Imports

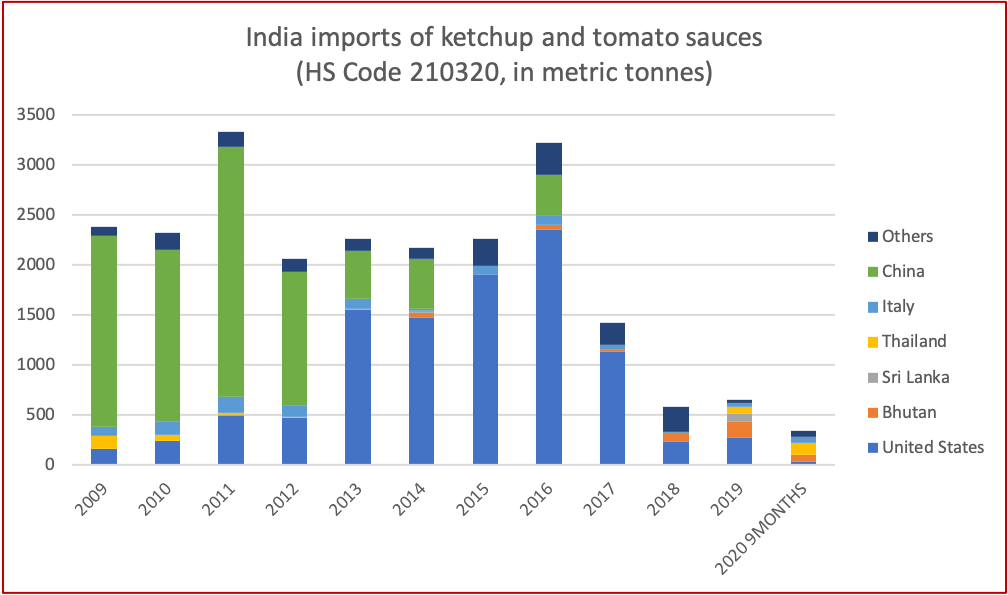

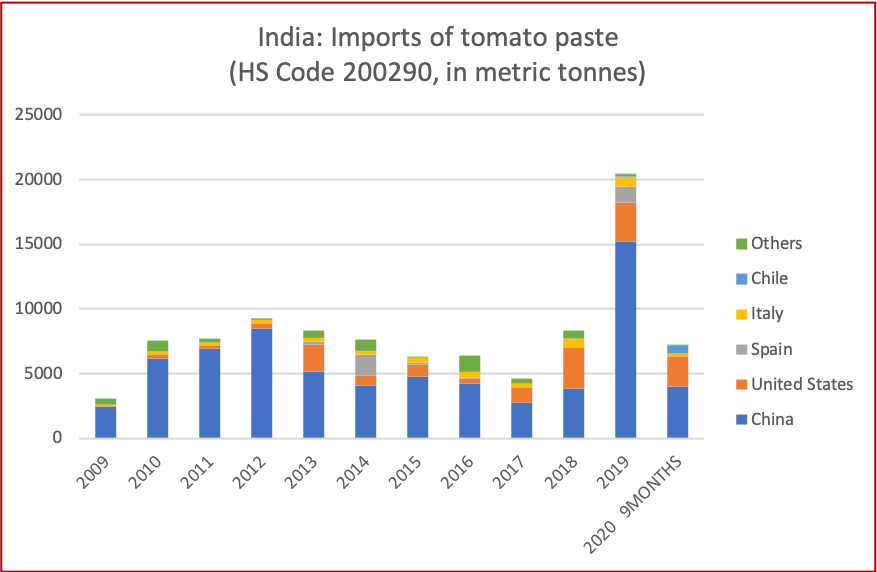

The total value of imports of finished products (canned tomato, sauce and paste) reached 20.64 Million US Dollars in 2019. Likewise, the total quantity of imports grew by 146 % in 2019.

