In 2022, in Western Europe, total sales of products processed from or containing tomatoes represented more than 9.5 million tonnes of finished products. Retail sales largely dominated this market, being accountable for a turnover of some EUR 39 billion, and selling 15 times more pizzas and twice as much ketchup as the foodservice sector.

Volume and components

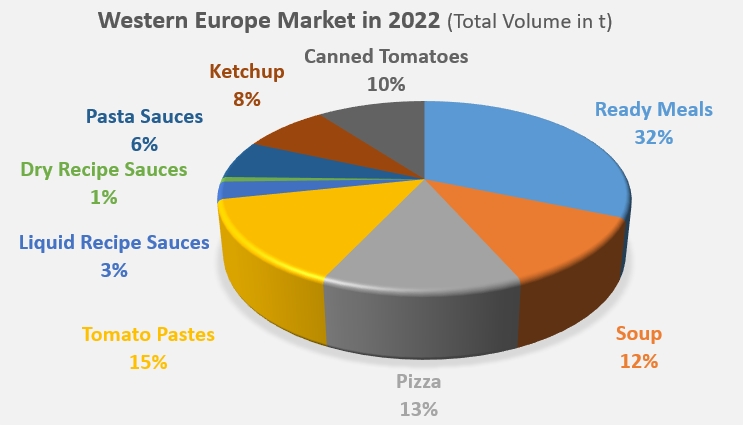

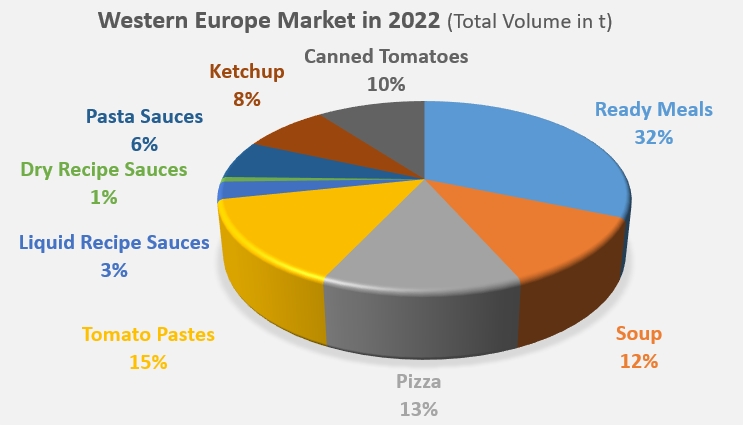

The volume of tomato products (ready meals, soup, pizza topping, tomato pastes and purees, liquid sauces, dehydrated sauces, pasta sauces, ketchup, canned tomatoes) sold on Western European markets reached just over 9.52 million tonnes (t) of finished products in 2022. Four segments clearly dominate consumption: ready meals, with 32% of the total volume, tomato pastes and purées (15%), pizza (13%) and soups (12%). These are followed by canned tomatoes (10%), and ketchup and sauces in various forms and to various destinations.

