The supply chain's weak links and California's fickle winter weather are clouding the forecast for the state's processing-tomato farmers.

Aaron Barcellos, a diversified grower in Los Banos, already cut his tomato acreage by more than half last year—from 810 hectares (2,000 acres) to 360 ha (900 acres)—due to water supply shortages. This year, he's cutting back further, to 215 ha (530 acres), and water's not the only reason.

"We've seen our cost just skyrocket over the past six or seven years," Barcellos said. "It used to cost us around $3,000 an acre to grow tomatoes. We're projecting costs of over $4,000 this year coming up. We just haven't had the revenues to match it." Yields have been flat or trending down over the past decade, he added, and "we haven't been able to get those yield increases to offset the cost increases."

Bruce Rominger, who grows tomatoes in Winters and serves as board chairman of the California Tomato Growers Association, named fuel and fertilizer costs among his top concerns.

"Primarily for us, the fuel cost hurts us in our production," Rominger said. "All our tractors, all our pickups, everything we do out here burns fuel. We are very concerned about what that does to our cost structure when we see our prices do what they've done in the last six months."

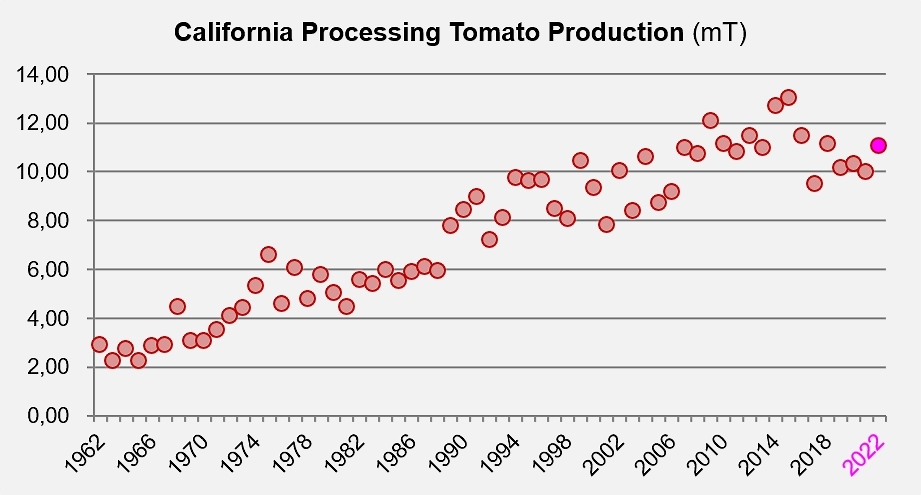

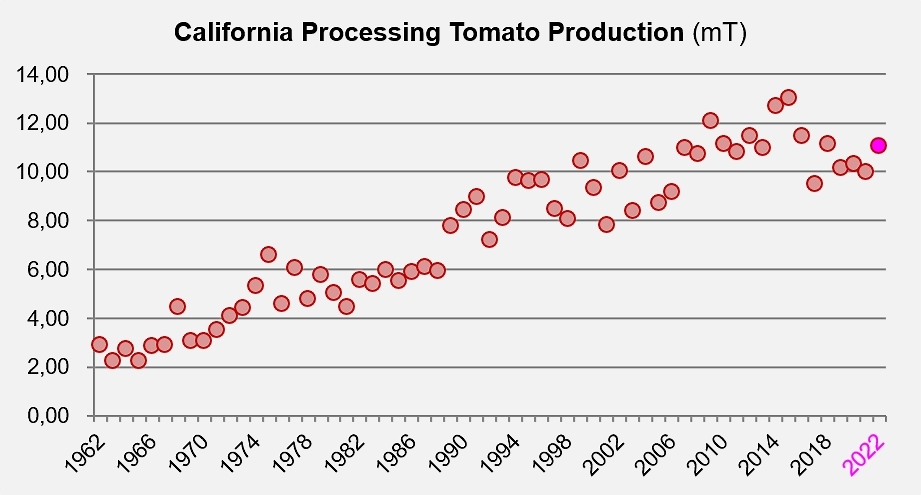

In January 2021, tomato processors intended to contract for 10.97 million mT (12.1 million short tons), according to the U.S. Department of Agriculture National Agricultural Statistical Service. That figure was lowered twice as the drought wore on—first to 10.52 million mT (11.6 million sT) in May, then to 10.07 million mT (11.1 million sT) in August.

