Transcript of the presentation by Filippo Roda (ARETE, Italy) during the 2022 Tomato News Conference held in Parma on 25 October 2022

“The aim of my presentation is to show you the impact of rising energy costs on major agrifood commodities, but also to show you how the energy crisis is increasingly impacting the European Union.

“The aim of my presentation is to show you the impact of rising energy costs on major agrifood commodities, but also to show you how the energy crisis is increasingly impacting the European Union.

The general framework

Before starting, I will give you a brief introduction to the general framework of agrifood commodities. Then we will move to the energy crisis and to the analysis of its impact on agrifood commodities. Then, since agrifood commodities are many, and time is limited, I will provide you with some case studies showing you how several markets – mainly sugar, corn, milk and palm-oil – are reacting to this spillover effect of the energy crisis. Finally, we will conclude with some useful insights for the understanding of the tomato market.

Since the second half of 2020, most agrifood commodities have seen an upward trend in prices resulting in several cases in record high levels. As you can see from the histogram at the right of this slide, most agrifood commodities faced a double-digit percentage increase in price – milk and corn price levels today are twice what they were two years ago, but double increases in prices have also been recorded for veg oils, pulses, other commodities like sugar and coffee. The list, as you can see, is quite long…

So there are many endogenous and exogenous variables that have resulted in what we analysts call “the perfect storm” of agrifood markets, with a generalized inflation in the agrifood sector.

First of all, the post-Covid recovery of demand, especially in Asia, was not matched with supply, which was still impacted and slowed by pandemic-related logistic issues. Supply has also been impacted (and is still impacted) by extreme adverse weather events in many exporting and producing areas. And finally, as we will see, the energy crisis has had (and is still having) a huge spillover effect on most agrifood commodities.

All of this has resulted again in a huge reduction of global stocks in agrifood commodities, with increasing prices, but also a certain degree of uncertainty, which is the ideal environment for speculators. There is no doubt that speculation aggravated the price volatility, at least in the short term. And last but not least, in 2022, Russia’s military intervention in Ukraine fueled this price tension, heightening the impact on the European market.

As we will see, since 2022, agrifood inflation in Europe has started following a more regional pattern, rather than a global one. So the agrifood sector has been impacted by inflation more in the EU than in other advanced economies.

