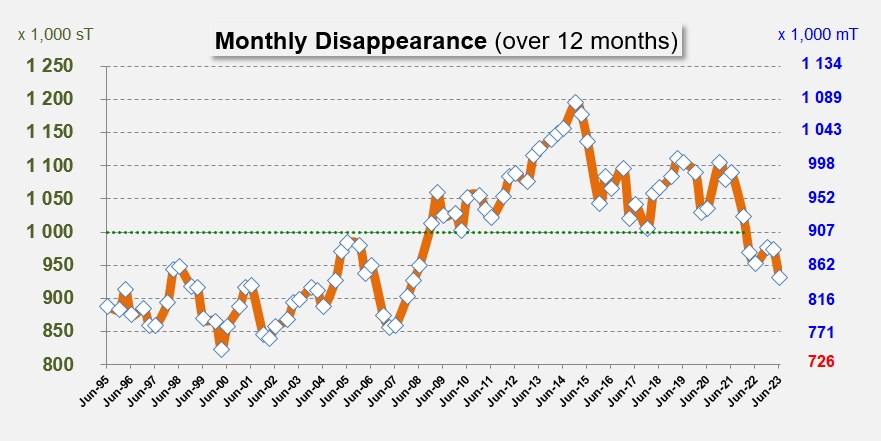

For the twelve months between June 1, 2022, and May 31, 2023, apparent monthly disappearance amounted to 845,000 mT, the lowest level recorded since March 2008.

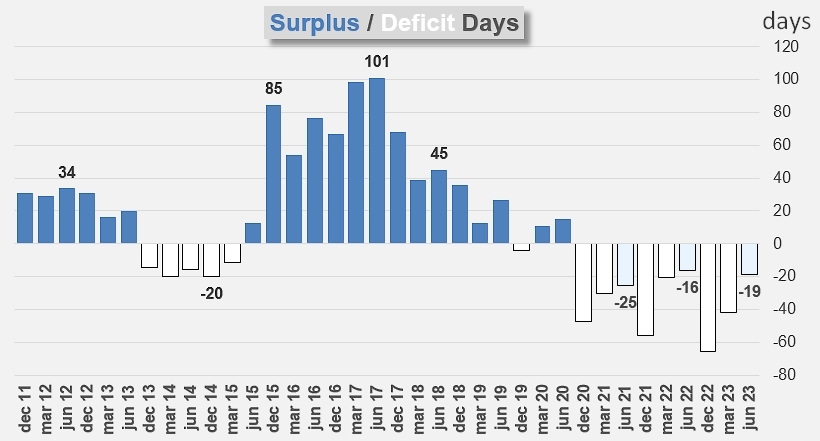

At the current rate of inventory drawdown, the quantities physically present in US plant warehouses should cover requirements for slightly less than three and a half months, which is lower than the four months generally considered as the ideal duration of coverage on June 1. At the same time, the tension that this low level of inventories may generate on the markets should not be more pronounced than in the similar circumstances of June 2022 and June 2021.

