Andalusia: the new Eldorado?

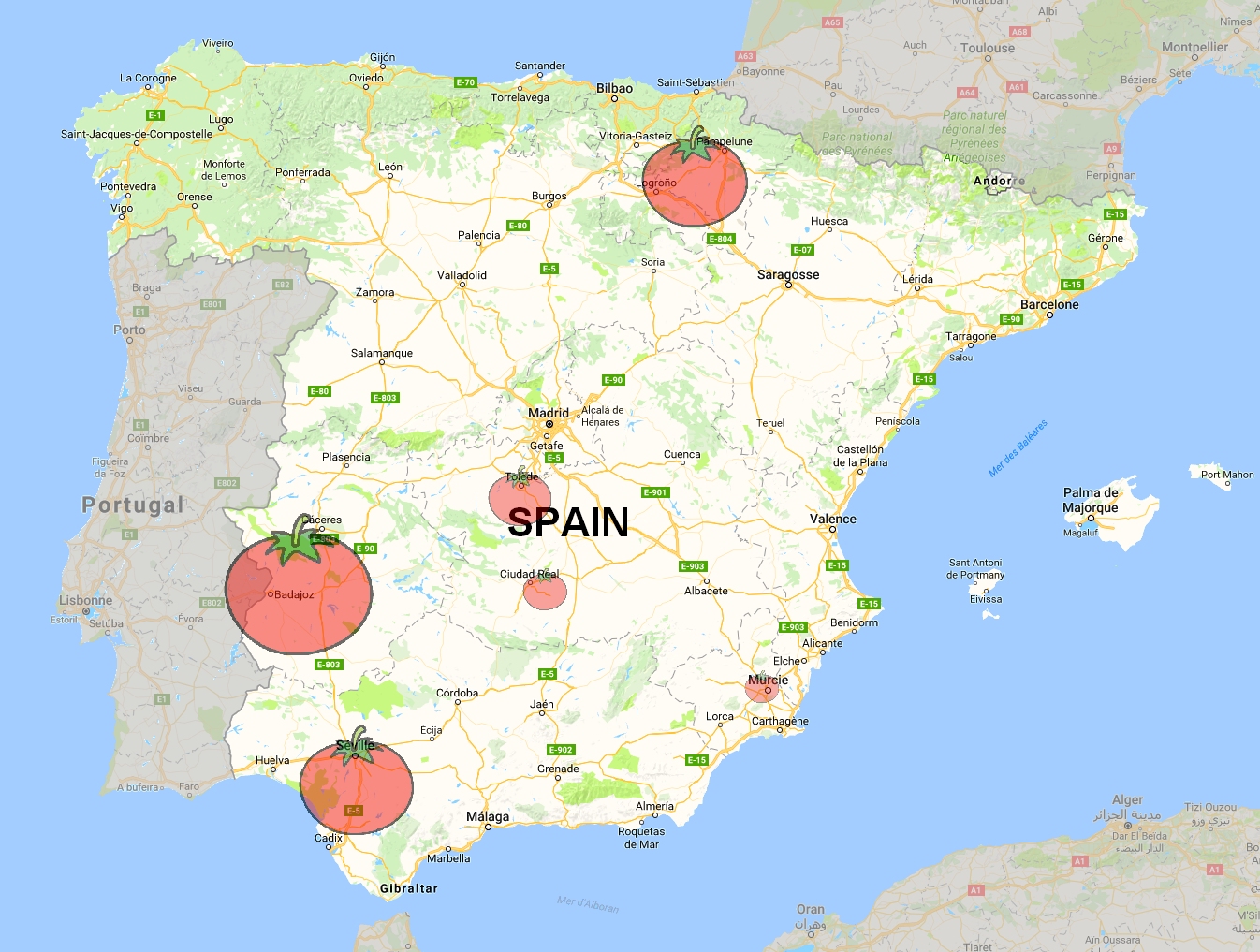

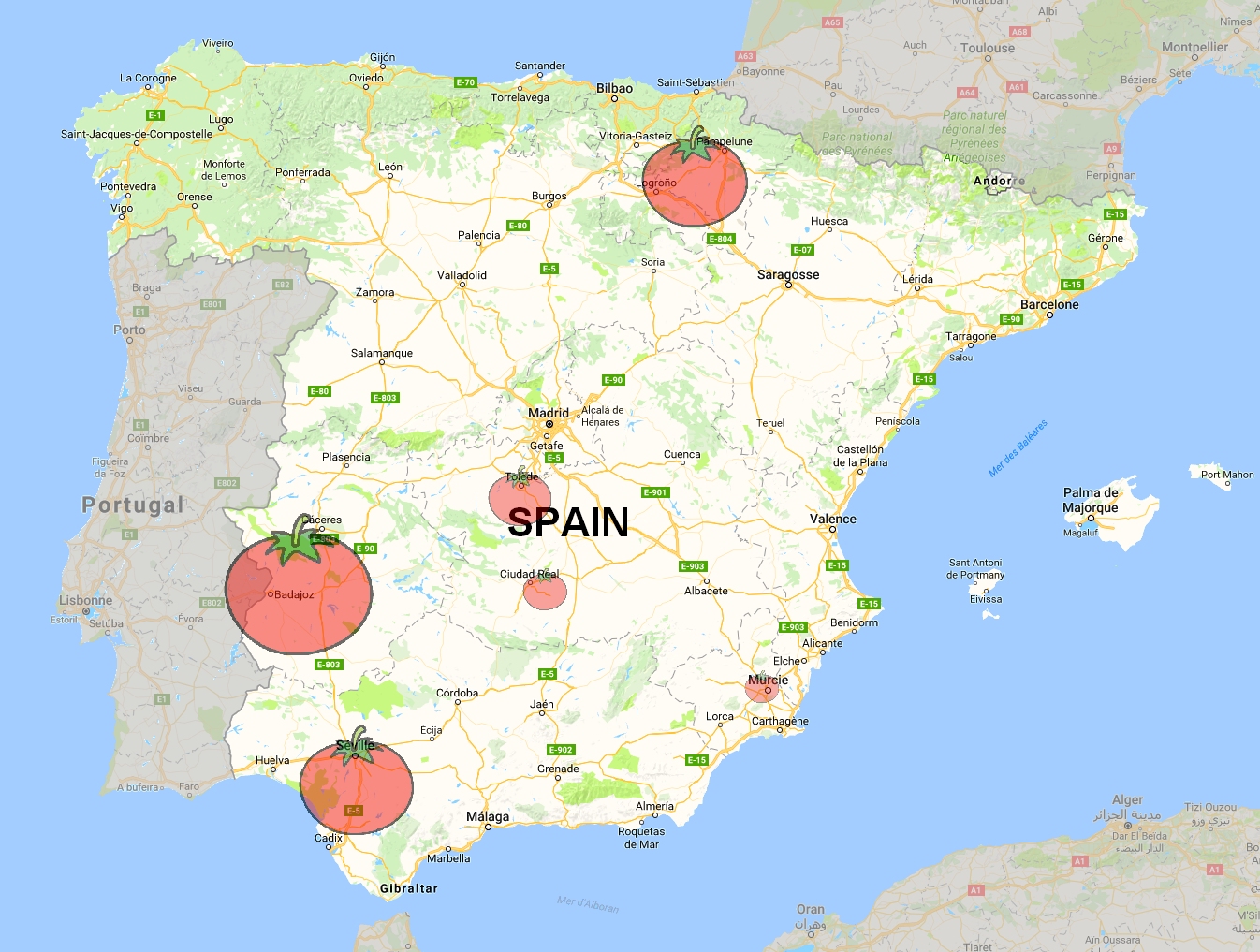

From the Ebro Valley in the north of the country to Extremadura and Andalusia in the south, the Spanish tomato growing industry stretches from one end to the other of a 700 km diagonal line, passing by Madrid and a number of other areas of lesser importance close to the cities of Toledo, Ciudad Real, Murcia, etc.

