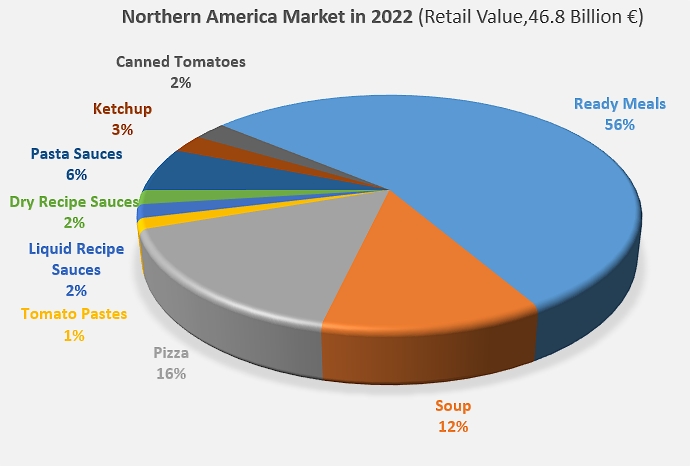

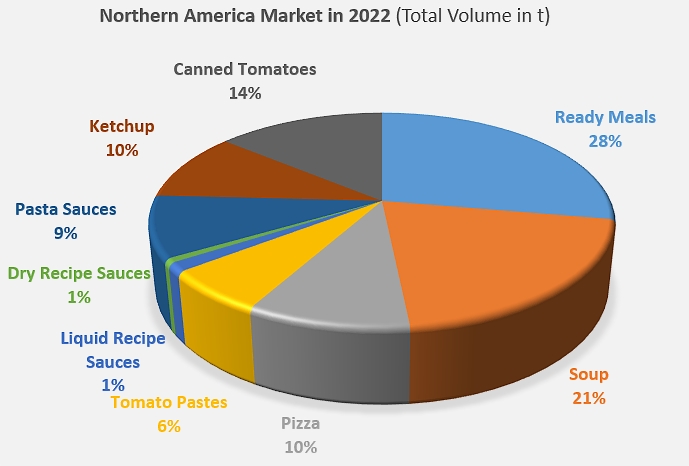

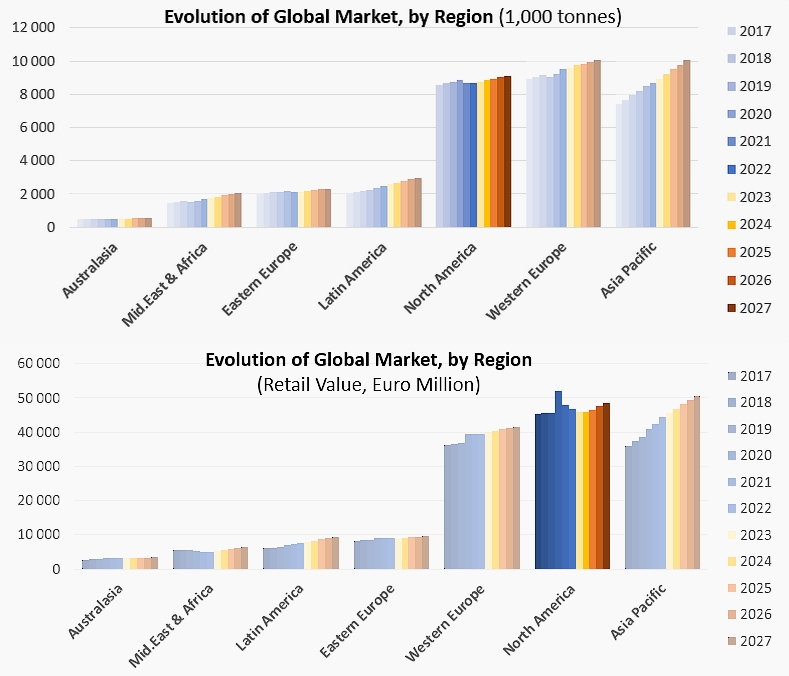

The North American market for tomato products (or types of products that may include tomato ingredients) has historically been one of the three largest in the world. In 2022, sales volumes represented 8.7 million tonnes of finished products and retail sales (excluding food service) amounted to EUR 46.8 billion, or around USD 49 billion (see additional information at the end of this article).

