Transcript of the presentation by Manuel Vazquez (CONESA) during the 2022 Tomato News Conference held in Parma on 25 October 2022

“I will talk about European policies and challenges for tomato processors.

“I will talk about European policies and challenges for tomato processors.

First of all, a few words about TomatoEurope. The association represents industrial tomato processors from Italy, Spain, Portugal, Greece and France, covering about 95% of the European industry. It was founded in 1979, as an umbrella association of national associations, indirectly representing more than 200 tomato processing entities.

TomatoEurope is a member of the EU Advisory Group on Fruit and Vegetables and the Forecast Working Group for Tomatoes.

Today, I will be talking about the Green Deal and how it will impact our sector, our industry and our farmers.

The Green Deal is a set of political initiatives taken by the European Union with the objective of achieving climate neutrality within the European Union by the end of 2050. So it is a huge issue. We have to focus basically on two initiatives coming from the Green Deal: that is the “Farm to Fork” Strategy and the “Fit for 55”, with the challenges and opportunities these two initiatives represent for our sector.

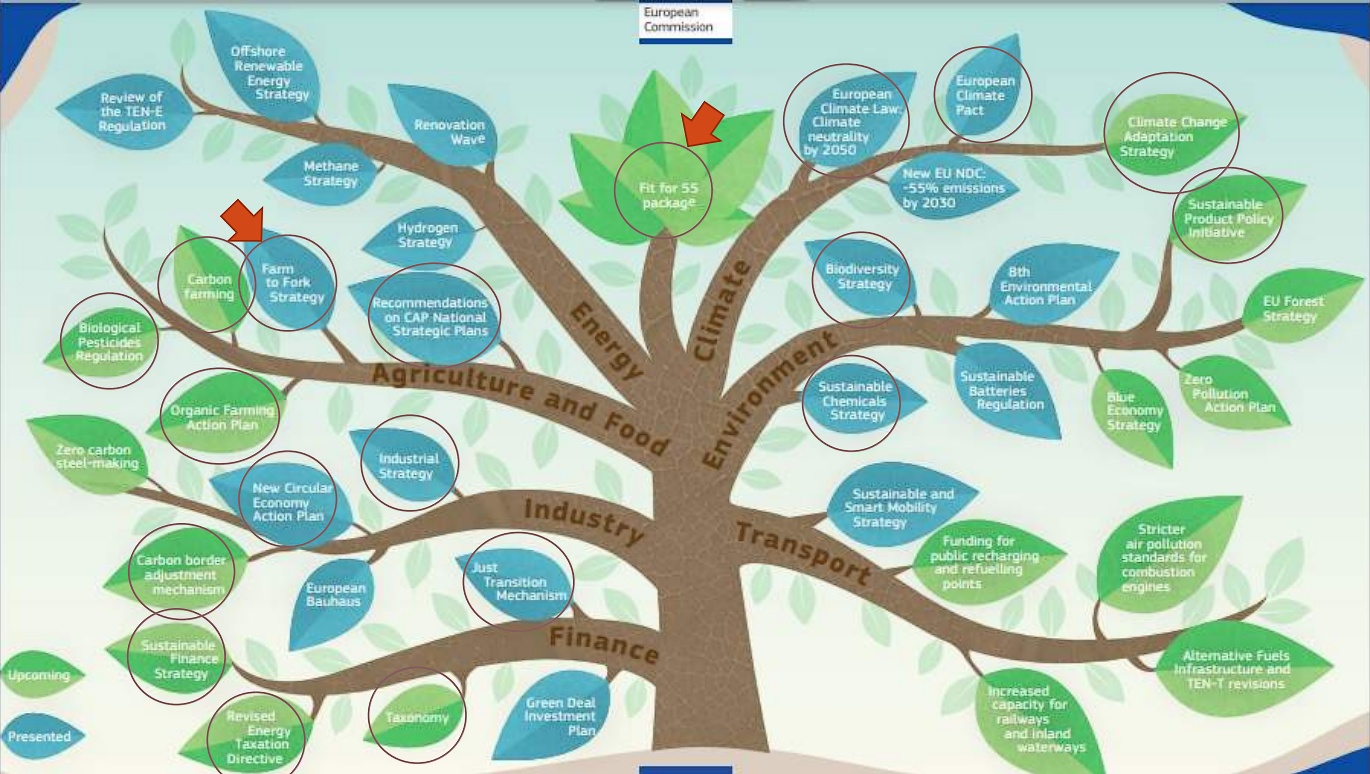

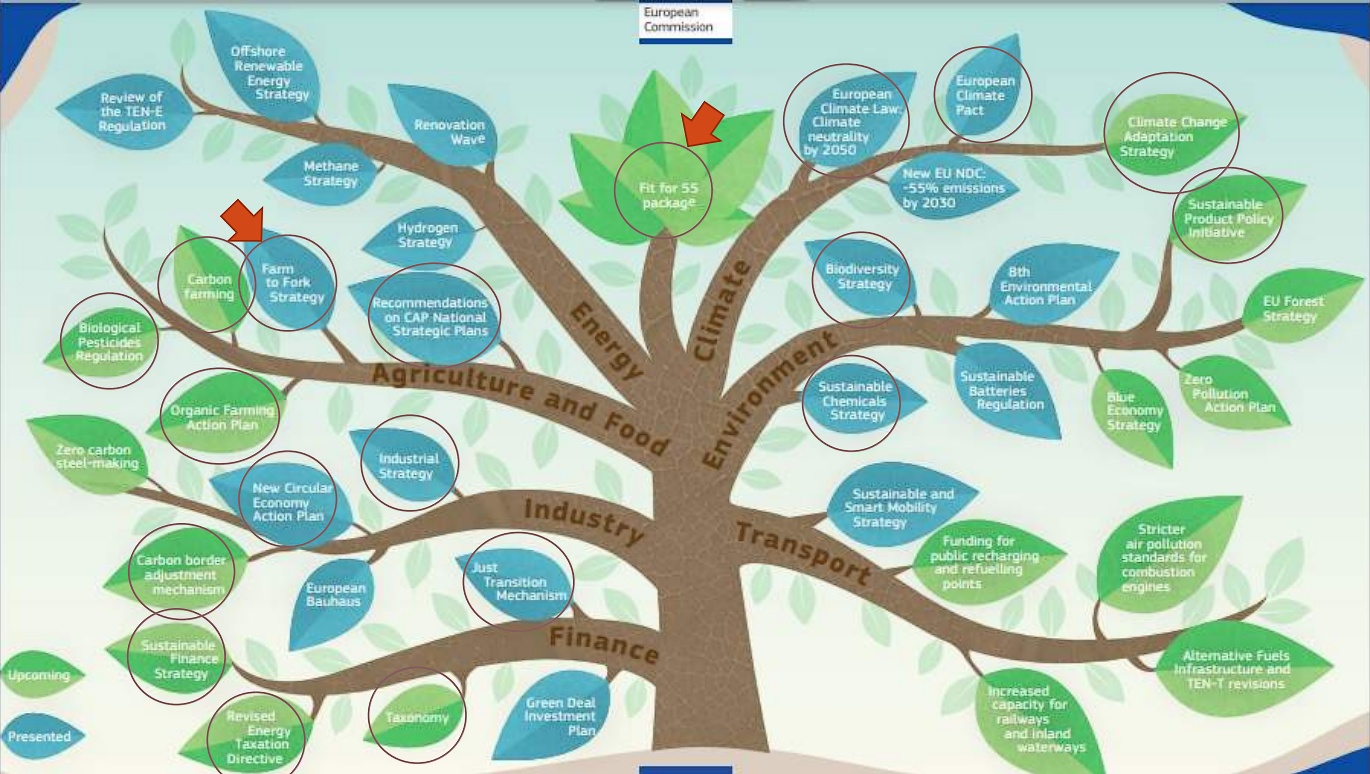

This slide is something our Secretary Marco Baldoli always presents to us to let us know how complicated the Green Deal is, and how many initiatives are coming from it. This tree represents the sectors that could be impacted by the initiatives and each leaf represents one initiative, so you can see how many initiatives there is in this Green Deal.