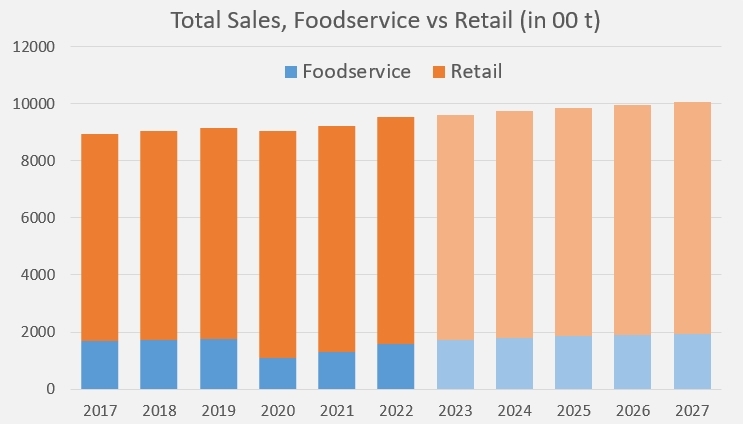

Distribution channels

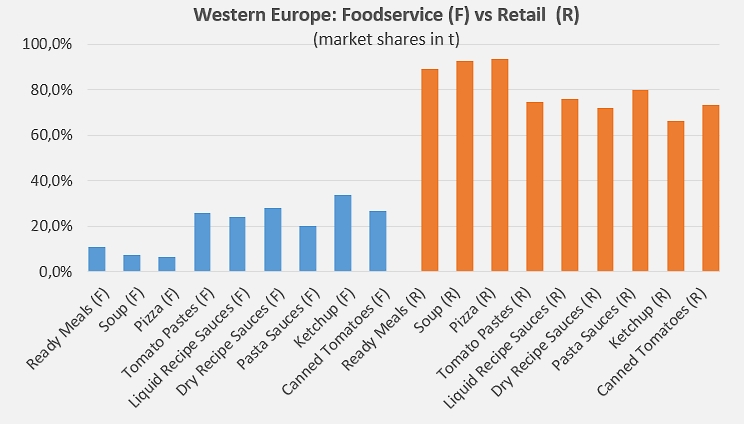

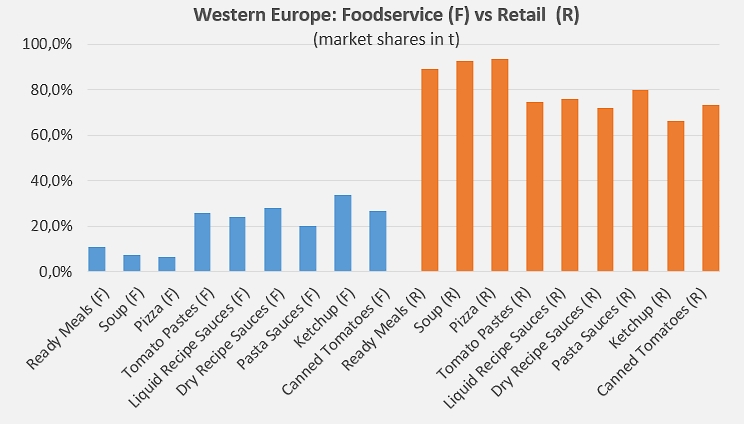

Euromonitor data shows that retail sales channels accounted for the bulk of distribution over the 2017-2022 period. Overall, it is estimated that 80% of volumes were sold in this type of outlet, and 20% in the Horeca (foodservice) sector. Over the period running 2022-2027, the balance between these different sales channels should shift in favor of the foodservice trade (22%) and away from retail (78%), with a resurgence in out-of-home catering, which was heavily penalized by anti-Covid measures.

Over the 2017-2022 period, 93% of pizzas and soups sold on the Western European market were sold in retail outlets. Most purchases of ready-made meals (89%) and pasta sauces (80%) were also made in this type of store. Retail distribution accounted for 72% of dehydrated sauces, 73% of canned tomatoes, 74% of tomato pastes and purees, and 76% of liquid sauces (with the exception of pasta sauces). Lastly, although ketchup was purchased mainly in the retail sector, it stands out with "only" two-thirds of its volume distributed in this sector. Among tomato products consumed in Western Europe, ketchup is the best performer in the foodservice sector, accounting for 34% of sales volumes. By way of comparison, only 7% of all pizzas sold in Western Europe are sold in the foodservice sector.

