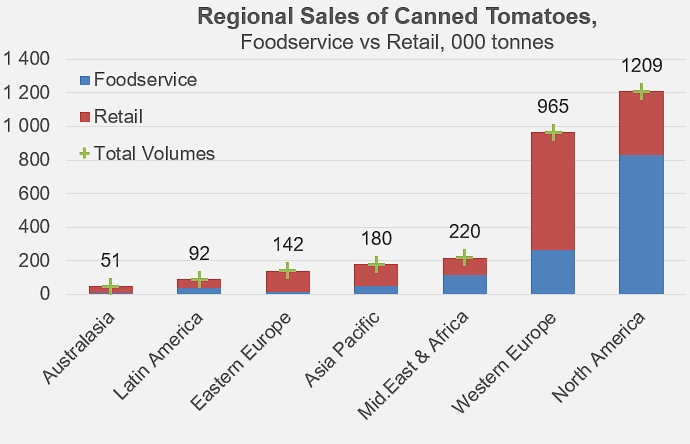

Worldwide, the canned tomato market is the one in which sales volumes are most evenly split between the retail sector (54%) and the food-service sector (46%). There are major price disparities between regions.

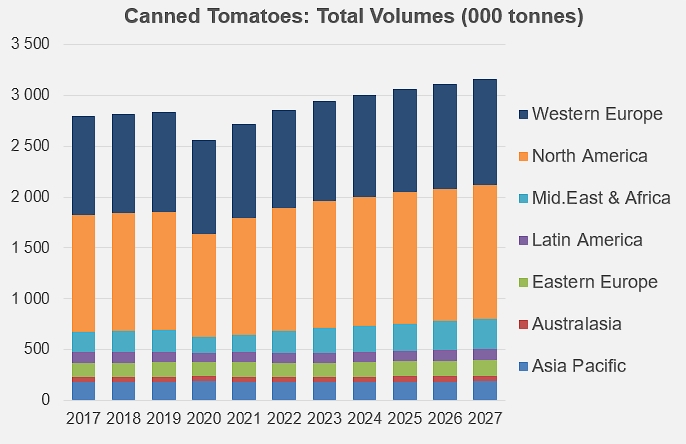

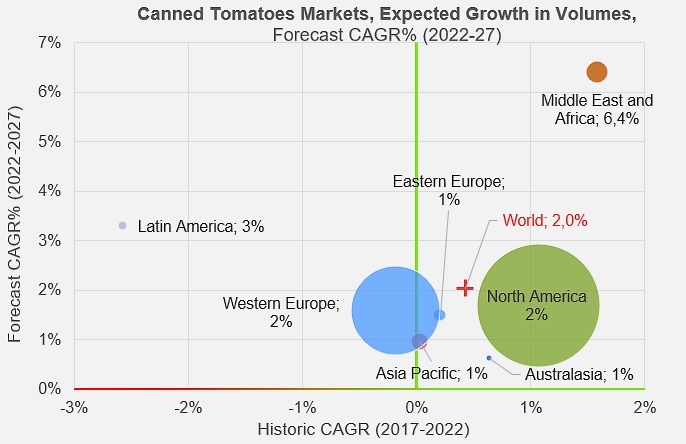

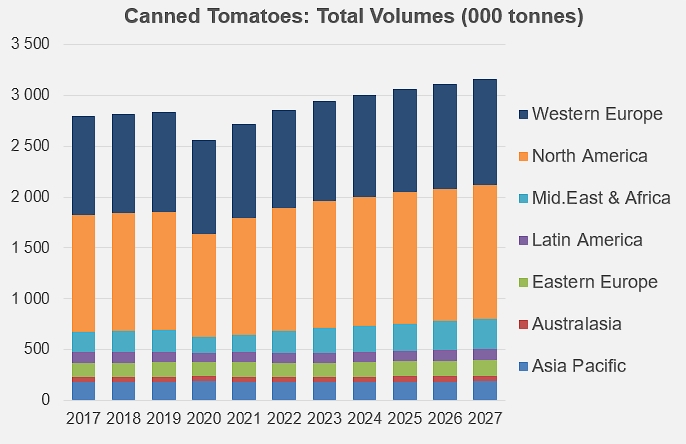

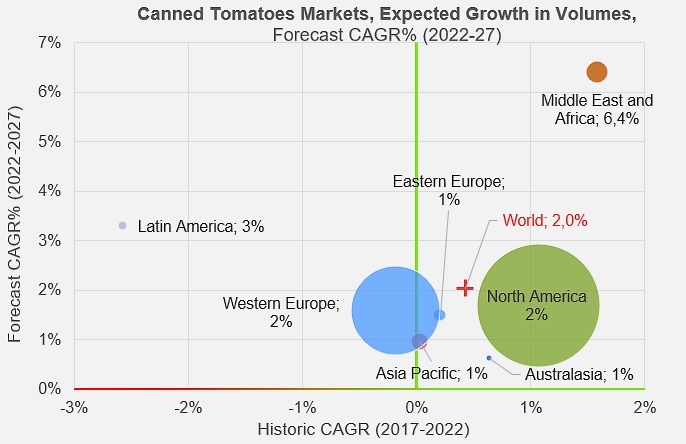

As we have already pointed out for other product categories, sales of canned tomatoes (see product definitions in appendices) recorded a sharp downturn in 2020 and 2021, followed by a recovery that suggests growth estimated by Euromonitor at around 2% for the period 2022-2027. The episode is the result of the spectacular drop in sales in the food-service sector during the Covid pandemic, which was not offset by the significant rise in retail sales. The quantitative effects of the slowdown were felt mainly in North America and Western Europe, but smaller markets were also impacted, such as the Middle East and Latin America. The Asia-Pacific and Australasia regions, on the other hand, recorded slight increases in sales.