The final harvest for 2021 was 9.8 million mT (10.8 million sT), well short of what growers wanted and processors needed, said Mike Montna, the president of CTGA.

"It puts us in a pretty low inventory position where we're going to have right around two months, maybe a little more than two months, worth of inventory starting June 1 based on projections," Montna said. "That's extremely tight." (see also our related articles below).

Unlike most years, tomato farmers already have a set price for their crop this year. The CTGA and processors agreed last month on $105 per ton, up from $84.50 in 2021. Montna said inflation and farmers' increasing costs of growing factored into the price boost, noting growers and processors were motivated to reach an agreement early.

"From a processor perspective, they can make commitments to their growers," Montna said. "From a grower perspective, you can know what you're going to get paid before you commit and make the best decision with your water, because that's your limited resource." Having a price now gives everyone "the best chance to make the right decisions," he said.

Even with the price increase, "we still have to have a really good crop, it looks like, to make money," Barcellos said. "We just have so much risk on the producers' side with this tomato crop, and what yields have been doing over the past 10 years, it's hard to justify putting a lot of acres in tomatoes right now."

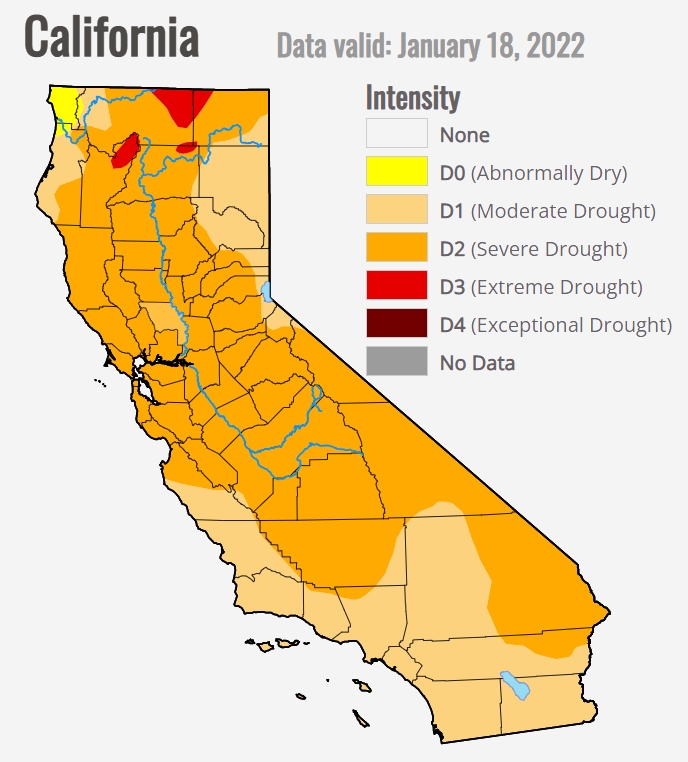

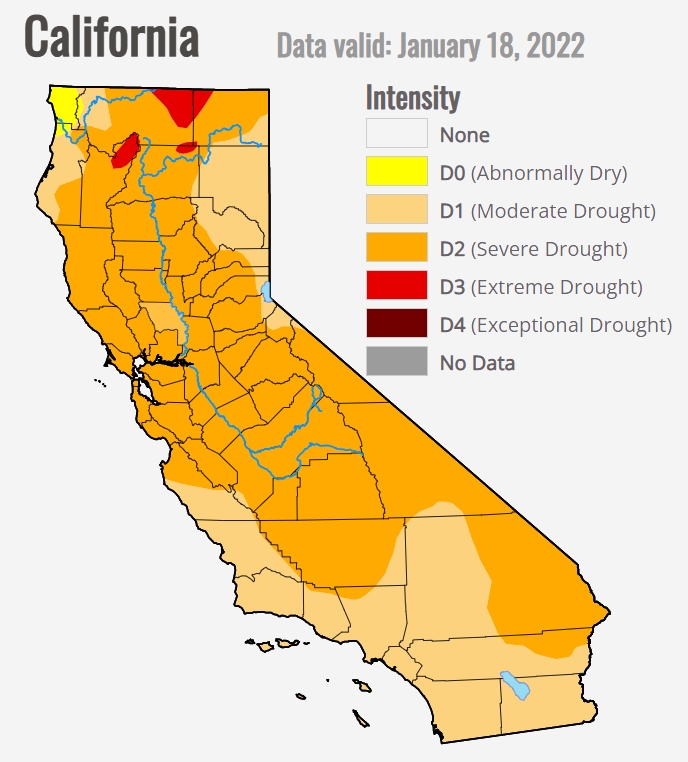

Chief among the risks is water. Late last week, the state announced a 15% allocation for water contractors, up from zero at the outset of winter. Montna noted that the rest of winter will tell the tale, as a dry January followed a wet December.

"We're going to need a good February and a good March to figure out what water position we're going to be in," Montna said. "We need better than normal to improve the situation. Normal might sustain the situation, but you can't improve it with normal rainfall. We'll just have to see how that plays out."

"We're going to need a good February and a good March to figure out what water position we're going to be in," Montna said. "We need better than normal to improve the situation. Normal might sustain the situation, but you can't improve it with normal rainfall. We'll just have to see how that plays out."

Rominger said the allocation is helpful, to a point.

