US sauce sales still going down

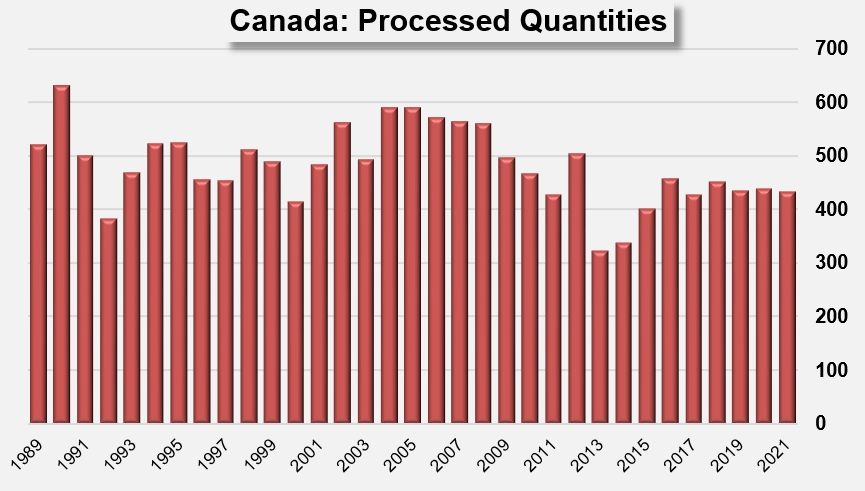

Canada is one of the countries that, although it has an efficient and established processing industry, only meets part of its domestic needs. Beyond the annual quantities processed, amounting to some 435,000 metric tonnes of fresh tomato equivalent over the last seven seasons, the country imports significant volumes of tomato products to meet an annual national demand estimated at around 1.1 to 1.2 million mT. The majority of foreign supplies come from the United States (72% of paste imports, 70% of canned tomatoes and 96% of sauce imports, on average over the last five years).

