As they do every year in November, the professional organizations representing the upstream segments of the Californian processing tomato industry (CTGA, PTAB, etc.) met in Napa to take stock of the 2023/2024 processing season.

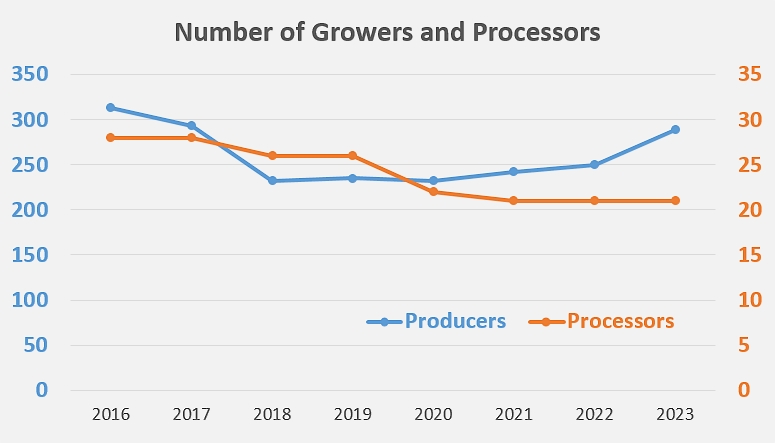

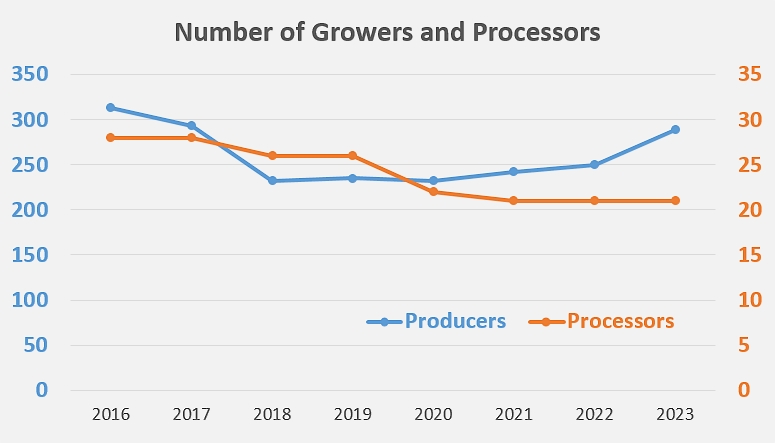

Over and above annual tonnages and the progress recorded by this past season's results (see additional information at the end of this article), the information presented by the PTAB highlights a renewed interest in growing processing tomatoes in California in 2023, with an increase in the number of growers of around 20% compared to the average of the previous three years, bringing this number to 289 growers last year. After a significant drop between 2018 and 2020, the number of processing companies remains stable at 17.

The processing season, which ended in the first fortnight of November, confirmed California growers' interest in this developing sector, with an increase registered compared to previous years both in terms of the proportion of acreage dedicated to this crop (+5%) and the quantities produced (578,890 metric tonnes, +7%).