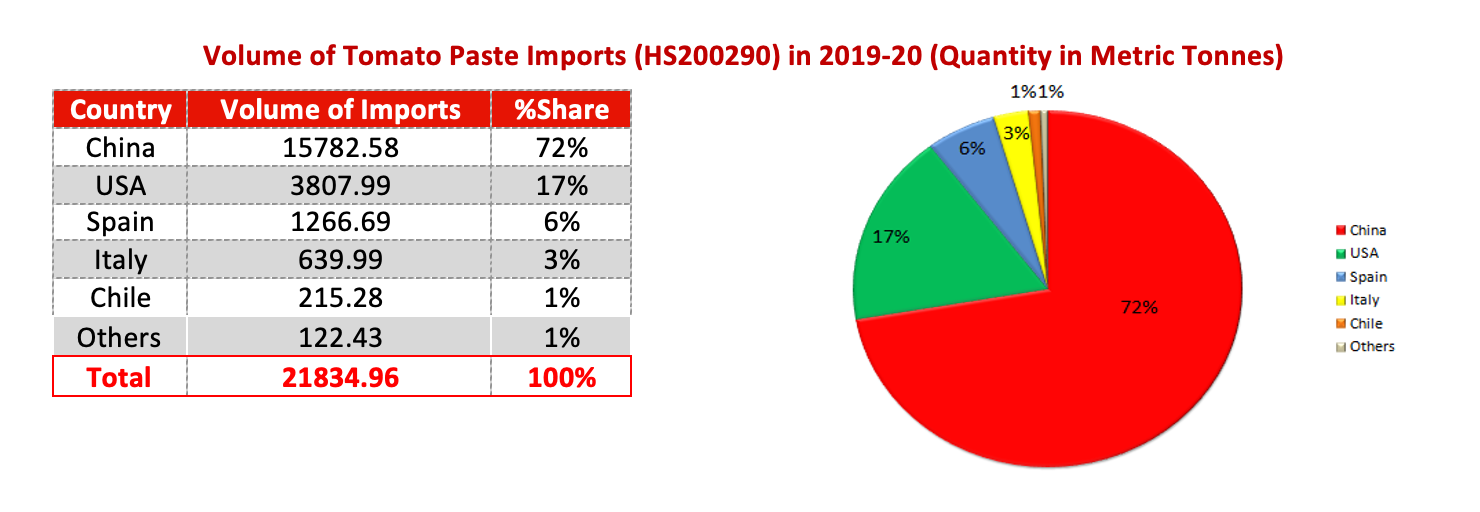

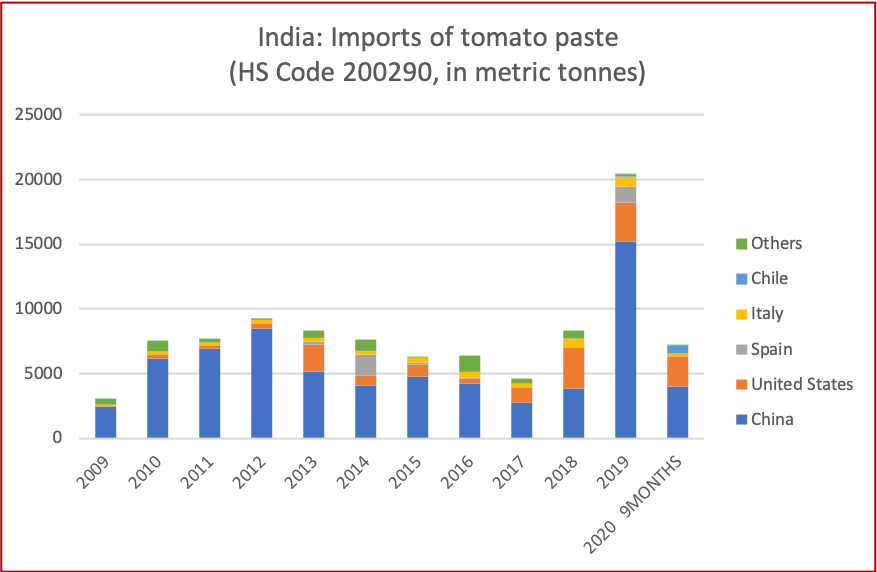

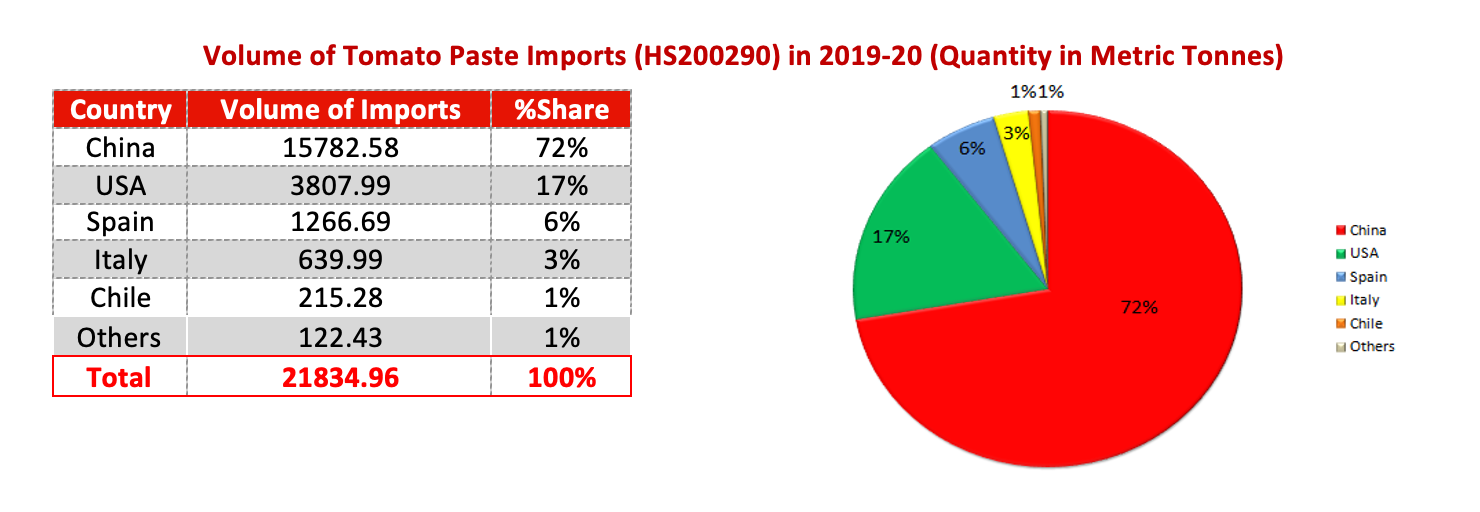

The total value of tomato paste (HS200290) imports in India, during the marketing year 2019-20 reached 19 Million US Dollars- a CAGR of 160% was registered in the same year. Nearly 72% of the imports were from China followed by USA, Spain, Italy and Chile. Tomato paste imports from the UK, Switzerland, Nigeria, Malaysia and Bhutan were miniscule.