The leaves circled with red are initiatives that can impact our sector. We are going to focus on the two initiatives I have already mentioned – the “Farm to Fork” Strategy and the “Fit for 55” Strategy.

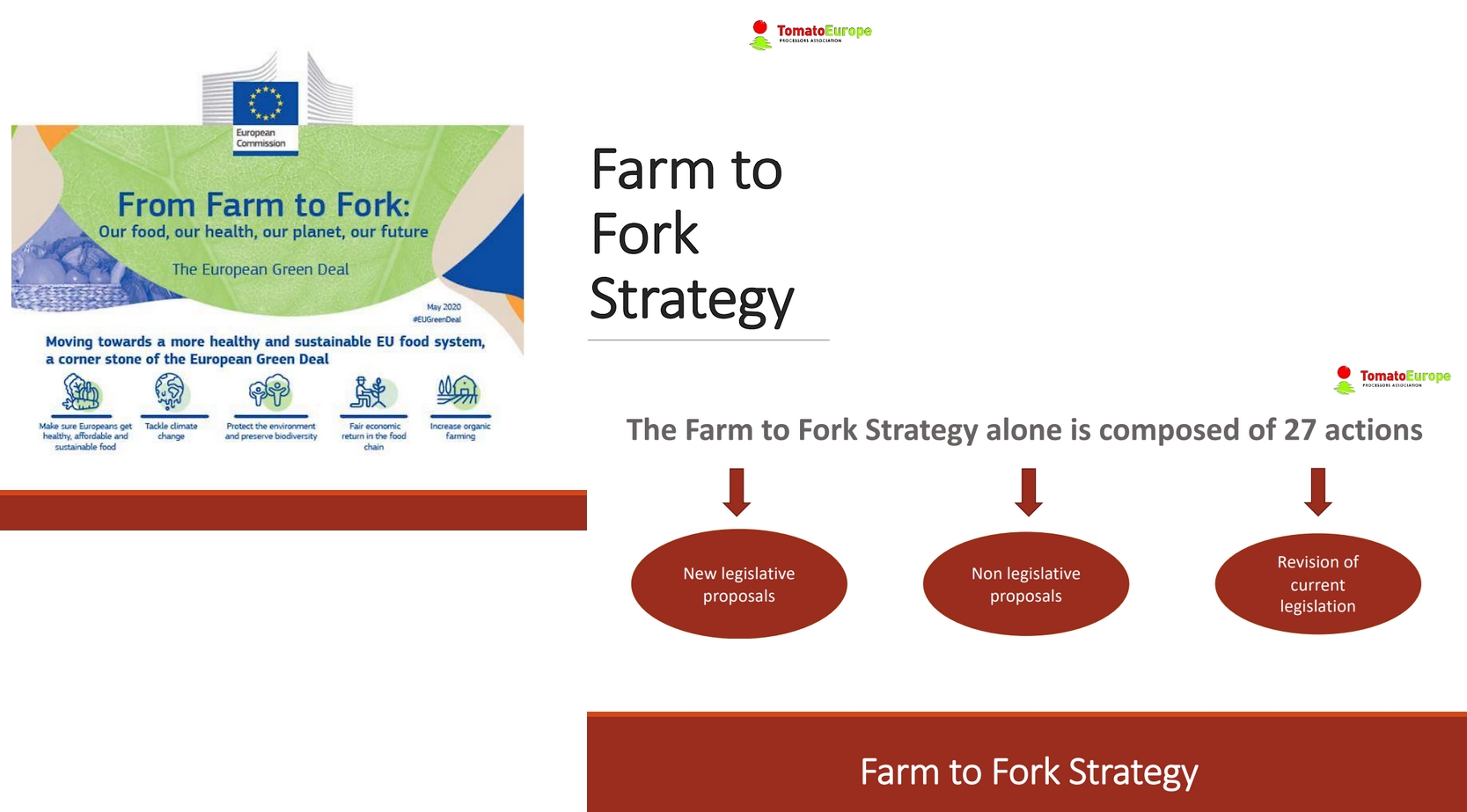

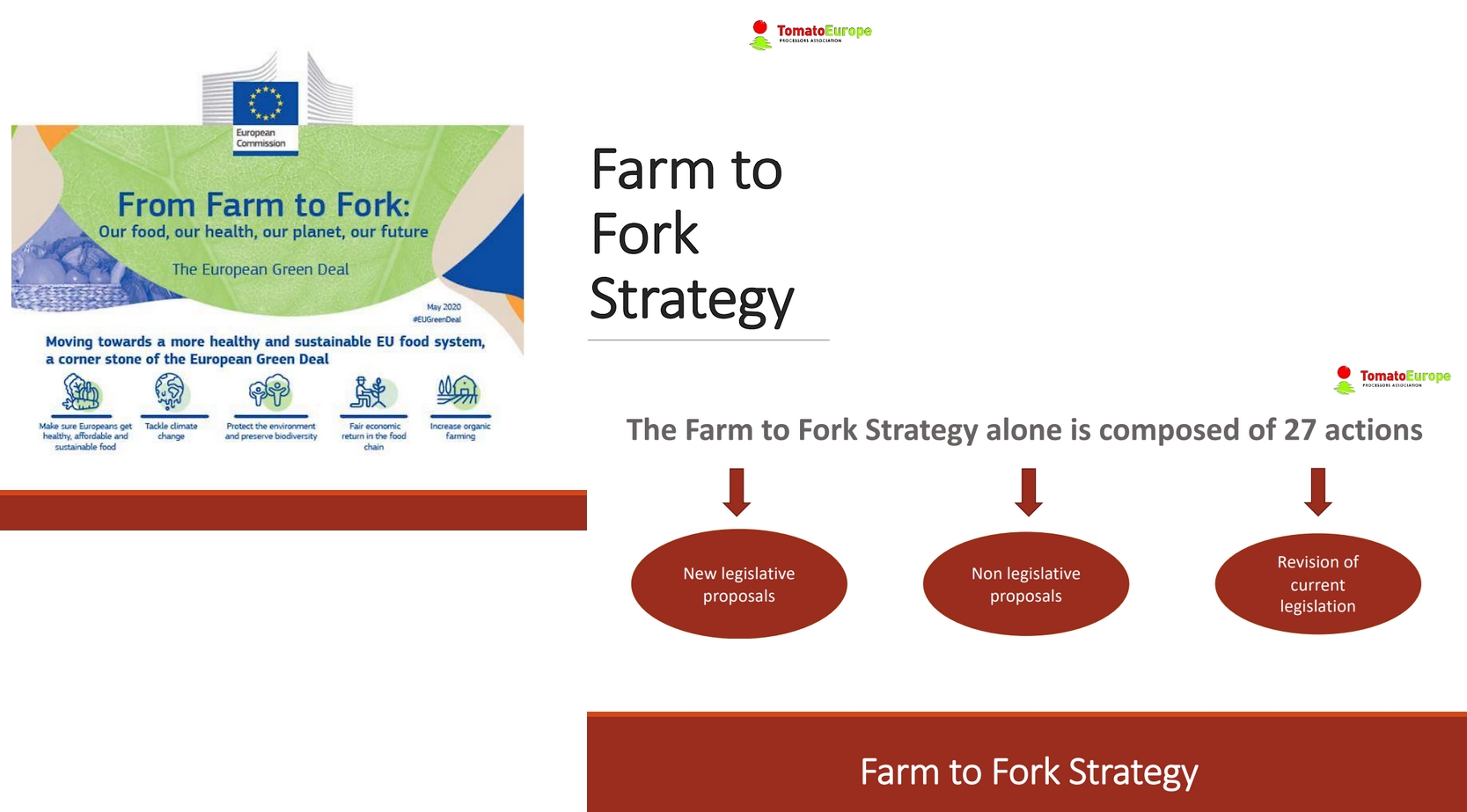

This is a copy of a European Commission book where they set up “From Farm to Fork: our food, our health, our planet, our future – the European Green Deal: Moving towards a more healthy and sustainable EU food system, a cornerstone of the European Green Deal”.

I mentioned that each leaf of the tree is an initiative: just the “Farm to Fork” initiative is composed of 27 actions – you can imagine how many actions are part of the total tree.

The “Farm to Fork” Strategy is composed of new legislative proposals, non-legislative proposals and a revision of current legislations.

Here is a statement from Frans Timmermans, the Executive Vice-President of the European Commission. I think it is useful to read it. “The coronavirus crisis has shown how vulnerable we all are, and how important it is to restore the balance between human activity and nature. At the heart of the Green Deal, the Biodiversity and “Farm to Fork” strategies point to a new and better balance of nature, food systems and biodiversity – to protect our people’s health and well-being, and at the same time to increase the EU’s competitiveness and resilience. These strategies are a crucial part of the great transition we are embarking upon.”

The European Union is absolutely committed to move on with all these initiatives. The objectives of the “Farm to Fork” strategy are covering things like “Make sure Europeans get healthy, affordable and sustainable food”, “Fair economic returns in the food chain”, “Tackle climate change”, “Protect the environment and preserve biodiversity” and “Increasing organic farming”.

