The annual surplus has amounted to between 390,000 and 400,000 mT of finished products on average over the last ten years.

The latest EU report on "EU Agricultural Outlook – for Markets, Income and Environment 2021-2031" states that "despite a strong global demand for processed tomatoes, EU exports expressed in fresh equivalent of raw tomatoes are expected to remain stable." The report continues: "This is the result of growing demand for higher added value products with a lower concentration", but it also adds: "Still, the EU should remain a net importer of concentrate."

Official figures provided by the customs services of the countries concerned, compiled by Trade Data Monitor, seem on the contrary to confirm the regular export vocation of the EU, both for tomato paste and for other industrial productions of the sector.

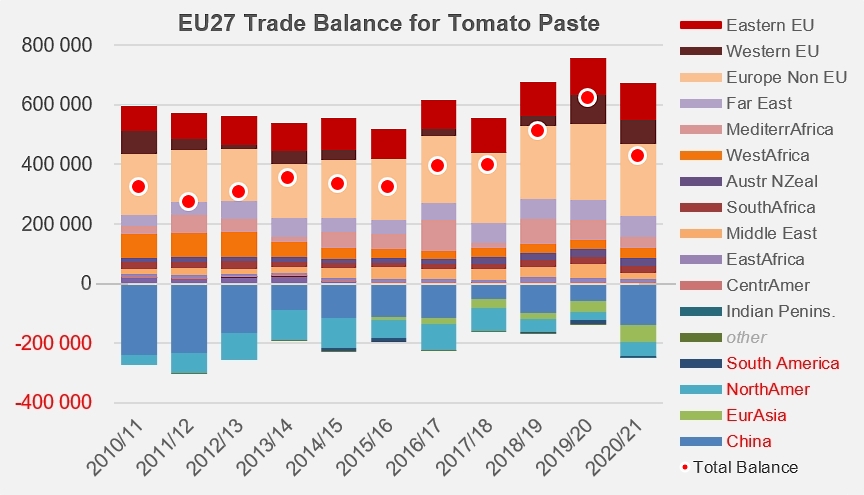

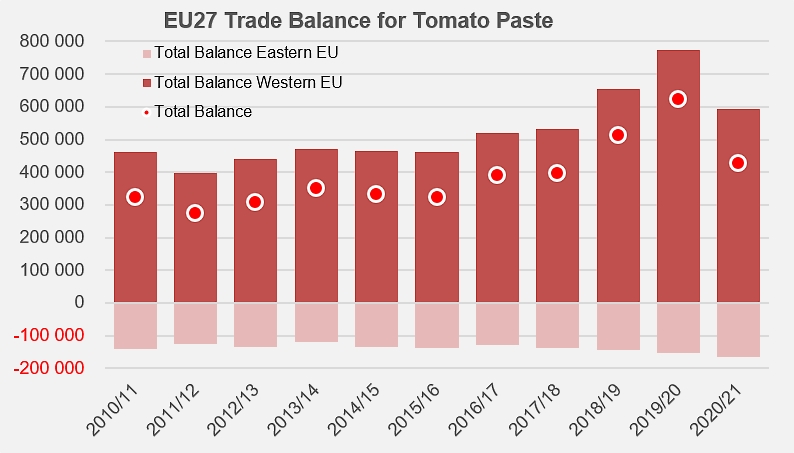

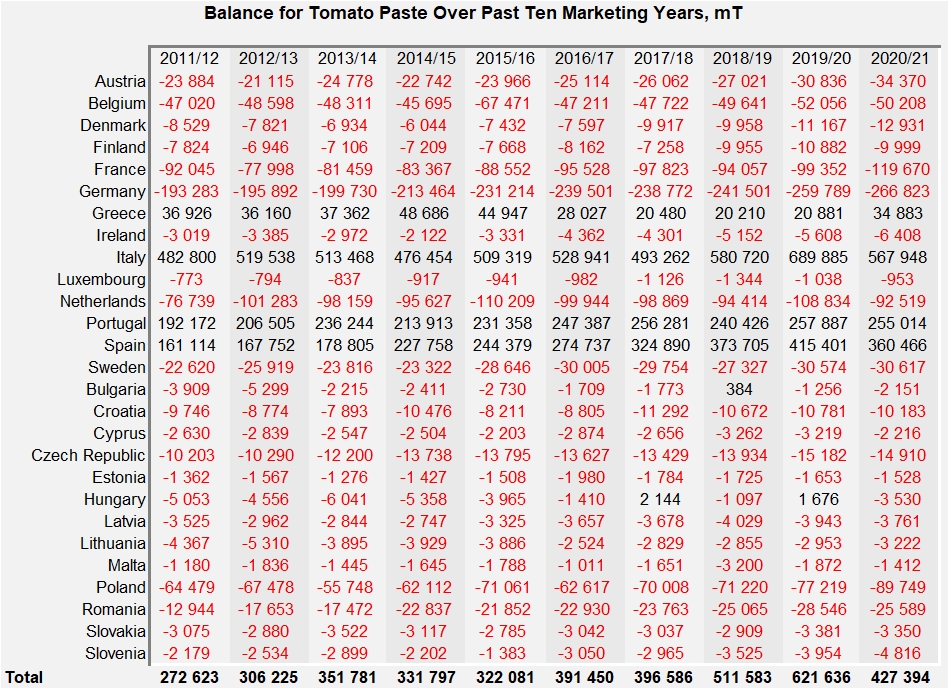

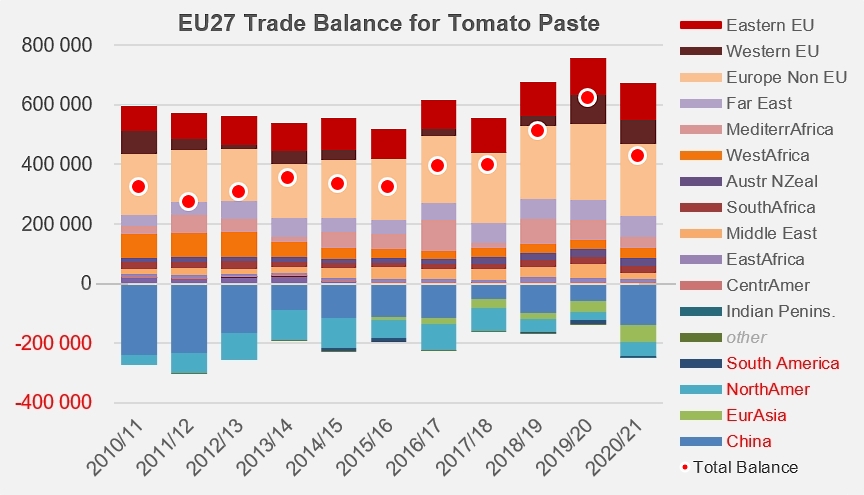

• An analysis of national statistics from the 27 EU Member States over the last ten years (trade balance figures for tomato pastes) shows a surplus that has increased significantly over the last decade, from more than 320,000 mT (all categories and qualities of finished products combined) in 2010/2011 to more than 620,000 mT in 2019/2020, before a significant readjustment of operations to nearly 430,000 mT in 2020/2021 (contraction of the surplus for countries of the Middle East and Mediterranean Africa, widening of the deficit for China). Overall, the EU's "tomato paste" trade balance can be summarized as a more or less pronounced positive balance between the deficits recorded for four regions (China, North America (USA (California)), South America (Chile) and Eurasia (Ukraine, Turkey)) and the surpluses generated on the markets of the European Union, non-EU Europe, the Far East, Africa, Australasia, etc., to mention only the main ones in terms of quantities.

