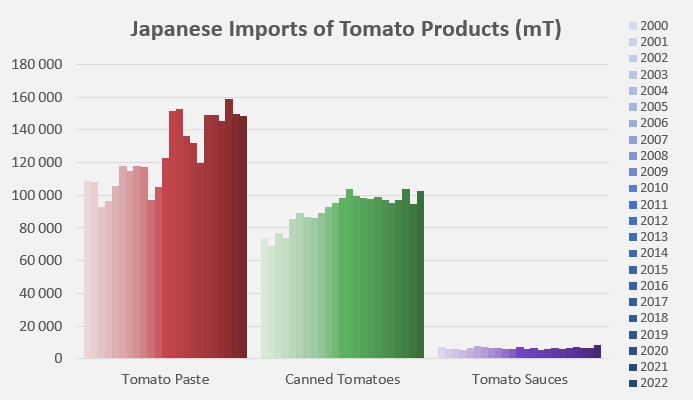

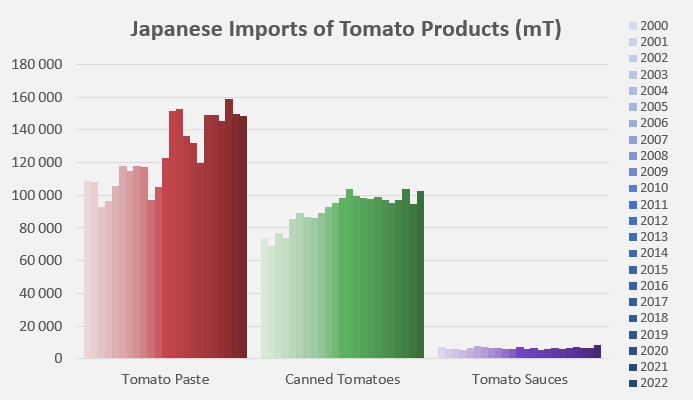

Slight readjustment in the pastes category, and a clear increase of canned tomatoes and sauces

After a fairly sharp dip in the middle of the previous decade, particularly in the tomato paste category, Japanese imports of tomato products have started to rise again and are now at levels rarely reached before.

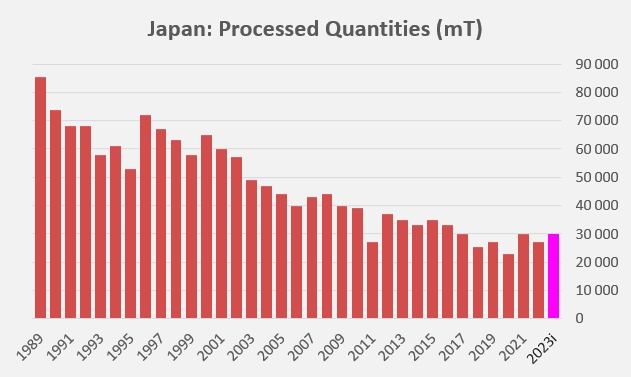

Japan has its own processing industry, but such activities have declined sharply since the early 1990s. The national industry currently processes about 25,000 to 30,000 tonnes of tomatoes per year, which is about 2 to 3% of the country's estimated annual consumption. Japan remains more than ever extremely dependent on imports to supply its national market.

From January to December 2022, tomato paste imports (148,400 metric tonnes (mT), under codes 200290) stalled slightly (-1.8%) compared to the previous three years (2019-2021), but remained in line (+0.4%) with the quantities purchased during the three years (2017-2020) prior to the Covid health crisis.