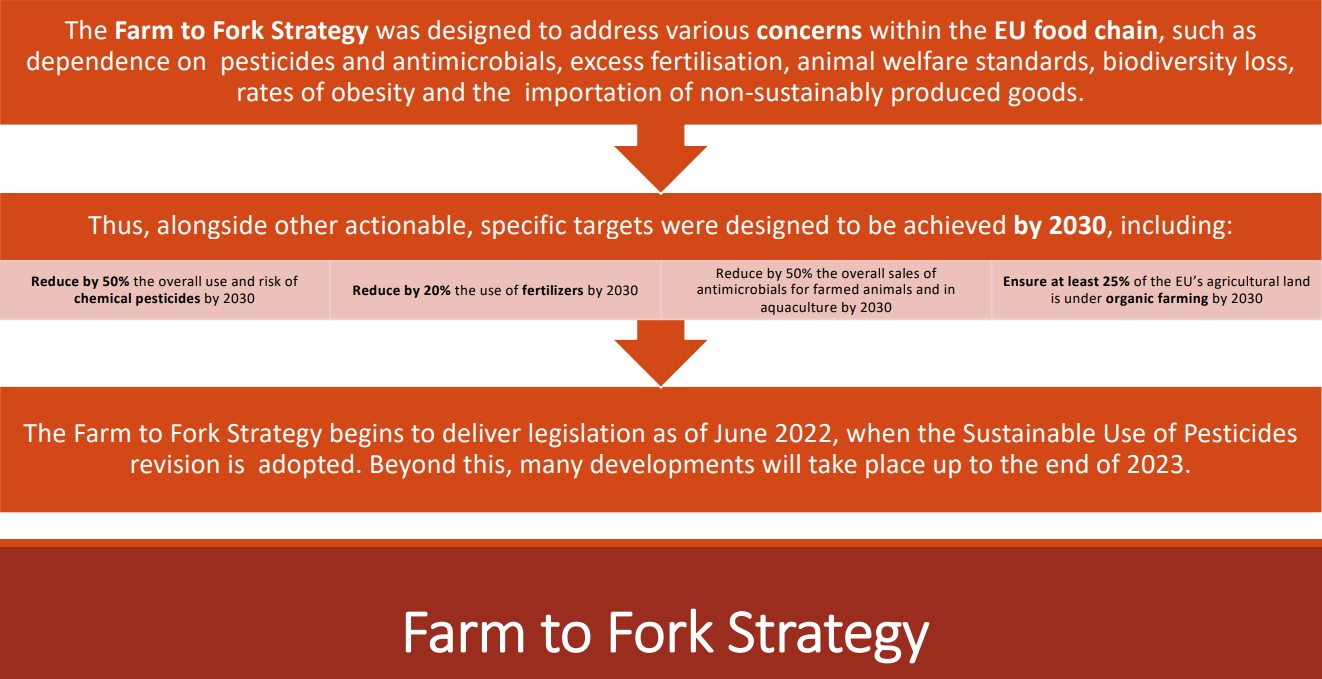

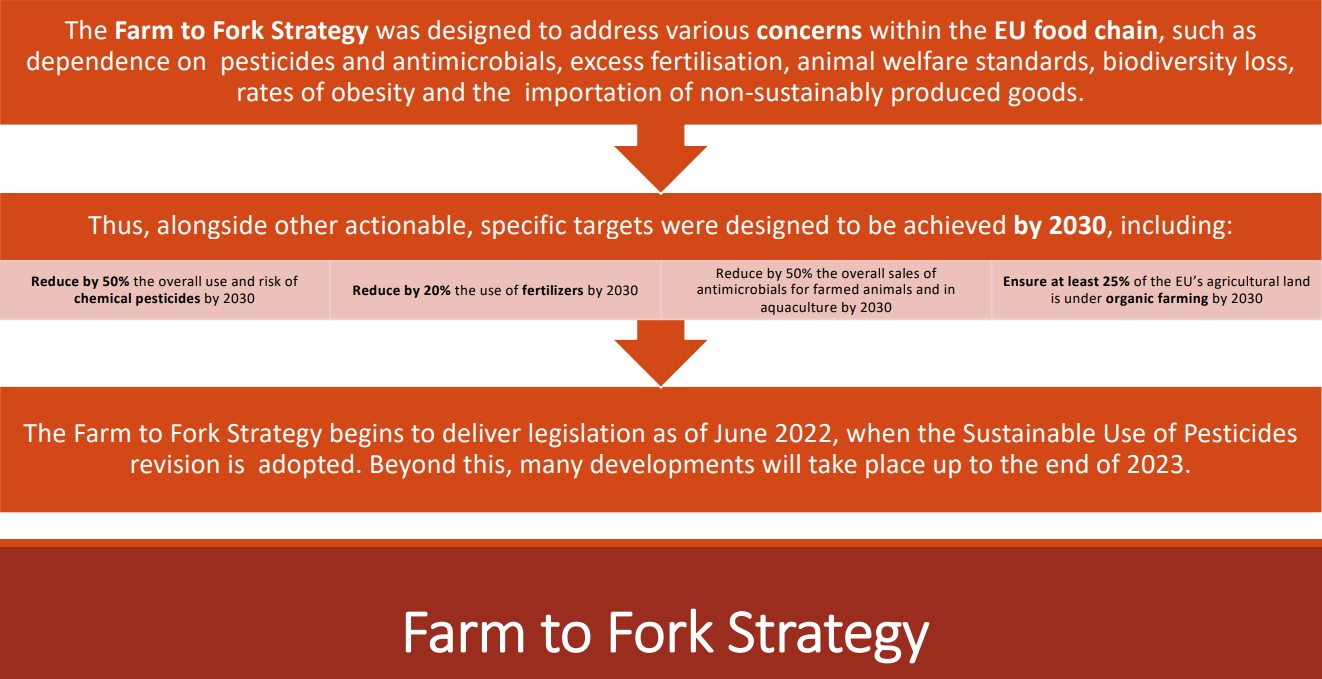

The “Farm to Fork” Strategy was designed to address various concerns within the EU food chain, such as the dependence on pesticides and antimicrobials, excess fertilization, animal welfare standards, biodiversity loss, rates of obesity and the importation of non-sustainably produced goods.

Actions that can impact our sector and that need to be achieved by 2030 for instance aim to reduce by 50% the overall use of chemical pesticides, to reduce by 20% the use of chemical fertilizers and – this could have an impact on our sector – to ensure that at least 25% of the European Union’s agricultural land is under organic farming. So you can imagine what will be the costs and what will be the impacts if we need to farm 25% of our sector under organic farming principles.

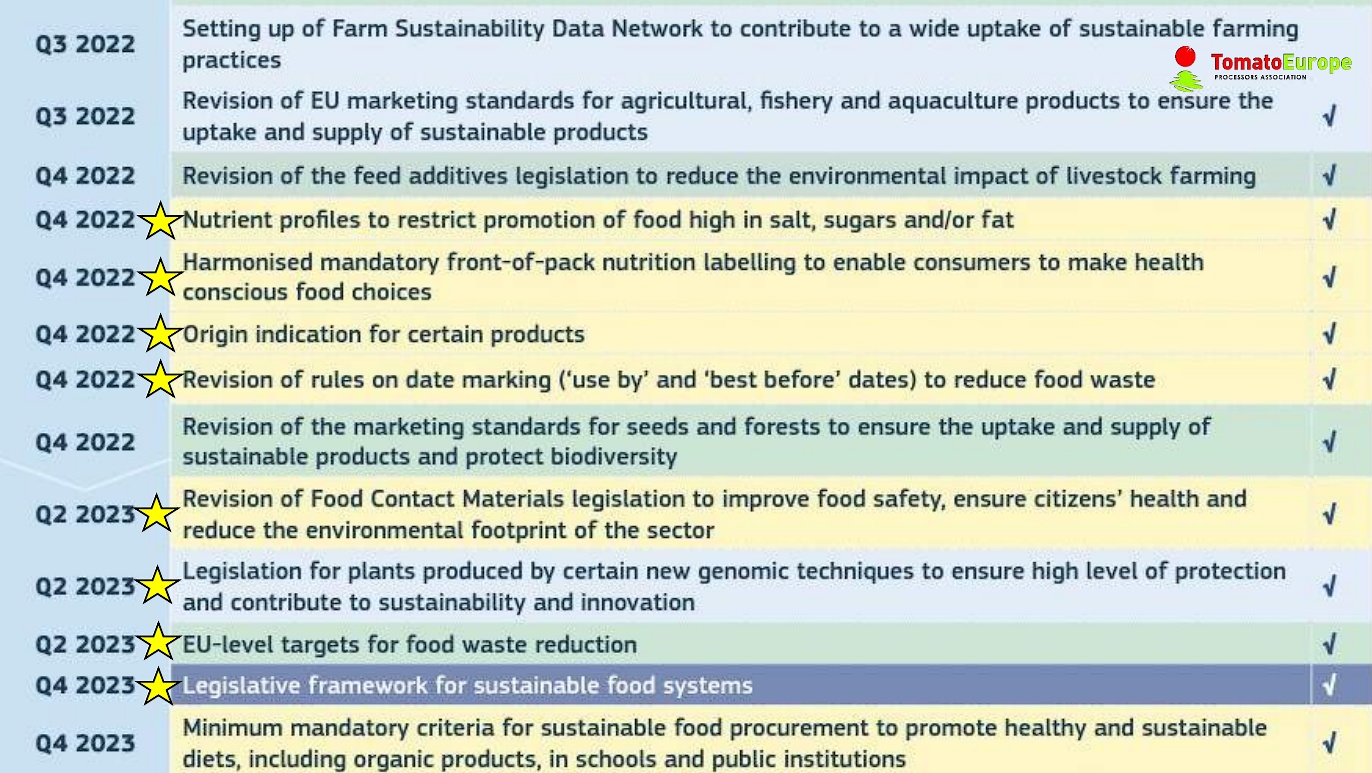

The “Farm to Fork” legislation started to be delivered in June 2022 and by the end of 2030, there will be a lot of initiatives already legislated.

Now we will have a look at three initiatives that could represent a threat to our sector and then we will have a look at three initiatives that can represent opportunities for our sector.