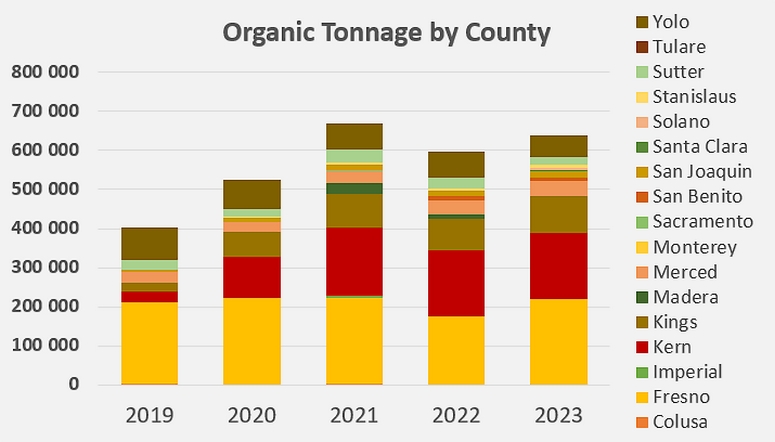

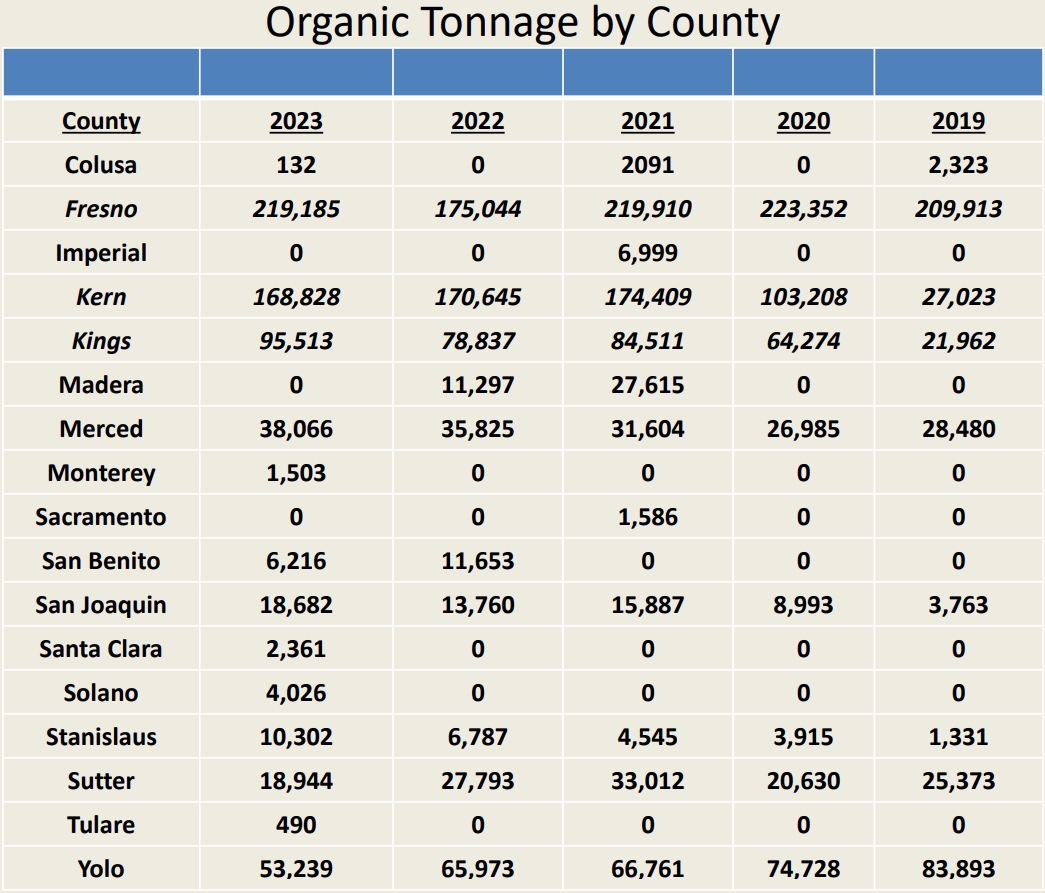

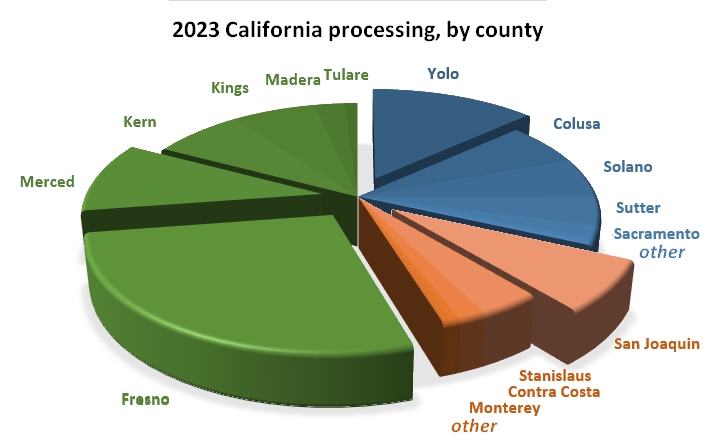

In 2023, the three southern counties of Fresno, Kern and Kings alone accounted for more than three-quarters of California's organic tomato production for processing. Yolo County, in the north of the state, is also a major and regular contributor to California's organic category.