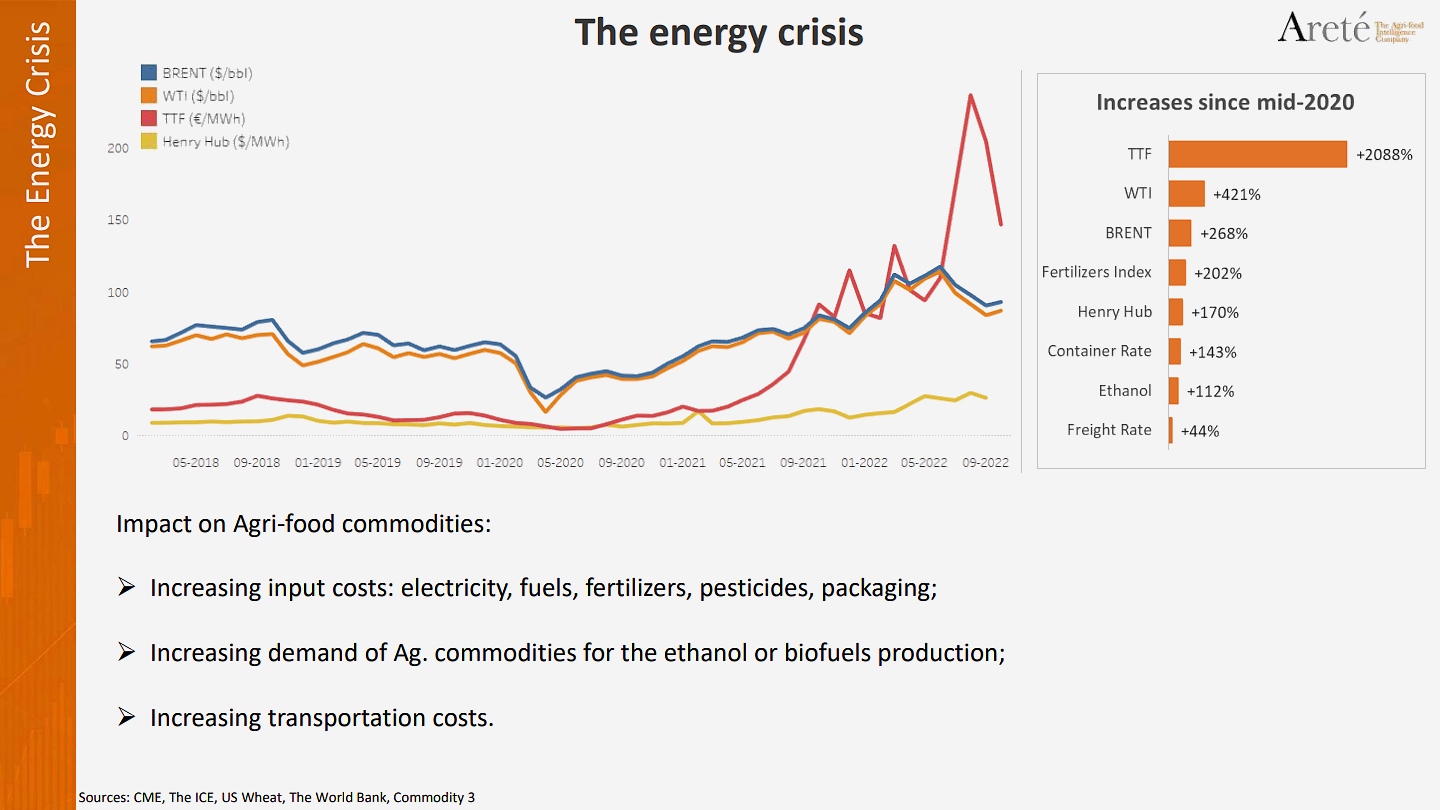

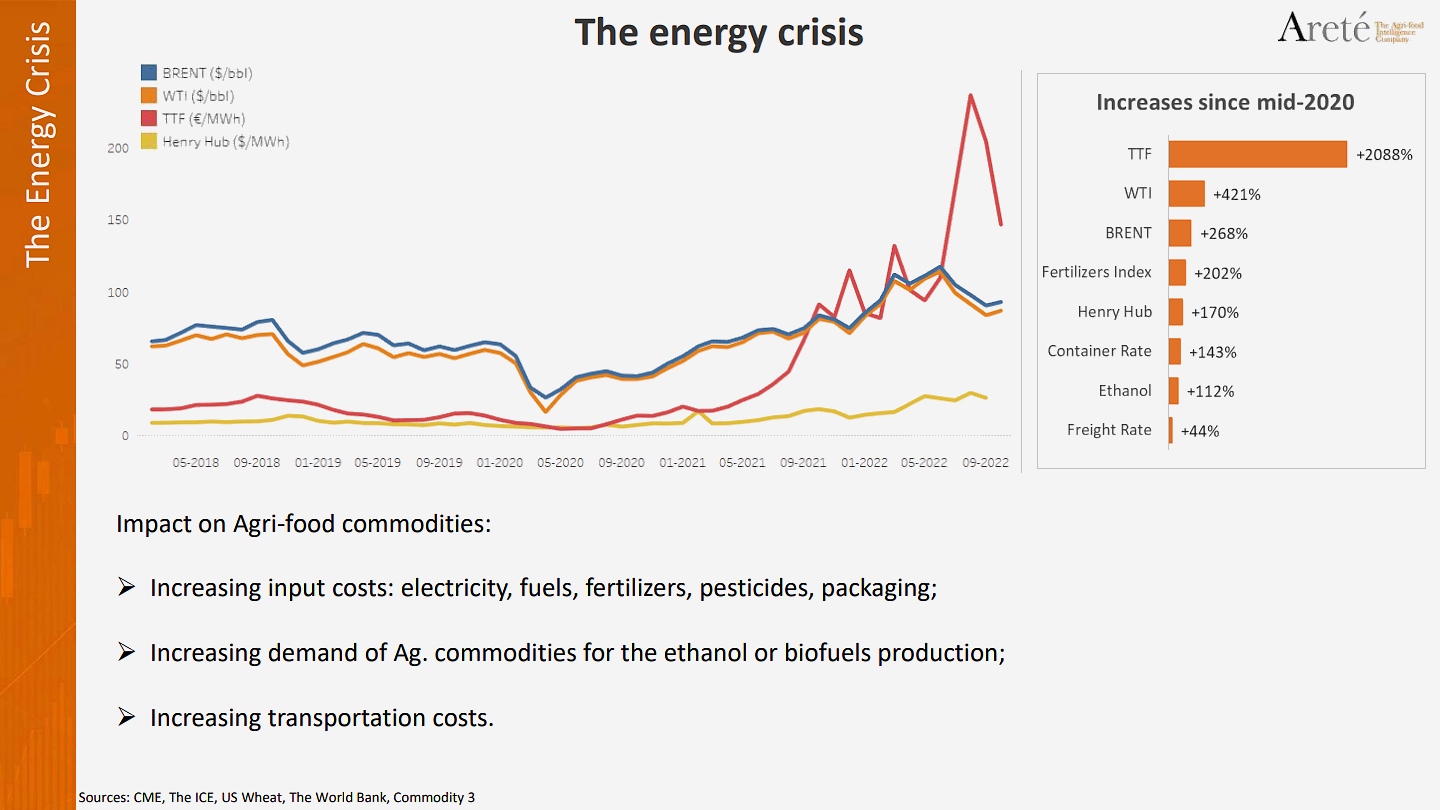

The energy crisis

As you can see from the graph at the top of this slide, since the second half of 2020, all the main benchmarks for energy prices both at the European and international levels have started increasing again because of a mismatch between demand and supply. In just one year, all of these references reached a multi-year high level: oil prices reached the highest level since 2008, and natural gas prices reached a record high level both in Europe and in the US. But you can see however how, with the war in 2022, the EU started paying a higher price for energy, especially for natural gas in Europe. Why? Of course because of the higher dependence of the EU on imports of Russian fossil fuels and mainly that country’s natural gas. As you can see in the last two years, while the natural gas benchmark for the US increased by around 170%, the benchmark price for natural gas in the EU (EU TTF in Amsterdam) increased by more than 2000%. So there is a complete misalignment between the European market and the US market, but also between the European market and all the markets of advanced economies.

But why is the energy crisis important, and why does it have a spillover factor on most agrifood commodities?

First of all because higher energy costs obviously result in increasing input costs for agrifood commodities. So higher energy costs also mean a higher cost for electricity, for fuels, but indirectly also for fertilizers, pesticides, packaging and so on and so forth. There is a direct effect on input costs of agrifood commodities, particularly on energy-intensive agrifood commodities.

Secondly, higher demand for energy also results in higher demand for agrifood commodities that can be used in the production of energy, for instance in the production of ethanol or biodiesel. Of course, cane sugar, beet sugar, but also cereals can indeed be used to produce ethanol in a context of a supply that is already tight. At the same time, when oil prices are high, there is a substitution effect over the use of that oil for the production of biodiesel, with an increasing demand for palm oil, soybean oil, or rapeseed oil, for instance.

Finally higher oil prices also result in higher transportation costs. These are relevant variables, given the fact that in most markets, producing and exporting areas are located at a distance from consuming and importing areas – think for instance about soft commodities like coffee, cocoa, sugar, etc.

