...but turnover results are unsatisfactory

Paste: progress is uneven

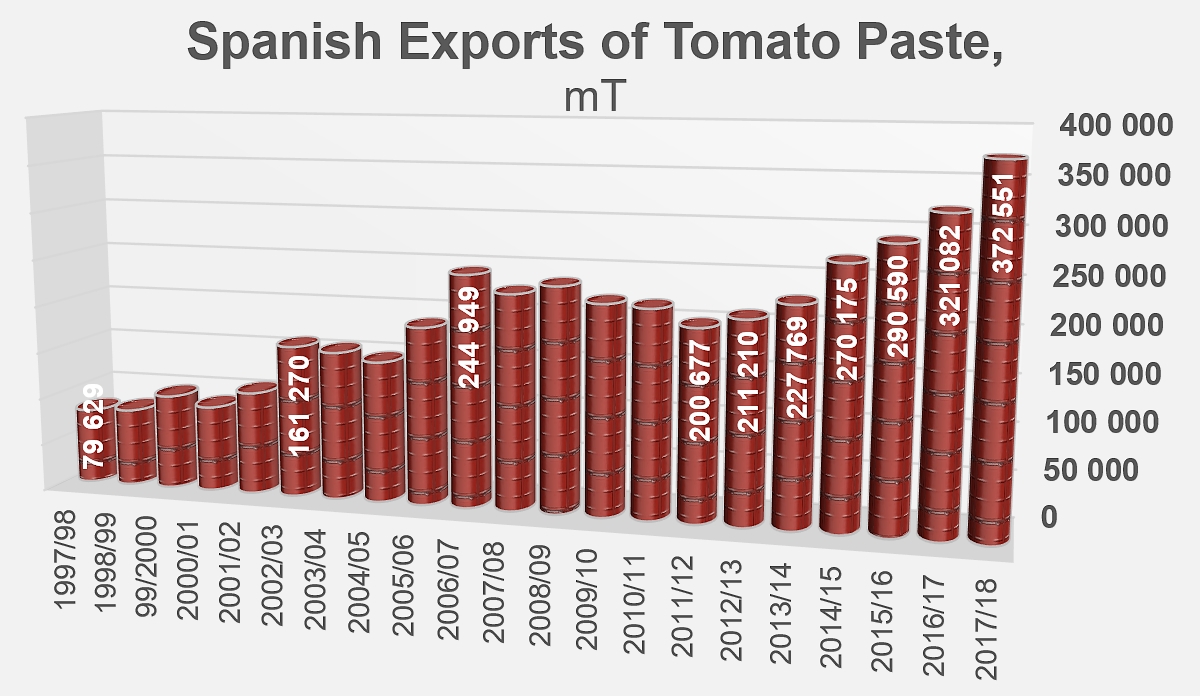

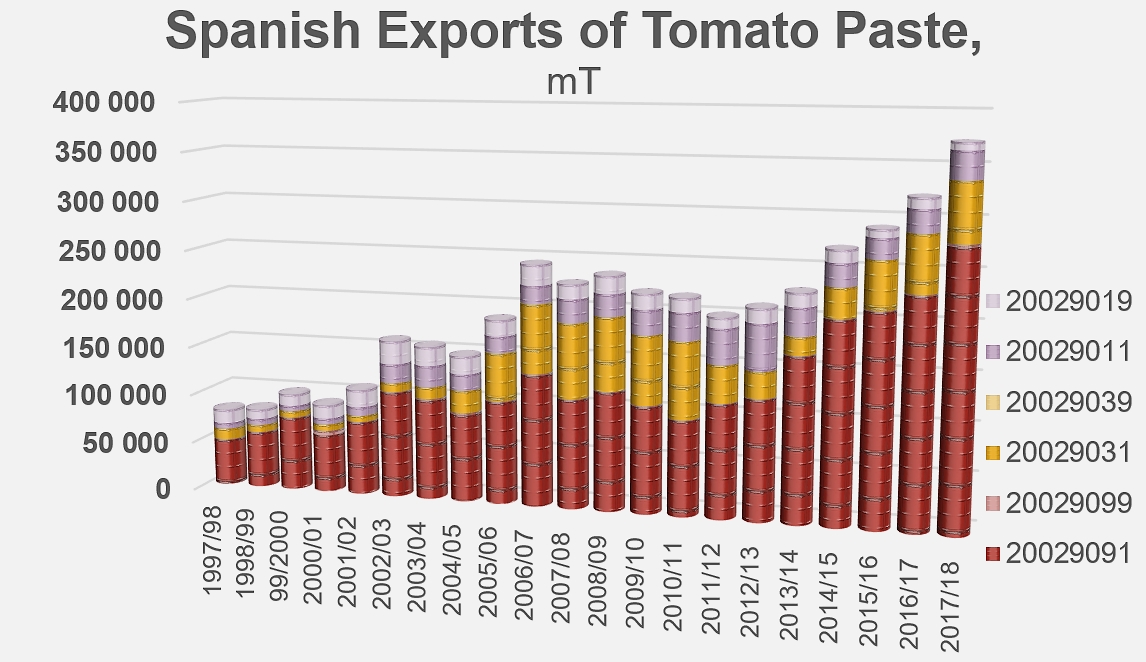

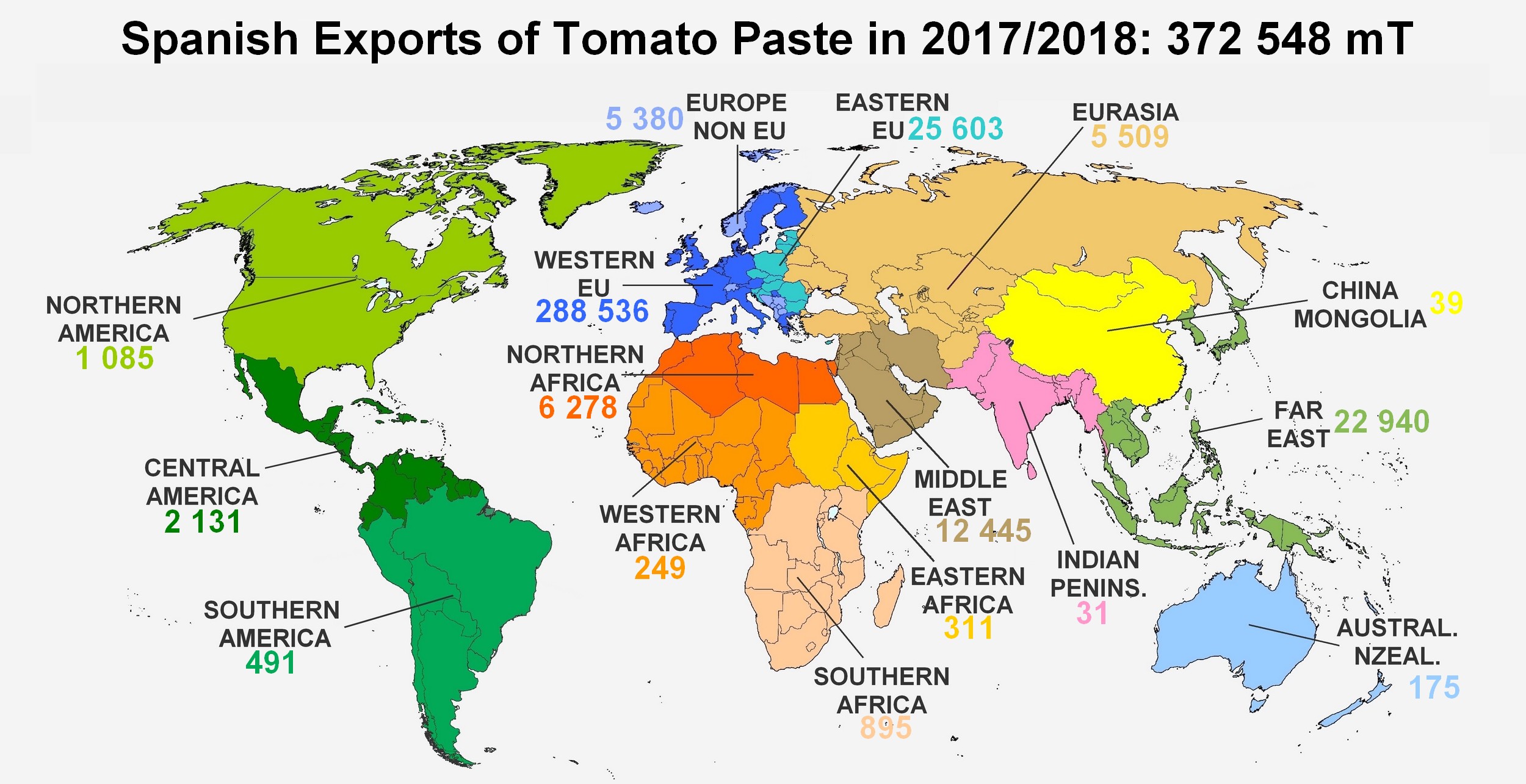

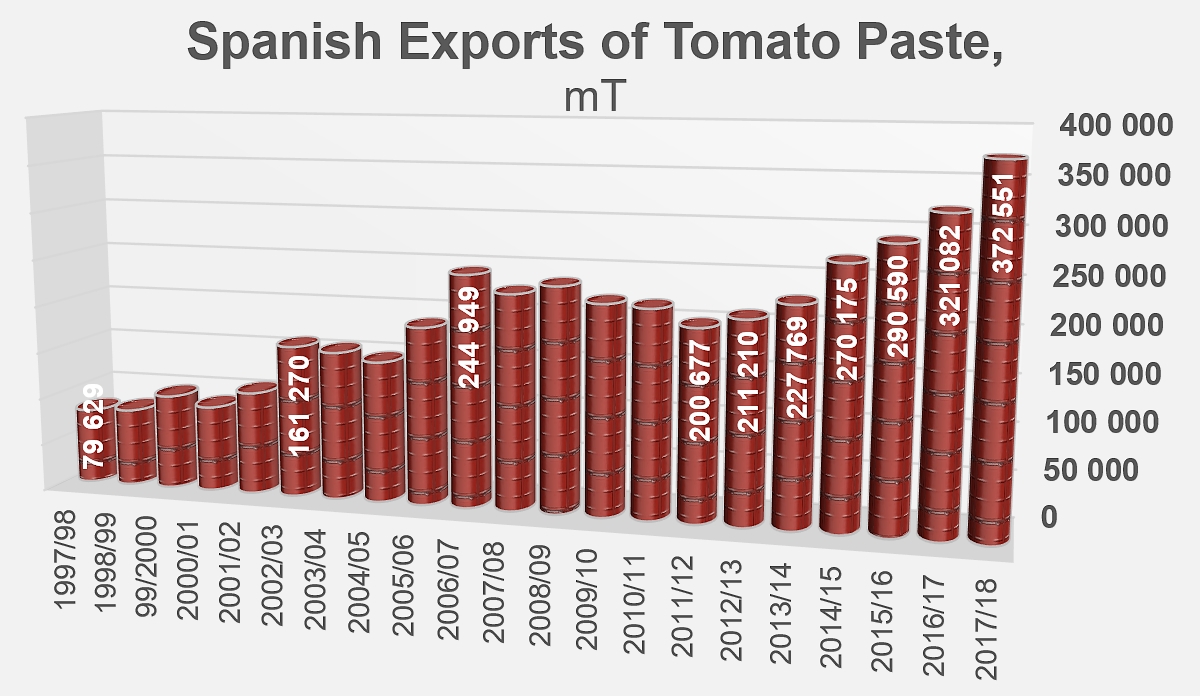

For the sixth year in a row, Spanish exports of tomato pastes recorded a notable increase last year, both in terms of quantity and in terms of value. The previous marketing year (2017/2018) finished on a result of 372 551 metric tonnes (mT) exported, which is 16% up on results of the previous marketing year (321 082 mT) and 20% up on the average of the three previous years (2014/2015, 2015/2016 and 2016/2017). This performance is exceptional, all the more so for the fact that it adds a further step to a growth pattern that is already remarkable, with an average annual growth rate of close on 11% over the past six marketing years. With this new development, the Spanish industry has taken the average annual growth rate of exports in this sector to more than 8% over the past two decades.

