The situation of stocks is tight; the 2023 season will be decisive

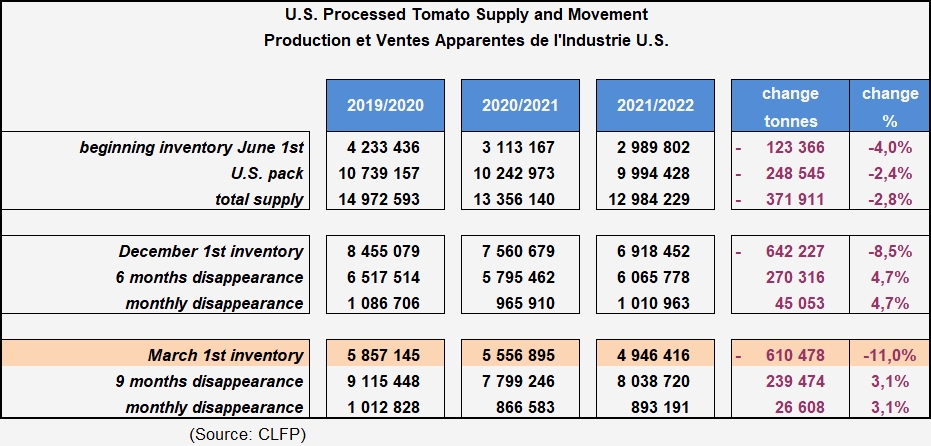

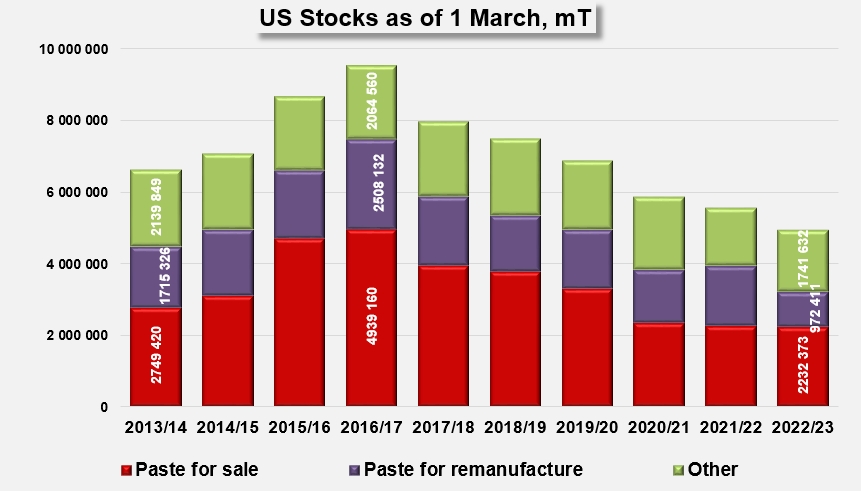

According to the report released on March 30 by the CLFP (California League of Food Producers, see our related articles below), the amount of tomato products in US warehouses as of March 1st, 2023, was down 11% from the same period last year.