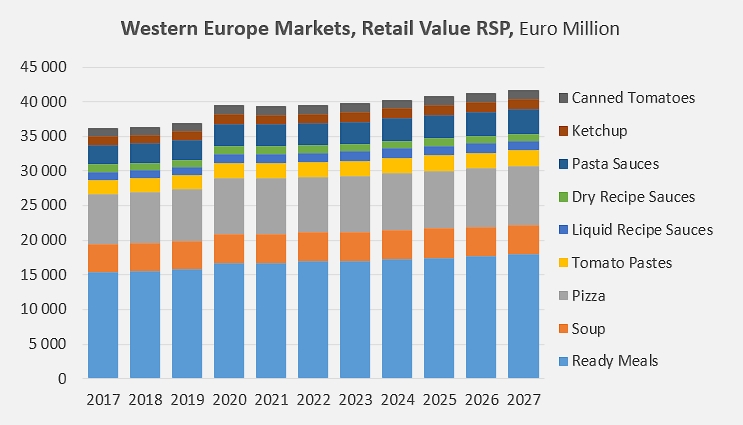

Components in value

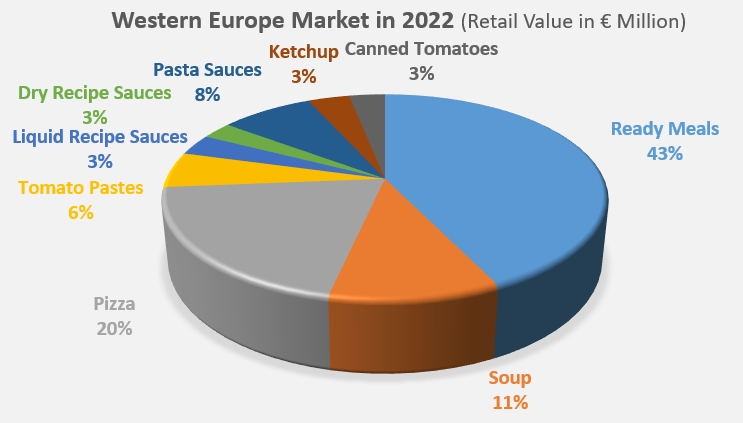

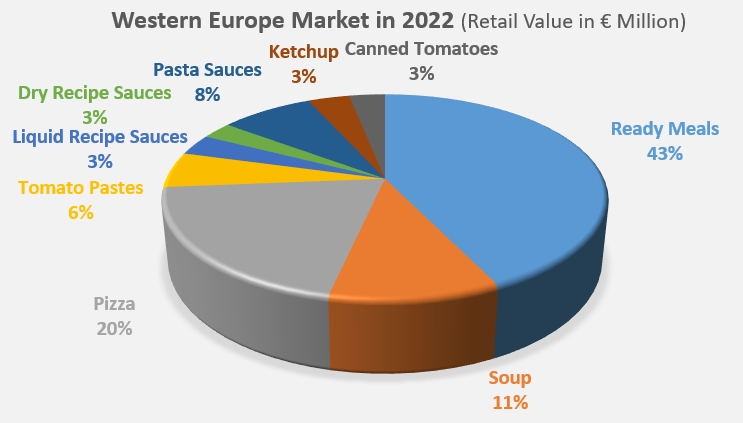

In 2022, this market accounted for sales of EUR 39.5 billion, virtually identical to those of 2021, but up 2.5% on the average of the previous three years (2019 to 2021, marked by the health crisis) and up by more than 8% on the pre-Covid period (2017-2019). Already dominant (32%) in terms of volume, the prepared dishes sector confirmed its leading position, absorbing 43% of total spending on tomato products by Western European consumers. The valorization of pizzas gave the sector a significantly higher share in value (20%) than in volume (13%). Conversely, the value share of tomato pastes and purees was well below the volume performance (15%), with only 6% of the total value of the Western European market.