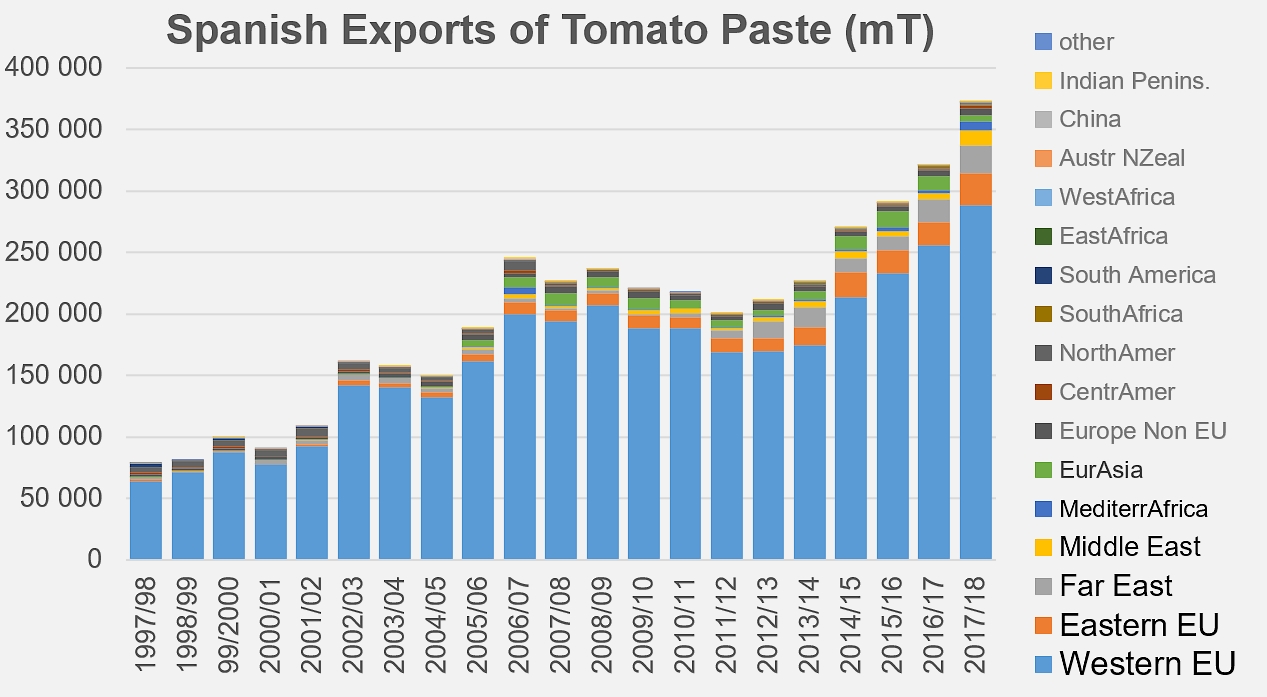

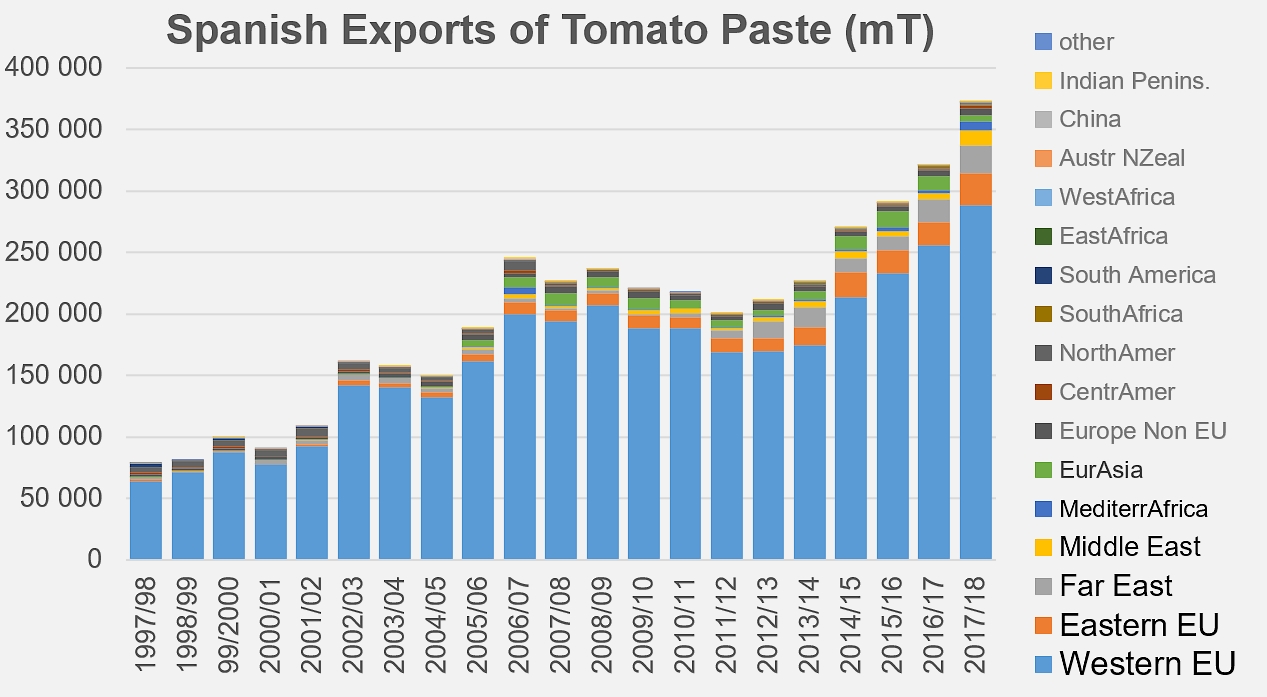

The mainly European outlets determined by geographical location remain a major feature of Spanish export operations, although efforts are clearly being made to develop paste sales on other markets. Since the end of the 10-year period running 2000-2010, during which the European markets (Community and non-Community) absorbed as much as 94% of Spanish tomato paste sales, the share of foreign markets, notably several countries of the Far East, the Middle East and Mediterranean Africa, has tended to increase. The progression margin remains sizable, but it should be noted that the Spanish paste production industry used 58 400 tonnes for manufacturing products for its sales "outside of Europe" in 2017/2018, which is close on 14% of total exports for this sector.

Outside of the borders of Europe – in the widest sense of the term – the best results in terms of progression compared to the previous marketing year (2016/2017) were recorded for sales to Oman (which have grown from slightly more than 700 mT to more than 7 500 mT), to Japan (from 18 400 mT to 22 600 mT), to Egypt (from 1 100 mT to 3 600 mT), to Cuba, etc. It is also on these markets outside of Europe that Spanish exporters have recorded the worst counter-performance of 2017/2018, with a drop of 5 200 mT (close on 50%!) on the Russian market, which called on more than 10 500 mT of paste from the factories of Extremadura and Andalusia in 2016/2017.

Spanish exports are clearly focused on the surrounding European markets

Conversely, the Spanish industry recorded excellent results for its prime markets, with its sales to countries of the EU. Among the countries of the eastern part of the European Community (previously EU13), Poland and the Baltic countries, which are traditionally among the top buyers of Spanish products, have developed their supply volumes in recent years, meaning that exports toward this region increased in 2017/2018 by more than 7 100 mT compared to the previous marketing year (+39%, from 18 500 mT to 25 600 mT).

But the really decisive increases last year were recorded for Italian purchases, which were up by close on 80 000 mT (+40%! compared to results of 2016/2017, from 45 100 mT to more than 63 000 mT), British purchases (+37%, from 35 600 mT to 48 900 mT), Portuguese purchases (+16%, from 23 400 mT to 27 100 mT), but also Greek purchases (from 172 mT in 2016/2017 to 2 700 mT in 2017/2018) and Danish ones. At the same time, it should be pointed out that notable decreases were recorded on markets that are generally considered "favorable", like the Netherlands, where Spanish pastes lost almost 4 500 mT (from 29 200 mT to 24 700 mT), Belgium (from 7 900 mT to 6 900 mT) and Sweden (from 8 400 mT to 7 700 mT).

Globally, Spanish operators improved their results in terms of quantity by close on 51 500 mT over the marketing year 2017/2018, of which 40 000 mT just to destinations within the European Community (more than 32 800 mT for western countries of the EU and 7 100 mT for countries of eastern EU). The growth in volume has mainly been supported by the development of foreign sales of pastes under codes 20029091 and 20029099 (more than 30°Brix, in industrial bulk conditioning or in retail packs), which accounted for three-quarters of the volumes used over the past three marketing years (see infographics at the end of this article).

