For the most popular products on the world market, the latest quotations show increases close to 75% over one year. But the problem is more often availability than price.

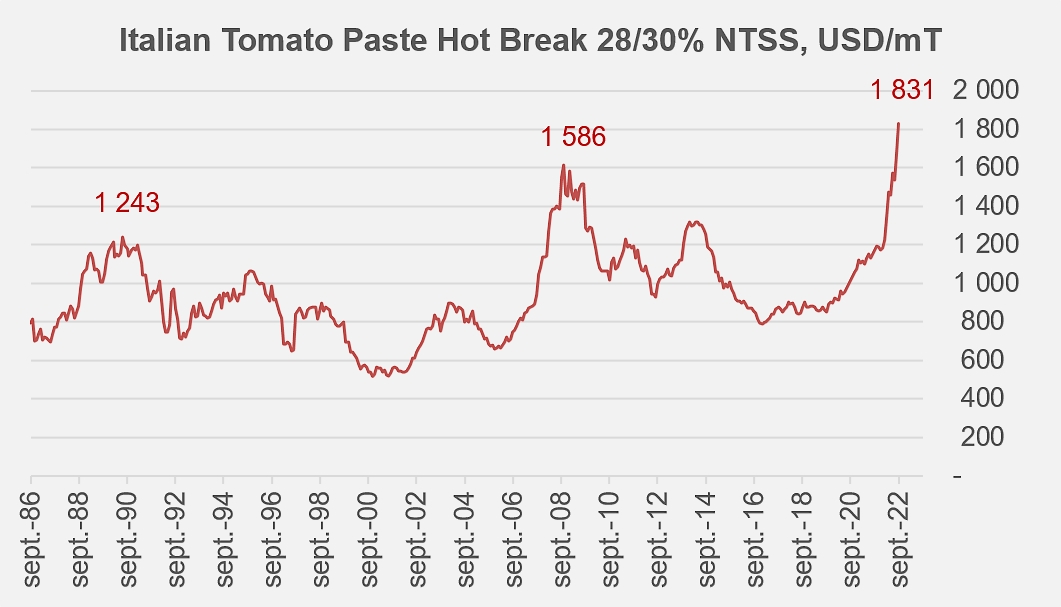

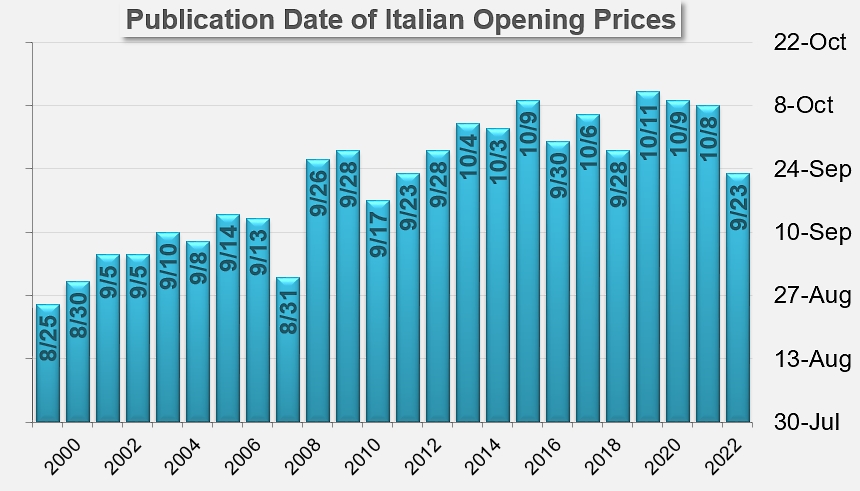

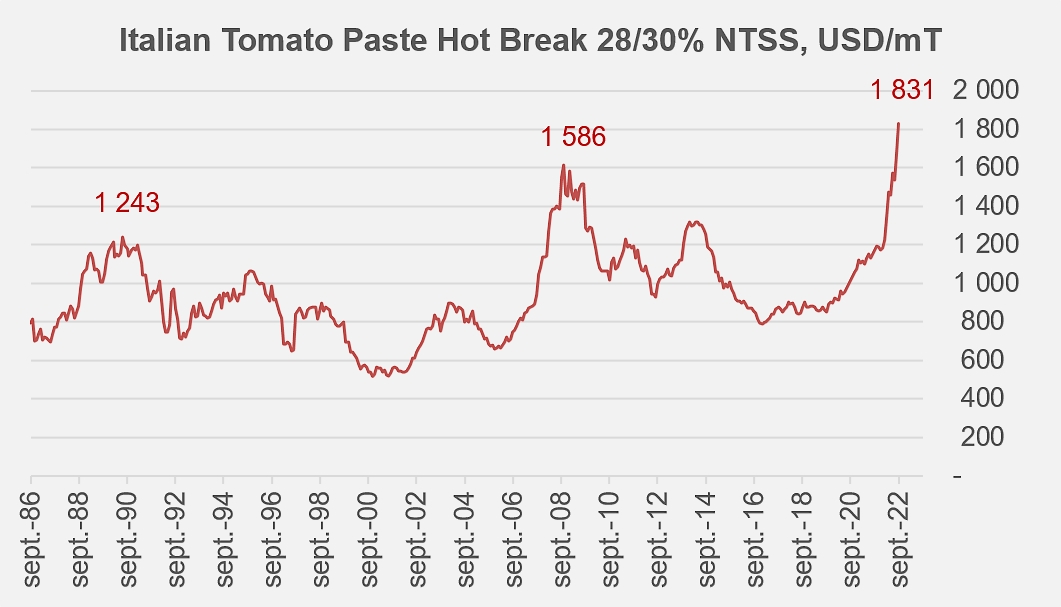

Italian opening prices, determined for the products of the last processing campaign, were published on September 23 by the Chamber of Commerce of Parma, much earlier than any time in the last ten years. And while available products are becoming increasingly difficult to find, the new 2022 quotes are at levels never before seen in our industry's history. The last two record levels for these values date back to July 1990 for the oldest one (1,243 USD/metric tonne of Hot Break 28/30 paste) (see also our additional information at the end of this article) and to January 2009 (1,586 USD/mT, same product) for the most recent one, established a few months before a plethoric campaign which was to destabilize the world industry for several years.

