The quantities absorbed have been more than 8% higher than in the pre-Covid period

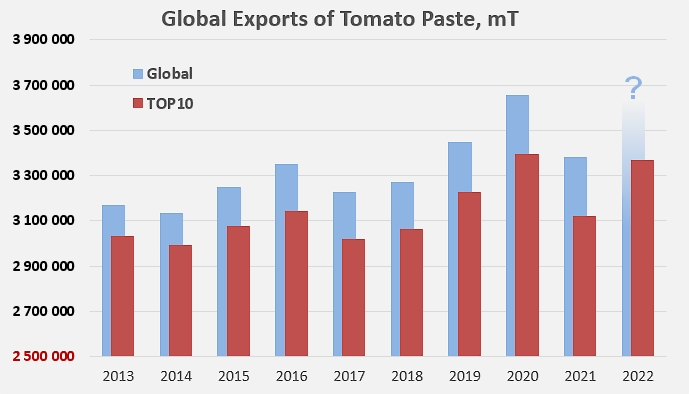

With 3.37 million metric tonnes (mT) of tomato paste exported in 2022, the TOP10 tomato processing countries achieved a performance close to the historical record of 2020 (3.39 million mT) and 265,000 mT (+8.5%) higher than the average of the three pre-Covid years (2017, 2018, and 2019).

As many countries have not yet reported their customs results at the time of writing, many figures are still missing to determine precisely the total level of global operations in the sector for 2022. But given the important share of worldwide operations for which the TOP10 countries accounted in previous years, it is to be expected that the quantities traded globally will also increase significantly. They could be at a level close to that of 2020, between 3.6 and 3.7 million mT.

Results for the TOP10 countries (China, Italy, Spain, Turkey, USA, Portugal, Chile, Iran, Greece, Peru) and global performance simulation