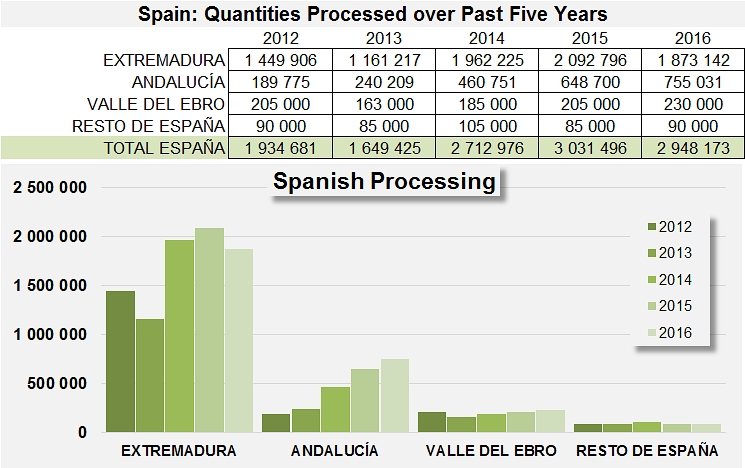

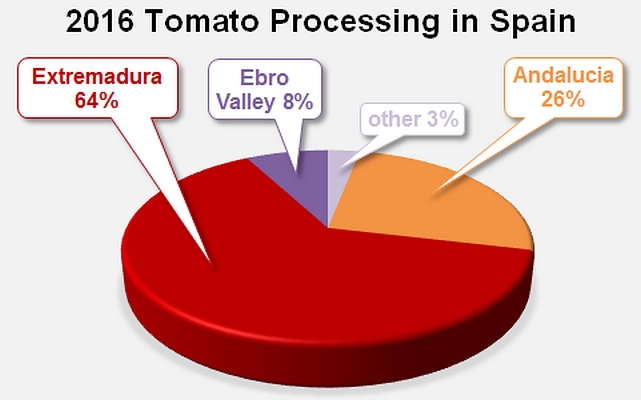

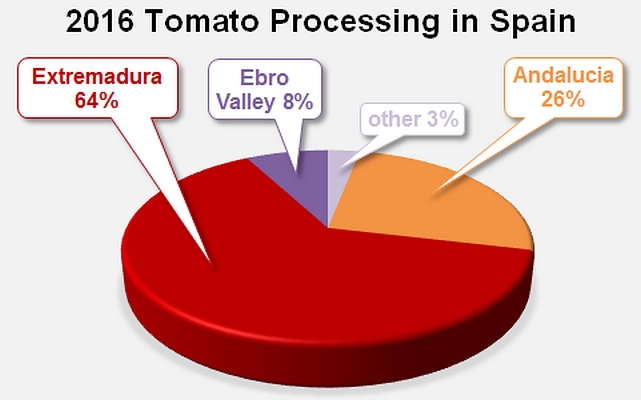

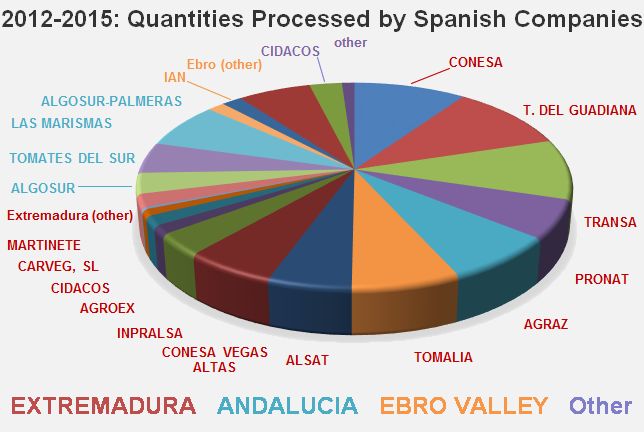

This great distance, similar to the distance separating Parma from Bari in Italy, is twice as long as the region where tomatoes are grown in California, which explains the exceptional duration of the Spanish harvest season, which generally starts in the first days of July in Andalusia and finishes end of October or early November in the Ebro Valley. The processing plants are also situated in these regions. At the outcome of an evolution that has seen the region of Andalusia recently emerge as a major player in the Spanish processing sector, last year's processed volumes were grown in Extremadura for a proportion of slightly less than two thirds (64%), in Andalusia for slightly more than one quarter (26%) and for approximately 8% in the Ebro Valley (Navarra, Rioja, Aragon). The crop in the rest of Spain only accounted for 3% of the total volume.

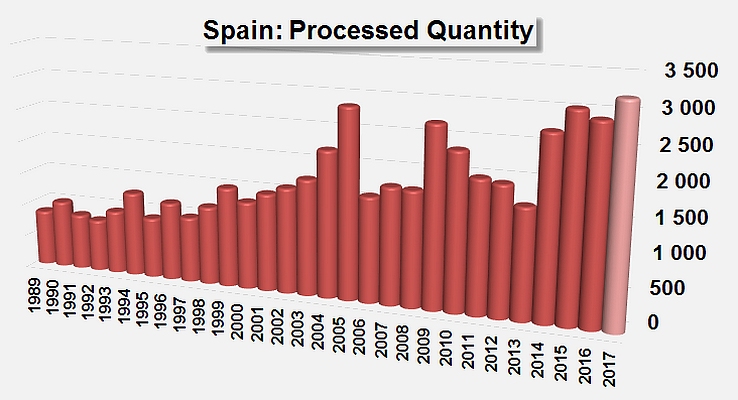

Over the past twenty-nine years and influenced by the many events that have occurred on the international markets over that period, the Spanish production of processing tomatoes has known a number of ups and downs, and has been particularly affected by the effects of the different stages of the European Common Agricultural Policy. In 1989, the Spanish industry processed 850 000 mT of raw tomatoes, accounting for 9% of the AMITOM production and 12% of total European operations (EU5). In 1998, when it hosted the 3

rd World Processing Tomato Congress (Pamplona), the volumes processed already amounted to close on 1.2 million tonnes. Impressive progress and wide variations have marked recent developments of the Spanish tomato processing industry. After two spectacularly large crops in 2005 and 2009, the Spanish industry returned to its highest levels after 2014, with volumes that have grown regularly to the point of reaching approximately 3 million mT in 2015 and 2016 and should take the processed total to about 3.2 million mT this year.

Such levels of processing operations have turned Spain into the second biggest European processor, in direct and intentional competition with Italy, with 19% of the tonnage processed by the AMITOM and 29% of the volumes processed within the EU5. To date, Spain accounts for approximately 8% of worldwide tonnage and ranks fourth among the world's biggest processing countries.

Recent dynamics

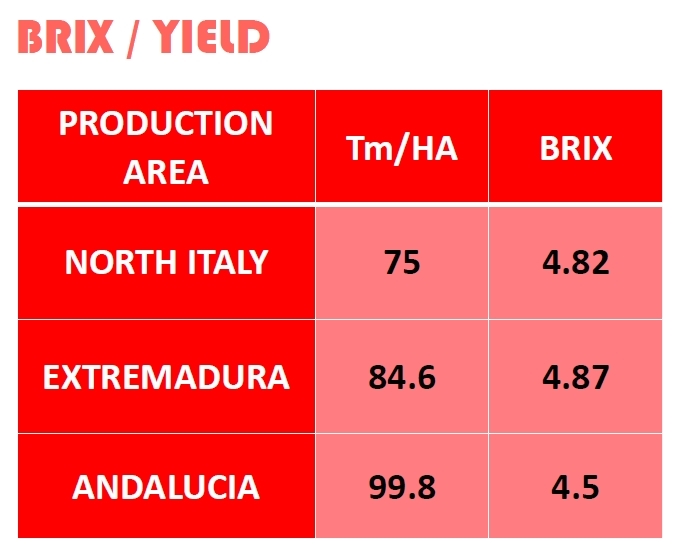

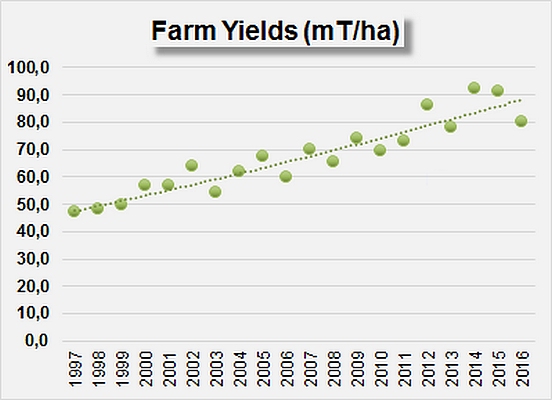

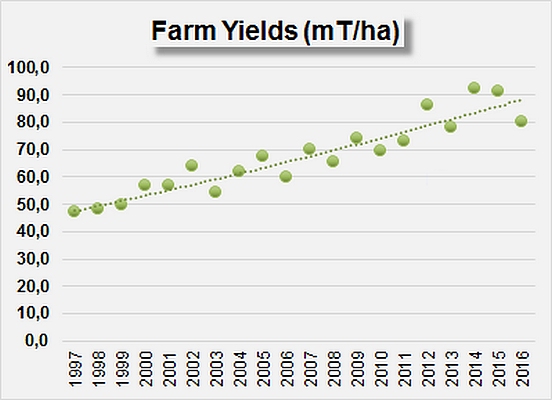

The development of Spanish production is based on a major extension (+75%) of planted surfaces, which have grown from 21 000 hectares in 1997 to almost 37 000 hectares in 2016. But this increase in surfaces would not have led to the levels recorded in recent years if agricultural yields had not also progressed decisively over the past ten years. While yields were close on 47 mT/ha twenty years ago, average Spanish yields amounted to more than 91 mT/ha in 2014 and 2015, two exceptional years for the Spanish industry.

