Press release

, François-Xavier Branthôme

-

“…just an unbelievable growing season for California”.

Ingredient tomato supply and demand experiencing improved alignment after record-high 2023 crop.

Welcome back to another TOMATO BITES by Morning Star video. The 2023 California processing season is now complete, and despite early-season odds, it concluded with a record-high crop. This is a welcome turn of events following multiple challenging years.

For this month’s video, Tomato Bites invites you to join Morning Star colleagues Aaron Giampetro and Mark De La Mater at the table for an in-depth discussion analyzing both the US and global supply and demand positions coming out of 2023. They explore a historical comparison to past record year crops and provide insight into what inventories will look like heading into 2024.

“Hello everyone, this is Aaron Giampetro from the Morningstar Packing Company with your November, 2023 to tomato bite update.

Very lucky today to have Mark De La Mater with us, our colleague Mark, to provide some additional insights and analysis on to some of the things that happened in the 2023 crop and how they’ll translate into industry structure and some of the impacts they may have on the market, and things we need to watch as we move forward.

Very lucky today to have Mark De La Mater with us, our colleague Mark, to provide some additional insights and analysis on to some of the things that happened in the 2023 crop and how they’ll translate into industry structure and some of the impacts they may have on the market, and things we need to watch as we move forward.

Mark, thank you very much for joining us.

Thank you for asking me.

