Press release

, François-Xavier Branthôme

-

“The takeaway is that we need to be very rigorous in making sure our 2021 pack is well-proportioned according to customer needs.”

In a recent newsletter, the largest tomato processor in California – and worldwide – reviewed the main elements of the current agro-industrial and commercial context. Here are some of the points put forward by Morning Star in its analysis of the situation of the US industry and in its negotiations with growers, as well as the arguments presented on the same issues by the Californian Tomato Growers Association to support their price proposals for the 2021 marketing year.

Balancing act ahead for the 2021 US tomato processing season

In its February analysis, the Californian tomato industry #1 signals “a 2021 pack year tightness. Although the new season is still over four months away, processors and growers have a good view of what tonnage is possible to achieve for the upcoming season; acres are booked, and seedlings will start going into the ground shortly. The industry is also tracked quite carefully and has good transparency of industry data, such as historical consumption averages (usually referred to as movement), and the collective US tomato industry inventory position published by the California League of Food Producers (CLFP).

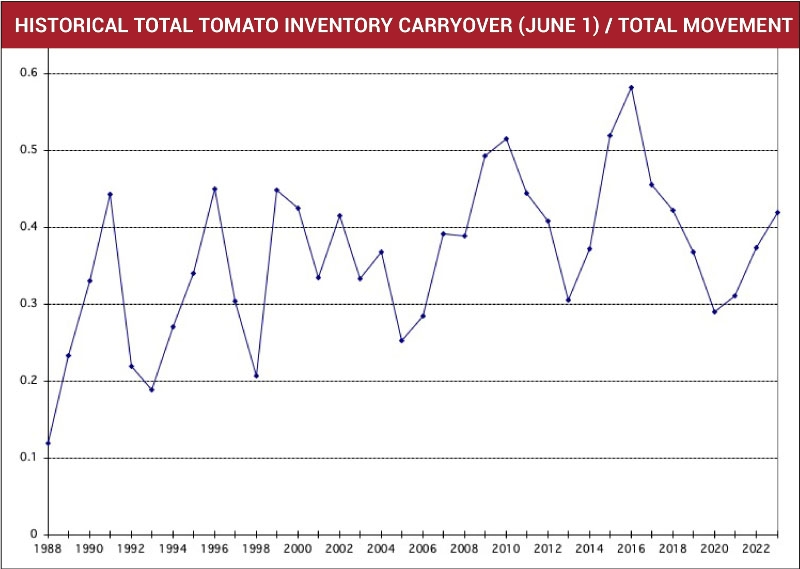

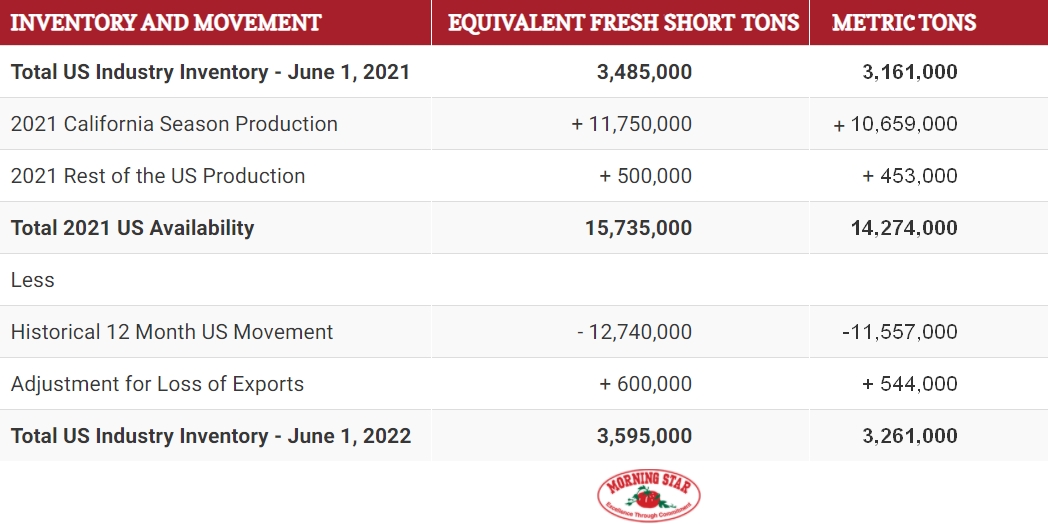

Taking into account the industry inventory position communicated by the CLFP on December 1, 2020, the five-year average historical movement patterns (which typically see a slowdown in the second half of the year), and knowledge of Morning Star’s own position and how it relates to the industry, the company forecasts a June 1, 2021, US total industry inventory of 3.162 million metric tonnes (mT).