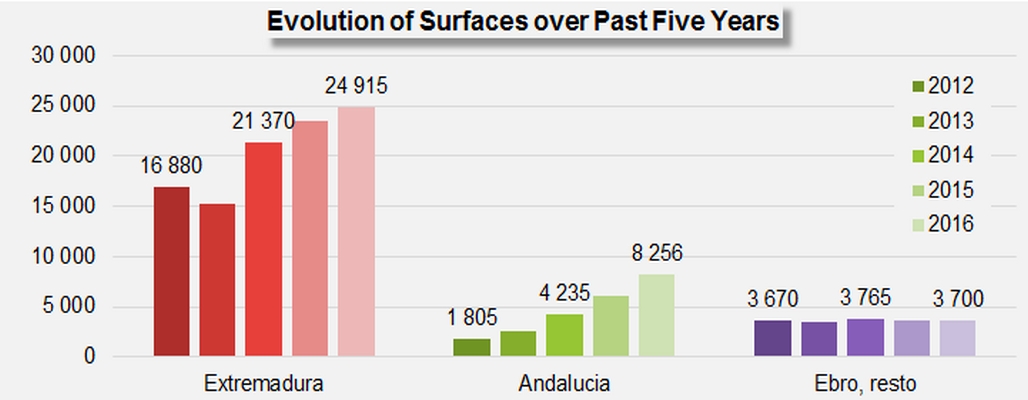

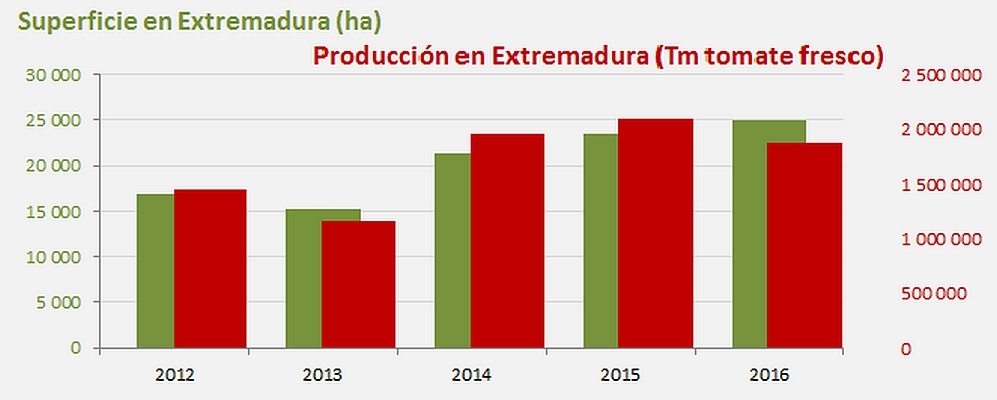

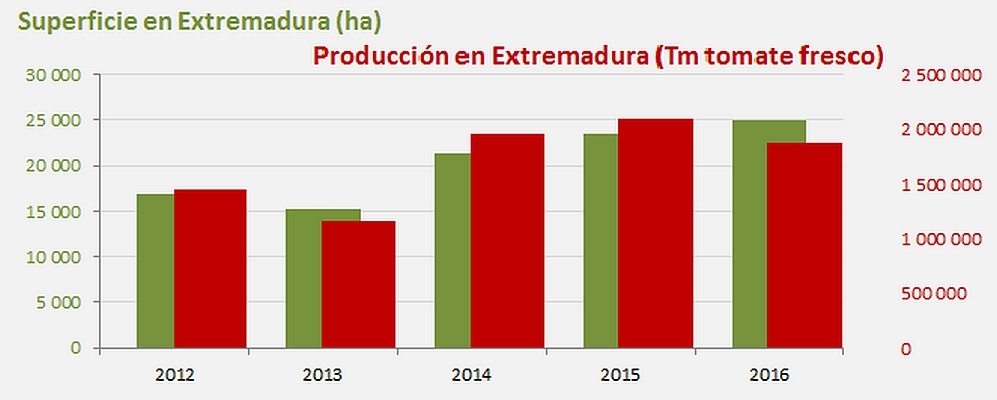

This occupation of surfaces, which has been growing year on year, has not progressed in a uniform fashion throughout the production regions. In 2016, the accumulated surfaces of the two main tomato cultivation regions – Extremadura and Andalusia (33 170 hectares) – were 45% higher than the average of the four previous years (2012-2015). But although surfaces in Extremadura grew by 5 700 hectares (+29%), the increase was much more rapid in Andalusia, where surfaces increased by 4 600 hectares, or 125%, over the same period. In total, the surfaces dedicated to processing tomatoes grew from 16 900 hectares in 2012 to 24 900 hectares in 2016 in Extremadura, and from 1 800 hectares in 2012 to 8 250 hectares in 2016 in Andalusia.

It is thought that Spain's organic processing tomato production currently occupies a total of 200 to 300 hectares.

This extremely fast development of Andalusian production, which emerged at the beginning of the 90s and for a long time remained anecdotal with regard to total Spanish volumes, has been matched by an explosive development in the region's processing capacity. Most of the factories currently operating largely in the paste production sector in the area around Lebrija, about fifty kilometers south of Seville, have been set up over the past ten years, and major investments have been carried out since 2012/2013.

One of the reasons that have motivated the installation of these factories over the past fifteen years, as well as the recent increase in processing capacity in Andalusia, is the very high levels of agricultural yields in the region. Except for the "bad" results of the 2016 season (91.4 mT/ha), which were penalized by particularly contrary weather conditions at the start of the season, average yields over the past five years have amounted to more than 103 mT/ha, a level that is close to Californian records. In comparison, the 86 mT/ha obtained in Extremadura over the same period, despite being satisfactory, remain 17% lower, and more closely match those obtained in neighboring Portugal, but more importantly are less motivating in terms of profitability.

The decrease in European aid granted to rice cultivation – a major competitor for tomato crops south of Seville – and the drop in profitability for industrial operations linked to the rice sector have also contributed to accentuating the inclination of operations and investments towards tomato processing.

Extremadura: between Vegas Altas and Vegas Bajas…

The fields that have been planted with tomato crops along the Guadiana river in Extremadura are mostly composed of silty loam, with varying proportions of sand. Although it is a long way from the sea, the region enjoys a climate that is both semi-Continental and Mediterranean, and particularly dry and warm. The risk of frost during the planting period (March-June) is minimal, but the very high temperatures in July (33-34°C in daytime, 19-20°C at night) can cause blossom drop. The region is well-equipped in terms of water resources and irrigation infrastructures and has not known heavy drought since 1995, but it is mostly the equipment in which growers have invested that has made the difference. Over all of Extremadura, virtually all the surfaces (93%) are now set up with drip-irrigation systems, of which 79% are conventional overhead installations and 14% are buried line installations. Only 7% of the surfaces are still watered by furrow irrigation, but this proportion continues to regularly decrease. More specifically, crops in the western part of the Guadiana Basin – the Vegas Bajas – all benefit from drip irrigation, whereas crops planted in the Vegas Altas are still partly watered by furrow irrigation.

In Extremadura, all of the crops are planted with plug seedlings. The average size of each plot of land still remains relatively small, but has tended to increase. It is estimated that between 60 and 70% of the surfaces are leased. Growers have come together to form the OPFH (

Organización de Productores de Frutas y Hortalizas), which deals with 90% of the contracts signed with processors. The harvest usually starts between 20 and 25 July. The average cost of growing tomatoes for processing is between EUR 5 500 and 6 000 /ha (val. 2016).