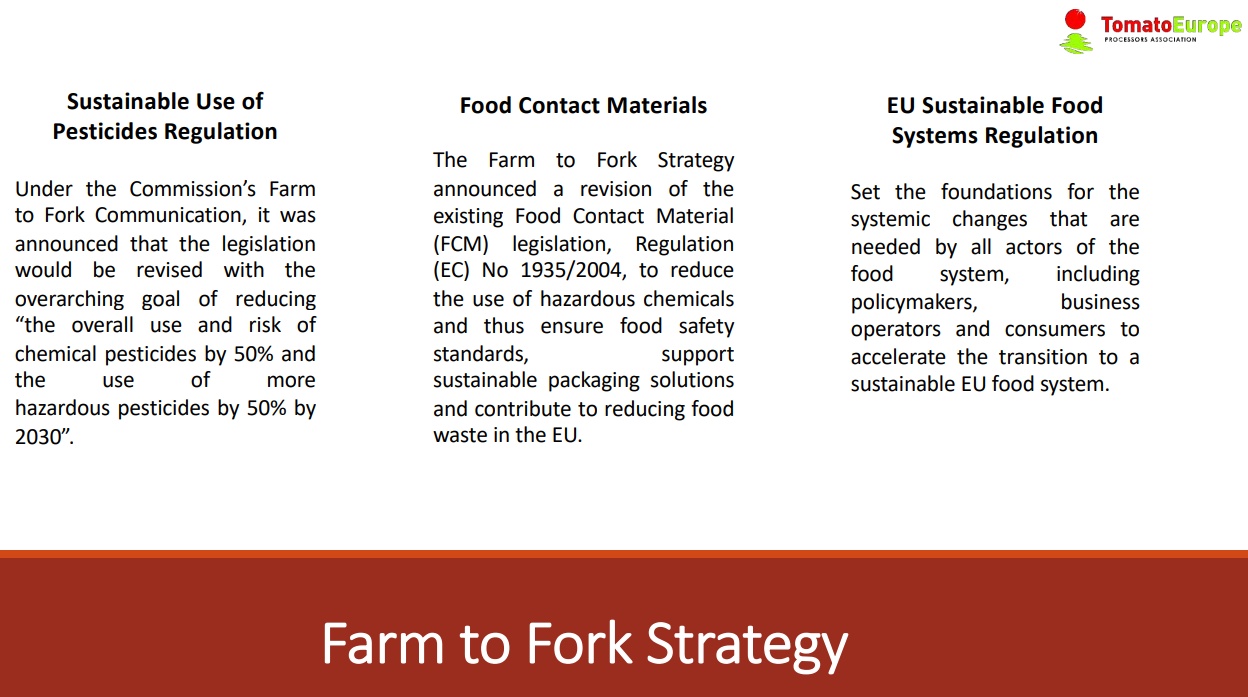

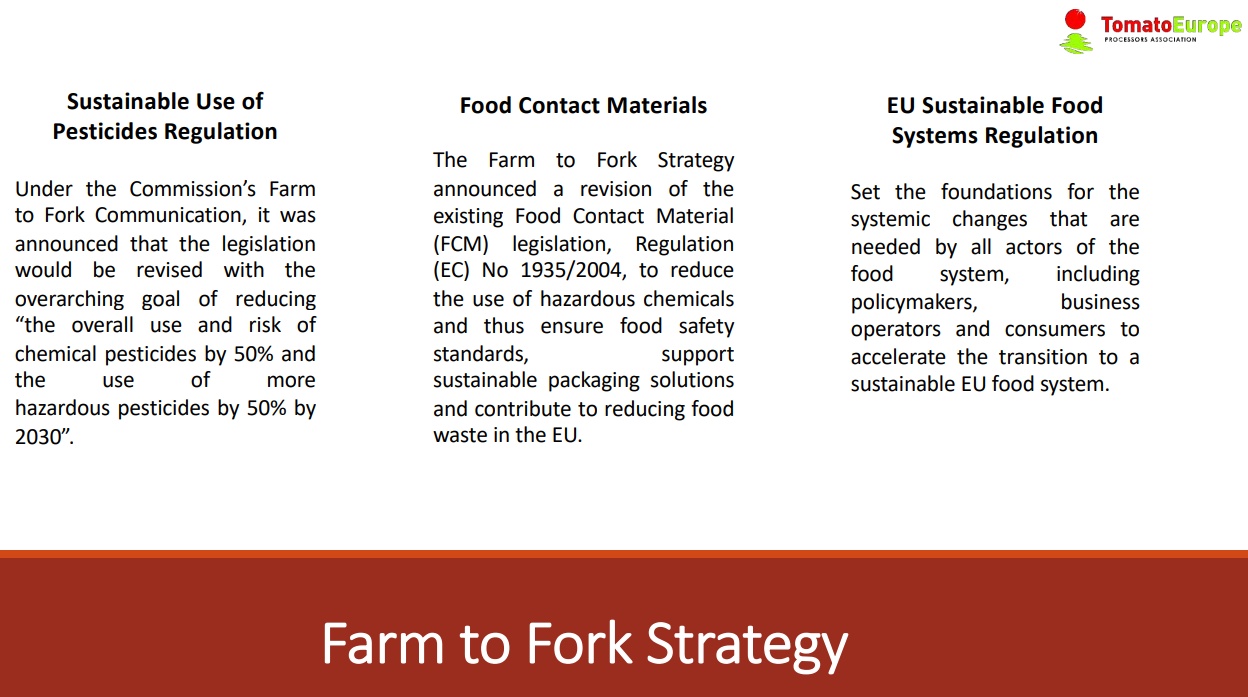

The first initiative is related to the sustainable use of pesticides regulation. We have already seen that one of the objectives of the European Union is to reduce by 50% the use of chemical pesticides before 2030. That could have a significant impact on our farmers and therefore throughout our sector.

Another initiative that could potentially have a negative impact on the sector is the Food Contact Materials: the “Farm to Fork” Strategy announced a revision of the existing food contact materials regulation, as they want to reduce the use of hazardous chemicals and materials. As there are not many options or alternatives for our packaging, currently, this could potentially negatively impact our sector.

The third issue may seem slightly strange, as it is linked to the European Union’s sustainable food system regulation. This means that the “Farm to Fork” Strategy wants all food products to be sustainable – at least to have a sustainable certification. We will need to have a sustainable certification for our tomato products, so we will need rules, auditors, and so on, so this could also be very problematic for our sector.

Then, talking about potential opportunities, there is the Carbon Farming scheme. Carbon farming is a green business model that will reward farmers for improving the land, increasing carbon storage, and so on. By enhancing carbon capture and/or reducing the release of carbon into the atmosphere, farmers will receive financial rewards. This is potentially an opportunity, not for the industry directly but for farmers. The next step in this initiative is that by the end of November of this year, there will be a legislative proposal framework for the certification of carbon removal, and there will be a development of tailored certification methodologies for different carbon removal activities. This is currently ongoing and in the next months, we will have information regarding how farmers can receive this aid, how they can obtain certification and how they can receive the incentives for the capture of carbon or for farming practices that comply with applicable environmental standards.

Another potential opportunity is the New Genomic Techniques program. In consideration of the “Farm to Fork” Strategy to reduce chemical pesticides and fertilizers, this will be a fundamental tool for maintaining and, if possible, improving the agronomic performance of tomatoes. There is currently no regulatory framework for these techniques, so there is a need for them to be developed. Scientists have communicated to the European Union that the current legislation is not supporting the research they are carrying out. So there is a need for new regulations to allow the use of these techniques to improve tomato varieties. So this also could potentially be an opportunity for the sector.

Another potential opportunity will be the information that will be sent out to consumers, or the revision of the food information to which consumers’ regulations refer. These regulations aim to enable consumers to make informed and health-conscious food choices. Their aim is to avoid a situation where nutrition and health claims could mask the overall nutritional status of a food item, thereby allowing consumers to better identify the origin of food. TomatoEurope is actively participating in open public consultations.

The next steps in this legislation will be a proposal and a co-decision process starting in 2023.

An important consideration for place-of-origin labelling is that processed tomatoes are among the few products that will be considered for this labelling program. This could potentially be an opportunity for our sector. For a long time, we have been pointing out that tomato is a superfood, very rich in nutrients and lycopene and other health components. But at times, this has not been sufficiently appreciated, so this could be a good opportunity for our sector to deal with the issue, if we are able to communicate to consumers how good our tomato products are.