Future prospects

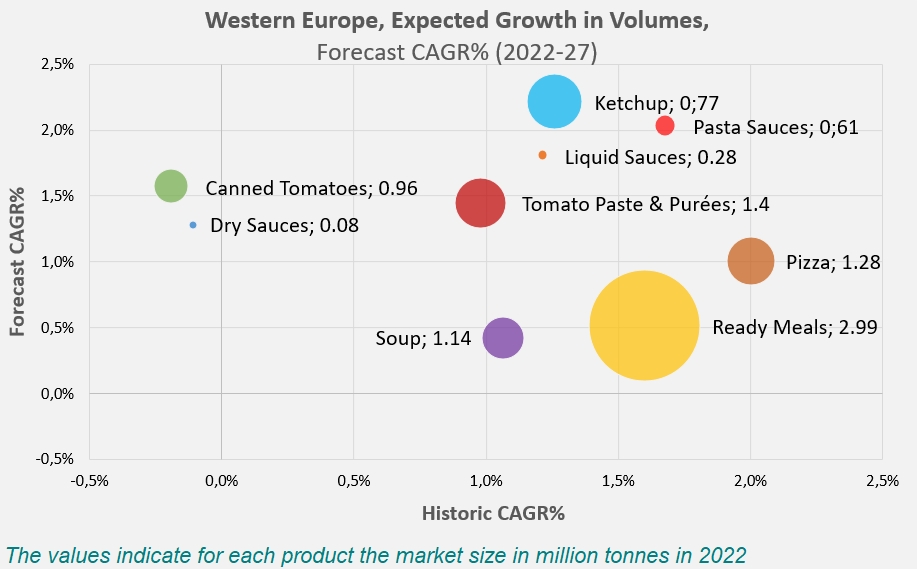

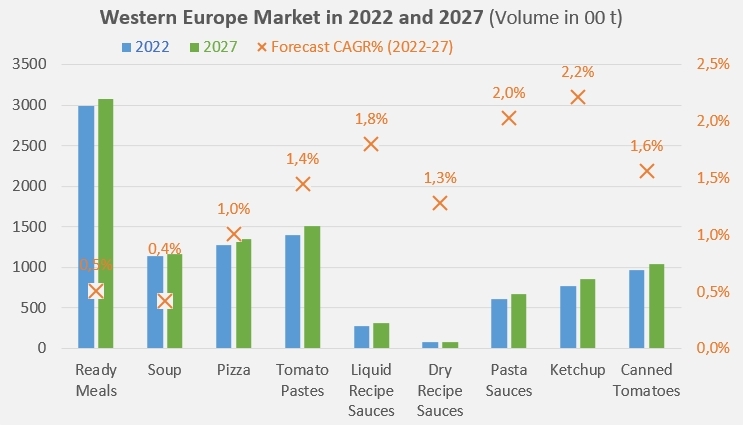

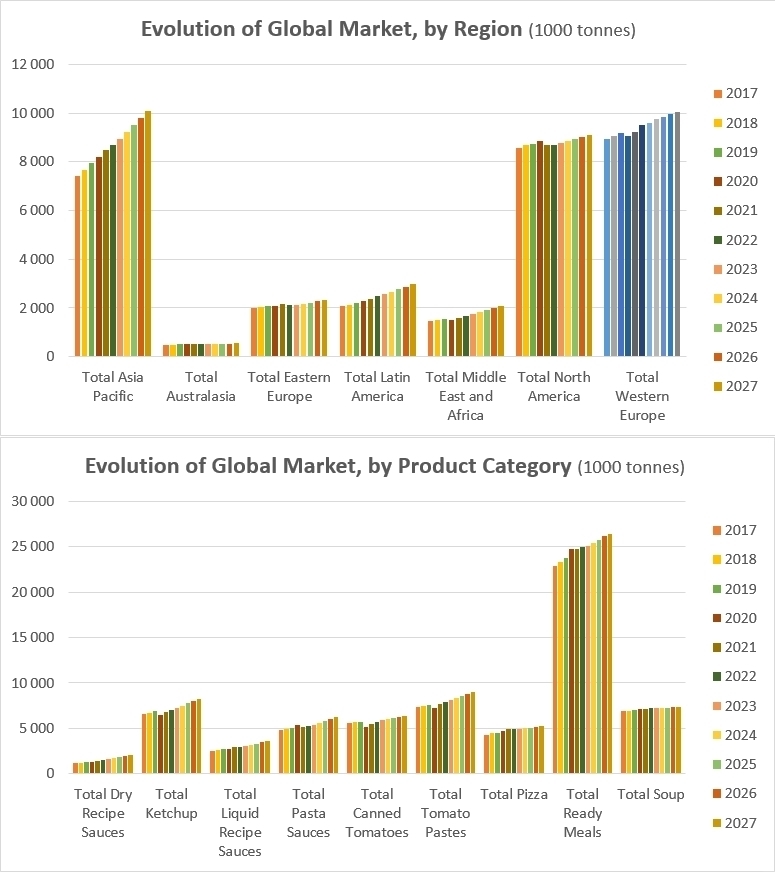

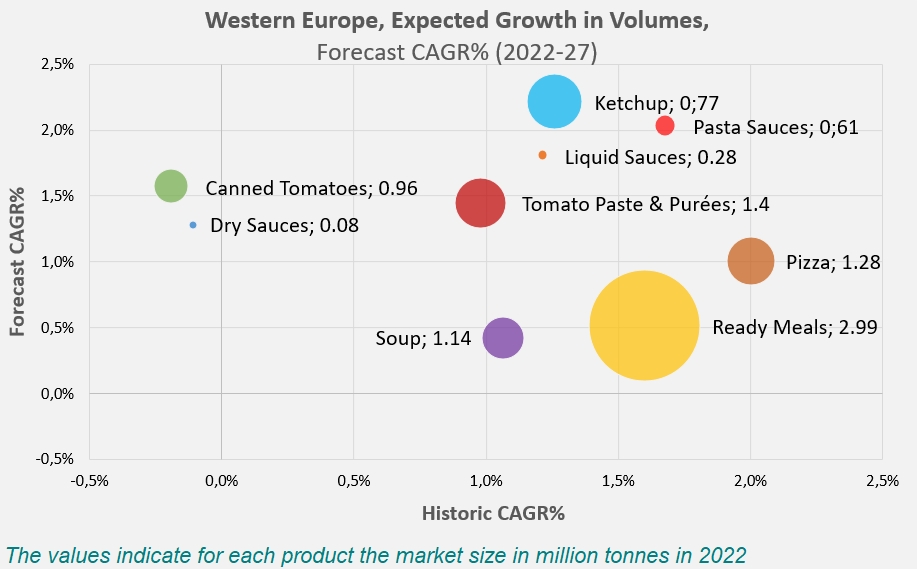

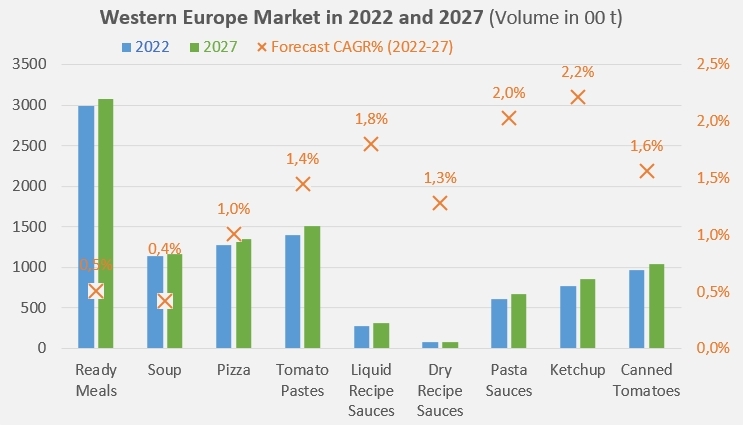

Expected growth should bring total tomato products sales volumes to around 10.1 million tonnes by 2027, following a slower average annual increase over the 2022-2027 period (CAGR 1.1%) than from 2017 to 2022 (CAGR 1.3%). In the absence of data regarding the value of products marketed in the foodservice sector, it should be noted that the value of the retail market in Western Europe is expected to grow over the 2022-2027 period at a rate just below that of volumes (CAGR 1.05%). This growth, which benefited from a "value jump" of around 8% driven by a net increase in volumes at the start of the Covid period (see additional information at the end of this article), should lead to a value in excess of EUR 41.6 billion by 2027. For information, as retail sales account for 80% of total volumes in the region, a rough estimate of the total value of the tomato products market in Western Europe is around EUR 51 to 52 billion.

There are major disparities in terms of development between the different types of products. While the growth rates (CAGR) recorded over the 2017-2022 period show slight slowdowns for powdered tomato sauces (-0.1%) and canned tomatoes (-0.2%), and notable increases for prepared dishes (1.6%), pasta sauces (1.7%), and pizza topping (2.0%), the annual growth rates expected for the 2022-2027 period are all positive, ranging from 0.4% (soups) to 2.2% (ketchup). All