Sales jumped 14% compared to the previous three years

The total value of Portuguese exports of tomato products in 2020/2021 was 15% higher than in the pre-Covid period. Most of Portugal's foreign trade involves tomato pastes and powders, and the products (paste, canned tomatoes and sauces) are mainly intended for shipment the EU27 countries and the United Kingdom.

The total value of Portuguese exports of tomato products increased in 2020/2021 by EUR 18 million (+7%) compared to that of the previous marketing year (EUR 248 million, in 2019/2020) as well as by 14% (EUR 32 million) compared to the average result of the three previous years but, above all, by 15% (EUR 35 million) compared to the average performance of the three years prior to the Covid pandemic.

Most of the country's foreign operations involve tomato pastes and powders (83% of the income), with exports of sauces and canned tomatoes representing only 12% and 6% respectively of the total value of products delivered abroad.

Apart from Japan, the main client countries for Portuguese exports of concentrated purees are European and, with the exception of the United Kingdom, they all belong to the EU: Germany, the Netherlands, Spain, Italy, France, Belgium, Poland, Sweden, Finland, Denmark, etc. In the last five years, these ten EU member countries accounted for 48% of all Portuguese exports of tomato pastes. Over the same period, Japan accounted for 11% of Portuguese outlets, and the United Kingdom accounted for 25%.

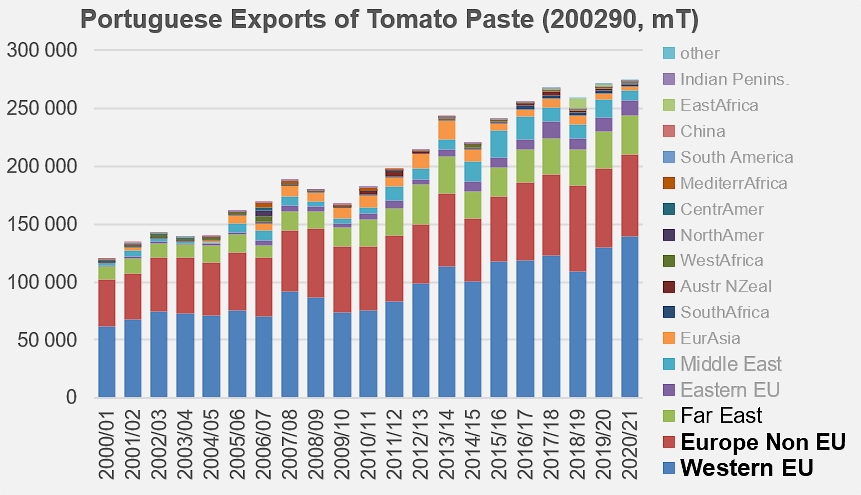

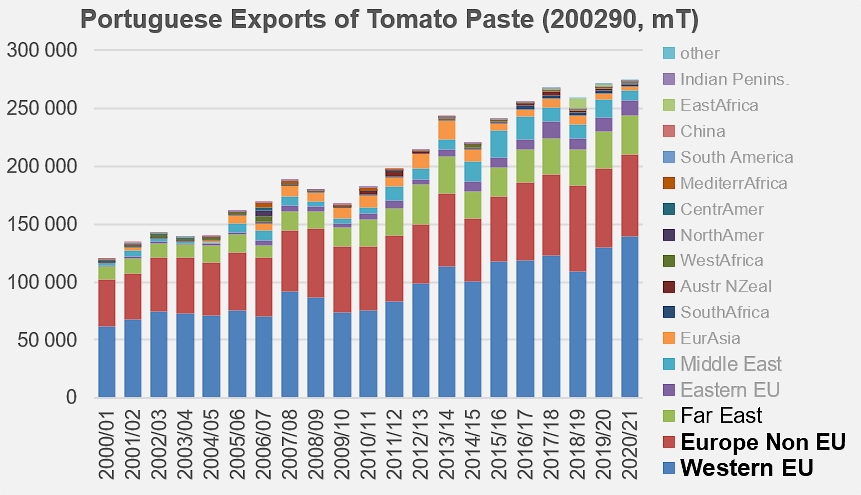

Among the important regions for Portuguese foreign sales of tomato pastes, Eastern EU countries (Poland, Lithuania, Czech Republic) have recorded the most dynamic growth rates over the last twenty years, but also over shorter periods of ten and five years. The annual growth rates (CAGR) of exports to this region are at least around 10%, and recent years have seen the quantities involved increase to between 12,000 and 14,000 metric tonnes of finished products.