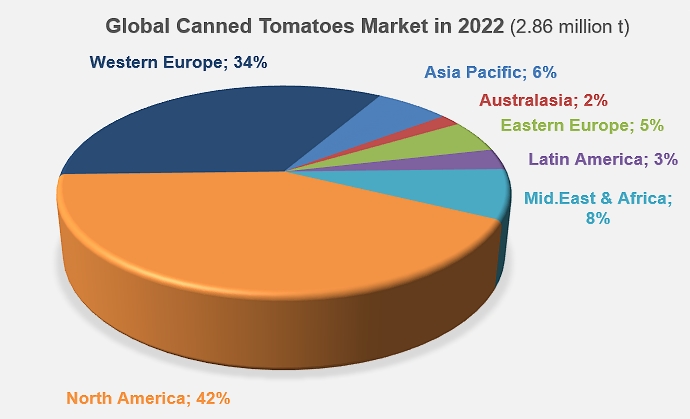

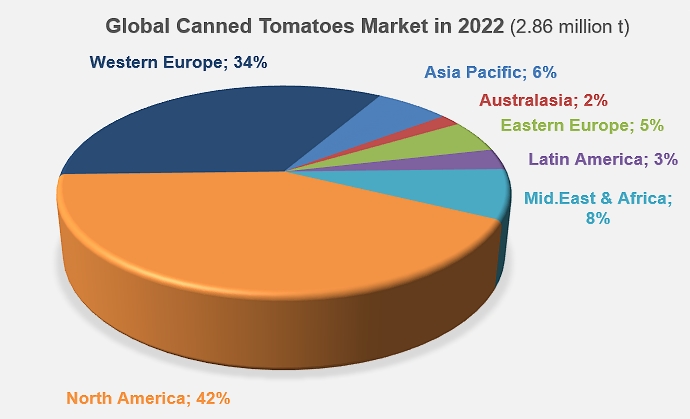

In 2022, the global market for canned tomatoes amounted to 2.86 million tonnes of finished products and generated sales of EUR 3.57 billion in retail distribution channels. The overall distribution of sales volumes among the various sales channels is much less clear-cut than in the case of ketchup (63% retail and 37% food-service) or pasta sauces (89% retail and 11% food-service). For canned tomatoes, on a global scale, consumers prefer retail distribution (54%) to the food-service sector (46%). This proportion leads to a rough estimate of the total value of the global canned tomatoes market in 2022 at some EUR 6.7 billion.

According to figures compiled by Euromonitor, global sales volumes of canned tomatoes could reach 3.2 million tonnes by 2027, generating retail sales of around EUR 3.8 billion.

