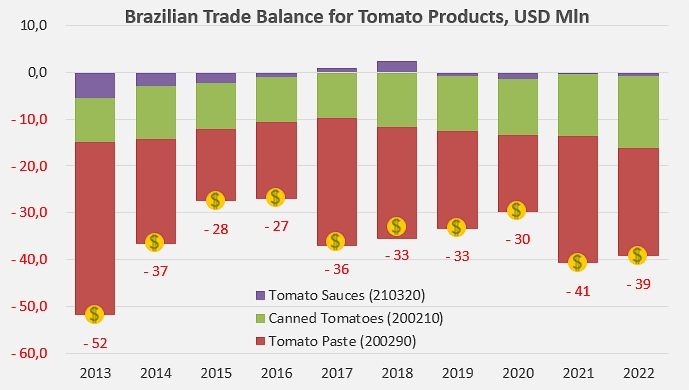

Brazil's trade balance in tomato products has been in chronic deficit for almost 15 years, but is now slowly improving. The 2023 crop year targets, if met, could bring the country closer to self-sufficiency.

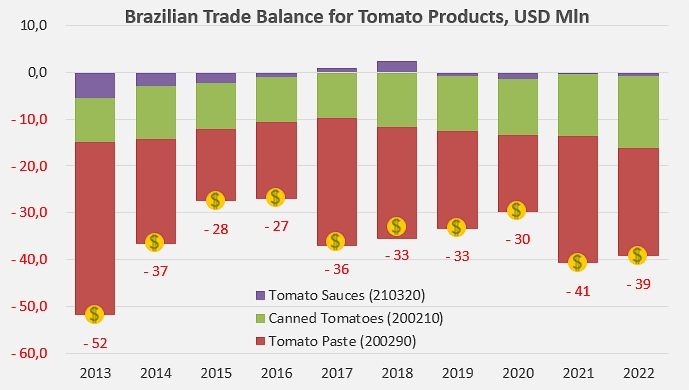

In spite of significant and particularly rapid growth in the quantities processed in recent years, the Brazilian industry is still struggling to stabilize the annual level of the national trade deficit and net expenditure below the USD 40 million mark. Brazil's trade is chronically in deficit in the tomato paste and canned tomato categories, with the paste deficit showing signs of decreasing and the canned tomato deficit tending to increase. At the same time, annual results for the sauces category have fluctuated for several years between a slight surplus in quantity and a slight deficit in value (see additional information at the end of the article).