However, these volumes remain much lower than those delivered to the three main client regions for Portuguese products, although the growth rates there are slower: with an average of just over 32,000 tonnes of Portuguese pastes imported over the last three years, the far eastern market (Japan) has grown at an average of 5% per year over the last two decades, and the health crisis has had a "booster" effect on product flows, which will be 9% higher in 2020/2021 than they were before the crisis.

The export dynamics of Portuguese pastes were only marginally impacted in the regions affected by Brexit, with the main effect being the significant "transfer" of volumes from the "European Union" region to the "non-EU Europe" region. With almost 71,000 mT delivered to the markets of non-EU Europe, Portugal's performance over the 2020/21 marketing year was only 0.6% higher than in the pre-Covid period (2016/17-2018/19). It remained virtually identical to that of the previous three years (2017/18, 2018/19 and 2019/20) and was 3.5% higher than 2019/20 results. So it appears that the pandemic has not had any particular effect on paste sales in the UK. Conversely, flows to the western EU countries already mentioned have surged: the 139,000 mT of pastes delivered in 2020/21 to Germany, the Netherlands, France, etc. were 19% higher than the level of trade (around 116,000 mT) recorded before the pandemic, but also 7% higher than the result for 2019/2020 (around 130,000 mT). This seems to indicate a certain continuation of the current dynamics set in motion during the health crisis.

The following four regions (in order of importance for Portuguese foreign trade) recorded a relatively homogeneous slowdown in their purchases, sufficiently noticeable to be reported. Without going into detail, total deliveries of Portuguese pastes to the Middle East, Eurasia, South Africa and the Asia-Pacific region (about 14,600 mT in total) declined in 2020/21 by almost 42% compared to the quantities shipped in 2019/20 (24,900 mT) and by 46% compared to the pre-Covid trade level (26,800 mT).

The Portuguese industry's performance in the canned tomato sector (peeled, unpeeled, whole, chopped) once again stalled in 2020/21, following a previous downturn during marketing year 2019/20 and at the end of a five-year period that has seen no significant growth. Over the last ten marketing years, two regions – the EU27 and non-EU Europe (as defined post-Brexit) – have shared 95% of Portuguese canned tomato exports, in a dynamic that has seen the gradual emergence of western EU countries (Germany, France, the Netherlands, Belgium, etc.) as strategic clients of Portugal in this category.

Already recording close on 35,000 mT per year over the previous four years, Portuguese foreign sales of canned tomatoes were not impacted (either positively or negatively) by the Covid pandemic and maintained similar volumes of sales last year (+0.8%).

The same geographical pattern and the same preponderance of EU member countries (or ex-member countries) is repeated for Portuguese exports of sauces and ketchup, whose hesitant dynamics of recent years have clearly been impacted by the pandemic, seeing a sharp increase that has taken quantities to unprecedented record levels (44,000 mT in 2020/21).

Buyers of Portuguese tomato-based sauces are mainly Britain (54% of total quantities in the pre-Covid period, 68% in 2020/21) and EU member countries (Germany, France, Spain and Ireland). However, this last marketing year has not left a good impression on Portuguese operators, since the quantities delivered within the EU were 21% lower than in the pre-Covid period (2016/17-2018/19) and 23% lower than in the previous marketing year (2019/20).

In the final count, the 2020/21 marketing year has extended and remarkably confirmed the financial results recorded for the previous year, with a total value of exported products (estimated at EUR 266 million) clearly "boosted" by the health crisis and 15% higher than results generated by the sector during the pre-Covid period.

Some additional information

Comparative evolution of Portuguese exports of tomato pastes over recent marketing years. The result of the last twelve months (val. December) was 27,600 mT lower (almost 10%) than the same period of the previous marketing year, and 9,100 mT lower (3%) than the average performance of the previous three years.

Evolution and composition of Portuguese exports of concentrated tomato purées: Portuguese foreign sales of pastes are mainly products conditioned in catering and industrial formats with a soluble solids content between 12 and 30%.

20029031, with a soluble solids content >= 12% but <= 30%, in intermediate packs with a net content > 1 kg

and 20029091, with a soluble solids content > 30%, in intermediate packs with a net content > 1 kg

Portuguese foreign sales have traditionally been mainly shipped to EU countries and to the United Kingdom (classified as "non-EU Europe" over the entire period shown in the following graph).

Sources: Trade Data Monitor