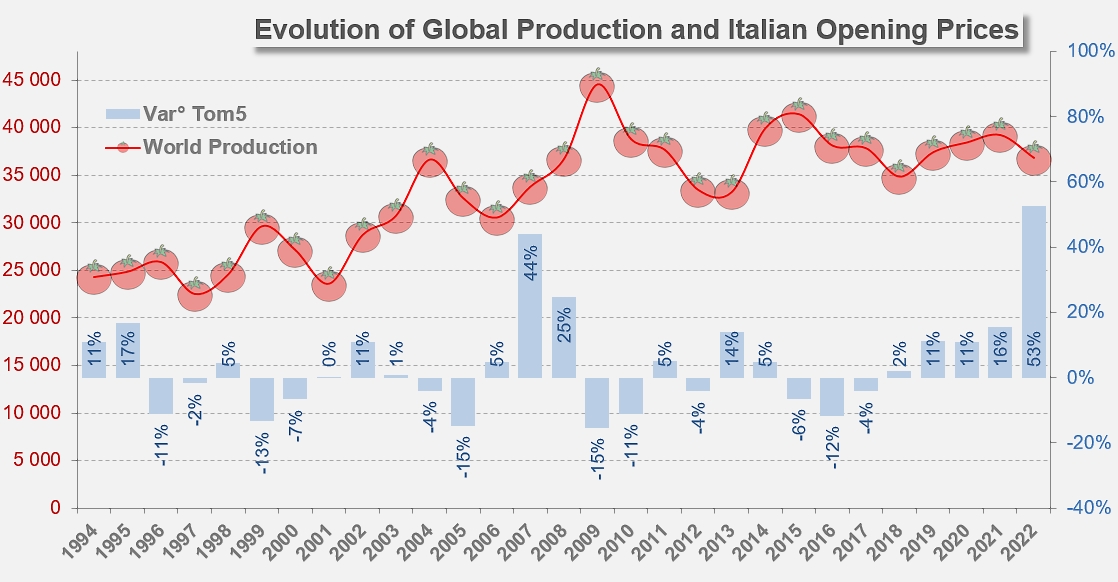

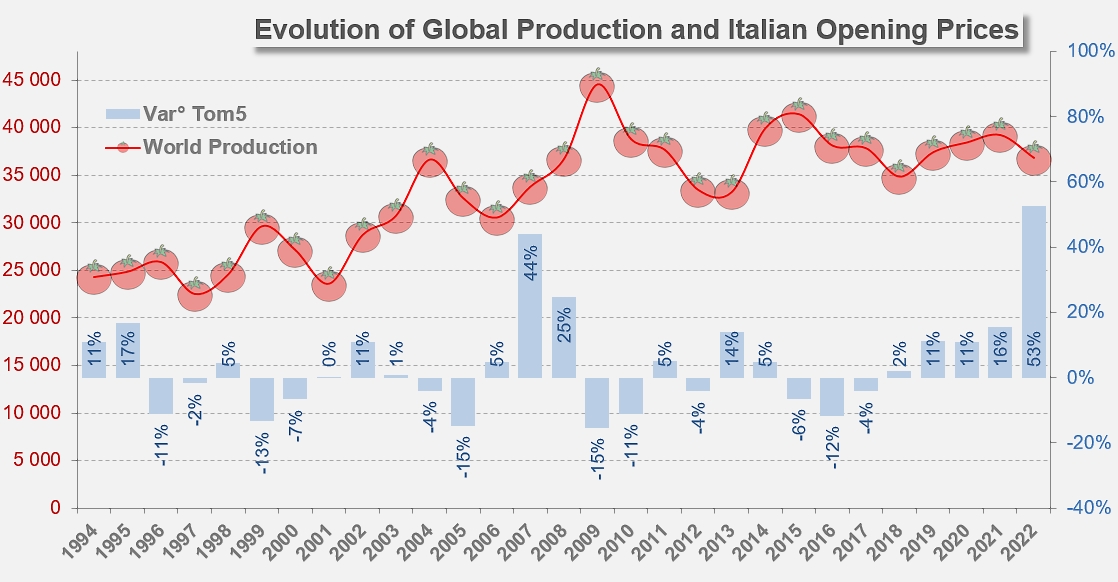

Between these significant episodes, quantifiable factors and recurrent hazards of all kinds have shaped the evolution of world prices for tomato products. However, the context of the 2022/2023 marketing year is radically different from the usual patterns and, above all, totally unprecedented in the history of our industry. In addition to the impact of droughts, the dramatic invasion of the Ukraine and the dizzying rise in costs at all levels of the food industry chain, the production outlook for this 2022 processing year-end, slightly below 37 million metric tonnes, reveals the growing inability of the global industry to fully satisfy global demand since the emergence of the health crisis caused by the Covid pandemic.

To quote a processor active in the global market context, “the market is being caught between two very significant drivers at the moment: a significant shortage, where the progressive running-down of inventories over the last years is now severely aggravated by a crop which is some 2 to 2.5 million [metric] tonnes smaller than last year; and the dramatic impact of the costs of energy on growing the crop, starting with fertilizers and ending with harvest and transport and then the processing of the raw tomatoes.”

Stocks that were still recording surplus volumes three to four years ago have now completely dried up and the difficulties encountered this year by the various sectors, particularly in terms of contracting and cultivation, have increased tensions on world markets: “There is quite simply no product available and many buyers without enough cover through to next crop.” Other sources confirm the situation: “There is an absolute lack of product in the market and with such a short crop in California, Spain and what looks [to be] a very bad end in China because of Covid restrictions to movements, it is going to be a very tough time till next crop.”