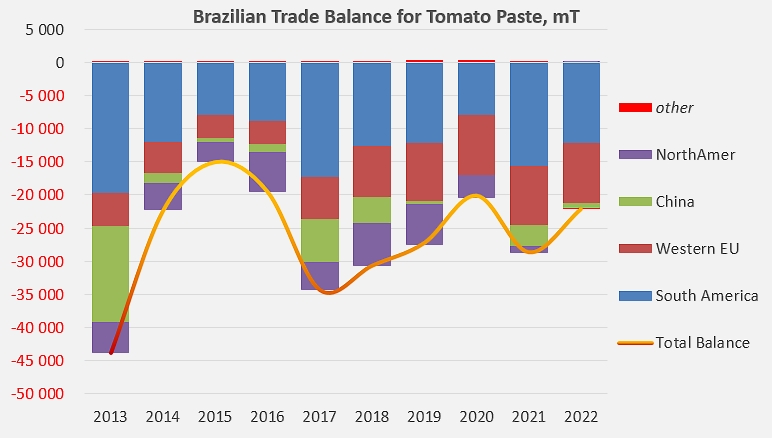

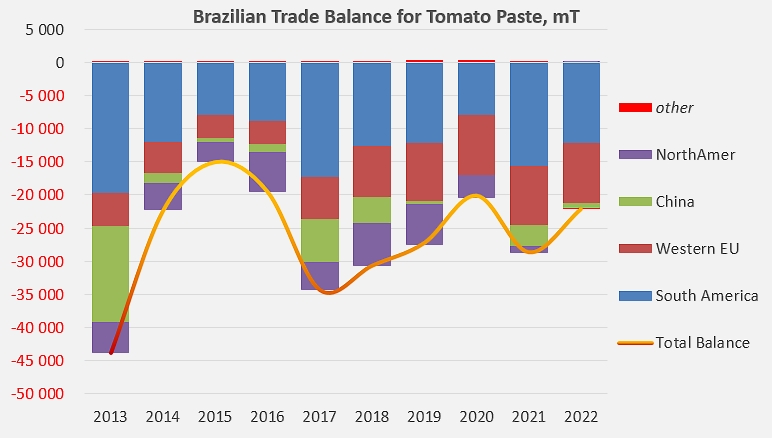

The largest disparity in Brazil's trade balance for pastes is with Chile, and to a lesser extent with Peru. Although trade flows vary greatly from year to year, the average annual net quantities imported by Brazil over the last five years have been just over 3,000 metric tonnes (mT) of product from Peru and more than 11,000 mT from Chile. To these quantities were added, over the same period, approximately 8,300 mT of Italian pastes each year, 3,000 mT of US products and several hundred tonnes from China, Portugal, Spain and Egypt.

In total, the paste balance deficit reached 22,000 mT last year, a clear improvement over 2021 (-28,600 mT) and over the average of the previous three years (-25,300 mT). The corresponding expenditure amounted to USD 23.2 million, a significant drop compared to the average of the previous three years (USD 21.5 million).

In 2022, the Brazilian balance for canned tomatoes recorded a deficit of about 17,000 mT, more marked than in 2021 and in the previous three years (-15,700 mT approximately). Net expenditure, at over USD 15.3 million, was significantly higher (+24%) than the average for the previous three years (USD 12.3 million). The majority of imported products are Italian, but also Argentinean and, to a very small extent, Spanish.

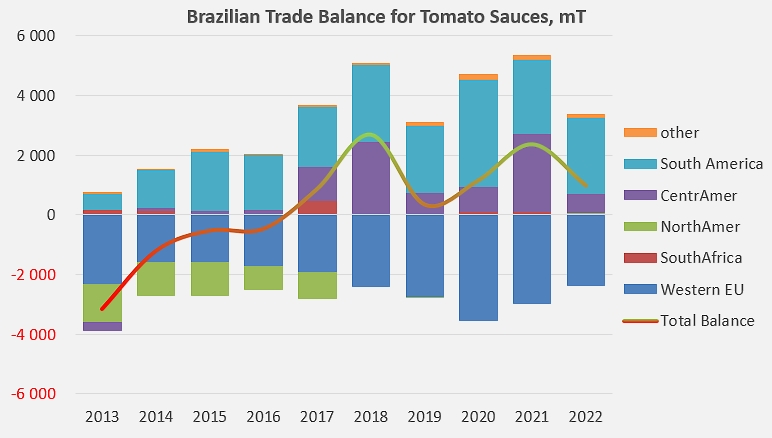

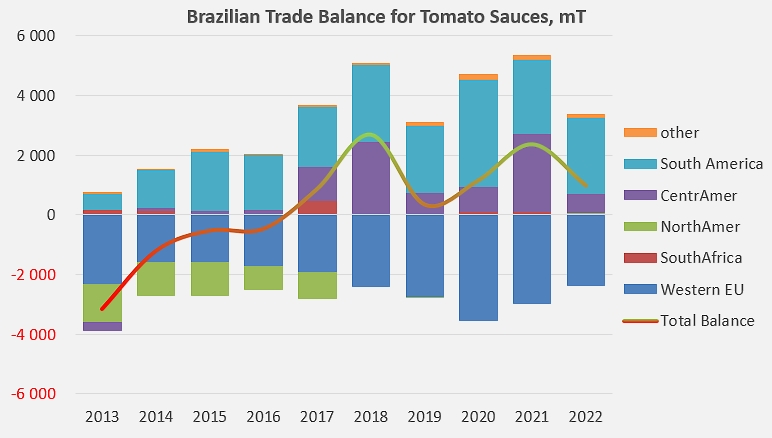

The sauces sector is the only one to show an active trade balance in terms of quantities, although that is irregular and relatively marginal: based on modest but almost regular product flows to the markets of Venezuela, Paraguay, Argentina and Uruguay, the Brazilian tomato sauce industry has managed to generate an annual surplus of around 1,400 mT on average over the last six years. However, the value of imported sauces and ketchup over the same period was slightly higher than that of exported products, so the sector's balance remains chronically negative (a few tens of thousands of US dollars).

Ultimately, despite a slight improvement over 2021 (USD 41 million), Brazil's net expenditure on tomato product supplies in 2022 (USD 39.3 million) remained higher than the average of the previous three years (USD 34.7 million).