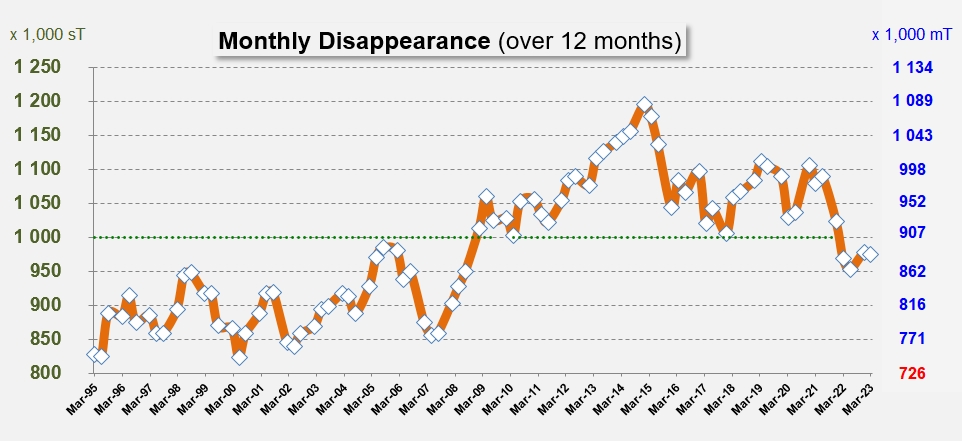

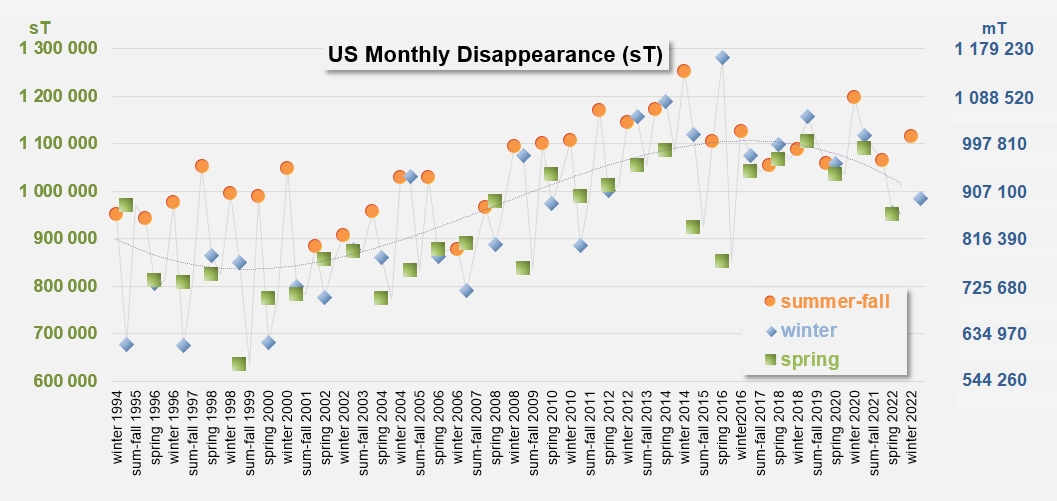

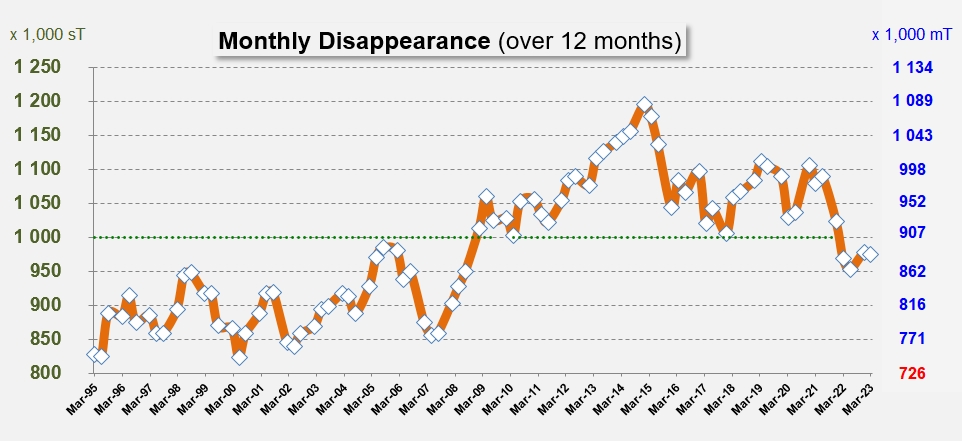

The apparent disappearance of tomato product stocks in the nine-month period from June 1st, 2022, to March 1st, 2023, increased by 3.1% from the previous reporting period to about 8.04 million mT (8.9 million short tons (sT)). The situation on March 1st also shows apparent annual disappearance (domestic consumption + exports) of around 10.6 million mT, slightly up (+0.6%) compared to the twelve-month period ending in March 2022 and 11% higher than the quantities processed during the last season (9.5 million mT).