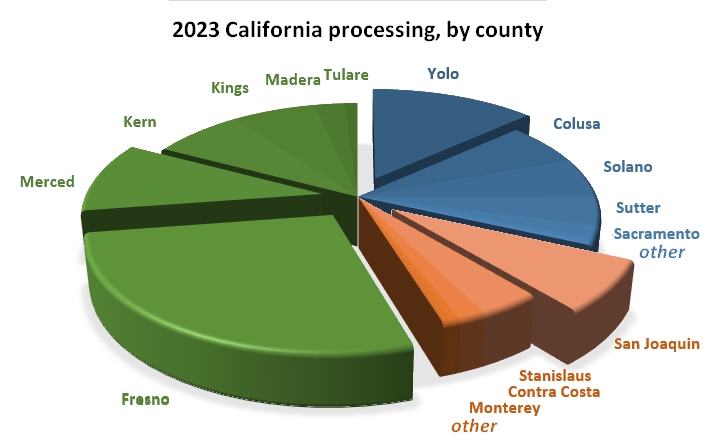

From a broader point of view, looking at the total production by county, Fresno (3.16 million metric tonnes (t)), Yolo (1.52 million t) and Merced (1.18 million t) have been the main supply areas for processing plants in 2023, with more than half of the tonnage delivered between July and November. San Joaquin and Kern follow, with over 820,000 t each.