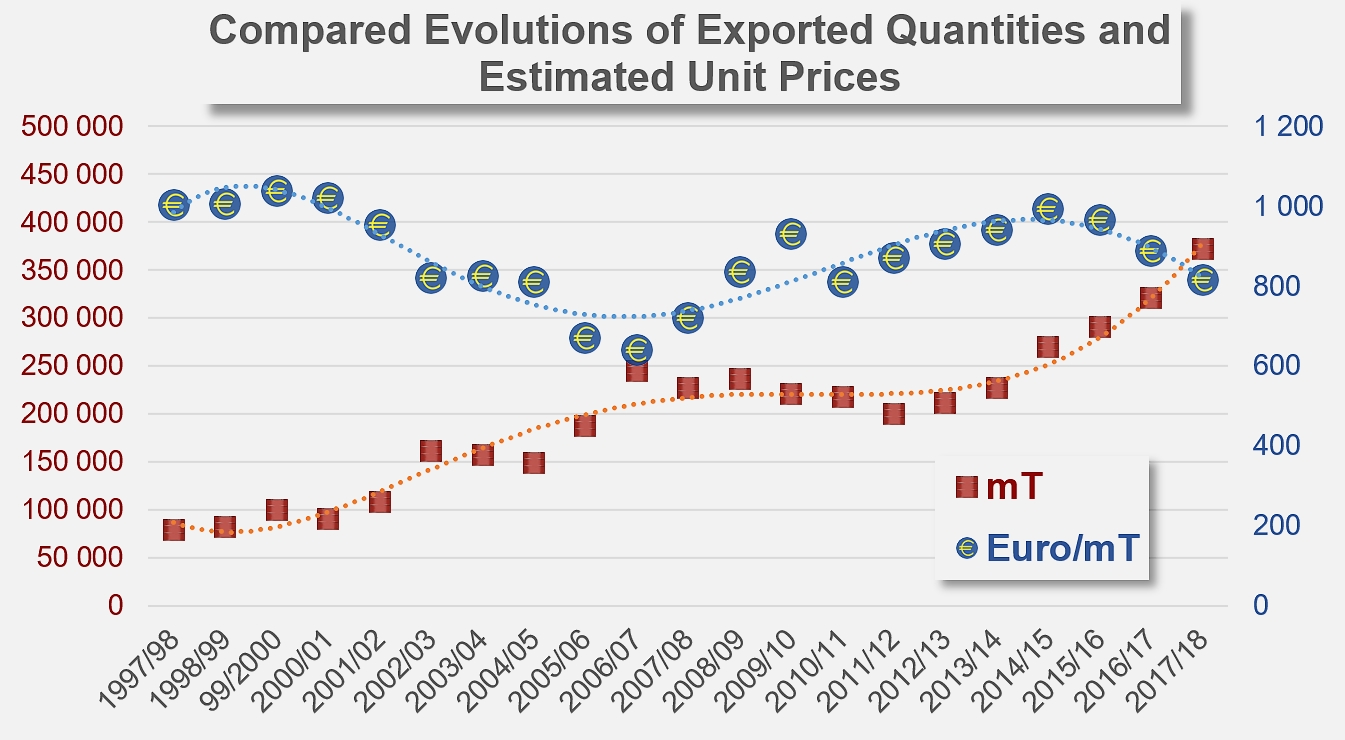

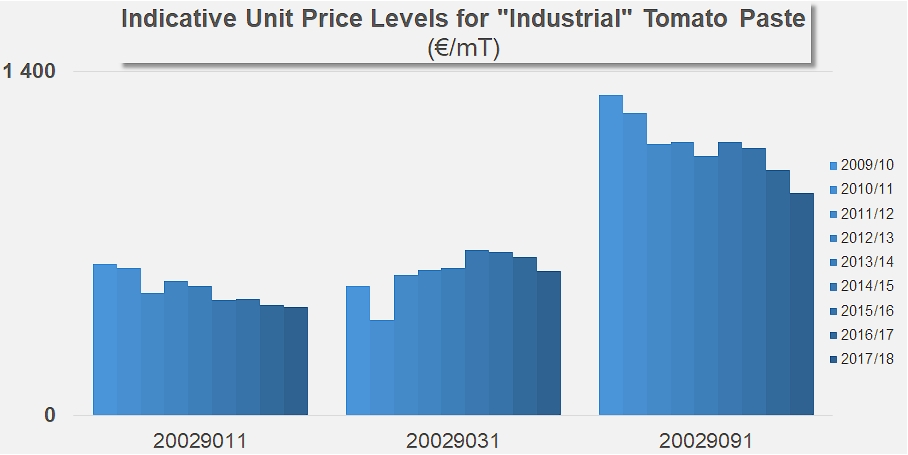

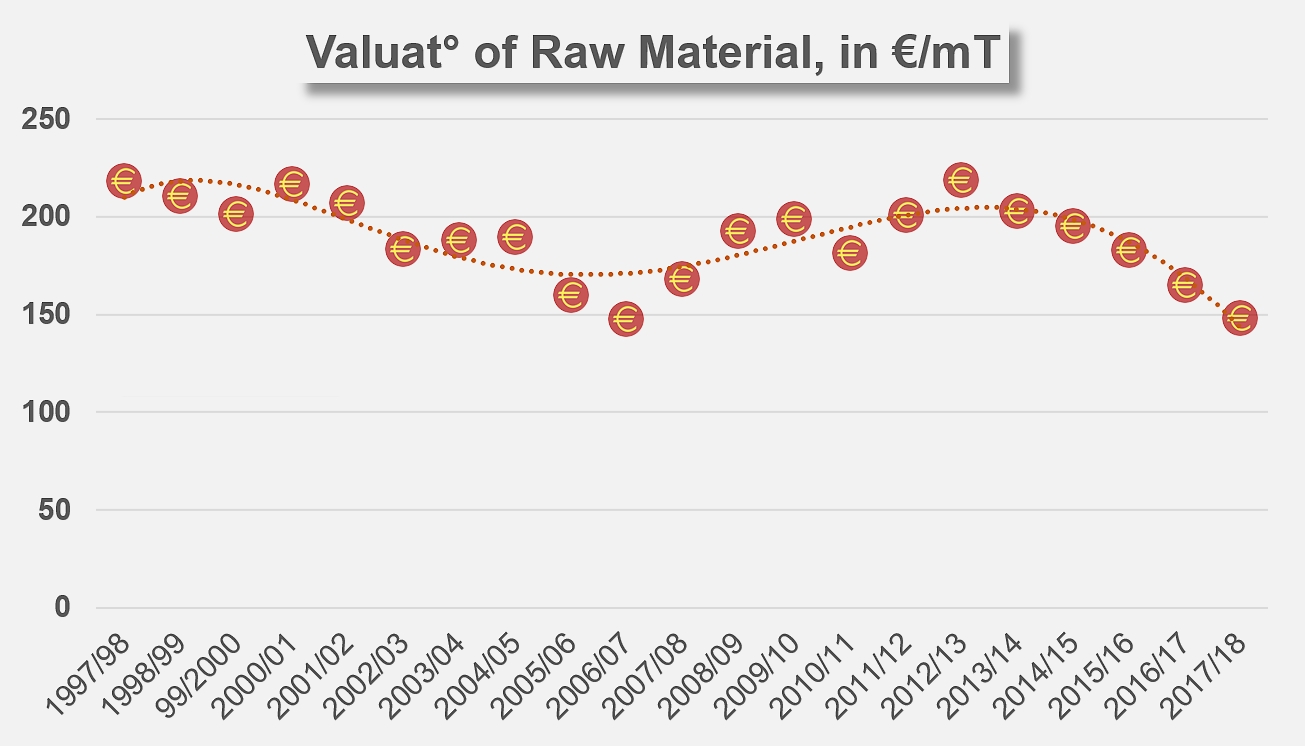

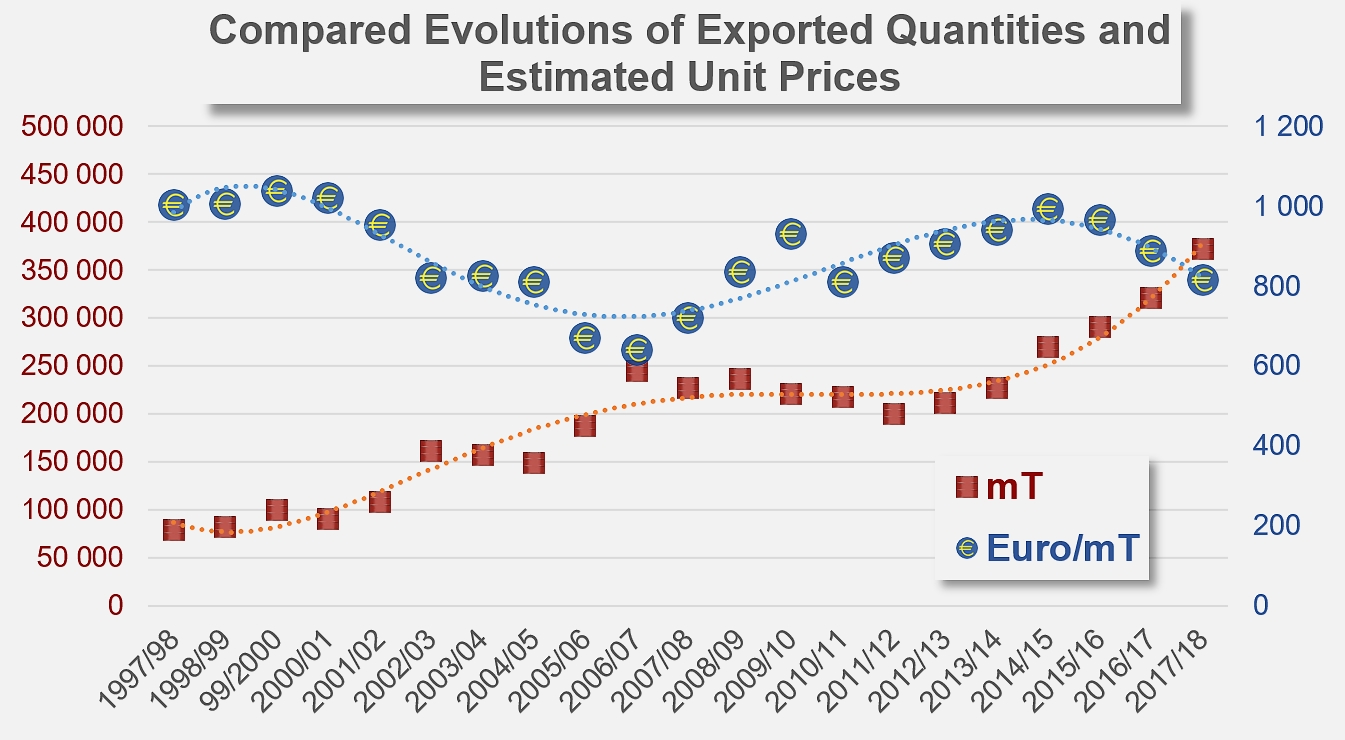

The reward that has crowned the success achieved in terms of quantities nonetheless comes at a price. The various boosts recorded by exports over the past 20 years have clearly been based on drastic drops in the prices of paste being offered on foreign markets. Conversely, price increases have closely matched notable slowdowns in foreign operations. In the final count, revenue from exports has grown at an annual rate that is slower than the growth rate of volumes, at about 10% over the past six years, whereas quantities have increased at an average of 11% per year. And the average indicative price for a tonne of paste has, in fact, fallen back at an average rate of 1.1% approximately per year over the past six years (see infographics at the end of this article).