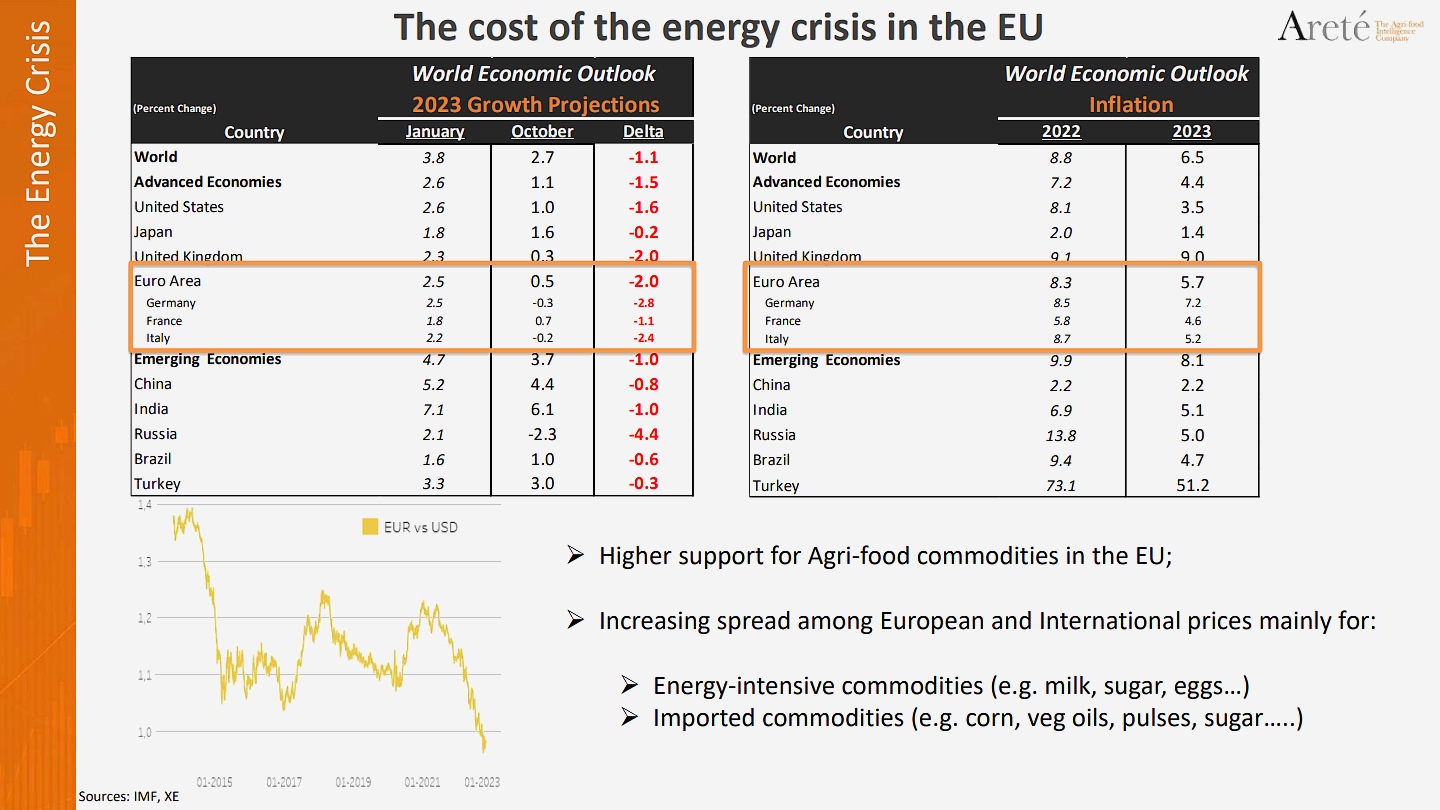

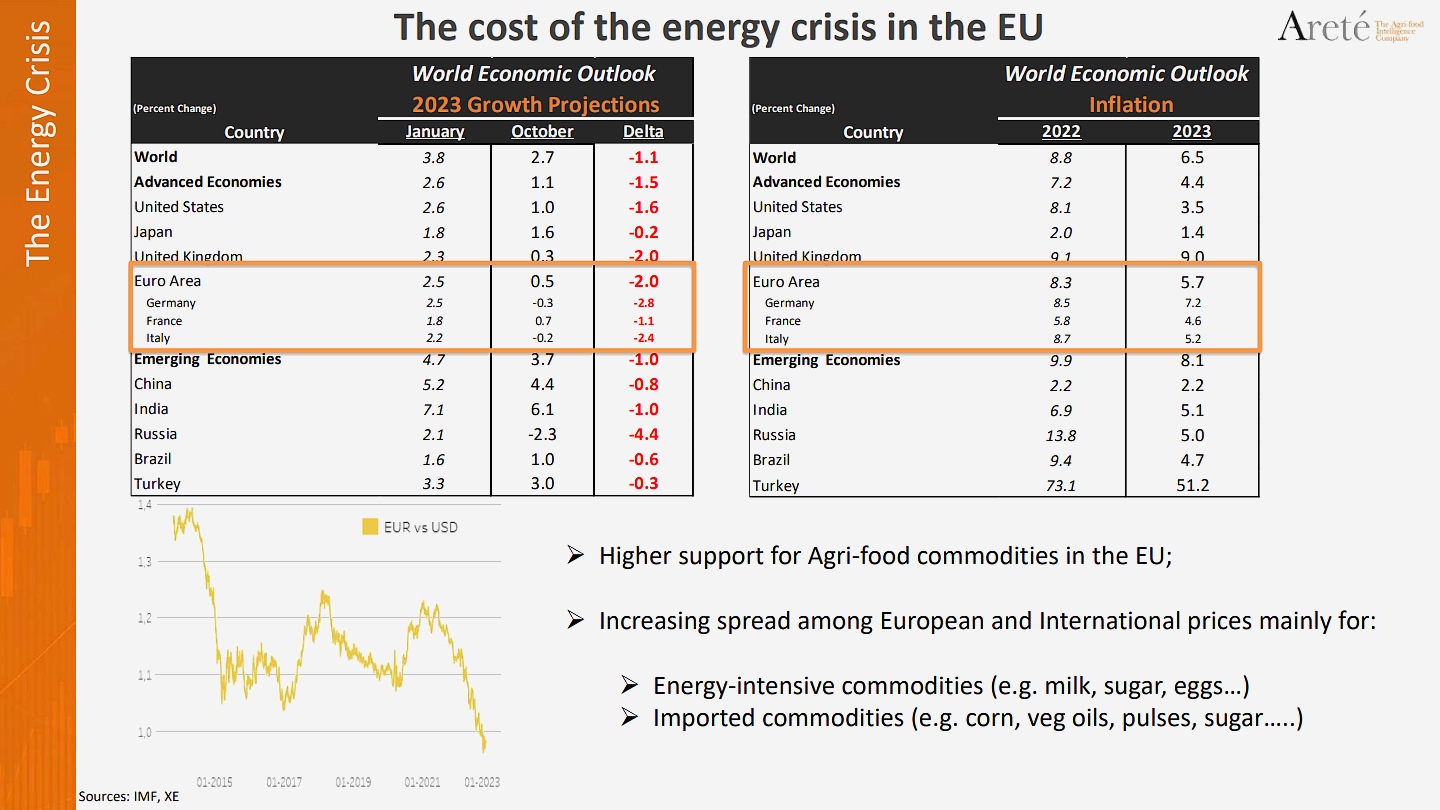

As I have already mentioned, with the war in Ukraine, the EU is basically paying a higher price for the energy crisis, both in terms of lower projection of the GDP but also in terms of higher inflation. Two weeks ago (in mid-October 2022), the International Monetary Fund (IMF) cut the GDP 2023 growth projection for the Euro area from 2.5% to 0.5%, which is one of its lowest historical levels and is below the average GDP projection for advanced economies (1.1%). Moreover, the IMF has forecast a recession for some key areas of the Euro zone, like Italy and Germany.

Consequently, as you can see here from the graph on inflation, the IMF is forecasting an inflation of 5.7% in the Euro zone, which is well above the inflation that is forecast for other advanced economies. And the higher impact of the energy crisis is also resulting somehow in a limitation of the European Central Bank’s restrictive monetary policy compared to the other Central Banks and compared to the Federal Reserve, aiming at reducing this inflation. This has also resulted in a lower purchasing rate for the EU currency. As you can see from the yellow line, in just one year, the Euro lost around 15% of its value against the US Dollar. This has clearly resulted in lower purchasing power for European operators on the international markets for agrifood commodities.

This is why the energy crisis, despite supporting prices at a global level, is now keeping prices up specially in the EU, and this is why we are in a framework of increasing European and international prices, especially for energy-intensive agrifood commodities like milk, sugar, and eggs, but also processed and imported commodities, because these also suffer from this disadvantage linked to the European currency.

