Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

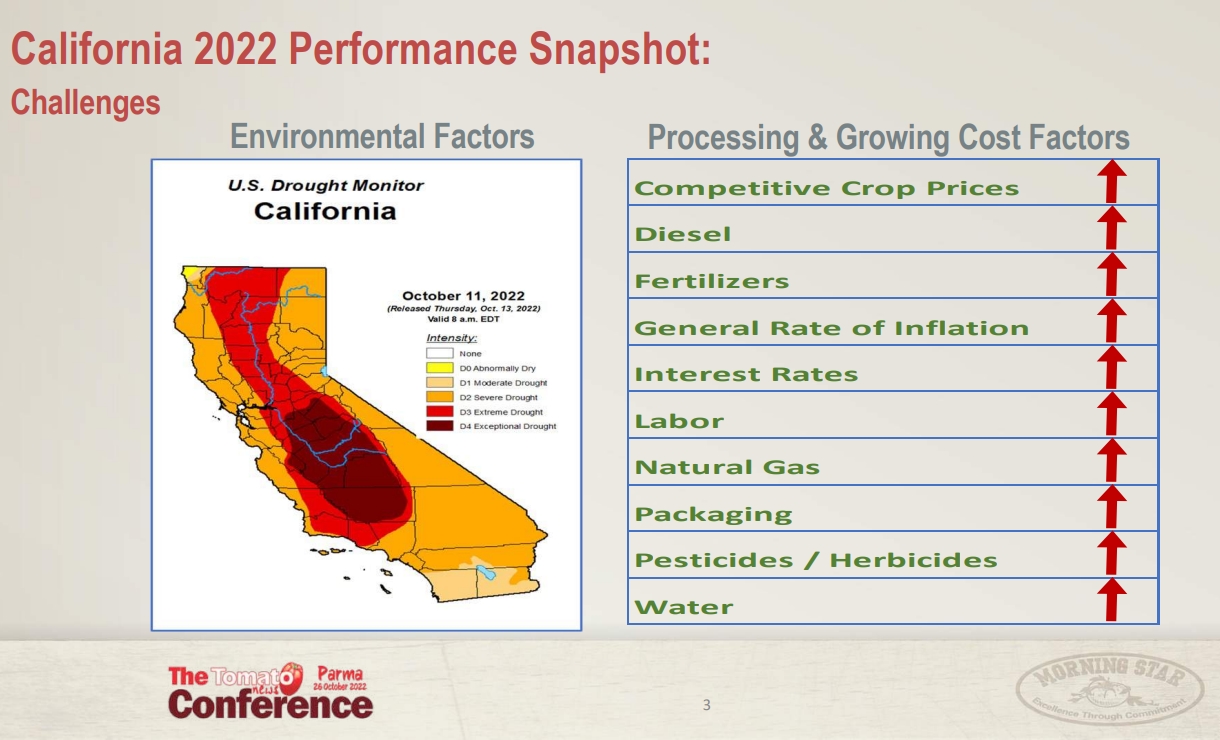

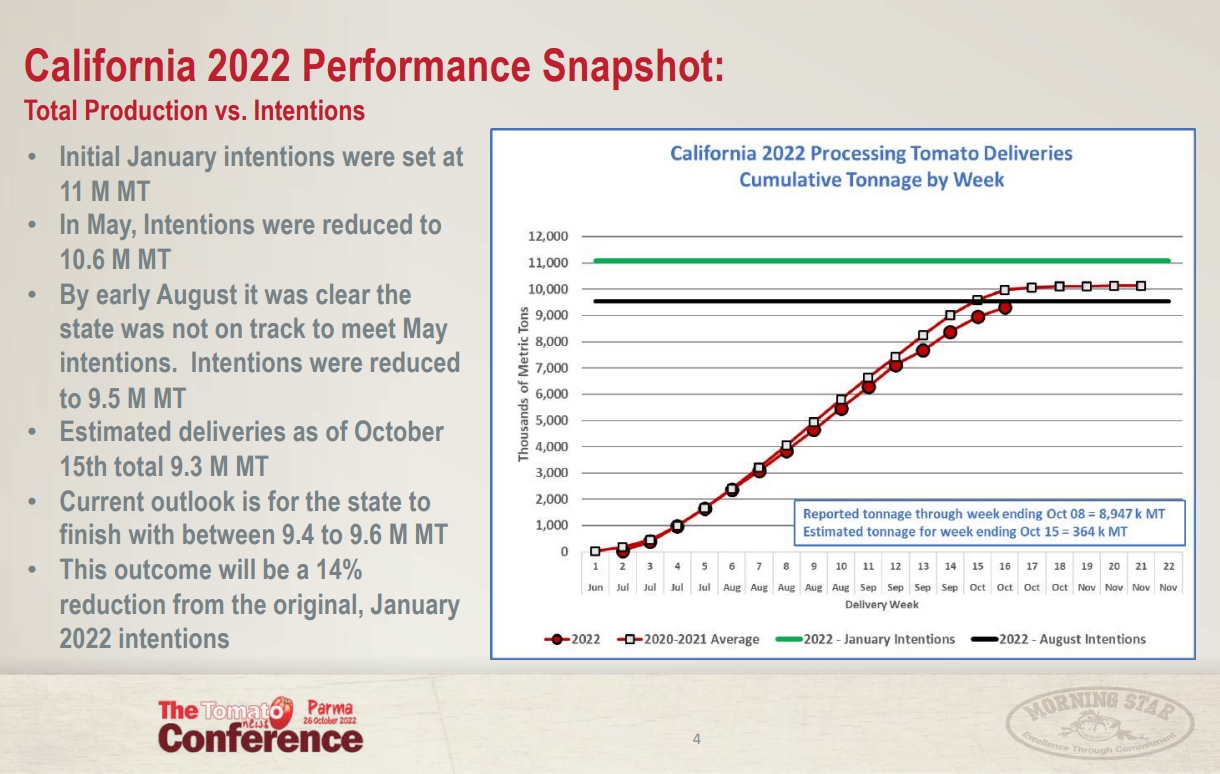

