After a significant decline between 2014 and 2019, the US trade balance for tomato products is tending to stabilize, in a context marked by inflation and the industry's difficulties in meeting demand in full.

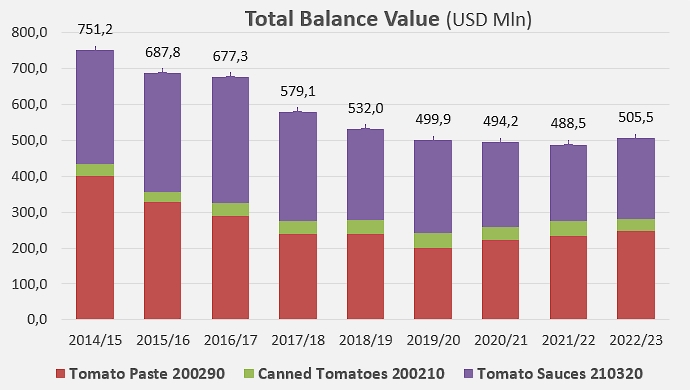

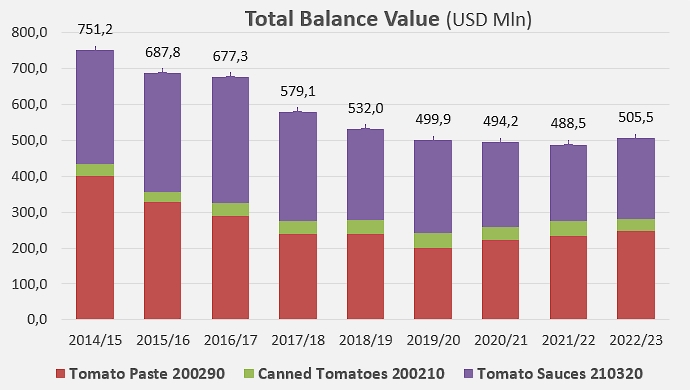

Sales generated by US exports of tomato products have fallen sharply in recent years, mainly due to the decline in the quantities that the sector has been absorbing. The total value of exported products fell from around USD 750 million in 2014/2015 to just over USD 500 million over the last marketing year (June 2022 – May 2023). Over 90% of the cumulative value comes from foreign sales of sauces & ketchup and pastes, with a slight upturn in this latter sector over the last four years.

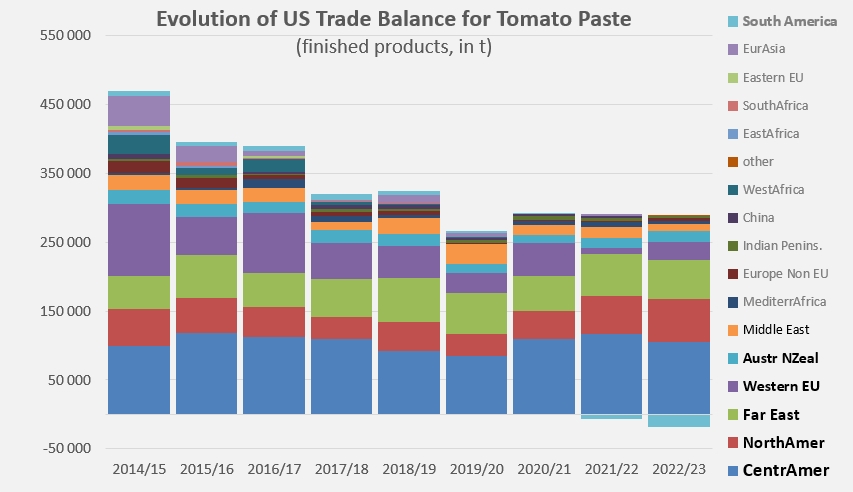

More than three-quarters of the pastes exported over the last three years (280,000 t of finished products on annual average) were destined for markets in Central America (111,000 t, 39%), North America (53,000 t, 19%) and the Far East (55,000 t, 20%). Over the last two years, the US trade balance for tomato paste has seen the emergence of relatively marginal but entirely new import flows from Chile and Peru.

