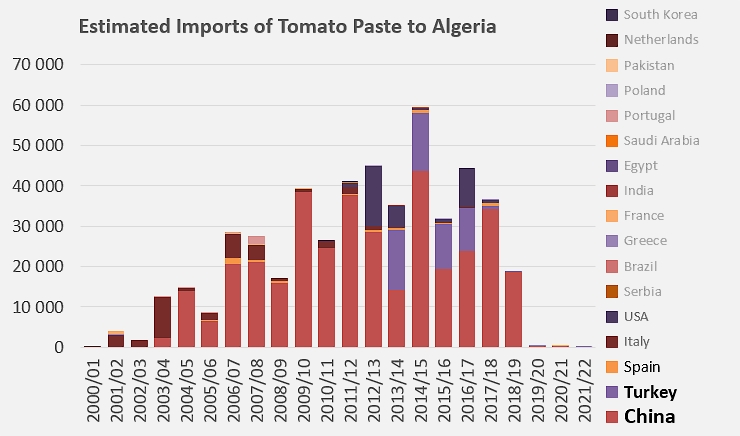

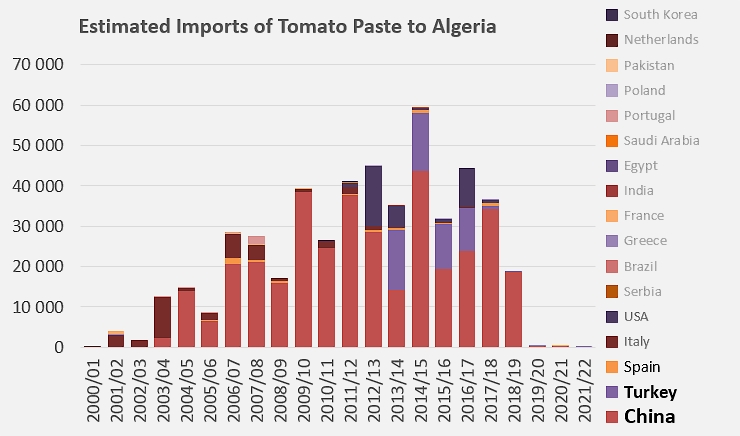

The Algerian processing tomato industry is facing difficulties that are both numerous and diverse, and the country could be forced to resort once again to importing tomato paste.

Despite repeated warnings from the President of the National Interbranch Council of the Tomato Industry (CNIFT), Mostefa Mazouzi, the situation presents a significant risk of disengagement on the part of local growers, whereas the country has virtually imported no tomato paste for the past four years. According to Mr. Mazouzi, tomatoes are available today in good quantities, accessible to all social levels of the population in Algeria and are present all year-round thanks to the participation of 22 wilayas across the country.