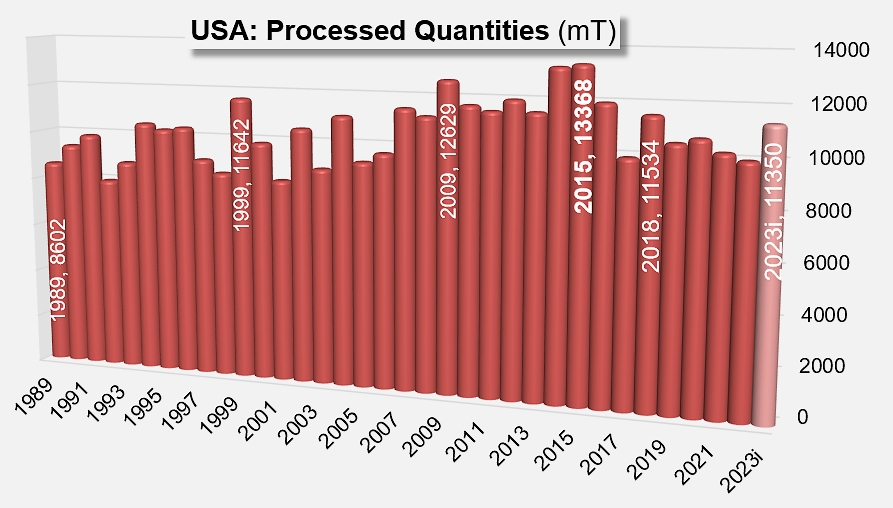

As things stand, consumption and inventory data point to an annual consumption trajectory of around 11.5 million mT of raw tomato equivalent for the United States as a whole, with which processing intentions published by the US industry (11.35 million mT) seem to be well in line.