This point is not linked directly to the “Farm to Fork” Strategy, but the new Common Agricultural Policy will enter into implementation in the beginning of 2023, and an important part of the subsidies that farmers will receive is linked to green activities. Most of these green activities are also related to “Farm to Fork”, so there is an indirect link between the new Common Agricultural Policy and the “Farm to Fork” Strategy, with everything linked to the same objectives.

We have been talking about the 27 initiatives, but we have just mentioned a few of them. We have already talked about food contact materials, the “Farm to Fork” Strategy in dealing with food waste reduction, and contingency plans for ensuring food supply and food security. This is closely linked to another initiative, which is the Biodiversity Strategy. In this regard, there are other initiatives such as the European Union Soil Strategy, the Action Plan for Organic Farming, which has been already mentioned, the Strategy on Pollinators, and the Zero Pollution Action Plan. So you can imagine how many initiatives are inside this “Farm to Fork” Strategy.

As for what is currently ongoing, the European Union is working actively on the Green Deal, and these are the initiatives that have been already legislated, while others will be legislated in the near future.

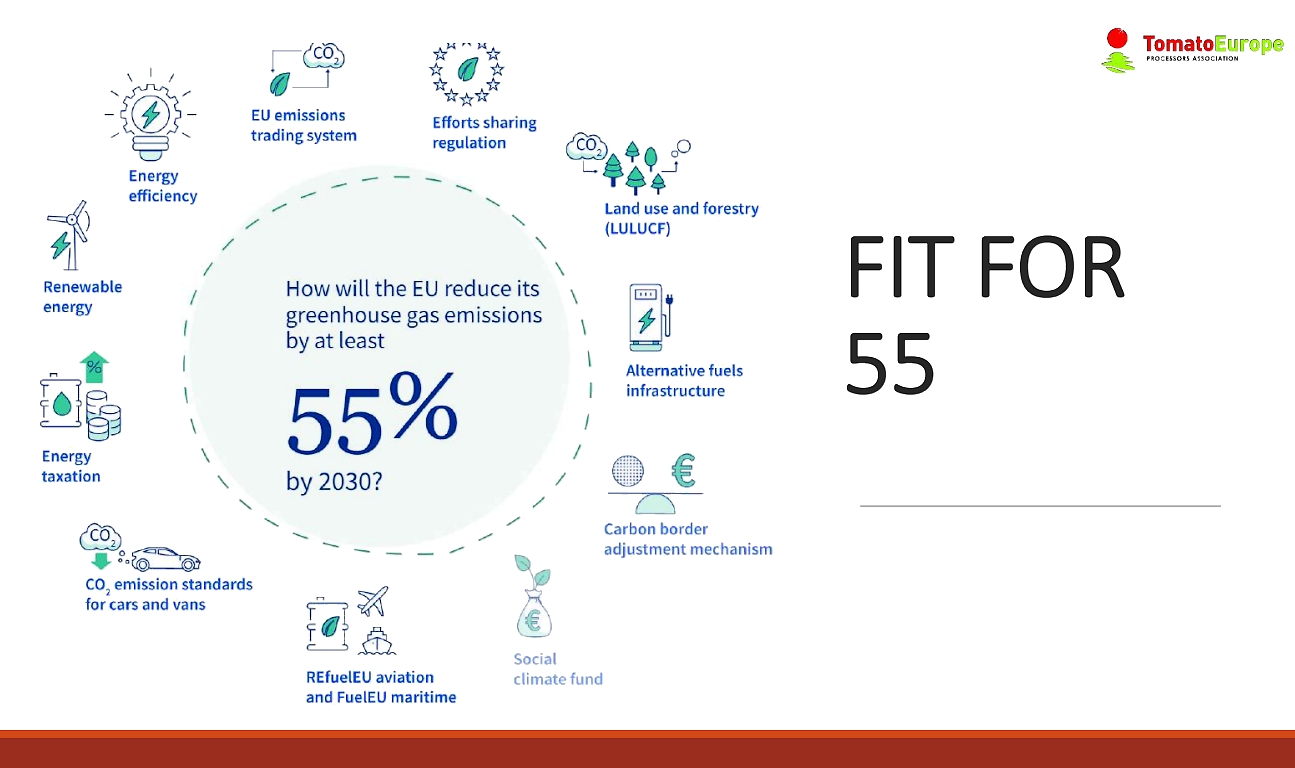

As I mentioned, we are only looking at two leaves of the tree I showed at the beginning. The first one has been the “Farm to Fork” Strategy. Now we will look at the “Fit for 55” plan. What this initiative is looking at is how the European Union will reduce its greenhouse gas emissions by at least 55% by 2030, so in seven years’ time practically. This is not in twenty or fifty years! It is just in seven years’ time. And you can see that there are about eleven main areas where they are looking to reduce the amount of emissions.

