Transcript of the presentation by Alistair Blake (AMITOM President & Merko, Turkey) during the 2022 Tomato News Conference held in Parma on 25 October 2022

“Good afternoon everyone and welcome to the Tomato News conference. But first I'd like to thank ANICAV for giving us this opportunity to get together and to go over the season; especially a season like this one where it's been exciting and very tiring for us all.

“Good afternoon everyone and welcome to the Tomato News conference. But first I'd like to thank ANICAV for giving us this opportunity to get together and to go over the season; especially a season like this one where it's been exciting and very tiring for us all.

First briefly about me, some of you know who I am some of you don’t; for the others benefits, I'm president of Merko in Turkey, we've been dealing with mainly exports of tomato paste since mid-1990s and I'm also now the present president of AMITOM.

Thank you very much for this honour, it's an extra honor for me, concerning the fact that my late father was also one of the past presidents. He used to like going back and forth with Martin Stilwell for many years on theories on how the markets could change and how the crop and consumption would go but I'm sure even he would not be able to make sense of the situation that we're all today.

What is AMITOM?

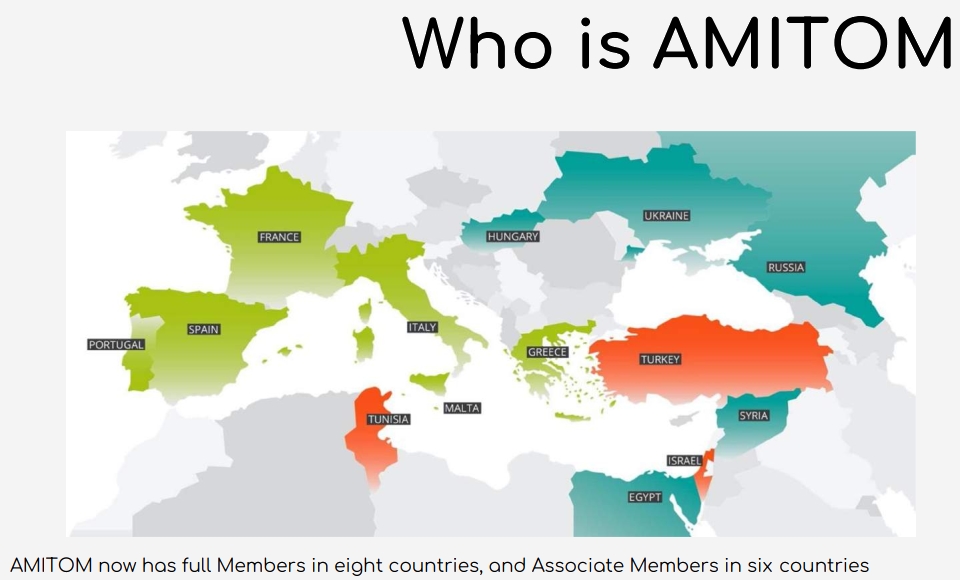

Quickly about it for those of you don't know what AMITOM is. AMITOM has full members in eight countries and associate members in six countries. It is made up of five EU countries; these include Spain, France, Greece, Italy and Portugal; three countries from outside the EU that's Israel, Tunisia and Turkey and there's another six countries where we have associate members. This means the country itself is not a member but companies from inside those countries are members and these are in Egypt, Hungary, Malta, Russia, Ukraine and Syria.

What is our mission, what do we do? If you go on our website, that basically is: to establish ongoing global and cross agency relationships; to collect reliable information about the sector; to ensure the flow of information between all players in the sector; to gather with world congresses and outside world congresses like this; to encourage agronomic and technological research; to increase consumption and participate in international standards.

Today I would like to concentrate on the highlighted items here: the collection of information and ensuring the flow of information.