in all, the best performances over the decade are expected to be recorded by pasta sauces (1.85%), ketchup (1.74%), liquid sauces (1.51%), pizza toppings (1.50%) and pastes and purées (1.21%). The Western European market as a whole is growing at an annual rate of 1.18%, with the slowest growth recorded by prepared dishes (1.05%), soups (0.74%), canned tomatoes (0.68%) and powdered sauces (0.59%).

Western Europe's position on the global market

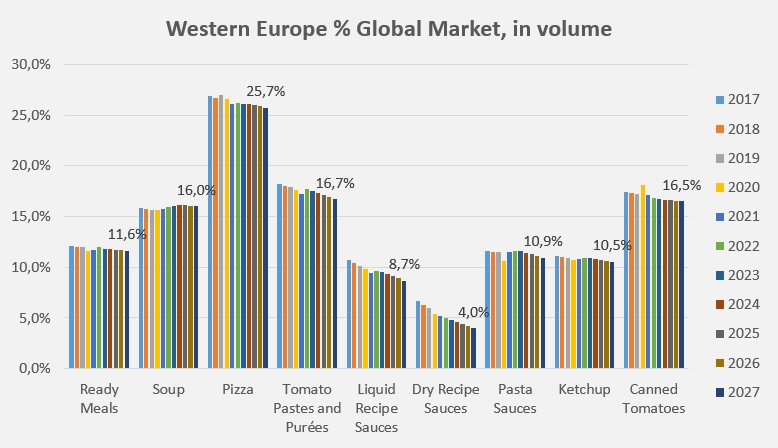

Although sales volumes are increasing, Western Europe's share of the world market is steadily declining. From almost 29% of total worldwide sales in 2017, the Western European market share has fallen to just over 28% in 2022 and is expected to continue its decline to around 27% in 2027. In so doing, Western Europe's market would give up its position as the world's leading market for tomato products to the Asia-Pacific region.

If these developments prove true, the Western European market in 2027 should account for around 26% of the global sales volumes of pizza toppings, 16% of canned tomatoes and just 4% of powdered sauces.

Some complementary data

Evolution and composition by volume of the market (Foodservice vs Retail sales) for tomato products in Western Europe from 2017 to 2022, and projected to 2027.

Evolution and composition of the value of the tomato products retail market in Western Europe from 2017 to 2022, and projected to 2027.

Evolution of the global market volume by region and product category, 2017 to 2022, and projected to 2027.

Sources: Euromonitor 2023 Global Market Report on Processed Tomatoes