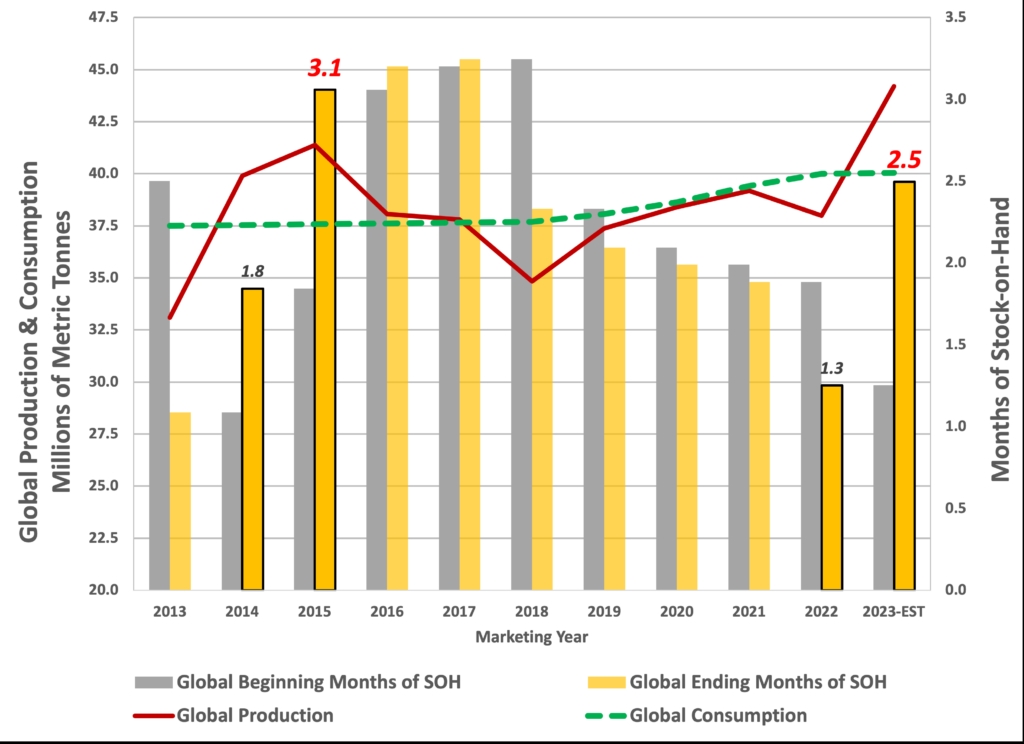

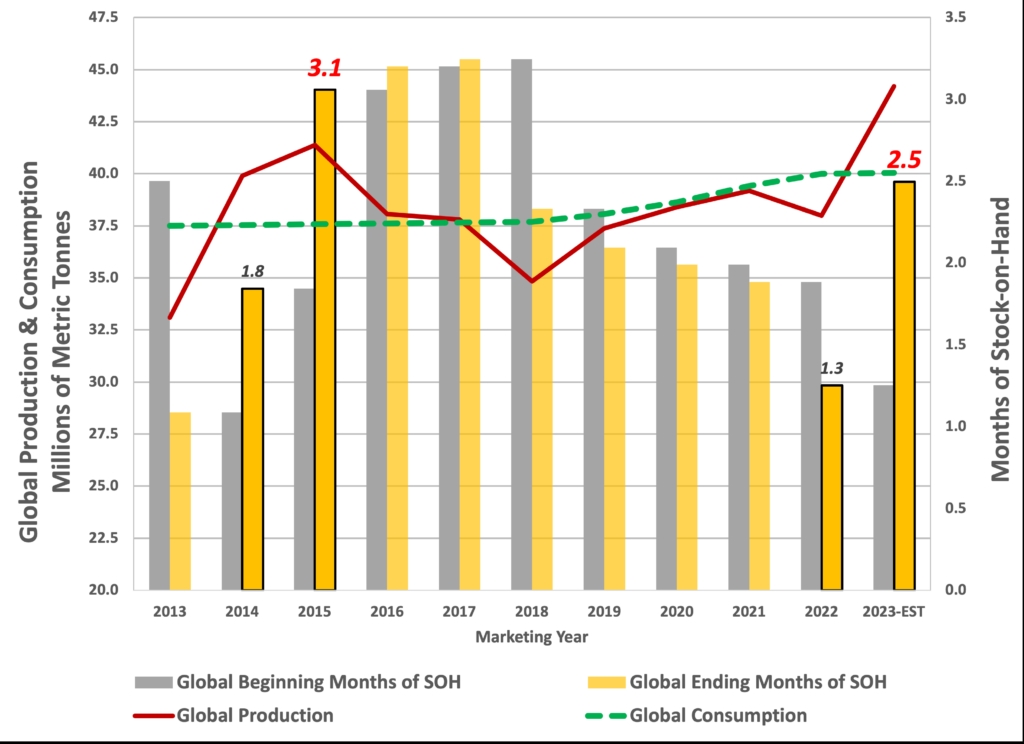

So, the 2023 crop is complete worldwide. We have visibility on a global crop that’s about 44.2 million metric tons, or 48.7 million short tons for the US viewers, which is about a 16% increase year over year. And of that 16%, most of the volume increases are coming from China and California - about 16% of that, California's up about 21%, and China's up about 29%.

California had a 12.74 million short ton crop, or 10.55 million metric tons. It seems to be shaping up to be a pretty dynamic year coming off a dynamic crop, and I think at this point, we're looking at the largest crop we’ve seen since 2015, the fourth largest crop in California in history, the world’s largest crop from a global production stand point. Are these elements what we would consider the new normal for California, or is there some more historical context or recent changes? I would say this is not quite the new normal, that maybe there's a bit of an anomaly that happened in the 2023 crop.