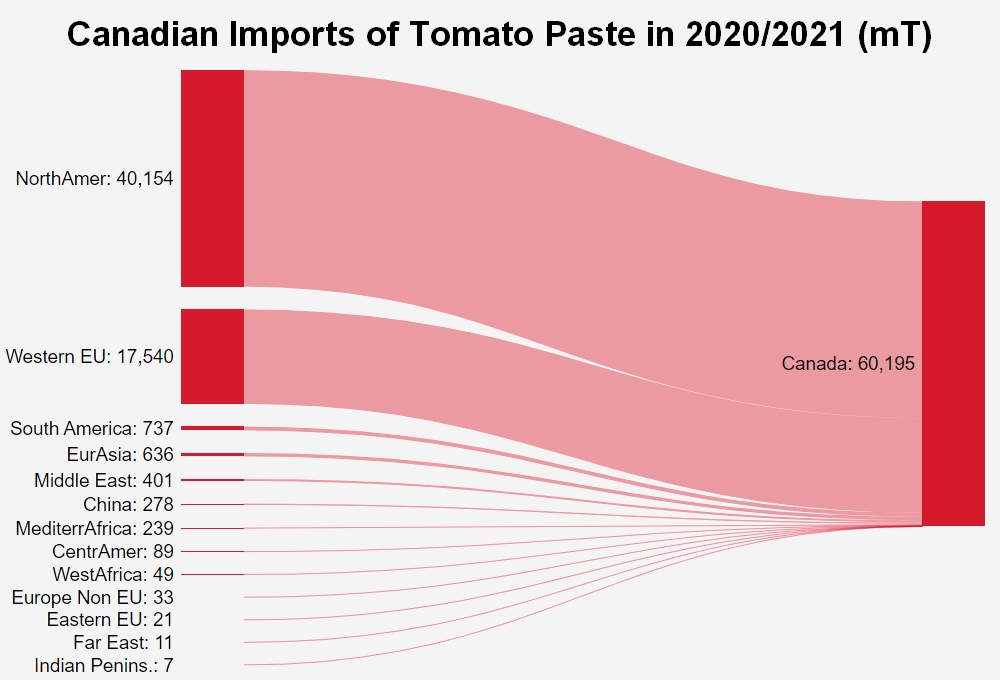

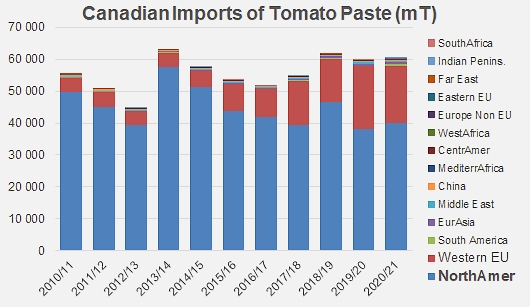

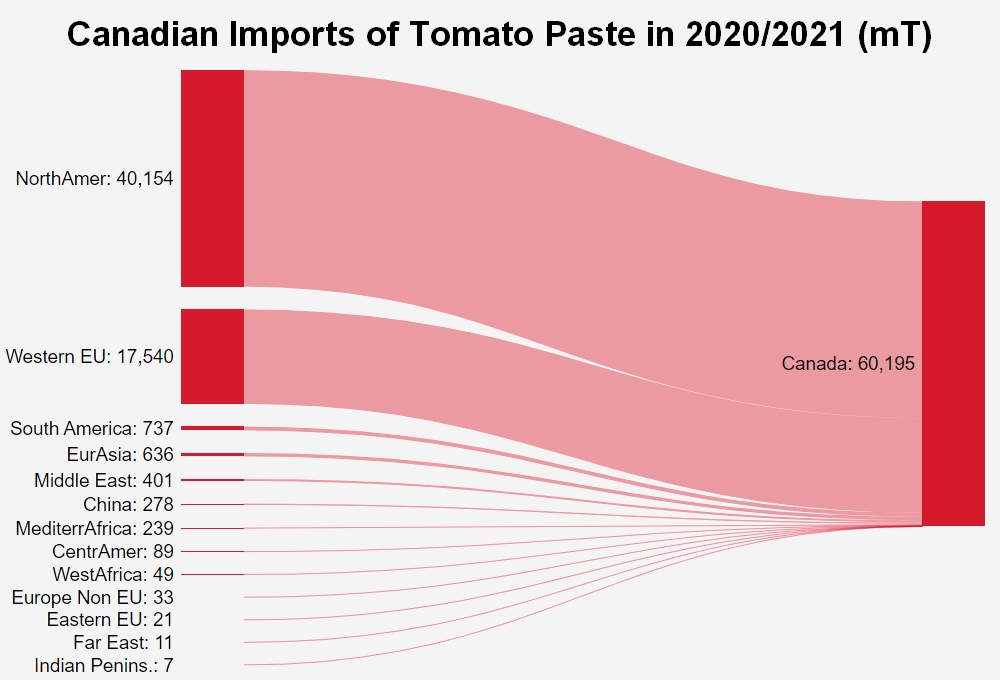

Tomato paste is the smallest of Canada's three tomato product import items in terms of volume and value. With an annual average of 60,000 mT of finished products imported over the last three years (a significant increase compared to previous years), foreign purchases of pastes only account for a minor share (19% on average) of total Canadian expenditure in the sector. The increase in foreign purchases has taken place alongside the drop in processed quantities recorded over the last fifteen years, particularly since 2009/2010 (see additional information at the end of this article).

As for the canned tomatoes category, the proximity to the USA explains the dominant position of US products on the Canadian market, although they face strong competition from Italian products. Quantities are slightly greater than in the pastes sector and, of the 71,000 mT of finished products supplied on average over the last three marketing years, 70% came from the United States and 29% from Italy. Far behind these two market leaders, Turkey, the third largest supplier in this category, supplied an average of 280 mT of canned tomatoes per year over the same period.

