Press release

, François-Xavier Branthôme

Market demand and the reduction of conversion time to organic practices have led to an increase in the surface areas planted with organic tomatoes, but a greater vulnerability of production and increasing inflationary pressure on consumption could slow down this sector.

From the article published in L'Informatore Agrario n.6/2023 "Organic tomatoes, what prospects after growth?", by Gabriele Canali and Gloria Zini.

The remarkable development of organic food production in recent years has included processed tomato products. The data for northern Italy collected by the Pomodoro IO for this part of the country clearly demonstrates this. Until 2015, surface areas planted with organic tomatoes in northern Italy varied between 1,000 and 1,300 ha, with a share of total areas dedicated to processing tomatoes of about 3% to 4%. These crops really took off after 2016: from 1,309 hectares cultivated organically in 2015, the trend continued to increase to 4,077 hectares in 2022. The same has been true for the share of organic in the total cultivated surface areas in northern Italy, which rose from 3-4% in 2015 to 11% in 2022.

The remarkable development of organic food production in recent years has included processed tomato products. The data for northern Italy collected by the Pomodoro IO for this part of the country clearly demonstrates this. Until 2015, surface areas planted with organic tomatoes in northern Italy varied between 1,000 and 1,300 ha, with a share of total areas dedicated to processing tomatoes of about 3% to 4%. These crops really took off after 2016: from 1,309 hectares cultivated organically in 2015, the trend continued to increase to 4,077 hectares in 2022. The same has been true for the share of organic in the total cultivated surface areas in northern Italy, which rose from 3-4% in 2015 to 11% in 2022.

The reasons for the success of organic production

There are two reasons for this growth.

Firstly, the increase in market demand. In recent years, the entire organic sector has seen an increase in demand in quantitative terms, both because of growing consumer interest and because of the increasingly massive arrival of these products on the shelves of the big retail chains.

Until a few years ago, organic food was mainly sold in specialized stores, whereas in recent years, the presence of organic produce in large retail outlets has allowed a larger number of consumers to be reached, and though they are perhaps less loyal to organic products, they are overall more likely to develop this market significantly, at least in terms of volumes.

The second reason is that it has been easier to enter organic farming thanks to a reduced or canceled conversion period.

For farms having complied with agro-environmental measures during the previous three years, for example related to the maintenance of mixed-grass meadows, farmers already have sufficient documentation to support their application, which facilitates the process. This has reduced the cost and time to enter the certified organic farming system for many farmers who, faced with increasing demand, have decided to take the plunge.

The cultivation of organic tomatoes in northern Italy is historically linked to the easternmost part of the territory, namely the provinces of Ferrara and Ravenna.

It is in this geographical context that organic tomato products have historically developed and, in 2022, the bulk of organic production was still clustered in these two provinces. The data collected by the IO Pomodoro Nord evaluates the surfaces dedicated to organic crops in the province of Ferrara at 2,484 hectares and in Ravenna at 636 hectares. The province of Parma follows at a distance, with only 246 hectares; then all the other regions with less than 100 hectares each (Figure 1).

What to expect in the future?

As we know (see our related articles below), the European Union's "Farm to Fork" strategy has set a target for organic production to reach the threshold of 25% of the total cultivated area by 2030. To this end, the National Strategic Plan has also consolidated the resources available for the organic sector, adding nearly EUR 2 billion by the time of the new CAP, from 2023 to 2027. There is therefore no lack of resources to support the sector.

But will this support be enough to stimulate growth? There is no doubt that the market remains the main driver of the sector and therefore also of the farmers' activity. Growers of tomatoes for processing are professionals and organic production requires them to have even greater specific skills to obtain economically coherent results in the face of the production hazards they inevitably face.