Final results indicate that the value of Spanish paste exports amounted to more than EUR 304 million in 2017/2018 (the equivalent of USD 363 million), an increase of 7% compared to 2016/2017 results (EUR 285 million) and of 9% compared to average results over the past three marketing years (EUR 278 million). Due to the big drop in value of exported products, the progression of turnover results has been far slower than that of quantities.

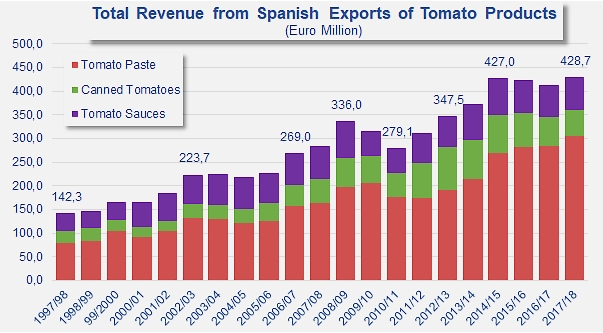

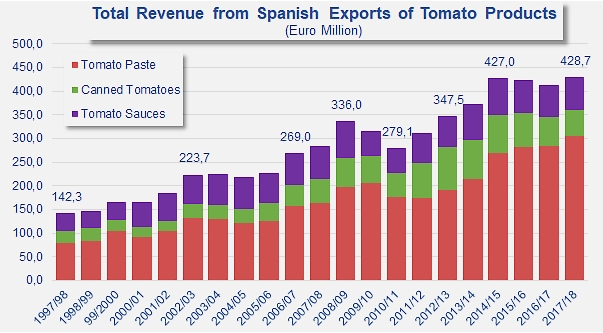

But on a nationwide scale, it has helped support a fragile increase in the total turnover for exports of the "tomato products" sector, which has been pulled down by a succession of mediocre results for the sauces category and, even more so, for the canned tomato category.

The decline in canned tomato exports

Despite stated ambitions to compete with the Italian industry, which is the world leader for the canned tomato sector, there is no getting around the fact that Spanish results in recent years have not been likely to threaten the solid grip of the peeled tomato giants operating from the South of Italy.

