Press release

, François-Xavier Branthôme

-

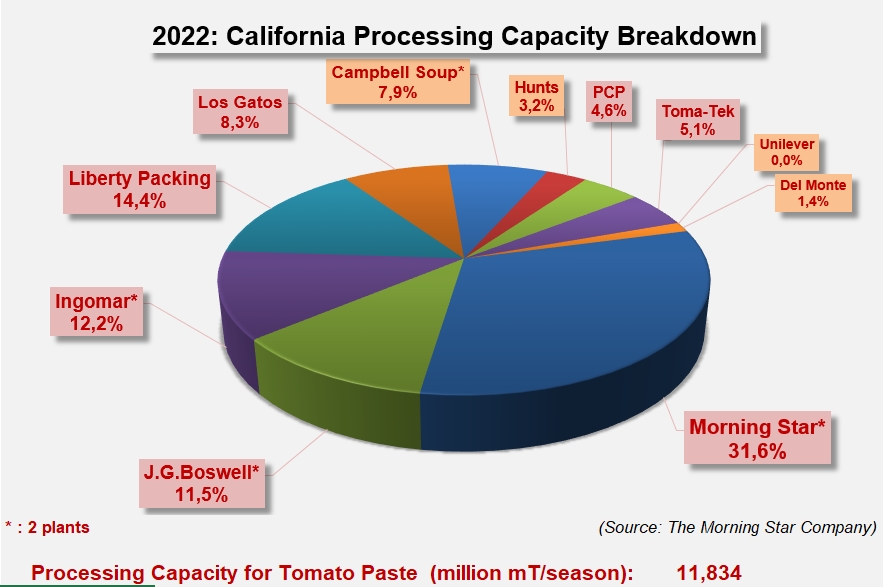

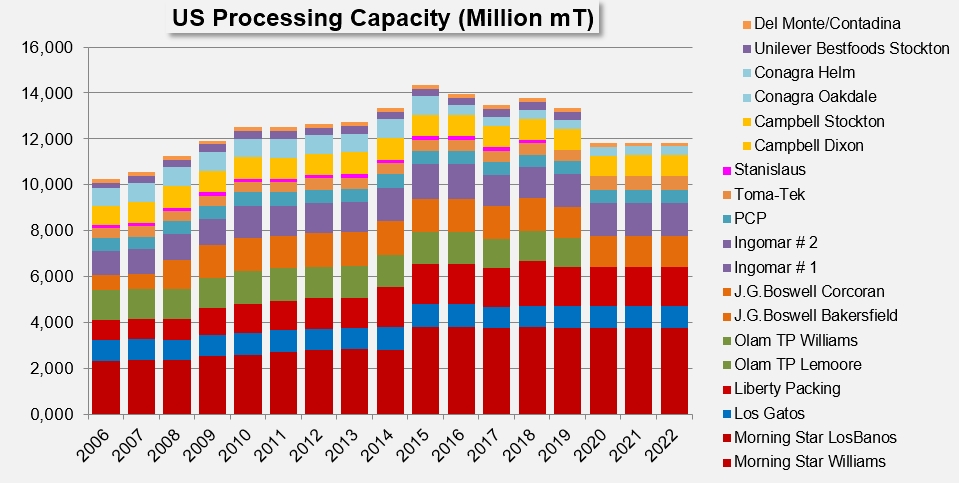

For the third year in a row, after Olam's plants ceased operations in 2020, California's industrial tomato processing capacity in 2022 will be around 140,000 mT per day, or about 12.7 million mT (14 million sT) for a season lasting over three months.

According to the ranking of the world's 50 largest tomato processing companies, MorningStar is in first place, ahead of Ingomar and JG Boswell.

