Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

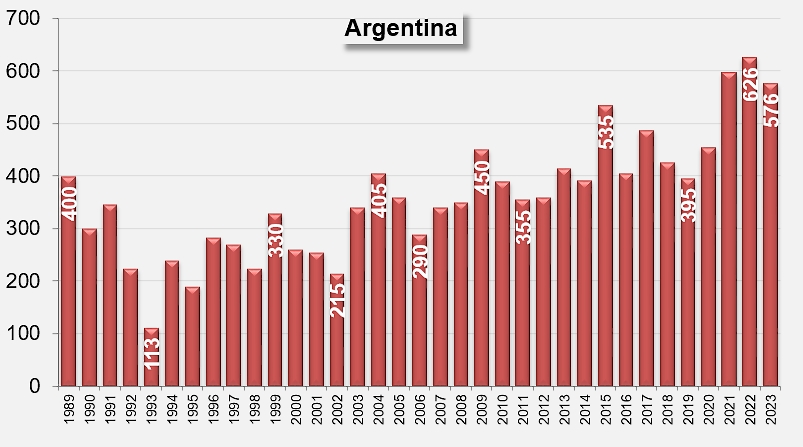

Despite expectations, the major climatic problems encountered during the 2023 processing campaign prevented the Argentinean industry from fully meeting domestic consumption demand. Local players remain confident, however, and believe that growth will be linked to exports.

Despite expectations, the major climatic problems encountered during the 2023 processing campaign prevented the Argentinean industry from fully meeting domestic consumption demand. Local players remain confident, however, and believe that growth will be linked to exports. On the other hand, the San Juan region, accustomed to an average yield of 100 tonnes per hectare, fell to around 80. In Mendoza, where yields should have reached or exceeded 90 mT/ha, the results were in line with the usual 80 mT/ha, because the Uco valley, where a large proportion of tomato production is concentrated, was among the worst affected areas.

On the other hand, the San Juan region, accustomed to an average yield of 100 tonnes per hectare, fell to around 80. In Mendoza, where yields should have reached or exceeded 90 mT/ha, the results were in line with the usual 80 mT/ha, because the Uco valley, where a large proportion of tomato production is concentrated, was among the worst affected areas.