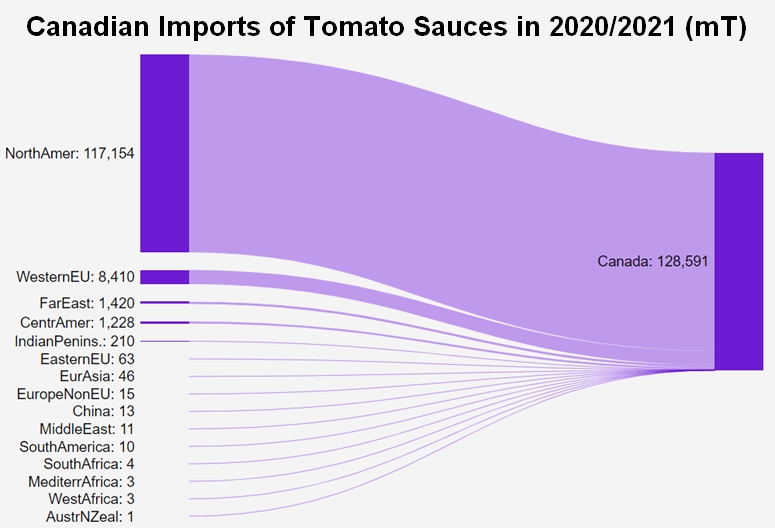

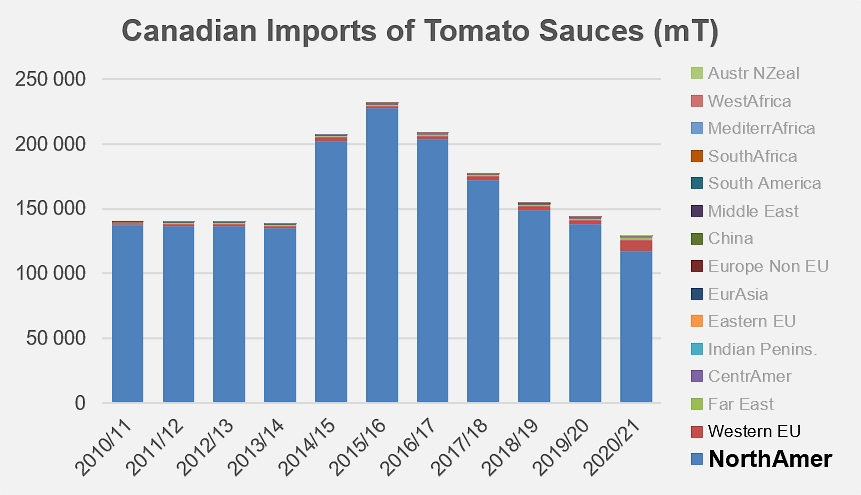

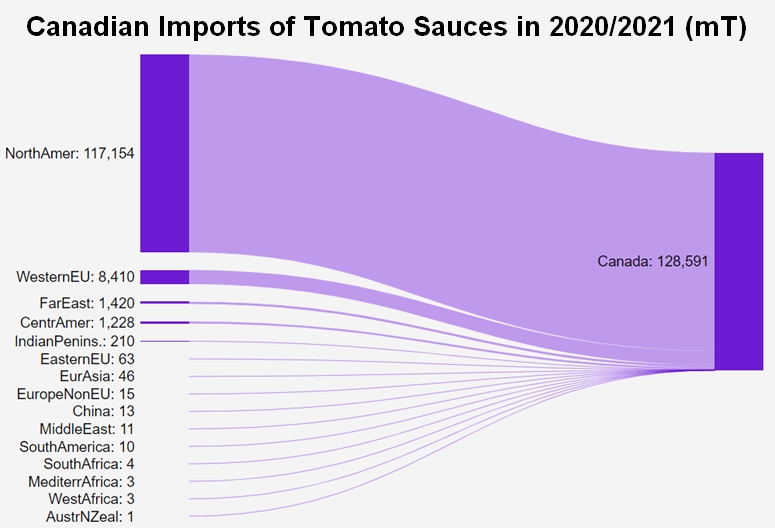

Although they have declined sharply over the past six years, foreign purchases of ketchup and tomato sauces (129,000 mT in 2020/2021) remain by far the largest single line of expenditure in the tomato products trade flow to the Canadian market.

In this category also, the proximity of the very influential US processing industry is felt, to the point that Canadian imports in recent years have been almost exclusively (96%) made up of US products, with imports from Italy (2%) and other origins (Philippines and Mexico, less than 0.6%) being confined to very secondary roles.

It is important to note, however, that in 2020/2021 there has been a sudden increase in the inflow of sauces from Italy which, although modest (7,700 mT) compared to the quantities arriving from the USA (117,000 mT), nevertheless increased by almost 220% compared to the three previous marketing years, while at the same time US products, more directly affected by the chronic decline observed since 2015, have recorded a further significant fall (-23%).