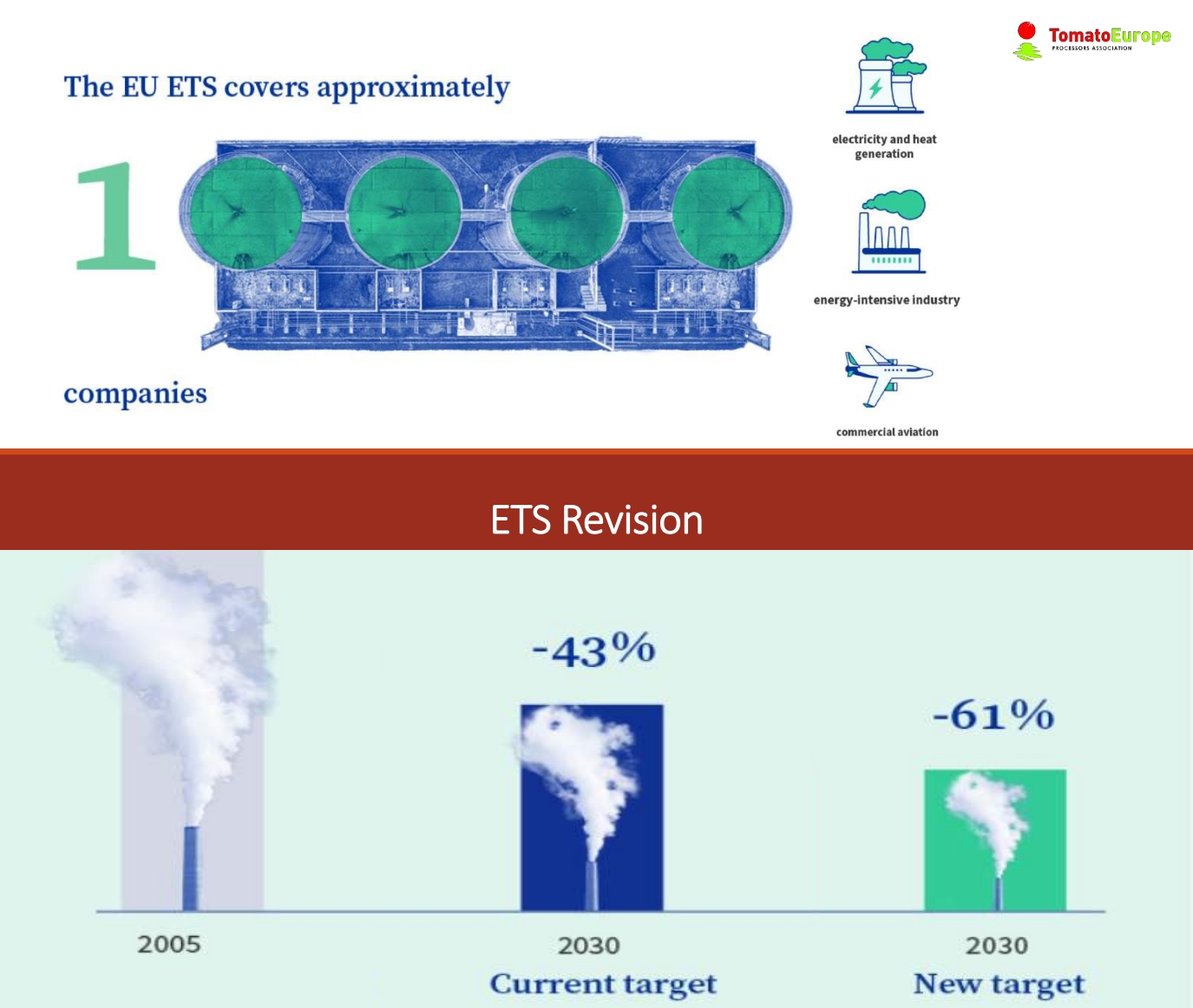

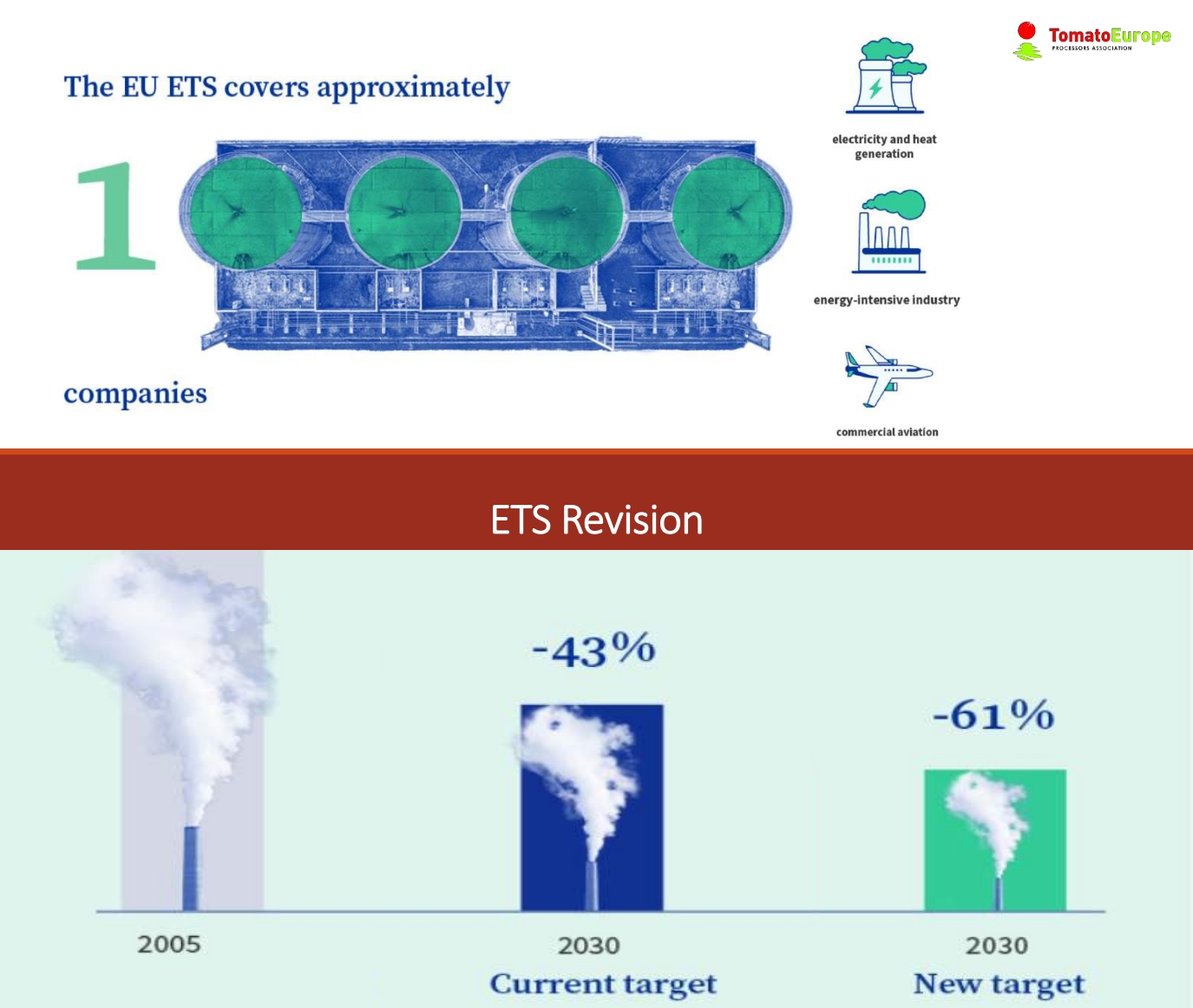

Most tomato industries are in what is called the ETS system – the Emissions Trading System, so most of the companies need to buy rights to the emissions that they are putting out. About 10,000 companies in the European Union are in this system – including electricity and heat generation, energy-intensive industries and commercial aviation. Tomato processors are considered to be energy-intensive industries and we think that we are not correctly included in this system. TomatoEurope is actively working on this issue, but that is unfortunately where we are, and we are now paying an important share of emissions. As we will see, we are expecting to pay more in the future.

Currently, the target of the European Union is to reduce emissions by 43%, but even if the system in which we currently are is still in place until 2025, they are looking to reduce not only by 43% but by 61%. TomatoEurope has been working actively on a carbon leakage status. A large proportion of the free allowances from which we benefit, mainly in paste, is thanks to the work of TomatoEurope, but other products like diced or pulped tomato, etc. are not in this system, unfortunately.