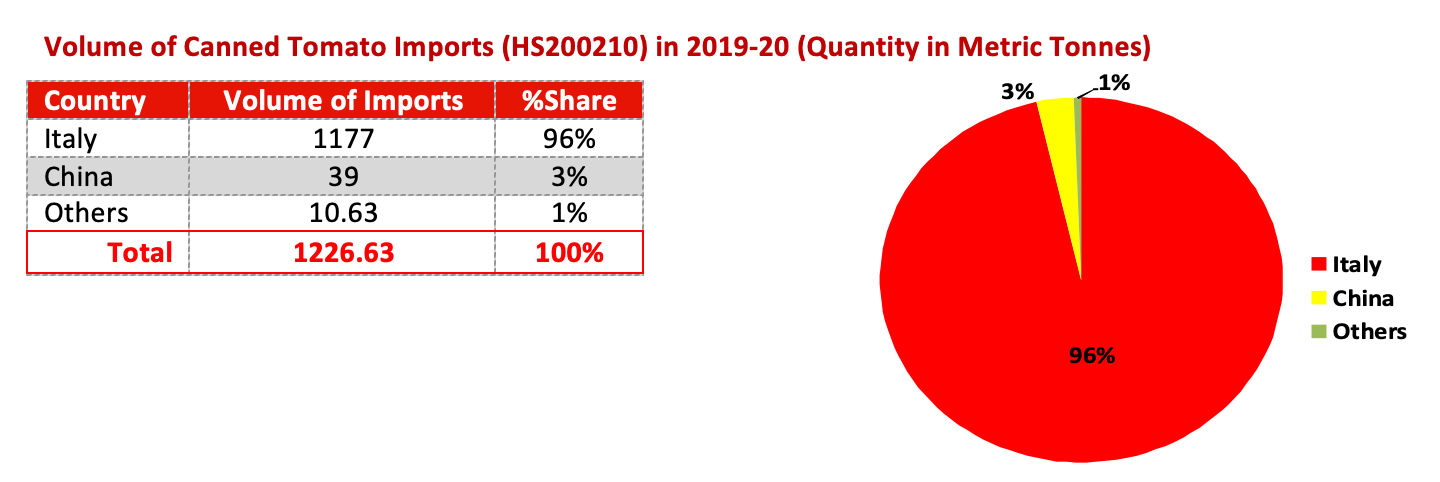

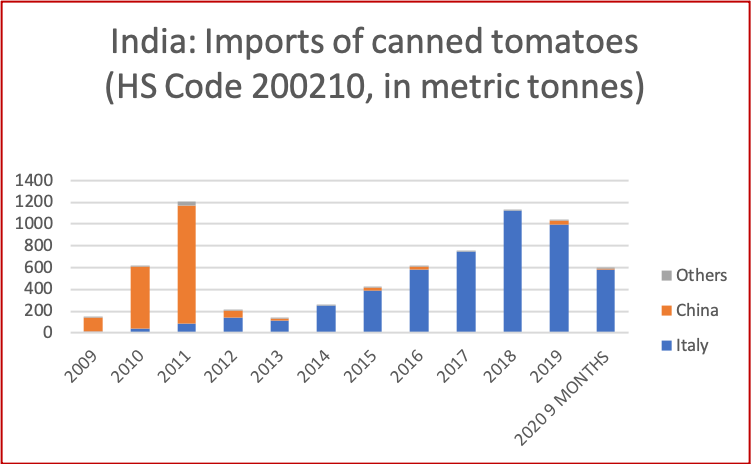

In 2019-20, Italy secured the largest share of canned tomato (HS200210) exports to India, followed by China. Canned tomato imports from the UK, Netherlands and Spain contributed to nearly 1% of the total imports. In 2018-19, some canned tomatoes were imported from UAE & Australia alone but, in 2019-20, no imports were recorded from these countries. The total value of canned tomato imports in India was as low as 0.94 Million US Dollars, during the marketing year 2019-20.