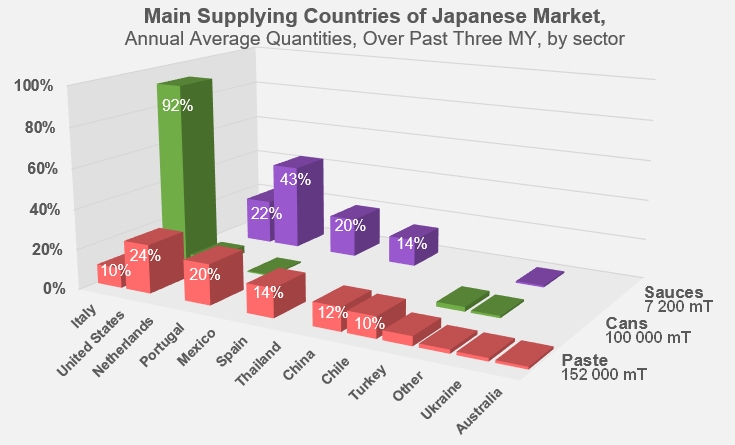

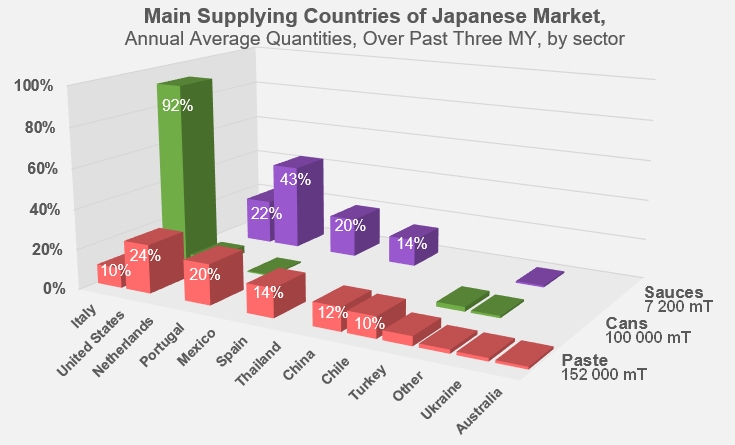

However, this stability in quantities masks a discreet refocusing of Japanese paste purchases on historical supplier countries, but above all some clear reorientations of purchases that have negatively impacted sales of Chinese products (-17% annual variation, -29% compared to pre-Covid) and, conversely, positively impacted Turkish products (+55% annual variation, +64% compared to the pre-Covid period), Australian products (49% more than in 2021 and 43% more than over the 2017-2019 period) and Italian products (4% more than in 2021 and 29% more than in the 2017-2019 period), to name only the most spectacular.

In the canned tomatoes category, Japanese imports (nearly 103,000 mT, under codes 200210) recorded a double increase in 2022, of more than 4% in annual variation and of nearly 7% compared to the pre-Covid period. In this sector largely dominated by products of Italian origin, Japanese purchases of Turkish products declined significantly in 2022, by about 9% compared to the year 2021 and by almost 12% compared to pre-Covid figures.

The quantities mobilized for the Japanese sauces market are much smaller than those for the categories of paste and canned tomatoes. Imports (under codes 210320) amounted in 2022 to 8,800 mT, up by about 30% compared to both 2021 and to the 2017-2019 period. This spectacular increase has benefited Dutch products, but also Thai and Mexican products, two origins that have been growing significantly on the Japanese market in recent years. Sales of US products, on the other hand, confirmed the downward trend observed over the past two or three years, with quantities down by almost 63% compared to the period preceding the Covid pandemic.

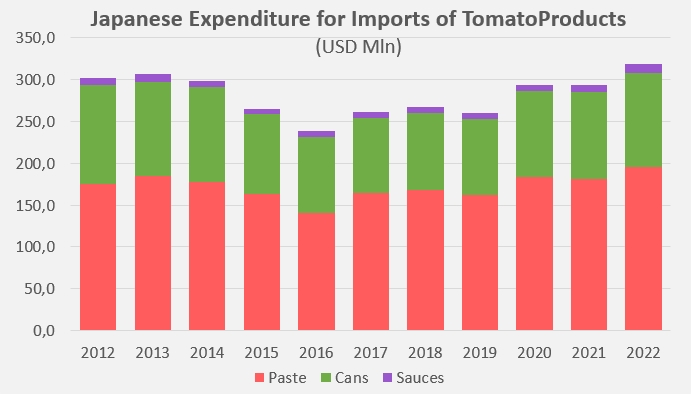

After declining significantly between 2010 and 2016, due to a decrease in the quantities involved and a decline in unit prices, Japan's expenditure on imported tomato products has increased again in recent years, reaching a value of around USD 320 million in 2022. Pastes (about 61%) and canned tomatoes (about 36%) account for most of Japan's expenditure.

Some complementary data

Quantities processed by the Japanese industry since 1989

Sources: TDM, WPTC