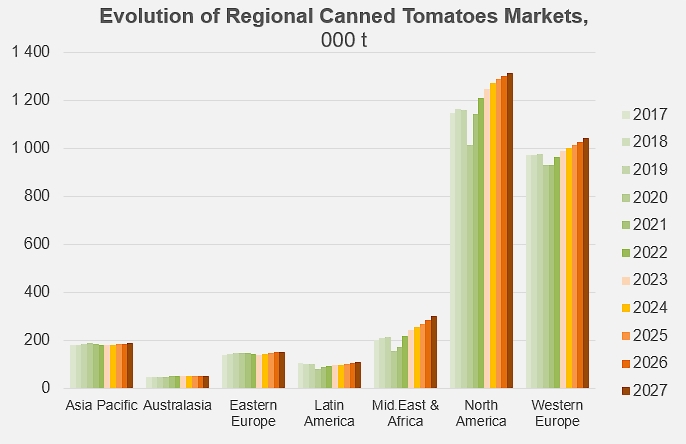

Two regions dominate the global canned tomatoes market. In 2022, North America accounted for 42% of worldwide canned tomatoes sales, while Western Europe accounted for 34%. As for the total markets of the Middle East and Africa, they accounted for 8% of worldwide sales. The growth rates forecast by Euromonitor are unlikely to bring about any major changes in global market distribution between now and 2027 (see additional information at the end of this article).

According to Euromonitor data, the most dynamic of these markets are the countries of the Middle East and Africa. Third in size, far behind the North American and European continents, this market, which already recorded the fastest growth rate between 2017 and 2022 (CAGR 1.6%), can count on an annual growth rate of over 6% between now and 2027. The Latin American market, which was losing momentum until 2022, is expected to return to growth, at an average annual rate of around 3%. Average annual growth in the larger North American and European markets, which has been relatively weak in recent years, is estimated by Euromonitor at around 2% for the period 2022-2027.

The overall result for the canned tomatoes market as a whole suggests average annual growth over the 2022/2027 period of around 2%, which is five times higher than that of the 2017/2022 period.

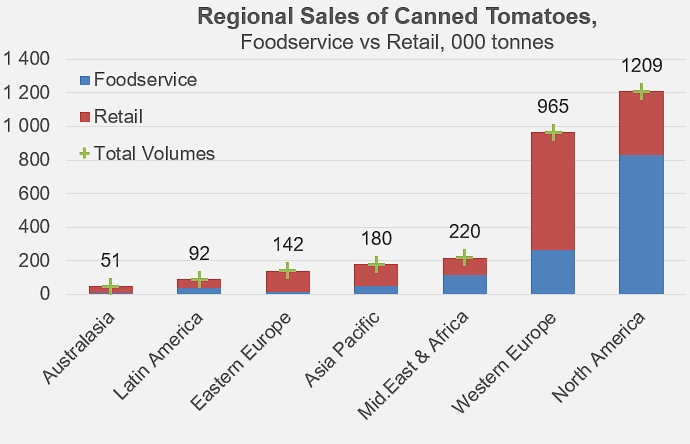

The relatively balanced worldwide distribution of canned tomato sales through the various marketing channels masks major regional disparities in terms of consumer purchasing behavior. Eastern Europe has the highest proportion of sales through retail channels (90%), while North America has the lowest (32%). The Latin American market is close to the global average, with 55% of canned tomato sales made through retail outlets. Middle Eastern and African consumers prefer to buy through the food-service sector (54%). In Asia-Pacific and Western Europe, 72% to 73% of canned tomatoes are sold in retail outlets, rising to 78% in Australasia.

