Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

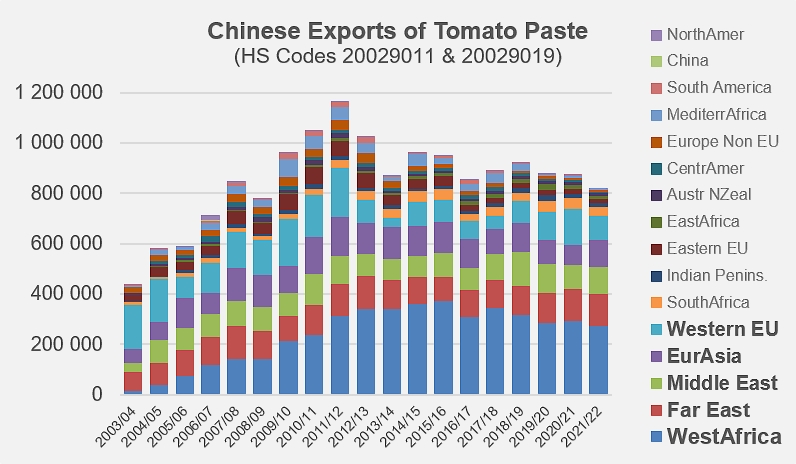

Xinjiang Guannong Fruit, another leading processing company, said that as Xinjiang mainly produces large buckets of tomato paste, its product is not diversified and highly dependent on the international market. “The global economic situation and trade policies would have an impact on the export and sales of tomato paste products,” it said in its annual report. “In the 2021 production season, the tomato industry encountered many challenges in terms of raw material supply, price, and foreign trade transport costs. “These problems may continue to exist in 2022, affecting the survival and development of tomato production enterprises to varying degrees.”

Xinjiang Guannong Fruit, another leading processing company, said that as Xinjiang mainly produces large buckets of tomato paste, its product is not diversified and highly dependent on the international market. “The global economic situation and trade policies would have an impact on the export and sales of tomato paste products,” it said in its annual report. “In the 2021 production season, the tomato industry encountered many challenges in terms of raw material supply, price, and foreign trade transport costs. “These problems may continue to exist in 2022, affecting the survival and development of tomato production enterprises to varying degrees.”