Collecting information: to collect from its members and other sources reliable information about the situation of the tomato processing industry worldwide. For this mission the collection of crop forecasts through regular survey amongst members are precious indicators. I think we can all agree that in today's environment every piece of information is precious. Among ourselves we meet regularly. Within AMITOM, we request initial forecasts for the year early on, even before any planting is going on and then we have frequent meetings to follow up on crop situations, political situations, markets etc. These are always shared on the Tomato News website as well as on the association’s website itself, which comes to the second point: it is to ensure the exchange information amongst everyone involved in the industry. Besides the exchange between its members, AMITOM launched the bilingual monthly magazine Tomato News in 1990 and it remains a major shareholder of the free information website launched in 2018, which is recognized as the best source of information for and about the global tomato processing industry. Our crop updates, which is possibly one of the most important things, which we're going to talk about today as well, gets around 1000 hits every single time which is a number which we have to increase. And to increase that we can do that with the people here together, because as it says up there, the information is no use to any of us if we keep it to ourselves. We have to get this information out to ministries, governments and our customers so that we're all basically on the same page.

What use is it?

Well, we have the historical data and just for a little bit of fun I'm going to start with some numbers from back in 2005. Why 2005? Well, that's when I started working in the company so obviously it must be an important year!

Back then Italy processed 5.3 million tonnes, not much different to where they are today so obviously in keeping a good position up there.

Back then Italy processed 5.3 million tonnes, not much different to where they are today so obviously in keeping a good position up there.  Spain: 2.85 million and back up in, I think, 2017, Spain went up to record-breaking 3.35 million and obviously today with problems with global warming and droughts, far short of that figure up there.

Spain: 2.85 million and back up in, I think, 2017, Spain went up to record-breaking 3.35 million and obviously today with problems with global warming and droughts, far short of that figure up there. Portugal at around 1 million, Turkey 1.6 million, Iran in those days 2 million. Iran is one of the countries which you'll see later on the presentation, we're not getting the information that we used to get out of there. If people do have contacts, we're always keen to find out from some more information.

Portugal at around 1 million, Turkey 1.6 million, Iran in those days 2 million. Iran is one of the countries which you'll see later on the presentation, we're not getting the information that we used to get out of there. If people do have contacts, we're always keen to find out from some more information. Moving down, Ukraine wasn't there, well we don't know if they were producing in those days but, definitely, we weren't getting information out from them. They started giving us figures the year after, in 2006 and from being blank there it's gone up to numbers of around 800,000 tonnes and growing drastically and obviously we will come back to where they are today.

Moving down, Ukraine wasn't there, well we don't know if they were producing in those days but, definitely, we weren't getting information out from them. They started giving us figures the year after, in 2006 and from being blank there it's gone up to numbers of around 800,000 tonnes and growing drastically and obviously we will come back to where they are today.  Similarly, Russia again was not on the table back in those days. They first started sharing data for our records in 2011 and today they're over to 600,000 tonnes of raw material being processed in Russia.

Similarly, Russia again was not on the table back in those days. They first started sharing data for our records in 2011 and today they're over to 600,000 tonnes of raw material being processed in Russia.  Back in those days Greece was at 850,000 tonnes. Now is comes to around half of that production, due to reasons we'll discuss and see about later.

Back in those days Greece was at 850,000 tonnes. Now is comes to around half of that production, due to reasons we'll discuss and see about later.

How did this year start?

As I mentioned earlier, we meet frequently to even before we have our own idea just to start sharing data and to get the ball rolling. This is from the official AMITOM reports, I've taken some quotes from it which are published on the websites.