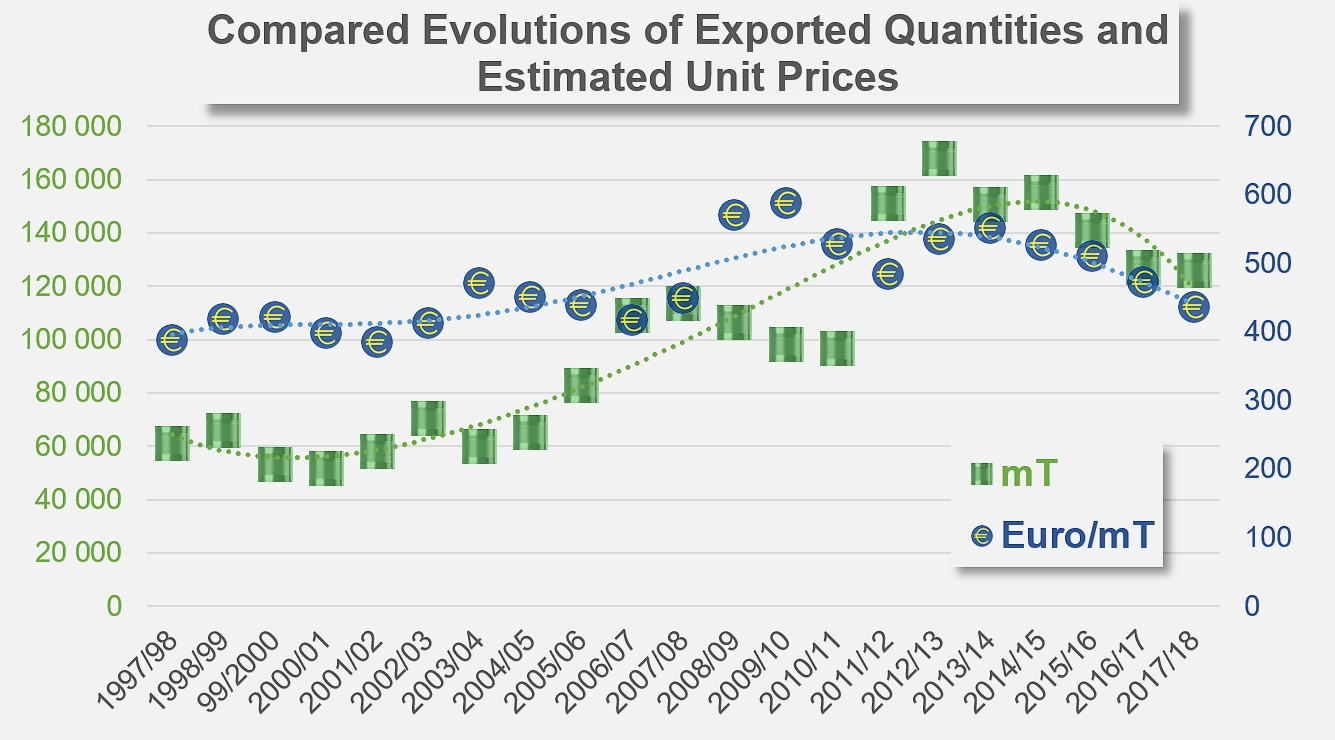

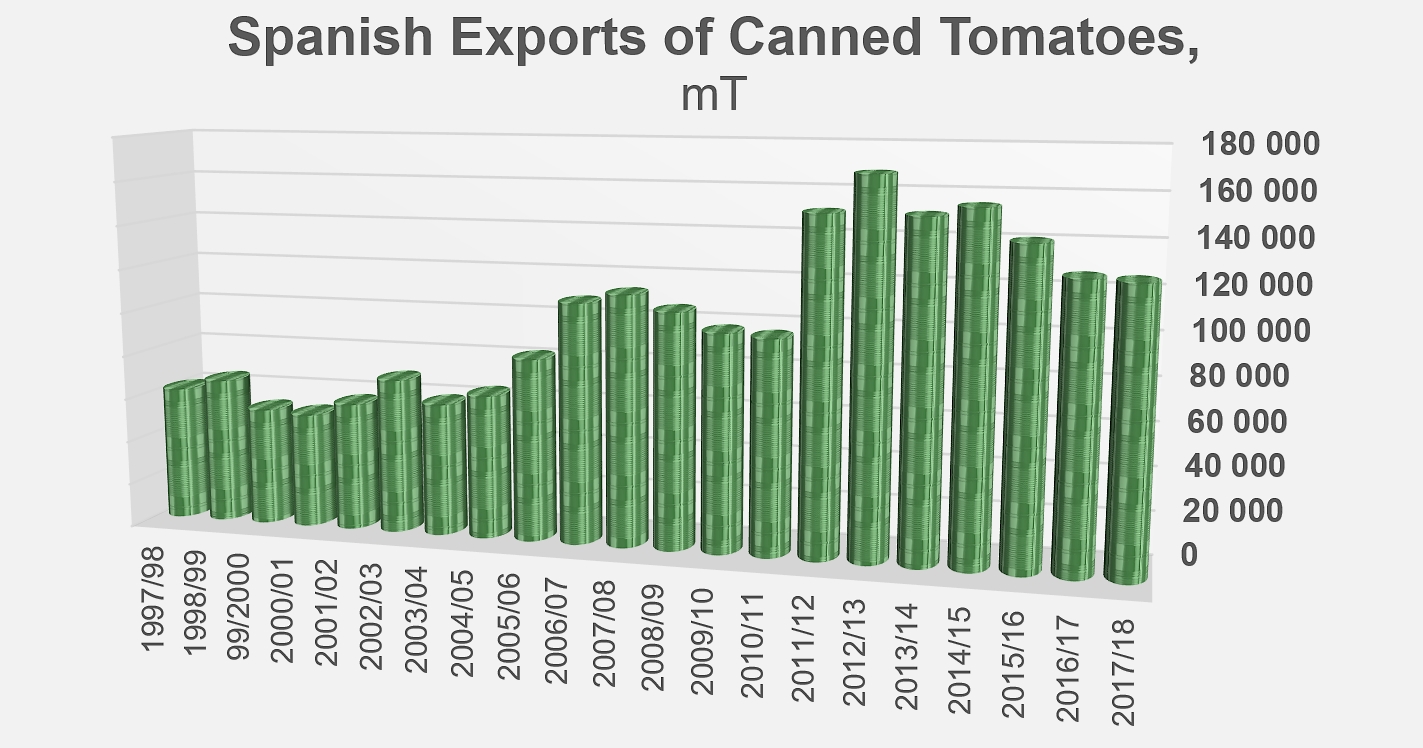

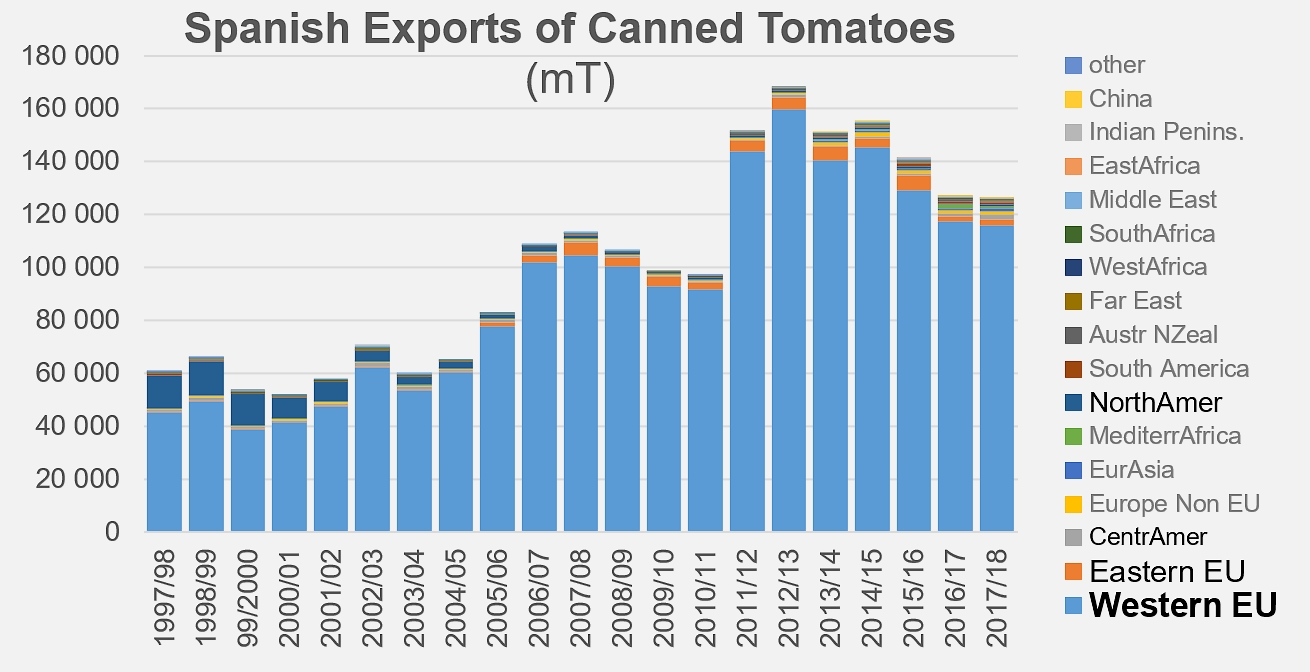

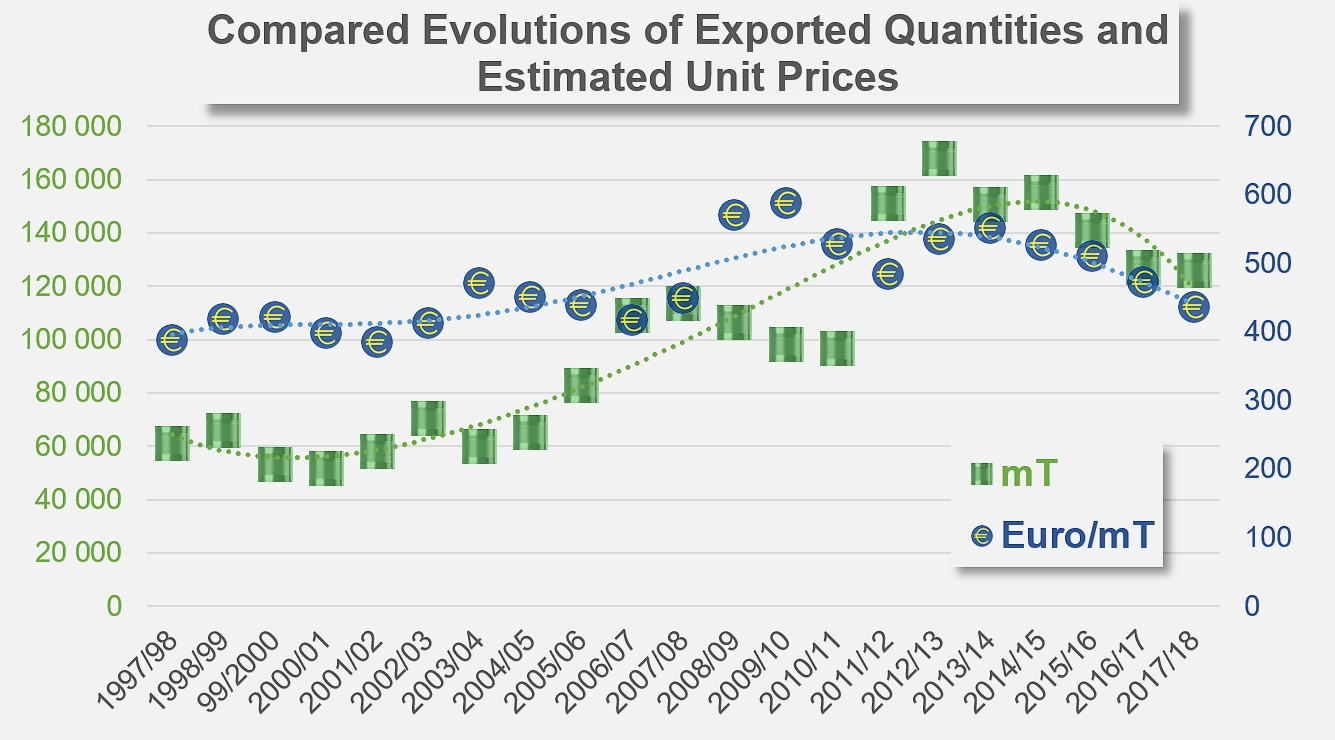

The volumes exported by Spain in 2017/2018 (126 000 mT) only recorded a drop of 1% against the result of the previous marketing year (127 000 mT), but they dropped 11% compared to the average level of operations (141 300 mT) over the past three marketing years (2014/2015, 2015/2016 and 2016/2017). Indeed, the drop recorded last year amounts to the fifth consecutive decrease for canned tomato exports, which reached their peak in 2012/2013 with more than 168 000 mT exported. Once again, the European market, and more specifically countries of western EU, the main outlet for Spanish production in this category, is also the main cause of the slowdown in Spanish sales. Over the past five years, sales of canned tomatoes to these destinations dropped by more than 43 600 mT, which is more than one quarter of the performance recorded in 2012/2013. The main markets to be affected were Germany, Italy, Portugal, France and the United Kingdom.

This category's turnover has been directly impacted by the drop in volumes and by the adjustments in prices resulting from an aggressive commercial approach, and it has therefore dropped from more than EUR 90 million in 2012/2013 (close on USD 117 million) to a mere EUR 55 million in 2017/2018 (close on USD 66 million).