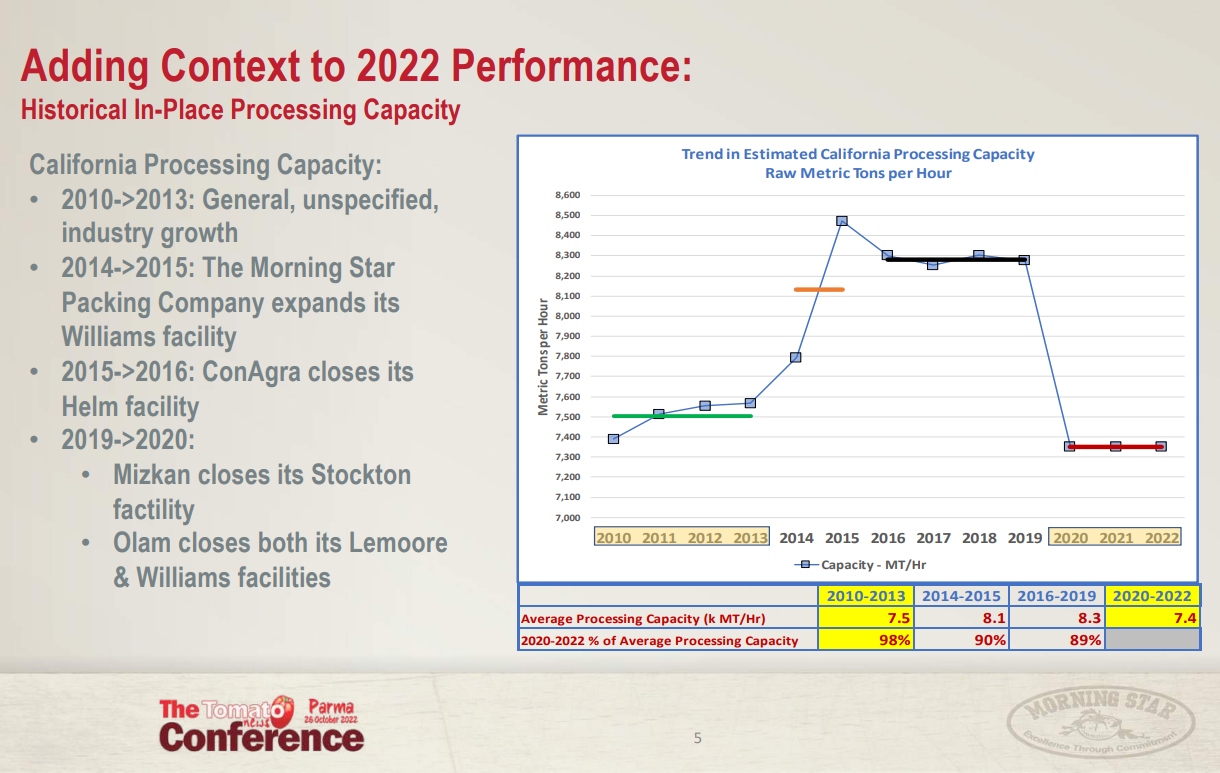

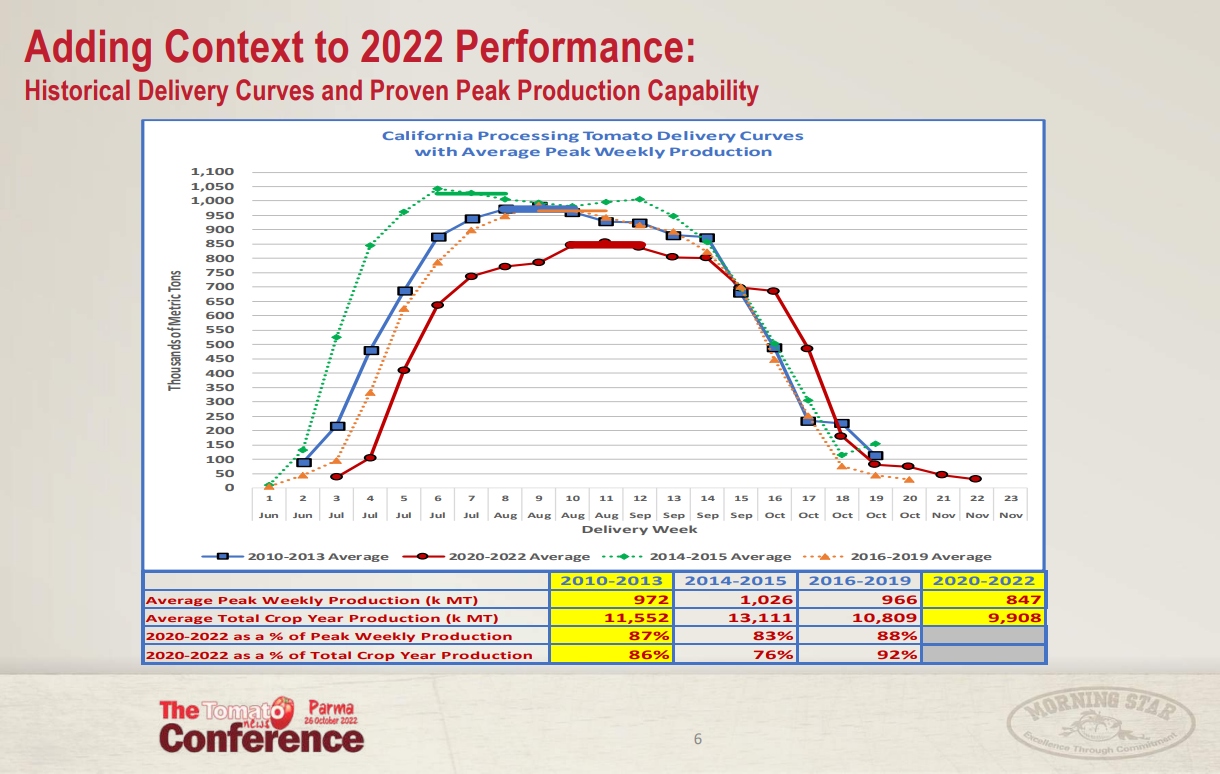

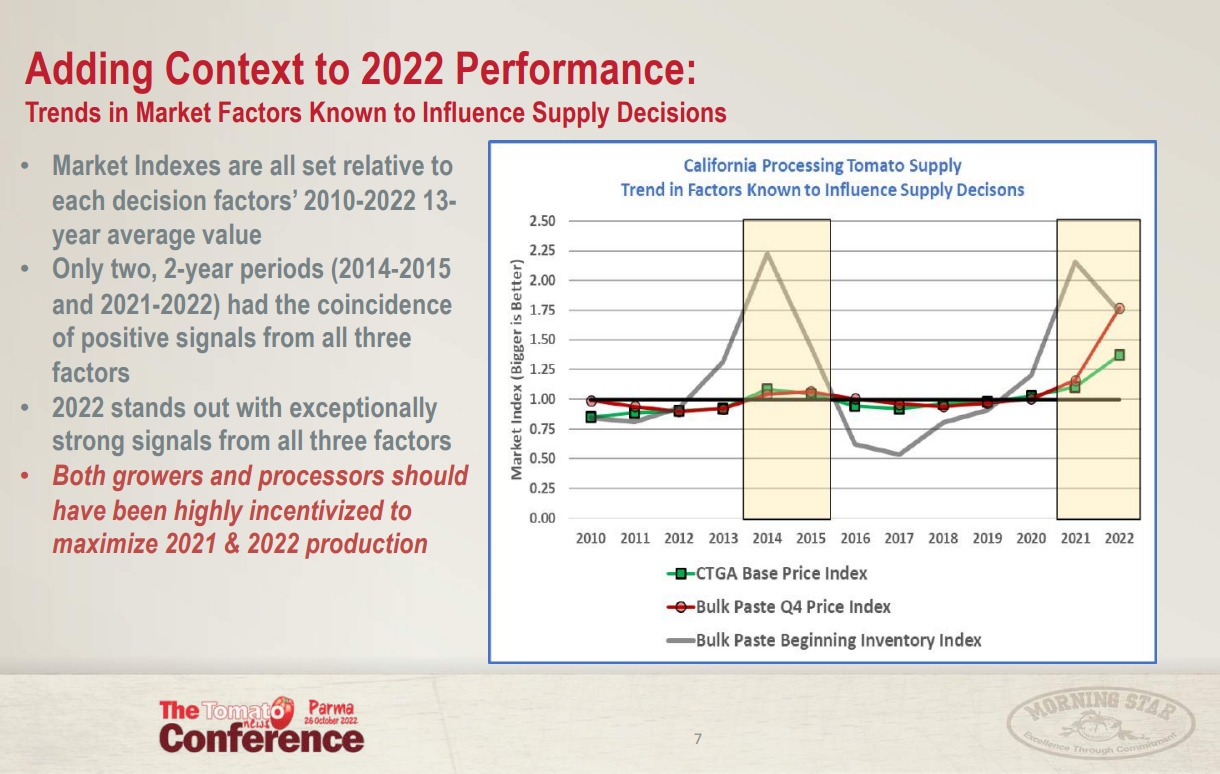