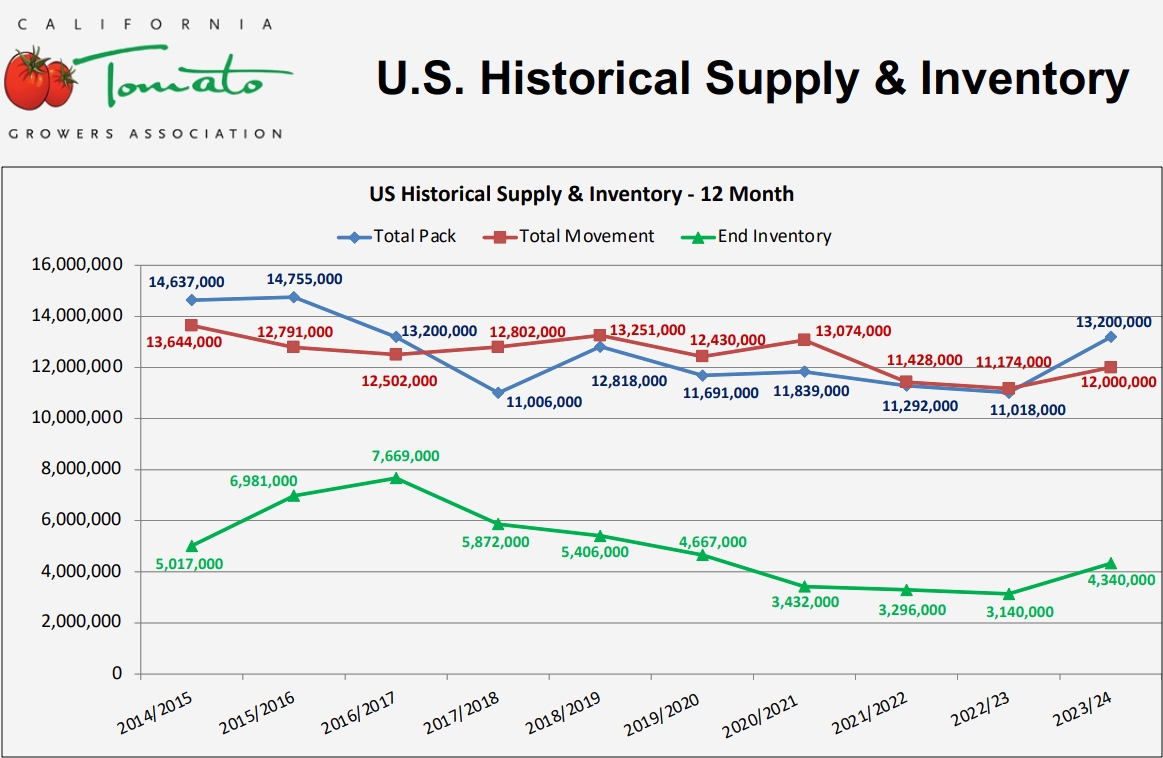

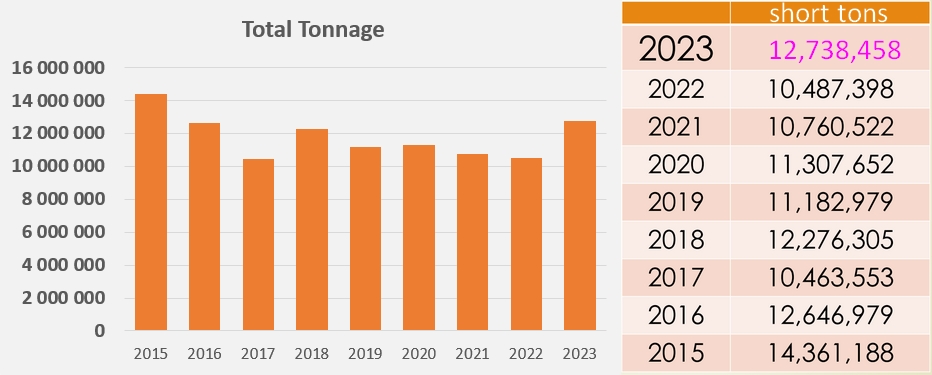

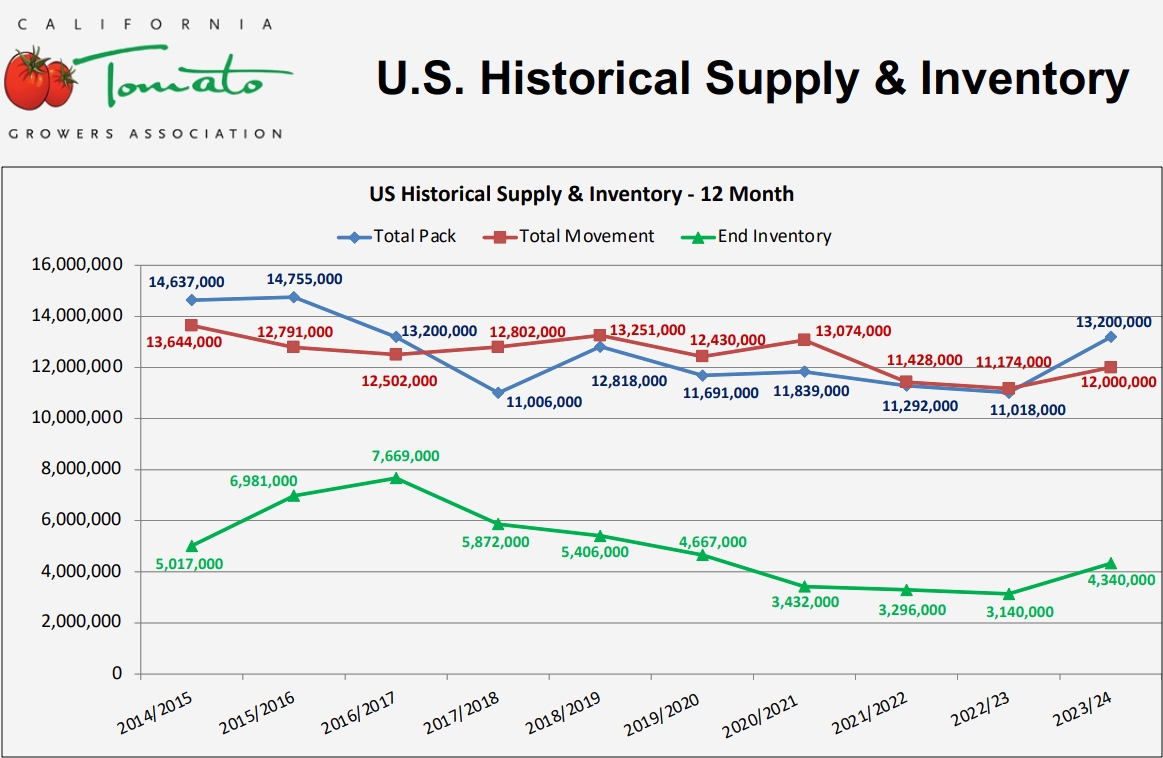

The 11.55 million metric tonnes (12.74 million short tons) processed last season in California, along with the 460,000 t processed in the other processing states, are one of the keys to the US movement dynamic.