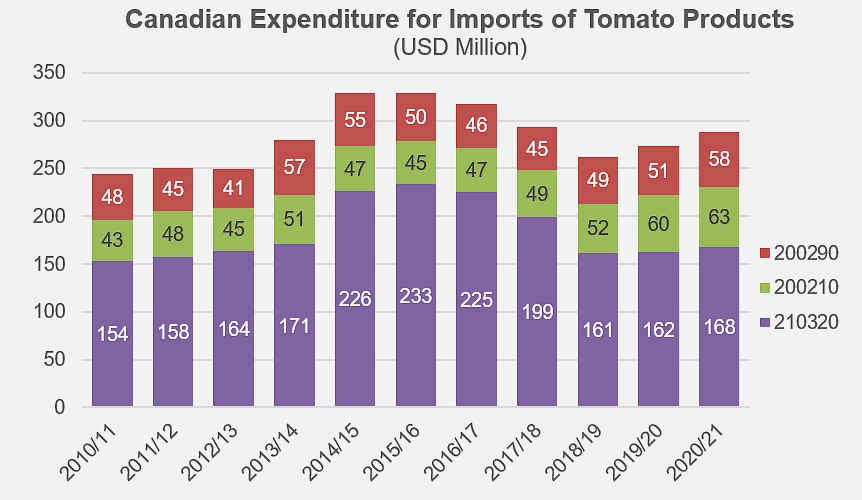

In 2020/2021, Canadian supplies of tomato products accounted for an expenditure of approximately USD 288 million, up 4% from the average expenditure of the previous three years : "invoices" for pastes (USD 58 million) and canned tomatoes (USD 63 million) increased by 19% and 17% respectively, while spending on imports of sauces (USD 168 million) decreased by 3%.

Some additional information

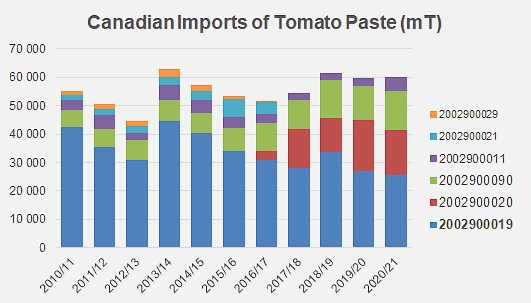

Evolution and composition of Canadian imports of tomato pastes, by category

2002900019: Tomato paste, prepared/preserved, in container > 1.4 kg

2002900020: Tomato purée, prepared or preserved otherwise than by vinegar or acetic acid

2002900090: Tomatoes, nes, prepared/preserved, o/t vinegar/acetic acid

2002900011: Tomato paste, prepared/preserved, in packs < 1.4 kg

200290021: Tomato purée, prepared/preserved, in packs < 1.4 kg

2002900029: Tomato purée, prepared/preserved, in packs >= 1.4 kg

Evolution and origins of Canadian imports of pastes

Evolution and origins of Canadian imports of sauces

Evolution of the quantities processed by the Canadian industry

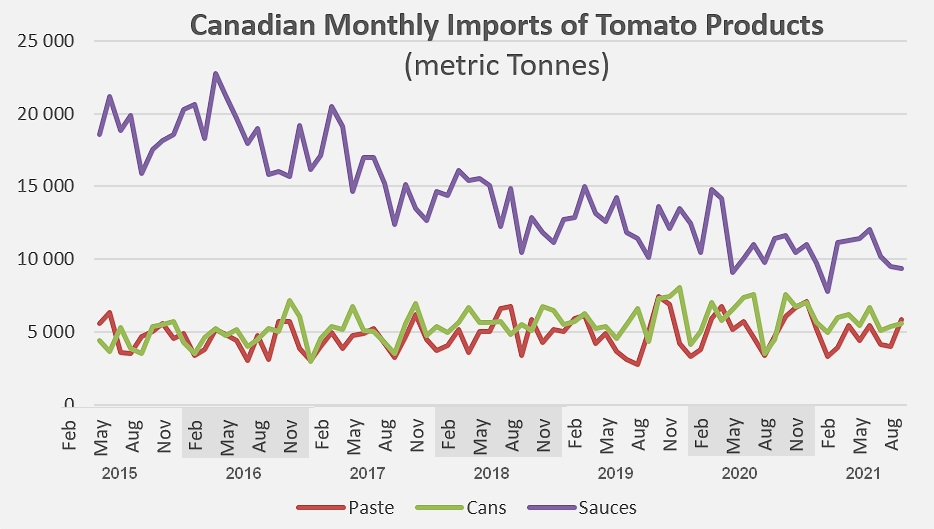

Evolution of Canadian monthly imports of pastes, canned tomatoes and sauces: over the last six marketing years, imports of pastes have grown at an annual rate (CAGR) of 3.9% and those of canned tomatoes at a rate of about 8%, while at the same time, imports of sauces have fallen at a rate of about -8.5%.

Sources: Trade Data Monitor