Progression is nonetheless shifting focus

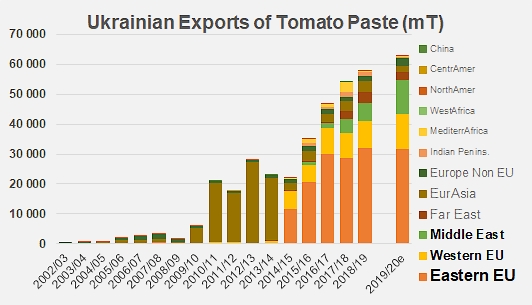

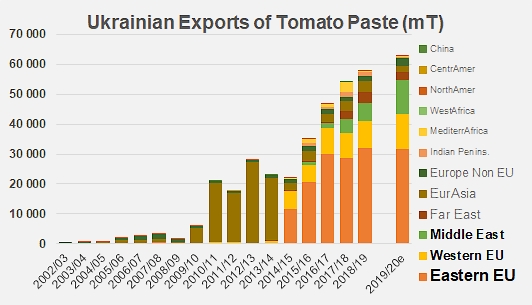

Unless there is a radical change in Ukrainian export dynamics for pastes in May and June, the result for the 2019/2020 marketing year could see an increase of about 9% compared to that of 2018/2019.

As of 30 April 2020, the quantities of paste exported by the Ukrainian industry over the first ten months of the marketing year amounted to 52 500 metric tonnes (mT), an increase of more than 11% compared to the 47 000 mT exported over the corresponding period of the previous year (July 2018-April 2019). If the pace of foreign sales has persisted over the last two months of the current marketing year, total export volumes could exceed 63 000 mT in 2019/2020.

It is difficult at the moment to take account of a possible "CoVid effect", similar to that described by a number of Turkish operators, given that these dynamic were in any case already rapidly expanding in previous years. These results will have to be refined in coming months, but it is already likely that the Ukrainian performance as of 30 June 2020 will be almost 20% higher than the average of the previous three years.

It is also important to note that this increase has been based on an intensification of trade flows to Germany and Sweden, the Czech Republic and Romania, and especially to the main buying countries of the Middle East (Israel, the Emirates, Bahrain, Saudi Arabia, Jordan and Oman), while several previously important destinations have visibly slowed the pace of their supplies from Ukrainian sources (Poland, Belarus, Pakistan, Indonesia, etc.).

Some complementary data

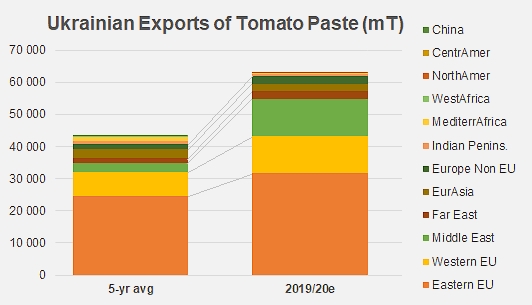

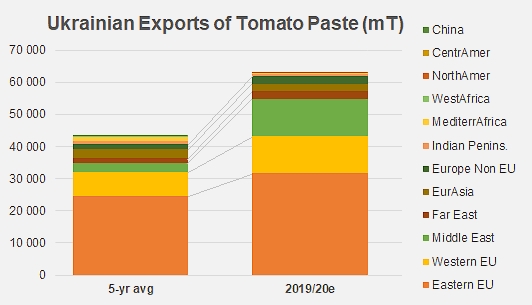

Comparison of average levels of operations for the past five marketing years with projected levels of operations in 2019/2020.

Source: Trade Data Monitor LLC