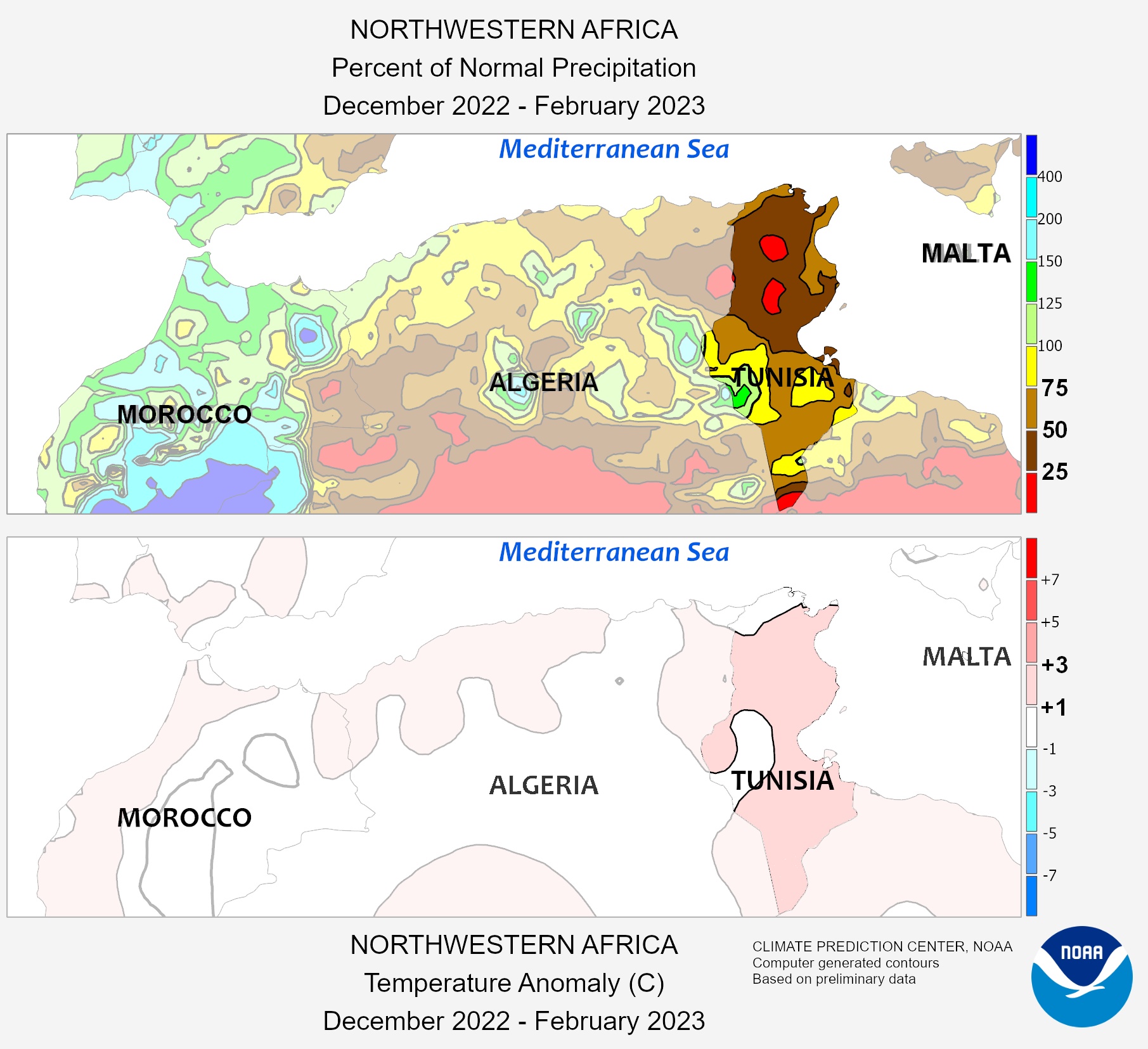

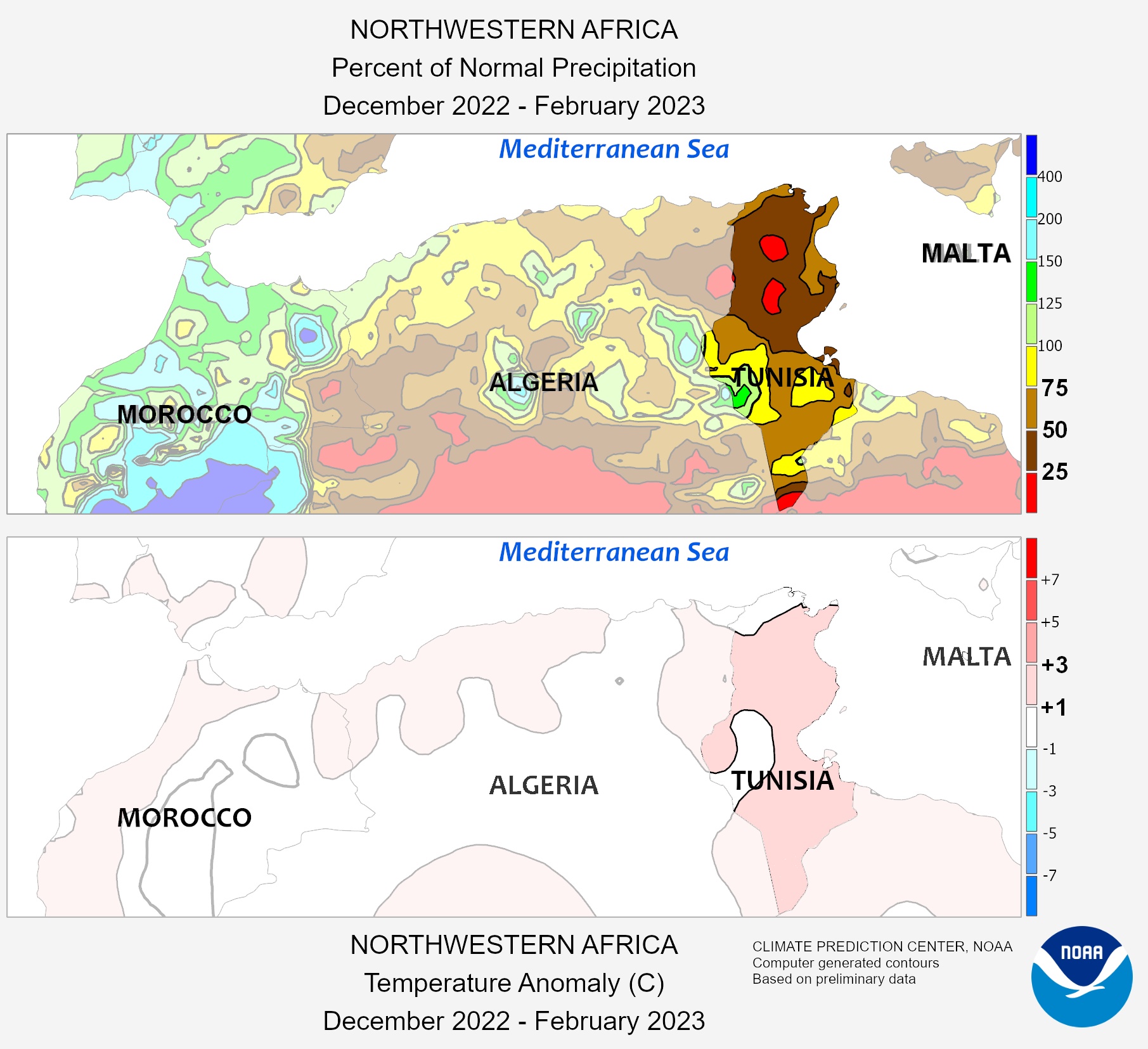

Following a dry winter and spring, the Mediterranean area is facing a drought which could have serious repercussions on agricultural crops including tomatoes.

