2021 quotations are up 13 to 19%

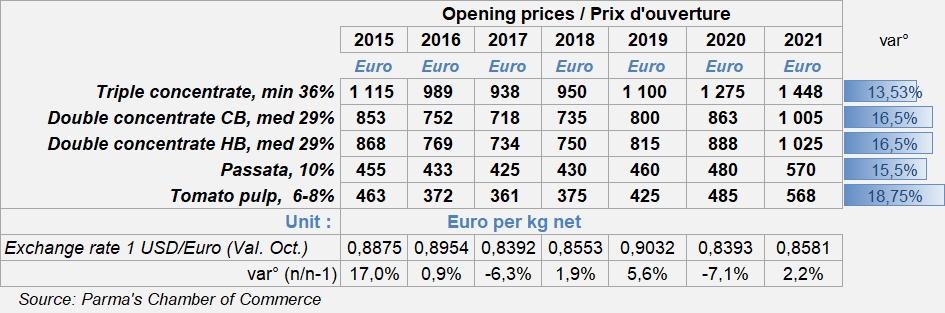

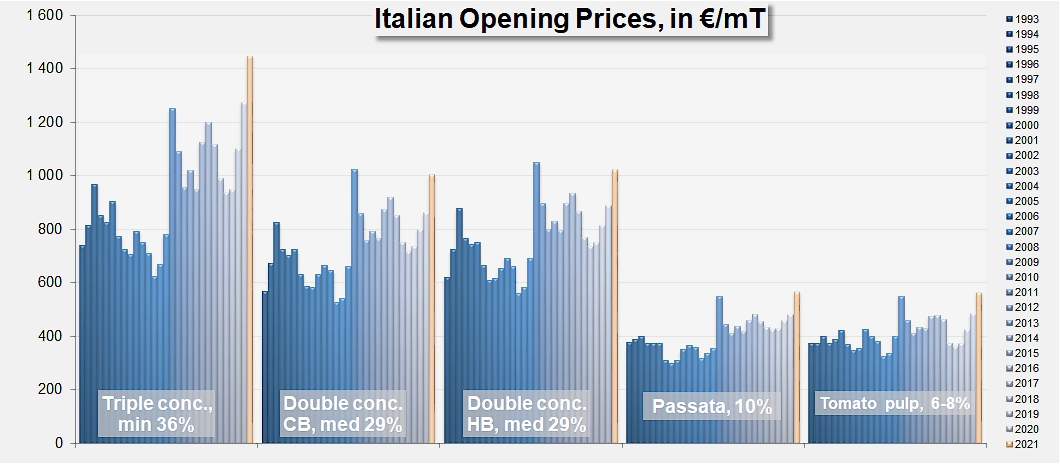

On 8 October, the Parma Chamber of Commerce published its opening prices for tomato products from the 2021 processing season. Italy's latest prices in EUR for the 2021/2022 marketing year have recorded increases that range from more than 13.5% (for triple-concentrated paste) to close on 19% (for pulped tomato).

See all of the quotations from the Parma chamber of commerce in the appendices at the end of this article.