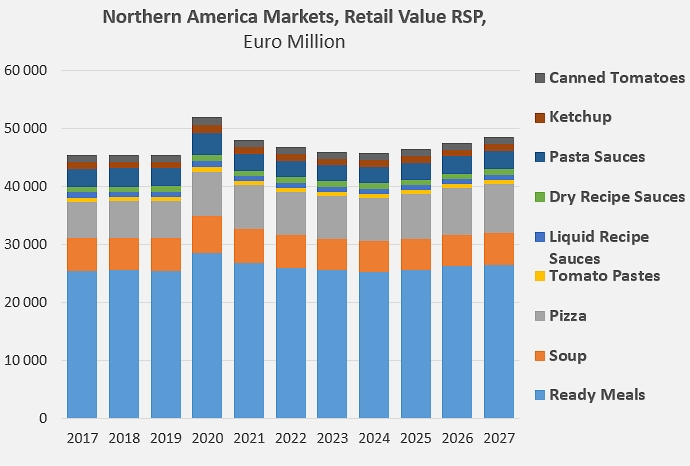

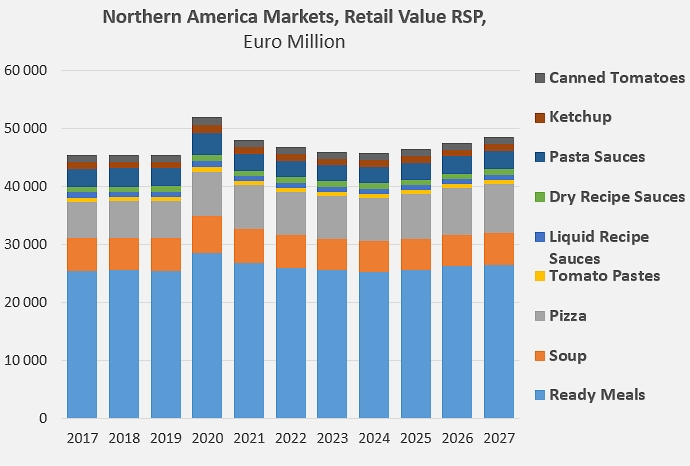

Data provided by Euromonitor shows a sharp rise in spending in 2020, along with a marked shift in the distribution of sales in favor of retail channels. This last feature, common to most regions and product families, is the consequence of the containment measures imposed in most countries during the Covid pandemic.

Like on the worldwide scale, prepared meals generate around 55% of the total value of retail sales in North America each year, ahead of pizzas (around 16%) and soups (12%). In 2022, these three main product families respectively accounted for EUR 26 billion (approx. USD 27.9 billion), EUR 7.5 billion (approx. USD 7.9 billion) and EUR 5.6 billion (approx. USD 5.9 billion).

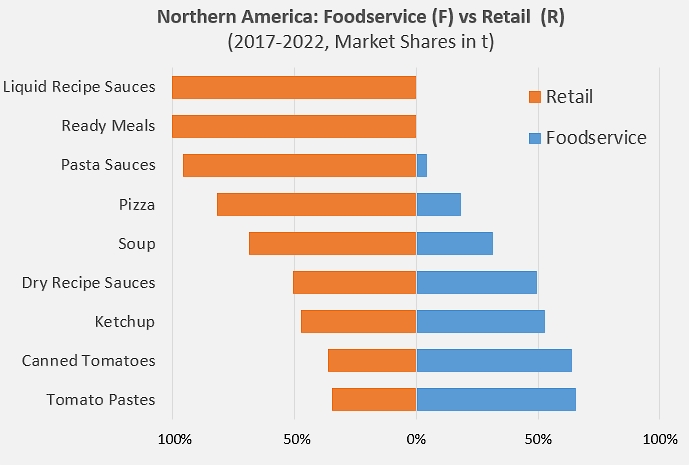

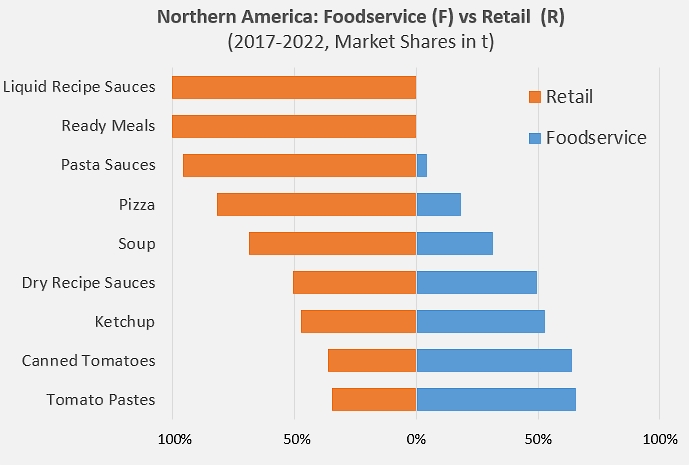

Given the specific value of each of them and the imbalance between retail distribution and the food service sector, the proportional "weight" of the same product families on total sales volumes is totally different: ready meals, pizzas and soups, which accounted for 84% of retail spending in 2022, only accounted for just under 60% of volumes the same year, while the importance of canned tomatoes (14%), ketchup (10%) and tomato pastes (6%) is clearer.