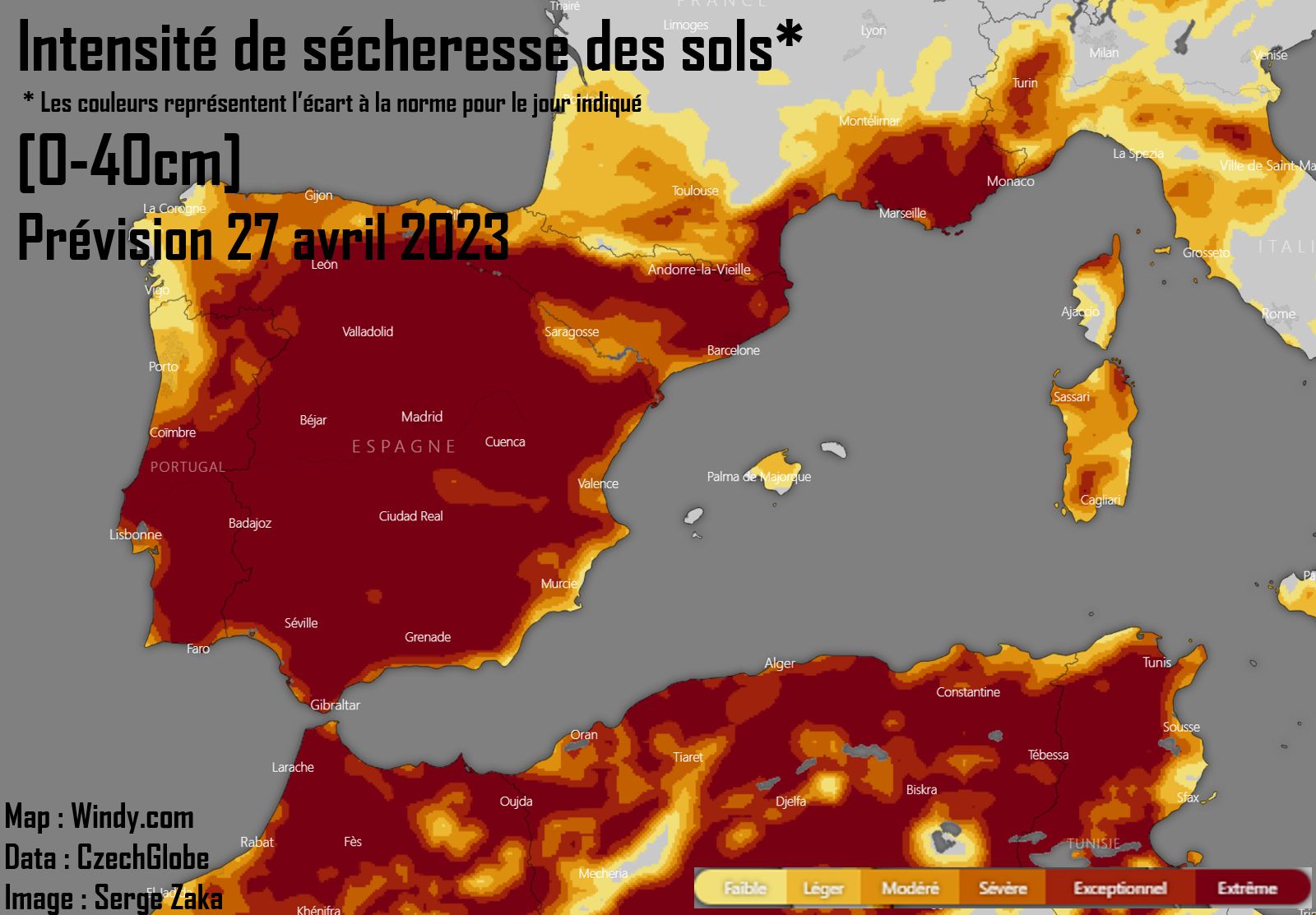

Intensity of drought in soils as of 27 April 2023 (comparison with normal range)

At the end of April, 1-10% water will remain in Mediterranean and Spanish soils. It can now be said that the region is plunging into an agricultural crisis that will certainly have international repercussions. Total crop losses are already confirmed over large Spanish and North African and no improvement is planned until further notice.