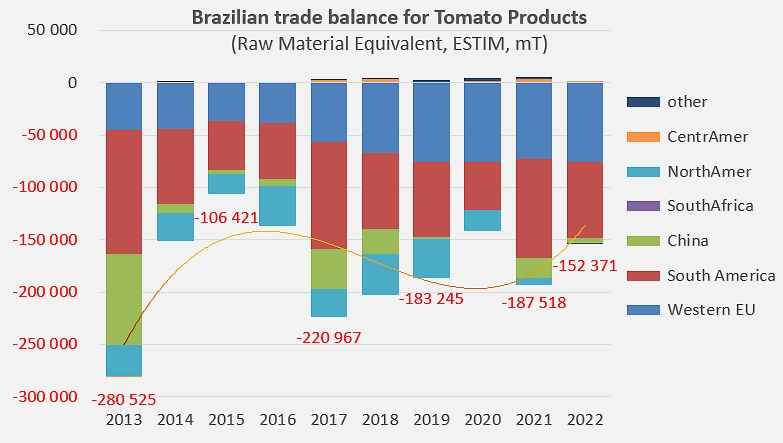

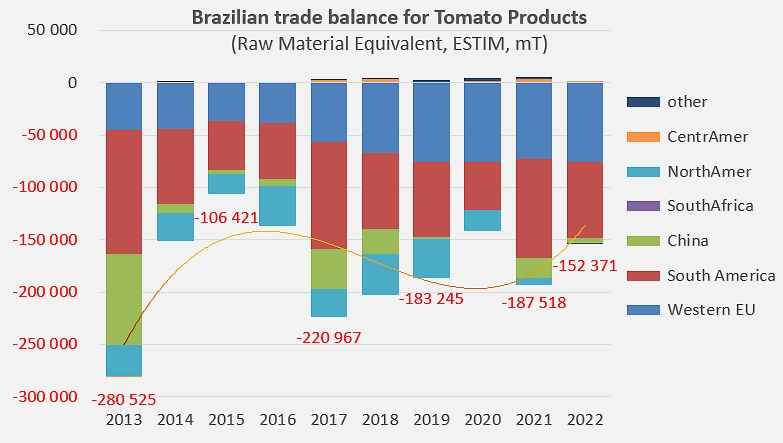

This financial deterioration, partly linked to the increase in product prices, does not, however, call into question the slow improvement in the Brazilian trade balance in terms of quantities, which is supported by the increase in processed volumes. A rough estimate of the quantities of tomato raw material mobilized in the trade balance shows a gradual reduction of this deficit, which can be quantified at around 150,000 mT last year while it reached more than 220,000 mT in 2017.

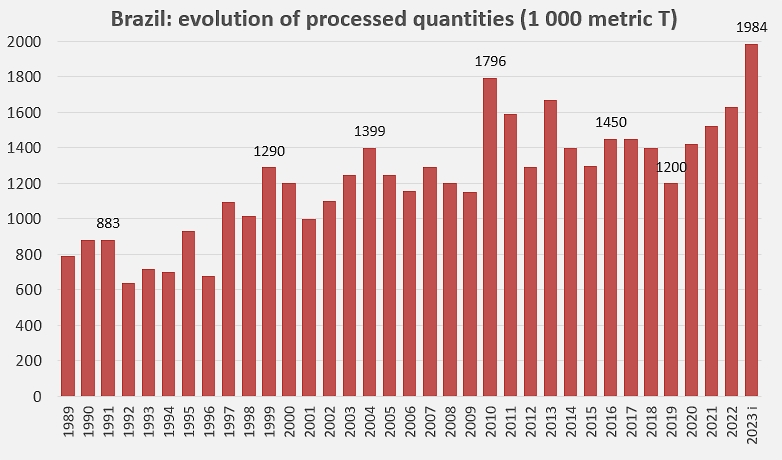

For 2023, Brazilian operators plan to process, according to data collected by the WPTC, more than 1.9 million tonnes of tomatoes, compared to 1.6 million mT in 2022. If achieved, Brazil's processing targets, up 7% in terms of area and 18% in terms of quantity, could bring the country closer to self-sufficiency.

Some complementary data

Evolution of the quantities processed by the Brazilian sector over the last three decades.

Source: Trade Data Monitor, WPTC