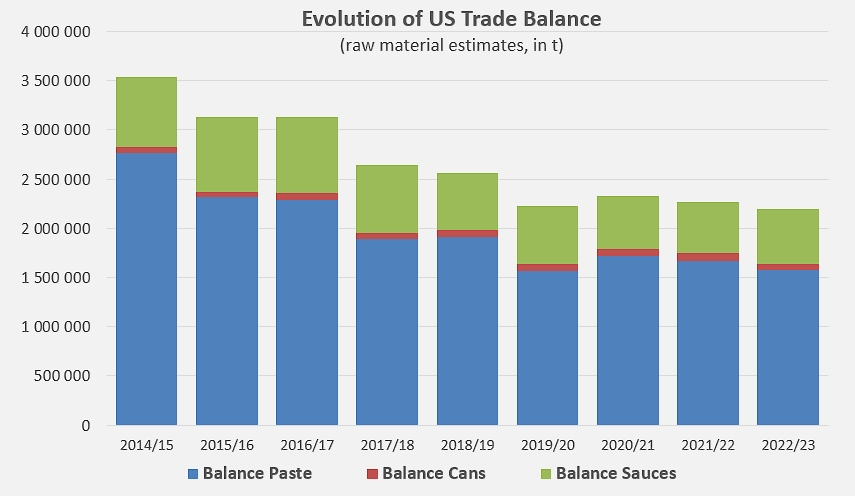

A reasonable estimate of the US trade balance in tomato products shows that the quantities of fresh tomato mobilized in exports have almost stabilized in recent years at an average of around 2.25 million tonnes.