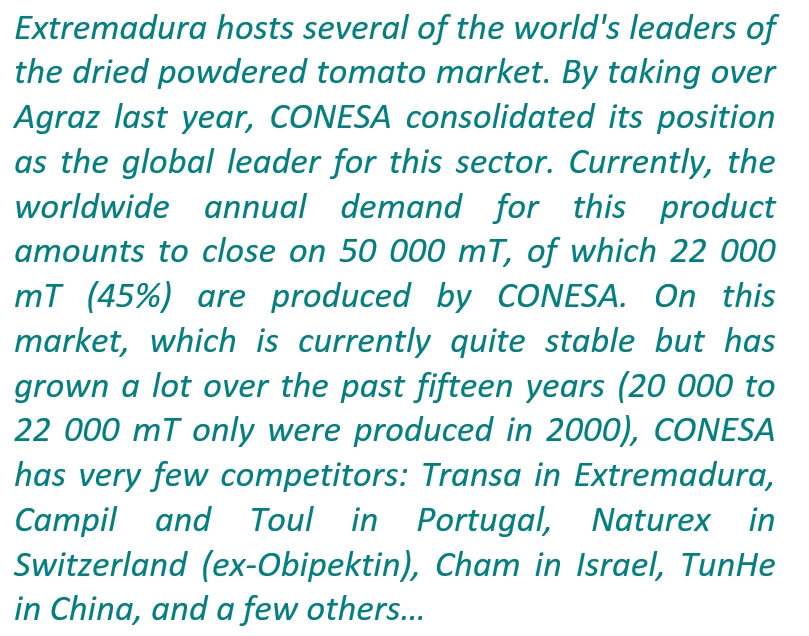

Extremadura hosts several of the main Spanish processing plants, whose primary activity remains tomato paste production. However, the processing of chopped tomatoes and sauces is a growing business in this region. It is also important to note that Extremadura is the region where the world's main factories of powdered dried tomato are located.

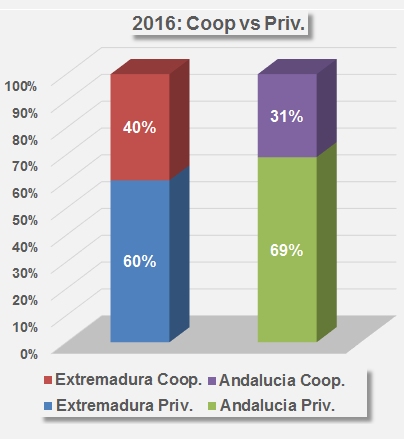

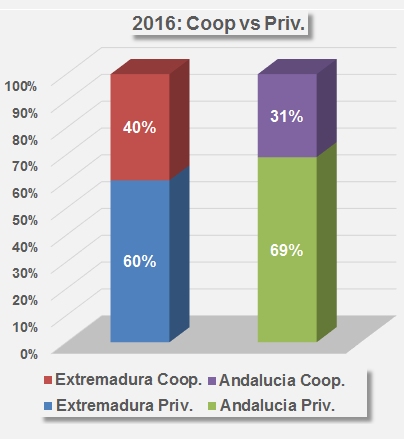

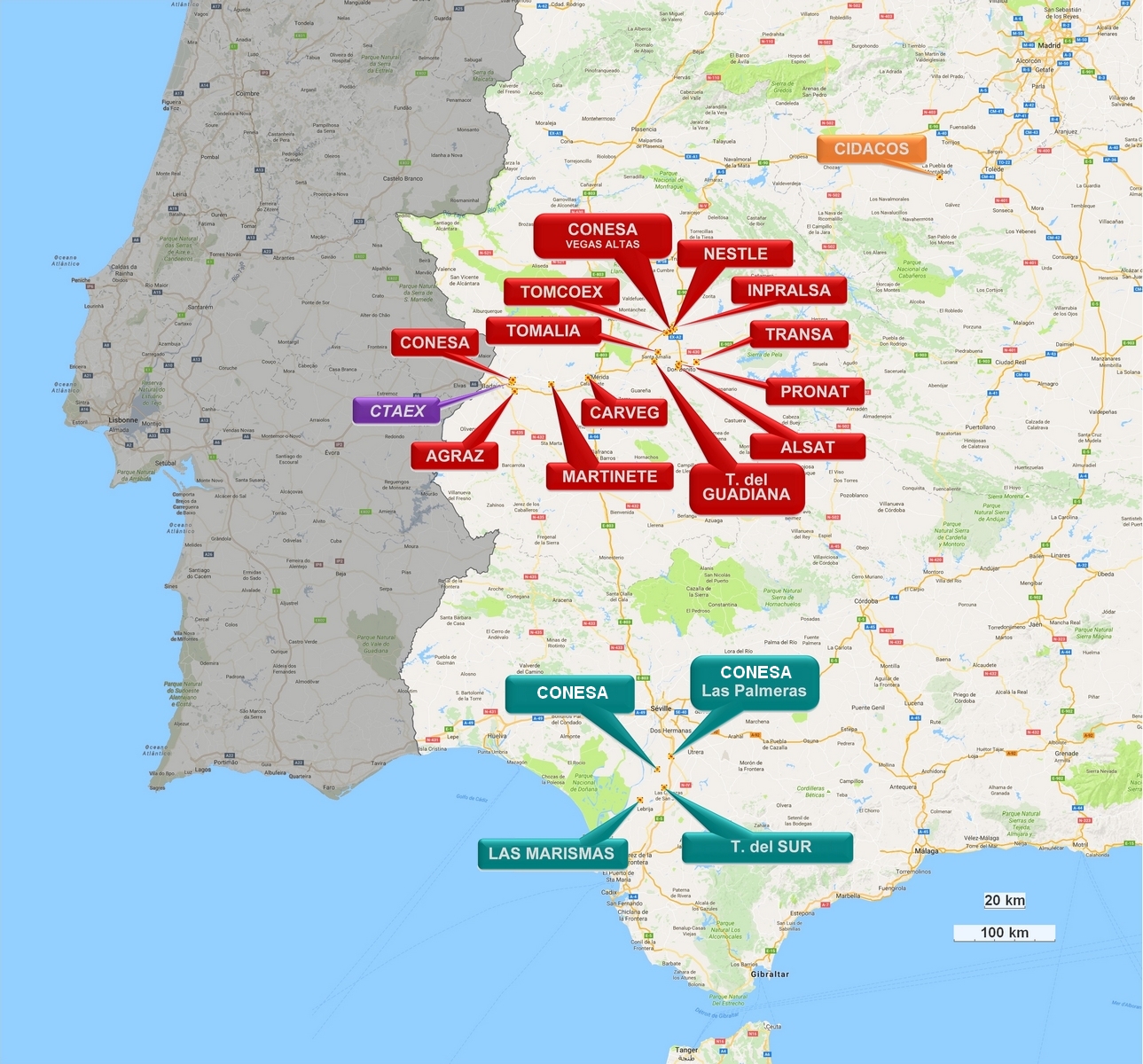

Processing in Extremadura is mainly carried out by private companies (CONESA, TRANSA, ALSAT, INPRALSA, etc.), but a number of larger agricultural cooperatives (TOMATES DEL GUADIANA, TOMALIA, PRONAT, etc.) have set up their own processing plants over the past fifteen years, and currently account for close on 40% of total operations.

Mesa del Tomate

In Spain, relations between growers and processors are handled by powerful and well-organized POs, based on contracts that are concluded prior to the harvest and that notably determine volumes and prices for raw tomato.

However, Extremadura is for the time-being the only region to have set up an independent association in charge of grading operations when raw tomato shipments arrive at the factories. Reorganized in 2001, the "Mesa del Tomate" Association ("Tomato Bureau") stems from an older government agency that was set up under Spanish legislation before being transferred to private management in 2000.

Today, 10% of private Spanish growers remain unaffiliated with Mesa del Tomate, but nonetheless benefit from the scheme. The Association is led by a council composed of twelve members, with equal representation of the agricultural and industrial sectors. Financially, it depends equally on growers and processors, in proportion to contracted volumes.