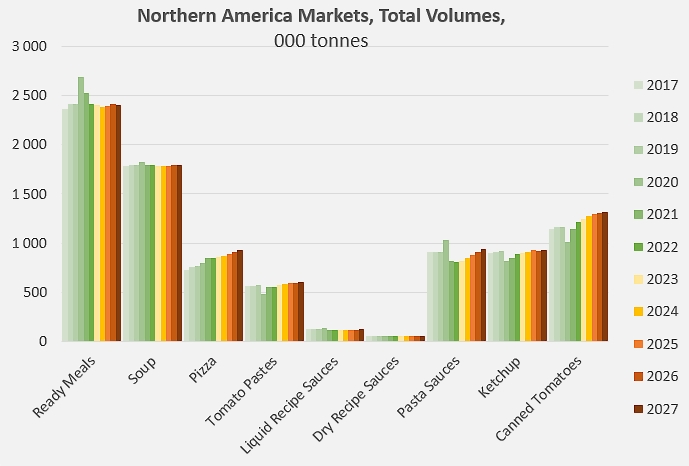

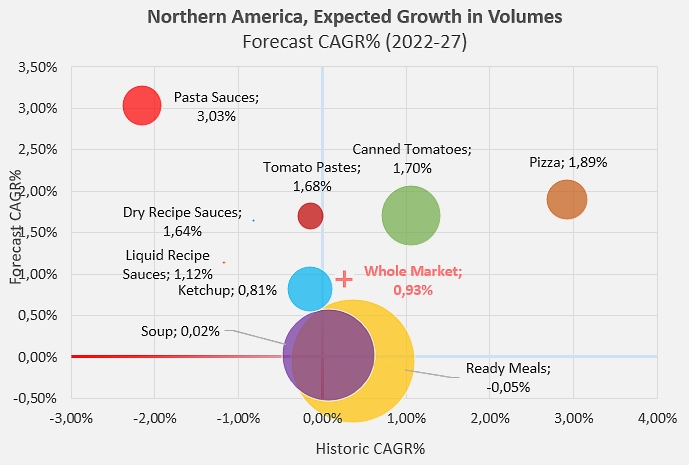

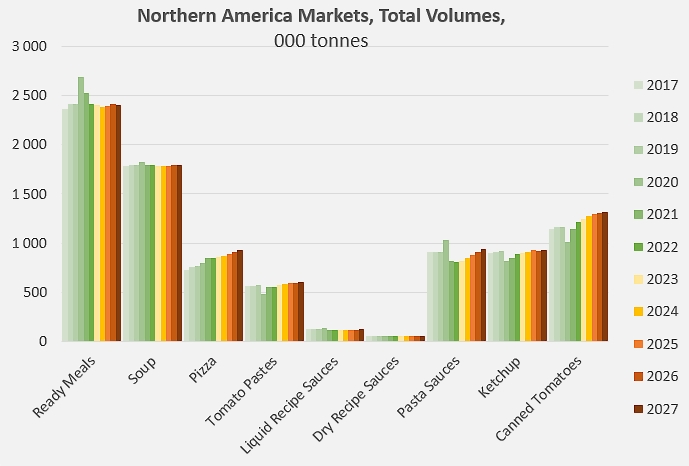

According to Euromonitor data, the North American market sold 2.4 million tonnes of ready-made meals in 2022. Sales volumes of soups and canned tomatoes reached 1.8 million tonnes and 1.2 million tonnes respectively. Sales of pizzas, pasta sauces and ketchup were recorded at between 810,000 and 890,000 tonnes in the same year. However, it is these latter categories, along with canned tomatoes, that show the strongest growth prospects, while sales volumes of ready meals and soups should, at best, maintain 2022 levels until 2027.

After 2022, the North American market as a whole should grow in terms of volume at an average annual rate (CAGR%) of 0.9%, reaching a total of 9.1 million tonnes in 2027. In contrast to ready meals and soups, the most dynamic segments should be pasta sauces, with average annual growth of over 3%, pizzas (1.9%) and canned tomatoes and pastes (1.7%). The growth ratio for ketchup should be around 0.8%. According to figures compiled by Euromonitor, overall growth in the North American market over the 2017-2027 period should be around 0.6%.

Prepared dishes and liquid sauces (excluding pasta sauces) are sold exclusively through the retail distribution network, where almost all pasta sauces and well over half of all pizzas and soups are also sold. Sales of dehydrated sauces are shared equally between the retail and food-service sectors, while the food-service sector accounts for the majority of sales of tomato pastes, canned tomatoes and ketchup.

All markets, studied from the angle of the eight major consumption regions and the nine tomato product families (or product families that may include ingredients derived from tomato) identified by Euromonitor, will be the subject of a summary presentation in the TomatoNews Yearbook 2024, which will be distributed free of charge to participants at the next World Processing Tomato Congress organized by the Hungarian processing industry, next June in Budapest.

Some complementary data

Evolution of the North American market in terms of volume and value (retail sales only) and situation in relation to other regions, from 2017 to 2027 (projected figures for the last five years).

Source: EMI International