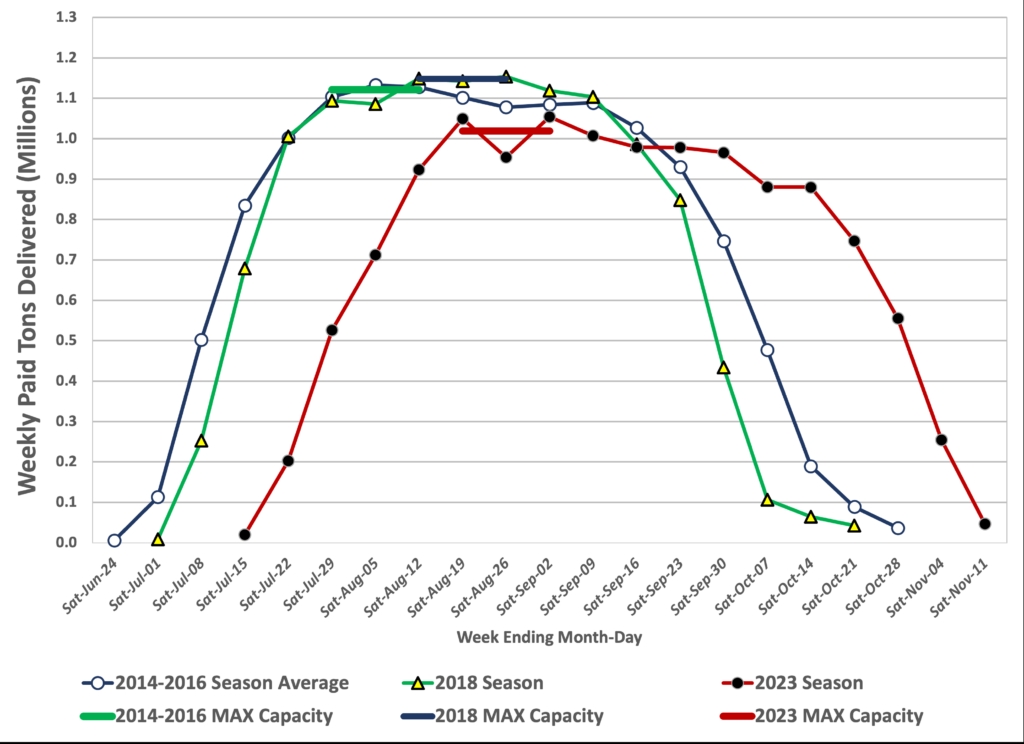

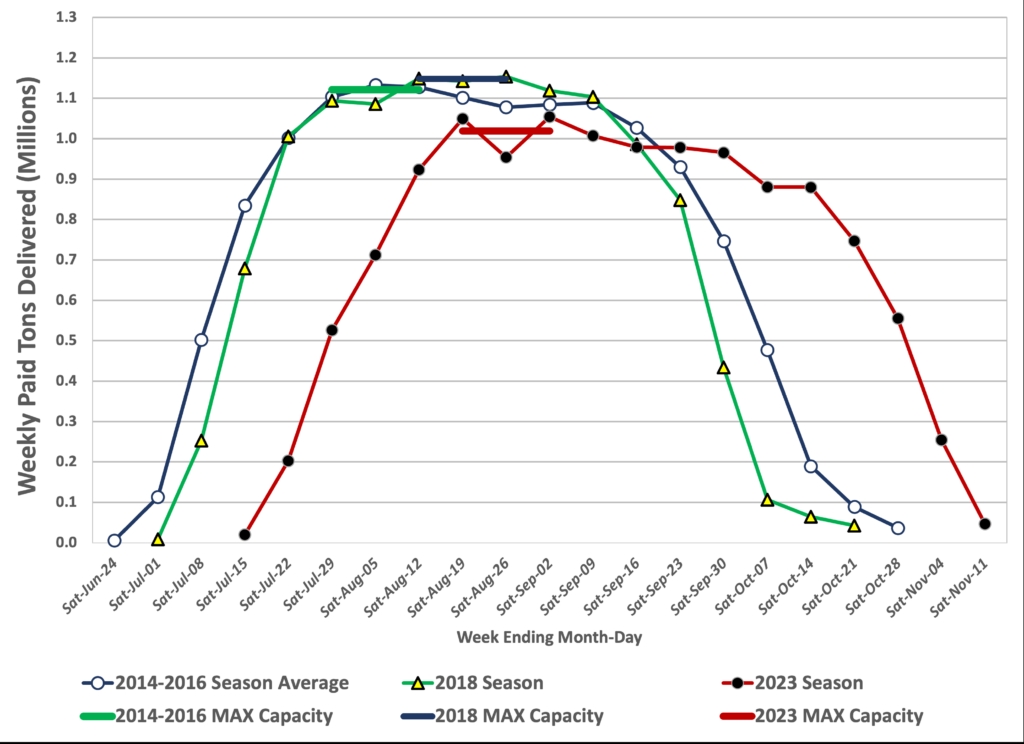

I mean, the 2023 crop was far from the norm. When we look at the circumstances of the crop, if you compare the 2023 delivery curve, let's say to the 2014, 2016 timeframe, the two things that jump at you are, number one, California has definitely had reduction in terms of its maximum peak weekly production capability. And that's to be expected given the plant shut downs that occurred back in 2020.

The other thing that immediately jumps out at you is the significant shift to the right moving further and further away from, you know, the first week of July and moving closer and closer to the middle of November. Once you pass September 30th, the risk, the uncertainty of being able to deliver the crop gets greater and greater and greater. If we look at the two reference periods that we talked about, they all had essentially delivered close to - let's say at least 82% and close to 90% of the total tonnage for the season, was delivered prior to October 1st.

So, in 2023, over 25% of the crop came in after October 1st. That shift to the right… That 25% of the crop was extremely risky, we were extremely lucky: we didn’t see the usual drop off in temperatures that we see beginning in early fall; we didn’t see the rains, even though maybe sporadic rains, but there can be some devastating rains that typically come in early fall. We didn’t see that.

So essentially the mild ideal growing conditions that we normality see in the July-August into mid-September timeframe just continued on through late September-October, and even into the first two weeks of November. It was just an unbelievable growing season for California, and without that 25% of the crop could have easily dropped off.

It could have been a much different outcome.

Right. So I think everybody's asking, what's going on in California? What is California gonna do next? And I think more specifically, if we look at how we got here, so where we are at with carry out inventories in 2023 as we ended that cycle? And then where are we forecasting ending inventories would be going into 2024? Because that'll really help set the table, I think, for where we think California is gonna go.