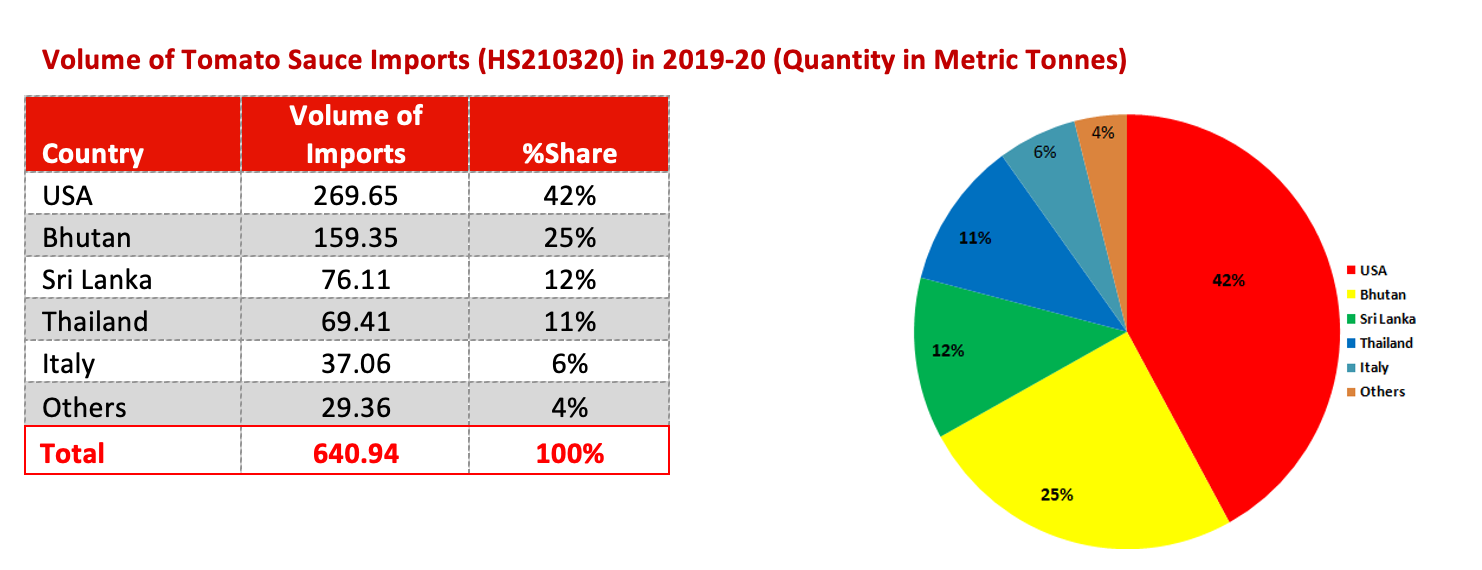

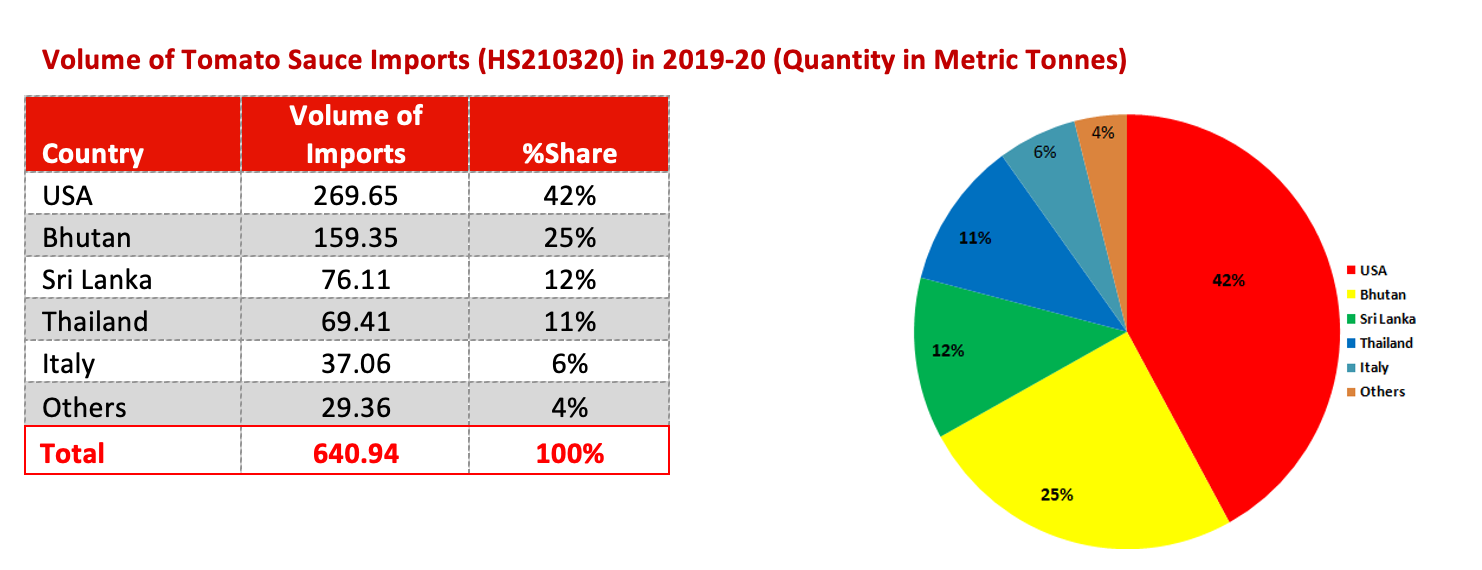

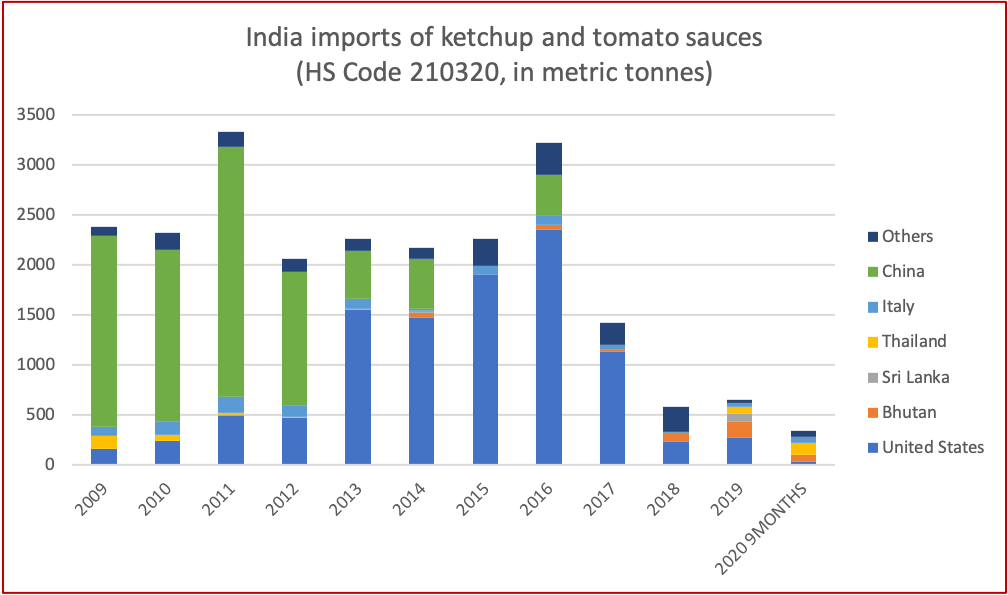

The total volume of Tomato Sauce (HS210320) imports in India reached 640.94 Metric Tonnes during the marketing year 2019-20.The total value of these imports dropped by 2.6% in 2019-20 to reach 733,000 US Dollars. The highest imports were from the USA, Bhutan, Sri Lanka, Thailand and Italy.