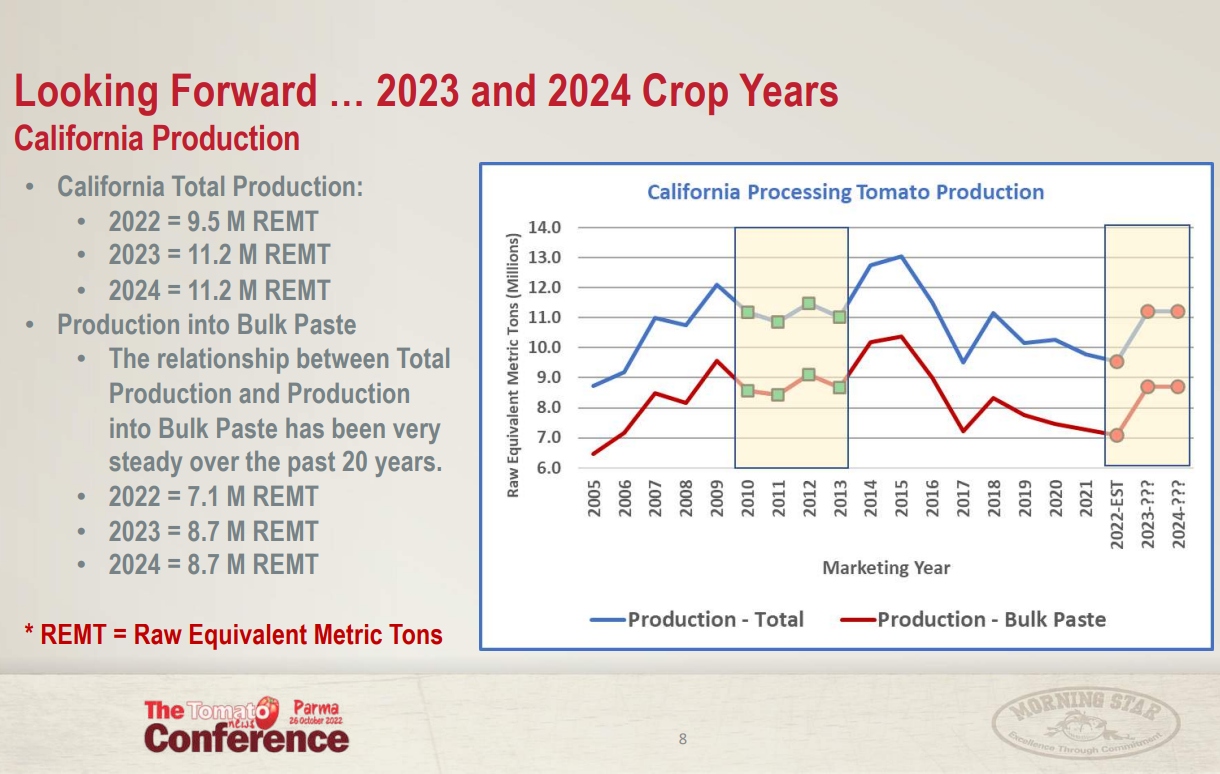

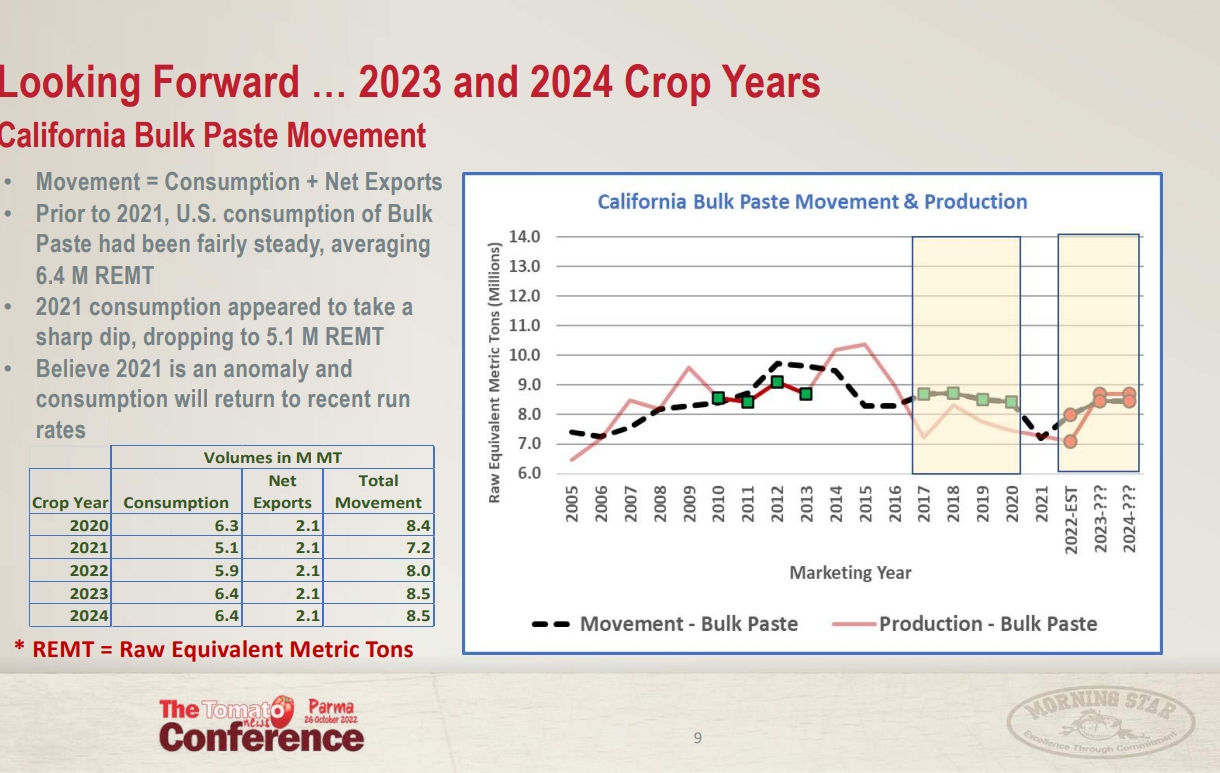

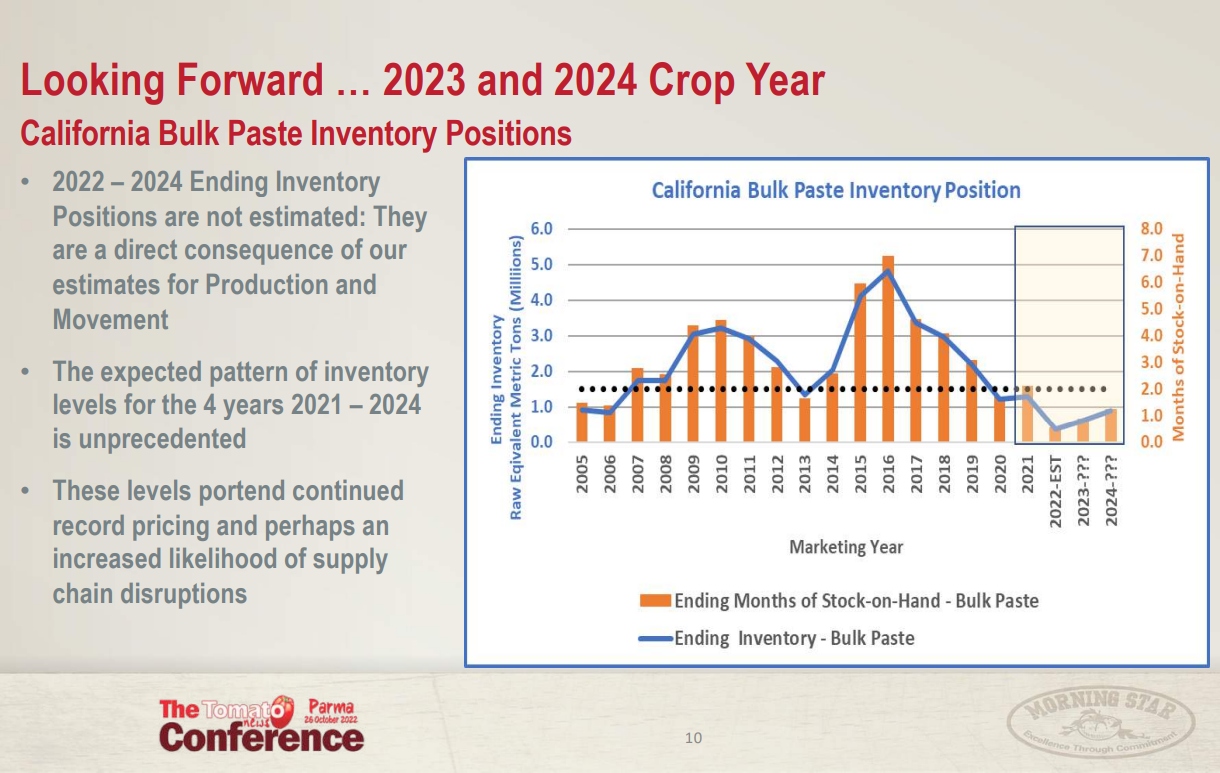

“I am here to provide an update on the 2022 processing tomato season in California, and also to talk about how the results for 2022 are likely to play forward into the expectations for the 2023 and 2024 crop years.

“I am here to provide an update on the 2022 processing tomato season in California, and also to talk about how the results for 2022 are likely to play forward into the expectations for the 2023 and 2024 crop years.