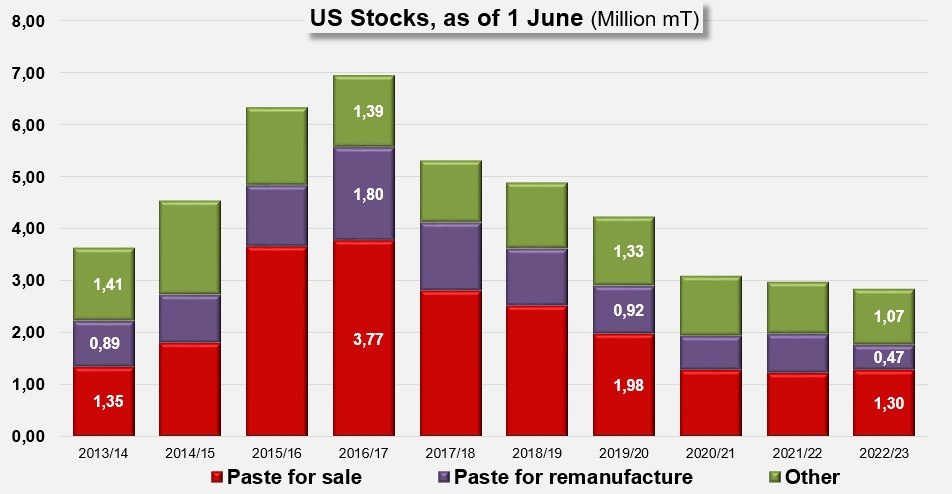

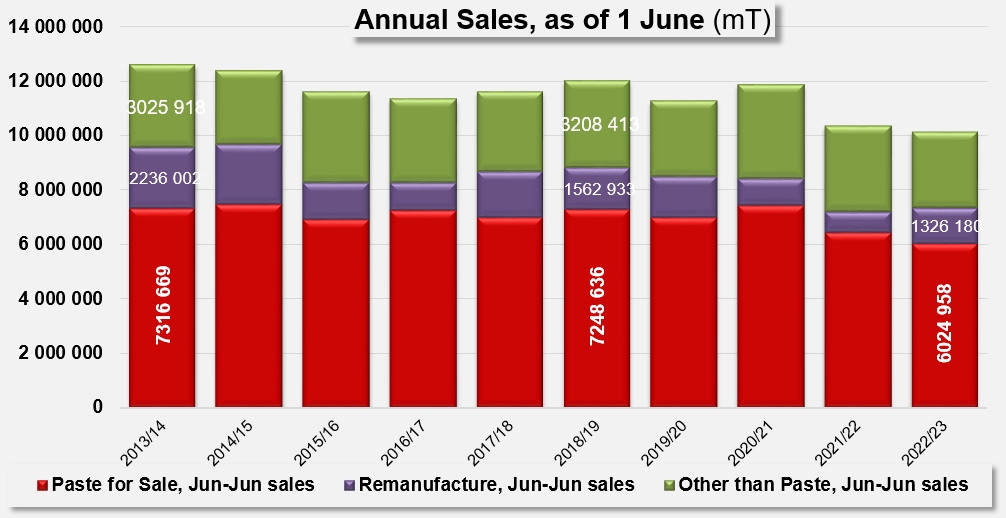

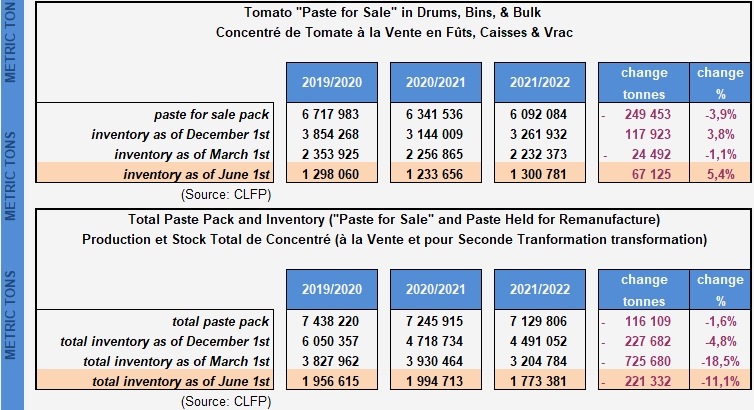

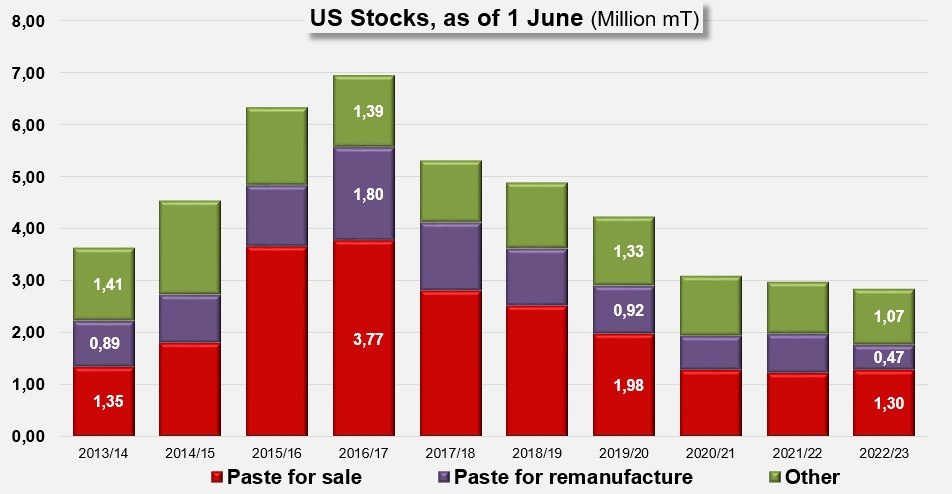

In a detailed breakdown, U.S. bulk tomato paste inventories on June 1, 2023, were around 1.3 million mT, up by around 5% compared to those of June 2022. Given that the volumes produced after the 2022 harvest were lower than in the previous season (-3.9%), it has to be said that this increase is the result of a slowdown in annual sales in this category, which absorbed just over 6 million tonnes (raw tomato equivalent) compared to over 6.4 million mT the previous year (see additional data at the end of this article).

At the same time, information available as of June 2023 also shows a slight improvement in the overall situation for pastes, whether intended for sale and/or for remanufacturing, with stocks down significantly (-11%) due to a reduction (-1.6%) in quantities produced during the season, and a slight increase in annual sales (+2%).

This good result is in fact the consequence of positive dynamics recorded in the segment of paste for remanufacturing, whose June 2023 inventories, amounting to just over 470,000 mT of raw tomatoes, have fallen sharply compared with the June 2022 situation (around 760,00 mT), following a significant increase in annual sales, from 800,000 mT (raw tomato equivalent) during the June 2021-May 2022 period to over 1.3 million mT during the June 2022-May 2023 period.

Some complementary information

The U.S. bulk tomato paste-for-sale inventory on June 1, 2023, was approximately 1.3 million mT, on a raw product "paid-for tonnes" equivalent basis.

Total bulk tomato paste stocks, including inventory held for remanufacture, were estimated to total 1.77 million mT, on a raw product "paid-for tonnes" equivalent basis, as of June 1, 2023.

Processing results and intentions in the USA (California + other states)

Sources: CLFP, WPTC