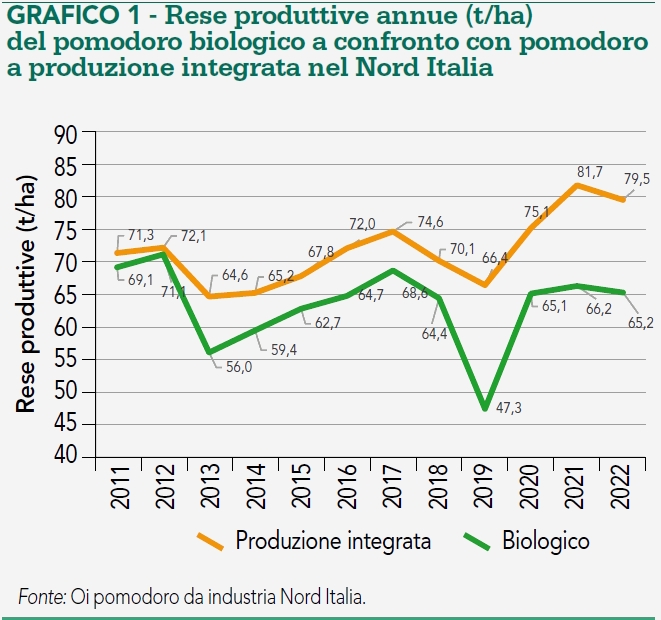

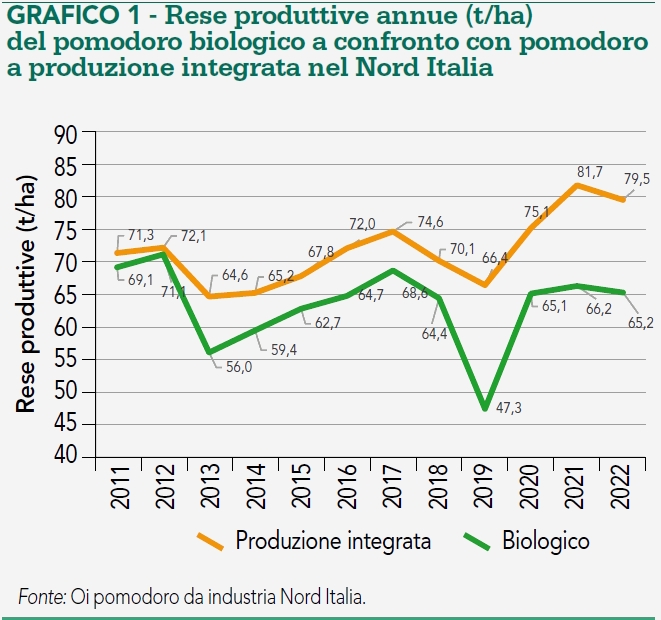

The production yields of organic products (Graph 1) are indeed lower than those obtained through integrated production methods, with high production costs, and the significantly higher (sales) price is not always sufficient to guarantee adequate profitability. But it is the increased agricultural risk that makes growers shy and cautious, especially those who have just gone organic.

The most important factor, once again, seems to be demand. Inflation in both the Italian and European markets in 2022 and early 2023 is dampening demand and, as a result, seems to be pushing processors towards a strategy of consolidating the quantities of organic products produced and marketed, rather than towards further growth, which currently seems unlikely.

On the other hand, after the strong increase of the last few years, a period of slower growth or stability could be beneficial for the market, in order to consolidate the path taken so far by organic products.

Perhaps with a view to a new leap forward in the years to come.

A second article presenting the figures of organic tomato processing industry for the entire Italian territory will be published very soon on the Tomato News website.

Source: informatoreagrario.it

The remarkable development of organic food production in recent years has included processed tomato products. The data for northern Italy collected by the Pomodoro IO for this part of the country clearly demonstrates this. Until 2015, surface areas planted with organic tomatoes in northern Italy varied between 1,000 and 1,300 ha, with a share of total areas dedicated to processing tomatoes of about 3% to 4%. These crops really took off after 2016: from 1,309 hectares cultivated organically in 2015, the trend continued to increase to 4,077 hectares in 2022. The same has been true for the share of organic in the total cultivated surface areas in northern Italy, which rose from 3-4% in 2015 to 11% in 2022.

The remarkable development of organic food production in recent years has included processed tomato products. The data for northern Italy collected by the Pomodoro IO for this part of the country clearly demonstrates this. Until 2015, surface areas planted with organic tomatoes in northern Italy varied between 1,000 and 1,300 ha, with a share of total areas dedicated to processing tomatoes of about 3% to 4%. These crops really took off after 2016: from 1,309 hectares cultivated organically in 2015, the trend continued to increase to 4,077 hectares in 2022. The same has been true for the share of organic in the total cultivated surface areas in northern Italy, which rose from 3-4% in 2015 to 11% in 2022.