Exports

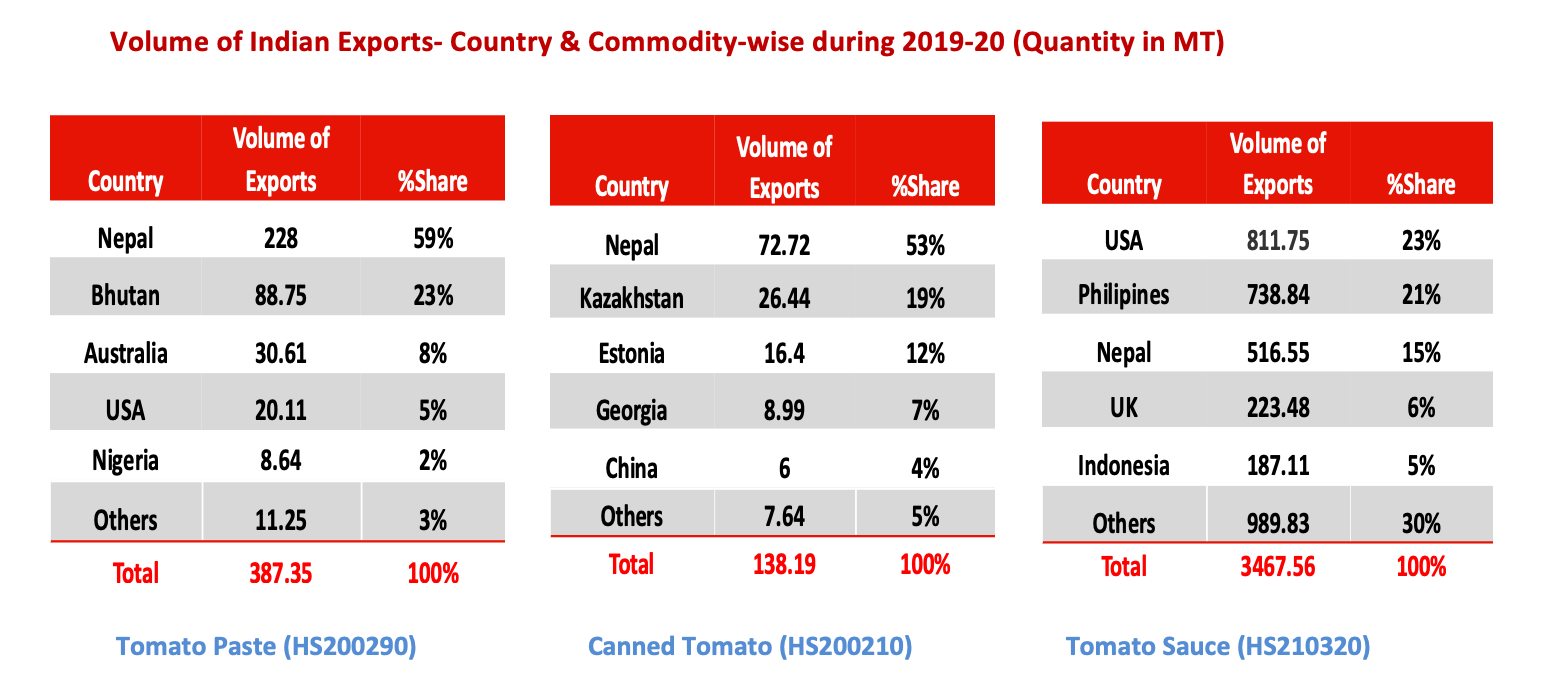

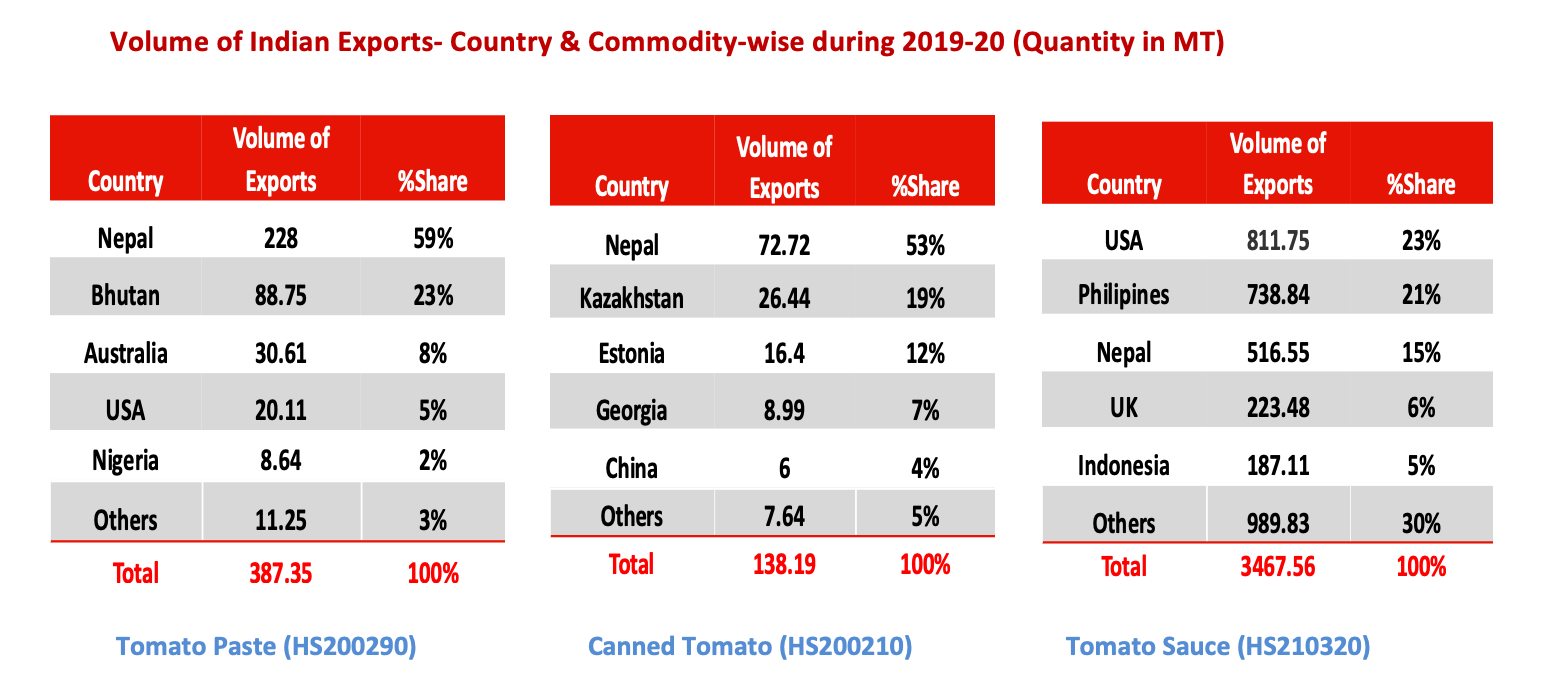

Nepal is a key trading partner to India and holds a market share of 59% of the total Tomato Paste (HS200290) exports. However, the volume of exports to Nepal dropped by almost 26% in 2019-20 to reach 228 MT from 309 MT in 2018-19. Export volumes to Bhutan surged by 108% in 2019 to reach 88.75 MT. In 2019-20, the total value of Tomato Paste Exports from India stood at 187,000 US Dollars, a significant growth of nearly 160% was recorded when compared to 2018-19.

India exported nearly 138.19 MT of Canned Tomato (HS200210) products in 2019-20. The value of these exports reached 94,000 US Dollars in 2019-20. Exports to Nepal acquired the highest market share of 53% out of India’s total trade volume. The remaining 47% share was split between Kazakhstan, Estonia, Georgia, China, and other countries in the Middle East, Europe and South East Asia.