Morning Star expects the 2021 California crop to be about 10.659 million mT and the rest of the US adding 453,000 mT for 11,113 million mT of total production. With the previously mentioned June inventory, the industry is heading into next year with a prospect of 14.274 million mT. History points to an annual movement close to 11.557 million mT; however, Morning Star expects to experience a 554,000 mT loss of industry exports, landing us at a consumption of 11.013 million mT for 2021/2022. This would leave the US industry with 3.26 million mT in inventory on June 1, 2022.

This means that if everything is perfectly balanced, the industry would have inventory on June 1 to cover customer demands for over three months, leading into the month of September. The current inventories for June 1, 2021 and 2022, are expected to be about 30% of four-year average historical movement, very close to the US industry inventory on June 1, 2014, which was about 3.63 million mT.

As industry needs to be very rigorous in making sure its 2021 pack is well-proportioned according to customer needs, knowing that it faces an imperfect 18-month planning cycle and inventories that are never perfectly in step with movement, things get demanding from a planning standpoint.

California processed tomato price negotiations

According to Morning Star, economic grower cost analysis explains proposed prices for the 2021 California tomato crop. The company also points out that from what it has heard from growers and its own sentiment, there exists a desire to set an early price.

Sellers and buyers both also have varying conditions and circumstances, which drive the variability in individual prices. Growers continue to hold their ground at USD 84.50 /short ton (EUR 78.25 /mT, val. March 16, 2021) for conventional and USD 136 (EUR 126 /mT) for organic. In all fairness, Morning Star genuinely feels USD 82.50 (EUR 76.4 /mT) for conventional, and USD 127.50 (EUR 118 /mT) for organic would be a reasonable 2021 price to maintain economic stability for the tomato processing and growing industry.

Many cost inputs for growing tomatoes are not yet fixed, so they must be estimated. This factor, along with the fact that there is diversity of how growers calculate what goes into the cost of growing tomatoes, increases the difficulty of predicting cost. Growers are facing higher costs for their inputs for 2021, compared to 2020, like: labor, fertilizer and chemicals, water, and rent. The agricultural environment has also provided price increases for some competitive crops. Taking these factors into account within our economic analysis, with adjustments for expected yield improvements of 1% per year, a fair price would arguably be USD 81.60, which is USD 3.10 higher than last year’s conventional tomato price. Some of the same inputs that accounted for the USD 3.50 per ton increase from 2019 to 2020 are once again factors for 2021.

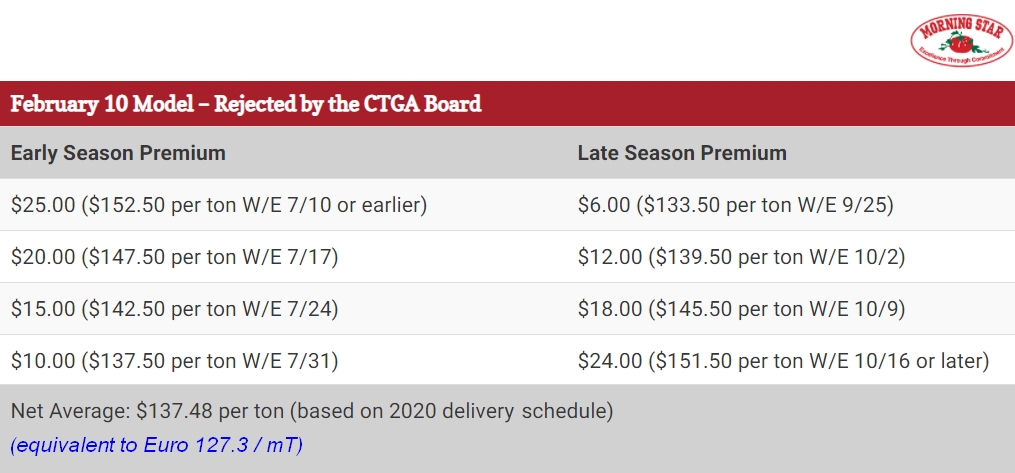

As in the case of conventional tomatoes, there are increasing costs for organic tomatoes, many of which are the same factors but to differing degrees by the nature of organic inputs. Looking at supply and demand for organic tomatoes, there is a high demand for organic at the early part of the season. Conversely, at the middle to the end of the season, there is not much of a demand because most tomato processors satisfy their pack at the beginning of the season. Morning Star felt that structuring a pricing model with early and late season premiums would provide a competitive price when there is an early season high demand and provide for a potential increase in growing costs during the late part of the season.

