Price quotations for tomato products for the 2023 season have risen for the 6th time in a row, by between 7% and 15% year-on-year. Buoyed by the recent crises in the fields of health, economics and geopolitics, as well as by internal cyclical tensions, these dynamics could be affected by the 2023 season results, which are generally satisfactory in terms of quantities.

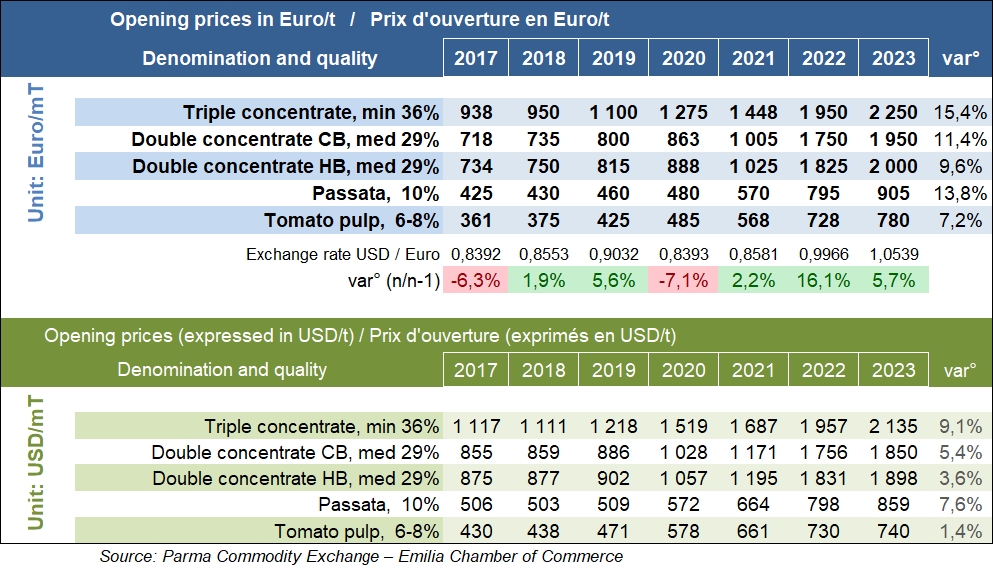

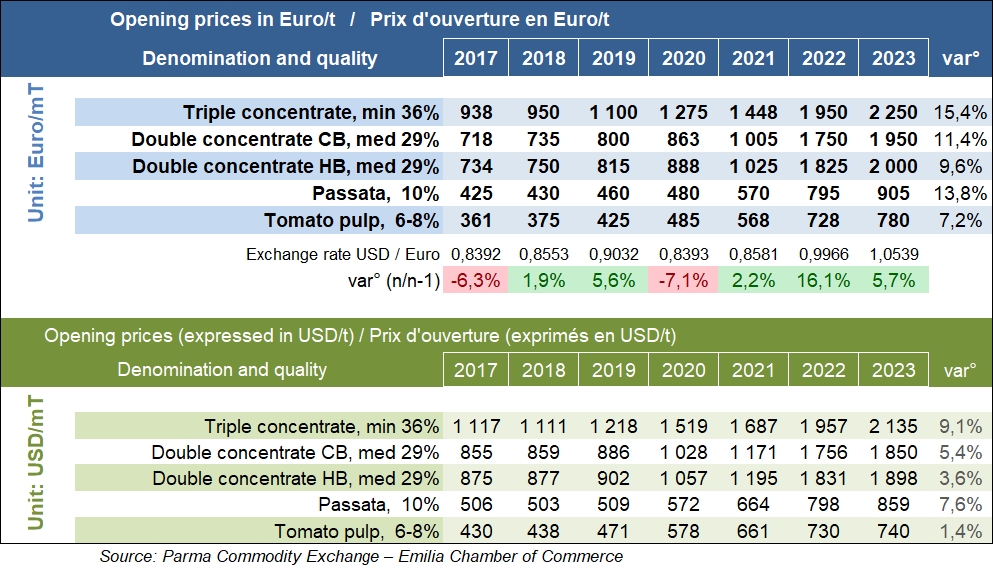

Mid-October, the Parma Commercial Exchange Authority of the Emilia Region Chamber of Commerce published the opening prices for Italian tomato products for the 2023/2024 marketing year. All product categories showed significant year-on-year increases in Euro quotations, ranging from 7% for pulp to 15% for triple-concentrated paste.

According to the Emilia Region Chamber of Commerce, tomato pastes at concentrations above 36% are trading this year from a base price of EUR 2,250 per metric tonne (t), double-concentrated CB and HB paste between EUR 1,950 and 2,000 per tonne, passata at around EUR 905 and pulp at EUR 780. The overall annual variation puts opening prices for 2023 in Euros at around 12% above those for 2022 (see additional information at the end of this article), an increase slightly cushioned for values expressed in US dollars by the annual evolution of the EUR/USD exchange rate (+5.7%).

This increase in quoted prices for new 2023 products follows a series of five consecutive price rises since 2018. Although less significant than the spectacular increase that marked 2022 opening prices, this testifies to continued tensions throughout the agro-industrial sector, and takes 2023 prices to levels unlike any recorded pre-Covid. For pulped tomato, the category that has seen the slowest growth since the 2017-2019 period, 2023 quotations in Euro have more than doubled (+102%). Passata has recorded similar growth (+106%), albeit considerably less than that recorded for triple-concentrated pastes (+126%). The biggest increases are for CB and HB double-concentrated pastes, whose 2023 prices are 160% higher than their pre-Covid levels.

Some of the factors that have gradually defined the market situation as we know it at the end of the 2023 processing season are likely to evolve in the direction of an easing of the tensions observed over the last three or four years in our sector, particularly with regard to the costs of agricultural production and industrial processing and, perhaps, in terms of the quantities produced and the extent to which they match local and global demand.

The cyclical nature of our business and markets is now well documented, as are the agro-industrial and economic dynamics and constraints that both drive and limit them. In 2023, the industry at a global level demonstrated its ability to adapt to a new normal in terms of climate, politics and, above all, economics. The coming year and the 2024 season will provide an opportunity to bring stability to a tomato industry that has been in a bad way since the start of 2020. In the words of Martin Stilwell at the beginning of the Tomato News Yearbook 2023, "estimates suggest that this crop will bring the market into balance after the severe shortages of the last two years, allowing inventories to cover demand.”

Some complementary data

Evolution of Italian opening prices for tomato products in Euros per tonne, by category over the last twenty years.

Estimate of the value added in Euros according to the soluble solids content of the various product categories in recent years.

Details of the opening quotations for tomato products from the Parma Commercial Exchange Authority of the Emilia CC, October 13, 2023.

Source: prezzi.emilia.camcom.it