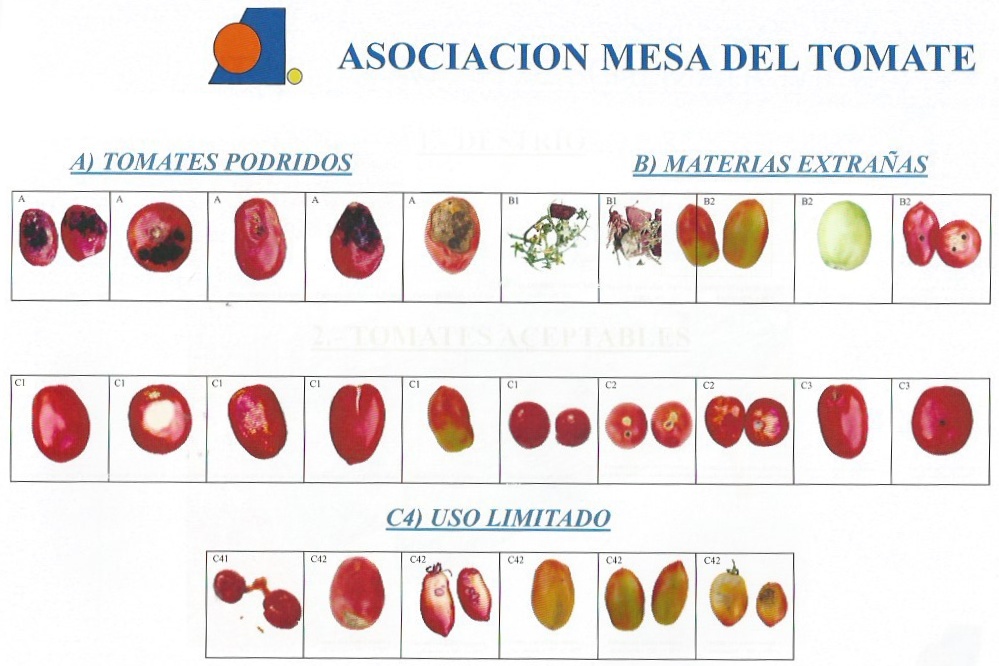

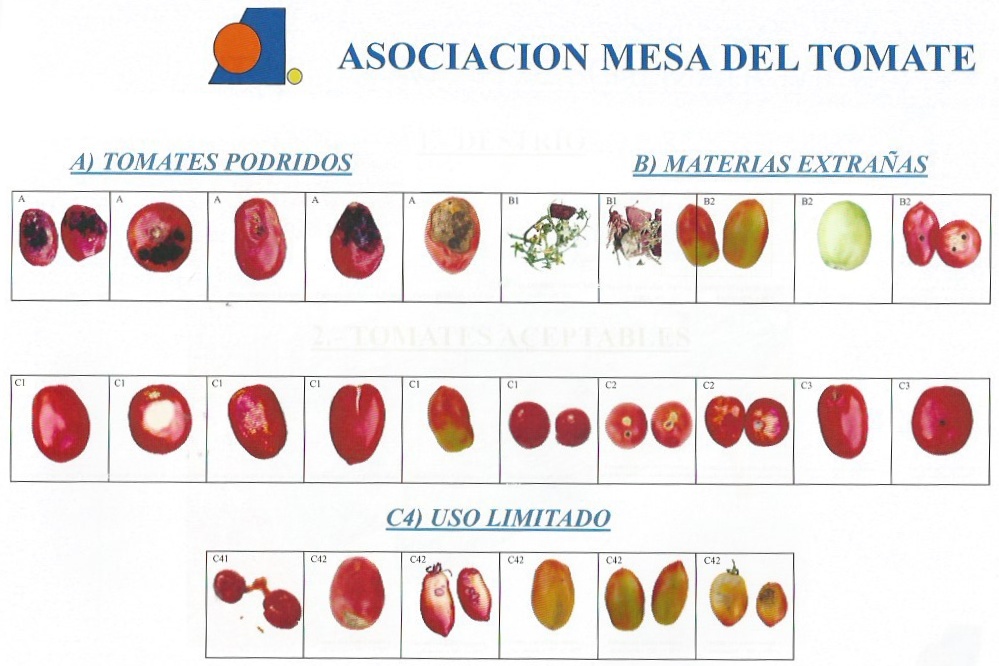

Each year, it trains and employs about 100 people, spread out into four teams, responsible for the independent control of the quality of shipments delivered (grading, detection of pesticides and heavy metal residues), according to a standard protocol. The Association acts as a mediator between the different partners. It no longer carries out agronomic trials since 2014.

Shipment reception data, consolidated at the end of the season, takes into account the quantities stated in the contracts, the quantities actually shipped, the planted surfaces and the yields for each of the POs and the companies involved in the sector. The information collected by Mesa del Tomate shows that the volumes actually processed in Extremadura over the past five years have considerably increased, growing from 1.45 million mT in 2012 to close on 2.1 million mT in 2015. 2016 results of "only" 1.87 million mT were badly affected by the destruction of several hundred hectares at the beginning of the season, whereas they could have reached 2.14 million mT on the basis of planted surfaces and average yields for previous years.

According to the information available at the time of writing this article, it is unlikely that surfaces will decrease in 2017. Growers in Extremadura, facing a drastic drop in the profitability of wheat and corn crops in recent years, have been considering alternative crops (tomatoes, almonds, broccoli, etc.). Among these crops, only tomatoes can currently ensure yields that are financially sufficiently motivating. (12th Technical Conference, Acopaex, Don Benito, January 2017). Average yields expected this year could nonetheless be 10% higher than they were last year.

Processors

The Spanish tomato processing industry includes more than twenty companies, private and cooperative, of which the largest deal with up to 850 000 mT per season while the smallest handle less than 5 000 mT. Most of the quantities processed are intended for paste production, but some are used to make dried tomato powders and diced tomato. Low concentration products have been developing slowly. The domestic market only absorbs small quantities of products, meaning that most of the production is shipped to foreign markets.

For historic reasons, Extremadura is the region that has the largest number of processing plants. The currently largest company of the Spanish industry is set up there: founded in 1976 and now led by Manuel Vazquez, the current president of the AMITOM, the

CONESA group (Conservas Vegetales de Extremadura) operates a total of nine tomato processing plants on three continents, for a total industrial capacity of close on 950 000 tonnes. Five of these plants are located in Spain, including four in the Vegas Bajas region, at Badajos, and one in Miajadas:

- CONESA (Badajoz): 7 000 mT/day

- AGRAZ (Badajoz): 3 200 mT/day

- AGROEX (Badajoz): 1 500 mT/day

- ASTEX (Badajoz): 9 000 mT/year (second-stage processing).

- CONESA VEGAS ALTAS (Miajadas): 4 000 mT/day

Two are located in Portugal:

- CONESA PORTUGAL (ex-Sopragol, at Mora): 2 200 mT/day

- TOMATAGRO (San Joao de Ribeira – Portugal): 1 000 mT/day

The group also operates two tomato powder production plants:

- one reprocessing plant in California (AGUSA, Lemoore): 7 700 mT/year of tomato powder

- and one plant in China (FUKANG XIANGFENG, Urumqi): 10 000 mT/year of tomato powder.

The group's Spanish output covers all of the usual product categories: for industrial, catering industry and retail uses, tomato pastes (from 6° to 36°Brix), Cold Break, Hot Break, super Hot Break, passata, pizza sauces, diced tomato, powdered tomato, sauces, organic products and "baby food", in various formats and conditioning types...

The company has been granted all of the main current certifications, for its products themselves, for its agricultural practices and for its traceability systems. In 2015/2016, CONESA produced 254 000 mT of finished products for sale, for a turnover of more than EUR 200 million, mostly thanks to the export market (80%) in Europe as well as in the Middle East, Asia, Canada, etc.

CONESA is involved in a number of agricultural experiments and improvement projects for agronomic practices, carried out on the 1 400 hectares that the group is currently cultivating (half of which is actually owned by the group and self-managed).

In addition to ensuring the supply for part of its raw material requirements, the fact that the company grows a lot of its own crops allows the group to disseminate its knowledge, to study new varieties according to criteria demanded by the industry (Brix, lycopene content, viscosity, etc.), to guarantee the quality of the raw materials used in its organic products and baby food production, and to carry out trials for new cultivation practices that are both profitable and sustainable.

The group also runs its own plant nurseries (40 000 m² of greenhouses), which have allowed it, since 2014, to supply at a very competitive price all of the plants for the growers with whom it collaborates (control of varieties, plant quality, planting programs and dates, product traceability, etc.).

Upstream along the Guadiana river, at Don Benito, in the Vegas Altas,

ALSAT (ALIMENTOS ESPAÑOLES ALSAT, S.L.) runs a processing plant with a capacity of 170 000-185 000 mT per season, dedicated to producing pastes and diced tomatoes in aseptic conditionings, in industrial formats (1 400 liter IBC, 220 liter drums) and bag-in-box packaging (5,10 and 20 liters). The plant belongs to the Centunion Group.

Since the plant was set up in 1985, its industrial capacity has almost never stopped increasing, and now reaches an operational level of approximately 20 000 to 25 000 mT of pastes in various concentrations and qualities (passata, pizza sauces, coulis, S23, Hot Break 28/30, Cold Break 28/30 and 36/38), 22 000 mT of chopped tomatoes and 12 000 mT of pulp and refined pulp.