Nearly 23% of the total volume of Ketchup and Tomato Sauce (HS210320) products were exported to the USA in 2019-20.The value of tomato sauce exports recorded a CAGR of 6% in 2019 to reach 4.85 million US Dollars during the marketing year 2019-20. Some of the lowest quantities of tomato sauce products were exported to countries in the African sub-continent.

Estimated demand

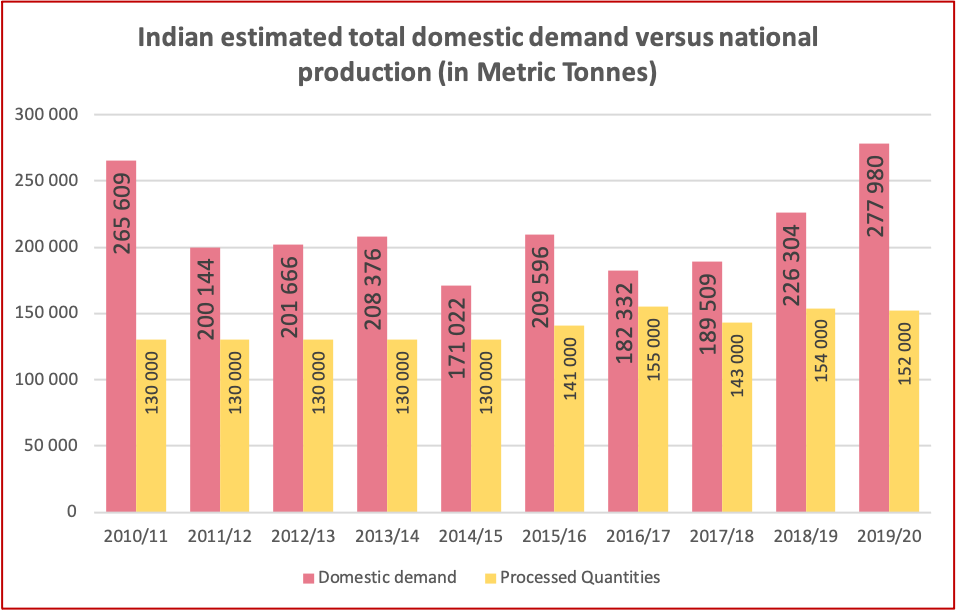

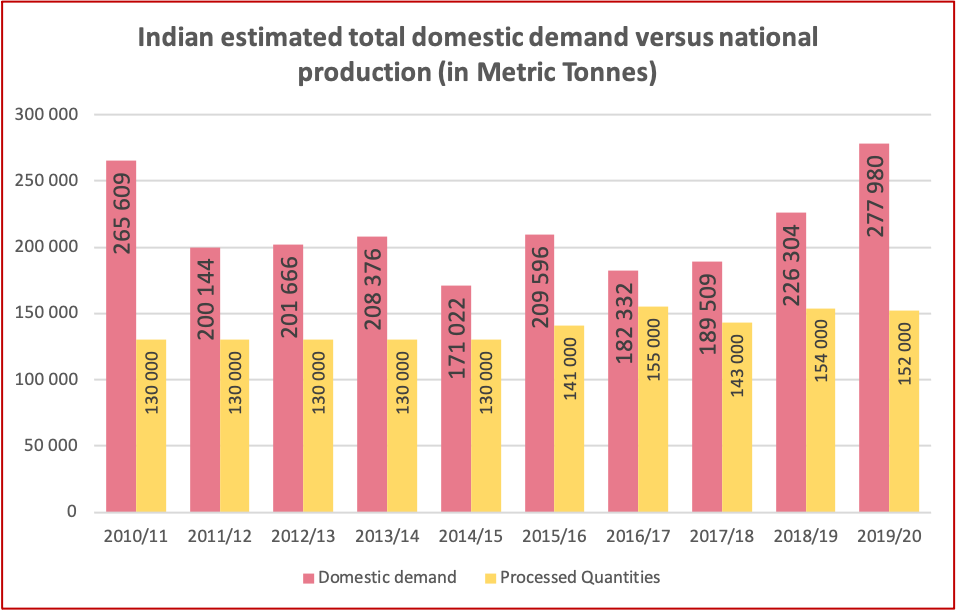

In India, the domestic consumption of products derived from processed tomatoes outweighs the total production of processed tomatoes. Based on the production estimates and on the import and export data, the apparent consumption of processed tomatoes can be estimated at abut 278,000 Metric Tonnes in 2019/20, an increase of more than 20% annually since 2017/18.

Based on these figures, the per capita consumption can be estimated at 0.17kg in 2018-19 and 0.21kg in 2019-20.