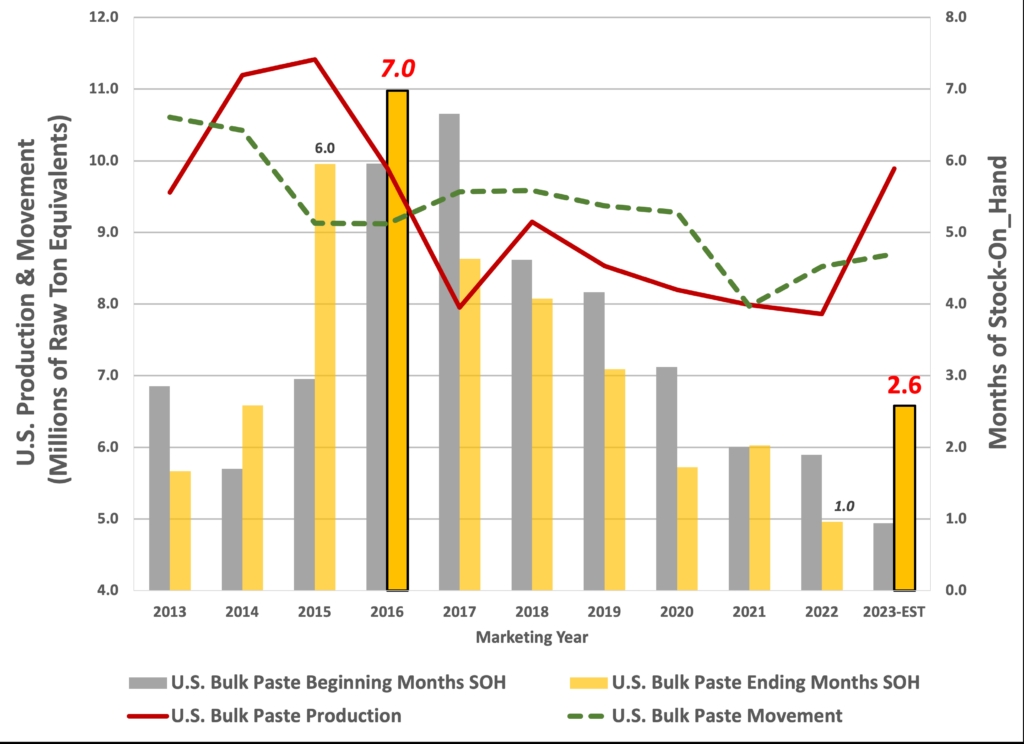

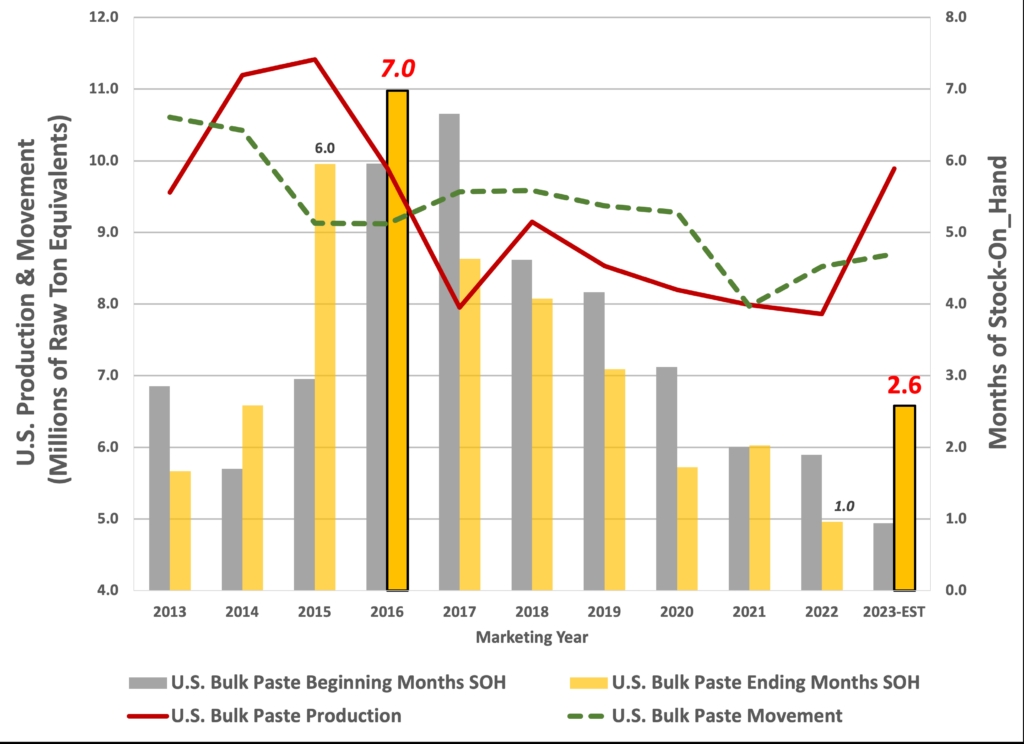

I mean, going back like you mentioned in the history, I think a good place to look back is the 2016 crop year, because that was also virtually right at 12.7 million short tons. So very, very comparable to what’s just happened in 2023. And if we go back to 2016, what we saw happen historically was that the beginning of a sustained downturn in the marketplace, both in terms of continuing production levels in California and in terms of market pricing in particular for bulk tomato paste. And so, an obvious question might be “well, then 2023 looks awful, a lot like 2016: is this what we should be expecting as we move into 2024 and beyond?”

And I mean, I think the answer to that is definitely no. If we go back and we look at 2016 - the inventory levels going into 2016 were already at record highs thanks to the two very, very large crops that happened in 2014 and 2015. So in both of those years, 2014, 2015, California production significantly exceeded movement of product within the US.