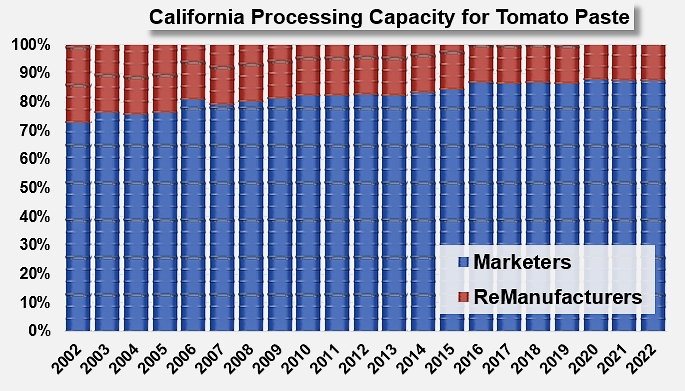

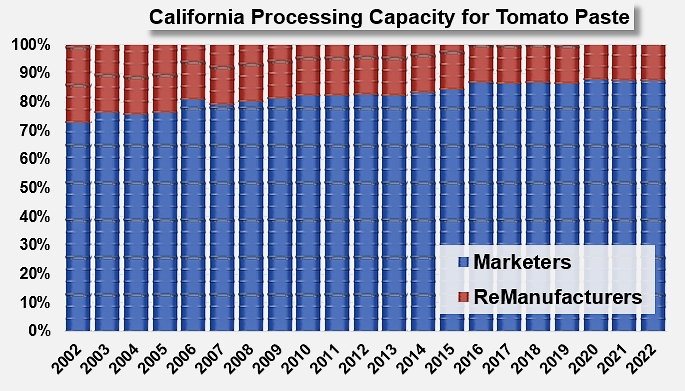

Processing capacity is mostly held by "marketers", which are companies that produce tomato pastes mainly for sale to secondary users. In 2022, their share will represent nearly 88% of California's industrial processing base, with the remaining 12% held by "remanufacturers", companies whose production is intended to be reused internally.

Over the past twenty years, the weight of marketers in California's processing sector has grown significantly, from less than 73% to nearly 88% of total processing capacity. At the same time, the share of remanufacturers has fallen from over 27% to around 12%.

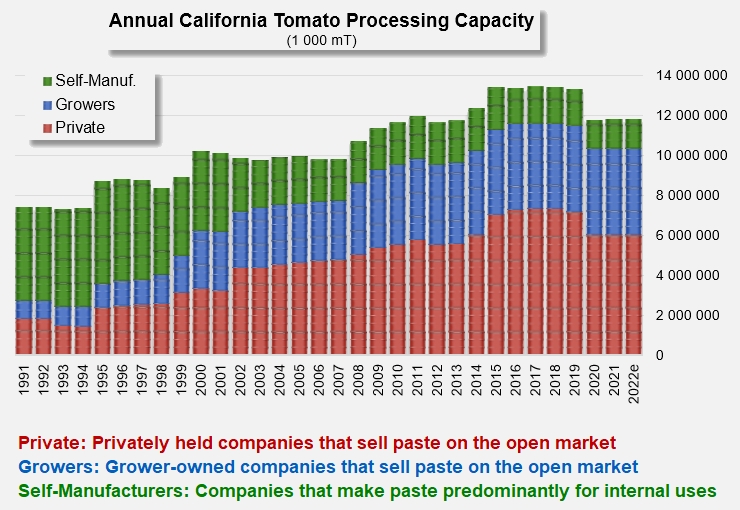

The landscape of California's tomato processing industry is also organized depending on the identity of company owners. Companies producing paste for their own use (remanufacturers), which were dominant players in the sector thirty years ago, have gradually given way to those whose production is intended for sale, whether they are private (51% of total capacity in 2022) or owned by the tomato growers themselves (37%).

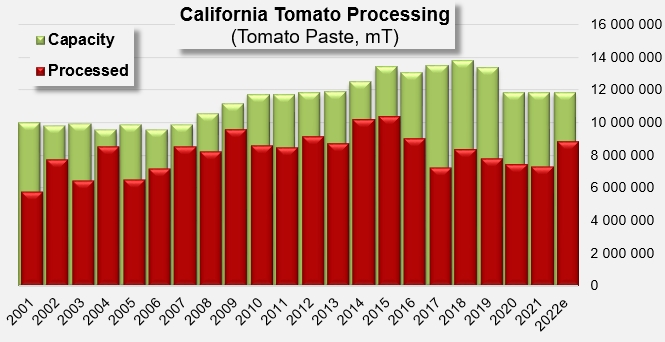

Between 2015/2016 and 2021/2022, the Californian tomato industry faced significant challenges that created severe inventory stress and motivated the capacity reductions observed in recent years. With a much healthier looking situation in 2022 (see our articles on inventories at the end of this report ), the outlook for operations in 2022 (10.6 million mT) should result in an increase of the utilization rate of industrial capacity to around 74%, compared with an average rate of just 61% over the last five years.

Distribution and evolution of California's paste production capacity since 2006.

Sources: Morning-Star-Statistics-Brochure-2022