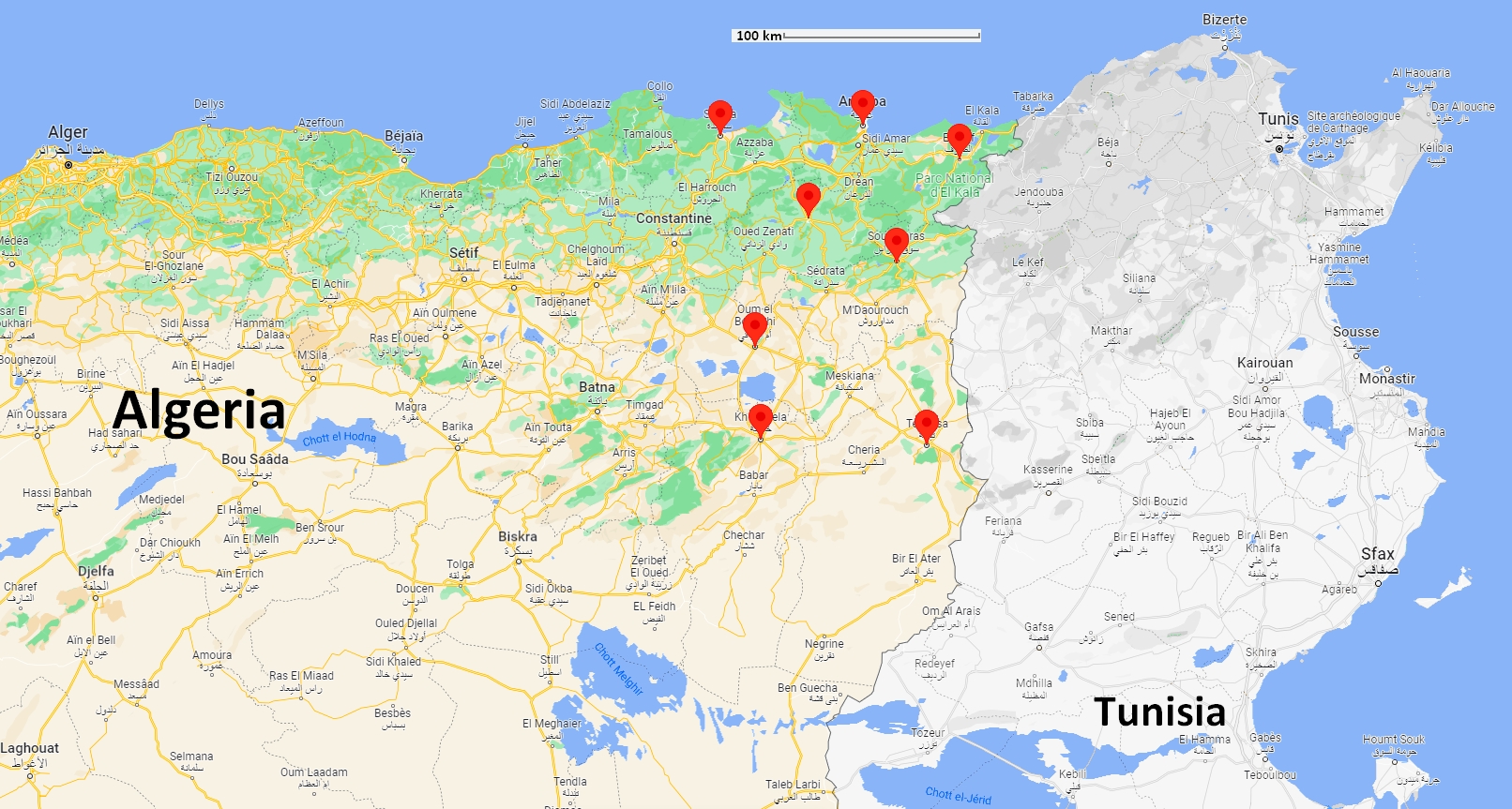

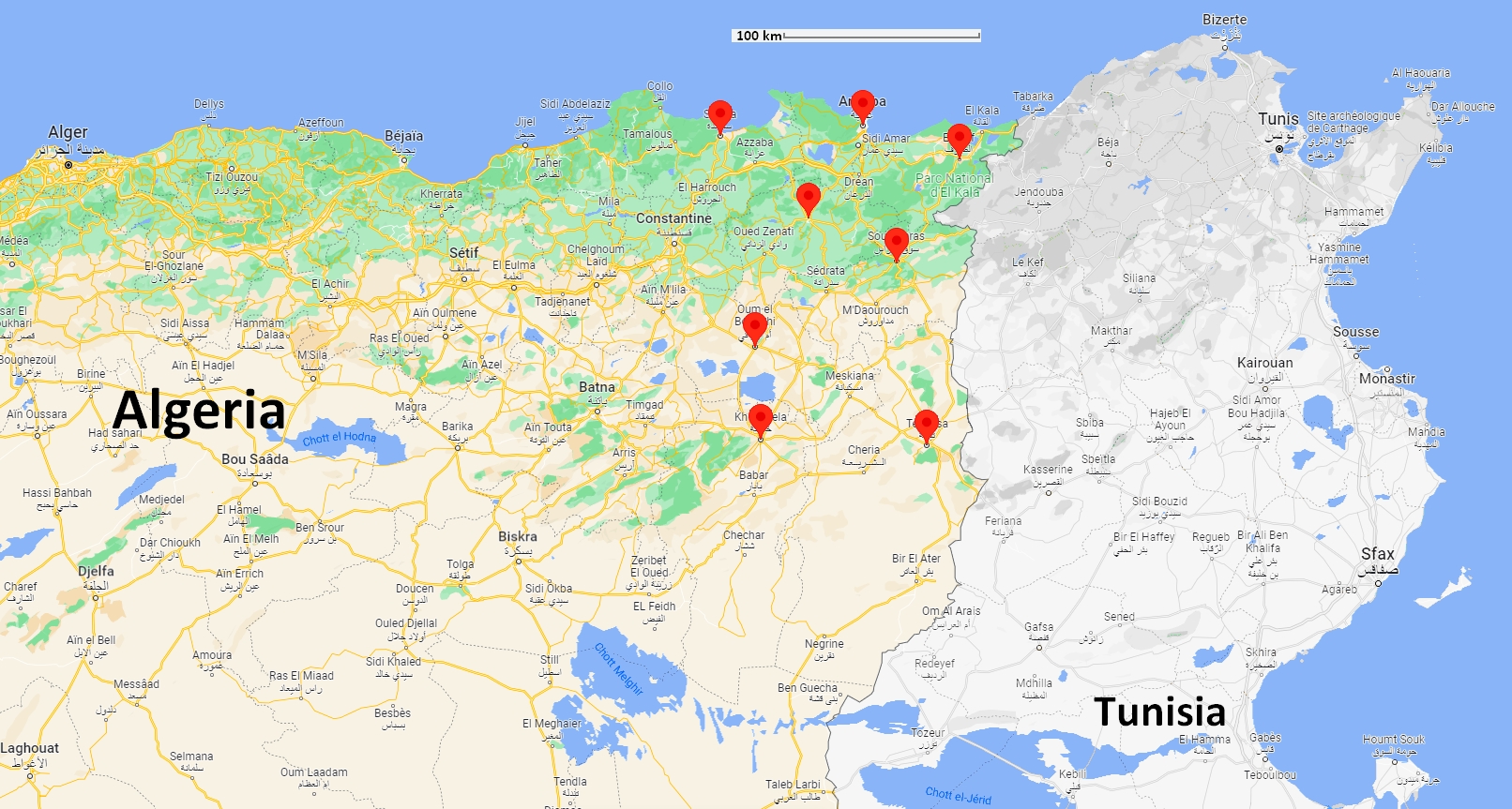

The CNIFT President recalls that the organization's strategy has been to develop new cultivation zones in several northern wilayas (Souk Ahras, Oum el Bouaghi, Khenchela, Tébessa), in addition to the historical growing regions of Guelma, Annaba, El Tarf and Skikda. With the production from other wilayas in the south and west (Oued Souf, In Salah, Adrar, El Ménia, Maghnia, Aïn Témouchent, Tlemcen), "the loop is closed in time and space and production continues from January to December," says Mr. Mazouzi.

Algerian tomato production is expected to drop

Mr. Mazouzi adds that the country's tomato crop has followed a pattern of "uninterrupted growth, with 1.8 million tonnes produced in 2019 and then a progression in subsequent years, with 2.2 million for the 2020 season and up to 2.5 million in 2021." However, the 2022 season has recorded a sharp decline in production, estimated at around 500,000 tonnes, the cause of which is a significant reduction in planted surfaces, a fact that concerns the President of the Algerian tomato sector. He has issued a warning about "a hemorrhage in the number of growers" and has actually referred to the possibility of a "flight" or exodus of growers over the coming seasons.

Northeast Wilayas

Mostefa Mazouzi is pessimistic regarding the coming season and estimates that "without exaggerating, production may fall by 20%", specifying that this is a possible decline in production, not in yield. "Last year, there were 3,600 tomato growers under contract, who planted 27,000 hectares. This year, it will be difficult to mobilize 2,500 growers, who will plant on 22,000 hectares for a crop of 1.8 million tonnes. Half goes to fresh table-tomato consumption and the other half to canned products. This figure should be compared with the 1.2 million tonnes received by the processing industry during the last season."

The cause of this decline in Algerian tomato production is essentially the chronic delay in payment of products delivered by farmers to processing plants. For tomatoes delivered to plants in July, the acceptable payment period is normally two to three months, i.e. September or October. Mr. Mazouzi has explained that "currently, delays are as long as nine months, or even a year." Speaking about the consequences of this delay, the President of the CNIFT believes that "this may bring us back to importing double- and triple-concentrated tomato paste from China. To be honest, the industry itself is in danger."

Southern and Western Wilayas

When asked about the position of the supervisory authorities, he said that the government ministry concerned has made corrections. Currently, premiums are no longer paid by the processing plants but by the National Interbranch Office for Vegetables and Meat (ONILEV). The computerization of procedures is underway, and part of the premiums have been paid.