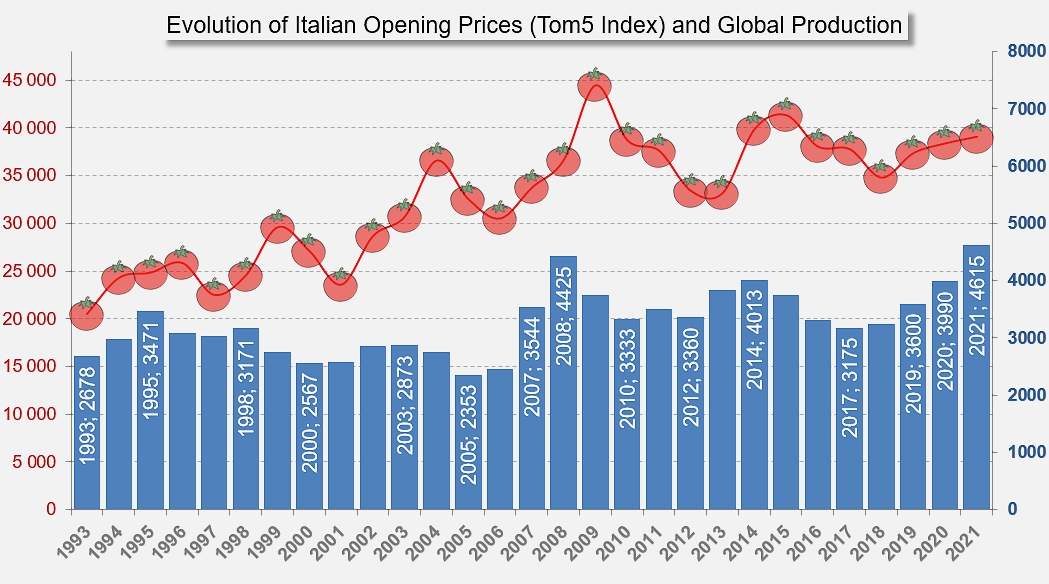

This fourth consecutive increase is all the more remarkable for the fact that it occurs in the context of good production results, at least in the main leading European countries, as recently underlined by comments from various representatives of the Italian industry, and by the harvest reports regularly published by the WPTC (see links at the end of this article).

This situation is similar to the one recorded in October 2020, with an overall increase that once again confirms this year the persistence of a tense situation affecting worldwide supply, whereas provisional results for the 2021 harvest at a global level, of approximately 39 million metric tonnes (slightly down on initial processing intentions (39.5 million mT)), turn out to be barely sufficient to satisfy current requirements in terms of consumption and replenishing stocks.

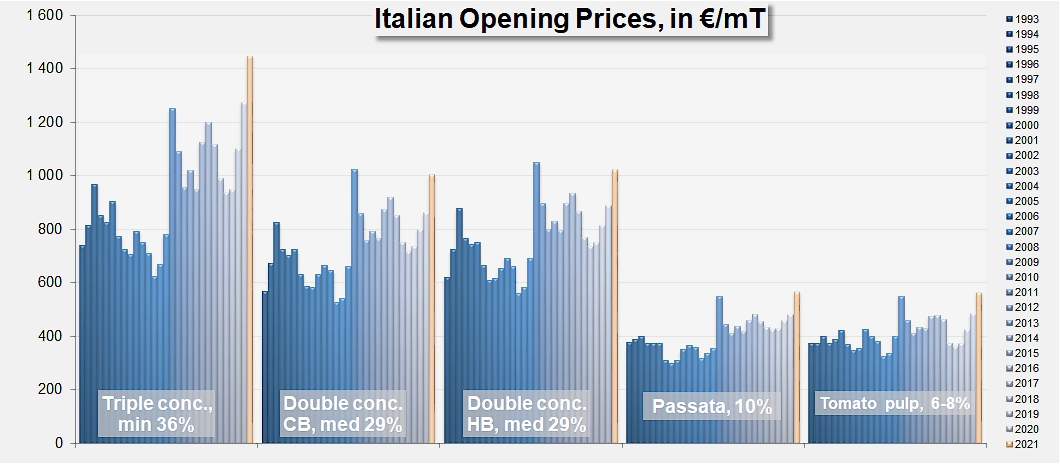

Quotations recorded in October 2021 indicate a sharp acceleration compared to the consolidations already observed at the end of the last three marketing years, amounting to levels that are similar or above the opening prices published in September 2008, which are reported to be among the highest of the past 28 years. So the price levels of Italian CB double-concentrated paste (as an example) have been stated at the beginning of the 2021/2022 marketing year at more than EUR 1005 /metric tonne, which is 16% higher than the opening quotation of October 2020 and close on 26% higher than the average of the three previous "opening prices".