However, these volumes only partially illustrate the company's strategy, as it has, for several years now, chosen to diversify its production (chopped, pulped) and to seek growth in the volumes and value of finished products rather than in the quantity of raw materials processed. This is why Alsat has endeavored to avoid standard product segments, which suffer too much international competition, and in which the company's relatively limited scope largely prevents it from taking part. So it has focused its strategy and its investments on developing more targeted products, with enhanced value, like low concentration products, particularly pulps and refined pulps, as well as back-in-box conditionings.

Alsat exports more than 90% of its production.

The

PRONAT company was founded in 2003/2004 by a growers cooperative (CASAT) involved in the production of tomatoes, corn, oil, etc., and currently includes 65 associate members with a daily processing capacity of 5 000 mT, which amounts to almost 250 000 mT per season. Tomato paste, pizza toppings, tomato juice and diced tomato are the main products manufactured, along with organic products, baby foods and other special sauces. A number of other fruits and vegetables are also processed (citrus fruits, strawberries, sweet peppers, peaches, apples, etc.). Tomato products are available in bag-in-box container, drums, IBC, tanks, etc.

The annual turnover of the company amounts to some EUR 17 million.

The company is very involved in the improvement of agricultural practices, and aims to obtain the Global GAP certification for the totality of its planted surfaces in the near future. Last year, Pronat planted more than 2 500 hectares, of which the most part (90%) is located within a 40 to 60 km radius around the processing plant. 80% of the fields are drip irrigated, including 5 to 6% with buried drip-lines. Pronat processes between 2 000 and 4 000 mT of organic tomatoes each year.

Since the launch of the project in 2001 right up to the most recent investments carried out last year, Tomates del Guadiana – a cooperative processing unit set up by growers in the Santa Amalia region – has invested close on EUR 38 million in installations that currently cover 150 000 m² (with a further 110 000 m still available), and offers a daily processing capacity of 8 200 mT, or 400 000 mT per season. Initially able to process 1 500 mT/day, the plant has regularly doubled the size of its equipment, which is now designed for manufacturing tomato pastes (28/30 CB and HB, 30/30 and 36/38 HB), pizza toppings, tomato juice and fine pulp, in industrial formats and bag-in-box containers, as well as concentrates of other fruits (peaches, apricots, pears, etc.). Between 2012 and 2016, Tomates del Guadiana invested EUR 16 million in two enzymatic inactivation lines, an evaporator with a capacity of 2 500 mT/day, a pre-concentrator with mechanical recompression of steam, two flash coolers, etc. So in 2016, the volumes of tomatoes under contract for this plant alone amounted to 360 000 mT, which gives the Santa Amalia plant the biggest industrial capacity for a single processing unit in Europe.

Since 2010, the company has used an exclusive patented method for the natural extraction of lycopene, and distributes several food products and cosmetics based on this innovation.

Tomates del Guadiana also endeavors to reduce the distance between crops and the factory, while investing at the same time in equipment and methods to improve quality control, water management, energy saving, etc.

In addition to the products distributed on the national market under the Fruco and Apis brands, Tomates del Guadiana exports 80% of its production, mainly to the markets of the EU, but also to Africa, America and Asia. The company's turnover amounted to EUR 43 million for the past marketing year and could soon reach EUR 50 million according to its executives.

Andalusia: the future of the Spanish industry?

Sometime in the 90s, a new production region developed south of Seville in the Lebrija region, where several companies have set up in the past 10 years. The region enjoys very attractive agricultural yields and has not suffered from drought for several years. Drip irrigation is largely generalized and currently covers approximately 88% of the planted surfaces. Processing capacity in the region has grown drastically since 2012, leading to a fourfold increase in the volumes processed. According to some processors, the average cost of growing tomatoes in Andalusia is estimated at between EUR 4 000 and 5 000 /ha (val. 2016). The production of tomato paste absorbs all of the available raw materials.

200 km south of the Guadiana,

Algosur-Pinzón S.L.U. (ALPINsur, at Los Palacios) buys the agricultural production (cotton, processing tomatoes, corn, and various vegetables, sunflower, etc.) spread out over several hundred hectares, in a region with a total of about 70 000 hectares of irrigated land.

Two processing plants, including one that was purchased in 2015/2016, exclusively manufacture tomato paste (Cold Break 28/30 and 36/38, HB, 6/8 Brix purée, 12/14 Brix pizza topping). Recent investments amounting to EUR 22 million for equipment and increased capacity have taken total capacity to 7 300 mT of fresh tomatoes per day, for a total of approximately 300 000 mT per season, variable according to the end products being manufactured. Alpinsur's target is to reach 10 000 mT/day in the near future.

The availability of irrigated agricultural land (Guadalquivir), the possibilities afforded by crop rotations (rice, corn, cotton, various vegetables, etc.), the excellent yields (an average of 100 mT/hectare, up to 120-130 mT/hectare), along with the low cost of local labor, energy and raw materials, are just several of the features that attract investors and motivate the installation and development of tomato processing plants. Alpinsur only produces a small proportion of its own supply requirements for processing, and all of the raw materials are grown on land that is cultivated according to integrated agriculture principles. 350 to 400 growers, each cultivating between 3 and 300 hectares of processing tomatoes, supply the two Alpinsur processing plants. A large proportion of the harvest (80%) is grown within a 15 to 20 km radius around the factory. Furrow irrigation still accounts for a considerable proportion (20 to 25%) of total surfaces, but drip irrigation is progressing.

Strict controls are carried out on agricultural production, particularly with regard to the use of pesticides, by technicians who are each responsible for approximately 300 hectares of crops: a certification for integrated production is pending.

Alpinsur products, which aim to be as competitive as possible, are exclusively intended for reprocessing by other companies, with regards to whom the company has adopted a strict "no competition" policy.

Set up in 2005 and recently taken over in totality by the Portuguese processing tomato leader Sugal,

Tomates del Sur operates a plant with a daily capacity of 3 000 to 4 000 mT of raw tomato at Las Cabezas de San Juan. A total surface of approximately 2 500 hectares is required to supply the 250 000 mT that the company processes, including 70% grown within a 40 km radius around the factory. The company is a private structure, and its individual growers – about 150 of them last year – have neither formed a cooperative nor a producers' organization.

With the proximity of the Guadalquivir, the region enjoys a major resource for irrigation capacity. Since 2010, Sugal has developed new production zones, and set up partnerships with new growers. Whereas 40% of the crops were still being watered by furrow irrigation in 2010/2011, drip-irrigation has now been set up on almost 90% of the surfaces, with a substantial gain in terms of yield. In the final count, the volumes that did not exceed 40 000 mT/year in 2003 have reached 250 000 mT in 2016. The company intends to further extend by 50% its surfaces dedicated to processing tomatoes and the volumes processed in the near future.