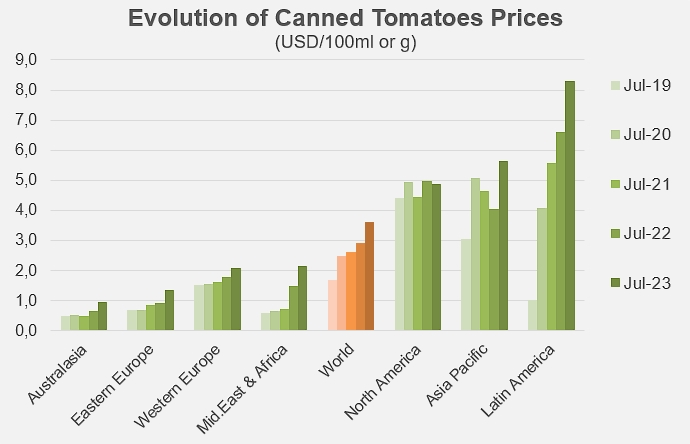

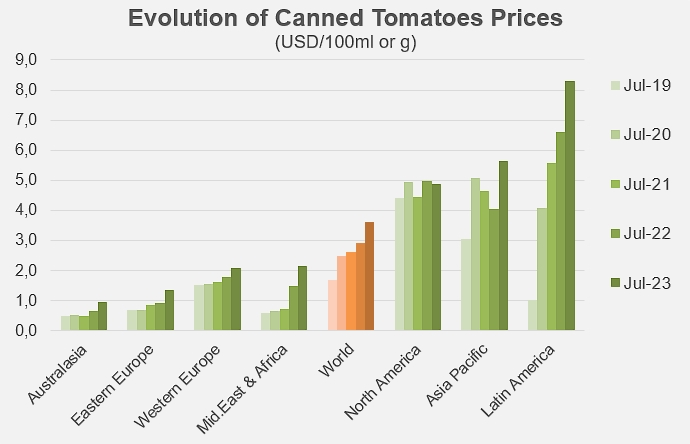

The strong regional contrasts in volumes, growth rates and distribution between marketing channels are also reflected in prices. Compared with a world average of around 3.6 USD/100g (or ml) in July 2023, the Australasian market offers the least expensive canned tomatoes (0.95 USD/100g), in stark contrast to the Latin American market, where equivalent products are sold at around 8.3 USD/100g. Canned tomatoes sold in Europe (Eastern and Western), no doubt due to their proximity to their regions of origin, have relatively modest unit prices (1.4 and 2.1 USD/100g). Prices in the Middle East and Africa remain close to the latter level (2.2 USD/100g).

Prices offered on the North American market, the world's largest consumer of canned tomatoes, are significantly higher than the global average, at around 4.9 USD/100g. But canned tomatoes consumed in the USA or Canada are, however, less expensive (July 2023 prices) than those sold in the Asia-Pacific region.

Some complementary data

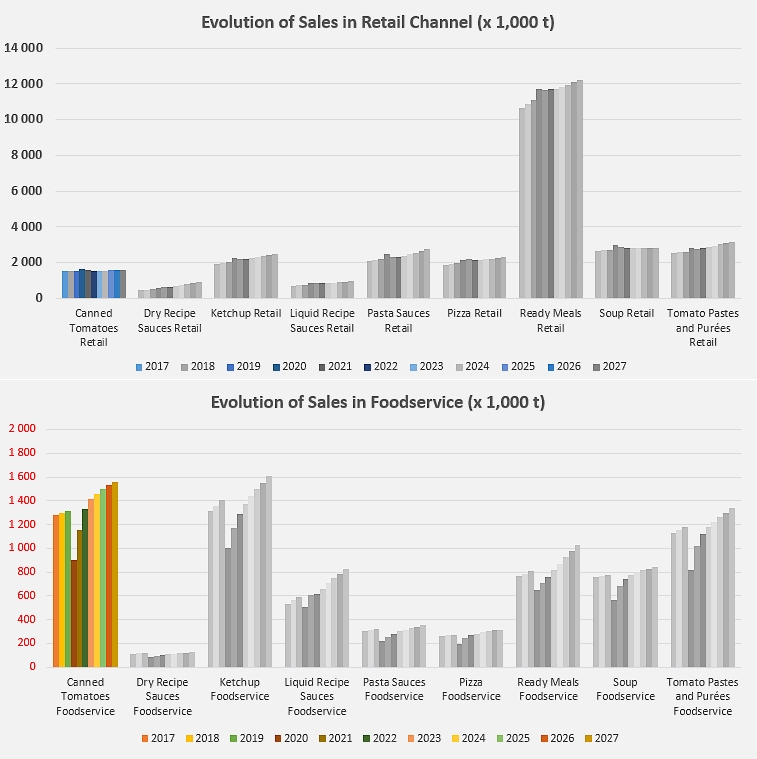

Comparative trends in sales of the different product categories in retail and food-service channels.

Evolution of total sales of canned tomatoes, by region.

Source: Euromonitor