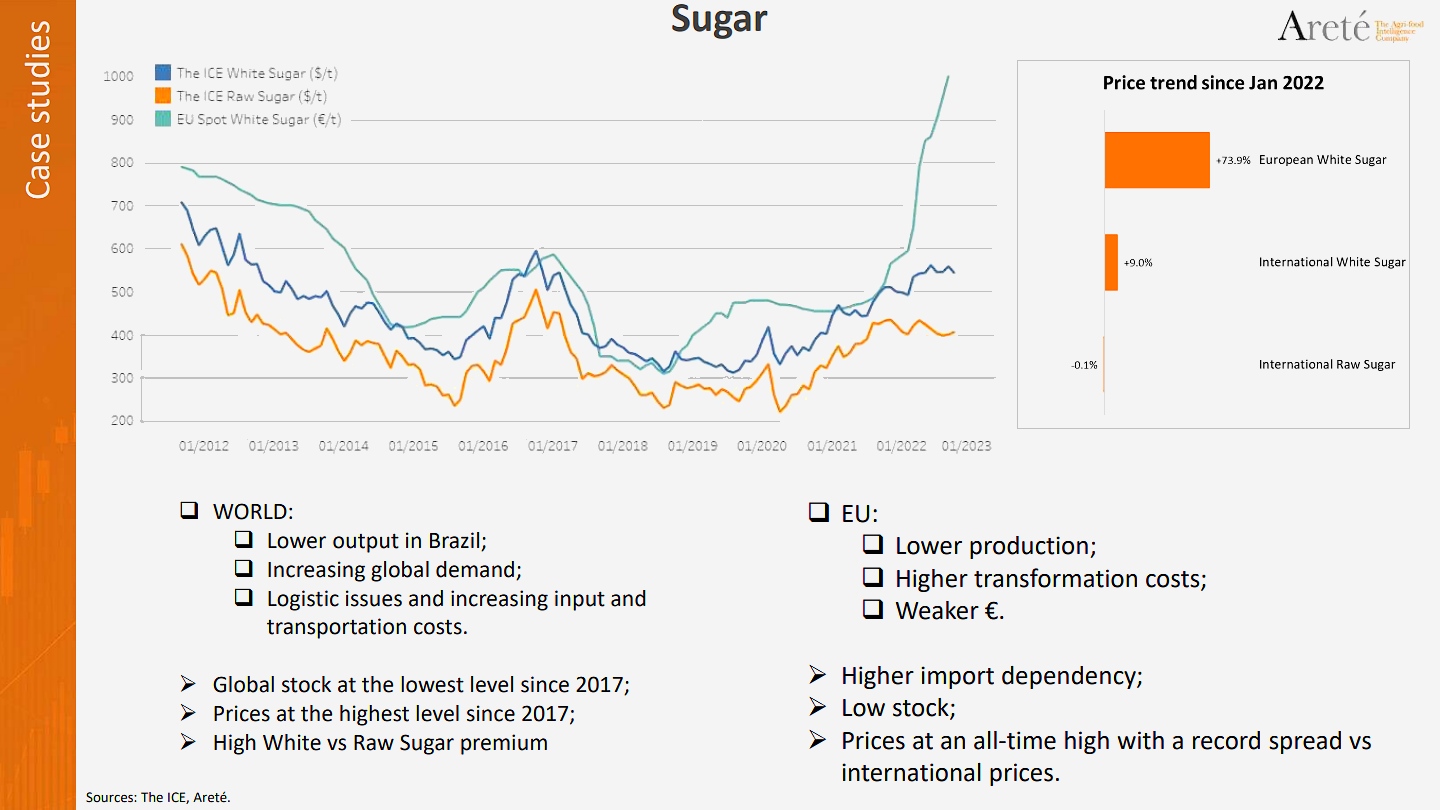

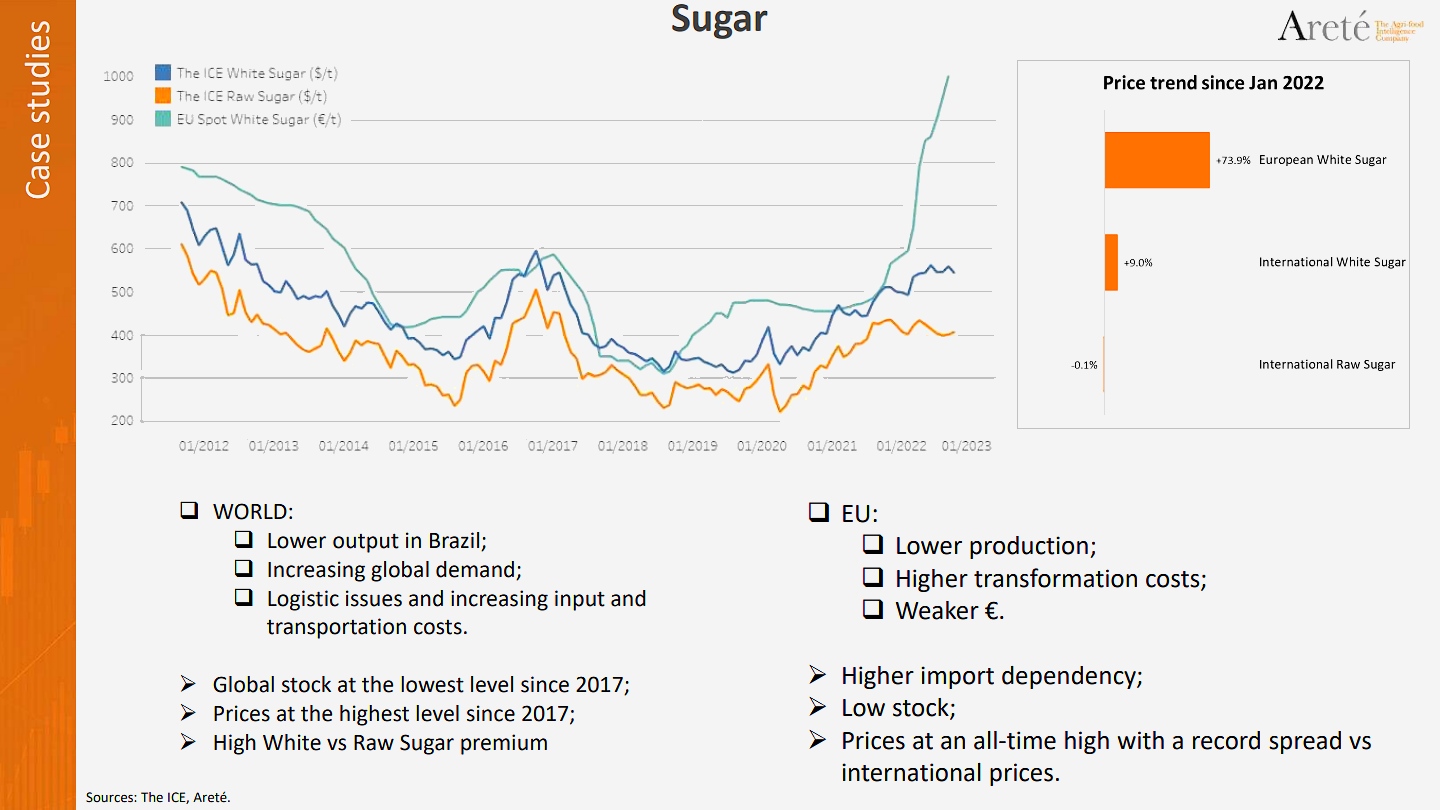

Let’s now move on to some case studies, starting with the sugar market. As you can see, this graph shows the sugar prices both at international and European levels. The orange line is the international benchmark for sugar, the blue line is the international benchmark for white sugar and finally the green line is a benchmark for the European white sugar spot-price. Starting with international prices, you can see again that because of a mismatch between demand and supply starting from the second half of 2020, prices have started increasing, reaching their highest level since 2017. This has been driven again by negative weather events in Brazil, but also by the energy crisis because of the lower incentive for Brazilian mills to produce sugar. Because of the energy crisis, they have a higher incentive to produce ethanol. So basically, in a market with a recovering demand, all of this has resulted in a global stock contraction – stocks reached their lowest level since 2017, while prices reached their highest levels since 2017.

As you can see, the energy crisis has also again resulted in a widening of the gap between the premiums for white sugar and those for raw sugar because of higher processing costs. But in 2022, you can see that while international prices stabilized, the European price increased. This increase reached an historical high level, with a record premium compared to international prices.

This is not only due to poor production in the European Union because of drought in Germany and France – the key producing areas – but is once again mainly due to the direct and indirect effects of the energy crisis. These include a weak Euro in a market where the EU is a net importer, and higher processing costs in a market that is protected by an import tax (which is quite high on white sugar) and in a market where EU refiners are strictly dependent on natural gas. So you can see how this graph is really close to the previous graph on natural gas. This is also why I said that 2022 inflation in the European agrifood sector started following a more regional pattern.