Trade is constantly growing

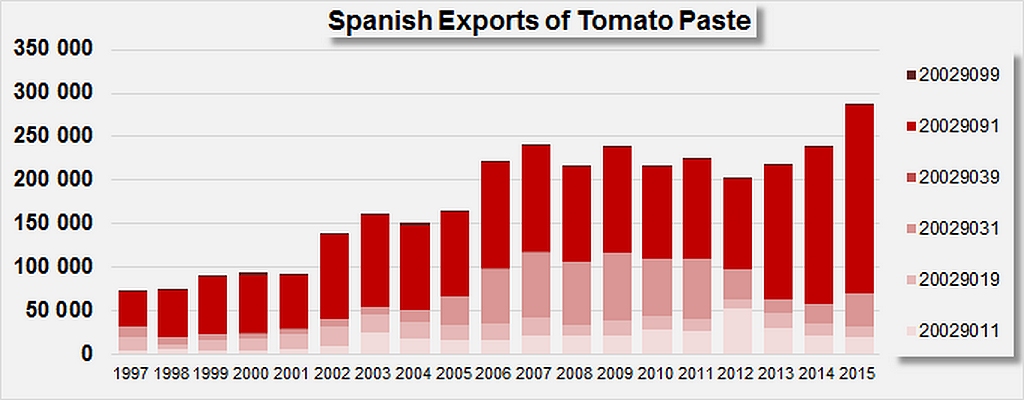

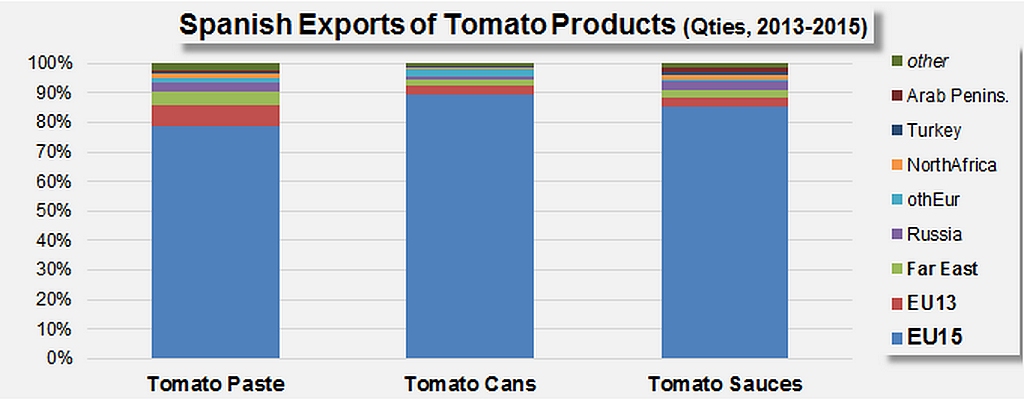

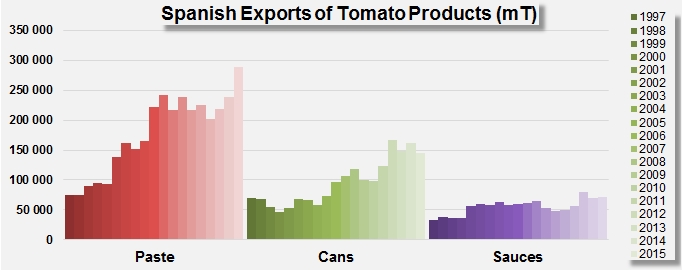

The Spanish tomato processing industry bases a large part of its operation on foreign outlets. In 2015, exports amounted to 288 200 mT for the paste category (finished products, all categories combined, up 31% against the average for the period running 2012-2014), to 145 500 mT for the canned tomato category (down 8% in comparison to the same period) and to 72 000 mT for the sauces category (+5%).

Pastes of more than 30°Brix in industrial formats (20029091) have represented the largest proportion of export shipments (75%) at the outcome of a shift that has seen them overtake 12-30°Brix paste in industrial conditionings (20029031). Foreign sales of low concentration products (less than 12°Brix) have recorded sharp drops in recent years.

Overall, exports of Spanish tomato products have recorded explosive growth over recent years. The volumes of raw materials absorbed by this aspect of operations amounted in 2015 to an estimated 2.37 million mT, up by almost 600 000 mT (+33%) compared to the average of the three previous years. Most of this progression has occurred thanks to the development of the paste category, and to a lesser extent of the sauces category, whereas canned tomato exports have suffered from the worldwide commercial context and from competition from Italy.

Simultaneously, the turnover generated by export activities in 2015 improved by 21% on the average performance of the three previous years (2012-2014), with sales estimated in excess of EUR 435 million. The weight of the Euro-Zone has considerably increased in recent years, growing from under 70% of the total at the end of the 90s to close on 75% for the last three years considered (2013-2015).

Spanish exports of tomato products are mostly intended for EC markets: over the 2013-2015 period, countries of the EU28 absorbed 79% of Spanish exports of tomato paste, 89% of canned tomato exports and 85% of sauces exports.

(See also our article in the November 2016 issue of Tomato News and the special report in the December 2016 issue.)

The editorial team of Tomato News wishes to extend its sincere thanks to all industry leaders, researchers, and association leaders, particularly the Agrucon, whose information and comments were essential to the compilation of this report.

Some complementary data

Compared evolution of surfaces in Extremadura, Andalusia and in the rest of Spain over the past five years.

Production results in the main regions of Spain, between 2012 and 2016.

Spanish exports of tomato products, from 1997 to 2015.

Comparison of agricultural yields and average soluble solids contents upon factory reception in the north of Italy and in the two main production regions of Spain.

Appendices/Annexes

For more information and further details, here are the websites of some of the Spanish industry's main operators:

This occupation of surfaces, which has been growing year on year, has not progressed in a uniform fashion throughout the production regions. In 2016, the accumulated surfaces of the two main tomato cultivation regions – Extremadura and Andalusia (33 170 hectares) – were 45% higher than the average of the four previous years (2012-2015). But although surfaces in Extremadura grew by 5 700 hectares (+29%), the increase was much more rapid in Andalusia, where surfaces increased by 4 600 hectares, or 125%, over the same period. In total, the surfaces dedicated to processing tomatoes grew from 16 900 hectares in 2012 to 24 900 hectares in 2016 in Extremadura, and from 1 800 hectares in 2012 to 8 250 hectares in 2016 in Andalusia.

This occupation of surfaces, which has been growing year on year, has not progressed in a uniform fashion throughout the production regions. In 2016, the accumulated surfaces of the two main tomato cultivation regions – Extremadura and Andalusia (33 170 hectares) – were 45% higher than the average of the four previous years (2012-2015). But although surfaces in Extremadura grew by 5 700 hectares (+29%), the increase was much more rapid in Andalusia, where surfaces increased by 4 600 hectares, or 125%, over the same period. In total, the surfaces dedicated to processing tomatoes grew from 16 900 hectares in 2012 to 24 900 hectares in 2016 in Extremadura, and from 1 800 hectares in 2012 to 8 250 hectares in 2016 in Andalusia. The fields that have been planted with tomato crops along the Guadiana river in Extremadura are mostly composed of silty loam, with varying proportions of sand. Although it is a long way from the sea, the region enjoys a climate that is both semi-Continental and Mediterranean, and particularly dry and warm. The risk of frost during the planting period (March-June) is minimal, but the very high temperatures in July (33-34°C in daytime, 19-20°C at night) can cause blossom drop. The region is well-equipped in terms of water resources and irrigation infrastructures and has not known heavy drought since 1995, but it is mostly the equipment in which growers have invested that has made the difference. Over all of Extremadura, virtually all the surfaces (93%) are now set up with drip-irrigation systems, of which 79% are conventional overhead installations and 14% are buried line installations. Only 7% of the surfaces are still watered by furrow irrigation, but this proportion continues to regularly decrease. More specifically, crops in the western part of the Guadiana Basin – the Vegas Bajas – all benefit from drip irrigation, whereas crops planted in the Vegas Altas are still partly watered by furrow irrigation.

The fields that have been planted with tomato crops along the Guadiana river in Extremadura are mostly composed of silty loam, with varying proportions of sand. Although it is a long way from the sea, the region enjoys a climate that is both semi-Continental and Mediterranean, and particularly dry and warm. The risk of frost during the planting period (March-June) is minimal, but the very high temperatures in July (33-34°C in daytime, 19-20°C at night) can cause blossom drop. The region is well-equipped in terms of water resources and irrigation infrastructures and has not known heavy drought since 1995, but it is mostly the equipment in which growers have invested that has made the difference. Over all of Extremadura, virtually all the surfaces (93%) are now set up with drip-irrigation systems, of which 79% are conventional overhead installations and 14% are buried line installations. Only 7% of the surfaces are still watered by furrow irrigation, but this proportion continues to regularly decrease. More specifically, crops in the western part of the Guadiana Basin – the Vegas Bajas – all benefit from drip irrigation, whereas crops planted in the Vegas Altas are still partly watered by furrow irrigation. Extremadura hosts several of the main Spanish processing plants, whose primary activity remains tomato paste production. However, the processing of chopped tomatoes and sauces is a growing business in this region. It is also important to note that Extremadura is the region where the world's main factories of powdered dried tomato are located.

Extremadura hosts several of the main Spanish processing plants, whose primary activity remains tomato paste production. However, the processing of chopped tomatoes and sauces is a growing business in this region. It is also important to note that Extremadura is the region where the world's main factories of powdered dried tomato are located. In Spain, relations between growers and processors are handled by powerful and well-organized POs, based on contracts that are concluded prior to the harvest and that notably determine volumes and prices for raw tomato.

In Spain, relations between growers and processors are handled by powerful and well-organized POs, based on contracts that are concluded prior to the harvest and that notably determine volumes and prices for raw tomato. Each year, it trains and employs about 100 people, spread out into four teams, responsible for the independent control of the quality of shipments delivered (grading, detection of pesticides and heavy metal residues), according to a standard protocol. The Association acts as a mediator between the different partners. It no longer carries out agronomic trials since 2014.

Each year, it trains and employs about 100 people, spread out into four teams, responsible for the independent control of the quality of shipments delivered (grading, detection of pesticides and heavy metal residues), according to a standard protocol. The Association acts as a mediator between the different partners. It no longer carries out agronomic trials since 2014.

