Marked improvement in meeting the requirements of domestic demand

According to recent data regarding the trade balances for tomato products during the 2019/2020 marketing year, Canada has spent the past ten years in sixth or seventh position in the worldwide ranking of the industry’s importing countries.

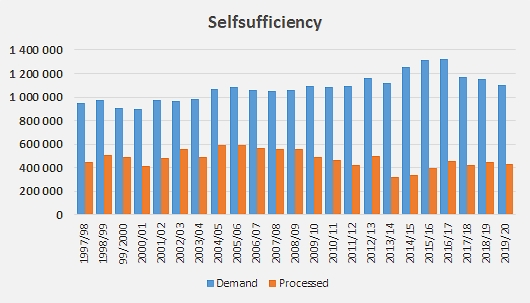

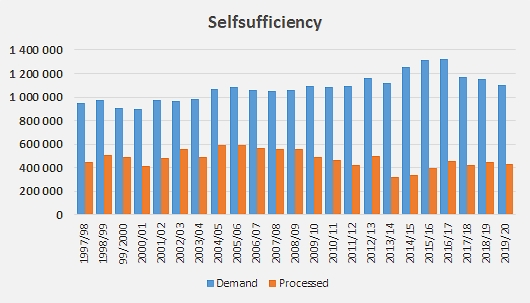

With an average demand estimated between 1.1 and 1.2 million tonnes (fresh tomato equivalent) over the last ten years and a processing activity that has undergone a notable recovery since 2013, Canada is now providing for just under 40% of its own needs. For the record, the Canadian industry only covered about a quarter of national demand in 2015 (see references at the end of this article).

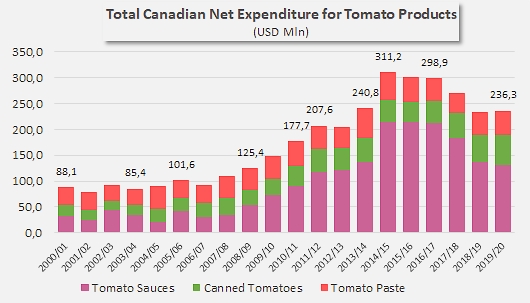

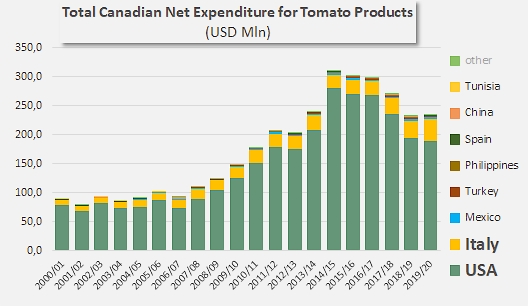

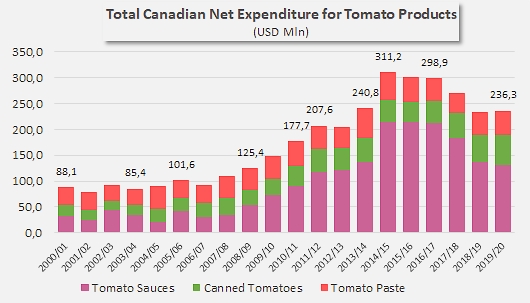

Over this period, the resumption of activity at the Leamington site (ex-Heinz) by Highbury Canco, the revitalization of the sector and the spectacular drop in imports of sauces were among the factors that largely contributed to reducing the deficit in the Canadian tomato products trade balance and to improving the sector's national balance sheet. Indeed, total Canadian expenditure for the supply of tomato products fell from more than USD 311 million in 2014/2015 to around USD 236 million in 2019/2020, i.e. a decrease of 12% compared to the three previous years (and 17% compared to the period running 2014-2019).

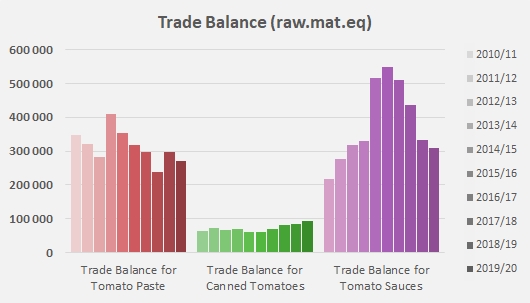

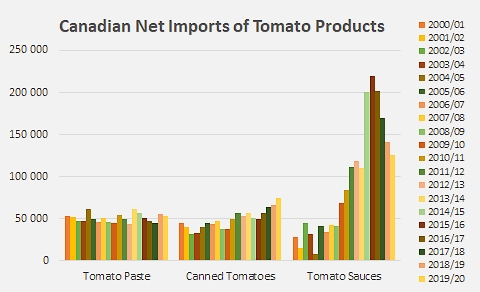

The main driver of this decrease was the significant reduction of Canada's main import category; the relatively massive foreign purchases of sauces and ketchup over the period running 2014-2019 (nearly 187,000 tonnes on annual average) recorded a remarkable drop of about one third. The deficit in the “sauces” balance for marketing year 2019/2020 did not exceed 125,000 tonnes of finished products, for an expenditure of approximately USD 130 million.