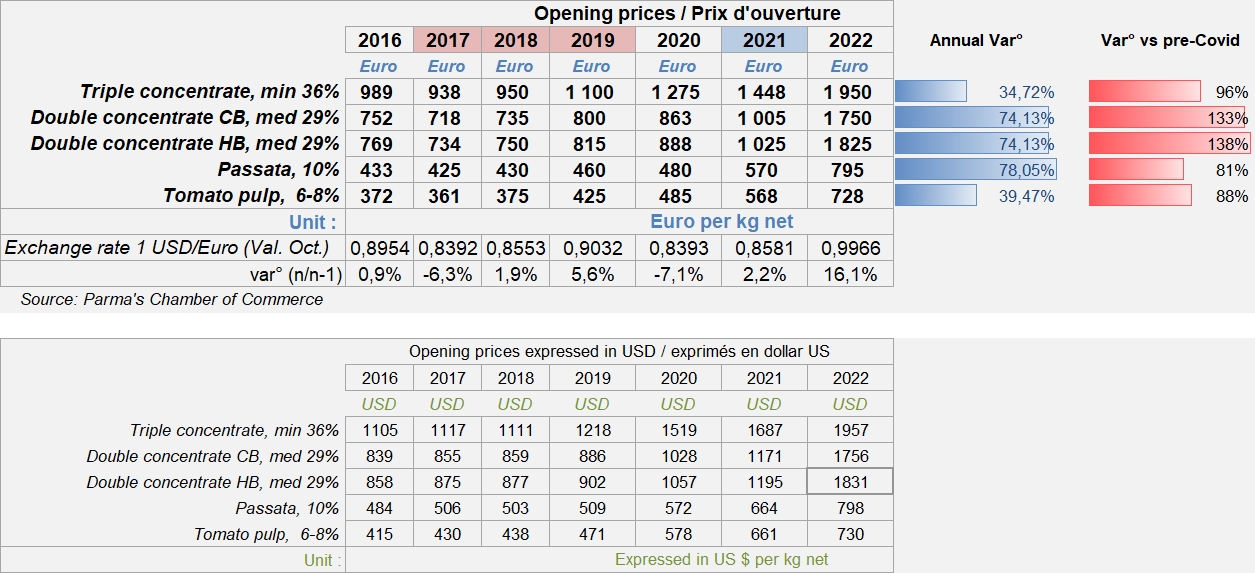

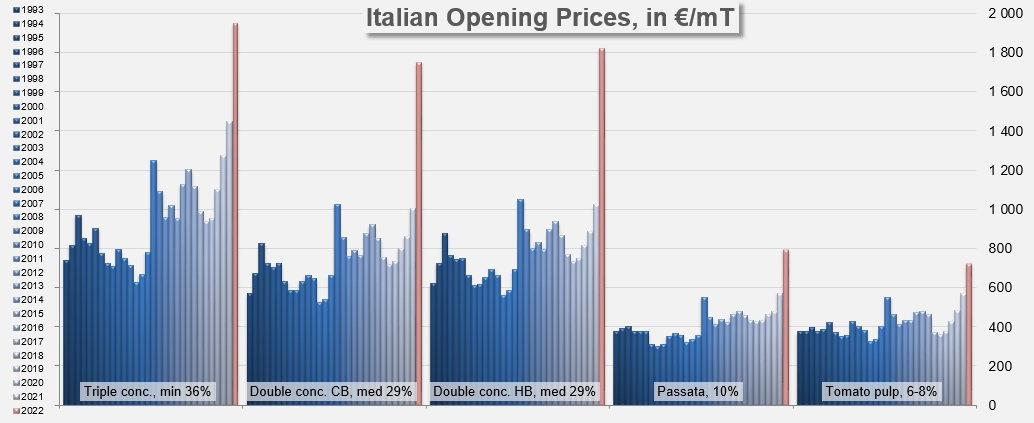

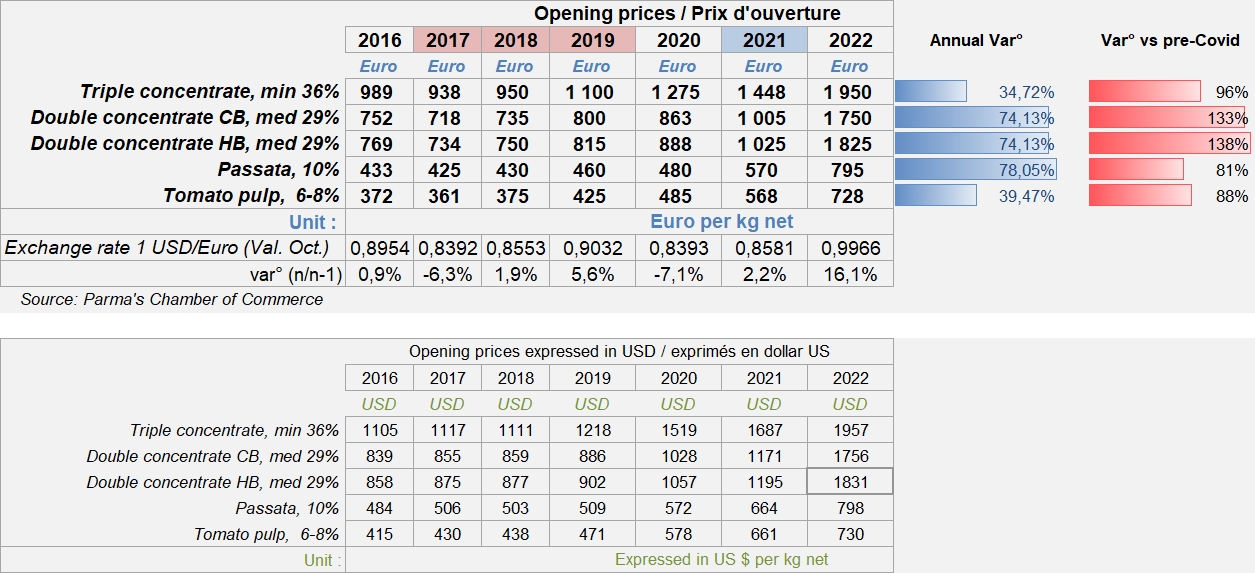

These tensions are reflected in dramatic increases in Italian opening prices, for example, reaching 74% year-on-year (and more than 130% compared to pre-Covid (2017-2019) opening quotations (in Euro)) for double-concentrated paste. The other product categories follow the same upward trend, of approximately 35% over one year for triple-concentrated paste, 40% for pulps, and 78% for passata. These increases are even more pronounced compared to pre-Covid opening prices, but beyond the numbers, some industry experts question the very meaning of the values mentioned due to the extremely limited availability of the products, and point to prices higher even than these quotes, especially on spot markets, which could potentially increase further in the coming weeks or months.

“Before the crop, contracts have been closed between 1,600 €/mT FCA (Free Carrier Alongside) and 2,000 €/mT FCA for double and triple tomato paste. Currently, after the crop, I doubt there is something to sell with so bad a crop, but if so, prices for double and triple could be even 20% more expensive.”

For many players in the global tomato industry, the situation described by the 2022 Italian opening prices is only one aspect of a larger and potentially longer-lasting problem. At the end of a period that has been deeply disrupted by the health crisis, these worries concern both the upstream and downstream sectors of our industry, with great uncertainties for 2023 in terms of the extent of surfaces planted with processing tomato and in terms of availability of water resources, which are essential for irrigation, with strong pressures on the price of raw materials (as well as on all other inputs) and a climate risk obviously increasing. Several industry experts say they are “concerned about the damage that these price levels may do to the industry” and believe that “we also have yet to see what impact these enormous cost increases will have on consumption.”

A rare combination of adverse circumstances – climatic, economic and political – have aggravated a difficult situation born of sluggish global consumption dynamics and an extreme health crisis. “It is too early to make predictions” say processors, for whom the industry is facing “a truly extraordinary perfect storm,” with “growers increasingly reluctant to grow the crop because of increases climate risks, the market undersupplied and historic costs and prices.”

Evolution of global production in parallel with the annual variation of Italian opening prices.