These calculations are consistent with other data showing that India’s demand for processed tomato products is expanding at an estimated 30% annually driven by both a growth in the population and by an increased consumer demand for established products like pasta sauce and ketchup as well as new ready-to-eat products, gravies and bulk supplies to food retail chains including fast-food restaurants, hotel chains. The Indian market is also witnessing strong product diversification with expansion into curry gravies, ready-to-eat curries and dry powder mixes in addition to traditional products like ketchup, puree, juice and dried tomato.

This growth has been triggered by an increase in domestic consumption (mainly in the HoReCa sector) of products derived from processed tomatoes. Due to the volatility of fresh tomatoes, the demand for packed tomato paste in particular is on the rise. According to NRAI India Food Services Report, the market size of the Indian HoReCa sector is estimated at Rs 1,48,353 cr (approx 20 Billion US Dollars) in 2018-19. The segment is further estimated to grow at a CAGR of 15 per cent to reach Rs 2,57,907 (35 Billion US Dollars) in 2022-2023.

Key Summary

“The use of tomato paste is increasing double digit in India: thus there is an emerging market. However, the size of the market is such that about 8000 hectares (out of about 900,000 hectares) of tomatoes will suffice to service the processing requirement- So it is still a very small market. The market in India is not very quality conscious and accepts sub-standard tomato paste: added sugar, pH corrected, artificial colouring. Many units only have basic HACCP (Hazard Analysis and Critical Control Points) certification using non-closed systems for processing. There is no dedicated tomato processing industry: tomato processing is an opportunistic activity when tomato APMC prices fall below Rs 4 per kg. These are some of the key issues to be addressed among others.”

Dr. Mans Lanting, Senior Consultant- Sustainable Agricultural (chain) Development- Green Innovation Centre (Excerpts of presentation titled,‘Economic production of processing tomatoes- a case study’ at NAAS Strategy Workshop on 24 Nov, 2020)