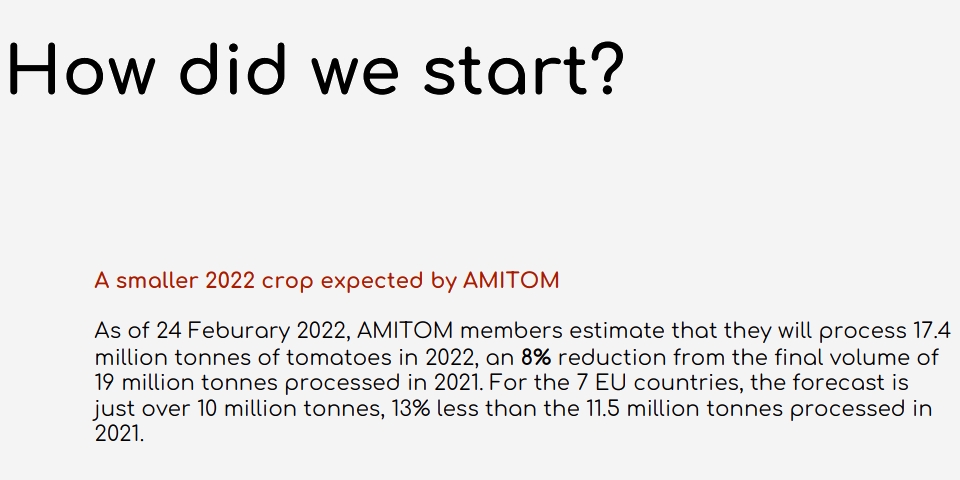

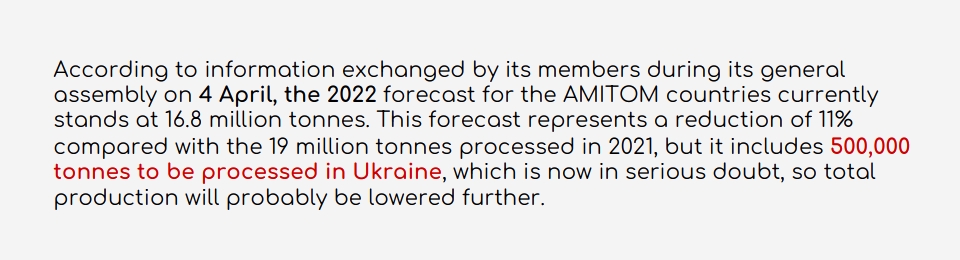

“A smaller 2022 crop expected by AMITOM”. Looking back, an understatement! “On the 24th of February, AMITOM members estimated that they will process 17.4 million tonnes in 2022”- I'd like to say that number is including Iran and Algeria which we now don't get data from, so that's why it could seem a bit higher- “a 8% reduction from the final volume of 19 million tonnes processed in 2021. For the 7 EU countries the forecast is just over 10 million tons, 13% less than the 11.5 million tonnes processed in 2021.” So already on the 24th of February we were looking at a tough year.

And this information was out there for everyone. It was out there for our buyers as well and maybe in those days back then no one took it too seriously.

Following up from the report, going through country by country, you'll start seeing a trend as I go through the countries.

France: “It is difficult for the processors to contract the higher volumes they would like to process in the part of France this year. Nevertheless, in all the country it seems to be the same thing because also of the competitiveness of alternative crops.”

France: “It is difficult for the processors to contract the higher volumes they would like to process in the part of France this year. Nevertheless, in all the country it seems to be the same thing because also of the competitiveness of alternative crops.” Greece: “The situation is still unclear but while the acreage should be similar to last year in the South there are serious issues in the center with farmers favoring alternative crops. “

Greece: “The situation is still unclear but while the acreage should be similar to last year in the South there are serious issues in the center with farmers favoring alternative crops. “ Italy: “It is expected that the services will be reduced due to increased costs and alternative crops.” Italy was estimating a very accurate 10% reduction, down to 5.4 million tons probably one of the closest estimates from back in that day.

Italy: “It is expected that the services will be reduced due to increased costs and alternative crops.” Italy was estimating a very accurate 10% reduction, down to 5.4 million tons probably one of the closest estimates from back in that day.  Hungary: “It is difficult for processors to contract all the surface they want due to alternative crops.” Again.

Hungary: “It is difficult for processors to contract all the surface they want due to alternative crops.” Again.

Portugal: “A slightly lower crop than in 2021 is expected at between 1.4 and 1.5 million tons as yields last year were exceptional and it's difficult for the processors to get all the surface required due to competitive crops.”

Portugal: “A slightly lower crop than in 2021 is expected at between 1.4 and 1.5 million tons as yields last year were exceptional and it's difficult for the processors to get all the surface required due to competitive crops.”  Russia: Again a country which has claimed 600,000 tonnes and ended up with around 638,000 tons in the final stages.

Russia: Again a country which has claimed 600,000 tonnes and ended up with around 638,000 tons in the final stages.  Turkey: “Strong competition with cotton and alternative crop is also at play. Consequently it is expected that the surface planted with tomatoes will decrease by 30 to 40% in the south.”