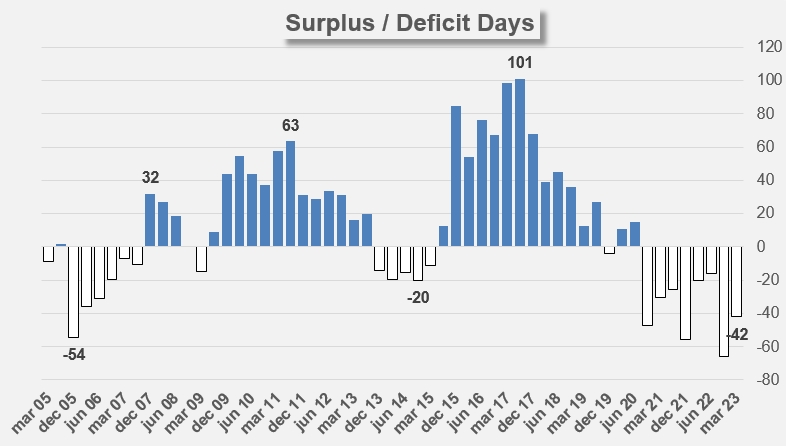

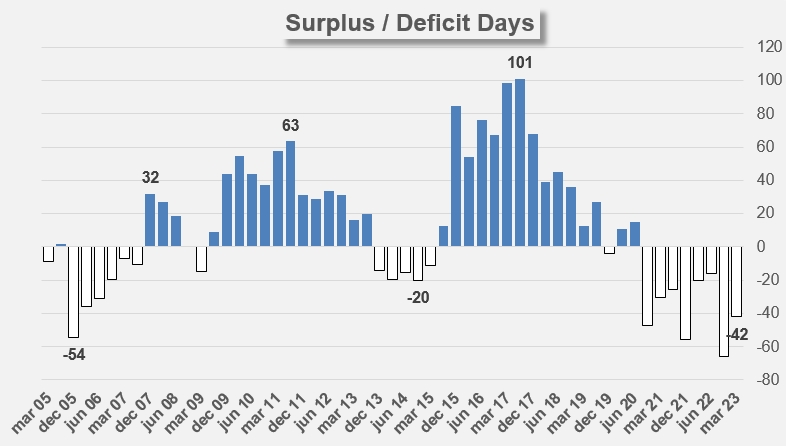

Currently, the quantities physically available should be able to supply apparent consumption for about five-and-a-half months, which is significantly less than the seven months considered optimal by US operators as of March 1st. The current situation is the consequence of a deficit of operations spread over several seasons, linked to multiple factors (climatic conditions, water availability, inflation, etc.), which has led to an imbalance between the quantities produced and the quantities consumed.

In the current inflationary context, the question of processed quantities is therefore becoming increasingly decisive, underpinning the spectacular rise in reference prices for tomatoes as raw material delivered to processors, both in the United States and in other processing regions. For now, US processing prospects for the 2023 crop year (11.7 million mT) are extremely close to the levels that recent apparent consumption trajectories indicate for the 2023/2024 marketing year. If the quantities processed this year were to be lower than the intentions and prospects communicated by the US industry to the WPTC (data as of March 31st, 2023, see our related articles below), the deficit would increase and lead to an extremely tense situation in terms of trade and with regard to the agro-industrial sector at the beginning of 2024.

Some complementary information

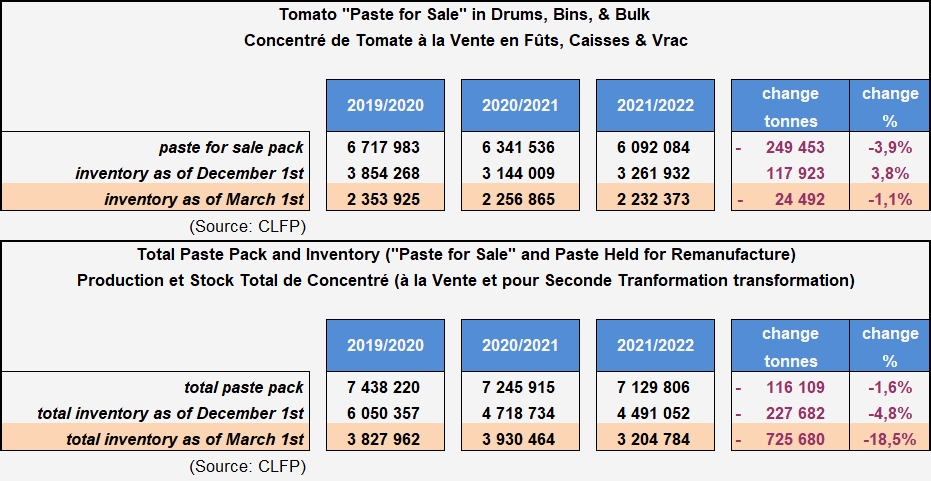

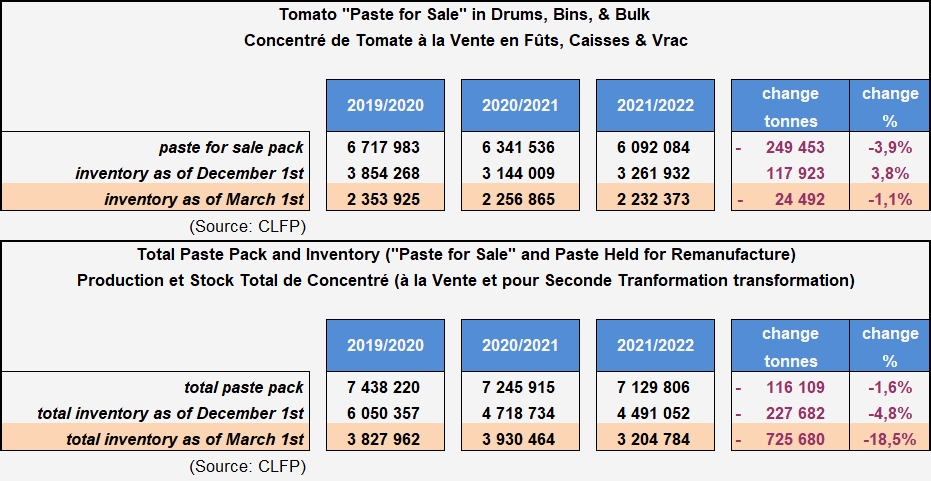

Evolution of stocks of paste for sale to the industrial sector and for remanufacturing.

Changes in the composition of tomato product stocks as of March 1st each year since 2014.

Evolution of monthly sales according to the seasonal periods (summer-fall, winter, spring) defined by the stock situations (December 1st, March 1st, June 1st).

Sources: CLFP