Utilizing the demand/supply economic model, which was based on 2020’s actual California organic delivery schedule, Morning Star proposed its base prices as such:

The reflections and arguments of the CTGA

Historically, the CTGA Board has negotiated conventional prices; however, California’s tomato processors were officially notified in November 2020 that the CTGA would now also negotiate pricing between organic tomato growers and processors.

The California Tomato Growers Association (CTGA) was formed in 1947 as a service association for growers of processing tomatoes. Its primary functions were to recruit field labor for tomato growers, set price rates for workers and hire attorneys to advise growers on the Bracero farm workers program. Today, the CTGA is involved in every phase of the State's processing tomato industry, from establishing a fair price to involvement with international trade, and assisting growers with all aspects of their production and marketing.

The reference price proposal put forward by the CTGA last December for conventional tomatoes is higher than the prices suggested by Californian processors at the end of the year (see our article from January 2021).

The study entitled “Tomato Industry Trends and Outlook: Regulatory Costs and Market Conditions”, which was commissioned by the CTGA from ERA Economics and submitted to the Association of Californian food producers in January last year, provided a picture of the local tomato industry’s situation as it was during preparations for the 2020 season. Despite being based on data from the 2018 marketing year, and therefore prior to the Covid pandemic, the results of this analysis provided a point-by-point breakdown of the important changes that have occurred in the recent past, and that justify, as far as growers are concerned, the importance of revaluing the raw materials shipped to processing plants.

In support of the CTGA’s proposals, this analysis carried out by ERA explains that “the industry started to adjust to changing market conditions in late 2019 and early 2020. Softer market conditions were a result of slowing global demand, decreased exports, and increased processing capacity. Total processing capacity and inventories were declining. This tends to put upward pressure on farm-gate prices.”

The report also noted that “sustainability, higher wages, and environmental stewardship are important for the long run viability of the industry. However, these changes come at a cost. Opportunities to grow the market through product innovation or expanding into new export markets can help offset some of these higher costs.

New laws, regulations, and policies are increasing the cost to produce tomatoes in California. Labor and water costs are increasing at the greatest rate, followed by materials and other regulatory compliance costs. The magnitude of these costs varies by region.”

In this study commissioned by the California Tomato Growers Association to quantify these trends, understand economic drivers of change, and develop a future outlook for industry costs, some examples are presented of key costs (labor, water, materials, etc., also mentioned in the comment published by Morning Star) that have impacted the profitability of growing tomatoes in California in recent years.

According to the ERA study, labor accounts for more than 20% of annual operating costs. This includes planting, harvest, hand weeding, irrigation, and other field work. Recent changes introduce an increase in minimum wage (AB 1066) while overtime requirements (SB 3) are changing with phased implementation by 2023 and 2025. Many growers already pay more than minimum wage to retain crews. Consequently, labor costs are estimated to increase between 5% and 9% per year through 2023, which means that total costs should increase by USD 100 to USD 200 per acre by 2023.

According to the ERA study, labor accounts for more than 20% of annual operating costs. This includes planting, harvest, hand weeding, irrigation, and other field work. Recent changes introduce an increase in minimum wage (AB 1066) while overtime requirements (SB 3) are changing with phased implementation by 2023 and 2025. Many growers already pay more than minimum wage to retain crews. Consequently, labor costs are estimated to increase between 5% and 9% per year through 2023, which means that total costs should increase by USD 100 to USD 200 per acre by 2023. Water costs are increasing due to water quality requirements, surface water changes that limit water supply availability, surface water programs that increase costs, and groundwater management requirements.

Water costs are increasing due to water quality requirements, surface water changes that limit water supply availability, surface water programs that increase costs, and groundwater management requirements.

Several laws, regulations, and policies have implemented significant changes: water quality management requires controlling material runoff and proper waste discharge. Basin Plans specify regional requirements for water quality management and are updated frequently. Water availability is affected by environmental stream flow requirements and operation of the State Water Project (SWP), the Central Valley Project (CVP), and local projects. The SGMA (Sustainable Groundwater Management Act) also reduces water supply. This has made water cost estimates increase between 5% and 10% per year through 2023, with total costs increasing by USD 100 to USD 250 per acre by 2023.