Turkey: “Strong competition with cotton and alternative crop is also at play. Consequently it is expected that the surface planted with tomatoes will decrease by 30 to 40% in the south.” Spain: Obviously Spain had much larger issues, apart from the competing crops, with the drought. There was a lot of hope that some acres would be opened up later on to reduce the damage, but the first estimate was 2.2 million and came in slightly lower unfortunately but very close with 2.1. Again, another concern apart from the drought was that growers preferred planting cotton which represents a lower risk than tomatoes; again the issue of competing crop.

Spain: Obviously Spain had much larger issues, apart from the competing crops, with the drought. There was a lot of hope that some acres would be opened up later on to reduce the damage, but the first estimate was 2.2 million and came in slightly lower unfortunately but very close with 2.1. Again, another concern apart from the drought was that growers preferred planting cotton which represents a lower risk than tomatoes; again the issue of competing crop. And finally Ukraine: a very sad story and on the news constantly for us. But let's show that the expectation for Ukraine back in February when obviously no one had any idea of the situation we'd be in today nor had any idea of the energy prices that we'll be dealing with and the inflation of prices and the shortages. Back at that time there was an intention of 900,000 tonnes to be processed this season. In the uptake after that, on the 4th of April obviously the war had begun and then even then there was some hope that at least 500,000 tonnes would be processed in Ukraine but as we all know, in the end it was far short of that number.

And finally Ukraine: a very sad story and on the news constantly for us. But let's show that the expectation for Ukraine back in February when obviously no one had any idea of the situation we'd be in today nor had any idea of the energy prices that we'll be dealing with and the inflation of prices and the shortages. Back at that time there was an intention of 900,000 tonnes to be processed this season. In the uptake after that, on the 4th of April obviously the war had begun and then even then there was some hope that at least 500,000 tonnes would be processed in Ukraine but as we all know, in the end it was far short of that number.

So how did we do?

Usually if you look on our reports that are shared on the website, you can compare to previous years, the last two years average etc. But just to keep it nice and short and simple as most everyone here knows numbers anyway, I just put down the final numbers. As you can see, if you remember back in the original slide we were expecting a 13% reduction, something smaller like that what we got in the first forecast from AMITOM expecting minus 13% in the European countries and you can see a very different picture with the numbers on the right. There's a variation compared to the previous year with 13%, 19%, 30%, 10%, 17% down, Russia up, Turkey slightly up, Ukraine what was 85% and the subtotal of 27% down, which obviously will give a lot for us to talk about in the round table later on and which is the talk on everyone's lips during this exhibition before and I'm sure will be out for the next few months to come.

What are we going to next year? What are these numbers going to be next year?

In my new position within AMITOM my request to you is to try and encourage your customers, your competitors, even your suppliers or ministries in your country or even newspapers to follow the website follow the status: the more information people have, the better it's going to be for us or for our communication with our customers and for us to invest and to grow in a much more stable environment. As we heard from Tomato Europe earlier that there are new sustainability targets etc., these are not easy things. Right now, yes our prices are up through the roof due to other costs etc., but we have also seen that we have valuable products: tomato paste, tomato sauce, passata are a viable product and for years and years and years we've been sitting here under the other headlines of AMITOM to promote the product to add value to the product but the product actually did have value in the first place. I think we ourselves are the ones who least value the product compared to the customers so please let's share information, let's share numbers and unlike in the presentation about the prices that they were hoping that they would come back to pre-pandemic price levels I hope we don't come back to pre-pandemic price levels but I hope we settle somewhere that is sustainable for everyone as a consumer and as a producer.

Thank you very much!”

You can find all the other presentations and slides from the 2022 Tomato News Conference held in Parma on 25 October 2022 by clicking here.

Source Tomato News

“Good afternoon everyone and welcome to the Tomato News conference. But first I'd like to thank ANICAV for giving us this opportunity to get together and to go over the season; especially a season like this one where it's been exciting and very tiring for us all.

“Good afternoon everyone and welcome to the Tomato News conference. But first I'd like to thank ANICAV for giving us this opportunity to get together and to go over the season; especially a season like this one where it's been exciting and very tiring for us all.