Two are located in Portugal:

Two are located in Portugal:

In addition to ensuring the supply for part of its raw material requirements, the fact that the company grows a lot of its own crops allows the group to disseminate its knowledge, to study new varieties according to criteria demanded by the industry (Brix, lycopene content, viscosity, etc.), to guarantee the quality of the raw materials used in its organic products and baby food production, and to carry out trials for new cultivation practices that are both profitable and sustainable.

In addition to ensuring the supply for part of its raw material requirements, the fact that the company grows a lot of its own crops allows the group to disseminate its knowledge, to study new varieties according to criteria demanded by the industry (Brix, lycopene content, viscosity, etc.), to guarantee the quality of the raw materials used in its organic products and baby food production, and to carry out trials for new cultivation practices that are both profitable and sustainable. Upstream along the Guadiana river, at Don Benito, in the Vegas Altas, ALSAT (ALIMENTOS ESPAÑOLES ALSAT, S.L.) runs a processing plant with a capacity of 170 000-185 000 mT per season, dedicated to producing pastes and diced tomatoes in aseptic conditionings, in industrial formats (1 400 liter IBC, 220 liter drums) and bag-in-box packaging (5,10 and 20 liters). The plant belongs to the Centunion Group.

Upstream along the Guadiana river, at Don Benito, in the Vegas Altas, ALSAT (ALIMENTOS ESPAÑOLES ALSAT, S.L.) runs a processing plant with a capacity of 170 000-185 000 mT per season, dedicated to producing pastes and diced tomatoes in aseptic conditionings, in industrial formats (1 400 liter IBC, 220 liter drums) and bag-in-box packaging (5,10 and 20 liters). The plant belongs to the Centunion Group.

The PRONAT company was founded in 2003/2004 by a growers cooperative (CASAT) involved in the production of tomatoes, corn, oil, etc., and currently includes 65 associate members with a daily processing capacity of 5 000 mT, which amounts to almost 250 000 mT per season. Tomato paste, pizza toppings, tomato juice and diced tomato are the main products manufactured, along with organic products, baby foods and other special sauces. A number of other fruits and vegetables are also processed (citrus fruits, strawberries, sweet peppers, peaches, apples, etc.). Tomato products are available in bag-in-box container, drums, IBC, tanks, etc.

The PRONAT company was founded in 2003/2004 by a growers cooperative (CASAT) involved in the production of tomatoes, corn, oil, etc., and currently includes 65 associate members with a daily processing capacity of 5 000 mT, which amounts to almost 250 000 mT per season. Tomato paste, pizza toppings, tomato juice and diced tomato are the main products manufactured, along with organic products, baby foods and other special sauces. A number of other fruits and vegetables are also processed (citrus fruits, strawberries, sweet peppers, peaches, apples, etc.). Tomato products are available in bag-in-box container, drums, IBC, tanks, etc. The annual turnover of the company amounts to some EUR 17 million.

The annual turnover of the company amounts to some EUR 17 million. Since the launch of the project in 2001 right up to the most recent investments carried out last year, Tomates del Guadiana – a cooperative processing unit set up by growers in the Santa Amalia region – has invested close on EUR 38 million in installations that currently cover 150 000 m² (with a further 110 000 m still available), and offers a daily processing capacity of 8 200 mT, or 400 000 mT per season. Initially able to process 1 500 mT/day, the plant has regularly doubled the size of its equipment, which is now designed for manufacturing tomato pastes (28/30 CB and HB, 30/30 and 36/38 HB), pizza toppings, tomato juice and fine pulp, in industrial formats and bag-in-box containers, as well as concentrates of other fruits (peaches, apricots, pears, etc.). Between 2012 and 2016, Tomates del Guadiana invested EUR 16 million in two enzymatic inactivation lines, an evaporator with a capacity of 2 500 mT/day, a pre-concentrator with mechanical recompression of steam, two flash coolers, etc. So in 2016, the volumes of tomatoes under contract for this plant alone amounted to 360 000 mT, which gives the Santa Amalia plant the biggest industrial capacity for a single processing unit in Europe.

Since the launch of the project in 2001 right up to the most recent investments carried out last year, Tomates del Guadiana – a cooperative processing unit set up by growers in the Santa Amalia region – has invested close on EUR 38 million in installations that currently cover 150 000 m² (with a further 110 000 m still available), and offers a daily processing capacity of 8 200 mT, or 400 000 mT per season. Initially able to process 1 500 mT/day, the plant has regularly doubled the size of its equipment, which is now designed for manufacturing tomato pastes (28/30 CB and HB, 30/30 and 36/38 HB), pizza toppings, tomato juice and fine pulp, in industrial formats and bag-in-box containers, as well as concentrates of other fruits (peaches, apricots, pears, etc.). Between 2012 and 2016, Tomates del Guadiana invested EUR 16 million in two enzymatic inactivation lines, an evaporator with a capacity of 2 500 mT/day, a pre-concentrator with mechanical recompression of steam, two flash coolers, etc. So in 2016, the volumes of tomatoes under contract for this plant alone amounted to 360 000 mT, which gives the Santa Amalia plant the biggest industrial capacity for a single processing unit in Europe.

200 km south of the Guadiana, Algosur-Pinzón S.L.U. (ALPINsur, at Los Palacios) buys the agricultural production (cotton, processing tomatoes, corn, and various vegetables, sunflower, etc.) spread out over several hundred hectares, in a region with a total of about 70 000 hectares of irrigated land.

200 km south of the Guadiana, Algosur-Pinzón S.L.U. (ALPINsur, at Los Palacios) buys the agricultural production (cotton, processing tomatoes, corn, and various vegetables, sunflower, etc.) spread out over several hundred hectares, in a region with a total of about 70 000 hectares of irrigated land.  Two processing plants, including one that was purchased in 2015/2016, exclusively manufacture tomato paste (Cold Break 28/30 and 36/38, HB, 6/8 Brix purée, 12/14 Brix pizza topping). Recent investments amounting to EUR 22 million for equipment and increased capacity have taken total capacity to 7 300 mT of fresh tomatoes per day, for a total of approximately 300 000 mT per season, variable according to the end products being manufactured. Alpinsur's target is to reach 10 000 mT/day in the near future.

Two processing plants, including one that was purchased in 2015/2016, exclusively manufacture tomato paste (Cold Break 28/30 and 36/38, HB, 6/8 Brix purée, 12/14 Brix pizza topping). Recent investments amounting to EUR 22 million for equipment and increased capacity have taken total capacity to 7 300 mT of fresh tomatoes per day, for a total of approximately 300 000 mT per season, variable according to the end products being manufactured. Alpinsur's target is to reach 10 000 mT/day in the near future. Set up in 2005 and recently taken over in totality by the Portuguese processing tomato leader Sugal, Tomates del Sur operates a plant with a daily capacity of 3 000 to 4 000 mT of raw tomato at Las Cabezas de San Juan. A total surface of approximately 2 500 hectares is required to supply the 250 000 mT that the company processes, including 70% grown within a 40 km radius around the factory. The company is a private structure, and its individual growers – about 150 of them last year – have neither formed a cooperative nor a producers' organization.

Set up in 2005 and recently taken over in totality by the Portuguese processing tomato leader Sugal, Tomates del Sur operates a plant with a daily capacity of 3 000 to 4 000 mT of raw tomato at Las Cabezas de San Juan. A total surface of approximately 2 500 hectares is required to supply the 250 000 mT that the company processes, including 70% grown within a 40 km radius around the factory. The company is a private structure, and its individual growers – about 150 of them last year – have neither formed a cooperative nor a producers' organization. With the proximity of the Guadalquivir, the region enjoys a major resource for irrigation capacity. Since 2010, Sugal has developed new production zones, and set up partnerships with new growers. Whereas 40% of the crops were still being watered by furrow irrigation in 2010/2011, drip-irrigation has now been set up on almost 90% of the surfaces, with a substantial gain in terms of yield. In the final count, the volumes that did not exceed 40 000 mT/year in 2003 have reached 250 000 mT in 2016. The company intends to further extend by 50% its surfaces dedicated to processing tomatoes and the volumes processed in the near future.

With the proximity of the Guadalquivir, the region enjoys a major resource for irrigation capacity. Since 2010, Sugal has developed new production zones, and set up partnerships with new growers. Whereas 40% of the crops were still being watered by furrow irrigation in 2010/2011, drip-irrigation has now been set up on almost 90% of the surfaces, with a substantial gain in terms of yield. In the final count, the volumes that did not exceed 40 000 mT/year in 2003 have reached 250 000 mT in 2016. The company intends to further extend by 50% its surfaces dedicated to processing tomatoes and the volumes processed in the near future.