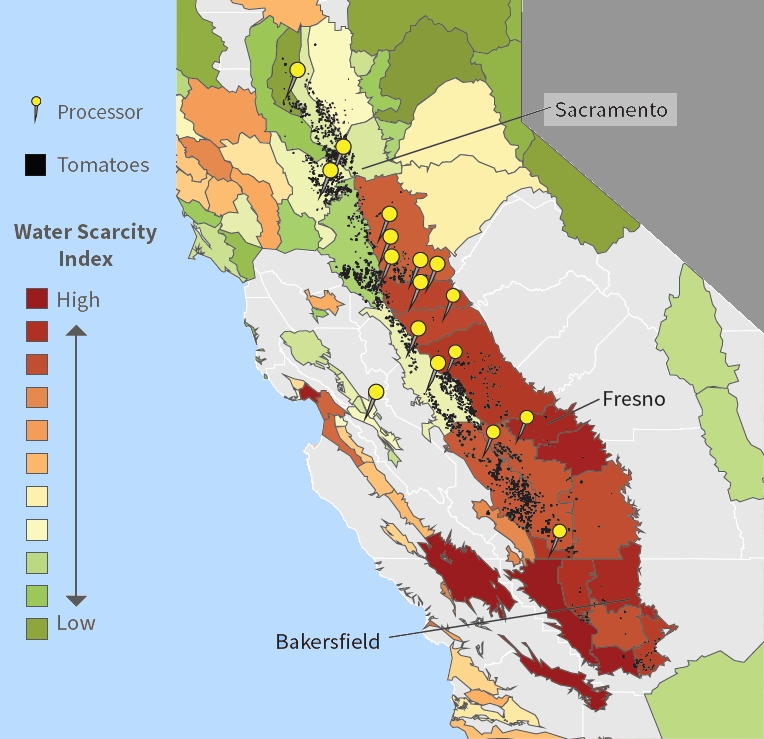

Several laws, regulations, and policies have implemented significant changes: water quality management requires controlling material runoff and proper waste discharge. Basin Plans specify regional requirements for water quality management and are updated frequently. Water availability is affected by environmental stream flow requirements and operation of the State Water Project (SWP), the Central Valley Project (CVP), and local projects. The SGMA (Sustainable Groundwater Management Act) also reduces water supply. This has made water cost estimates increase between 5% and 10% per year through 2023, with total costs increasing by USD 100 to USD 250 per acre by 2023. Approximately 90% of California tomatoes are grown in groundwater sub-basins that are classified as high priority or critically over-drafted. Restrictions on groundwater pumping under SGMA will increase competition for water, which increases the cost of water to growers in those regions.

Approximately 90% of California tomatoes are grown in groundwater sub-basins that are classified as high priority or critically over-drafted. Restrictions on groundwater pumping under SGMA will increase competition for water, which increases the cost of water to growers in those regions.Current (without SGMA) irrigation water costs vary between USD 50 and USD 250 per acre foot (1,233 m3), depending on the water supply source and location. Some GSPs (Groundwater Sustainability Plans) are identifying new water supply options. New water supply is expensive, with costs ranging from USD 300 to over USD 1,000 per acre foot, depending on location and water source.

SGMA increases tomato production costs by USD 75 to USD 235 per acre, or 3% to 7%, depending on production region. However, in “white areas” (with no access to surface water), SGMA is likely to restrict pumping to levels that make it impossible irrigate a crop, and costs would be significantly higher. Groundwater markets are being explored in some areas as one option to reduce costs. Market prices would vary by region, which would affect crops that could be profitably irrigated.

The figure illustrates water scarcity across the State and the location of tomato production and processors. Most production in the San Joaquin Valley is in water-stressed areas.

It should also be mentioned that State regulators continually review materials for evolving environmental standards. Public focus on the environment has resulted in increasing material regulations. Changes in regulations from the Department of Pesticide Regulation (DPR) and other State agencies affect what is registered for use, application rates, and management practices, like, for example, limiting aerial spraying of nematicide fumigant applications within a ¼ mile of schools and regional limits. New regulations are difficult to anticipate but typically impose direct compliance costs and indirect costs for management and training. In this connection, material costs are estimated to increase between 2% and 4% per year through 2023, which will lead to an increase in total costs of USD 25 to USD 50 per acre by 2023.