This may be good news in and of itself, but Italian opening prices must absolutely be considered in the complex, unstable, and uncertain context that has affected the 2021 season as a whole, from the programming stage to the last revolutions of the harvesting machine wheels. Without going into detail regarding the many difficulties that have affected the 2021 harvest in a number of places, it is impossible to overlook the profound economic and social disruptions linked to the Covid pandemic, with weather conditions that have sometimes impacted the contract-signing stages as well as processing programs, as well as an acceleration of the costs of products and services that has hit all forms of expenditure, from the agricultural upstream right down to the industrial and distribution downstream stages.

In fact, even from the point of view of a generalized increase in the price of food products that has already been widely announced for the beginning of 2022 (see linked articles), it is still unclear to what extent it will be possible to sustainably pass on all or part of the increase in the price of industrially processed tomato products to large chain retailers, who remain reluctant to increase the economic pressure on end-consumers. In other words, the spectacular progression of prices recorded at the beginning of October this year will not necessarily generate an increase as remarkable for the profitability of the business, both for industrial operators and for tomato growers.

Some additional information

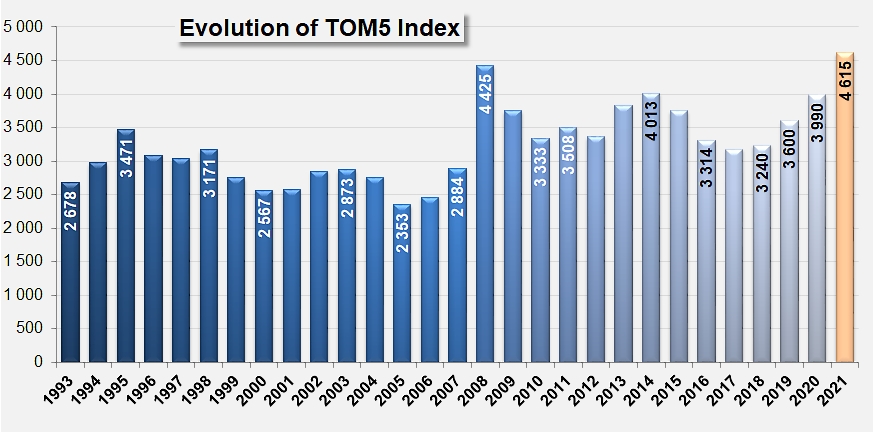

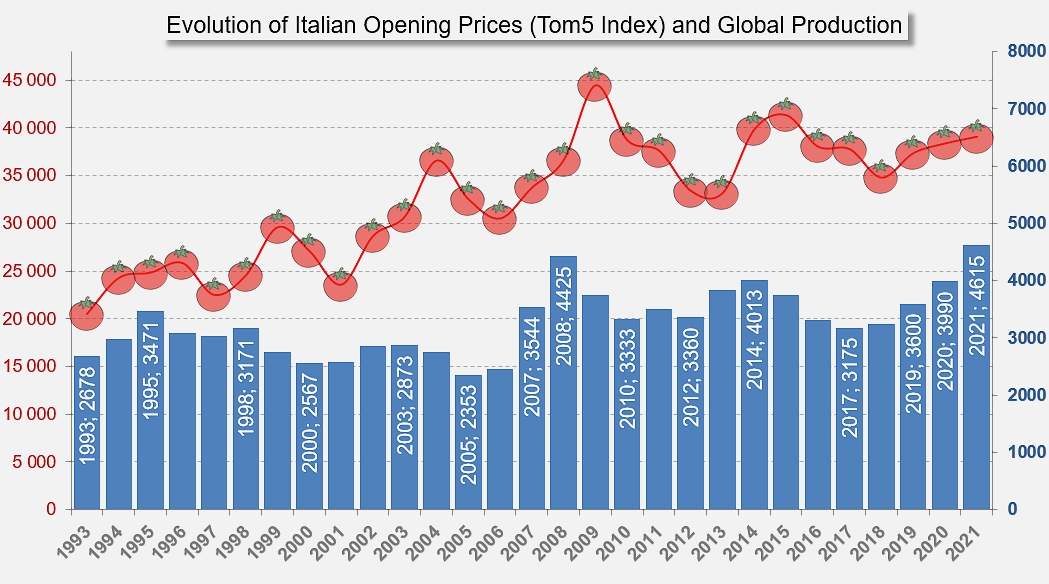

Evolution of the index composed of accumulated prices (per metric tonne) of the five main industrially processed tomato products (triple-concentrated paste, HB and CB double-concentrated paste, passata and pulped tomato).