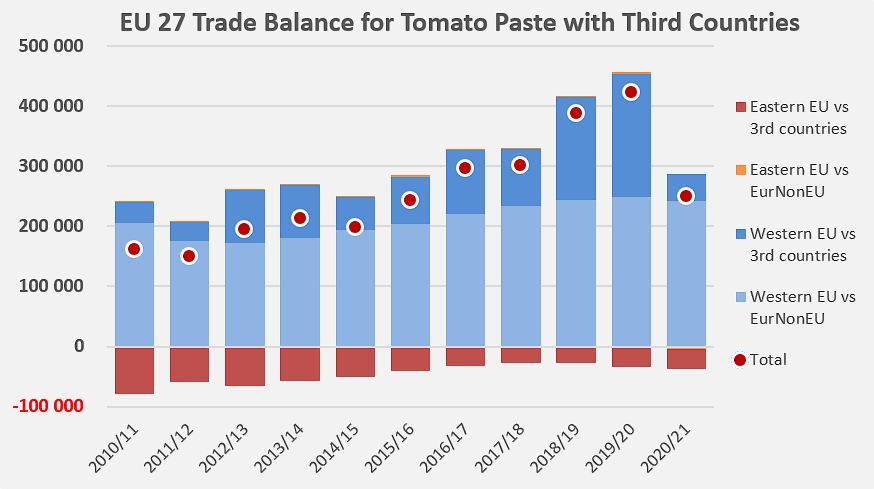

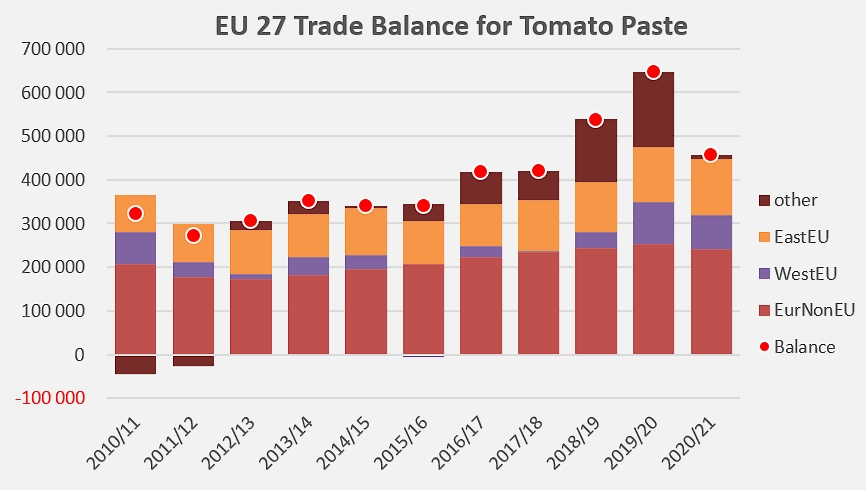

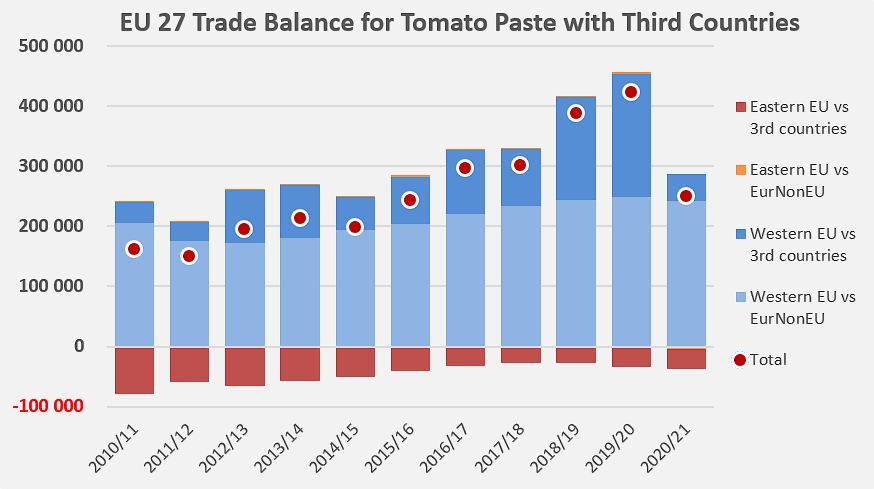

• Both the internal and external components of European operations in the paste sector show a steady positive result: intra-EC trade, essentially driven by sales of Italian, Spanish, Portuguese and Greek products to other EU countries (particularly in eastern EU) has fluctuated between just under 100,000 mT and over 220,000 mT over the last ten years. However, it is sales outside the EU (non-EU Europe and third-party countries) (which increased strongly over the period under consideration, from 160,000 to 420,000 mT) that have contributed most clearly to the surplus that characterizes European operations on the global stage of processed tomato products. In 2020/2021, as already mentioned, the change in the trade balance pattern with third-party countries, which occurred in correction of the peaks in operations recorded over the previous marketing year, is at the origin of a decrease in the overall balance observed for the last marketing year (see the detailed table of national results in the additional information at the end of this article).

• The very marked distinction in terms of processing activity between the western and eastern regions of the EU is reflected in a spectacular contrast in terms of trade balance: eastern EU has recorded a chronic deficit in its "tomato paste" trade balance, due in particular to imports from other western EU countries (Italy, Spain, Portugal, Greece), which are essential to satisfy demand, while the operations of these same "heavyweights" of European processing continue to maintain and develop the sector's trade surplus – except in specific circumstances, as observed during the last marketing year.

• Most of the surplus comes from trade with non-EU countries (United Kingdom, Switzerland) and third-party countries (Japan, Libya, Burkina Faso, Gabon, Ghana, Togo and Cote d'Ivoire, Australia and New Zealand, and to a lesser extent South Africa and Tanzania, Saudi Arabia, Kuwait and Oman).

Some additional information

Detailed table of national results ("paste" trade balance results) over the last ten years.

Sources: Trade Data Monitor