Fertilizer price support has been a welcome move

A recent decision by the Algerian government to help with the cost of fertilizer by covering 50% of its price was particularly appreciated by the profession. Mostefa Mazouzi has underlined the importance of this gesture, but points out that another problem remains: the actual price paid to growers as well as the amount of the premiums.

According to figures provided by the head of the tomato industry, the selling price of raw tomatoes to processing plants is between 12 and 13 Algerian dinars (DA) per kg, or about 86 Euros or 91 US dollars per metric tonne. This is complemented by a State premium of 4 DA/kg (about 28 Euros or 29 US dollars per tonne), bringing the total to 17 DA/kg (117 Euros or 124 US dollars per tonne). Another premium of 1.5 DA per kg (10 Euro or 11 US dollars per tonne) received is attributed to processors.

For the industry representative, these current prices are insufficient. The cultivation costs borne by the growers amount to about 1.25 million DA per hectare, or approximately EUR 7,000 or USD 7,500. With a yield of about 60 mT/ha, the cost of production is close to 21 DA/kg (about 144 Euros or 152 US dollars): the 17 DA/kg of tomato that is paid to the grower is therefore not enough to cover costs. The CNIFT President estimates that yields of 100 to 120 metric tonnes per hectare would be needed for tomato cultivation to be profitable at the price of 17 dinars per kilo. According to him, "current prices do not cover the overall cost of the planted field, even taking into account the premium of 4 DA."

He nonetheless believes that the problem is not the premium, or lack thereof, but the fact that the price of tomatoes shipped to processing plants needs to be revised, as part of a contract farming system that provides an agreement and a contract between the fellah-grower and the processor. For Mostefa Mazouzi, the new price should be "between 20 and 22 DA/kg, so the fellah can be properly remunerated" (about 152 Euros or 160 US dollars per tonne). He states that "support for the industry must be shared between the State and processors."

Difficult conditions for companies

Another problem more specifically affects processors. Several companies have to pay back their credit with the BADR (Bank of Agriculture and Rural Development). A number of them are currently in arrears and eight of them are even at risk of seizure for non-payment of their installments. These eight units represent a processing capacity of 16,000 mT/day, or more than 40% of national capacity.

Source: tsa-algerie.com