"That 15% certainly helps quite a few growers, but a lot of us, including myself, don't get any state or federal water," Rominger said. "We're relying locally, here in Yolo County, on the water coming out of Clear Lake and Indian Valley, and there's still no allocation going to come out of there at the levels they have right now. We're still looking for a lot more rain and keeping our fingers crossed."

Farmers also cited the rising cost of labor as a factor, especially the lower overtime threshold. As of Jan. 1, overtime for employers of 26 or more people kicks in at eight hours in a day or 40 in a week.

"The overtime constrictions are going to really hamper a lot of growers," Barcellos said. "It's really hard to get everything done that you need to do in a 40-hour workweek or eight hours a day. The labor pool is not what it was in the past, so it's not like we can run multiple shifts."

Rominger said he runs drip irrigation 24 hours a day at times.

"We can't find enough people to run three shifts," Rominger said. "We end up running several employees on a second shift that's more like a swing shift." These folks can change drip-irrigation valves at 10 or 11 p.m., he noted; valves should be good till 6 a.m. "That's going to be more expensive because of overtime issues this next season."

That assumes he was able to install the irrigation system in the first place.

"It's been really hard to get materials for putting in new drip-tape fields for drip irrigation, because the supply chain can't get it to us," Rominger said.

Barcellos is worried about fertilizer, noting that some products have doubled or tripled in price—if it's even available.

"There's concerns about availability this summer when we need a lot of these products," Barcellos said. "There's more unknowns than normal this year." Some of the main ingredients come from China, he added.

"A lot of that stuff just isn't getting over here, and China's got their own demands and needs for it as well," he said.

All of this could once again hamper output, Barcellos said.

"There's probably plenty of demand for a 12 million-plus-ton crop, but I don't think the industry's going to be able to source the acres or the water to produce that size of a crop," Barcellos said. "Until we have a decent water supply again in California, and have a nice wet year, I just don't see us having the acres to produce the crop for the demand that we'll have."

Source: California Farm Bureau Federation