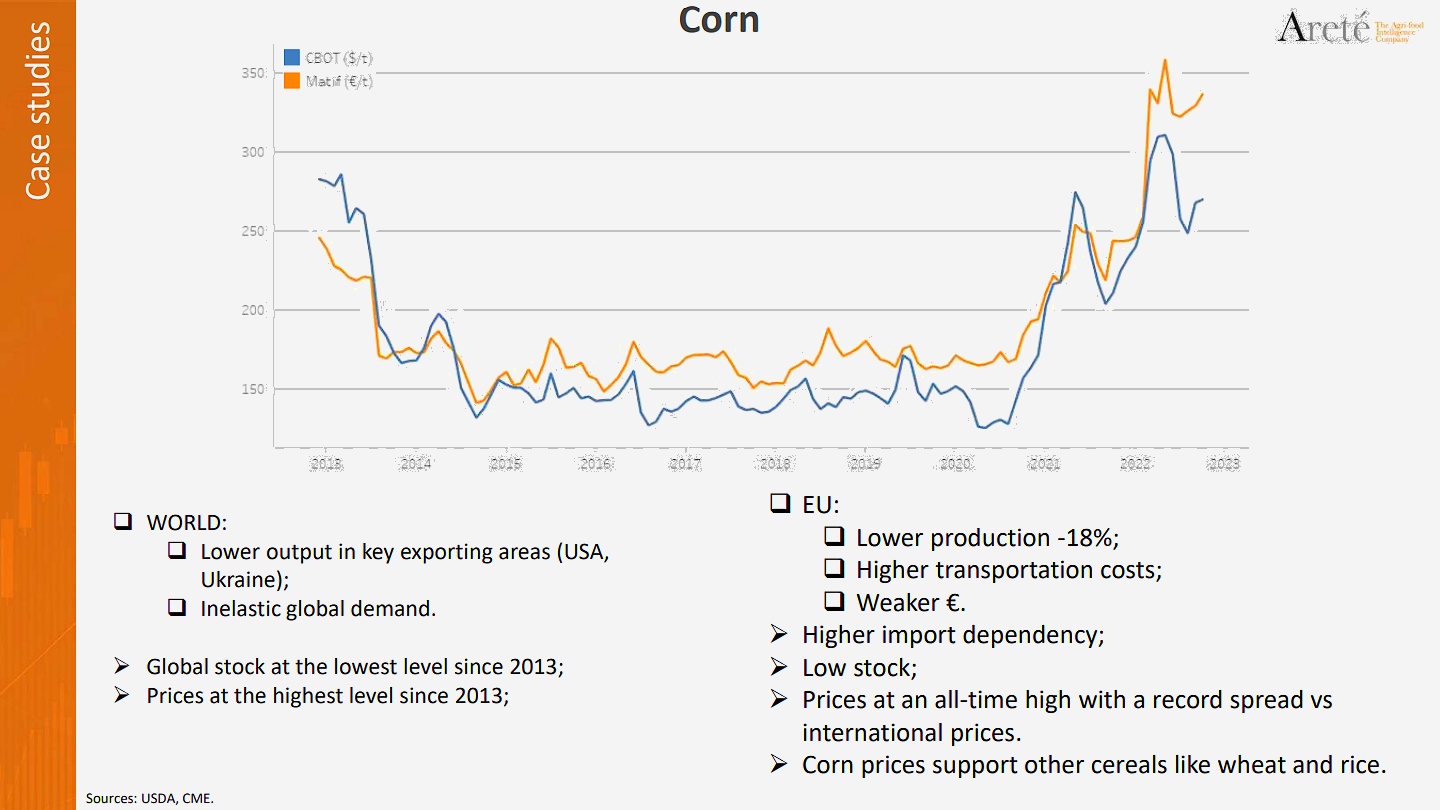

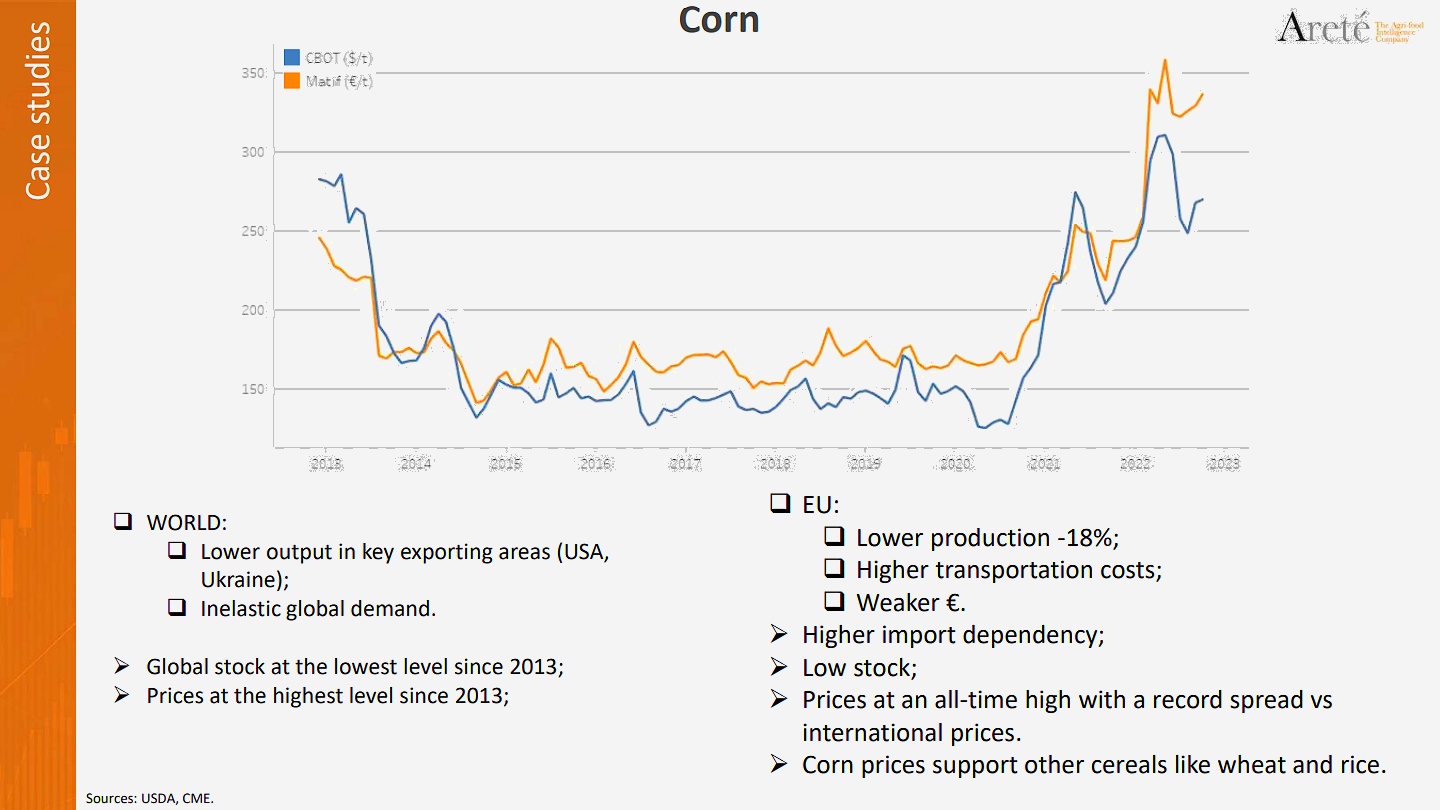

A market that followed similar dynamics to those of sugar is the corn market, another market where the EU is a net importer. Again, you can see that both international and European prices have tended to rise since 2020. But you can also see how in 2022, European prices have recorded an historically high premium compared to international prices, also because of the cost of the energy crisis, in terms of a weaker Euro, in terms of higher transportations costs, and also in terms of lower production because of the high incentive for the production of ethanol. Current corn prices in Europe are also providing support to other cereals, because of a substitution effect, like wheat prices, or rice prices. If you want to better understand the effects of the energy crisis, you can look at the cost of processing operations, for instance for flour.