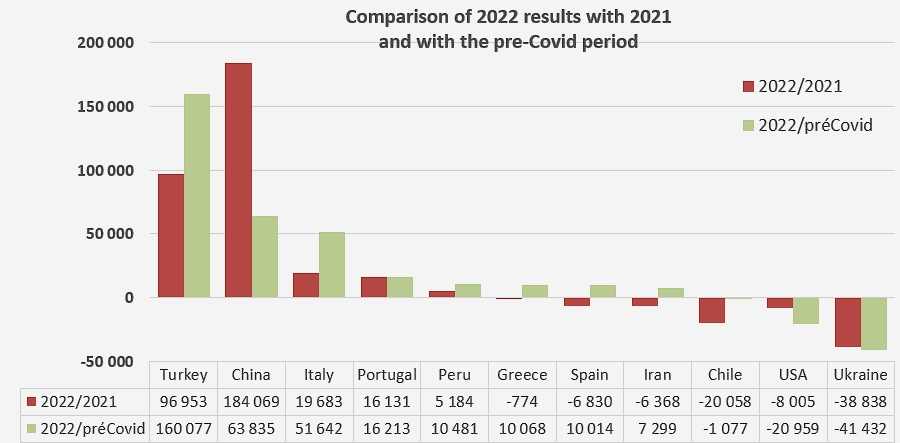

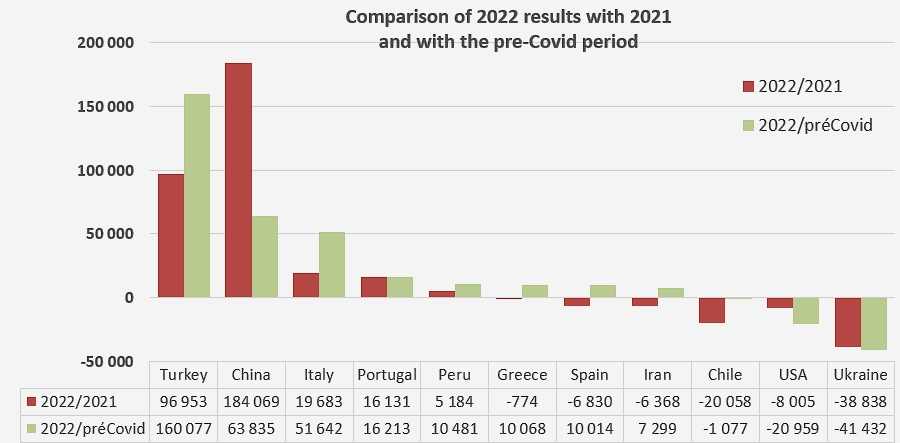

The most remarkable performance of the year can be attributed to Turkey, whose foreign sales of pastes (codes 200290 and derived products) jumped by more than 45% compared to 2021, and by more than 160,000 mT compared to the pre-Covid period. Compared to the same period 2017-2019, exports of Chinese and Italian products also recorded very good results, up by nearly 64,000 mT for the former and nearly 52,000 mT for the latter. The quantities recorded in 2022 by China, however, showed a more significant increase (+24%) compared to 2021 than that of Italian pastes (+3%). On the same basis of customs declarations, the Portuguese industry has increased its foreign sales by about 16,000 mT compared to the 2017-2019 period, while Peruvian, Greek and Spanish exports have increased by "only" about 10,000 mT each. It is important to note that, of the countries already mentioned, Greece and Spain are the only ones to have recorded a slight drop in foreign activity compared to the previous year. This is also the case for Iran, whose exports slowed down in 2022 by about 6,400 mT compared to 2021, while remaining higher than pre-pandemic levels.

For the other national industries in the TOP10 this year, the quantities exported in 2022 were lower than in 2021 and lower than in the pre-Covid period. For both Chile and the United States, this decline is the consequence of a contraction in the quantities processed, in a context that has suffered climatic issues. For Ukraine, the collapse in activity is directly linked to the Russian invasion in February 2022 (see also our related articles below).

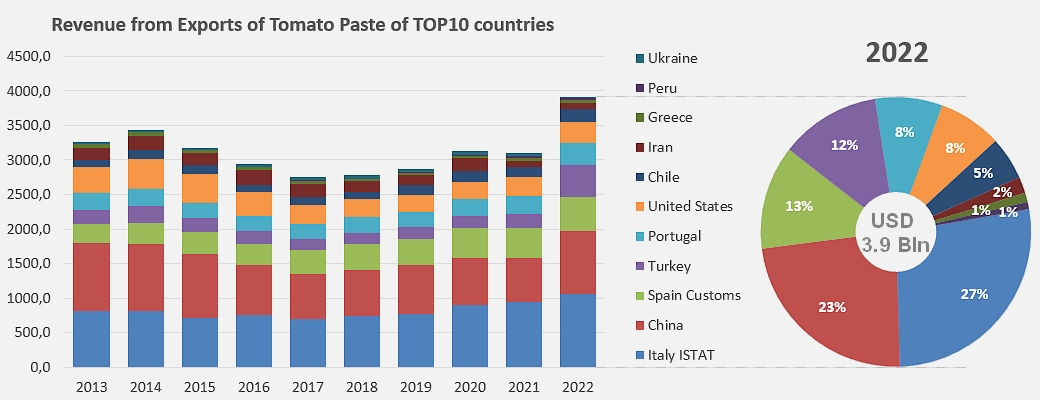

But the surge in operations has been about more than just quantity. Another extremely significant aspect of the current commercial context observed in this rapid assessment of 2022 activity is the total value of exported products. On this point, with a total value exceeding USD 3.9 billion for the year 2022, customs declarations show a jump of more than USD 800 million (+26%!) in the value of tomato products exported by all the TOP10 countries compared to the previous year. Moreover, the soaring "export" turnover of the TOP10 countries increased almost 40% compared to the average of the pre-Covid period, i.e. more than USD 1.1 billion.

For the record, this value is about four times higher than in 1998/1999 and twice as high as in 2007. More than three-quarters of the increase can be attributed to the rise in unit prices of exported products.

Sources: Trade Data Monitor