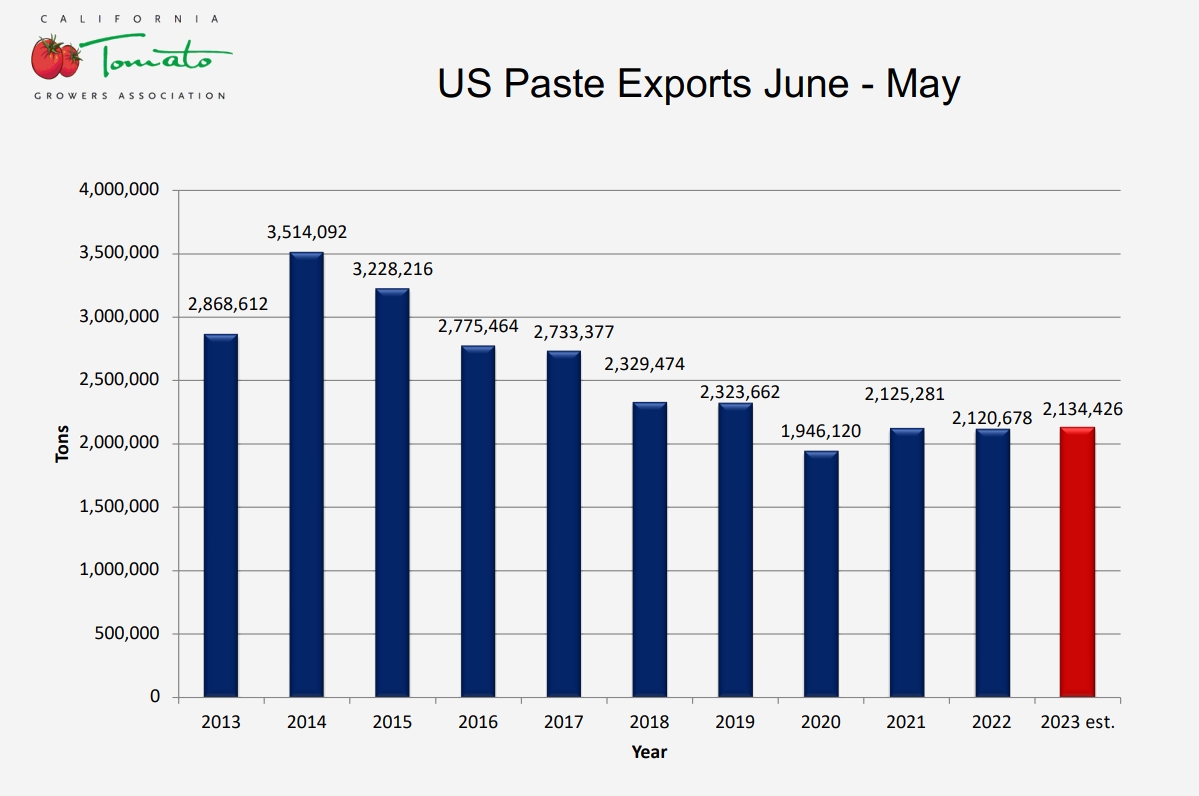

After six years of slowly eroding inventories, Mark de La Mater stated recently (MorningStar, Tomato Bites November 27, 2023), that California processors "were at an extremely low inventory level" as of June 1, 2023. For the third year running, the quantities available at that date were just equivalent to three months' consumption at the current rate of disappearance (domestic and export). The California Tomato Growers Association has shown that with annual exports of pastes being relatively stable over the past three years at around 1.93 million t, and a campaign result that far exceeded forecasts, the 2023 season has given the industry real room to maneuver and has set consumption dynamics on a new trajectory. According to CTGA projections, which will be refined by stock data as of December 1, stocks on May 31, 2024, could be close to 4 million t, a level generally considered satisfactory as the new season approaches.

Some complementary data

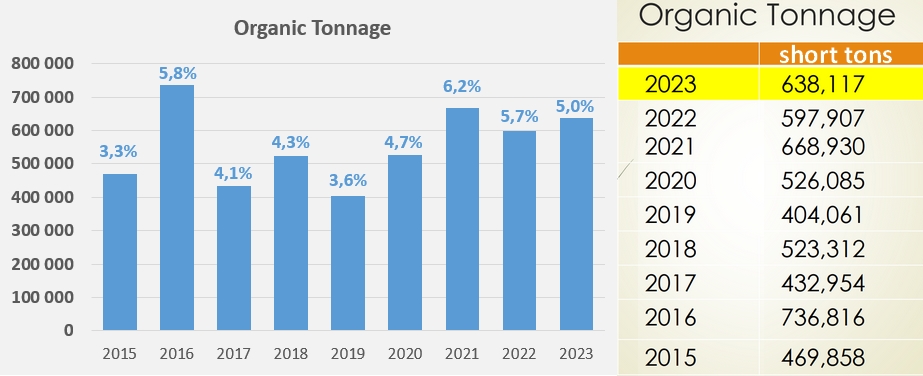

Quantities processed in California

Organic tomato production by county since 2019

Quantities of US pastes exported annually (period running June to May), expressed in raw material equivalent

Sources: PTAB, CTGA