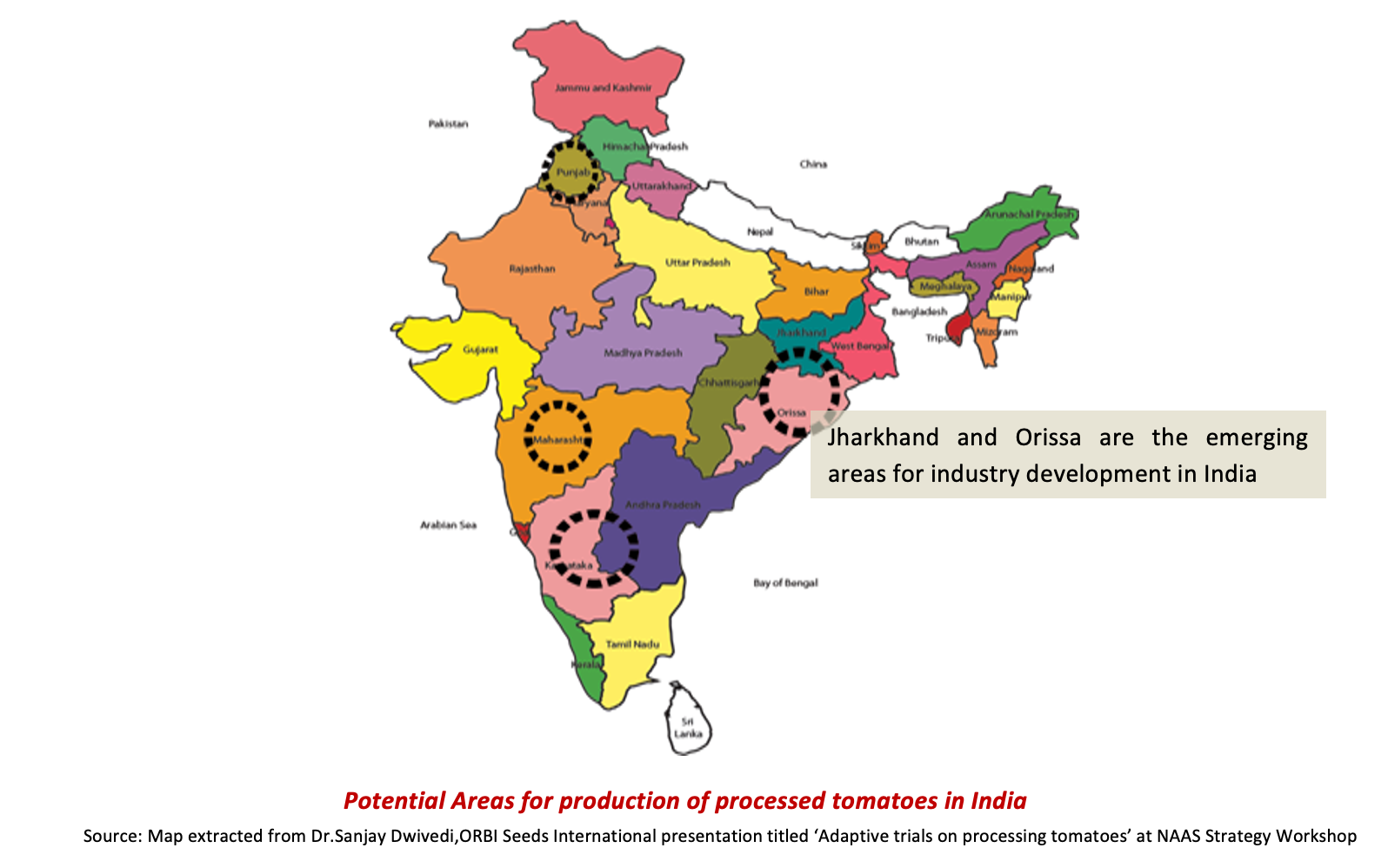

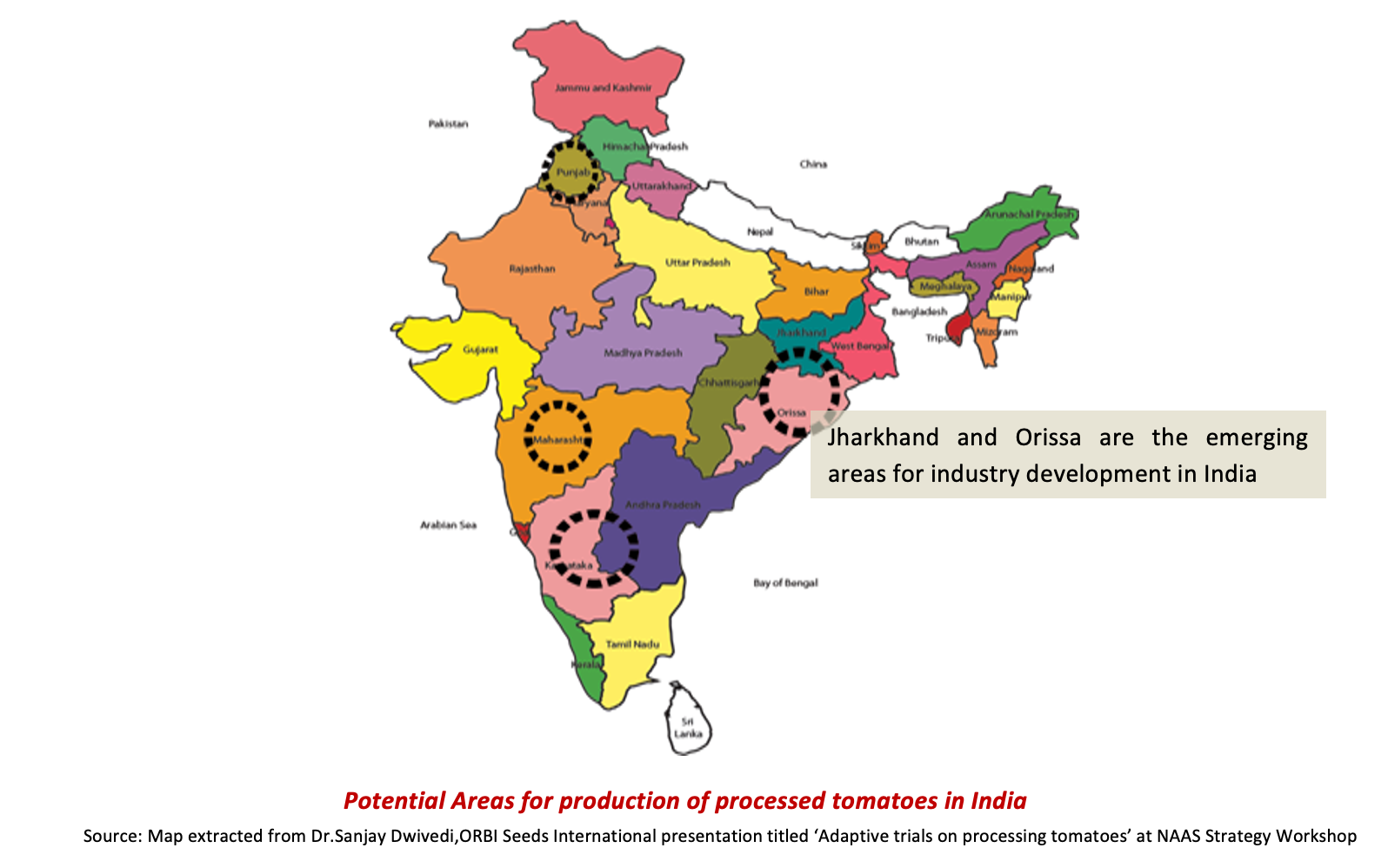

Most paste processors supply to a number of value-added product makers though some ketchup and snack manufacturers have annual processing contracts with paste makers. Processers use between 10-20% of their annual processing capacities for tomato paste production while the remainder is used for processing other vegetables and fruit, particularly mango pulp. Andhra Pradesh and Maharashtra remain the leading center for processors, possibly due to the availability of large volumes of fresh tomatoes and other raw material supplies, followed by Karnataka, Tamil Nadu and Punjab.

A 46.5% customs duty is levied on import of tomato paste, pulp and juice concentrate since 2014 which has moved value-added producers to procure and use paste and pulp sourced from domestic sources, either through:

a - The establishment of in-house paste production units;

b - Managing the supply chain management for raw material but hiring processing facilities based on seasonal needs as pursued by the "Global Green" initiative; and,

c - Sourcing paste from intermediaries through long-term supply contracts or spot purchases.

Secondly, paste/pulp producers as well as value-added product processers are more vigorously developing networks with farmer groups and clusters and incentivizing the adoption of contract farming. There is an increased recognition that value enhancement along the supply chain can make the subsequent manufacturing process both more sustainable and commercially viable. Product manufacturers indicate a willingness to source paste from wherever it is available in India.

Conclusion

Considering India’s volume of annual trade balance which are equivalent to approximately 130,000 metric tonnes of fresh tomatoes in addition to about 150,000 tonnes processed, the total market is currently estimated at under 300,000 tonnes but it estimated to grow at a rate of up to 30% per year. In view of the land availability in areas with a suitable climat, the growing middle class urban population and continued growth of the HoReCa sector, and government policy, it can only be expected that the volume of tomato products processed and consumed in the country should see a rapid growth in the next few years. India could even emerge as an exporter of processed tomato products in the future. We will explore these opportunities further in another article to be published in January 2021.

This dossier was complied by Shruti Sasidharan, an Independant Market Research Consultant in cooperation with the Tomato News Team. Shruti can be contacted at shruti@tomatonews.com.

Attached document: A list of companies and organizations in India