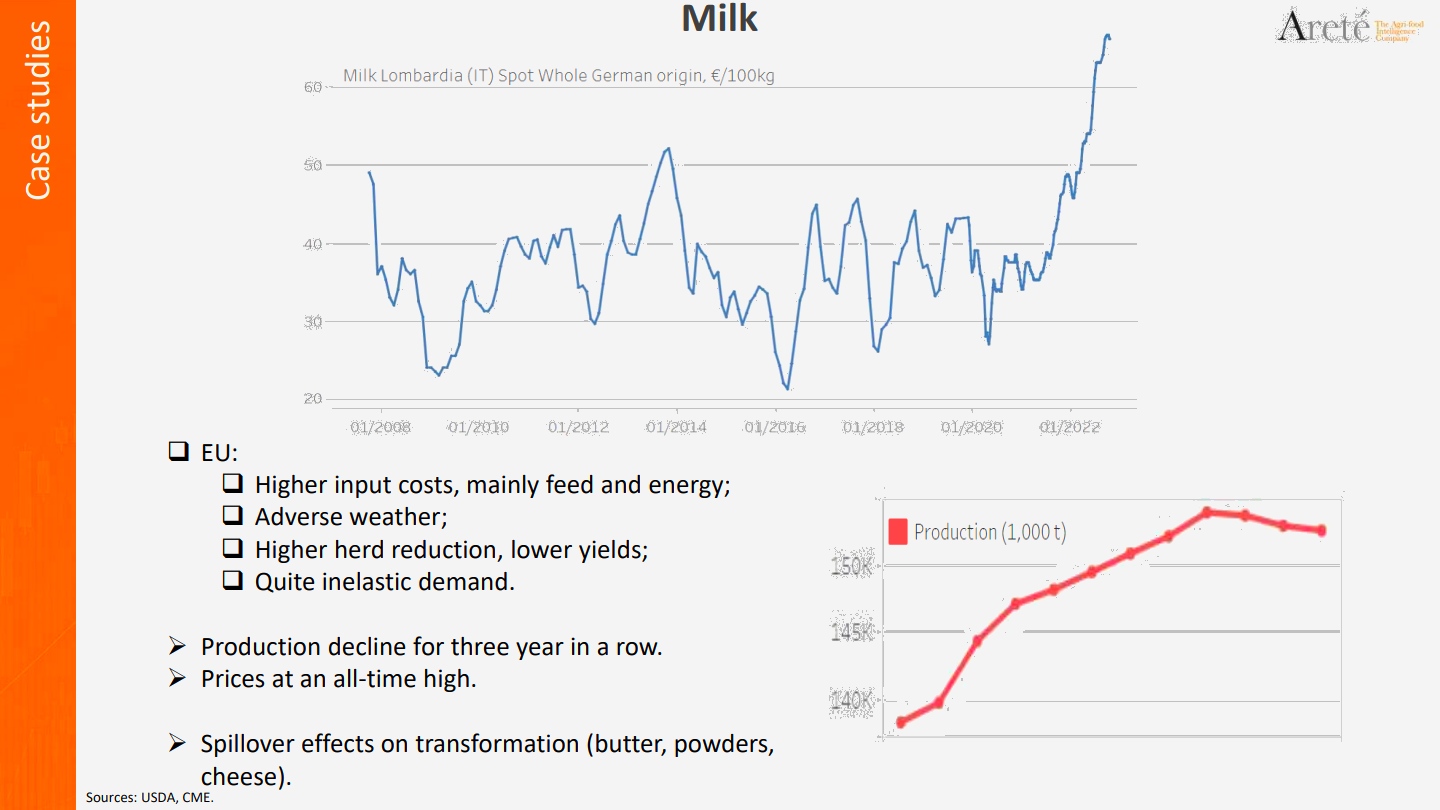

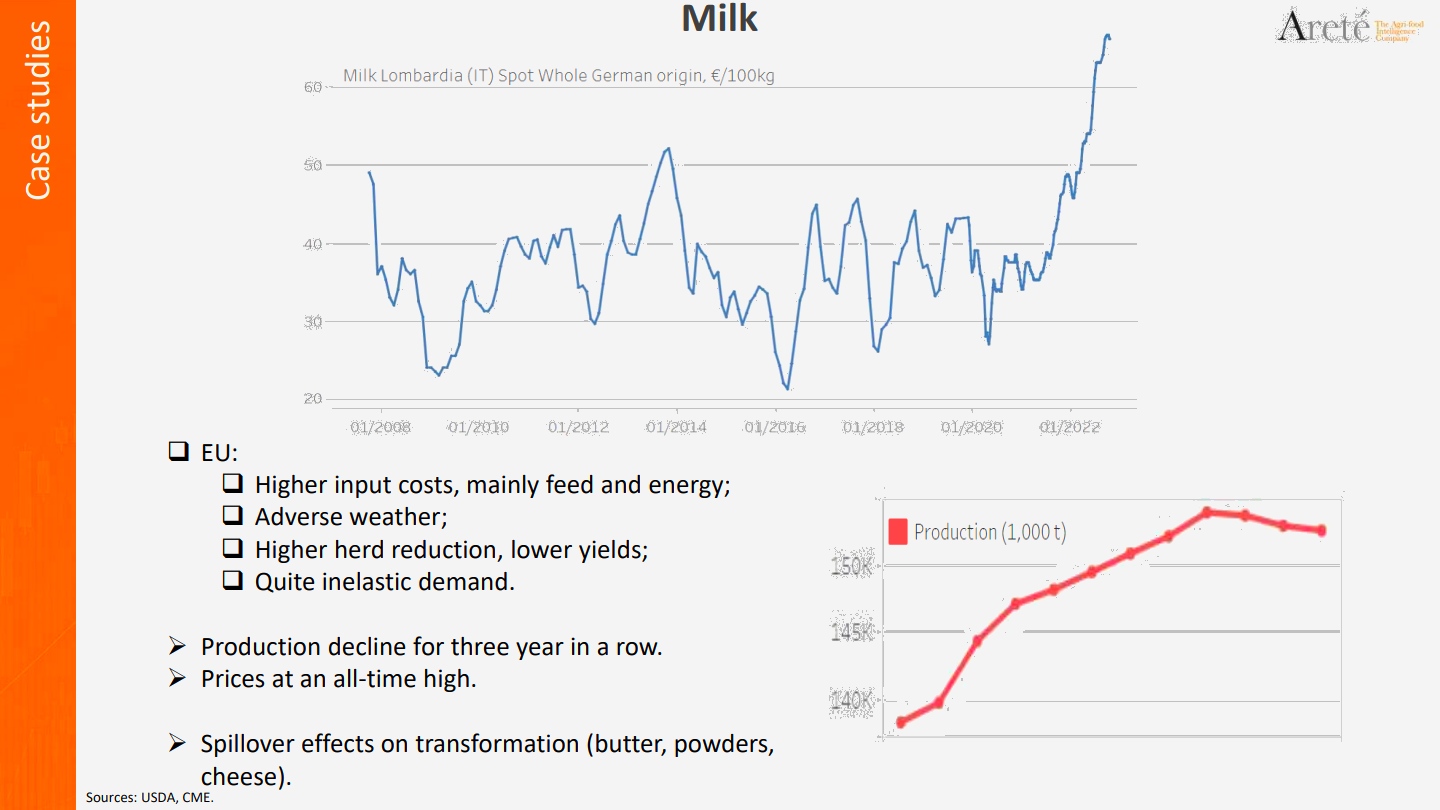

Looking now at a more specifically European market – the milk market, for which the European Union is basically self-sufficient – you can see that the effect of rising energy costs has mainly been an increase in input costs in a market that is one of the most energy intensive agrifood markets. So in a context of already high input costs because of feed, higher input costs resulted in a higher rate of slaughter, lower yields and consequently lower milk production – again in a context of a quite inelastic demand. As you can see from the red graph line, the European Commission, the EU, is basically forecasting for 2023 a production decline for the third year in a row, which has never happened before, and in a market that historically is following a fairly rapid increasing pattern in terms of production.

And of course the spillover effect has been worse for milk-based processed products like butter, powdered-milk or cheese, which have even higher processing costs. At times, these issues resulted not only in higher prices but also in availability problems, with difficulties in finding the products, independently of prices, both in terms of quantity and quality.