Some complementary data

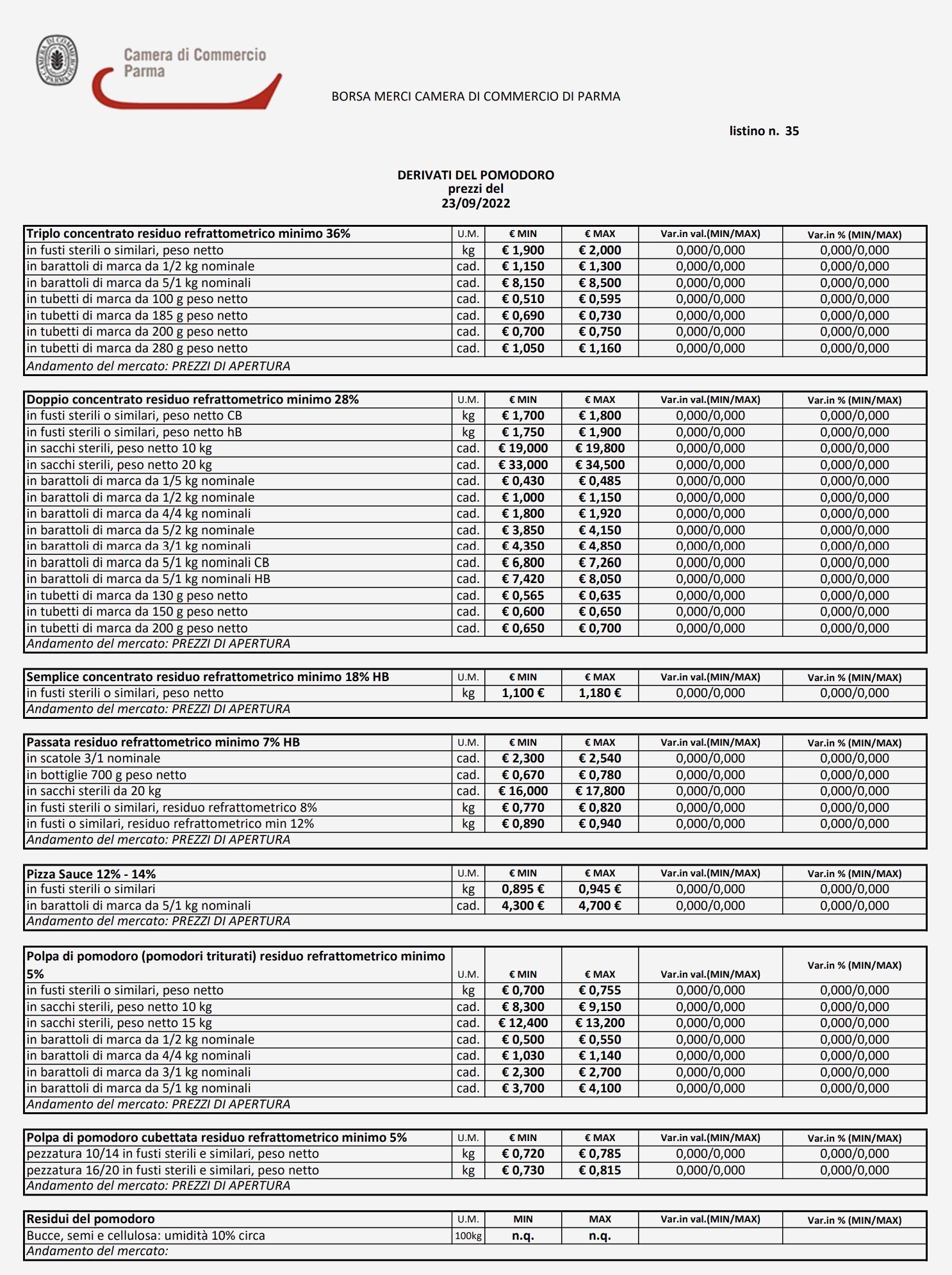

Details of the September 23, 2022, opening quotes for all Italian tomato products on offer.

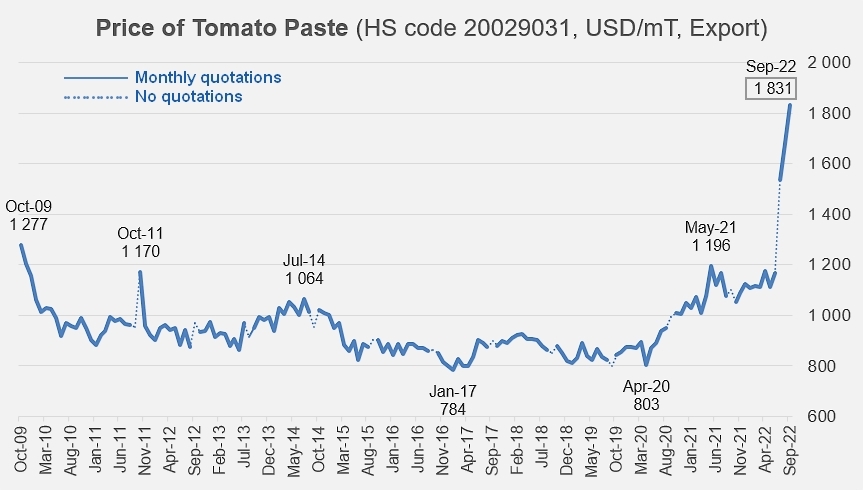

Evolution of the price of tomato paste: for example, tomato pastes under code 20029031 (dry matter between 12 and 30%, net content packaging over 1 kg).

Evolution of Italian opening prices of tomato products, by category over the last thirty years.

Publication dates of Italian opening prices since 2000.

Sources: Camera di Commercio Parma