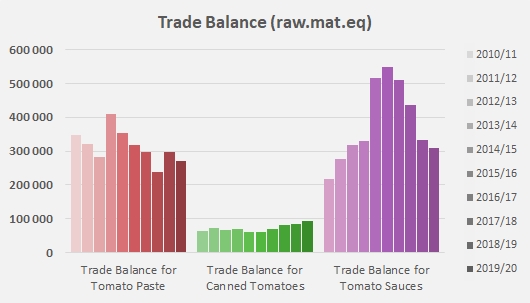

However, sauces are not the only category for which Canada is dependent on other countries, and the trade balances for "pastes" and especially "canned tomatoes" have not seen the same improvement in recent years as the one recorded for the sauces category.

With a little more than 53,000 mT imported in 2019/2020, the balance of the paste category has seen a continuation of its results from previous years, featuring a "sluggish" increase in quantities (a CAGR of 0.01% over the past nineteen years) and corresponding expenditure. Its impact on the total Canadian balance of tomato products has remained approximately constant, at approximately 40% in terms of volume and 19% in terms of value over the past ten years.

The "weight" of canned tomatoes in the Canadian trade balance is hardly more marked: although imports have gradually but rapidly increased in recent years, to the point of doubling over a dozen years (from 37,000 mT in 2008/2009 to 74,000 mT during the last marketing year), the dynamics affecting canned tomatoes did not really accentuate the Canadian trade deficit, because in the final count, the category only accounts for 10% of the total balance in terms of volume (fresh tomato equivalent) and just over 18% in terms of value.

Ultimately, the preponderance of the sauces category in the Canadian tomato products trade balance – 49% in terms of volume, but more importantly 63% in terms of value – is perfectly consistent with recent patterns in Canada’s national processing activity, as well as with the purchasing behavior observed since Heinz's withdrawal from industrial tomato processing in Canada (see our article in reference) and with the effects of these factors on Canadian foreign spending.

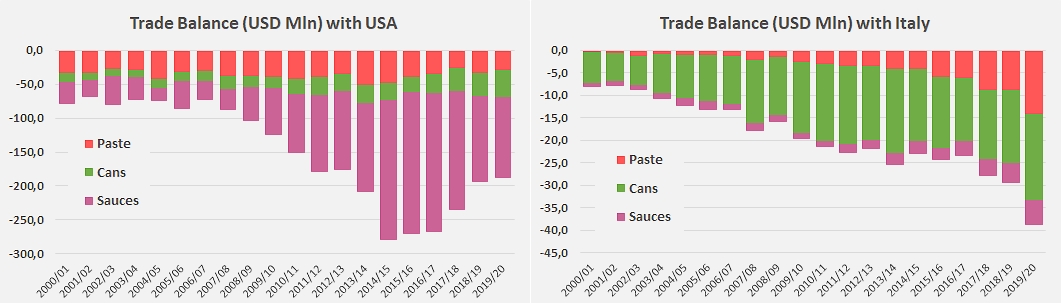

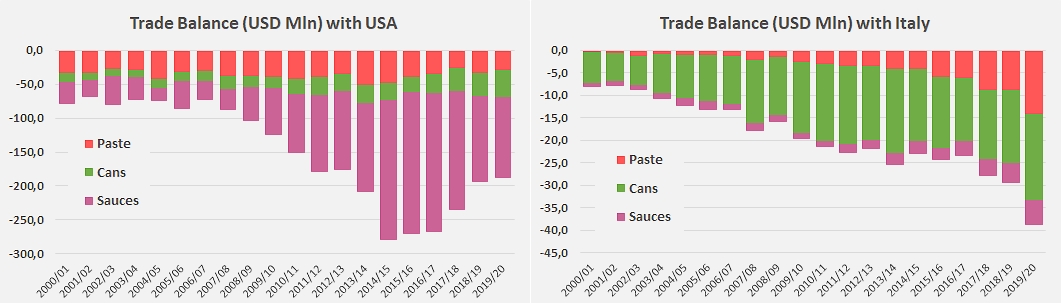

To be convinced of this, it is only necessary to look closer at the status of the Canadian market in the global tomato products trading landscape: like a few other rare markets that are virtually completely captive, Canada's supplies almost exclusively come from the USA and Italy, with merely anecdotal quantities supplied by the rest of the world.

Over the past few years, the US and Italian market shares of the revenue generated by Canadian foreign purchases of tomato products have altogether accounted for an average of about 97% of total Canadian expenditure for this sector. Depending on variations of exchange rates and the different components of competitiveness, the respective shares of the USA and of Italy have evolved in opposite directions, with the recent progression of Italian products (in particular pastes and sauces) occurring against a clear backdrop of declining US sales on the Canadian market.

So while US sales have recorded some clear slowdowns, more particularly pronounced in the sauces and ketchup category (which is essential and strategic for US operators), Italian import shipments of canned tomatoes and paste, most often driven by commercial initiatives set up at an industry-wide level, have continued or even accelerated their growth. This is why the 2019/2020 marketing year has seen the balance between the market shares (in terms of value and in USD) held by US operators on the one hand and Italian operators on the other hand return very exactly to what it was in 2008/2009 (80% against 16.5%).

In this context, the intention announced by Kraft-Heinz to resume production of sauces in Canada takes on its full significance.

Some additional data:

Distribution of Canadian expenditure according to the various supplier countries of tomato products.

Canadian net imports of tomato products over the last twenty years, in metric tonnes of finished products.

Source: Trade Data Monitor