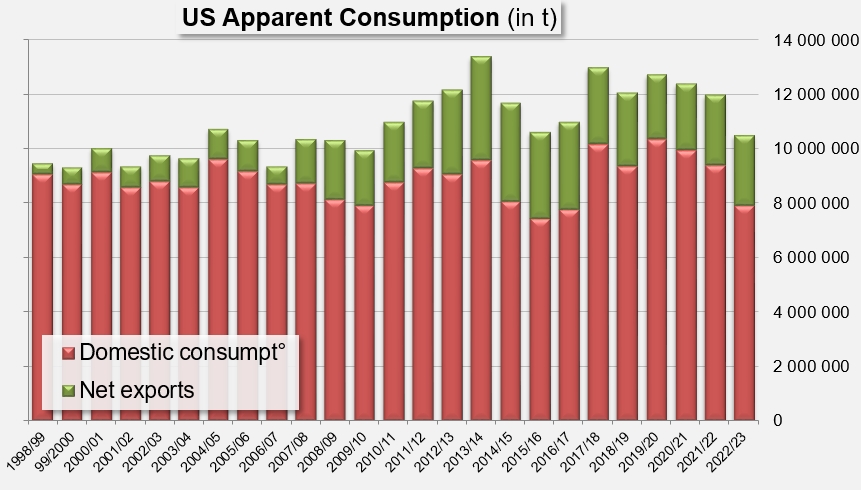

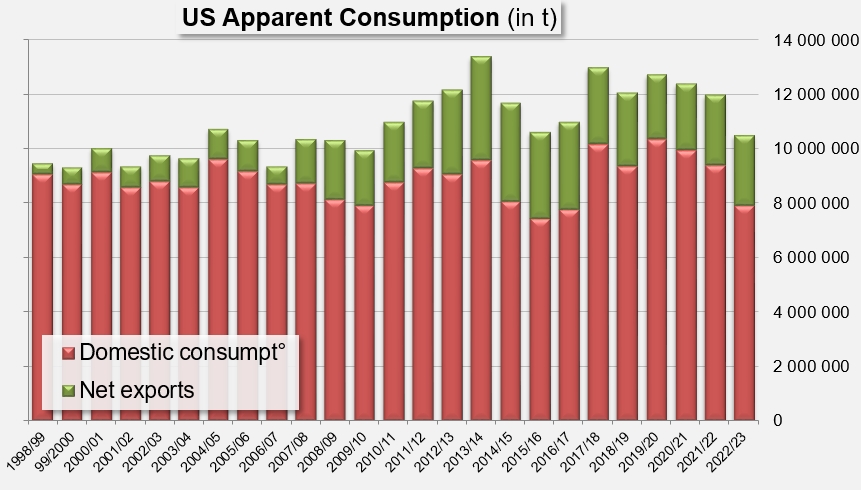

At the same time, for the third year running, apparent annual US disappearance has fallen from almost 12.7 million t in 2019/2020 to just over 10.5 million t in 2022/2023. However, this pattern, in addition to what it suggests about domestic consumption, has taken place in a context of constrained production and marketing, so that it is difficult to know whether the decline in apparent disappearance is the result of real market contractions dictated by purchasing behavior, or whether the downturn is merely the consequence of the reduction in the quantities of raw material processed, and therefore of a shortage of finished products in sales channels.

In fact, the level of apparent disappearance recorded in 2022/2023 was 15% lower than over the previous three years. Whatever the causes, it has to be said that the decline of apparent disappearance has been more brutal in terms of its domestic component than of its foreign component. The quantities mobilized last year by US foreign sales of tomato products were approximately 5% higher than the average for the period running 2019/2020–2021/2022, while the quantities absorbed by the US domestic market fell by around 15% compared with the same period.

To quote our colleague Aaron Giampetro (MorningStar, Tomato Bites August 2, 2023), "recent study of Nielsen IQ Data and observations from the CLFP stock on hand report from June 30th indicate that consumption is facing headwinds. In the retail sector, CPG companies have noticed revenue growth from higher prices, but unit sales have softened. This trend is even more significant in the organic tomato product market where consumers are reducing purchases or switching to private label options and considering conventional goods instead of organic. Turning to food away from home, there are still 80,000 fewer food service workers employed than pre-pandemic levels, and the pace of wage growth for these jobs is slowing. This may be an adaptation to softer consumer demand and structural changes from efficiency investments and partnerships with delivery aggregators.”

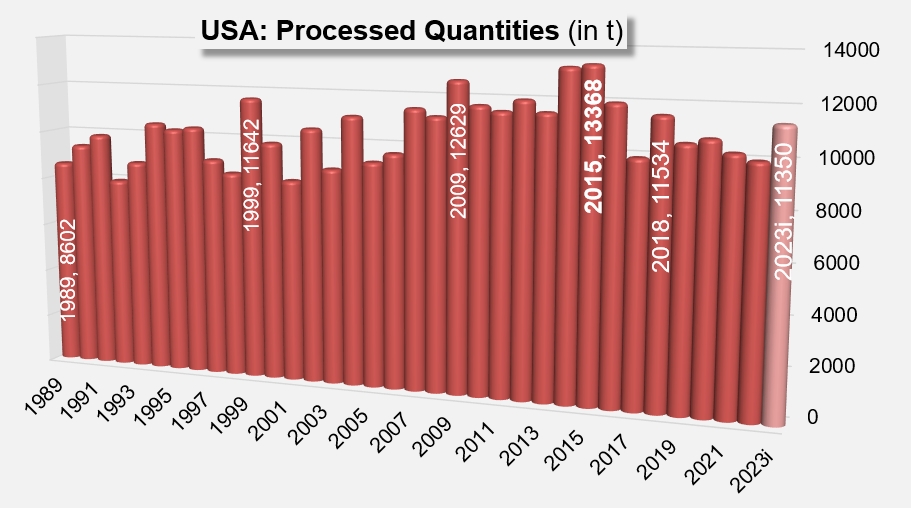

If achieved, the processing outlook for the US industry as a whole for the current season (11.35 million metric tonnes, val. August 2023) will raise US activity to a level not seen since 2018, due in particular to climatic upheavals. In a market awaiting volumes on a global scale, such a result could bring about notable changes in consumption dynamics, including on a national scale as well as a local scale.