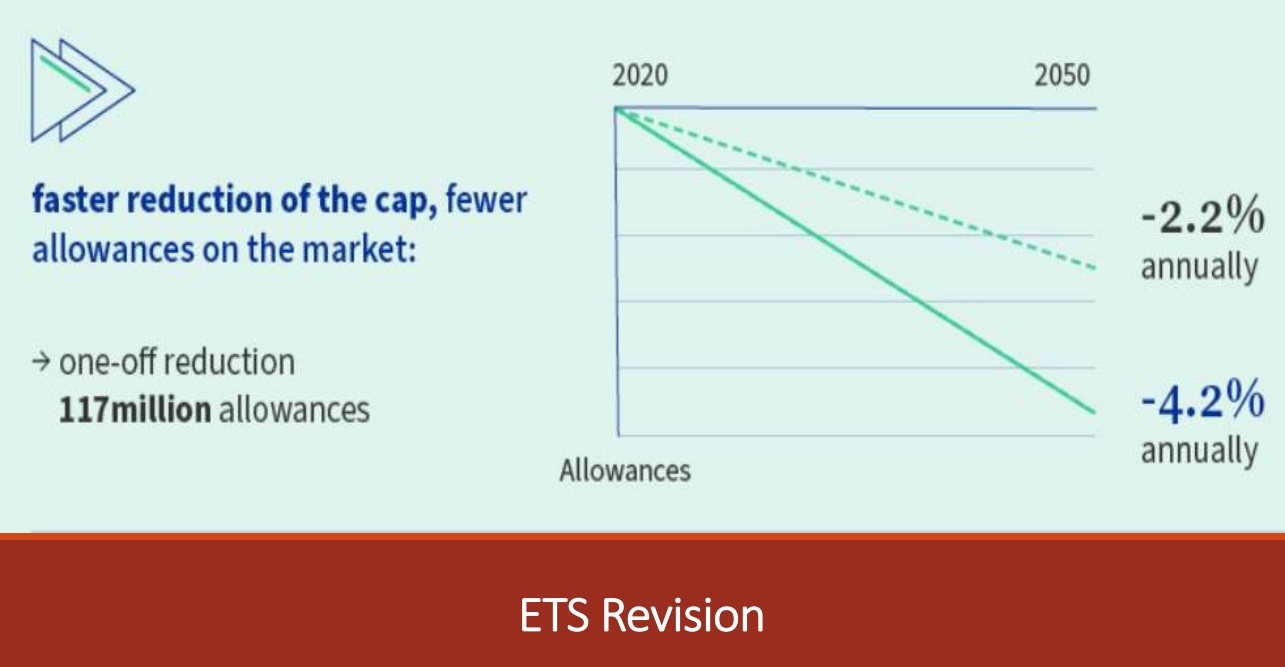

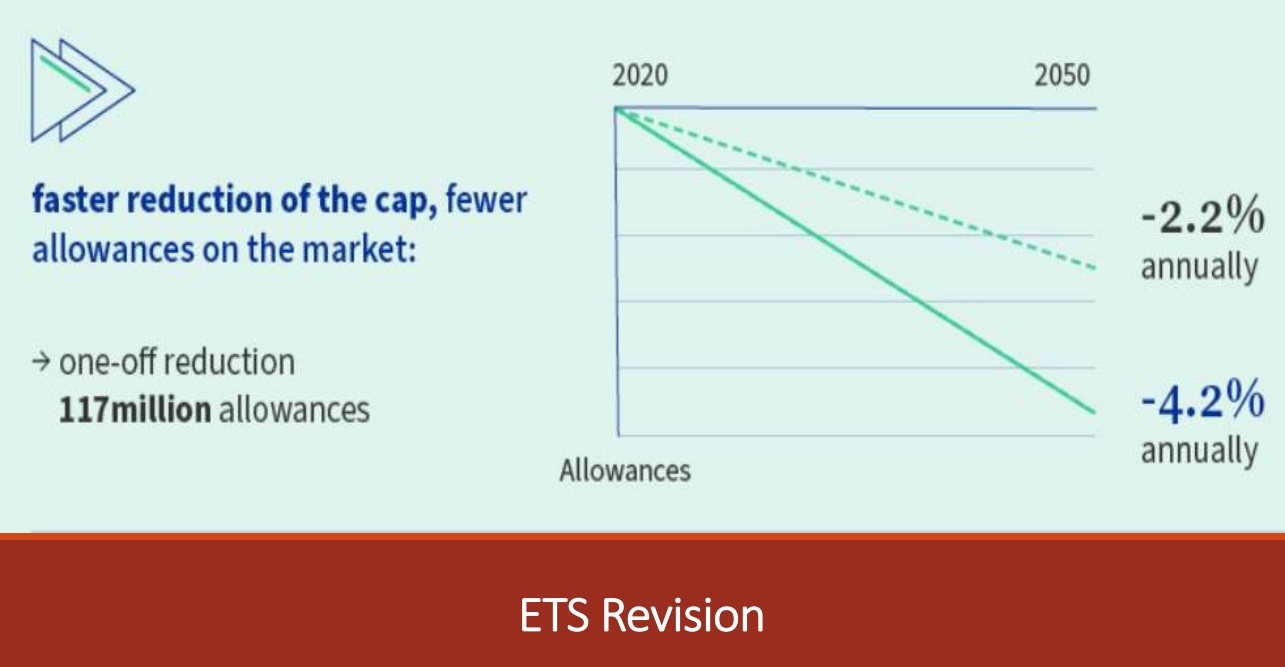

As I have mentioned, there is currently an annual reduction of 2.2% of the free allowances, but with the new initiatives that we have been looking at, with the new target, there will probably be a reduction of 4.2% of the free allowances every year. So there is going to be an acceleration in the reduction of allowances.

I have mentioned that there will be a gradual phasing out of the free allowances for certain sectors, in parallel with the introduction of the Carbon Border Adjustment Mechanism. This is a scheme that the European Union has established, as they say, in order to try “to compensate the companies who are paying for the emissions inside the European Union” versus those companies that are acting outside the European Union and exporting products to the European Union. This Carbon Border Adjustment is a tax that companies from outside the European Union need to pay for bringing their products into the European Union, but unfortunately, it does not currently concern tomato products. At the moment, it concerns aluminum, concrete and other industries, but not tomato products. This is something TomatoEurope is also looking into actively, to try to introduce the tomato sector into this Carbon Border Adjustment Mechanism.

There are some points for revision in this emissions trading system that are critical for the tomato processing industry: we don’t have a sectorial benchmark, so we have not been included in a system where we are compared with other tomato industries or with similar industries. We have been included in a benchmark where there are many different operators and one of these operators is the biomass energy power stations sector, where they consider that they are not emitting. So, as we are in the same benchmark group, the average level of emissions is really very low. As we are above the average, the European Union has removed free allowances for our companies.

It is also difficult for our sector to dramatically reduce emissions because, as you know, we are a very seasonal sector, functioning two to three months per year. So, for instance, to move from natural gas to other alternative energies like biomass would not really be efficient because there would be no payback on investments.

This is really an important problem for the sector, and TomatoEurope is working actively on it.

There are other major Green Deal Initiatives that are impacting the tomato industry. We have already mentioned the Biodiversity Strategy, the New Circular Economy Action Plan, everything relating to the re-use of all residues, the Industrial Strategy, and also Corporate Due Diligence. They want to introduce due diligence to check that companies are really acting in the way that the Green Deal Initiative is aiming at.

In summary, we have been focusing mainly on two initiatives – the “Farm to Fork” Strategy and the “Fit for 55” Strategy. We have some policy opportunities, as I mentioned, with the Revision of Food Information to Consumers – concerning everything related to labelling and information to consumers, the New Genomic Techniques that can improve the varieties that are currently used, and also Carbon Farming, providing farmers with potential extra income if they use beneficial practices that capture carbon. We have also mentioned threats, linked to the emissions trading system and the Carbon Border Adjustment scheme, the Sustainable Products Labelling program and all the initiatives linked to new farming practices and standards, particularly in relation to pesticides, fertilizers, organic farming, and so on.”

Manuel Vazquez' presentation

Some complementary data

You can find all the other presentations and slides from the 2022 Tomato News Conference held in Parma on 25 October 2022 by clicking here.

Source: Tomato News

“I will talk about European policies and challenges for tomato processors.

“I will talk about European policies and challenges for tomato processors.