Under the CBAM, EU importers of goods at high risk of carbon leakage will have to purchase carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules. The emissions price of the imported goods will be calculated on the "embedded emissions" of the goods (i.e., emissions occurring during manufacturing and certain indirect emissions), and the average weekly carbon auction price under the ETS, minus the potential charges paid by the non-EU producer pursuant to the carbon pricing regime in force in the country of production.

Under the CBAM, EU importers of goods at high risk of carbon leakage will have to purchase carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules. The emissions price of the imported goods will be calculated on the "embedded emissions" of the goods (i.e., emissions occurring during manufacturing and certain indirect emissions), and the average weekly carbon auction price under the ETS, minus the potential charges paid by the non-EU producer pursuant to the carbon pricing regime in force in the country of production.

In this respect, the provisional agreement of December 13, 2022, clarifies the initial list of goods falling under the CBAM, namely iron, steel and some of their downstream products, cement, aluminum, fertilizers, electricity, and hydrogen. EU institutions also agreed to postpone the entry into effect of the mechanism. The CBAM should start as of October 2023 for a transitional period, during which EU importers will only have to report the embedded emissions of the imported goods.

The Carbon Border Adjustment Mechanism (CBAM), on which MEPs reached an agreement with EU governments in December 2022 to prevent carbon leakage will be phased in at the same speed that the free allowances in the ETS will be phased out for them. The CBAM will therefore start in 2026 and be fully phased in by 2034. For the sectors affected by CBAM, the free allowances to industries in the ETS will be phased out as follows: 2026: 2.5%, 2027: 5%, 2028: 10%, 2029: 22.5%, 2030: 48.5%, 2031: 61%, 2032: 73.5%, 2033: 86%, 2034: 100%.

Currently, tomato products are not included in the list of items affected by this scheme, which was set up to reestablish some balance for the competitiveness of European products subject to carbon legislation against imports of products from countries outside the EU that do not apply an equivalent tax. The text provides for the evolution of European legislation in the future on this point and, in the long term, the inclusion in the system of products currently considered to be at risk of carbon leakage, including those from our tomato industry.

At present, no mechanism has been put in place to protect exports, but in the same way, the European Commission will examine in the future the case of exports of European products, whose competitiveness is affected by taxes paid under the ETS, when these exports are destined for countries where equivalent products are not subject to equivalent environmental regulations. By 2025, the Commission will assess the risk of carbon leakage for goods produced in the EU intended for export to non-EU countries and, if needed, present a WTO-compliant legislative proposal to address this risk. In addition, an estimated 47.5 million allowances will be used to raise new and additional financing to address any risk of export-related carbon leakage.

A second provisional agreement was reached on December 18, 2022, on the revision of the ETS. This agreement settles key issues such as the increase of emission reduction targets, the creation of an ETS II for buildings and road transport, and the addition of new conditions to benefits from free allowances. This will directly impact the CBAM: as free allowances in sectors covered by the CBAM will be phased out, EU importers will have to start purchasing these certificates after 2027 for embedded emissions of the goods that no longer benefit from free allowances.

Key points

2030 emissions reduction target increased to 62% vs 43% previously

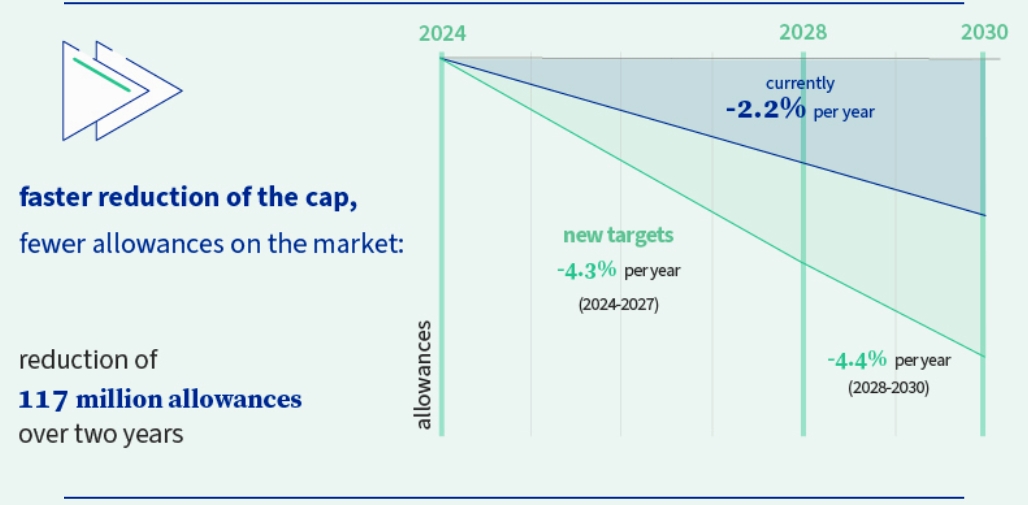

2030 emissions reduction target increased to 62% vs 43% previouslyo Emissions cap will fall at a faster 4.3% rate between 2024-2027, and 4.4%

between 2028-2030 vs the current rate of 2.2%

o There will also be a two-step cap reduction with a 90 million tonne cut in 2024 and another 27 million tonne cut in 2026

? Carbon Border Adjustment Mechanism will begin in transitional form in 2023.