Drought in Tunisia leads to lower tomato volumes

Like other Mediterranean countries, Tunisia is facing a severe drought that has compelled the Tunisian government to implement water-use quotas, increasing the price of water for agricultural use, and even restricting household access to tap water.

Tomatoes are among the most impacted crops, according to Marwa Balti, an agronomist at Sicam Agri. She says, "The climatic conditions have led to a significant decrease in the tomato acreage. At our level, we estimate this decline at 10%, corresponding to our areas in the north of the country. The decrease is much more important at the national level since we have added new surfaces equipped with groundwater irrigation, which is not the case with our competition."

The drop in production comes at a time when demand for Tunisian tomatoes is increasing due to insufficient volumes from Morocco and Spain as well. Tunisian growers are deploying efforts to place themselves in a better position this season, according to Marwa. "For this campaign, we can still increase our volumes since we have planted only 70% of our area. There is a strong demand for Tunisian tomatoes from European markets, especially for peeled tomatoes and crushed peeled tomatoes. This year, the opportunity is important for us to open new markets and develop our share in existing ones."

Sicam Agri is a contracting company that supports a significant part of the Tunisian tomato industry, according to Marwa. "We provide funding, seeds, equipment, and technical advice to growers, and we hold a 50% market share in the tomato sector for these specific services, corresponding to 5,000 hectares spread throughout the country. We are the only contractor to provide upstream 100% of production costs and one of the few to provide plant-health treatment products that are 100% homologated."

Regarding Sicam's supply possibilities this season, and the demand, Marwa says, "We're expecting a volume of 360,000 tonnes, which is one-third of the national production of Tunisia. We grow the varieties Ercole, Gladis, H1886, Farah, Dorra, Savera, H7709, Saada, and Topspore. Usually, a significant part of our production goes to our tomato processing plant, and we export up to 40% of our fresh volumes. But foreign demand for fresh tomatoes is spectacularly increasing this season, coming mainly from Libya, France, Italy, and Germany. On the other hand, we are witnessing a slower demand from the Gulf countries."

Italy: medium-term concerns over issues regarding tomatoes and drought

Agricultural operations in rural areas started a few weeks ago, and there are still three months to go before the start of the tomato harvest and the processing season. But growers already know they are going to have to face difficulties linked to the weather in terms of high temperatures and drought, against which there are no easy solutions.

"Unfortunately, there are few short-term solutions," explained Alessandro Squeri, General Manager of Steriltom. "We are indeed very concerned. I am referring to what our grandparents accomplished, who built water-collecting infrastructures allowing our basins to maintain active economic systems, which are based on agriculture."

"Unfortunately, there are few short-term solutions," explained Alessandro Squeri, General Manager of Steriltom. "We are indeed very concerned. I am referring to what our grandparents accomplished, who built water-collecting infrastructures allowing our basins to maintain active economic systems, which are based on agriculture."

Long-term measures are needed to set up infrastructures that can be used for the coming decades. The Piacenza-based group is doing its part with an investment of EUR 30 million to achieve a level of efficiency that will allow a 30% reduction in CO2, as announced at the Cibus Connecting event in Parma.

Industries in the South are also concerned

According to the Italian press on March 19, the drought is also likely to affect the South, especially Campania. The phenomenon could affect the tomato processing industry, an indirect consequence of the water deficit that is recorded in some areas of the central and northern regions, especially the Po Valley basin.

The Coldiretti fears a reduction in available supplies. "Water is essential to keep alive the agricultural systems without which food production and the competitiveness of the entire food sector are threatened," explained Coldiretti President Ettore Prandini. Tomatoes are one of the crops that need the most water and "the risk is real for the agro-industry of Campania, which processes and buys precisely in the at-risk areas."