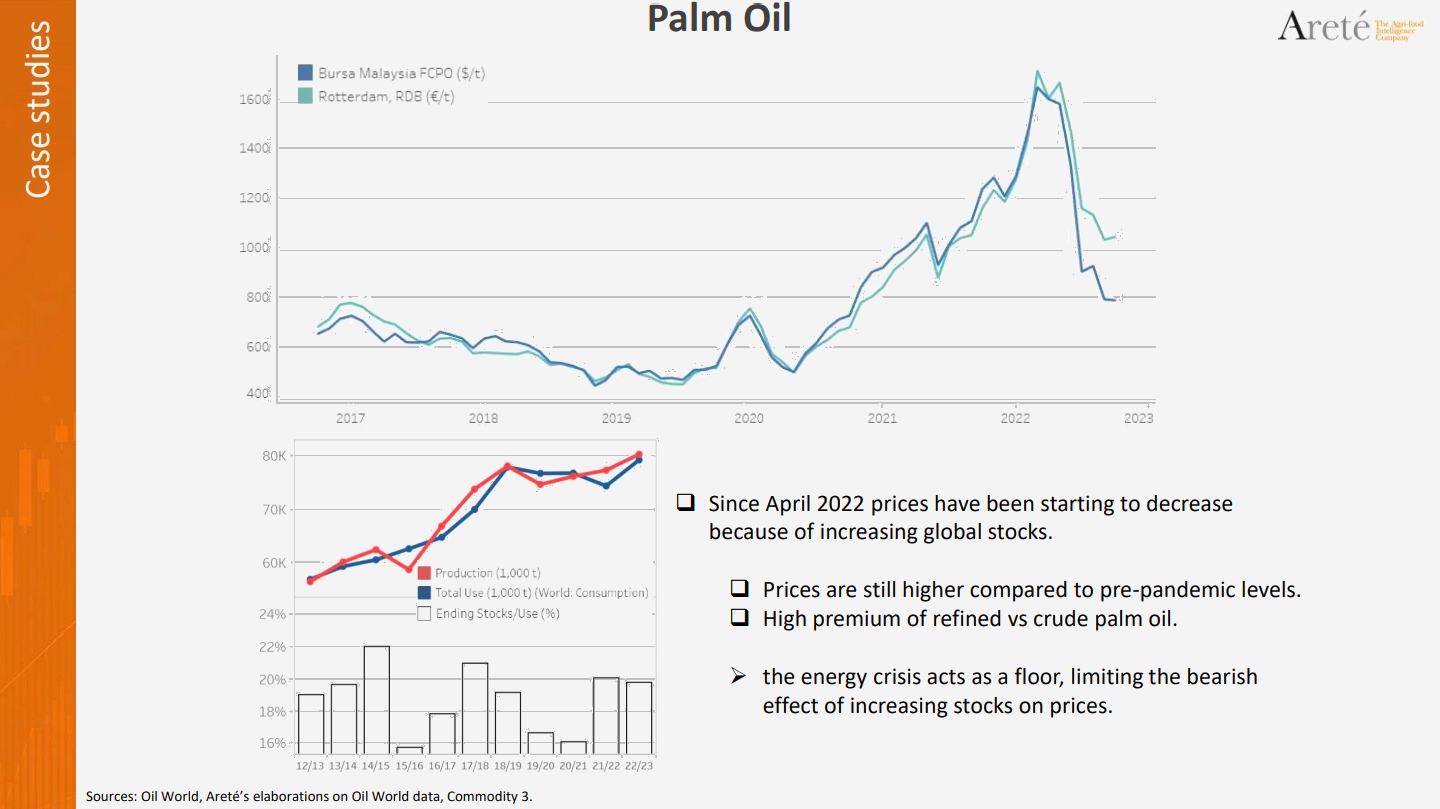

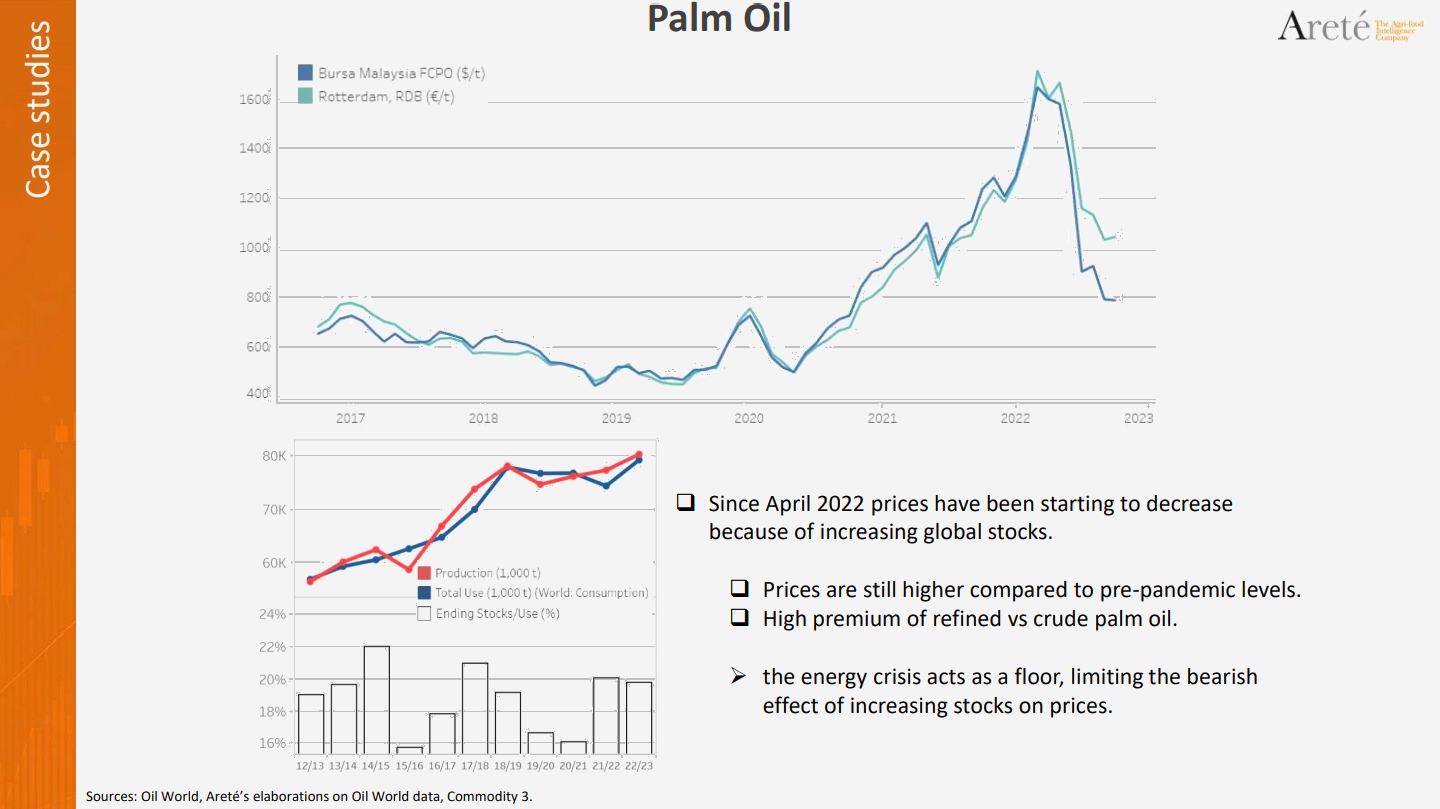

I want to finish by looking at the palm-oil market, which in 2022 is following a downward pattern in terms of prices because of increasing stocks in many producing areas and renewed production in Indonesia and in Malaysia. However, you can see the effects of the energy crisis on this market also. Basically, despite global stocks being at the same level as in 2017-2018 – as you can see in the histogram –, post-pandemic price levels, despite their decrease, are still well above pre-pandemic levels. There has been a structural change in the market, and this is the effect of the support given by energy prices, with oil prices that are above pre-pandemic levels. And again there is a wide gap between refined oil and crude oil due to processing operations.

In conclusion, since mid-2020, most agrifood commodity prices have started increasing, and reached an all-time record level.

The energy crisis was and still is one of the many factors that are providing support to global agrifood commodity price increases.

In 2022, with the war in Ukraine, this inflation in the agrifood sector started affecting with a higher intensity the European Union especially, resulting in support for the price-rise in agrifood commodities in the EU and also increasing the difference between European and international prices.

In the short- and medium-term, given the geopolitical context, with the development of the war, but also given the fact that we are close to winter and so the demand for energy will increase, the most likely scenario is one of continued fluidity, meaning persistent price volatility and, as already mentioned, in some cases availability issues, both in terms of quantity and quality.

Of course, in the medium- and long-term, the resilience of the agrifood sector will be crucial for easing prices. However, it is clear that global stocks and European stocks are too low to quickly bring prices to levels that are similar to pre-pandemic ones, as I showed you in the case of the palm-oil market."

Filippo Roda's presentation video:

You can access all the other presentations and slides from the 2022 Tomato News Conference held in Parma on 25 October 2022 by clicking here.

Source: Tomato News

“The aim of my presentation is to show you the impact of rising energy costs on major agrifood commodities, but also to show you how the energy crisis is increasingly impacting the European Union.

“The aim of my presentation is to show you the impact of rising energy costs on major agrifood commodities, but also to show you how the energy crisis is increasingly impacting the European Union.