? Carbon Border Adjustment Mechanism will begin in transitional form in 2023.o Full adoption will be phased in over the 2026-2034 period

o No direct exemption/rebate for exporters

Shipping inclusion finalized with an aim to also add waste incineration from 2028

Shipping inclusion finalized with an aim to also add waste incineration from 2028 Free allocation changes will reward ‘good performers’ and punish ‘bad performers’

Free allocation changes will reward ‘good performers’ and punish ‘bad performers’o Aviators to lose all free allocation by 2026

REPowerEU sales will start in 2023

REPowerEU sales will start in 2023o Allowances will be sold to raise EUR 20 billion to help the transition away from Russian fossil fuels

In order to determine the number of free allowances that a company can be allocated, a calculation is made based on its own energy activity data (in terajoules (TJ)). This data related to active operations is then translated into allocated allowances (emission rights (in metric tonnes of CO2 equivalent)) using "benchmarks" defined at the European level. These reference standards are numerous and are regularly revised to promote technological progress in order to improve the environmental performance of companies. They are subject to a periodical adjustment whose maximum annual coefficient of degressivity is currently 1.6%. The current revision of the ETS could be accompanied by an acceleration of the requirements. Currently, the benchmark for the sector to which the processing tomato industry belongs is 47.3 t C02/TJ until 2025, but for the period 2026 to 2030, the maximum annual adjustment of the benchmarks is increased to 2.5% (compared to 1.6% applied until now), so that the applicable benchmark could decrease to 31.15 t C02/TJ for the period 2026-2030, thus decreasing the quantities of allowances allocated.

In order to determine the number of free allowances that a company can be allocated, a calculation is made based on its own energy activity data (in terajoules (TJ)). This data related to active operations is then translated into allocated allowances (emission rights (in metric tonnes of CO2 equivalent)) using "benchmarks" defined at the European level. These reference standards are numerous and are regularly revised to promote technological progress in order to improve the environmental performance of companies. They are subject to a periodical adjustment whose maximum annual coefficient of degressivity is currently 1.6%. The current revision of the ETS could be accompanied by an acceleration of the requirements. Currently, the benchmark for the sector to which the processing tomato industry belongs is 47.3 t C02/TJ until 2025, but for the period 2026 to 2030, the maximum annual adjustment of the benchmarks is increased to 2.5% (compared to 1.6% applied until now), so that the applicable benchmark could decrease to 31.15 t C02/TJ for the period 2026-2030, thus decreasing the quantities of allowances allocated. If they do not comply with the recommendations addressed to them, facilities subject to the obligation to carry out an energy audit or to have a certified energy management system will incur a 20% penalty on the free emissions rights allocated to them (unless the amortization of the recommended investments exceeds 3 years or if the costs are deemed disproportionate).

If they do not comply with the recommendations addressed to them, facilities subject to the obligation to carry out an energy audit or to have a certified energy management system will incur a 20% penalty on the free emissions rights allocated to them (unless the amortization of the recommended investments exceeds 3 years or if the costs are deemed disproportionate).  Facilities whose emissions levels are higher than those recorded for 80% of the companies subject to the corresponding benchmarks must prepare a decarbonization plan before May 1, 2024 (on pain of a penalty of 20% of their free emissions rights) and must verify compliance with the associated interim targets every five years.

Facilities whose emissions levels are higher than those recorded for 80% of the companies subject to the corresponding benchmarks must prepare a decarbonization plan before May 1, 2024 (on pain of a penalty of 20% of their free emissions rights) and must verify compliance with the associated interim targets every five years.

The new directive and CBAM regulation will be published shortly.

Some complementary information

For further details about the Agreement on the EU Emissions Trading System, click here.

Background

Source: TomatoEurope, jdsupra.com, consilium.europa.eu, europarl.europa.eu

Under the CBAM, EU importers of goods at high risk of carbon leakage will have to purchase carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules. The emissions price of the imported goods will be calculated on the "embedded emissions" of the goods (i.e., emissions occurring during manufacturing and certain indirect emissions), and the average weekly carbon auction price under the ETS, minus the potential charges paid by the non-EU producer pursuant to the carbon pricing regime in force in the country of production.

Under the CBAM, EU importers of goods at high risk of carbon leakage will have to purchase carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules. The emissions price of the imported goods will be calculated on the "embedded emissions" of the goods (i.e., emissions occurring during manufacturing and certain indirect emissions), and the average weekly carbon auction price under the ETS, minus the potential charges paid by the non-EU producer pursuant to the carbon pricing regime in force in the country of production.