Processing companies located in Campania (Naples, Salerno, etc.) say they are worried, as the processing season approaches. "We work from July to September," explained Gaetano Torrente, Commercial director of La Torrente, which processes 60,000 tonnes of tomatoes each year. "For the coming season, drought is a real worry, because it means less production. Furthermore, the current situation is likely to result in higher prices as costs will have to be spread over smaller quantities of product. Sales of products in foodservice conditionings, intended for out-of-home consumption, have recovered, while retail formats, intended for in-home consumption, are still somewhat slower than previous years. The purchasing power of the consumers who are customers of supermarket retailers has decreased, and they buy less," concludes Gaetano Torrente.

An analysis of tomato product sales in 2022 shows that in retail channels throughout Italy, the most sold product was tomato puree (60.7%), followed by pulp (21.6%), peeled tomatoes (11.8%), cherry tomatoes (4.2%) and pastes and other products (1.7%). The results of the 70 companies in the sector located in Campania – 55 of which are in the province of Salerno – show an overall annual turnover of EUR 2.1 billion, of which 1.5 billion is generated by exports. "We achieve about 50% of the total turnover of Italy's tomato sector in Campania. We have always been strongly export-oriented. The canning sector alone moves about 12,000 containers a month through the ports of Salerno and Naples," says Giovanni De Angelis, director of Anicav, the national association of the canning industry.

On the potential impact of the drought on food supply, De Angelis shifts the focus: "We have a production basin located 60% in Apulia, which is served by two river basins. Drought is a medium-term concern. In 2023, I don't think we should have any problems, but they will certainly occur in the years to come. We must hurry to build useful infrastructures to solve the problem. By infrastructures, we mean a network of small reservoirs distributed throughout the territory, without resorting to 'hard' construction programs, in order to store water and distribute it when needed to citizens, industry and agriculture."

On the potential impact of the drought on food supply, De Angelis shifts the focus: "We have a production basin located 60% in Apulia, which is served by two river basins. Drought is a medium-term concern. In 2023, I don't think we should have any problems, but they will certainly occur in the years to come. We must hurry to build useful infrastructures to solve the problem. By infrastructures, we mean a network of small reservoirs distributed throughout the territory, without resorting to 'hard' construction programs, in order to store water and distribute it when needed to citizens, industry and agriculture."

The attractiveness of the region has been confirmed by an investment plan announced a few weeks ago by the La Doria group in four southern processing plants, three of which are in Campania, in Sarno, Fisciano and Angri. In late February, leading Italian canning company La Doria approved a EUR 38 million investment plan for 2023, which will mainly address production capacity, environmental impact, and digital transformation. The figure comes in addition to the more than EUR 160 million invested over the five-year period 2018-2022.

Sources: hortidaily.com, sicam-tunisia.com, today.it, ilmattino.it, LinkedIn-Serge Zaka

"Unfortunately, there are few short-term solutions," explained Alessandro Squeri, General Manager of Steriltom. "We are indeed very concerned. I am referring to what our grandparents accomplished, who built water-collecting infrastructures allowing our basins to maintain active economic systems, which are based on agriculture."

"Unfortunately, there are few short-term solutions," explained Alessandro Squeri, General Manager of Steriltom. "We are indeed very concerned. I am referring to what our grandparents accomplished, who built water-collecting infrastructures allowing our basins to maintain active economic systems, which are based on agriculture." On the potential impact of the drought on food supply, De Angelis shifts the focus: "We have a production basin located 60% in Apulia, which is served by two river basins. Drought is a medium-term concern. In 2023, I don't think we should have any problems, but they will certainly occur in the years to come. We must hurry to build useful infrastructures to solve the problem. By infrastructures, we mean a network of small reservoirs distributed throughout the territory, without resorting to 'hard' construction programs, in order to store water and distribute it when needed to citizens, industry and agriculture."

On the potential impact of the drought on food supply, De Angelis shifts the focus: "We have a production basin located 60% in Apulia, which is served by two river basins. Drought is a medium-term concern. In 2023, I don't think we should have any problems, but they will certainly occur in the years to come. We must hurry to build useful infrastructures to solve the problem. By infrastructures, we mean a network of small reservoirs distributed throughout the territory, without resorting to 'hard' construction programs, in order to store water and distribute it when needed to citizens, industry and agriculture."