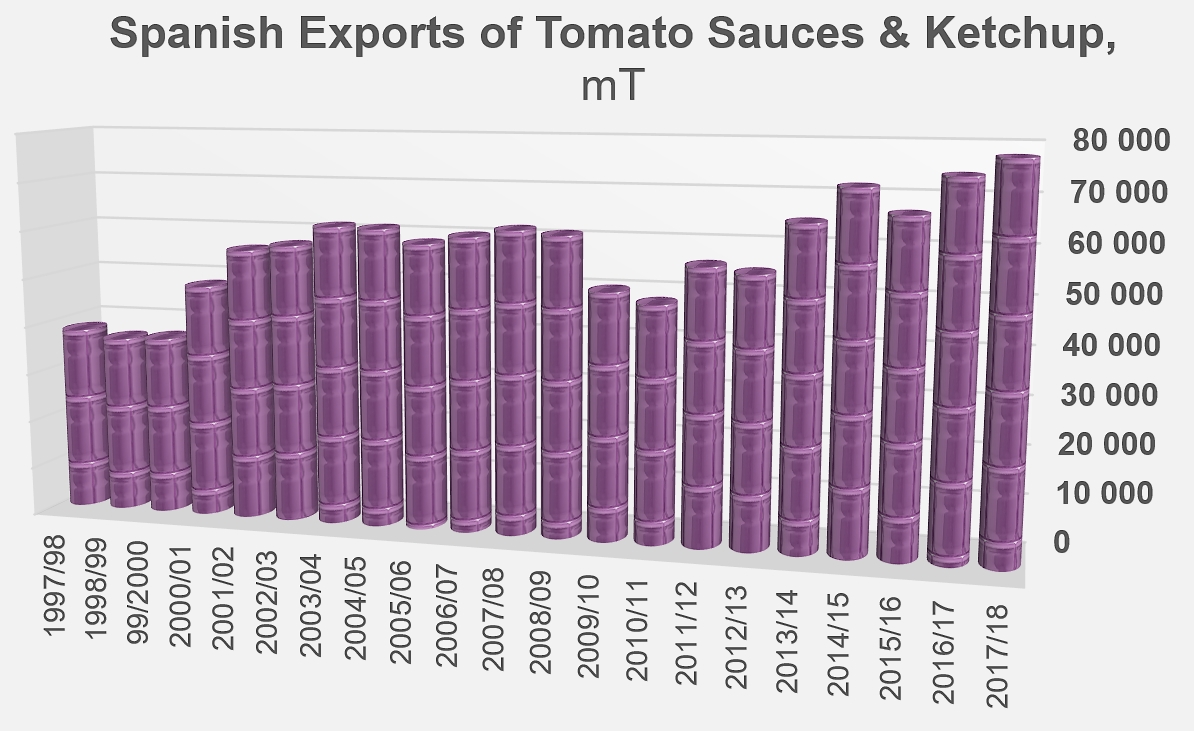

Sauces: turnover has been stagnating

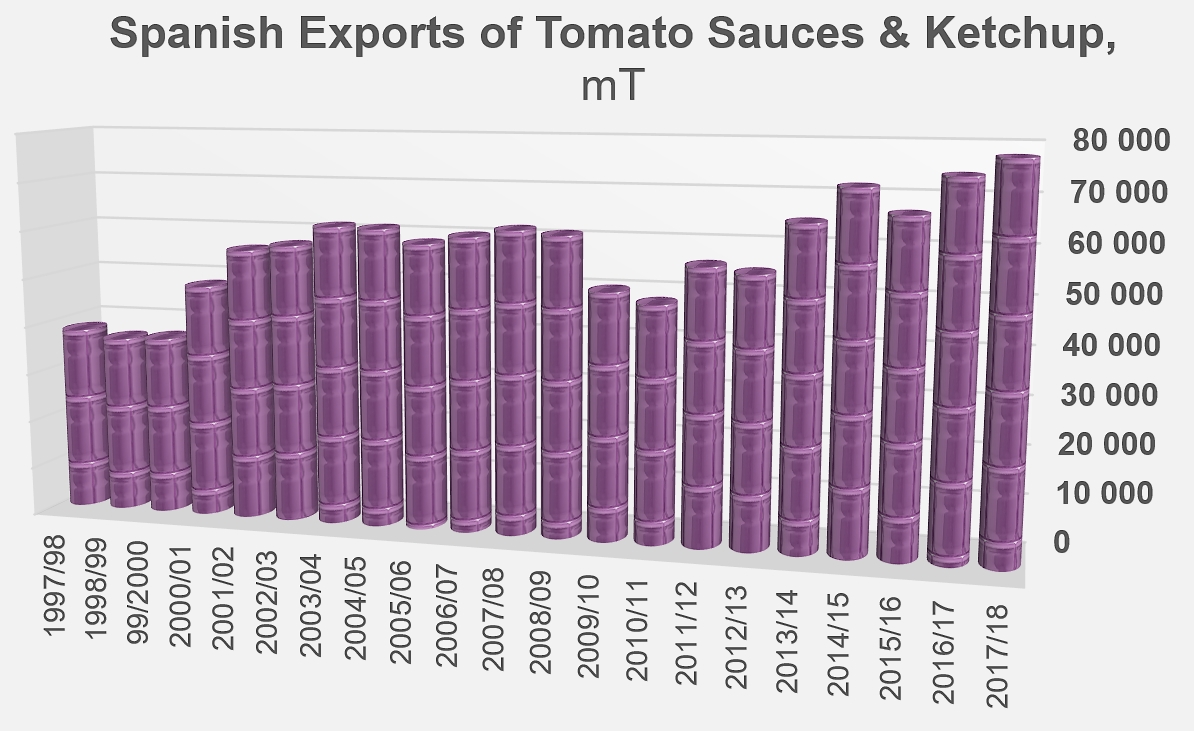

In recent years, similar mechanisms have impacted Spain's foreign operations in the sauces category. Despite impressive growth (CAGR of 7%) and an almost regular increase in the volumes exported over the past eight marketing years, progress of this category's turnover has been heavily slowed by repeated drops in the average prices for products (CAGR -2.5%). The good performances recorded on Community markets, notably in France and Germany, have led to an increase in the volumes shifted, but deteriorating prices over the same period have led to an increase in turnover that has ended up being relatively insignificant, around an average of about EUR 67 million (equivalent to approximately USD 82 million) over the past ten marketing years.

Exports and value of raw materials

Overall, Spain's exports of industrially processed tomato products have absorbed increasing quantities of raw materials in recent years. In total, for all of the different categories and/or product qualities, the volumes of raw tomato used to manufacture Spanish exports can be estimated at approximately 2.9 million metric tonnes for the marketing year 2017/2018, which is a 15% increase compared to the quantities absorbed by foreign sales in 2016/2017 and a 25% increase compared to the average of the three previous years. This fact is an eloquent indication of the focus and evolution of Spanish operations in recent years: since 2010/2011, volumes of raw tomato used to make the products exported by Spain have increased at an average annual rate of 9.5%, which amounts to an exceptional performance in the trade context of the worldwide industry during that period. At the same time, the average value of a tonne of Spanish raw tomato (for all products, conditionings, delivery modalities, contractual conditions, etc.) has decreased each year by about 3% (see infographics at the end of this article).

In the final count, after growing spectacularly over the four marketing years between 2010/2011 and 2013/2014, the total turnover of Spanish exports of tomato products seems to have stagnated since 2014/2015, with sluggish growth of around EUR 425-430 million (about USD 512 million). Most of this amount (71%) was generated last year by foreign sales of paste, while exports of canned tomatoes and sauces accounted respectively for 13% and 16% of the total.

But beyond the turnover results achieved by Spanish operators as a whole and the performances of the different product categories and segments, the question remains as to whether the income generated by the export of each tonne of raw tomato for processing, estimated at less than EUR 150 for the latest marketing year, is sufficient to sustain the industry in the long term.

Some complementary data

Progression of export volumes across the different quality segments (customs tariff codes) of Spanish pastes

Per unit indicative annual price levels for tomato pastes in bulk industrial pack

Spanish exports of tomato paste, by trade region

Spanish exports of canned tomatoes over the past 20 years

Spanish exports of canned tomatoes, by region

Average annual value estimation for one tonne of raw tomato used to manufacture Spain's processed products for export

Source: IHS statistics