It should also be mentioned that State regulators continually review materials for evolving environmental standards. Public focus on the environment has resulted in increasing material regulations. Changes in regulations from the Department of Pesticide Regulation (DPR) and other State agencies affect what is registered for use, application rates, and management practices, like, for example, limiting aerial spraying of nematicide fumigant applications within a ¼ mile of schools and regional limits. New regulations are difficult to anticipate but typically impose direct compliance costs and indirect costs for management and training. In this connection, material costs are estimated to increase between 2% and 4% per year through 2023, which will lead to an increase in total costs of USD 25 to USD 50 per acre by 2023. Air quality standards also lead to new laws and regulations. These regulations typically require a capital investment in new equipment or machinery. Implementation of GHG requirements, stricter air quality standards for PM 10 (coarse particles with a diameter of 10 micrometers (μm) or less), and other air quality standards increase California farming costs.

Air quality standards also lead to new laws and regulations. These regulations typically require a capital investment in new equipment or machinery. Implementation of GHG requirements, stricter air quality standards for PM 10 (coarse particles with a diameter of 10 micrometers (μm) or less), and other air quality standards increase California farming costs.ERA emphasizes that equipment costs are higher in California as a result of stricter regulations. Costs are estimated to increase between 1% and 3% per year through 2023. This means that total costs should increase by USD 20 to USD 40 per acre by 2023.

One last example of the spectacular increase in costs was supplied by Morning Star in a newsletter published on March 16, 2021. It relates to the expected 30% increase in the price of natural gas used to power the heating units in factories. According to Aaron Giampetro (Morning Star Packing Company), “during the summer months, the three MS factories combined have an equivalent annual usage of 60,000 typical US households. Natural gas pricing, along with related transportation and regulatory costs have a major impact on factory economics and translate to real changes in prices of tomato products. Following the natural gas price market is crucial for understanding pricing for tomato products in coming years. Deep-freeze and exceptional weather conditions in Texas and surrounding States caused a huge increase in demand and drew from natural gas storage reserves and made prices go up. Future weather-related demand will create challenges; below-average precipitation will result in less hydro-electric power production, putting additional pressure on natural gas demand; transportation and regulatory costs continue their steady increase over time.

One last example of the spectacular increase in costs was supplied by Morning Star in a newsletter published on March 16, 2021. It relates to the expected 30% increase in the price of natural gas used to power the heating units in factories. According to Aaron Giampetro (Morning Star Packing Company), “during the summer months, the three MS factories combined have an equivalent annual usage of 60,000 typical US households. Natural gas pricing, along with related transportation and regulatory costs have a major impact on factory economics and translate to real changes in prices of tomato products. Following the natural gas price market is crucial for understanding pricing for tomato products in coming years. Deep-freeze and exceptional weather conditions in Texas and surrounding States caused a huge increase in demand and drew from natural gas storage reserves and made prices go up. Future weather-related demand will create challenges; below-average precipitation will result in less hydro-electric power production, putting additional pressure on natural gas demand; transportation and regulatory costs continue their steady increase over time.For these reasons, it is expected that natural gas pricing during summer months should average around USD 0.63 per Therm burner tip, approximately 30% higher than the average 2020 price.”

It is clear that events and changes that have occurred in recent months further reinforce the points put forward by growers in their proposals: “Now with regards to 2021, explained CTGA President/CEO Mike Montna in early March, that study made cost assumptions based on historical items, i.e. diesel, water, fertilizer etc. What we are seeing in 2021 is that costs are rising more than what we would say are historical and some of this has happened over the last few months. For example, farm diesel has increased 19% since January. Water and the lack of rainfall is also increasing costs that were not expected.”

In its conclusion, ERA noted that “California processing tomato growers face increasing production costs, but stable or decreasing prices and stagnant consumption growth rates. Growers interviewed for this study realize that low prices for raw processing tomatoes are due to slowing domestic consumption, excess processing capacity, and fewer growth opportunities in the export market. In the face of these market trends and increasing production costs, growers noted that the only ways to increase revenue in the long term is either to increase yields per acre, or to invest in labor-saving mechanization.”

One local operator summarized it this way: “The bottom line is growers here in the US are the same as in the other areas in the world, the margins have not been acceptable versus the risk.”

Some complementary data

USD 1 = Euro 0.8401 as of March 16, 2021

Source: Morning Star, CTGA