So inventories were already building up. And then 2016 was another year, a third consecutive year where production exceeded movement. So 2016 went out of the 2016 crop year with about seven months of inventory…

Pretty substantial!

You know, that means we wouldn’t have had to start processing tomatoes until sometime in January, assuming we could do that.

So now let’s fast forward to 2023 in terms of inventory positions, it’s virtually the opposite situation. Going out of 2022 into the 2023 crop year, we were at a record low level of inventory, at approximately just one month of stocks on hand. And if you think about that, that’s starting July 1st, given the relatively late season that we had, or the late start to the season that we had, one month of inventory starting July 1st is basically running on fumes. So we were at an extremely low inventory level. So we hit our 12.7 million tons similar to 2016, 12.7 million tons will be greater than what we expect total movement to be.

But if we look at what we expect movement to be, versus that 12.7 million tons, it should only add about one and a half months to stock on hand. So right now, our best estimate is that we'll be going out of the 2023 crop year into 2024 with - maybe about two and a half months of stock on hand.

And when we look back historically, that's a very average type of stock on hand position - it’s a pretty healthy balance. You know, it gets you past August and into early September in terms of coverage for your customers. And really, we wouldn’t want to be much lower than that. So certainly nothing close to being excessive in terms of the inventory position.

No, no kind of strong signal for a market downturn and a very, very, very different position than things were back in 2016.

In the context of California’s performance, now, I think we can kind of zoom out and look a little bit more at the worldwide production. And there was an increase in worldwide production even though California and China comprised a large amount of it, and the rest of the world did perform pretty good too.

At 44 million metric tons of production, you're looking at about a 10% increase, or a 10% overage relative to what movement is or global consumption is. Again, very similar to California, that should add somewhere around one and a half or so months of stock on to stock on hand. And so, again, very, very similar to California, our estimate is that globally global processors should also be looking at somewhere around 2.5 months of stock on hand going into the 2024 year. So while a significant increase in inventory relative to where things were at the beginning of the 2023 year, when we look back at 2015, 2016, 2017, significantly lower inventory positions than were in existence at that time.

So the inventory position doesn’t seem excessive; it doesn’t seem like it should be signaling any kind of strong market downturn, or any panic selling on the part of processors. It should be a welcome signal to customers that the supply chain has added back some buffer stock. And the kind of potential supply chain disruptions that people were facing in late 22, early 2023 have probably gone away that, customers don’t, shouldn't have to be concerned about that.

And this buffer will essentially help bridge, you know, or act as an insurance against some of these potential supply chain issues that could result from weather related losses.

Absolutely. You know, for our customers, I think the name of their game is their consumer not losing shelf space, making sure their product is available to their consumer whenever their consumer wants it. And so as primary processors, you know, we need to make sure we have got the ingredient inventory that can be there when our customers need it.

Well, at least in the short term part of this reliability, for California is certainly enhanced by having good reservoir position at this point.

Reservoirs are about 70% full as of today, which is 120% of the average. So, we are looking relatively good on water, at least for this coming year. Who knows what the next two, three years looks like? But some of those elements of reliability are certainly there and will help contribute to, you know, providing some stability into 2024 as well.

Yeah, I think it looks pretty promising.

Well, definitely appreciate all your insights, Mark. They're really well timed, really thoughtful and, and certainly help us understand quite a bit more of what’s happening in the market or in the world around us.”

Some complementary data

Some complementary data

Video is available here.

Sources: Morningstar Company

Very lucky today to have Mark De La Mater with us, our colleague Mark, to provide some additional insights and analysis on to some of the things that happened in the 2023 crop and how they’ll translate into industry structure and some of the impacts they may have on the market, and things we need to watch as we move forward.

Very lucky today to have Mark De La Mater with us, our colleague Mark, to provide some additional insights and analysis on to some of the things that happened in the 2023 crop and how they’ll translate into industry structure and some of the impacts they may have on the market, and things we need to watch as we move forward.

Some

Some