Some complementary data

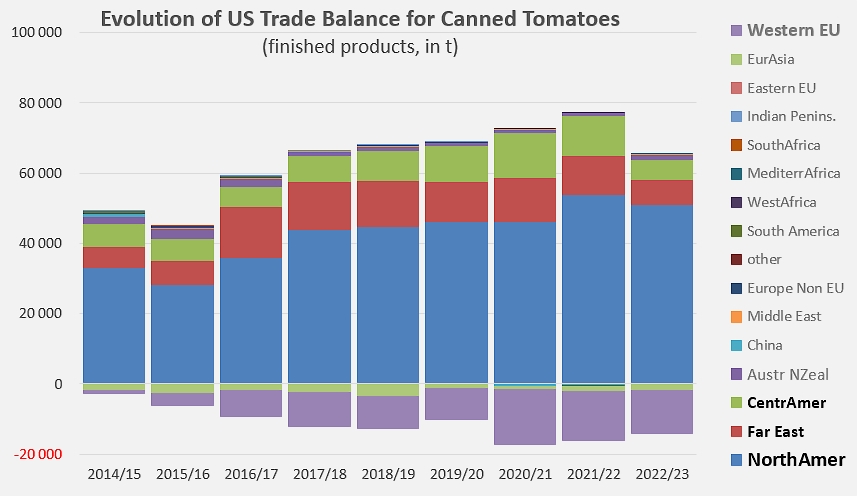

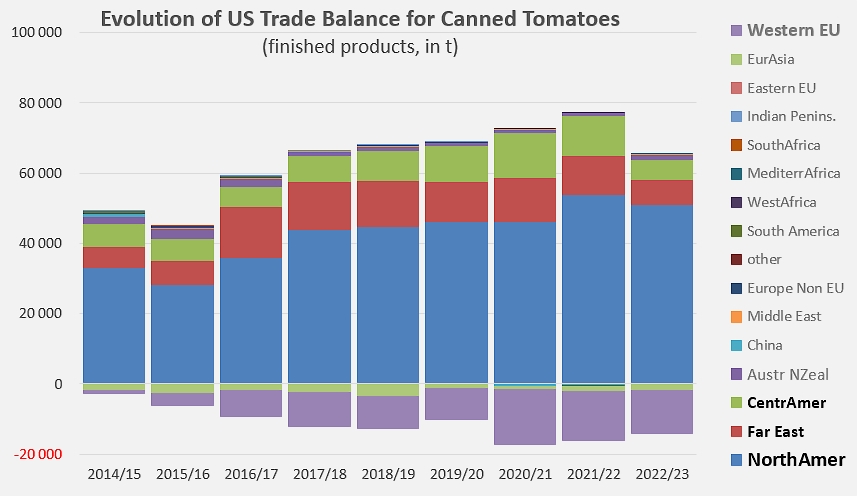

Evolution of the US trade balance for canned tomatoes: the North American market is a privileged outlet for the US industry, but the United States also remains an important market for products of European origin.

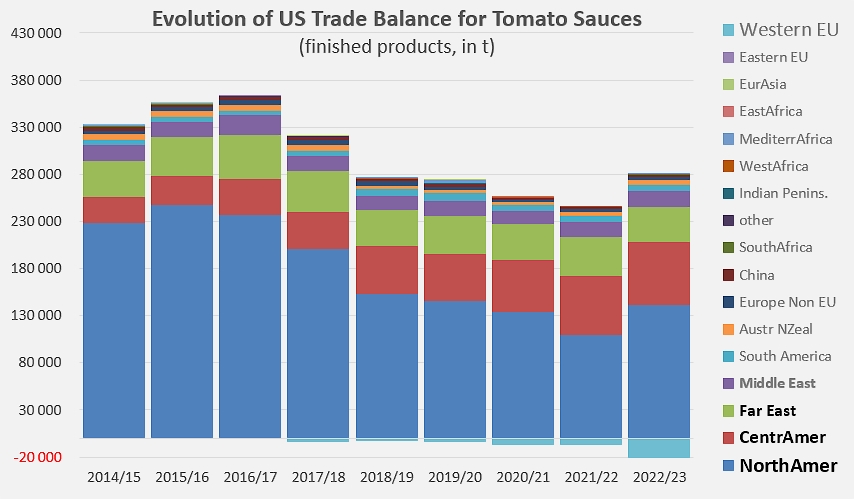

Trends in the US trade balance for tomato sauces & ketchup: North America, Central America and the Far East account for almost all US exports of sauces; imports from the European Union have been appearing over the last two or three years.

Evolution of quantities processed by the US industry since 1989 and outlook for processing in 2023.

Sources: Trade Data Monitor, WPTC