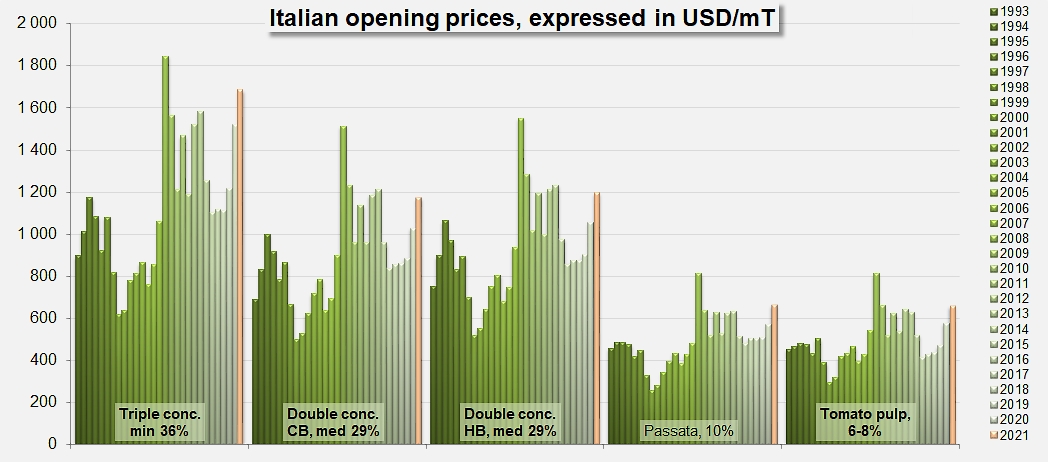

Evolution of Italian opening prices expressed in US dollars.

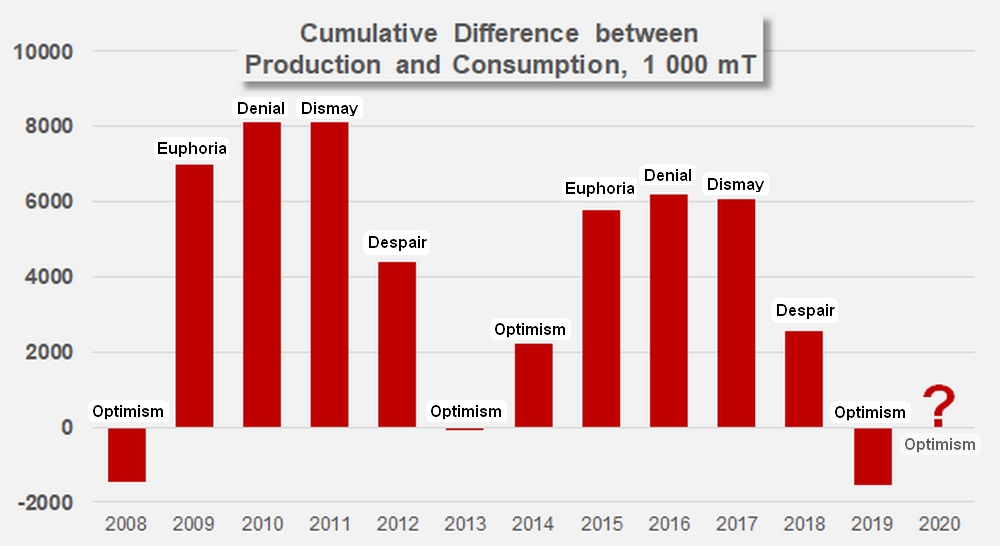

Martin Stilwell's production/consumption balance cycle.

Inspired by the presentation given by Martin Stilwell at the Tomato News conference in Avignon in May 2019.