Press release

, François-Xavier Branthôme

-

Concern over the geopolitical crisis in the Red Sea region is having an impact on several markets, including the food industry. The Italian processing tomato sector is no exception, as it has always been strongly export-oriented, with around 60% of production destined to cross national borders.

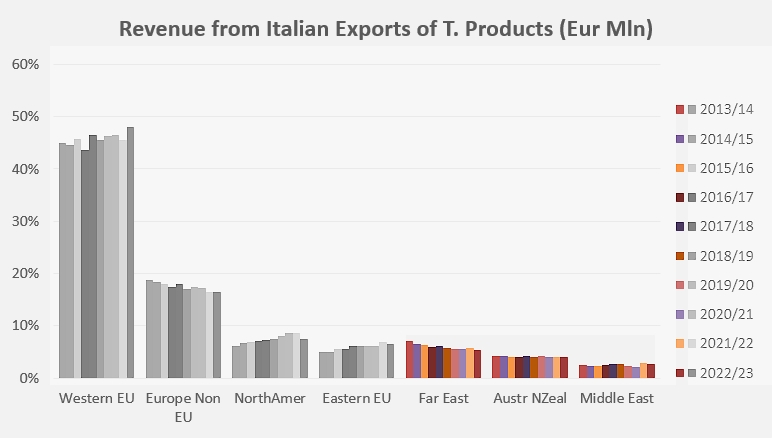

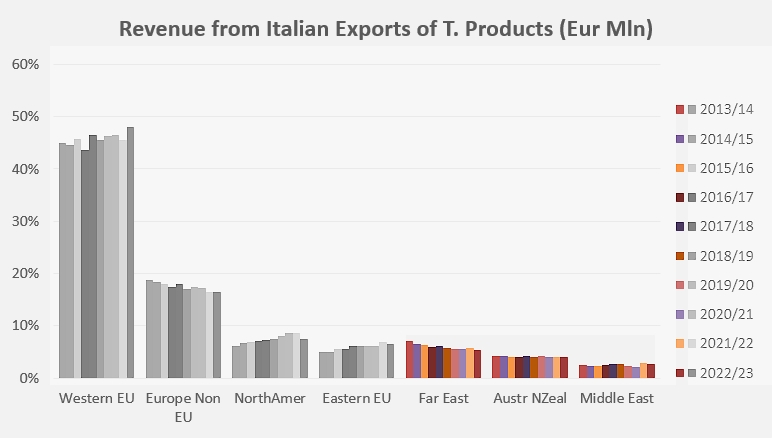

The main markets affected by these new difficulties are in Asia, Australasia and, to a lesser extent, the Middle East. The industry estimates exports at nearly EUR 380 million (13.5% of total exports). For this reason, tensions in the Suez Canal are likely to have a very serious impact on trade flows, particularly in terms of higher freight costs.

"Sharp rise in freight costs"

"Sharp rise in freight costs"

"We are concerned about the high level of uncertainty currently characterizing the global geopolitical scenario," said Giovanni de Angelis, Managing Director of ANICAV, at the end of January. "What is happening in the Suez Canal is likely to have a major impact on the export of our products. The markets of Asia and Australasia – I'm thinking in particular of Japan and Australia, but also of many other countries – represent an essential commercial outlet. The increase in freight costs generated by the context needs to be monitored very closely, as it could affect the competitiveness of our companies abroad. Among other things, due to this situation and the reduced availability of ships and containers, we are also facing difficulties on other routes, with a consequent increase in freight costs. Added to this is the impact on the supply of raw materials and semi-finished products – mainly metal packaging – which are mostly sourced in the Far East."

The industry in figures

The tomato processing industry is Italy's largest producer of processed fruit and vegetables. With total sales (2023) of EUR 5 billion (3.5 billion generated by ANICAV member companies), it plays a strategic role and stimulates the national economy, employing around 10,000 permanent workers and over 25,000 seasonal workers, in addition to the workforce engaged in related industries.

Italy is the world's third-largest tomato processor after the United States and China, and it remains the leading processor of products intended directly for final consumption, accounting for 12.2% of worldwide production (44.2 million tonnes in 2023) and 53% of European processing operations.

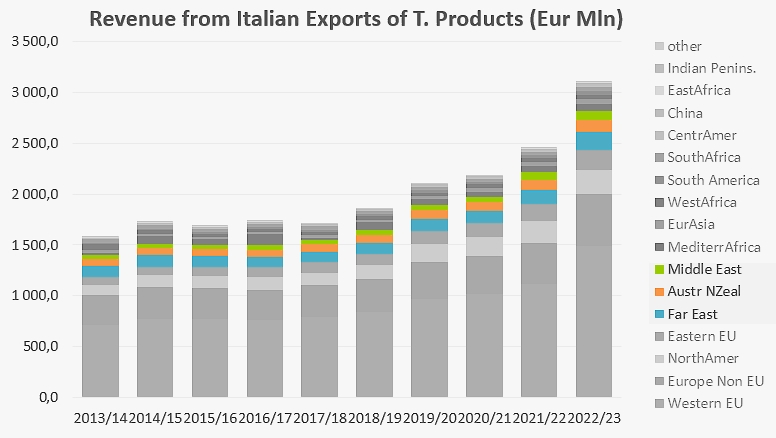

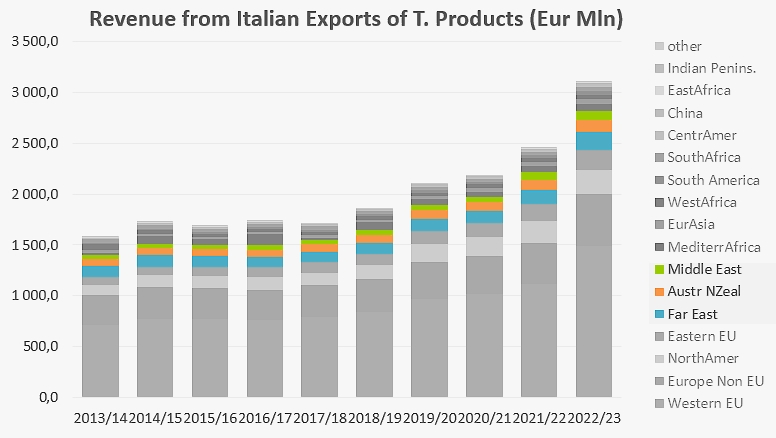

In 2022/2023, Italian exports generated sales of EUR 3.1 billion, 378 million of which were accounted for by the Far East, Australia-New Zealand and the Middle East alone.

In mid-February, the ANICAV also commented on the 2024 campaign targets for the South-Central production basin. Following a series of meetings over the past few weeks, the ANICAV's Territorial Committee Coordination for the South-Central region has identified a processing target of around 2.6 million tonnes for the entire region.

"We believe that the processing season in the Central and Southern parts of the country should be concentrated over eight/nine weeks," said Marco Serafini, President of the ANICAV "This will enable the entire industry to optimize costs, reduce consumption, particularly water consumption, while guaranteeing better product quality for the end consumer. What is required is agricultural planning that takes into account the industry's need for greater concentration of deliveries and a quantity of oblong tomatoes that does not exceed 40% of production."

"Our wish," continued Serafini, "is to see, in the short term, a discussion taking place with the agricultural sector that could lead to the conclusion of an agreement for the management of the next processing season, based on the Zone's Framework Contract with which the partners have become largely familiar over recent years."

Some complementary data

Evolution of Italian Revenues from Exports of Tomato Products, by Region

Sources: corriereortofrutticolo.it